Smart Money Is Betting Big In SMCI Options

Financial giants have made a conspicuous bullish move on Super Micro Computer. Our analysis of options history for Super Micro Computer SMCI revealed 13 unusual trades.

Delving into the details, we found 46% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $2,286,540, and 9 were calls, valued at $866,659.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $24.0 and $75.0 for Super Micro Computer, spanning the last three months.

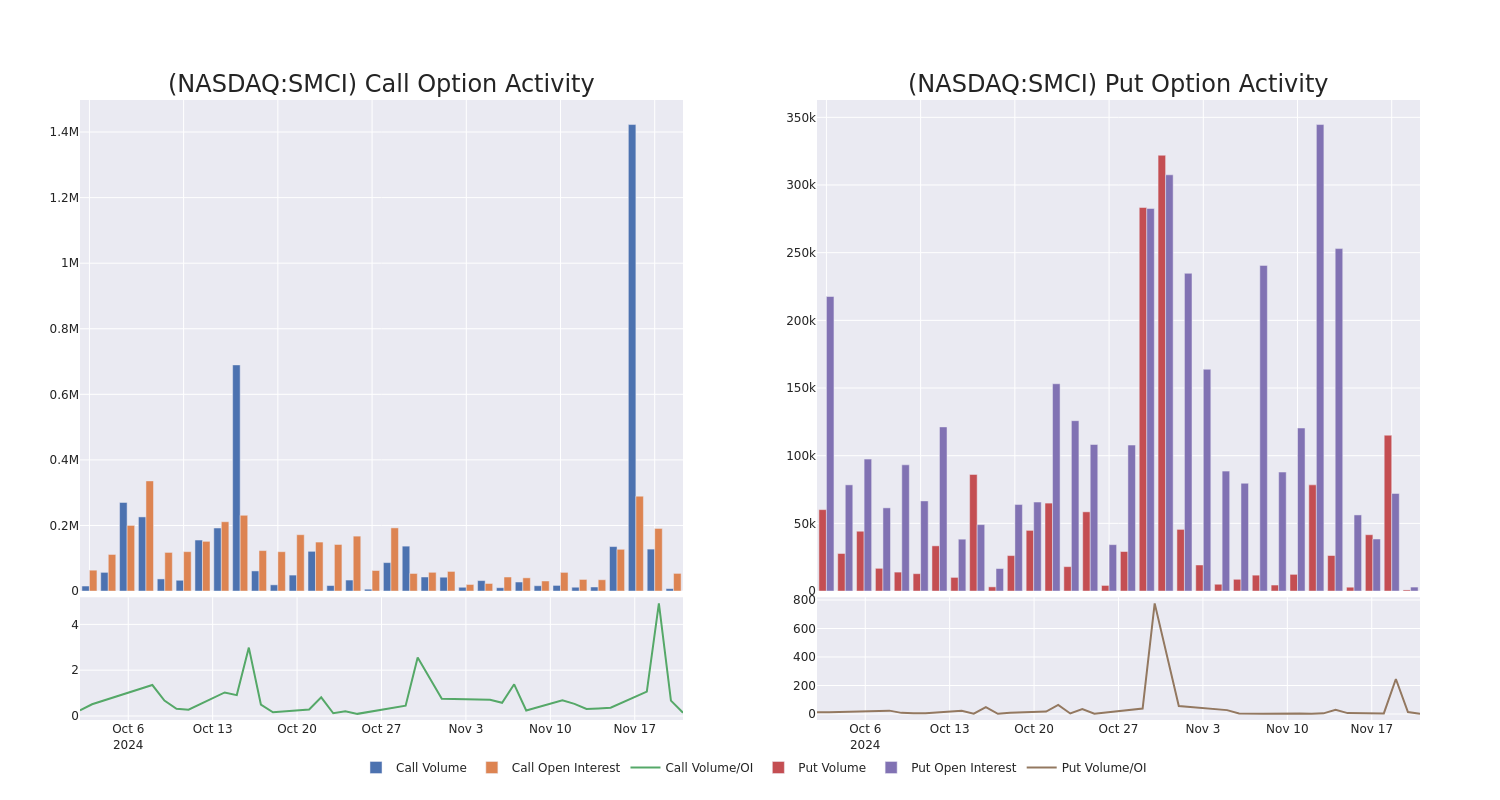

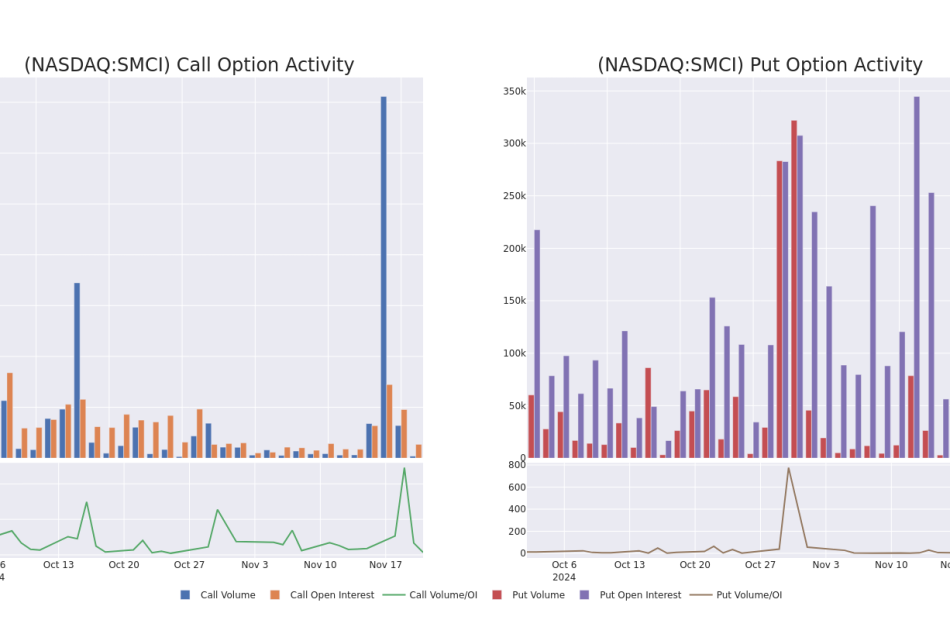

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Super Micro Computer’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Super Micro Computer’s substantial trades, within a strike price spectrum from $24.0 to $75.0 over the preceding 30 days.

Super Micro Computer Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | PUT | TRADE | BULLISH | 01/16/26 | $50.3 | $48.1 | $48.8 | $75.00 | $1.4M | 551 | 298 |

| SMCI | PUT | TRADE | NEUTRAL | 01/16/26 | $29.95 | $28.6 | $29.25 | $53.00 | $731.2K | 1.4K | 250 |

| SMCI | CALL | SWEEP | BULLISH | 12/20/24 | $3.45 | $3.3 | $3.45 | $30.00 | $312.3K | 12.8K | 455 |

| SMCI | CALL | SWEEP | BEARISH | 12/20/24 | $6.5 | $6.4 | $6.4 | $24.00 | $205.4K | 2.6K | 335 |

| SMCI | CALL | SWEEP | BULLISH | 03/21/25 | $5.85 | $5.75 | $5.75 | $35.00 | $115.0K | 5.2K | 1.2K |

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and “Internet of Things” embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm’s revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

In light of the recent options history for Super Micro Computer, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Super Micro Computer’s Current Market Status

- With a volume of 21,385,693, the price of SMCI is up 7.98% at $27.86.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 12 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Super Micro Computer options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply