Spire Analysts Boost Their Forecasts After Q4 Results

Spire Inc. SR reported a loss for the fourth quarter on Wednesday.

The company reported a quarterly loss of 54 cents per share, compared to market estimates of a loss of 52 cents per share. The company reported quarterly sales of $293.800 million which missed the analyst consensus estimate of $382.540 million.

“During fiscal 2024, despite the impacts of warm winter weather and rising interest expense, our team delivered solid financial and operating performance while providing affordable, reliable and safe energy to our customers,” said Steve Lindsey, president and chief executive officer of Spire. “Significant infrastructure investments and improved operational efficiency drove growth in our gas utilities during the year. In addition, Gas Marketing and Midstream continued to deliver solid results. We remain focused on continued execution of our strategy committed to capital-driven growth and operational excellence.”

Spire reaffirmed long-term adjusted EPS growth target of 5% to 7% and launched fiscal 2025 adjusted EPS guidance of $4.40 to $4.60.

Spire shares gained 2.9% to trade at $70.35 on Thursday.

These analysts made changes to their price targets on Spire following earnings announcement.

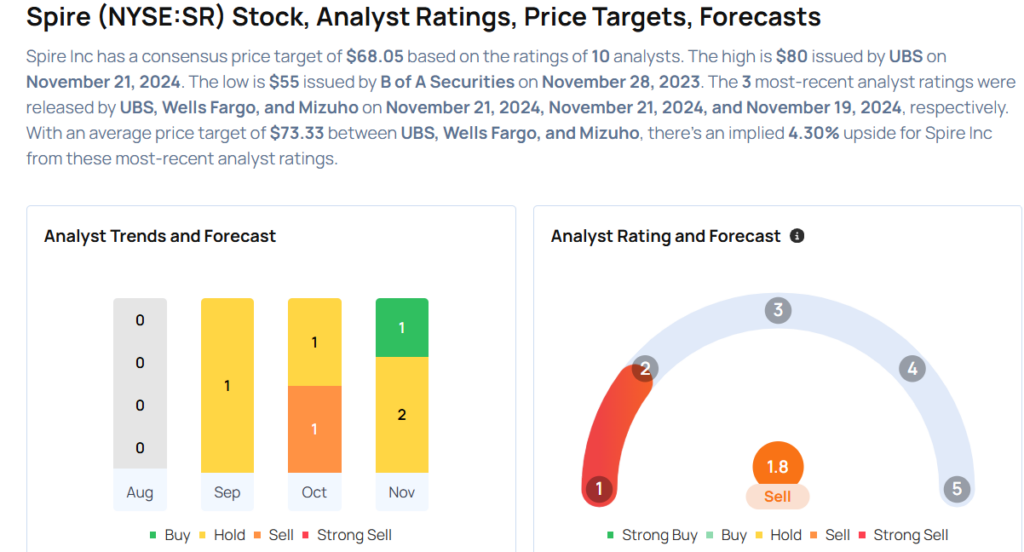

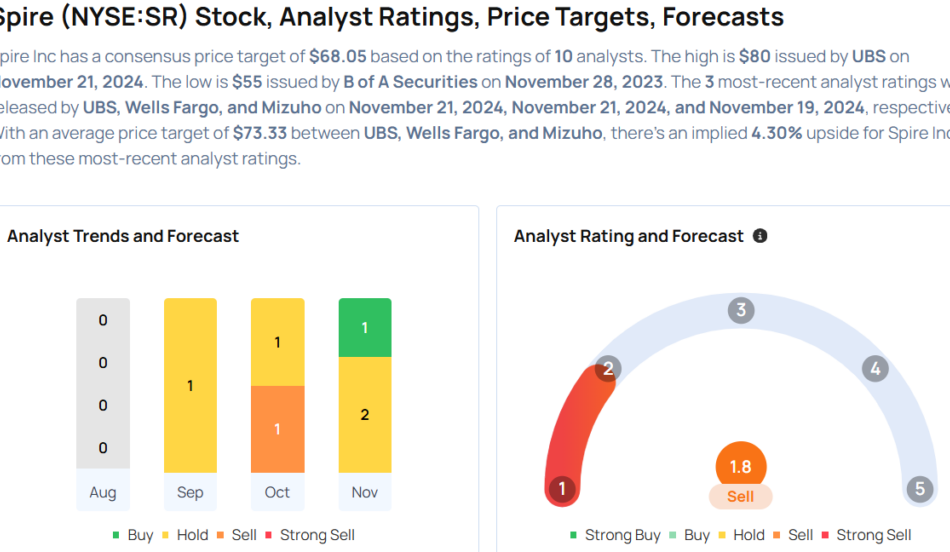

- Wells Fargo analyst Sarah Akers maintained Spire with an Equal-Weight and raised the price target from $73 to $75.

- UBS analyst William Appicelli maintained the stock with a Buy and raised the price target from $75 to $80.

Considering buying SR stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply