Top 3 Tech Stocks Which Could Rescue Your Portfolio In Q4

The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

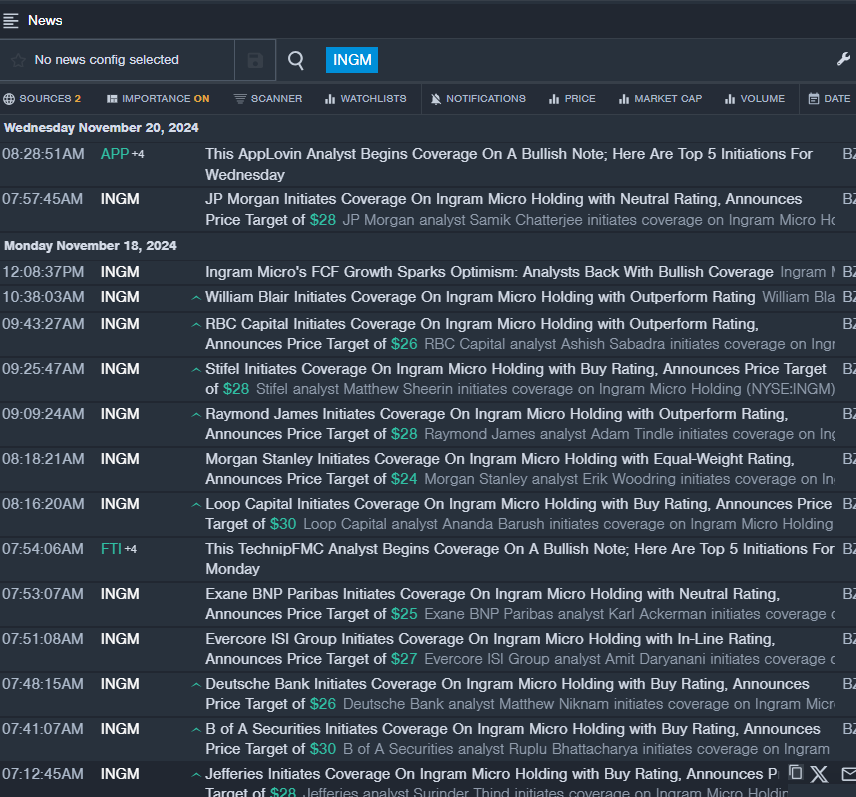

Ingram Micro Holding Corp INGM

- On Nov. 20, JP Morgan analyst Samik Chatterjee initiated coverage on Ingram Micro with a Neutral rating and announced a price target of $28. The company’s stock fell around 8% over the past five days and has a 52-week low of $21.84.

- RSI Value: 24.61

- INGM Price Action: Shares of Ingram fell 0.1% to close at $21.89 on Wednesday.

- Benzinga Pro’s real-time newsfeed alerted to latest INGM news.

Qorvo Inc QRVO

- On Nov. 11, Loop Capital analyst Gary Mobley initiated coverage on Qorvo with a Hold rating and announced a price target of $73. The company’s stock fell around 36% over the past month and has a 52-week low of $64.98.

- RSI Value: 18.70

- QRVO Price Action: Shares of Qorvo closed at $65.66 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in QRVO stock.

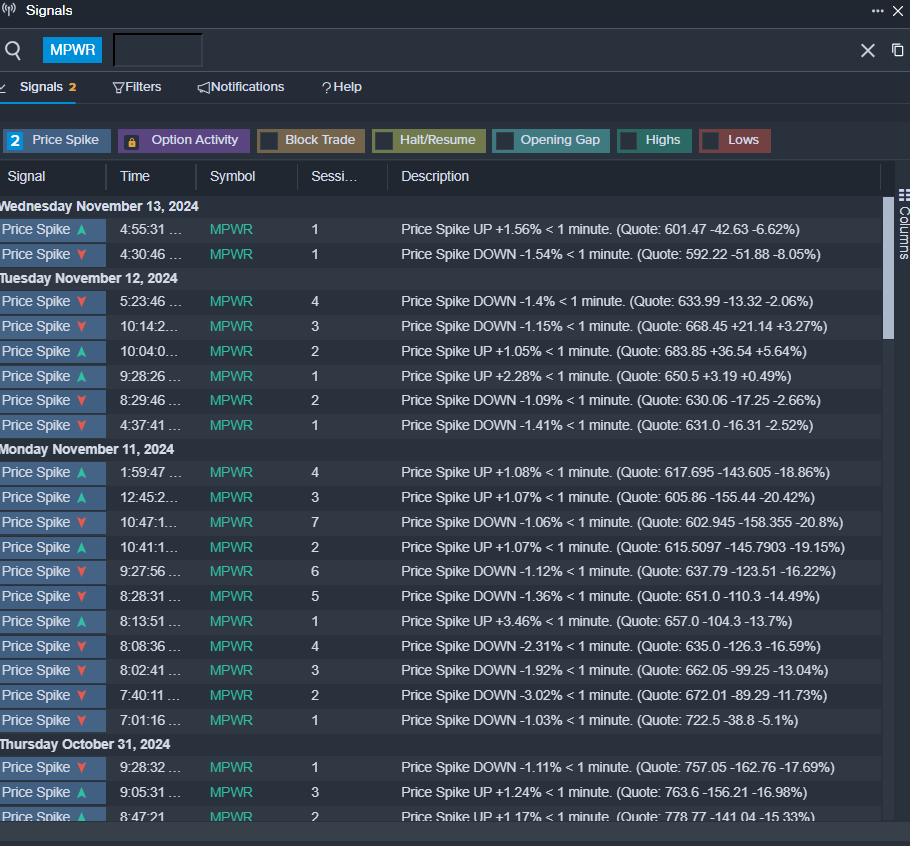

Monolithic Power Systems Inc MPWR

On Nov. 18, Loop Capital analyst Gary Mobley upgraded Monolithic Power from Hold to Buy and maintained the price target of $660. The company’s stock fell around 37% over the past month and has a 52-week <a href=”https://www.benzinga.com/quote/MPWR”><em> low of $538.00.</em></a>

RSI Value: 19.26

MPWR Price Action: Shares of Monolithic Power closed at $560.06 on Wednesday.

Benzinga Pro’s signals feature notified of a potential breakout in MPWR shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply