A Closer Look at Booking Holdings's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bearish stance on Booking Holdings.

Looking at options history for Booking Holdings BKNG we detected 31 trades.

If we consider the specifics of each trade, it is accurate to state that 29% of the investors opened trades with bullish expectations and 64% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $285,901 and 24, calls, for a total amount of $2,263,422.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $4000.0 and $5800.0 for Booking Holdings, spanning the last three months.

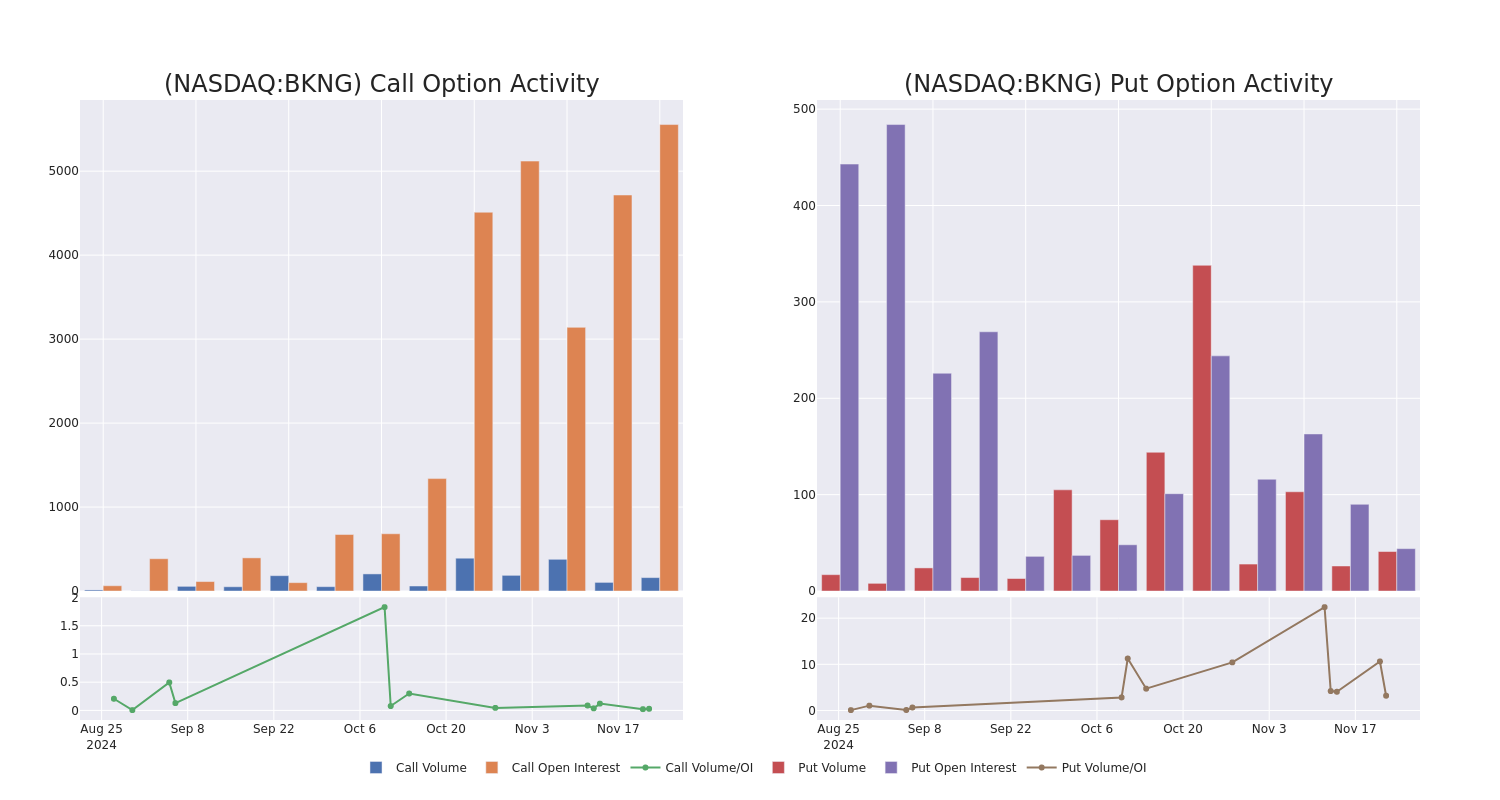

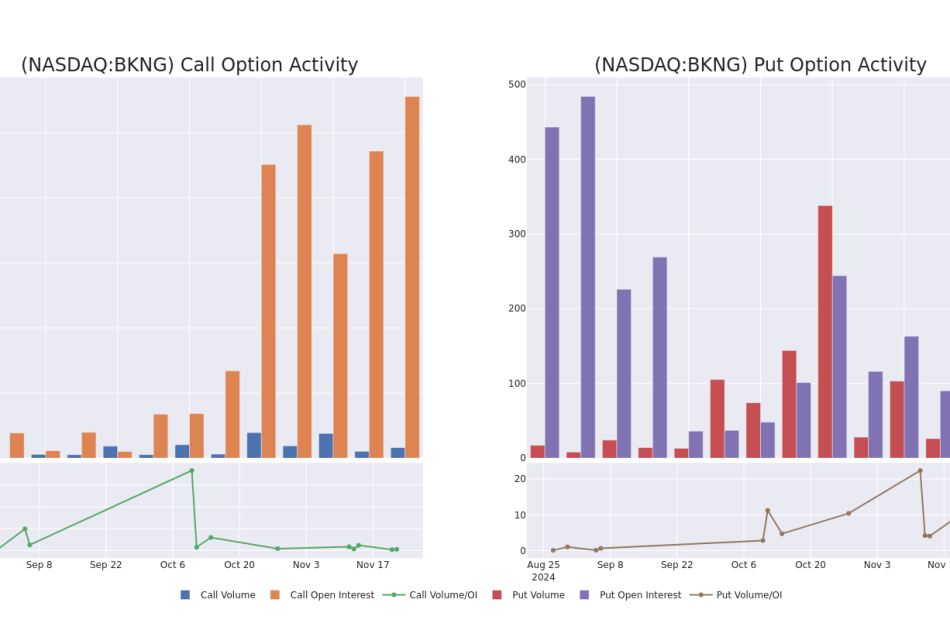

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Booking Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Booking Holdings’s significant trades, within a strike price range of $4000.0 to $5800.0, over the past month.

Booking Holdings Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BKNG | CALL | TRADE | BULLISH | 12/18/26 | $1618.6 | $1593.6 | $1615.0 | $4300.00 | $807.5K | 8 | 5 |

| BKNG | CALL | TRADE | BULLISH | 06/20/25 | $1143.9 | $1107.0 | $1129.16 | $4300.00 | $225.8K | 18 | 2 |

| BKNG | CALL | TRADE | BEARISH | 06/20/25 | $1394.7 | $1380.1 | $1380.1 | $4000.00 | $138.0K | 51 | 1 |

| BKNG | CALL | TRADE | NEUTRAL | 12/20/24 | $66.5 | $56.1 | $60.63 | $5350.00 | $121.2K | 363 | 94 |

| BKNG | CALL | SWEEP | BEARISH | 12/20/24 | $321.1 | $320.0 | $320.0 | $4950.00 | $96.0K | 38 | 3 |

About Booking Holdings

Booking is the world’s largest online travel agency by sales, offering booking and payment services for hotel and alternative accommodation rooms, airline tickets, rental cars, restaurant reservations, cruises, experiences, and other vacation packages. The company operates several branded travel booking sites, including Booking.com, Agoda, OpenTable, and Rentalcars.com, and has expanded into travel media with the acquisitions of Kayak and Momondo. Transaction fees for online bookings account for the bulk of revenue and profits.

After a thorough review of the options trading surrounding Booking Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Booking Holdings’s Current Market Status

- With a volume of 10,693, the price of BKNG is down -0.29% at $5196.0.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 90 days.

Professional Analyst Ratings for Booking Holdings

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $5131.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from RBC Capital has decided to maintain their Outperform rating on Booking Holdings, which currently sits at a price target of $5250.

* Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Booking Holdings, targeting a price of $5200.

* Consistent in their evaluation, an analyst from DA Davidson keeps a Buy rating on Booking Holdings with a target price of $5005.

* An analyst from Citigroup persists with their Buy rating on Booking Holdings, maintaining a target price of $5500.

* An analyst from Truist Securities persists with their Hold rating on Booking Holdings, maintaining a target price of $4700.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Booking Holdings, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply