ASML Holding's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bearish stance on ASML Holding ASML.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ASML, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 40 uncommon options trades for ASML Holding.

This isn’t normal.

The overall sentiment of these big-money traders is split between 37% bullish and 50%, bearish.

Out of all of the special options we uncovered, 17 are puts, for a total amount of $1,038,822, and 23 are calls, for a total amount of $1,378,563.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $600.0 to $960.0 for ASML Holding over the recent three months.

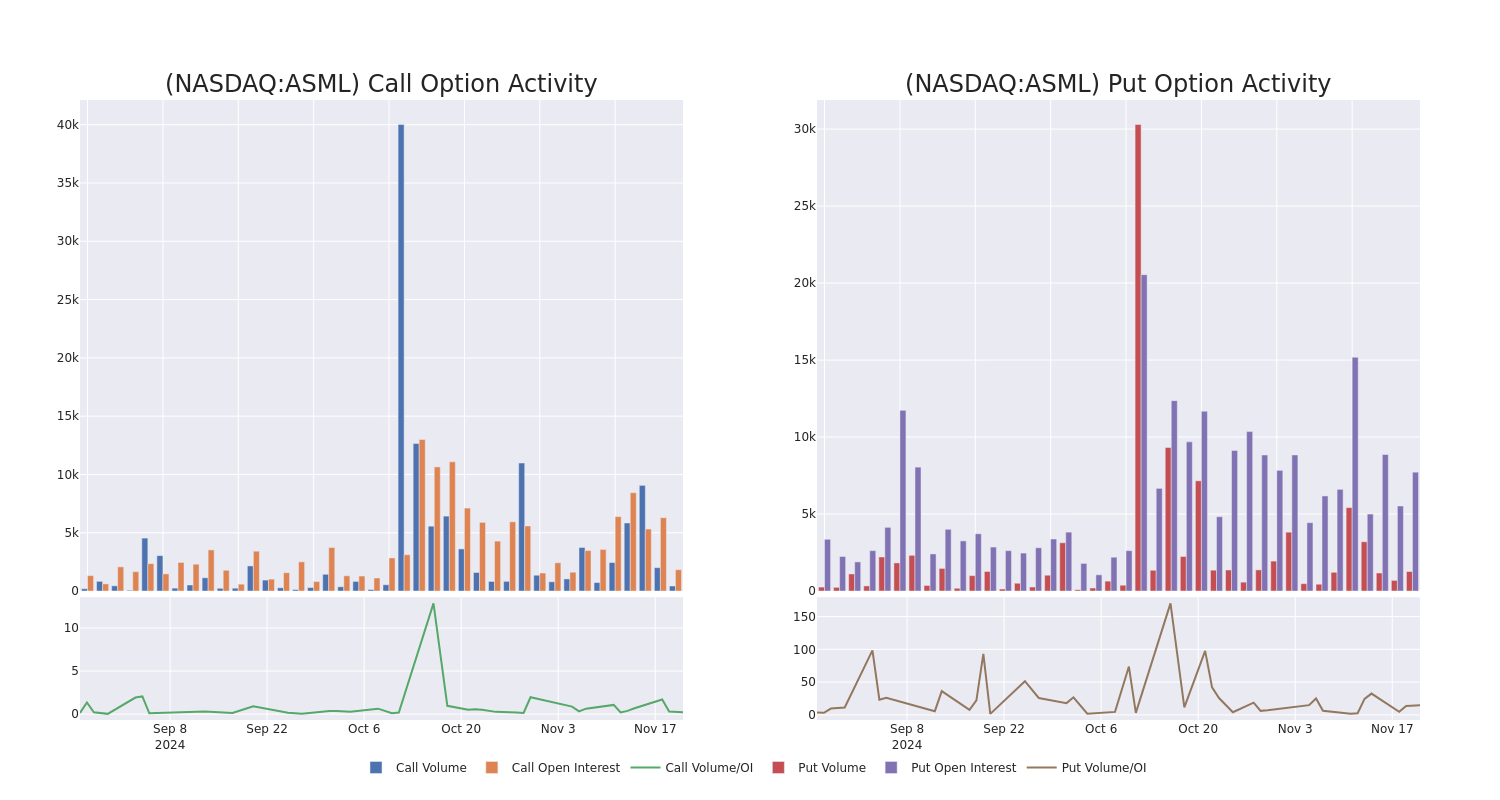

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ASML Holding’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ASML Holding’s significant trades, within a strike price range of $600.0 to $960.0, over the past month.

ASML Holding Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | CALL | TRADE | BULLISH | 01/16/26 | $108.4 | $105.9 | $108.4 | $700.00 | $227.6K | 604 | 21 |

| ASML | PUT | TRADE | BULLISH | 03/21/25 | $39.0 | $38.4 | $38.58 | $640.00 | $192.9K | 648 | 100 |

| ASML | CALL | TRADE | BULLISH | 01/16/26 | $89.7 | $87.0 | $89.7 | $750.00 | $188.3K | 95 | 21 |

| ASML | CALL | TRADE | BULLISH | 03/21/25 | $48.8 | $48.5 | $48.8 | $700.00 | $102.4K | 269 | 23 |

| ASML | CALL | SWEEP | NEUTRAL | 01/17/25 | $27.4 | $25.4 | $25.4 | $700.00 | $93.9K | 932 | 38 |

About ASML Holding

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML’s main clients are TSMC, Samsung, and Intel.

Following our analysis of the options activities associated with ASML Holding, we pivot to a closer look at the company’s own performance.

ASML Holding’s Current Market Status

- Trading volume stands at 482,394, with ASML’s price down by -0.55%, positioned at $668.45.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 68 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ASML Holding options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply