Behind the Scenes of JD.com's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards JD.com JD, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in JD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 12 extraordinary options activities for JD.com. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 58% leaning bullish and 41% bearish. Among these notable options, 10 are puts, totaling $365,631, and 2 are calls, amounting to $146,200.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $29.0 and $44.0 for JD.com, spanning the last three months.

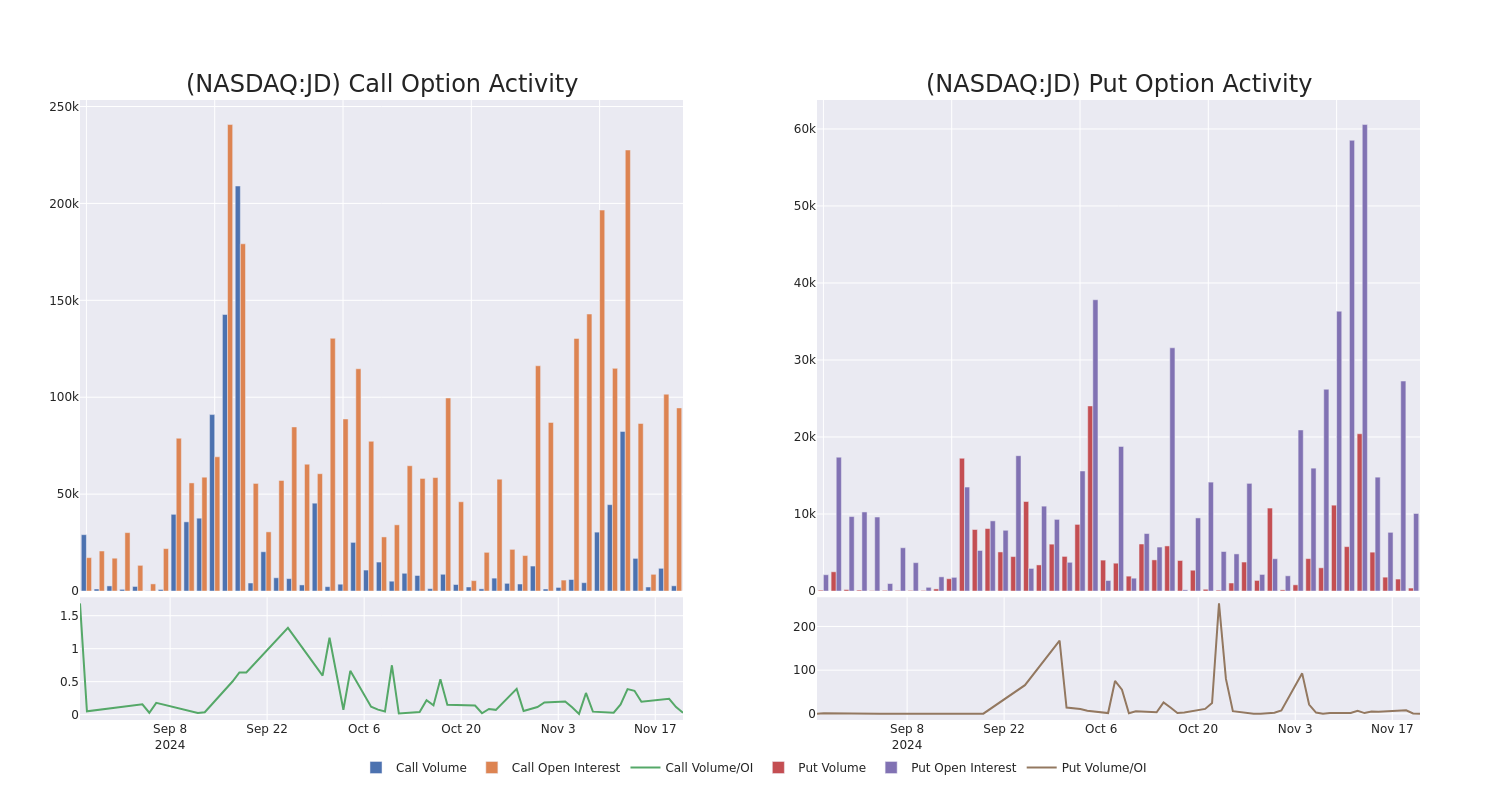

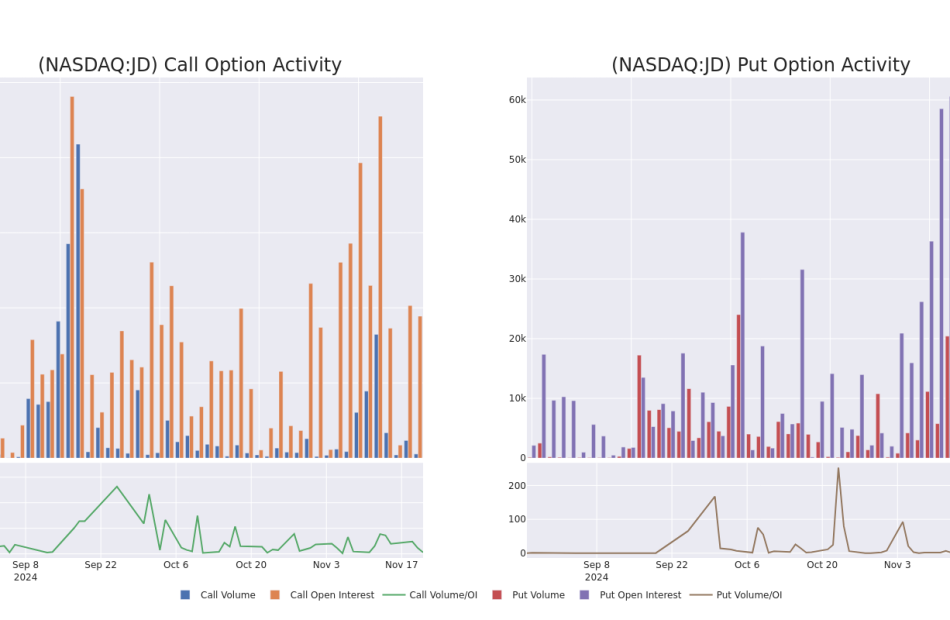

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for JD.com’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JD.com’s whale activity within a strike price range from $29.0 to $44.0 in the last 30 days.

JD.com Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | SWEEP | BULLISH | 04/17/25 | $4.25 | $4.05 | $4.21 | $35.00 | $84.2K | 122 | 200 |

| JD | PUT | SWEEP | BEARISH | 01/17/25 | $9.55 | $9.4 | $9.45 | $44.00 | $67.1K | 1.0K | 80 |

| JD | CALL | TRADE | BULLISH | 12/20/24 | $1.55 | $1.49 | $1.55 | $35.00 | $62.0K | 3.9K | 411 |

| JD | PUT | SWEEP | BEARISH | 03/21/25 | $2.84 | $2.81 | $2.84 | $34.00 | $56.8K | 1.0K | 243 |

| JD | PUT | TRADE | BULLISH | 02/21/25 | $2.27 | $2.25 | $2.25 | $34.00 | $35.3K | 1.8K | 200 |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

Having examined the options trading patterns of JD.com, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

JD.com’s Current Market Status

- Trading volume stands at 7,562,490, with JD’s price down by -1.94%, positioned at $34.7.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 103 days.

What Analysts Are Saying About JD.com

2 market experts have recently issued ratings for this stock, with a consensus target price of $49.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for JD.com, targeting a price of $51.

* Reflecting concerns, an analyst from Benchmark lowers its rating to Buy with a new price target of $47.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JD.com with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply