German Commercial Property Market Is 'Source Of Elevated Risk'

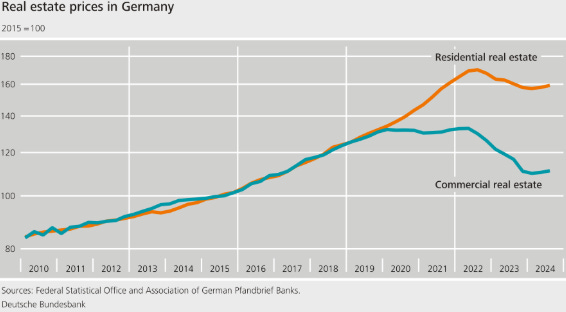

The Germany commercial property market “remains a source of elevated risk,” one that financial regulators are monitoring closely after a rapid succession of interest rate increases hit property values.

“The financial system is facing acute challenges due to geopolitical tensions and a weak economy,” Michael Theurer, an Executive Board member of the Deutsche Bundesbank, said on Thursday. “This is making supervisors more vigilant, particularly with regard to the commercial real estate sector.”

The European Central Bank (ECB) hiked interest rates in 2022 as the eurozone witnessed an “extraordinary surge” in inflation fueled by the energy crisis from Russia’s invasion of Ukraine. Even though the ECB began lowering rates this year, cutting from 4.5% to 3.4%, German commercial property developers remain at risk, according to the Bundesbank.

“Higher interest rates and energy prices caused a number of risks to emerge,” Theurer said. “Real estate prices fell and credit risk rose.”

The DAX subsector All Real Estate has declined to its lowest level since August 16. It traded at €159.11 at CET 11:30 today. The country’s biggest landlord by market volume, Vonovia (VNAn.DE), dropped 44% during the past three years, despite rising 16% in the past year.

German Financial System ‘Weathered’ High Rates

The German financial system has “weathered the phase of exceptionally strong rises in interest rates well overall,” he said. “The resilience of the banking system is adequate thanks to high capital reserves. Vulnerabilities are declining, but only gradually.”

But conditions in the commercial property market are influencing German open-end retail real estate funds, according to the Bundesbank.

“As a rule, such funds have high liquidity risk,” Theurer said. “Most recently they have seen net outflows, with investors anticipating higher returns on alternative investments. This could accentuate negative developments in commercial real estate.”

Given the overall risk, a package of additional capital buffers that regulators ordered banks to build up in 2022 “remains appropriate.”

German Economic ‘Malaise’ Shows No Signs Of Improving

In the meantime, Germany’s “economic malaise” showed no signs of improving, according to a survey compiled by S&P Global. The latest HCOB ‘flash’ PMI® survey showed business activity in November falling for the fifth month running and at the quickest rate since February.

The first decrease in services activity for nine months compounded a “sustained weakness in manufacturing production,” the survey said today. Weaker demand for goods and services led to further job losses during the year’s penultimate month, it said.

“Until recently, the German economy was stabilized somewhat by the service sector, which was making up for the steep decline in manufacturing,” Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said. “Not anymore,”

As a result, German gross domestic product (GDP) contracted an annual 0.3% in Q3, Federal Statistical Office (Destatis) data showed today. GDP rose quarterly by 0.1% in Q3, though growth was revised 0.1 percentage points lower from its October 30 forecast.

German Economy Hurt By Domestic Political Turmoil

While German officials regularly point to trade tensions and geopolitical risks, domestic political turmoil has weighed on economic growth. Political uncertainty since the announcement of snap elections “isn’t helping,” Rubia said.

Chancellor Olaf Scholz’s coalition government collapsed earlier this month after weeks of government squabbling about the ailing economy. Until early elections on February 23, the European nation will be politically rudderless.

Amid the weak German economy, corporate insolvencies have “risen significantly,” according to the Bundesbank. Insolvencies among trading companies are particularly high – totaling over €7 billion as of the end of June 2024.

Insolvency claims against the services sector and against the real estate activities sector are somewhat lower. They are nevertheless “substantial” at €5.5 billion and roughly €6.5 billion, respectively, according to the Bundesbank.

“The path ahead is an arduous one,” Theurer said. “Geopolitical tensions continue to harbor risks to the future stability of the financial system.”

Disclaimer

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply