Market Whales and Their Recent Bets on CEG Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Constellation Energy.

Looking at options history for Constellation Energy CEG we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 54% of the investors opened trades with bullish expectations and 36% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $899,650 and 9, calls, for a total amount of $374,012.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $270.0 for Constellation Energy during the past quarter.

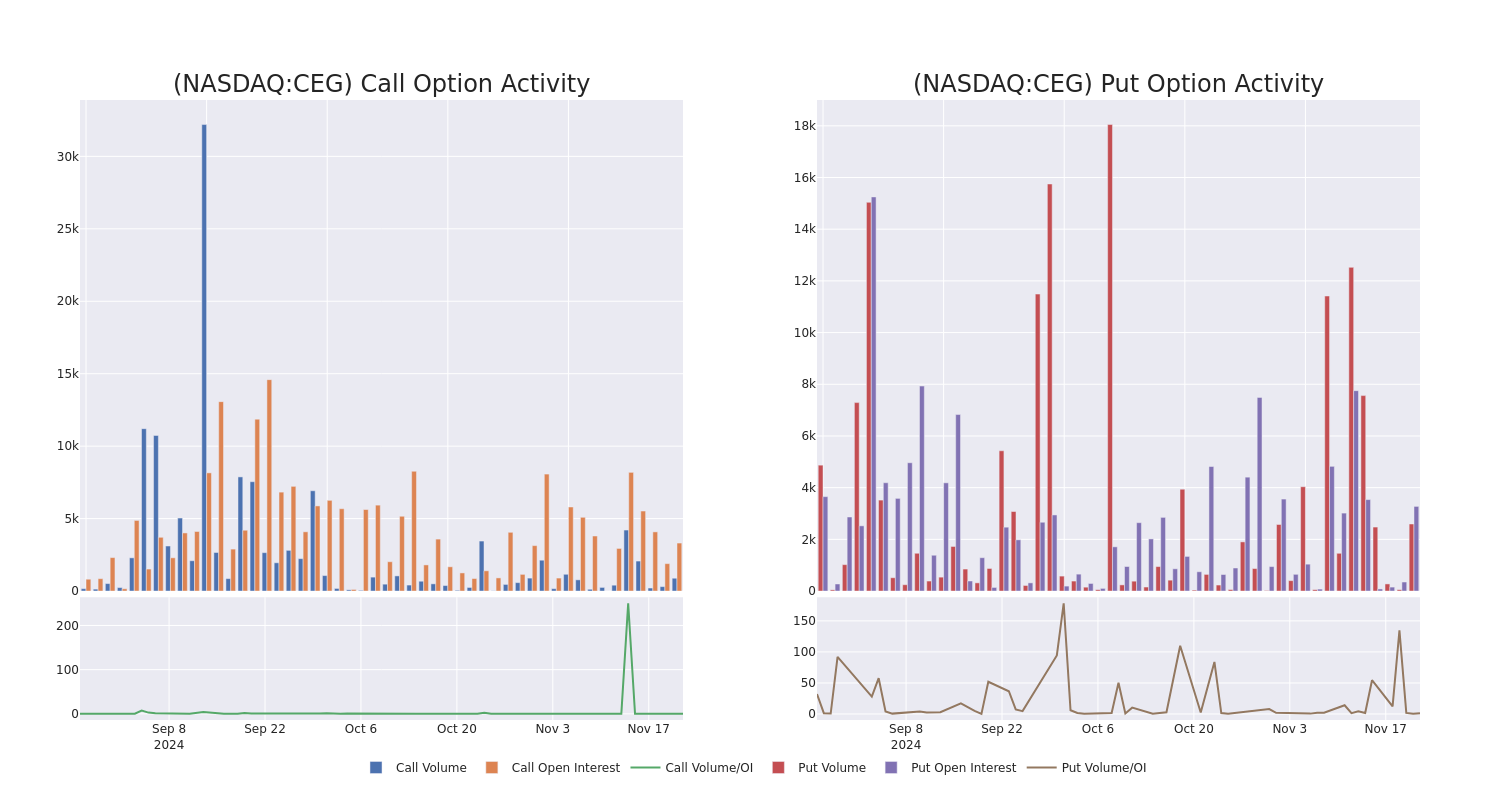

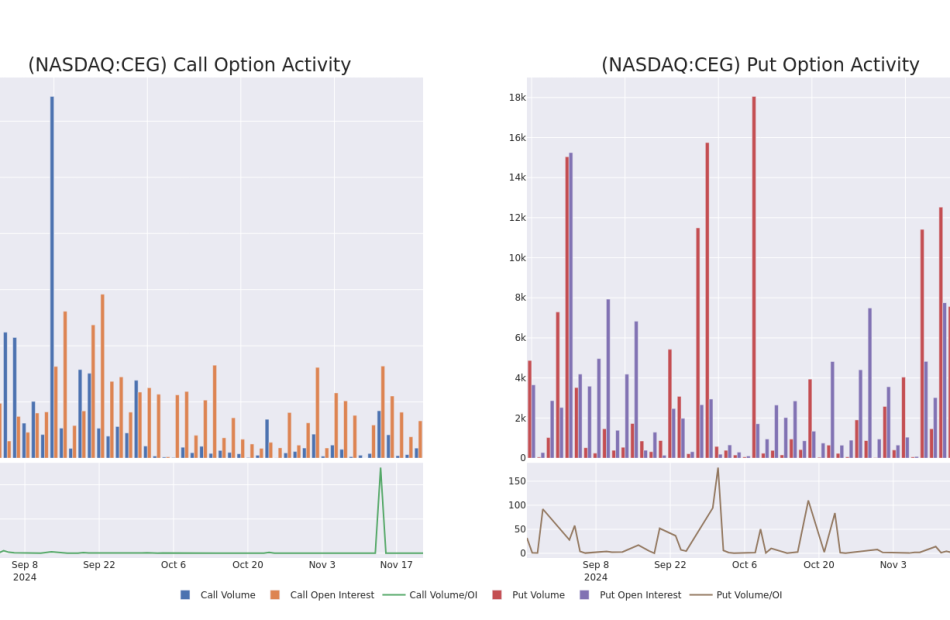

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Constellation Energy’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Constellation Energy’s significant trades, within a strike price range of $100.0 to $270.0, over the past month.

Constellation Energy Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | PUT | TRADE | BULLISH | 01/17/25 | $3.1 | $2.8 | $2.8 | $210.00 | $708.4K | 3.1K | 2.5K |

| CEG | PUT | SWEEP | BEARISH | 04/17/25 | $37.5 | $37.4 | $37.5 | $270.00 | $191.2K | 95 | 60 |

| CEG | CALL | SWEEP | BEARISH | 01/17/25 | $23.4 | $21.6 | $21.96 | $240.00 | $98.8K | 1.2K | 45 |

| CEG | CALL | TRADE | BULLISH | 01/16/26 | $156.5 | $154.5 | $156.5 | $100.00 | $46.9K | 14 | 3 |

| CEG | CALL | SWEEP | BULLISH | 12/20/24 | $18.6 | $18.0 | $18.6 | $240.00 | $40.5K | 1.1K | 354 |

About Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Following our analysis of the options activities associated with Constellation Energy, we pivot to a closer look at the company’s own performance.

Where Is Constellation Energy Standing Right Now?

- With a volume of 1,059,895, the price of CEG is down -0.29% at $251.11.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 95 days.

Professional Analyst Ratings for Constellation Energy

4 market experts have recently issued ratings for this stock, with a consensus target price of $273.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from BMO Capital persists with their Outperform rating on Constellation Energy, maintaining a target price of $291.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Constellation Energy with a target price of $270.

* Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for Constellation Energy, targeting a price of $298.

* An analyst from Mizuho persists with their Neutral rating on Constellation Energy, maintaining a target price of $235.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Constellation Energy options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply