Market Whales and Their Recent Bets on CRWD Options

High-rolling investors have positioned themselves bearish on CrowdStrike Holdings CRWD, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CRWD often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 9 options trades for CrowdStrike Holdings. This is not a typical pattern.

The sentiment among these major traders is split, with 22% bullish and 55% bearish. Among all the options we identified, there was one put, amounting to $61,500, and 8 calls, totaling $240,940.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $370.0 for CrowdStrike Holdings over the recent three months.

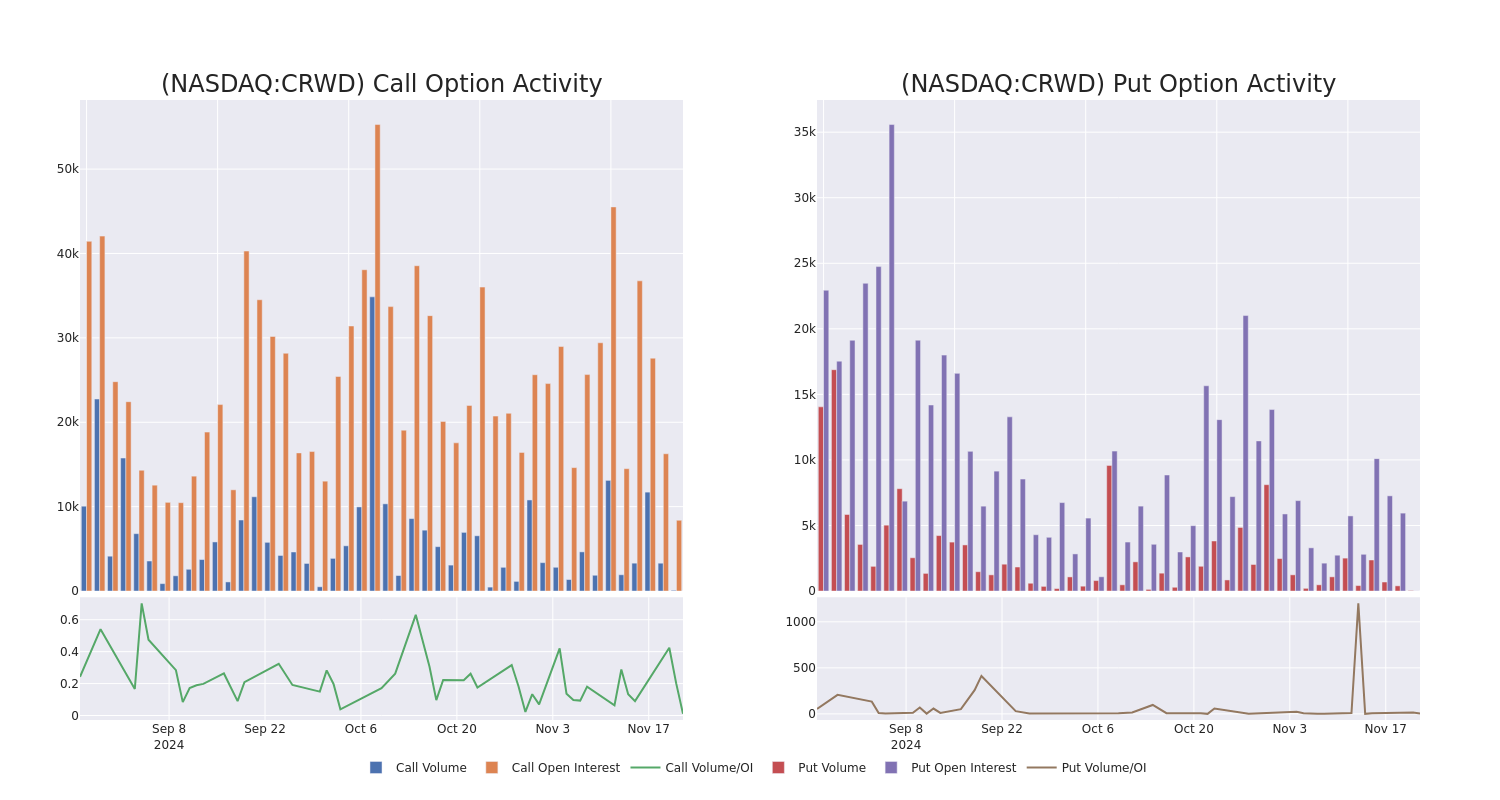

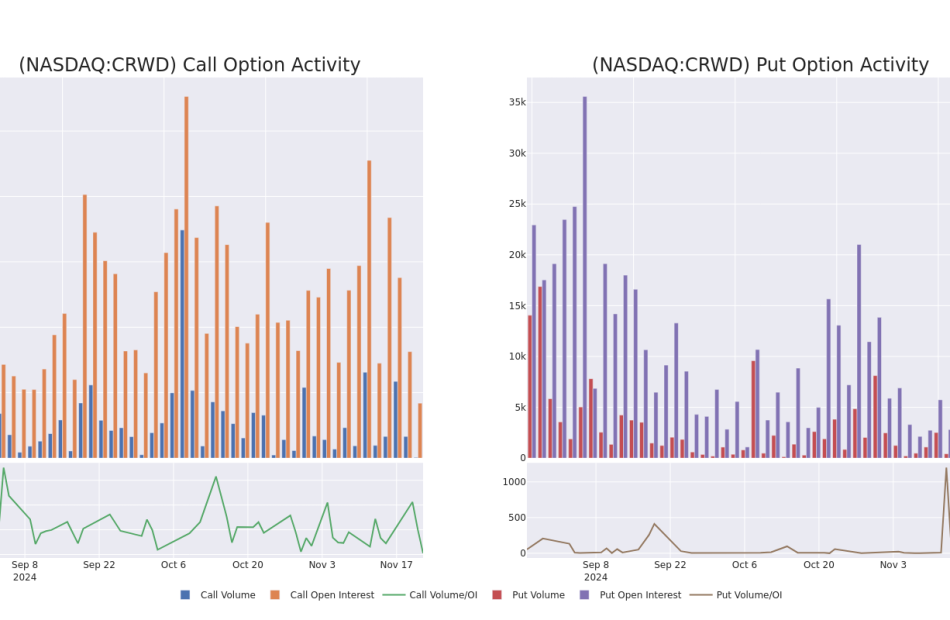

Volume & Open Interest Development

In today’s trading context, the average open interest for options of CrowdStrike Holdings stands at 932.67, with a total volume reaching 124.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in CrowdStrike Holdings, situated within the strike price corridor from $80.0 to $370.0, throughout the last 30 days.

CrowdStrike Holdings Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | PUT | TRADE | BEARISH | 12/13/24 | $21.05 | $19.3 | $20.5 | $365.00 | $61.5K | 7 | 38 |

| CRWD | CALL | SWEEP | BULLISH | 12/20/24 | $87.15 | $84.7 | $86.5 | $280.00 | $34.6K | 967 | 4 |

| CRWD | CALL | TRADE | BEARISH | 12/06/24 | $26.3 | $23.0 | $23.0 | $350.00 | $34.5K | 369 | 0 |

| CRWD | CALL | TRADE | NEUTRAL | 12/20/24 | $21.4 | $20.2 | $20.84 | $370.00 | $31.2K | 1.5K | 18 |

| CRWD | CALL | SWEEP | BEARISH | 12/20/24 | $30.05 | $29.7 | $29.7 | $350.00 | $29.7K | 2.7K | 41 |

About CrowdStrike Holdings

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike’s primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

Having examined the options trading patterns of CrowdStrike Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of CrowdStrike Holdings

- Currently trading with a volume of 328,151, the CRWD’s price is up by 1.61%, now at $363.32.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 4 days.

Professional Analyst Ratings for CrowdStrike Holdings

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $358.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Barclays persists with their Overweight rating on CrowdStrike Holdings, maintaining a target price of $372.

* In a cautious move, an analyst from CICC downgraded its rating to Market Perform, setting a price target of $295.

* An analyst from JMP Securities downgraded its action to Market Outperform with a price target of $400.

* An analyst from Cantor Fitzgerald persists with their Overweight rating on CrowdStrike Holdings, maintaining a target price of $370.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on CrowdStrike Holdings with a target price of $355.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for CrowdStrike Holdings, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply