NIO Unusual Options Activity For November 22

Whales with a lot of money to spend have taken a noticeably bearish stance on NIO.

Looking at options history for NIO NIO we detected 22 trades.

If we consider the specifics of each trade, it is accurate to state that 4% of the investors opened trades with bullish expectations and 90% with bearish.

From the overall spotted trades, 17 are puts, for a total amount of $1,002,691 and 5, calls, for a total amount of $164,560.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $4.0 and $20.0 for NIO, spanning the last three months.

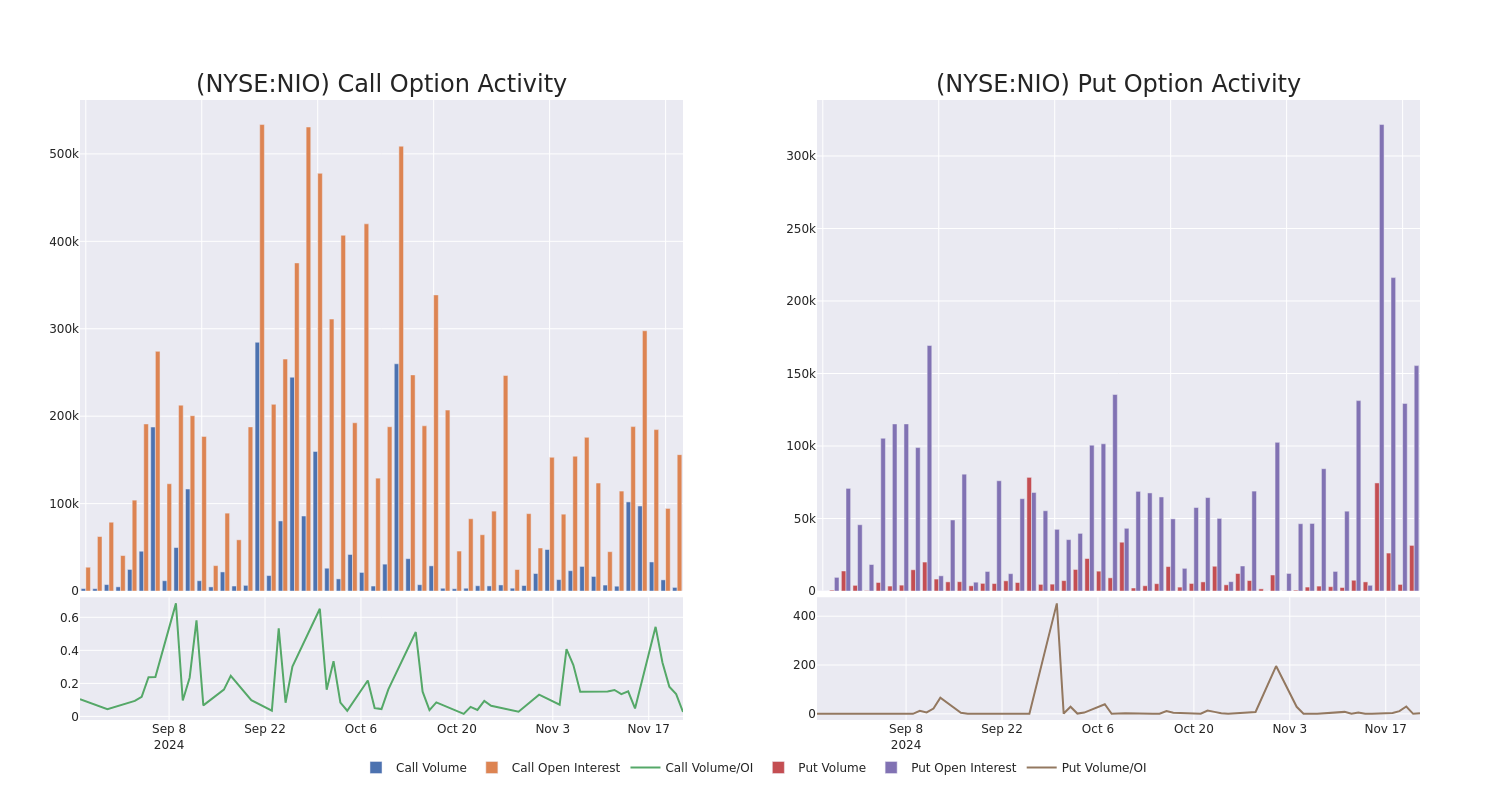

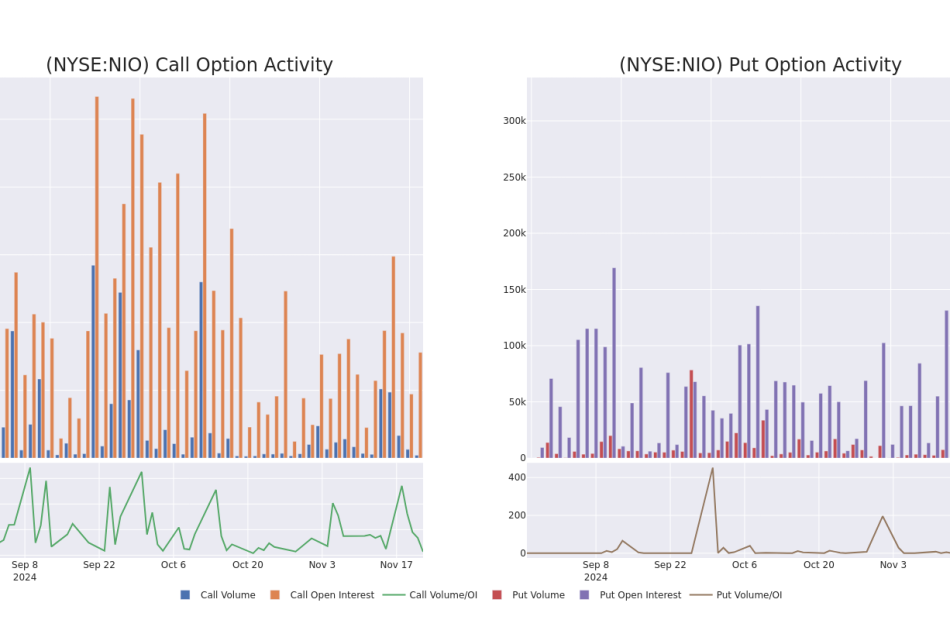

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for NIO’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NIO’s whale activity within a strike price range from $4.0 to $20.0 in the last 30 days.

NIO Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NIO | PUT | SWEEP | BEARISH | 01/16/26 | $4.0 | $3.9 | $3.95 | $8.00 | $129.1K | 17.6K | 881 |

| NIO | PUT | SWEEP | BEARISH | 01/16/26 | $3.95 | $3.85 | $3.95 | $8.00 | $83.6K | 17.6K | 3.9K |

| NIO | PUT | SWEEP | BEARISH | 01/16/26 | $3.95 | $3.9 | $3.95 | $8.00 | $78.9K | 17.6K | 1.8K |

| NIO | PUT | SWEEP | BEARISH | 01/16/26 | $3.95 | $3.9 | $3.92 | $8.00 | $68.8K | 17.6K | 1.5K |

| NIO | PUT | SWEEP | BEARISH | 01/17/25 | $0.67 | $0.65 | $0.67 | $5.00 | $67.0K | 63.0K | 1.0K |

About NIO

Nio is a leading electric vehicle maker, targeting the premium segment. Founded in November 2014, Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles. The company differentiates itself through continuous technological breakthroughs and innovations such as battery swapping and autonomous driving technologies. Nio launched its first model, its ES8 seven-seater electric SUV, in December 2017, and began deliveries in June 2018. Its current model portfolio includes midsize to large sedans and SUVs. It sold over 160,000 EVs in 2023, accounting for about 2% of the China passenger new energy vehicle market.

In light of the recent options history for NIO, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is NIO Standing Right Now?

- With a volume of 45,538,092, the price of NIO is up 3.4% at $4.86.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 102 days.

What The Experts Say On NIO

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $5.699999999999999.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Macquarie has revised its rating downward to Neutral, adjusting the price target to $4.

* An analyst from Macquarie has elevated its stance to Outperform, setting a new price target at $6.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NIO options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply