Statement by the Prime Minister on National Housing Day

OTTAWA, ON, Nov. 22, 2024 /CNW/ – The Prime Minister, Justin Trudeau, today issued the following statement on National Housing Day:

“Canada’s housing market just hasn’t been working. Ask anyone you know, and they’ll say it hasn’t worked for decades. Put simply, the cost to build homes is too high, and the time it takes to finish projects is too long.

“So, the federal government is fixing it, starting by making it easier to build homes faster. The Housing Accelerator Fund is a transformative program that partners with communities across the country to speed-up housing construction. It does this by incentivizing municipalities to speed up approvals, remove red tape, and unlock faster development. This helps build more homes near transit and schools and allows greater density. We’ve already signed 178 agreements across the country to fast-track more than 750,000 homes, and earlier this year, we topped up the Fund to build over 12,000 new homes.

“We’re not stopping there. The Affordable Housing Fund is helping build new affordable homes while renovating and repairing existing ones. Through the Apartment Construction Loan Program, we’re helping builders create the housing supply Canadians need. By enhancing the Home Buyers’ Plan, first-time home buyers are able to save up more money for their down payment, faster. To protect renters’ rights, we introduced a Blueprint for a Renters’ Bill of Rights, to protect tenants from unfair rent hikes, renovictions, and bad landlords. And to reduce chronic homelessness in Canada, we’re creating supportive environments and delivering essential services to those in need, including through the Reaching Home: Canada’s Homelessness Strategy. These are only some of the actions we’re taking to solve the housing crisis.

“All of this is part of Canada’s Housing Plan, our ambitious blueprint to build millions more homes. On National Housing Day, we keep this work going. There’s more to do.”

This document is also available at https://pm.gc.ca

SOURCE Prime Minister’s Office

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c9566.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c9566.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Tapestry Stock Today?

Tapestry, Inc. TPR has entered into Accelerated Share Repurchase agreements with Bank of America N.A. and Morgan Stanley & Co. LLC to repurchase $2.0 billion shares of common stock.

While recently announcing its termination of Capri Holdings merger agreement, the company revealed that its Board approved an additional $2 billion share repurchase program to be implemented at least in part through an Accelerated Share Repurchase program.

Related: Tapestry And Capri Call Off $8.5B Deal Amid Legal Hurdles

The ASRs will be completed under the company’s recently expanded $2.8 billion share repurchase authorization.

In addition to the $2 billion ASR program, Tapestry still has $800 million in remaining capacity under its share repurchase authorization for future buybacks.

This move is part of Tapestry’s broader plan to return over 100% of its free cash flow in fiscal 2025 to shareholders through dividends and share repurchases.

As part of the agreements, Tapestry expects to receive an initial delivery of 28.4 million shares of common stock on November 26, representing about 80% of the shares to be repurchased.

The final number of shares repurchased will depend on the volume-weighted average price of Tapestry’s stock during the term of the agreements, subject to adjustments.

The final settlement is expected by the first quarter of fiscal 2026, ending September 27, 2025.

To fund the share repurchases, Tapestry is utilizing a mix of financing sources, including $750 million in borrowings under a new term loan agreement, $1.0 billion under its revolving credit facility, and $250 million in cash on hand.

Price Action: TPR shares are trading higher by 4.84% to $59.14 at last check Friday.

Image: Shutterstock/ bangoland

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Ken Griffin Increased His Stake in This Artificial Intelligence (AI) Semiconductor Stock by 172% (Hint: It's Not Nvidia)

Hedge funds typically have a reputation for being tight-lipped about their investing moves, rarely offering much insight to retail investors. However, once every quarter, institutional money managers are required to file a form 13F with the Securities and Exchange Commission (SEC) — a document that essentially outlines all of the stocks their funds bought or sold during the previous quarter, and their holdings at the end of it.

Citadel Advisors, run by billionaire investor Ken Griffin, is one of the most prestigious hedge funds on Wall Street, and while reviewing the 13F it filed on Nov. 14, I noticed something. In the third quarter, the fund increased its stake by 172% in a semiconductor stock that isn’t Nvidia.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Should retail investors follow Griffin’s lead, or would they be better off staying on the sidelines?

During the third quarter, Citadel significantly increased its position in Intel (NASDAQ: INTC). The table below illustrates Citadel’s stakes in Intel as of the ends of the last five quarters.

|

Metric |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|---|---|---|---|---|---|

|

Intel shares owned (in millions) |

3.8 |

3.7 |

5.4 |

6.8 |

18.5 |

Data source: Hedge Follow

As the data above shows, Citadel has been scooping up the chipmaker’s shares during the last three quarters. What’s curious, however, is the company’s purchase of 11.7 million shares over the last three months, nearly tripling its stake.

It’s well-known that one of President-elect Donald Trump’s primary campaign themes was his support for investing more into American-made products and domestic manufacturing. That said, Trump hasn’t exactly endorsed President Biden’s CHIPS Act — which will put $280 billion worth of government support behind growing the country’s semiconductor manufacturing capacity — with a glowing review.

Nevertheless, I personally don’t think Trump will try to change the CHIPS Act too much after he assumes office in January. At the end of the day, the CHIPS Act is doing precisely what Trump wants — incentivizing semiconductor businesses to expand their manufacturing capabilities in the U.S.

And perhaps no other U.S.-based chipmaker has benefited from the CHIPS Act more than Intel. In my opinion, Intel is also well positioned to receive even more business from the federal government over the next four years.

As of the time of this writing, shares of Intel are down by more than 50% this year. I tend to see the narrative surrounding Intel as being “one step forward, two steps backward.” Over the last several years, the company has lost significant market share to competitors, and it hasn’t exactly been impressing potential partners with its foundry process. Most recently, Intel was replaced in the Dow Jones Industrial Average by Nvidia.

A Glimpse of Alarum Technologies's Earnings Potential

Alarum Technologies ALAR is gearing up to announce its quarterly earnings on Monday, 2024-11-25. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Alarum Technologies will report an earnings per share (EPS) of $0.04.

Alarum Technologies bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

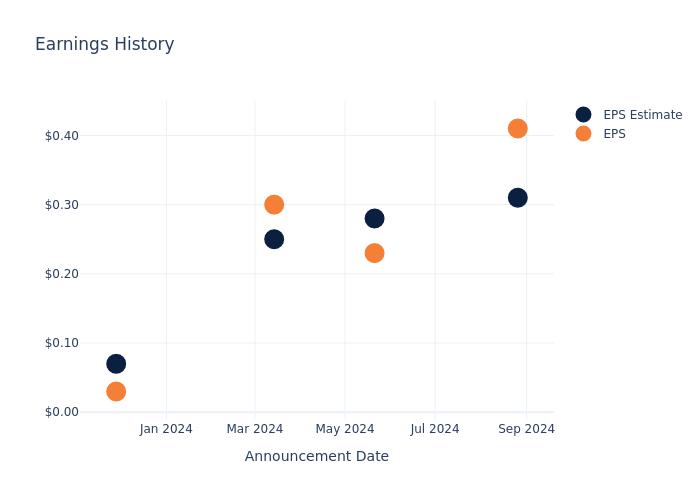

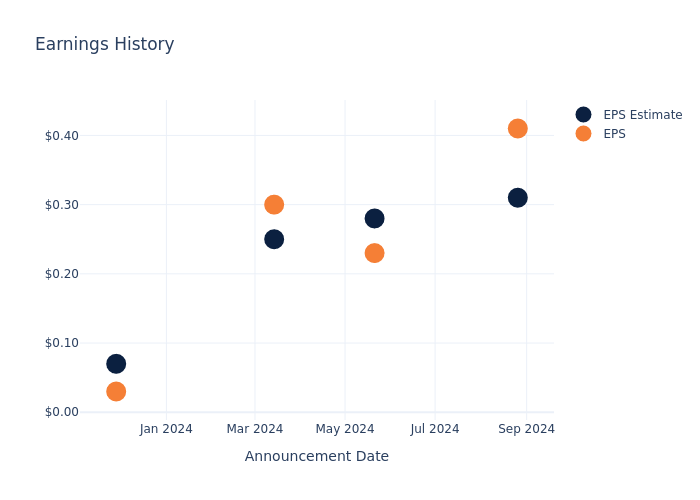

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.10, leading to a 8.56% drop in the share price the following trading session.

Here’s a look at Alarum Technologies’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.31 | 0.28 | 0.25 | 0.07 |

| EPS Actual | 0.41 | 0.23 | 0.30 | 0.03 |

| Price Change % | -9.0% | 7.000000000000001% | -11.0% | -1.0% |

Market Performance of Alarum Technologies’s Stock

Shares of Alarum Technologies were trading at $13.29 as of November 19. Over the last 52-week period, shares are up 143.85%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Opinions on Alarum Technologies

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Alarum Technologies.

Analysts have given Alarum Technologies a total of 1 ratings, with the consensus rating being Buy. The average one-year price target is $28.0, indicating a potential 110.68% upside.

Understanding Analyst Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Duos Technologies Group, Silvaco Group and Telos, three key industry players, offering insights into their relative performance expectations and market positioning.

- Duos Technologies Group received a Buy consensus from analysts, with an average 1-year price target of $8.0, implying a potential 39.8% downside.

- As per analysts’ assessments, Silvaco Group is favoring an Buy trajectory, with an average 1-year price target of $20.71, suggesting a potential 55.83% upside.

- The consensus outlook from analysts is an Buy trajectory for Telos, with an average 1-year price target of $4.75, indicating a potential 64.26% downside.

Snapshot: Peer Analysis

The peer analysis summary provides a snapshot of key metrics for Duos Technologies Group, Silvaco Group and Telos, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Alarum Technologies | Buy | 27.19% | $6.83M | -1.87% |

| Duos Technologies Group | Buy | 111.57% | $919.10K | -52.24% |

| Silvaco Group | Buy | -26.58% | $8.19M | -6.53% |

| Telos | Buy | -34.28% | $3.14M | -20.14% |

Key Takeaway:

Alarum Technologies ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit and Return on Equity.

Discovering Alarum Technologies: A Closer Look

Alarum Technologies Ltd is a company engaged in the information security business. The company has two Internet access segments which include Enterprise Internet Access and Consumer Internet Access. Its Enterprise Internet Access offers web data collection and a private Internet browsing platform and Consumer Internet Access provides solutions for secure and private Internet browsing. Geographically, the company has a presence in the UK Virgin Islands, Israel, Europe, APAC, MEA, Hong Kong, the USA, and others, and generates a majority of its revenue from the APAC followed by the United States.

Breaking Down Alarum Technologies’s Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Alarum Technologies displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 27.19%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Alarum Technologies’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive -3.95% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Alarum Technologies’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of -1.87%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of -1.22%, the company showcases effective utilization of assets.

Debt Management: Alarum Technologies’s debt-to-equity ratio is below the industry average. With a ratio of 0.09, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Alarum Technologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dollar Hits 2-Year High As European Recession Fears Hammer Euro, Pound

The U.S. dollar surged to its highest level in over two years against a basket of currencies on Friday, extending its rally to an eighth consecutive week — the longest winning streak in 14 months.

A wave of weaker-than-expected business activity data from Europe has weighed heavily on the euro and the British pound, as investors brace for faster rate cuts by the European Central Bank (ECB) and the Bank of England (BoE).

Eurozone PMI Dives Into Contraction

In November, private-sector activity in the eurozone unexpectedly contracted, triggering fresh concerns about the region’s economic outlook.

The Composite Purchasing Managers’ Index (PMI), compiled by S&P Global, fell to 48.1, well below the neutral 50 threshold and missing forecasts for an unchanged reading. This marks the first contraction in eurozone business activity since January.

The downturn was driven by a drop in new orders, higher input prices, and escalating political uncertainty.

Chris Williamson, chief business economist at S&P Global, commented: “The flash PMI survey data for November showed the eurozone economy falling back into contraction, as malaise spread from the struggling manufacturing sector to the larger services economy.”

UK Economy Also Contracts

Across the Channel, the UK also delivered a disappointing PMI reading. The Composite PMI fell to 49.9, a drop from the previous month’s 51.8, and below market expectations of 51.7.

This marks the first contraction in UK private-sector activity since October 2023.

“The November PMI is indicative of the economy slipping into a modest decline, with GDP dropping at a 0.1% quarterly rate, but the loss of confidence hints at worse to come – including further job losses -unless sentiment revives,” Williamson said.

Dollar Index Climbs as Euro, Pound Tumble

The U.S. Dollar Index (DXY), a key measure of the greenback’s performance which is closely tracked by the Invesco DB USD Index Bullish Fund ETF UUP, climbed above 107 — a level last seen on Nov. 18, 2022.

The euro plunged to 1.04 against the dollar, its lowest level in two years. The pound fell to 1.25, on track for its eighth straight weekly loss — the longest losing streak since 1980.

On Friday, S&P Global will release flash PMI data for the U.S. economy at 9.45 a.m. ET. Economists predict the Services PMI to edge higher from 55 to 55.2 in November, which would mark the strongest expansion since August.

Manufacturing momentum is also expected to improve from 48.5 to 48.8, albeit remaining in contractionary territory.

Analysts: Euro Vulnerable Amid Weak Data And Geopolitical Risks

Forex analysts point to several catalysts for the euro’s sharp decline.

“The worsening of the Ukrainian crisis has opened up a phase of risk aversion, hitting the EUR and GBP,” said Luca Cigognini, a forex strategist at Intesa Sanpaolo.

Chris Turner, an analyst at ING Group, highlighted the technical significance of the euro’s drop: “Today’s release of softer-than-expected eurozone PMIs proved the catalyst for EUR/USD to break to the downside of its two-year trading range. Even though a near 7% drop in just two months is exceptionally rapid by historical standards, we remain confident in a lower EUR/USD trajectory. Support is limited, with the next key level around 1.0190/1.0200.”

BBVA analyst Alejandro Cuadrado echoed similar concerns, pointing out that additional downside pressure on the euro could arise from political instability in Germany, the outcome of the U.S. elections, and intensifying geopolitical risks.

“The tense situation in Europe could worsen in the short term, and investors are clearly taking a cautious approach on the EUR,” he said.

Cuadrado’s colleague, Michalis Onisiforou, shed light on Germany’s economic struggles: “The collapse of Germany’s coalition government and early elections mean there won’t be any immediate fiscal response to alleviate the pessimism surrounding the domestic economy. Coupled with escalating risks in the Russo-Ukrainian war, Germany faces significant headwinds.”

Read Next:

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

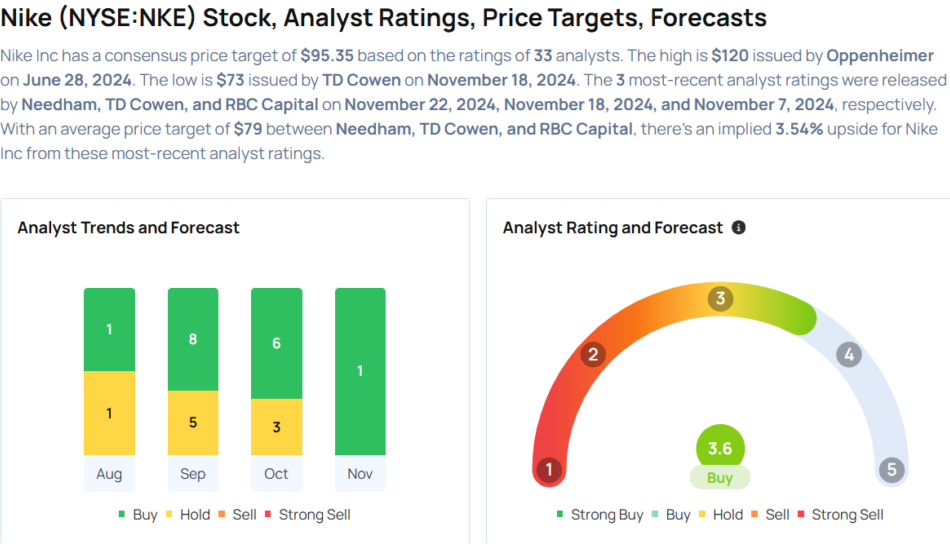

This Nike Analyst Begins Coverage On A Bullish Note; Here Are Top 5 Initiations For Friday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

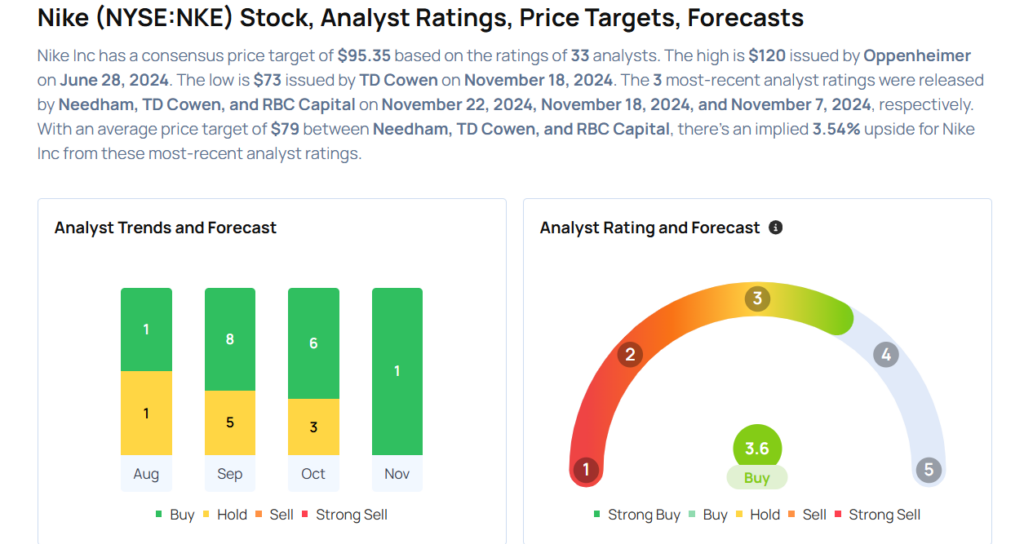

- Needham analyst Tom Nikic initiated coverage on NIKE, Inc. NKE with a Buy rating and announced a price target of $84. Nike shares closed at $75.10 on Thursday. See how other analysts view this stock.

- JP Morgan analyst Bennett Moore initiated coverage on Carpenter Technology Corporation CRS with an Overweight rating and announced a price target of $220. Carpenter Tech shares closed at $180.71 on Thursday. See how other analysts view this stock.

- B of A Securities analyst Tyler DuPont initiated coverage on Kyndryl Holdings, Inc. KD with a Buy rating and announced a price target of $40. Kyndryl shares closed at $32.49 on Thursday. See how other analysts view this stock.

- UBS analyst John Hodulik initiated coverage on Roku, Inc. ROKU with a Neutral rating and announced a price target of $73. Roku shares closed at $68.68 on Thursday. See how other analysts view this stock.

- Wells Fargo analyst Joe Quatrochi initiated coverage on Arm Holdings plc ARM with an Overweight rating and announced a price target of $155. ARM shares closed at $133.14 on Thursday. See how other analysts view this stock.

Considering buying NKE stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Buckle Q3 Earnings Assessment

Buckle BKE just disclosed its Q3 earnings on Friday, November 22, 2024 at 06:50 AM.

Here’s a brief overview of the earnings report.

Earnings

Buckle beat estimated earnings by 5.0%, reporting an EPS of $0.88 versus an estimate of $0.84.

Revenue was down $9.84 million from the same period last year.

Earnings History Overview

The company beat on EPS by $0.02 in the previous quarter, leading to a 5.0% increase share price change the next day.

Here’s a look at Buckle’s past performance:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.76 | 0.74 | 1.44 | 0.98 |

| EPS Actual | 0.78 | 0.69 | 1.59 | 1.04 |

| Revenue Estimate | 272.42M | 263.64M | 383.63M | 316.70M |

| Revenue Actual | 282.39M | 262.48M | 382.38M | 303.46M |

To track all earnings releases for Buckle visit their earnings calendar here.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer Says This Stock Is A Bitcoin Play And He Prefers To Own Bitcoin

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said MicroStrategy Incorporated MSTR is a Bitcoin play and he prefers to actually own Bitcoin BTC/USD.

MicroStrategy announced it completed its previously announced offering of its 0% convertible senior notes due 2029. MicroStrategy said the aggregate principal amount of the notes sold in the offering was $3 billion, which includes $400 million aggregate principal amount of notes issued pursuant to an option to purchase.

When asked about Oscar Health, Inc. OSCR, he said, “Until I saw that Mark Bertolini is the CEO, I didn’t really have much in store for this. But Bertolini’s a winner and a hitter.”

On Nov. 7, Oscar Health reported a quarterly loss of 22 cents per share which missed the analyst consensus estimate of a loss of 19 cents per share. The company reported quarterly sales of $2.42 billion which beat the analyst consensus estimate of $2.34 billion.

CNH Industrial N.V. CNH is a “second-rater,” Cramer said. “I want to go with best of breed, and best of breed is John Deere DE.”

On Nov. 7, CNH Industrial reported worse-than-expected third-quarter EPS results and also lowered FY24 adjusted EPS outlook.

“The former, BGS, is a total loser and has been a loser for many, many years,” Cramer said when asked about B&G Foods, Inc. BGS.

On Nov. 5, B&G Foods reported worse-than-expected third-quarter financial results and issued FY24 net sales guidance below estimates.

When asked about Rocket Lab USA, Inc. RKLB, he said, “It’s moth to flame, but I don’t know how close the moth is to the flame.”

On Nov. 19, Goldman Sachs analyst Noah Poponak maintained Rocket Lab with a Neutral and raised the price target from $5 to $12.

Price Action:

- Oscar Health shares fell 4.1% to settle at $16.31 on Thursday.

- CNH Industrial shares gained 4.6% to close at $11.92.

- Rocket Lab shares gained 11.1% to close at $22.41.

- MicroStrategy shares fell 16.2% to settle at $397.28 during the session.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Citius Pharmaceuticals, Inc. Announces 1-for-25 Reverse Stock Split

CRANFORD, N.J., Nov. 22, 2024 /PRNewswire/ — Citius Pharmaceuticals, Inc. (“Citius Pharma” or the “Company”) CTXR announced today that it will be executing a reverse stock split of its common stock, par value $0.001 per share, at a ratio of 1-for-25 (“Reverse Stock Split”). Pursuant to the laws of the State of Nevada and subject to prior approval by the Company’s Board of Directors, Citius Pharma was not required to obtain shareholder approval to effectuate the Reverse Stock Split. The Reverse Stock Split will become effective at 5:00 pm Eastern Time on November 25, 2024. The Company’s common stock will begin trading on the Nasdaq Capital Market on a split-adjusted basis beginning upon market open on November 26, 2024, under the Company’s existing trading symbol “CTXR” with the new CUSIP number 17322U306.

The Reverse Stock Split is intended to increase the per share trading price of Citius Pharma’s common stock to regain compliance with the minimum bid price requirement of $1.00 per share of common stock for continued listing on the Nasdaq Capital Market. Under Section 78.207 of the Nevada Revised Statutes, the Company may decrease its authorized shares of Common Stock and correspondingly decrease the number of issued and outstanding shares of Common Stock by resolution adopted by the Board of Directors, without obtaining the approval of the stockholders. The Reverse Stock Split was approved by the Company’s Board of Directors pursuant to the Nevada Revised Statutes and was effectuated by the filing of a Certificate of Change with office of the Nevada Secretary of State.

At the effective time of the Reverse Stock Split, every twenty-five (25) issued and outstanding shares of the Company’s common stock will be combined automatically into one (1) share of the Company’s common stock without any change in the par value per share. No fractional shares will be issued in connection with the reverse stock split, and any fractional shares resulting from the Reverse Stock Split will be rounded up to the nearest whole share at the participant level.

The reverse stock split will reduce the number of authorized shares of the Company’s common stock from 400 million shares to 16 million shares and the ownership percentage of each stockholder will remain unchanged other than as a result of the rounding of fractional shares. The Reverse Stock Split will reduce the number of issued and outstanding shares of the Company’s common stock from approximately 193 million to approximately 7.7 million.

In addition, the Reverse Stock Split will apply to the Company’s common stock issuable upon the exercise of the Company’s outstanding warrants and stock options, with proportionate adjustments to be made to the exercise prices thereof and under the Company’s equity incentive plans, as applicable.

The Company’s transfer agent, VStock Transfer LLC, will act as the exchange agent for the reverse stock split. Stockholders holding their shares in book-entry form or in “street name” through a bank, broker, or other nominee will not need to take any action in connection with the reverse stock split.

About Citius Pharmaceuticals, Inc.

Citius Pharmaceuticals, Inc. is a biopharmaceutical company dedicated to the development and commercialization of first-in-class critical care products. In August 2024, the FDA approved LYMPHIR™, a targeted immunotherapy for an initial indication in the treatment of cutaneous T-cell lymphoma. Citius Pharma’s late-stage pipeline also includes Mino-Lok®, an antibiotic lock solution to salvage catheters in patients with catheter-related bloodstream infections, and CITI-002 (Halo-Lido), a topical formulation for the relief of hemorrhoids. A Pivotal Phase 3 Trial for Mino-Lok and a Phase 2b trial for Halo-Lido were completed in 2023. Mino-Lok met primary and secondary endpoints of its Phase 3 Trial. Citius is actively engaged with the FDA to outline next steps for both programs. Citius Pharmaceuticals owns 92% of Citius Oncology. For more information, please visit www.citiuspharma.com.

Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are made based on our expectations and beliefs concerning future events impacting Citius. You can identify these statements by the fact that they use words such as “will,” “anticipate,” “estimate,” “expect,” “plan,” “should,” and “may” and other words and terms of similar meaning or use of future dates. Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition and stock price. Factors that could cause actual results to differ materially from those currently anticipated, and, unless noted otherwise, that apply to Citius Pharma and Citius Oncology, are: the potential impact of the reverse split on the bid price of the Company’s common stock; Citius Pharma’s ability to regain compliance with and continue to meet Nasdaq’s continued listing standards; our ability to raise additional money to fund our operations for at least the next 12 months as a going concern; risks relating to the results of research and development activities, including those from our existing and any new pipeline assets; risks related to research using our assets but conducted by third parties; our ability to commercialize LYMPHIR and any of our other product candidates that may be approved by the FDA; the estimated markets for our product candidates and the acceptance thereof by any market; the ability of our product candidates to impact the quality of life of our target patient populations; our dependence on third-party suppliers; our ability to procure cGMP commercial-scale supply; our ability to obtain, perform under and maintain financing and strategic agreements and relationships; uncertainties relating to preclinical and clinical testing; the early stage of products under development; market and other conditions; risks related to our growth strategy; patent and intellectual property matters; our ability to identify, acquire, close and integrate product candidates and companies successfully and on a timely basis; government regulation; competition; as well as other risks described in our SEC filings. These risks have been and may be further impacted by any future public health risks. Accordingly, these forward-looking statements do not constitute guarantees of future performance, and you are cautioned not to place undue reliance on these forward-looking statements. Risks regarding our business are described in detail in our Securities and Exchange Commission (“SEC”) filings which are available on the SEC’s website at www.sec.gov, including in Citius Pharma’s Annual Report on Form 10-K for the year ended September 30, 2023, filed with the SEC on December 29, 2023, as updated by our subsequent filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date hereof, and we expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as required by law.

Investor Relations for Citius Pharmaceuticals:

Investor Contact:

Ilanit Allen

ir@citiuspharma.com

908-967-6677 x113

Media Contact:

STiR-communications

Greg Salsburg

Greg@STiR-communications.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/citius-pharmaceuticals-inc-announces-1-for-25-reverse-stock-split-302313772.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/citius-pharmaceuticals-inc-announces-1-for-25-reverse-stock-split-302313772.html

SOURCE Citius Pharmaceuticals, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2025 US Economy Outlook 'Cloudier Than Normal,' JPMorgan Says: Boom, Bust Scenarios

The U.S. economy could face a high-stakes, casino-like scenario in 2025, with risks swinging between a potential boom fueled by tax cuts and deregulation and a possible stagflationary bust triggered by policy uncertainty and trade restrictions.

This is the core message from JPMorgan’s chief economist, Michael Feroli, who laid out a sharply divided economic outlook shaped by the red sweep in the 2024 elections and the early policy indications from the incoming Donald Trump administration.

Dueling Narratives For 2025: Economic Boom Or Stagflation

In a note shared with clients earlier this week, Feroli presented competing narratives about the direction of the U.S. economy in 2025.

“One path sees tax cuts and deregulation unleashing animal spirits, thereby boosting productivity growth and GDP,” the economist wrote.

“The other path foresees policy uncertainty hindering growth, while trade and immigration restrictions impart a stagflationary bias,” he added.

Striking a balance between two extremes, JPMorgan projects a modest slowdown in growth to 2% in 2025, accompanied by a slight uptick in unemployment to 4.5%.

Feroli highlights that the U.S. Federal Reserve’s dual mandate of maximum employment and stable inflation faces a complex road ahead.

While inflation risks have moderated compared to two years ago, core PCE (the Fed’s preferred inflation gauge) remains stubbornly high, hovering in the upper 2% range. Simultaneously, the labor market is slowing but hasn’t bottomed in a way that assures confidence in avoiding further unemployment increases.

“Next year’s outlook is cloudier than normal,” the investment bank wrote.

Policy and Tariff Risks on the Horizon

Immigration and Labor Supply

Immigration policy is expected to take center stage in 2025 under the Trump administration.

A reduction in net immigration could significantly dampen labor supply growth, employment gains, and overall GDP expansion.

JPMorgan projects that immigration restrictions will tighten labor markets, potentially curbing economic growth over the long term.

Yet, they “don’t anticipate immigration policy will have first-order effects on inflation.”

Tariffs On China And Inflation Effects

On trade policy, JPMorgan assumes a 60% across-the-board tariff on Chinese imports will likely be implemented in 2025.

Tariffs on imports from other countries are expected to remain more limited in scope, though their potential introduction could further disrupt supply chains.

Currently, U.S. tariffs on Chinese goods stand at 11%. A steep increase to 60% would represent a dramatic escalation and could significantly strain the U.S.-China trade relationship.

While the broader economic impact is still uncertain, Feroli warns of inflationary pressures arising from such protectionist measures.

“Based on the volume of trade, the U.S. would be levying $215bn in taxes on Chinese imports and China would be levying just over $70bn in taxes on US exports,” he stated.

JPMorgan anticipates further progress toward the Fed’s 2% inflation target in 2025.

However, policies proposed by President-elect Trump, particularly higher tariffs on China, pose a risk of modestly higher inflation. The most significant impact is expected midyear, as increased tariffs could temporarily lift prices.

As a result, JPMorgan forecasts core PCE inflation to run at 2.3% by the end of 2025, before gradually aligning with the Fed’s 2% target in 2026.

The Fiscal Deficit: A Growing Challenge

Fiscal policy is also under scrutiny, as the U.S. budget deficit is projected to expand significantly in the years ahead.

The Trump administration and a Republican-controlled Congress are expected to extend the 2017 Tax Cuts and Jobs Act (TCJA), whose personal income tax provisions are set to expire at the end of 2025.

“We expect essentially all the current tax code will be extended, which we project will mean a federal fiscal deficit of around 7% of GDP in 2026, at a time when we are at full employment and not directly involved in a war. The vagaries of the business cycle and geopolitics both skew risks toward a wider deficit,” Feroli said.

Read Next:

Image created using artificial intelligence via Midjourney.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.