Biosimulation Market to Hit USD 9.18 Billion by 2029 with 16.7% CAGR | MarketsandMarkets™.

Delray Beach, FL, Nov. 22, 2024 (GLOBE NEWSWIRE) — The global biosimulation market growth forecasted to transform from USD 4.24 billion in 2024 to USD 9.18 billion by 2029, driven by a CAGR of 16.7% from 2024 to 2029. The major factors driving the growth of the biosimulation market include the high rate of clinical trial failures, the growing necessity of being able to predict drug pharmacokinetics and pharmacodynamics, as well as toxicity management. According to a research article published by the National Library of Medicine in February 2022, the drug discovery and development process takes about 10-15 years for a new drug to be approved for clinical use. And 90% of the drug candidates fail during the phases I, II, and III of clinical trials and drug approvals. The possible reasons stated for the failure include lack of clinical efficacy, unmanageable toxicity, poor drug-like properties, lack of commercial needs, and poor strategic planning. The use of biosimulation helps address these challenges to increase the chances of drug approval and facilitate swift trial processes.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=838

Browse in-depth TOC on “Biosimulation Market“

153 – Tables

54 – Figures

350 – Pages

By application, the drug discovery segment is expected to capture the largest share of the biosimulation market. This large share is attributed to the rising burden of chronic and infectious diseases, coupled with technological advancements that enhance understanding of disease mechanisms. Some other drivers for the drug discovery segment include the emphasis on personalized medicine, increased investment in drug discovery, and supportive regulatory frameworks.

Pharmaceutical and biotechnology companies are expected to hold a major share of the biosimulation market by end users. Companies have been putting in much effort in new drug discovery and development, having strong candidate drugs in their pipelines. With stringent regulatory requirements, pharma and biotech companies heavily rely on biosimulation tools to support clinical trial designs and optimize therapeutic dosing. In 2023, the US FDA approved 55 novel drug therapies, while as of 2024, 36 novel drug therapies have been approved so far, reflecting the scope of the segment and its substantial large market share.

Request Sample Pages : https://www.marketsandmarkets.com/requestsampleNew.asp?id=838

The major players in the biosimulation market with a significant global presence are Certara USA. (US), Simulations Plus. (US), Dassault Systèmes (France), Schrödinger, Inc. (US), Advanced Chemistry Development, Inc. (Canada), Chemical Computing Group ULC. (Canada), Rosa & Co. LLC. (US), Genedata AG (US), Physiomics Plc (United Kingdom), In Silico Biosciences. (US), Allucent. (US), OpenEye, Cadence Molecular Sciences. (US), Cellworks Group, Inc. (US), VeriSIM Life. (US), Netabolics SRL (Italy), Charnwood Discovery (United Kingdom), The MathWorks, Inc. (US), ANSYS, Inc (US), Instem Group of Companies (United Kingdom), Insilico Medicine (US), SCM – Software Chemistry & Materials (Netherlands), BioSymetrics, Inc. (Canada), Atomwise Inc. (US), insitro. US), and Clinithink. (US). The market players have adopted strategies such as acquisitions, collaborations, partnerships, mergers, product/service launches & enhancements, and approvals to strengthen their position in the biosimulation market. The product and technology innovations have helped the market players expand globally by providing biosimulation and modeling solutions.

Certara USA.:

As a global leader in manufacturing software and services for drug discovery and development, Certara provides Model-informed Drug Development (MIDD) software solutions to support all stages of drug development, from preclinical through clinical and commercial. Its proprietary, end-to-end platform integrates generative AI technology with biosimulation, regulatory science, and market access solutions. The company boasts a strong presence in North America, Europe, and Asia Pacific. The customer base includes more than 2,400 biopharmaceutical companies, academic institutes, and regulatory agencies from 66 countries.

Dassault Systèmes:

Dassault Systèmes is a multinational software company that develops and sells 3D design software and intelligence products for modeling and simulation. The company offers a number of products and services – 3DEXCITE, 3DEXPERIENCE, 3DVIA, BIOVIA, DraftSight, CATIA, DELMIA, ENOVIA, EXALEAD, GEOVIA, NETVIBES, SIMULIA, for multiple industries, including aerospace & defence, architecture, engineering & construction, consumer goods & retail, consumer packaged goods & retail, energy, process & utilities, financial and business services, high-tech, industrial equipment, life sciences, marine & offshore, natural resources, and transportation & mobility. Dassault Systèmes operates in 140 countries with more than 194 offices across North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa, serving more than 270,000 customers.

Schrödinger:

Schrödinger is a scientific leader in developing state-of-the-art chemical simulation software for pharmaceutical and biotechnology research. It operates through two business segments: software and drug discovery. The company provides products ranging from general molecular modeling programs to a full-featured drug design software suite using ligand—and structure-based methods. Schrödinger has a geographical presence in the US, Europe, the Middle East, Africa, and Asia-Pacific.

For more information, Inquire Now!

Related Reports:

Infectious Disease Diagnostics Market

Molecular Quality Controls Market

Get access to the latest updates on Biosimulation Companies and Biosimulation Market Share

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MEDIA ADVISORY – FEDERAL GOVERNMENT TO MAKE HOUSING ANNOUNCEMENT IN WINNIPEG

WINNIPEG, MB, Nov. 21, 2024 /CNW/ – Media are invited to join Terry Duguid, Member of Parliament for Winnipeg South, Janice Lukes, City Councillor of Waverly West Ward, Josephine Hartin, Chairperson of Roseau River Anishinaabe First Nation Trust, Nigel Furgus, President & CEO of Paragon Design Build, and Dan Bockstael, Co-President, Bockstael Construction.

|

Date: |

November 22, 2024

|

|

Time: |

10:00 am CT

|

|

Location: |

26 Gaylene Place, Winnipeg, MB |

SOURCE Government of Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/21/c0306.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/21/c0306.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CIBC Asset Management announces CIBC ETF cash distributions for November 2024

TORONTO, Nov. 22, 2024 /CNW/ – CIBC CM CM – CIBC Asset Management Inc. today announced the November 2024 cash distributions for CIBC ETFs and ETF Series of the CIBC Fixed Income Pools, which distribute monthly.

Unitholders of record on November 29, 2024, will receive cash distributions payable on December 4, 2024. Details of the final “per unit” distribution amounts are as follows:

|

CIBC ETF |

Ticker |

Exchange |

Cash Distribution |

|

CIBC Active Investment Grade Corporate Bond ETF |

CACB |

TSX |

$0.077 |

|

CIBC Active Investment Grade Floating Rate Bond ETF |

CAFR |

TSX |

$0.071 |

|

CIBC Flexible Yield ETF (CAD-Hedged) |

CFLX |

TSX |

$0.078 |

|

CIBC Conservative Fixed Income Pool ETF |

CCNS |

TSX |

$0.057 |

|

CIBC Core Fixed Income Pool ETF |

CCRE |

TSX |

$0.061 |

|

CIBC Core Plus Fixed Income Pool |

CPLS |

TSX |

$0.066 |

|

CIBC Canadian Bond Index ETF |

CCBI |

TSX |

$0.044 |

|

CIBC Canadian Short Term Bond Index ETF |

CSBI |

TSX |

$0.046 |

|

CIBC Global Bond ex-Canada Index ETF (CAD-Hedged) |

CGBI |

TSX |

$0.043 |

|

CIBC Sustainable Canadian Core Plus Bond Fund |

CSCP |

NEO |

$0.068 |

|

CIBC Qx Canadian Low Volatility Dividend ETF |

CQLC |

NEO |

$0.066 |

|

CIBC Qx U.S. Low Volatility Dividend ETF |

CQLU |

NEO |

$0.039 |

|

CIBC Qx International Low Volatility Dividend ETF |

CQLI |

NEO |

$0.062 |

|

CIBC 2025 Investment Grade Bond Fund — ETF Series |

CTBA |

CBOE |

$0.030 |

|

CIBC 2026 Investment Grade Bond Fund — ETF Series |

CTBB |

CBOE |

$0.025 |

|

CIBC 2027 Investment Grade Bond Fund — ETF Series |

CTBC |

CBOE |

$0.036 |

|

CIBC 2028 Investment Grade Bond Fund — ETF Series |

CTBD |

CBOE |

$0.035 |

|

CIBC 2029 Investment Grade Bond Fund — ETF Series |

CTBE |

CBOE |

$0.047 |

|

CIBC 2030 Investment Grade Bond Fund — ETF Series |

CTBF |

CBOE |

$0.042 |

|

CIBC 2025 U.S. Investment Grade Bond Fund — ETF Series (USD)* |

CTUC.U |

CBOE |

$0.021 |

|

CIBC 2026 U.S. Investment Grade Bond Fund — ETF Series (USD)* |

CTUD.U |

CBOE |

$0.027 |

|

CIBC 2027 U.S. Investment Grade Bond Fund — ETF Series (USD)* |

CTUE.U |

CBOE |

$0.032 |

|

* Cash distribution per unit ($) amounts are USD for CTUC.U, CTUD.U, and CTUE.U |

CIBC ETFs are managed by CIBC Asset Management Inc., a subsidiary of Canadian Imperial Bank of Commerce. Commissions, management fees and expenses all may be associated with investments in exchange traded funds (ETFs). Please read the CIBC ETFs prospectus or ETF Facts document before investing. To obtain a copy, call 1-888-888-3863, ask your advisor or visit www.cibc.com/etfs. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated. CIBC ETFs are offered by registered dealers.

Morningstar® Canada Core Bond Index™, Morningstar Canada 1-5 Year Core Bond Index and Morningstar® Global ex-Canada Core Bond Hedged CAD Index™, are trademarks or service marks of Morningstar, Inc., and have been licensed for use for certain purposes by CIBC Asset Management. CIBC Canadian Bond Index ETF, CIBC Canadian Short-Term Bond Index ETF and CIBC Global Bond ex-Canada Index ETF (CAD Hedged), are not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in the CIBC Canadian Bond Index ETF, CIBC Canadian Short-Term Bond Index ETF and CIBC Global Bond ex-Canada Index ETF (CAD-Hedged).

About CIBC

CIBC is a leading North American financial institution with 14 million personal banking, business, public sector and institutional clients. Across Personal and Business Banking, Commercial Banking and Wealth Management, and Capital Markets, CIBC offers a full range of advice, solutions and services through its leading digital banking network, and locations across Canada, in the United States and around the world. Ongoing news releases and more information about CIBC can be found at https://www.cibc.com/en/about-cibc/media-centre.html.

About CIBC Asset Management

CIBC Asset Management Inc. (CAM), the asset management subsidiary of CIBC, provides a range of high-quality investment management services and solutions to retail and institutional investors. CAM’s offerings include: a comprehensive platform of mutual funds, strategic managed portfolio solutions, discretionary investment management services for high-net-worth individuals, and institutional portfolio management. CAM is one of Canada’s largest asset management firms, with over $227 billion in assets under administration as of October 2024.

SOURCE CIBC

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/22/c9666.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/22/c9666.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Laser Processing Market Insights: Technology Advancements and Growth Drivers | Exactitude Consultancy

Luton, Bedfordshire, United Kingdom, Nov. 22, 2024 (GLOBE NEWSWIRE) — Laser systems, which use electromagnetic radiation for material processing, are becoming increasingly integral in industries such as manufacturing, medical devices, and surgery. The growing demand for lasers is largely driven by their precision, efficiency, and versatility compared to traditional material processing methods like mechanical tools or electrical equipment.

Access PDF Sample Report (Including Graphs, Charts & Figures) @

https://exactitudeconsultancy.com/reports/35469/laser-processing-market/#request-a-sample

The manufacturing sector, in particular, is rapidly adopting laser technology due to its significant advantages, including:

- Precision and Accuracy: Laser systems can focus on fine details with pinpoint accuracy, reducing material waste and enabling intricate designs.

- Non-contact Process: Unlike mechanical methods, laser systems do not require physical contact with the material, leading to reduced wear and tear on tools.

- Increased Efficiency: Laser processing is faster than traditional methods, improving production rates while maintaining high quality.

- Minimal Heat-Affected Zone: The small thermal impact during laser processing reduces the risk of material damage, making it ideal for delicate or high-precision tasks.

Applications of lasers are broad and encompass cutting, engraving, welding, drilling, marking, and micro-machining, among others. These systems offer precision far beyond what conventional tools such as saws or drill bits can achieve, allowing for more detailed and complex designs.

In sectors like sculpture creation, trophy design, and prototyping, laser technology has replaced traditional, labor-intensive methods. This transition has not only improved precision and productivity but also lowered costs by reducing the need for skilled labor and shortening production timelines.

The global market for laser systems is expected to expand significantly, driven by advancements in nanofabrication technology and the increasing adoption of lasers in industries such as automotive manufacturing, electronics, and healthcare. Additionally, lasers are becoming more prevalent in medical devices, with applications ranging from surgical tools to diagnostic instruments, contributing to overall market growth.

In 2023, the fiber lasers segment dominated the laser processing market, accounting for a significant share. Fiber lasers, a type of solid-state laser, are known for their high power output, energy density, and superior reliability. These lasers are widely used in applications such as cutting, welding, engraving, and marking, particularly for materials requiring high precision. Their compact design, energy efficiency, and adaptability make them ideal for integration into automated manufacturing systems. As advancements in fiber laser technology continue, these systems are also gaining traction in fields like additive manufacturing and microprocessing, further enhancing their market presence.

The hybrid configuration segment is expected to hold the largest market share during the forecast period. Hybrid systems combine laser technology with other complementary manufacturing techniques, such as milling, drilling, and waterjet cutting, to improve processing efficiency. Unlike traditional moving beam systems, hybrid configurations offer a constant beam delivery path length, which simplifies the beam delivery system and enhances overall system performance. This integration of multiple processes into a single system provides significant advantages in terms of flexibility, speed, and precision, contributing to the growing adoption of hybrid solutions across industries.

In terms of application, the marking and engraving segment is expected to experience the highest compound annual growth rate (CAGR) during the forecast period. Lasers are increasingly used in marking and engraving due to their flexibility, high precision, and maintenance-free operation. These features make lasers an attractive option for various end-user industries, including electronics, medical devices, aerospace, automotive, consumer products, gifts and trophies, and food and beverage. The ability to apply intricate designs and personalized markings efficiently and cost-effectively is driving the demand for laser-based marking and engraving solutions.

Asia Pacific Laser Processing Market Size and Growth 2024 to 2031

The Asia Pacific region is projected to dominate the laser processing market, holding more than 40% of the global revenue share in 2023, with substantial growth expected over the next decade. China, in particular, is anticipated to emerge as a leading consumer of industrial lasers, materials processing, and micro-processing systems. The rapid expansion of original equipment manufacturers (OEMs) in countries like India, South Korea, Japan, and China, along with the growth of the automotive industry, are key drivers of this regional market surge. Additionally, the increasing adoption of laser systems across various applications, coupled with government regulations mandating permanent, clear markings on consumer products, is expected to further boost demand for laser processing technologies.

Europe is anticipated to be the fastest-growing market in the laser processing sector, driven primarily by the increasing use of lasers in medical devices and applications. The rapid advancement of nanofabrication technology is expected to continue aiding the expansion of the laser market. Furthermore, the manufacturing industry’s growing preference for laser technologies over traditional material processing methods, owing to the former’s superior precision, speed, and versatility, will contribute to sustained market growth. Regulatory frameworks governing laser use in product marking and engraving will further drive demand across various industries.

The automotive sector is one of the key industries fueling the growth of laser processing. With the increasing demand for high-power carbon dioxide lasers in the manipulation of automotive components, laser technology is becoming integral at every stage of the car manufacturing process. For example, major automobile manufacturers such as Volkswagen employ hundreds of high-power lasers across their global assembly plants. The shift from traditional methods like resistance spot welding to laser-welded sheet assemblies is expected to be a key market driver, as laser processing offers faster, more efficient, and more precise results.

Laser processing offers numerous advantages over traditional material processing methods. These include high precision, no wear and tear on the laser beam, and the ability to produce distortion-free cuts. The precision of laser cutting is particularly beneficial as the demand for miniaturization in microelectronics grows. Laser welding also offers higher weld strength due to its thin, deep penetration and excellent depth-to-width ratio. As these advantages continue to be recognized, the adoption of laser processing in various industries, including electronics, automotive, and manufacturing, is expected to rise significantly during the forecast period.

Report Link Click Here:

https://exactitudeconsultancy.com/reports/35469/laser-processing-market/

Laser Processing Market Companies

- Alpha Nov laser

- Coherent Inc.

- IPG Photonics Corporation

- Altec GmbH

- Universal Laser Systems, Inc.

- Xenetech Global Inc

- Newport Corporation

- Amada Co., Ltd.

- Bystronic Laser AG

- Epilog Laser, Inc.

- Eurolaser GmbH

- Han’s Laser Technology Industry Group Co., Ltd.

- IPG Photonics Corporation

- Newport Corporation (MKS Instruments, Inc.)

- LaserStar Technologies Corporation

- Trumpf GmbH + Co. KG

Recent Developments:

- TRUMPF and ZEISS Collaboration (January 2024): A partnership between TRUMPF, ASML, and ZEISS resulted in the creation of a CO₂ laser system with a peak power exceeding 120 kW. This laser system is capable of processing more than 100 substrates per hour, marking a significant advancement in industrial and scientific applications

- A.R.C. Laser’s Precision Advancements (February 2024): A.R.C. Laser GmbH introduced new precision laser technologies in the medical sector, aiming to redefine accuracy in diagnostics and therapeutic treatments. These systems focus on non-invasive techniques, which reduce recovery times

- LightWELD XR by IPG Photonics (February 2024): IPG Photonics released the LightWELD XR handheld laser welding and cleaning system, offering improved energy efficiency and enhanced material handling capabilities. The new system provides superior welding precision, broadening its use across industrial applications

- EU-Funded Laser Research Facilities (March 2024): The European Union announced the funding of three large laser research facilities, designed to advance laser technologies in particle acceleration, drug discovery, and scientific research. These facilities are expected to support the development of high-power laser systems

- Laser Induced Damage Threshold (LIDT) Research by LASEROPTIK GmbH (March 2024): LASEROPTIK GmbH, in collaboration with ELI-ERIC, developed new methods to improve the LIDT of laser optics. This research is crucial for enhancing the durability of optical components in high-power systems used in scientific and industrial settings

Segments Covered in the Report

By Product

By Process

- Material Processing

- Marking & Engraving

- Micro-processing

By Application

- Automotive

- Aerospace

- Machine Tools

- Electronics and Microelectronics

- Medical

- Packaging

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample PDF Brochure: https://exactitudeconsultancy.com/reports/35469/laser-processing-market/#request-a-sample

Related Reports:

Power Semiconductor Market

https://exactitudeconsultancy.com/reports/22072/power-semiconductor-market/

The power semiconductor market is expected to grow at 6.30% CAGR from 2022 to 2029. It is expected to reach above USD 97.33 billion by 2029 from USD 59.7 billion in 2020.

Voice Over WLAN Market

https://exactitudeconsultancy.com/reports/22399/voice-over-wlan-market/

The global Voice-Over WLAN Market is projected to reach USD 70.21 billion by 2029 from USD 26.04 billion in 2020, at a CAGR of 12.3 % from 2022 to 2029.

Fiber Optic Cable Market

https://exactitudeconsultancy.com/reports/10696/fiber-optic-cable-market/

The global fiber optic cable market is expected to grow at 14% CAGR from 2022 to 2029. It is expected to reach above USD 30.05 billion by 2029 from USD 9.24 billion in 2020.

Plastic Decking Market

https://exactitudeconsultancy.com/reports/18825/plastic-decking-market/

The plastic decking market is expected to grow at 11% CAGR from 2022 to 2029. It is expected to reach above USD 10.85 Billion by 2029 from USD 4.24 Billion in 2020.

Aircraft Sensors Market

https://exactitudeconsultancy.com/reports/4648/aircraft-sensors-market/

The global aircraft sensors market size is expected to grow at 5.5% CAGR from 2022 to 2029. It is expected to reach above USD 6.8 billion by 2029 from USD 4.2 billion in 2020.

Next Generation Packaging Market

https://exactitudeconsultancy.com/reports/13832/next-generation-packaging-market/

The global Next-generation packaging market is expected to grow at 6.1 % CAGR from 2020 to 2029. It is expected to reach above USD 77.08 million by 2029 from USD 45.24 million in 2020.

Flat Panel Display Market

https://exactitudeconsultancy.com/reports/10947/flat-panel-displays-market/

The global flat panel display market is expected to grow at 4.4% CAGR from 2020 to 2029. It is expected to reach above USD 0.40 billion by 2029 from USD 0.27 billion in 2020.

Embedded Die Cutting Market

https://exactitudeconsultancy.com/reports/3581/embedded-die-cutting-market/

The global embedded die-cutting market is expected to grow at 23.4% CAGR from 2020 to 2029. It is expected to reach above USD 315.18 million by 2029 from USD 64.8 million in 2020.

Silicon Carbide (SiC) Market

https://exactitudeconsultancy.com/reports/2786/silicon-carbide-sic-market/

The global silicon carbide (SiC) market is expected to grow at 7% CAGR from 2022 to 2029. It is expected to reach above USD 787.44 million by 2029 from USD 428.31 million in 2020.

Automatic Rebar Tying Machine Market

https://exactitudeconsultancy.com/reports/937/automatic-rebar-tying-machine-market/

The Global Automatic Rebar Tying Machine Market is expected to grow at more than 5.8% CAGR from 2019 to 2028. It is expected to reach above USD 134 million by 2028 from a little above USD 88 million in 2019.

Flexible Electronics & Circuit Market

https://exactitudeconsultancy.com/reports/21703/flexible-electronics-and-circuit-market-growth/

The global Flexible Electronics & Circuit market is expected to grow at a 7.5% CAGR from 2022 to 2029, from USD 28.84 billion in 2020.

Semiconductor CVD Equipment Market

https://exactitudeconsultancy.com/reports/21279/semiconductor-cvd-equipment-market/

The semiconductor CVD equipment market is expected to grow at 8.6% CAGR from 2022 to 2029. It is expected to reach above USD 23 billion by 2029 from USD 10.95 billion in 2020.

Irfan Tamboli (Head of Sales) Phone: + 1704 266 3234 Email: sales@exactitudeconsultancy.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Destination XL Group, Inc. Reports Third Quarter Financial Results

CANTON, Mass., Nov. 22, 2024 (GLOBE NEWSWIRE) — Destination XL Group, Inc. DXLG, the leading integrated-commerce specialty retailer of Big + Tall men’s clothing and shoes, today reported operating results for the third quarter of fiscal 2024, and updated sales and earnings guidance for the fiscal year.

Third Quarter Financial Highlights

- Total sales for the third quarter were $107.5 million, down 9.8% from $119.2 million in the third quarter of fiscal 2023. Comparable sales for the third quarter of fiscal 2024 decreased 11.3% as compared to the third quarter of fiscal 2023.

- Net loss for the third quarter was $(0.03) per diluted share, as compared to net income of $0.06 per diluted share in the third quarter of fiscal 2023.

- Adjusted EBITDA (a non-GAAP measure) for the third quarter was $1.0 million, or 1.0% of sales, as compared to $8.6 million, or 7.3% of sales in the third quarter of fiscal 2023.

- Total cash and investments were $43.0 million at November 2, 2024, as compared to $60.4 million at October 28, 2023, with no outstanding debt for either period.

- Repurchased 3.6 million shares of common stock for $10.2 million, or an average cost of $2.85 per share, pursuant to a $15.0 million stock repurchase program approved during the third quarter of fiscal 2024.

Management’s Comments

“DXL’s business continued to be challenged in the third quarter by consumer spending headwinds which resulted in lower traffic to our stores and lower conversion online. The consumer has been very price conscious, and our customers are gravitating toward our more moderate and entry-level price points. Despite these challenges, we have maintained our disciplined operating regimen, and we have avoided a material erosion in merchandise margin, while keeping our inventory position healthy and controlling our operating expenses,” said Harvey Kanter, President and Chief Executive Officer.

“As we head into the fourth quarter, we will remain focused on achieving profitable sales, generating free cash flow and maintaining a healthy balance sheet. While we expect that consumer spending headwinds will persist into the fourth quarter, we are optimistic. With inflation stabilizing, interest rates coming down and the election now behind us, we believe that consumer sentiment will recover over time. Until our Big + Tall consumer is ready to more actively engage with DXL, we will continue to look for opportunities to drive sales through a mix of promotional activities and limited advertising. As I provide an update on our strategic initiates, it is important to note that we are proceeding cautiously until the macroenvironment improves by pausing our brand campaign and slowing the velocity of new store openings.

Marketing & Brand Building: In the second quarter of fiscal 2024, we launched our new brand advertising campaign to build awareness of our brand. The campaign ran in a three-matched-market test in Boston, Detroit, and St. Louis and the results were positive in all three markets, with increased traffic, sessions, and customer acquisition. However, as we previously disclosed, given current market conditions, we have paused our brand campaign at this time and are instead investing our marketing dollars back into our traditional marketing channels that will be more productive, including a video campaign on various social media platforms.

Store Development: Our initiative to open new stores was driven by insights into the frustrations our customers have with limited access to our stores. Consumers told us that they do not shop with us because no store is near or convenient to them. During the third quarter, we opened two new stores for a total of four new stores year to date, with four additional stores opening in the fourth quarter. We are developing our fiscal 2025 store development schedule and are targeting 8 new store openings, down from our previous expectation of 10 new store openings.

New Website Platform: We are making significant progress in our transition to a new and improved eCommerce platform, with 100% of the site traffic now on our new platform. The platform addresses friction online and will drive a richer and simpler consumer experience, as well as drive measurably greater speed and agility. During the third quarter, we completed the second phase of this project, which included catalog pages, product detail pages, and a new site search experience. The last phase, which will improve the checkout process and other user experiences is scheduled to be completed in early 2025.

Alliances & Collaborations: In the second quarter of fiscal 2024, we launched our DXL Big + Tall merchandise assortment on Nordstrom’s digital marketplace platform and currently have 37 brands and over 1,400 styles available on the platform, with plans for an additional 500 styles in the next month. We believe this collaboration will allow us to bring the DXL experience beyond our four walls and directly to the Nordstrom customer, thereby further extending DXL’s relationship with the female consumer.”

“Pulling back on parts of our initiatives was prudent to ensure that we remain fiscally responsible with our investment spending and remain focused on near-term profitability and positive free cash flow,” Kanter concluded.

Third Quarter Results

Sales

Total sales for the third quarter of fiscal 2024 were $107.5 million, as compared to $119.2 million in the third quarter of fiscal 2023. The decrease in total sales was primarily attributable to a decrease in comparable sales for the third quarter of 11.3%, partially offset by an increase in non-comparable sales.

The comparable sales decrease of 11.3% consisted of comparable sales from our stores down 9.9% and our direct business down 14.7%. This third quarter decline was consistent with the trend from the first half of fiscal 2024, with the decrease in comparable sales principally driven by a decrease in traffic in our stores and decreased conversion in our direct business. We continued to see a shift toward our private-label merchandise, as opposed to our national brands, as customers continued to be cost-conscious with their discretionary spending.

Gross Margin

For the third quarter of fiscal 2024, our gross margin rate, inclusive of occupancy costs, was 45.1% as compared to a gross margin rate of 47.5% for the third quarter of fiscal 2023.

Our gross margin rate decreased by 240 basis points, which was driven by an increase of 220 basis points in occupancy costs, as a percentage of sales, primarily due to the deleveraging of sales and increased rents as a result of lease extensions. Merchandise margin for the third quarter decreased by 20 basis points, as compared to the third quarter of fiscal 2023, primarily due to an increase in markdown activity on seasonal merchandise as well as an increase in inbound freight. These increases were partially offset by favorable outbound shipping costs, a decrease in loyalty expense and a shift in product mix. For 2024, we expect gross margin rates to be approximately 130 to 180 basis points lower than fiscal 2023 primarily related to the deleveraging of occupancy on a lower sales base.

Selling, General & Administrative

As a percentage of sales, SG&A (selling, general and administrative) expenses for the third quarter of fiscal 2024 were 44.1% as compared to 40.2% for the third quarter of fiscal 2023.

On a dollar basis, SG&A expenses decreased by $0.6 million as compared to the third quarter of fiscal 2023. The decrease was primarily due to a decrease in marketing of $1.4 million as compared to the prior year’s third quarter, partially offset by increases in healthcare costs, technology costs and professional services. On a percentage of sales basis, SG&A expenses increased due to the decrease in sales for the third quarter of fiscal 2024 as compared to the third quarter of fiscal 2023.

Marketing costs were 5.7% of sales for the third quarter of fiscal 2024 as compared to 6.3% of sales for the third quarter of fiscal 2023. For fiscal 2024, marketing costs are expected to be approximately 6.8%.

Management views SG&A expenses through two primary cost centers: Customer Facing Costs and Corporate Support Costs. Customer Facing Costs, which include store payroll, marketing and other store and direct operating costs, represented 24.2% of sales in the third quarter of fiscal 2024 as compared to 22.5% of sales in the third quarter of fiscal 2023. Corporate Support Costs, which include the distribution center and corporate overhead costs, represented 19.9% of sales in the third quarter of fiscal 2024 as compared to 17.7% of sales in the third quarter of fiscal 2023.

Interest Income, Net

Net interest income for the third quarter of fiscal 2024 was $0.6 million, which was flat as compared to the third quarter of fiscal 2023. For both periods, interest income was earned from investments in U.S. government-backed investments and money market accounts. Interest costs for both periods were minimal because we had no outstanding debt and no borrowings under our credit facility.

Income Taxes

Our tax provision for income taxes for interim periods is determined using an estimate of our annual effective tax rate, adjusted for discrete items, if any. Each quarter, we update our estimate of the annual effective tax rate and make a year-to-date adjustment to the provision.

For the third quarter of fiscal 2024, the effective tax rate was 9.2% as compared to an effective tax rate of 30.2% for the third quarter of fiscal 2023. The difference in the effective tax rate for the third quarter of fiscal 2024, as compared to the third quarter of fiscal 2023, was due to the net loss reported during the third quarter of fiscal 2024 and its impact on our estimated annual effective tax rate for fiscal 2024. For the fiscal year, we expect an increase in the effective tax rate primarily due to permanent book-to-tax differences combined with a lower pretax income as compared to fiscal 2023.

Net Income (Loss)

For the third quarter of fiscal 2024, net loss was $1.8 million, or $(0.03) per diluted share, as compared to net income for the third quarter of fiscal 2023 of $4.0 million, or $0.06 per diluted share.

Adjusted EBITDA

Adjusted EBITDA, a non-GAAP measure, for the third quarter of fiscal 2024 was $1.0 million, as compared to $8.6 million for the third quarter of fiscal 2023.

Cash Flow

Cash flow from operations for the first nine months of fiscal 2024 was $12.5 million as compared to $33.1 million for the first nine months of fiscal 2023.

Free cash flow, before capital expenditures for store development, a non-GAAP measure, was $2.5 million for the first nine months of fiscal 2024 as compared to $26.5 million for the first nine months of fiscal 2023.

Free cash flow, a non-GAAP measure, was $(7.0) million for the first nine months of fiscal 2024 as compared to $22.7 million for the first nine months of fiscal 2023. The decrease in free cash flow was primarily due to a decrease in operating income as well as increases in capital expenditures of $5.6 million for store development and other capital projects of $3.4 million.

| For the nine months ended | |||||||||

| (in millions) | November 2, 2024 | October 28, 2023 | |||||||

| Cash flow from operating activities (GAAP basis) | $ | 12.5 | $ | 33.1 | |||||

| Capital expenditures, excluding store development | (10.0 | ) | (6.6 | ) | |||||

| Free Cash Flow before capital expenditures for store development (non-GAAP basis) | $ | 2.5 | $ | 26.5 | |||||

| Capital expenditures for store development | (9.4 | ) | (3.8 | ) | |||||

| Free Cash Flow (non-GAAP basis) | $ | (7.0 | ) | $ | 22.7 | ||||

Non-GAAP Measures

Adjusted EBITDA, adjusted EBITDA margin, free cash flow before capital expenditures for store development and free cash flow are non-GAAP financial measures. Please see “Non-GAAP Measures” below and reconciliations of these non-GAAP measures to the comparable GAAP measures that follow in the tables below.

Balance Sheet & Liquidity

As of November 2, 2024, we had cash and investments of $43.0 million as compared to $60.4 million as of October 28, 2023, with no outstanding debt in either period. We did not have any borrowings under our credit facility during either period and, as of November 2, 2024, the availability under our credit facility was $78.1 million, as compared to $87.6 million as of October 28, 2023. Availability under our credit facility is primarily driven by our available inventory.

As of November 2, 2024, our inventory decreased approximately $10.7 million to $89.1 million, as compared to $99.9 million as of October 28, 2023. We continue to take proactive measures to manage our inventory and adjust our receipt plan given the ongoing macroeconomic factors affecting consumer spending. At November 2, 2024, our clearance inventory was 9.2% of our total inventory, as compared to 9.7% at October 28, 2023. Our inventory position is very strong and our clearance levels are in line with our benchmark of 10% even with the 10.7% decrease in total inventory. Our inventory turnover rate has improved by over 30% from fiscal 2019.

Stock Repurchase Program

In September 2024, our Board of Directors approved a stock repurchase program. Under the stock repurchase program, we may repurchase up to $15.0 million of our common stock, including excise tax, through open market and privately negotiated transactions. The stock repurchase program will expire on February 1, 2025. During the third quarter of fiscal 2024, we repurchased 3.6 million shares at a total cost, including fees, of $10.2 million under this stock repurchase program.

Retail Store Information

The following is a summary of our retail square footage since the end of fiscal 2021 through the end of the third quarter of fiscal 2024:

| At November 2, 2024 | Year End 2023 | Year End 2022 | Year End 2021 | |||||||||||||||||||||

| # of Stores |

Sq Ft. (000’s) |

# of Stores |

Sq Ft. (000’s) |

# of Stores |

Sq Ft. (000’s) |

# of Stores |

Sq Ft. (000’s) |

|||||||||||||||||

| DXL retail | 239 | 1,753 | 232 | 1,725 | 218 | 1,663 | 220 | 1,678 | ||||||||||||||||

| DXL outlets | 15 | 76 | 15 | 76 | 16 | 80 | 16 | 80 | ||||||||||||||||

| CMXL retail | 12 | 37 | 17 | 55 | 28 | 92 | 35 | 115 | ||||||||||||||||

| CMXL outlets | 19 | 57 | 19 | 57 | 19 | 57 | 19 | 57 | ||||||||||||||||

| Total | 285 | 1,923 | 283 | 1,913 | 281 | 1,892 | 290 | 1,930 | ||||||||||||||||

During the first nine months of fiscal 2024, we opened four new DXL stores, relocated one DXL store, converted four Casual Male XL stores to the DXL format, completed four DXL remodels, closed one Casual Male XL store and one DXL store. We expect to open four additional DXL stores, convert another Casual Male store to the DXL store format and complete one additional DXL remodel before the end of fiscal 2024. We expect our capital expenditures to range from $21.0 million to $24.0 million, net of tenant incentives, in fiscal 2024. Over the next five years, we believe we could potentially open approximately 50 net new DXL stores across the country, which could average 6,000 square feet or 300,000 sq. ft. in total, a 15% increase over our current square footage. We are currently planning to open 8 stores in fiscal 2025.

Digital Commerce Information

We distribute our national brands and own brand merchandise directly to consumers through our stores, website, app, and third-party marketplaces. Digital commerce sales, which we also refer to as direct sales, are defined as sales that originate online, whether through our website, at the store level or through a third-party marketplace. Our direct business is a critical component of our business and an area of significant growth opportunity for us. For the third quarter of fiscal 2024, our direct sales were $31.3 million, or 29.1% of retail segment sales, as compared to $36.2 million, or 30.4% of retail segment sales in the third quarter of fiscal 2023.

Financial Outlook

As a result of continuing headwinds in men’s apparel and our sales results through the first nine months of fiscal 2024, we are revising our full year guidance, with expected sales for fiscal 2024 to be at the low end of our previous guidance, which is approximately $470.0 million. We have lowered our adjusted EBITDA guidance to 4.5% from 6.0%, primarily as a result of the deleveraging of costs on the lower sales base. Sales guidance for fiscal 2024 reflects a comparable sales decrease of approximately 10%.

Conference Call

The Company will hold a conference call to review its financial results on Friday, November 22, 2024, at 9:00 a.m. ET.

To participate in the live webcast, please pre-register at: https://register.vevent.com/register/BI086e2ca09b4247779965833973a12671

Upon registering, you will be emailed a dial-in number, and unique PIN.

For listen-only, please join and register at: https://edge.media-server.com/mmc/p/x2e2arje. An archived version of the webcast may be accessed by visiting the “Events” section of the Company’s investor relations website for up to one year.

During the conference call, the Company may discuss and answer questions concerning business and financial developments and trends. The Company’s responses to questions, as well as other matters discussed during the conference call, may contain or constitute information that has not been disclosed previously.

Non-GAAP Measures

In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this press release contains non-GAAP financial measures, including adjusted EBITDA, adjusted EBITDA margin, free cash flow before capital expenditures for store development, and free cash flow. The presentation of these non-GAAP measures is not in accordance with GAAP and should not be considered superior to or as a substitute for net income (loss), net income (loss) per diluted share or cash flows from operating activities or any other measure of performance derived in accordance with GAAP. In addition, not all companies calculate non-GAAP financial measures in the same manner and, accordingly, the non-GAAP measures presented in this release may not be comparable to similar measures used by other companies. The Company believes the inclusion of these non-GAAP measures help investors gain a better understanding of the Company’s performance, especially when comparing such results to previous periods, and that they are useful as an additional means for investors to evaluate the Company’s operating results, when reviewed in conjunction with the Company’s GAAP financial statements. Reconciliations of these non-GAAP measures to their comparable GAAP measures are provided in the tables below.

Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation and amortization and adjusted for asset impairment charges (gain) and the loss from the termination of retirement plans, if any. Adjusted EBITDA margin is calculated as adjusted EBITDA divided by total sales. The Company believes that providing adjusted EBITDA and adjusted EBITDA margin is useful to investors to evaluate the Company’s performance and are key metrics to measure profitability and economic productivity.

Free cash flow is a metric that management uses to monitor liquidity. Management believes this metric is important to investors because it demonstrates the Company’s ability to strengthen liquidity while supporting its capital projects and new store development. Free cash flow is calculated as cash flow from operating activities, less capital expenditures and excludes the mandatory and discretionary repayment of debt. Free cash flow before capital expenditures for store development is calculated as cash flow from operating activities less capital expenditures other than capital expenditures for store development. Capital expenditures for store development includes capital expenditures for new stores, conversions of Casual Male XL stores to DXL and remodels. Capital expenditures related to store relocations and maintenance are not included in store development.

About Destination XL Group, Inc.

Destination XL Group, Inc. is the leading retailer of Men’s Big + Tall apparel that provides the Big + Tall man the freedom to choose his own style. Subsidiaries of Destination XL Group, Inc. operate DXL Big + Tall retail and outlet stores and Casual Male XL retail and outlet stores throughout the United States, and an e-commerce website, DXL.COM, and mobile app, which offer a multi-channel solution similar to the DXL store experience with the most extensive selection of online products available anywhere for Big + Tall men. The Company is headquartered in Canton, Massachusetts, and its common stock is listed on the Nasdaq Global Market under the symbol “DXLG.” For more information, please visit the Company’s investor relations website: https://investor.dxl.com.

Forward-Looking Statements

Certain statements and information contained in this press release constitute forward-looking statements under the federal securities laws, including statements regarding our guidance for fiscal 2024, including expected sales, gross margin rate and adjusted EBITDA margin; expected sales trends for fiscal 2024; expected marketing costs and expected capital expenditures in fiscal 2024; expected store openings and store conversions in the remainder of fiscal 2024 and fiscal 2025; our long-range strategic plan and the expected impact of our strategic initiatives on future growth, including with respect to marketing efforts and raising brand awareness, store development and future alliances and collaborations; our ability to manage inventory; expected changes in our store portfolio and long-term plans for new or relocated stores; the expected completion of our rollout of our improved eCommerce platform; and our ability to achieve profitable sales and generate free cash flow. The discussion of forward-looking information requires the management of the Company to make certain estimates and assumptions regarding the Company’s strategic direction and the effect of such plans on the Company’s financial results. The Company’s actual results and the implementation of its plans and operations may differ materially from forward-looking statements made by the Company. The Company encourages readers of forward-looking information concerning the Company to refer to its filings with the Securities and Exchange Commission, including without limitation, its Annual Report on Form 10-K filed on March 21, 2024, its Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission that set forth certain risks and uncertainties that may have an impact on future results and the direction of the Company, including risks relating to: changes in consumer spending in response to economic factors; the impact of inflation with rising costs and high interest rates; the impact of ongoing worldwide conflicts on the global economy, including the Israel-Hamas conflict and the ongoing Russian invasion of Ukraine; potential labor shortages; and the Company’s ability to execute on its marketing, digital, store and collaboration strategies, ability to grow its market share, predict customer tastes and fashion trends, forecast sales growth trends and compete successfully in the United States men’s big and tall apparel market.

Forward-looking statements contained in this press release speak only as of the date of this release. Subsequent events or circumstances occurring after such date may render these statements incomplete or out of date. The Company undertakes no obligation and expressly disclaims any duty to update such statements occurring after such date may render these statements incomplete or out of date. The Company undertakes no obligation and expressly disclaims any duty to update such statements.

| DESTINATION XL GROUP, INC. | ||||||||||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| For the three months ended | For the nine months ended | |||||||||||||||

| November 2, 2024 | October 28, 2023 | November 2, 2024 | October 28, 2023 | |||||||||||||

| Sales | $ | 107,503 | $ | 119,188 | $ | 347,812 | $ | 384,673 | ||||||||

| Cost of goods sold including occupancy | 59,064 | 62,577 | 183,520 | 196,767 | ||||||||||||

| Gross profit | 48,439 | 56,611 | 164,292 | 187,906 | ||||||||||||

| Expenses: | ||||||||||||||||

| Selling, general and administrative | 47,409 | 47,962 | 148,594 | 143,689 | ||||||||||||

| Depreciation and amortization | 3,569 | 3,393 | 10,232 | 10,338 | ||||||||||||

| Total expenses | 50,978 | 51,355 | 158,826 | 154,027 | ||||||||||||

| Operating income (loss) | (2,539 | ) | 5,256 | 5,466 | 33,879 | |||||||||||

| Loss on termination of retirement plans | — | (57 | ) | — | (4,231 | ) | ||||||||||

| Interest income, net | 552 | 564 | 1,673 | 1,408 | ||||||||||||

| Income (loss) before provision (benefit) for income taxes | (1,987 | ) | 5,763 | 7,139 | 31,056 | |||||||||||

| Provision (benefit) for income taxes | (182 | ) | 1,743 | 2,768 | 8,436 | |||||||||||

| Net income (loss) | $ | (1,805 | ) | $ | 4,020 | $ | 4,371 | $ | 22,620 | |||||||

| Net income (loss) per share: | ||||||||||||||||

| Basic | $ | (0.03 | ) | $ | 0.07 | $ | 0.08 | $ | 0.37 | |||||||

| Diluted | $ | (0.03 | ) | $ | 0.06 | $ | 0.07 | $ | 0.35 | |||||||

| Weighted-average number of common shares outstanding: | ||||||||||||||||

| Basic | 57,135 | 60,169 | 57,801 | 61,612 | ||||||||||||

| Diluted | 57,135 | 63,464 | 60,642 | 64,995 | ||||||||||||

| DESTINATION XL GROUP, INC. | |||||||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||||||||||

| November 2, 2024, February 3, 2024 and October 28, 2023 | |||||||||||

| (In thousands) | |||||||||||

| (unaudited) | |||||||||||

| November 2, | February 3, | October 28, | |||||||||

| 2024 | 2024 | 2023 | |||||||||

| ASSETS | |||||||||||

| Cash and cash equivalents | $ | 7,108 | $ | 27,590 | $ | 10,723 | |||||

| Short-term investments | 35,851 | 32,459 | 49,632 | ||||||||

| Inventories | 89,139 | 80,968 | 99,858 | ||||||||

| Other current assets | 8,159 | 12,228 | 10,287 | ||||||||

| Property and equipment, net | 51,988 | 43,238 | 38,429 | ||||||||

| Operating lease right-of-use assets | 167,814 | 138,118 | 139,907 | ||||||||

| Intangible assets | 1,150 | 1,150 | 1,150 | ||||||||

| Deferred tax assets, net of valuation allowance | 19,609 | 21,533 | 22,223 | ||||||||

| Other assets | 503 | 457 | 451 | ||||||||

| Total assets | $ | 381,321 | $ | 357,741 | $ | 372,660 | |||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Accounts payable | $ | 28,013 | $ | 17,353 | $ | 28,256 | |||||

| Accrued expenses and other liabilities | 26,728 | 36,898 | 33,297 | ||||||||

| Operating leases | 181,124 | 154,537 | 160,340 | ||||||||

| Stockholders’ equity | 145,456 | 148,953 | 150,767 | ||||||||

| Total liabilities and stockholders’ equity | $ | 381,321 | $ | 357,741 | $ | 372,660 | |||||

CERTAIN COLUMNS IN THE FOLLOWING TABLES MAY NOT FOOT DUE TO ROUNDING

| GAAP TO NON-GAAP RECONCILIATION OF ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN (unaudited) |

||||||||||||||||

| For the three months ended | For the nine months ended | |||||||||||||||

| November 2, 2024 | October 28, 2023 | November 2, 2024 | October 28, 2023 | |||||||||||||

| (in millions) | ||||||||||||||||

| Net income (loss) (GAAP basis) | $ | (1.8 | ) | $ | 4.0 | $ | 4.4 | $ | 22.6 | |||||||

| Add back: | ||||||||||||||||

| Loss on termination of retirement plans | — | 0.1 | — | 4.2 | ||||||||||||

| Provision (benefit) for income taxes | (0.2 | ) | 1.7 | 2.8 | 8.4 | |||||||||||

| Interest income, net | (0.6 | ) | (0.6 | ) | (1.7 | ) | (1.4 | ) | ||||||||

| Depreciation and amortization | 3.6 | 3.4 | 10.2 | 10.3 | ||||||||||||

| Adjusted EBITDA (non-GAAP basis) | $ | 1.0 | $ | 8.6 | $ | 15.7 | $ | 44.2 | ||||||||

| Sales | $ | 107.5 | $ | 119.2 | $ | 347.8 | $ | 384.7 | ||||||||

| Adjusted EBITDA margin (non-GAAP), as a percentage of sales | 1.0 | % | 7.3 | % | 4.5 | % | 11.5 | % | ||||||||

| GAAP TO NON-GAAP RECONCILIATION OF FREE CASH FLOW (unaudited) |

||||||||

| For the nine months ended | ||||||||

| (in millions) | November 2, 2024 | October 28, 2023 | ||||||

| Cash flow from operating activities (GAAP basis) | $ | 12.5 | $ | 33.1 | ||||

| Capital expenditures, excluding store development | (10.0 | ) | (6.6 | ) | ||||

| Free Cash Flow before capital expenditures for store development (non-GAAP basis) | $ | 2.5 | $ | 26.5 | ||||

| Capital expenditures for store development | (9.4 | ) | (3.8 | ) | ||||

| Free Cash Flow (non-GAAP basis) | $ | (7.0 | ) | $ | 22.7 | |||

| FISCAL 2024 FORECAST GAAP TO NON-GAAP ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN RECONCILIATION (unaudited) |

||||||||

| Projected | ||||||||

| Fiscal 2024 | ||||||||

| (in millions, except per share data and percentages) | per diluted share | |||||||

| Sales (low-end of guidance) | $ | 470.0 | ||||||

| Net income (GAAP basis) | 5.6 | $ | 0.09 | |||||

| Add back: | ||||||||

| Provision for income taxes | 3.4 | |||||||

| Interest income, net | (2.3 | ) | ||||||

| Depreciation and amortization | 14.5 | |||||||

| Adjusted EBITDA (non-GAAP basis) | $ | 21.2 | ||||||

| Adjusted EBITDA margin as a percentage of sales (non-GAAP basis) | 4.5 | % | ||||||

| Weighted average common shares outstanding – diluted | 60.0 | |||||||

| * forecasted weighted average common shares outstanding does not reflect share repurchase activity | ||||||||

Investor Contact:

investor.relations@dxlg.com

(603) 933-0541

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Web3 Games Are Poised to Surpass Console Gaming by 2030: What Investors Need to Know

If you are a gamer, you are probably playing on a console like X Box. Three main players – Sony Group SONY, Nintendo and Microsoft MSFT — control that market. Then there are the newcomers. They operate in the blockchain universe: the so-called Web3 games. Analysts estimate Web3 gaming’s market size at $23.9 billion, about half the size of the console gaming market.

Investors have an upside here, however. Market analysts forecast Web3 gaming compound annual growth rates (CAGR) somewhere between 18.7% to 30%. Console gaming CAGR: 4.8%.

Web3 gaming taps into the cryptocurrency, decentralized blockchain hype. That is what separates them from traditional video games. In the most bullish case, the market could hit $133 billion by 2030. Analysts expect the console gaming market size to reach around $73 billion in 2027.

These forecasts might be why Sony is building a blockchain called Soneium to support Web3 games. No word yet on rivals Microsoft and Nintendo doing the same.

“Our goal is to make Web3 games as enjoyable as the ones you play on your Xbox, but with less hassle. Browser games are more versatile; you can play them on your TV by connecting your laptop, and you can take them with you when you travel,” said Riccardo Sibani, Chief Product Officer at My Neighbor Alice, a blockchain-based game.

Web3 games are similar to traditional PC games in some ways. Some key differences are:

- Wallet Connection: Most Web3 games require a cryptocurrency wallet to play. It acts as your identity and stores any in-game assets or tokens in play-to-earn games.

- Browser-based: Many Web3 games are browser-based, allowing gamers to play directly in a web browser after connecting a wallet.

- Downloadable Clients: Complex Web3 games often require users to download a dedicated game client, similar to traditional online games. Australia-based Illuvium (ILV) is an example of this type. ILV is down considerably year-to-date.

They also differ from console games and traditional PC games as they allow for in-game transactions, which means players can buy “assets” like non-fungible tokens (NFTs). Recent market shifts destroyed these asset values from an investor standpoint.

NFT trading volumes fell by 61% from $3.1 billion to $1.2 billion dollars, based on CoinGecko data. NFT loan volumes dropped by around 74% to $284 million. The fortunes of Web3 gaming tie many NFTs to their success. This segment of the digital assets market has not recovered from its 2021 highs despite recent gains.

“A fully decentralized game, unlike console games, cannot just disappear. You keep the ownership of the items you bought, and they can be used in different games and decentralized applications,” said Sibani, comparing Web3 in-game purchases to those one makes to upgrade console games that are usually not transferable to new versions of the same game. “Some major NFT collections are usable across various games. That level of interoperability is unheard of in traditional games,” he said.

Paul Thomas, founder of the blockchain project Somnia –- a blockchain geared towards Web3 gaming and other applications — said that despite the bear market, Web3 games are getting better and the user base is growing.

“Critics say that it’s time to start giving people high-quality games they can’t put down, and games that they would play without the financial incentives in play-to-earn models,” he said. “I think those incentives should just be an added bonus, not the main reason you’re playing the game. We are seeing this shift happening already. Look at Pirate Nation (PIRATE), Parallel,or Off the Grid — they all are engaging games that have kept people hooked. They attracted players, not just cryptocurrency speculators,” he said.

Blockchain Gaming Growth Stories and Newcomers

Web3 gaming ranked fifth in the digital asset markets for venture capital raised in 2024, according to RootData.

The gaming sector has attracted some $580 million in investments, ending in the third quarter. Blockchain games have about 4.2 million daily active users as of August, according to a DappRadar report.

Gamer blockchain Ronin (RON) leads this space based on unique active wallets, thanks to super popular games like its flagship game Axie Infinity (AXS) and now Pixels.

(See Benzinga interview with Pixels founder here.)

Pixels reportedly hit over 1 million daily active users (DAUs) for the first time in May, although this number has since fallen to around 725,000 DAUs.

“I’m excited about games like Shrapnel (SHRAP), Unioverse (a first-of-its-kind composable IP-as-a-service platform), and IconX(ICNX), with their tokenized game management layer for e-sports,” said Alex Casassovici, CEO and Founder of Azarus, a San Francisco-based blockchain gaming and live streaming platform.

He also mentioned Off the Grid, which is traditionally a console and PC game made by Gunzilla Games out of Frankfurt. The third-person shooter game recently launched a Web3 version on Epic Store and hit 900,000 concurrent users.

“If they maintain that momentum, they could help bring Web3 gaming mainstream,” Casassovici said.

Gunzilla is privately held. Accredited investors can potentially invest in Gunzilla Games through platforms like EquityZen, which offers pre-IPO shares.

Web3 is a growth story.

“Gamers are everywhere. Many haven’t made the jump to Web3 gaming yet,” said Sibani.

Web3 Gaming Hype and the “Degens” that Ruin Markets

The sector is a victim of its own hype. Investors have paid the price. Timing is everything in these alt-coins, which have moved wildly thanks to what the crypto market refers to as “degens”.

The degens, or “degenerates” to put it bluntly, refers to the player or investor who speculates on blockchain-based games and platform tokens. They often invest heavily in new or unproven games and build up their hype. There’s tons of pump and dump. That trade has killed the sector as an investment theme, and made it roulette wheel.

“There is good reason for the criticism of this market. Web3 games have been built to generate yield, not fun. They attract people looking for quick gains, but then it all crashes when the hype dies down, and users disappear,” said Casassovici.

With Azarus and Stream, “It’s not about players buying from each other to pump up items,” Casassovici said. “Our Watch, Play, and Earn model is about creating value from activities people already enjoy, then sharing it with stakeholders. No wash trading; no market manipulation.”

Thomas from Somnia predicts 2025 will see Web3 games breaking out of their primarily Web3 gamer audience and will attract more of the traditional console and PC gamer.

“Web3 has a really bad rep from console and PC players, especially in the U.S.,” Thomas said. “People have a misconception that everything in Web3 is play-to-earn or is just there to exploit cryptocurrency traders. Now we are seeing a lot more games where those Web3 components are optional or hidden unless the player wants to find them. I think that this subtle introduction will work to get more gamers familiar with Web3 and realize that it’s basically just Steam (a digital distribution platform for PC games developed by Valve Corporation) with better fees and more freedom,” said Thomas. “You have major game streamers like Shroud talking about blockchain when he is playing Off the Grid,” he said. “We are seeing the changes develop.”

*The writer of this article is an investor in the Decentraland token.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

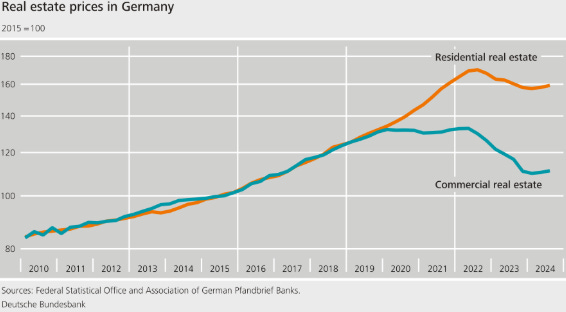

German Commercial Property Market Is 'Source Of Elevated Risk'

The Germany commercial property market “remains a source of elevated risk,” one that financial regulators are monitoring closely after a rapid succession of interest rate increases hit property values.

“The financial system is facing acute challenges due to geopolitical tensions and a weak economy,” Michael Theurer, an Executive Board member of the Deutsche Bundesbank, said on Thursday. “This is making supervisors more vigilant, particularly with regard to the commercial real estate sector.”

The European Central Bank (ECB) hiked interest rates in 2022 as the eurozone witnessed an “extraordinary surge” in inflation fueled by the energy crisis from Russia’s invasion of Ukraine. Even though the ECB began lowering rates this year, cutting from 4.5% to 3.4%, German commercial property developers remain at risk, according to the Bundesbank.

“Higher interest rates and energy prices caused a number of risks to emerge,” Theurer said. “Real estate prices fell and credit risk rose.”

The DAX subsector All Real Estate has declined to its lowest level since August 16. It traded at €159.11 at CET 11:30 today. The country’s biggest landlord by market volume, Vonovia (VNAn.DE), dropped 44% during the past three years, despite rising 16% in the past year.

German Financial System ‘Weathered’ High Rates

The German financial system has “weathered the phase of exceptionally strong rises in interest rates well overall,” he said. “The resilience of the banking system is adequate thanks to high capital reserves. Vulnerabilities are declining, but only gradually.”

But conditions in the commercial property market are influencing German open-end retail real estate funds, according to the Bundesbank.

“As a rule, such funds have high liquidity risk,” Theurer said. “Most recently they have seen net outflows, with investors anticipating higher returns on alternative investments. This could accentuate negative developments in commercial real estate.”

Given the overall risk, a package of additional capital buffers that regulators ordered banks to build up in 2022 “remains appropriate.”

German Economic ‘Malaise’ Shows No Signs Of Improving

In the meantime, Germany’s “economic malaise” showed no signs of improving, according to a survey compiled by S&P Global. The latest HCOB ‘flash’ PMI® survey showed business activity in November falling for the fifth month running and at the quickest rate since February.

The first decrease in services activity for nine months compounded a “sustained weakness in manufacturing production,” the survey said today. Weaker demand for goods and services led to further job losses during the year’s penultimate month, it said.

“Until recently, the German economy was stabilized somewhat by the service sector, which was making up for the steep decline in manufacturing,” Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said. “Not anymore,”

As a result, German gross domestic product (GDP) contracted an annual 0.3% in Q3, Federal Statistical Office (Destatis) data showed today. GDP rose quarterly by 0.1% in Q3, though growth was revised 0.1 percentage points lower from its October 30 forecast.

German Economy Hurt By Domestic Political Turmoil

While German officials regularly point to trade tensions and geopolitical risks, domestic political turmoil has weighed on economic growth. Political uncertainty since the announcement of snap elections “isn’t helping,” Rubia said.

Chancellor Olaf Scholz’s coalition government collapsed earlier this month after weeks of government squabbling about the ailing economy. Until early elections on February 23, the European nation will be politically rudderless.

Amid the weak German economy, corporate insolvencies have “risen significantly,” according to the Bundesbank. Insolvencies among trading companies are particularly high – totaling over €7 billion as of the end of June 2024.

Insolvency claims against the services sector and against the real estate activities sector are somewhat lower. They are nevertheless “substantial” at €5.5 billion and roughly €6.5 billion, respectively, according to the Bundesbank.

“The path ahead is an arduous one,” Theurer said. “Geopolitical tensions continue to harbor risks to the future stability of the financial system.”

Disclaimer

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Scinai Publishes Financial Results and Provides Business Update; Shareholders' Equity up from negative $7.3 million as of June 30, 2024, to positive $10 million

JERUSALEM, Nov. 22, 2024 /PRNewswire/ — Scinai Immunotherapeutics Ltd. SCNI (“Scinai”, or the “Company”), a biopharmaceutical company focused on developing inflammation and immunology (I&I) biological products and on providing CDMO services through its Scinai Bioservices business unit, today published its financial results for the nine months ended September 30, 2024 and provided a business update.

Business Update & Recent Highlights

Conversion of EIB Loan into Equity bringing shareholders’ equity to $10 million

On August 21, 2024, the Company announced that it had closed a Loan Restructuring Agreement, which included an amendment and restatement to the amended Finance Contract with the European Investment Bank (the “EIB”). In connection with the transaction, an amount equal to approximately EUR 26.6 million (equal to approximately $28.1 million as of November 21, 2024), including interest accrued through the closing date, owed by the Company to the EIB under the amended Finance Contract between the parties was converted into 1,000 preferred shares, no par value per share, of the Company (the “Preferred Shares”) convertible into a fixed number of ADSs, calculated at the closing date to represent 19.5% of the then fully diluted outstanding capital stock of the Company (364 thousand ADSs). The Preferred Shares do not contain any anti-dilution provisions, do not accrue dividends, and are not subject to mandatory redemption, but are redeemable at the election of the Company at a cumulative redemption value of $34 million. Under the terms of the agreement, EIB may not convert its Preferred Shares into ADSs for a period of twelve (12) months from the date of issuance of the Preferred Shares. In addition, EIB may not convert its Preferred Shares into ADSs if at the time of conversion, the aggregate number of ADSs EIB will receive or would have been entitled to receive within the twelve months prior to such conversion would exceed 4.99% of the ADSs issued and outstanding at the time of such conversion.

Following the conversion, the total outstanding amount owed by the Company to the EIB was reduced to EUR 250,000 (equal to approximately $264,000 as of November 21st, 2024). This remaining outstanding amount has a maturity date of December 31, 2031, is not prepayable in advance, and no interest accrues or is due and payable on such amount.

On August 29, 2024, the Company announced that on August 27, 2024, it had received formal notification from the Listing Qualification Department of the Nasdaq Stock Market that the Company had regained compliance with Nasdaq Listing Rule 5550(b)(1) (the “Rule”) that requires listed companies to maintain stockholders’ equity of at least $2.5 million. Regaining compliance with the Rule was facilitated by the closing of the Loan Restructuring Agreement with the EIB and the concomitant conversion of the EIB loan as described above.

CDMO business unit

Since Jan 2024, the Company has received CDMO work orders valued at approximately $600K, and the Company is in advanced contract discussions with several other potential clients. The Company’s sales guidance for 2024 is at $600,000 in expected revenues. The Company has also received $575,000 in grants from the Israeli Innovation Authority in support of its CDMO business unit creation. The Company applied for a grant extension that, if granted, would provide reimbursement for 66% of approved CDMO costs covering up to NIS 1.5 million (approximately $400,000 as of November 21, 2024) of costs. As the Company’s CDMO unit is new, and the Company is focused on rapidly growing, acquiring new clients and building its reputation and brand awareness of its CDMO services, the Company expects revenues from the CDMO business to increase materially in the coming years. This is also coupled with growing demand for boutique CDMO services from early-stage biotech companies looking for fast project onset at competitive pricing without compromising on meeting the most stringent scientific and quality standards.

In addition, in 2024 the Company has been pursuing extensive targeted marketing activities, including online advertisements, direct outreach campaigns and participation in major pharmaceutical conferences, such as BIO Europe Spring in Barcelona (March 2024), the BioMed Israel conference in Tel Aviv, Israel (May 2024), and Bio Europe in Stockholm Sweden (November 2024) at which the Company marketed its CDMO services and met with prospective clients for its CDMO business unit, potential partners for its R&D pipeline and potential investors.

The Company’s CDMO unit is currently focused both on executing drug development projects for its clients and on validating its processes and facilities as required by cGMP standards.

R&D business unit – Pipeline Development

On June 4, 2024, the Company met for a scientific advisory meeting with the Paul Erlich Institute (the PEI) of Germany, the scientific advice of which is considered acceptable guidance for IMPD filing with the European Medicines Agency (EMA) and is also considered the European comparable to a pre-IND meeting with the FDA in the U.S. Consequently, on July 23, 2024, the Company announced the receipt of positive regulatory feedback from the PEI for its drug development program towards Phase 1/2a clinical trial of its anti-IL-17A/F nanoAb (SCN-1) in Plaque Psoriasis. The Phase 1/2a study is expected to include approximately 24 plaque psoriasis patients and is expected to commence in the second half of 2025 with readout in 2026.