DEA Slammed For Unlawful Talks With Cannabis Opponents – The Plot Thickens

The Drug Enforcement Administration (DEA) is facing legal heat following accusations of unlawful communication with Smart Approaches to Marijuana (SAM), a leading opponent of the Biden administration’s plan to reschedule marijuana from Schedule I to Schedule III under the Controlled Substances Act (CSA). Now, a judge has given both DEA and SAM until November 25 to respond.

Here’s what we know.

The Facts

On November 20, DEA Administrative Law Judge (ALJ) John Mulrooney issued an order responding to a motion filed by cannabis organizations Village Farms International and Hemp for Victory. The motion disputes the DEA’s role as a “proponent” of the rescheduling rule, alleging conflicts of interest.

The motion argues that the DEA’s advocacy for the rescheduling rule violates impartiality principles:

“Not once in its history as an agency had DEA ever rejected an HHS scheduling recommendation. This time, however, DEA did not just disagree with HHS’s views, it opposed them so vehemently that the Attorney General had to refer the interagency dispute to the Office of Legal Counsel for resolution.”

As a result, Mulrooney has set a deadline for the DEA to respond by November 25, 2024. Part of the argument is that the DEA engaged in unlawful communications with the anti-cannabis group SAM, thus indicating its bias on the cannabis issue.

The plot thickened and legal tension escalated the very next day, on November 21, when Mulrooney extended the invitation for SAM to address allegations of unlawful ex parte communications with the DEA.

“As such, it is herein ORDERED, that in addition to the Government, should Smart Approaches to Marijuana (and by this order only that Designated Participant) elect to respond to the Motion it may do so no later than 2:00 P.M. Eastern Time on November 25, 2024,” stated his last order, as reported Marijuana Moment.

Read Also: DEA Is Compromised, DOJ Should Replace It In Cannabis Rescheduling, Claims Joint Motion

The Arguments And SAM’s Alleged Role

The motion, filed on November 18, claims that the DEA’s actions contradict its traditional role.

The groups argue that the DEA, which enforces controlled substances law, should not also be advocating for changes to that law.

The motion also points out that the DEA’s strong opposition to the rescheduling proposal, despite the Department of Health and Human Services (HHS) recommendation, raises concerns about the agency’s neutrality. The involvement of SAM in this process, especially regarding alleged unlawful communications, has become a key issue in the case.

That is the reason why Mulrooney has ordered both the DEA and SAM to respond to the allegations, something they have failed to do so far.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Legal And Political Implications

As the December 2, hearing approaches, the stakes in this legal battle continue to rise. The outcome could significantly affect cannabis policy in the United States. Cannabis advocates, researchers and veterans groups are calling for a fair and transparent process.

These groups have raised concerns about the list of approved participants for the hearing, pointing out that Village Farms is the only cannabis company selected by the DEA. Additionally, despite over 42,000 public comments supporting rescheduling or delisting cannabis, the DEA’s list is dominated by anti-cannabis groups.

Cover: AI Generated Image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'I Have Yet to Sell A Building Where I Didn't Regret Selling ': Families Forced To Sell NYC Icons

New York’s storied real estate dynasties are breaking a rule passed down through generations – never sell your buildings.

As the office market crumbles under the weight of remote work, New York families are forced to part with properties they’ve held for decades.

William Rudin, whose family helped shape Manhattan’s skyline, recently sold control of two financial district towers his family developed in the 1960s. “The world has changed,” Rudin, the co-executive chairman of his family’s firm, told the Wall Street Journal. “We have to take a cold hard look at our business to make sure there’s a foundation for the next generation.”

Don’t Miss:

The sales mark a shift for families that have weathered world wars, financial crashes and even a pandemic without letting go of their core assets. According to real estate investment firm Eastdil Secured, New York’s real estate families have sold about 10 office buildings in the past two years – double the number sold in the previous decade.

“Instead of 50 different aunts and uncles getting distributions, they’re getting capital calls,” Gary Phillips, an Eastdil managing director, told the WSJ, highlighting the financial strain on extended family businesses.

With a 100-year legacy in Manhattan real estate, the Kaufman family is also reluctantly selling. “We and the other families did not sell,” Jonathan Iger, CEO of Sage Realty, the Kaufman family’s management firm, said to the WSJ. “You see yourself through the dips and you come out – not just fine, but more than fine.”

Trending: Unlock the hidden potential of commercial real estate — This platform allows individuals to invest in commercial real estate offering a 12% target yield with a bonus 1% return boost today!

Some families are fighting to hold on. The Gurals recently invested fresh capital into their 60-year-old DuMont Building on Madison Avenue. “It’s called a capital call, which is the most dreaded term in our industry,” said Jeffrey Gural, chairman of GFP Real Estate.

Despite the pain, Gural remains convinced holding is the right choice. “I have yet to sell a building where I didn’t regret selling,” he said.

For the Rudins, even a $100 million renovation at 80 Pine Street couldn’t save it from the chopping block. “Even if we spent money to fix up the building, the ceilings are too low, there are a lot of columns, the floors are too big,” Rudin explained. “It became clear to us we needed to stop putting capital back into the building.”

The sales represent more than just business decisions – they’re the end of an era for families who built New York’s commercial landscape. “When I go by 80 Pine Street, I remember the good times and bad times,” Rudin reflected. “But you’ve got to move on.”

The shift might signal a broader transformation in urban real estate, as aging office towers face obsolescence in a post-pandemic world demanding modern amenities and flexible workspaces.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Blackbaud Board Member Trades Company's Stock

Making a noteworthy insider sell on November 21, Sarah Nash, Board Member at Blackbaud BLKB, is reported in the latest SEC filing.

What Happened: Nash’s decision to sell 1,600 shares of Blackbaud was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $133,542.

The latest update on Friday morning shows Blackbaud shares up by 0.01%, trading at $85.38.

Discovering Blackbaud: A Closer Look

Founded in 1981, Blackbaud provides software solutions designed to serve the “social good” community, including nonprofits, foundations, corporations, educational institutions, healthcare institutions, and individual change agents. Through M&A and organic product development efforts, the company has also moved into related areas outside core fundraising, notably into K-12 schools. The firm enables more than $100 billion in donations annually across a customer base in excess of 40,000 customers in over 100 countries.

Understanding the Numbers: Blackbaud’s Finances

Revenue Growth: Blackbaud displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 3.28%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 55.53%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Blackbaud’s EPS is below the industry average. The company faced challenges with a current EPS of 0.41. This suggests a potential decline in earnings.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.9, caution is advised due to increased financial risk.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 84.52 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 3.97 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 20.47, Blackbaud presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Understanding Crucial Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Blackbaud’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Timothy W Byrne Implements A Sell Strategy: Offloads $6.22M In United States Lime Stock

It was reported on November 21, that Timothy W Byrne, President & CEO at United States Lime USLM executed a significant insider sell, according to an SEC filing.

What Happened: Byrne opted to sell 44,215 shares of United States Lime, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The transaction’s total worth stands at $6,219,751.

Tracking the Friday’s morning session, United States Lime shares are trading at $150.9, showing a up of 0.38%.

Unveiling the Story Behind United States Lime

United States Lime & Minerals Inc is engaged in the business of manufacturing lime and limestone products including PLS, quicklime, hydrated lime, and lime slurry. It supplies its products predominantly to the construction (including highway, road, and building contractors), industrial (including paper and glass manufacturers), environmental (including municipal sanitation and water treatment facilities and flue gas treatment processes), metals (including steel producers), oil and gas services, roof shingle manufacturers and agriculture (including poultry and cattle feed producers) industries. The company operates through its Lime and Limestone Operations segment.

Understanding the Numbers: United States Lime’s Finances

Revenue Growth: United States Lime’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 19.43%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Materials sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 48.21%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): With an EPS below industry norms, United States Lime exhibits below-average bottom-line performance with a current EPS of 1.17.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.01.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: United States Lime’s current Price to Earnings (P/E) ratio of 43.68 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 14.2 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 29.56, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of United States Lime’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Core Scientific's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on Core Scientific.

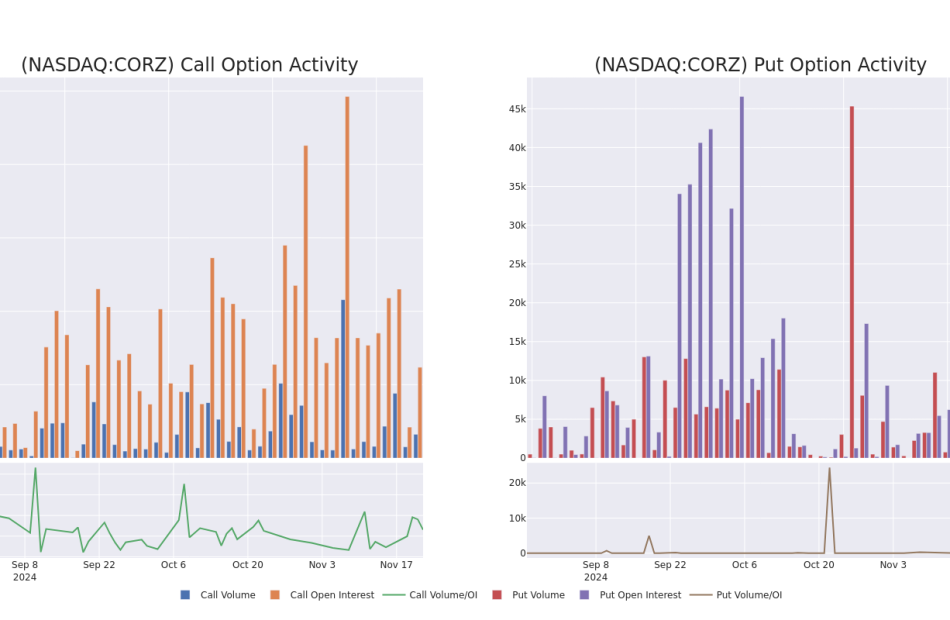

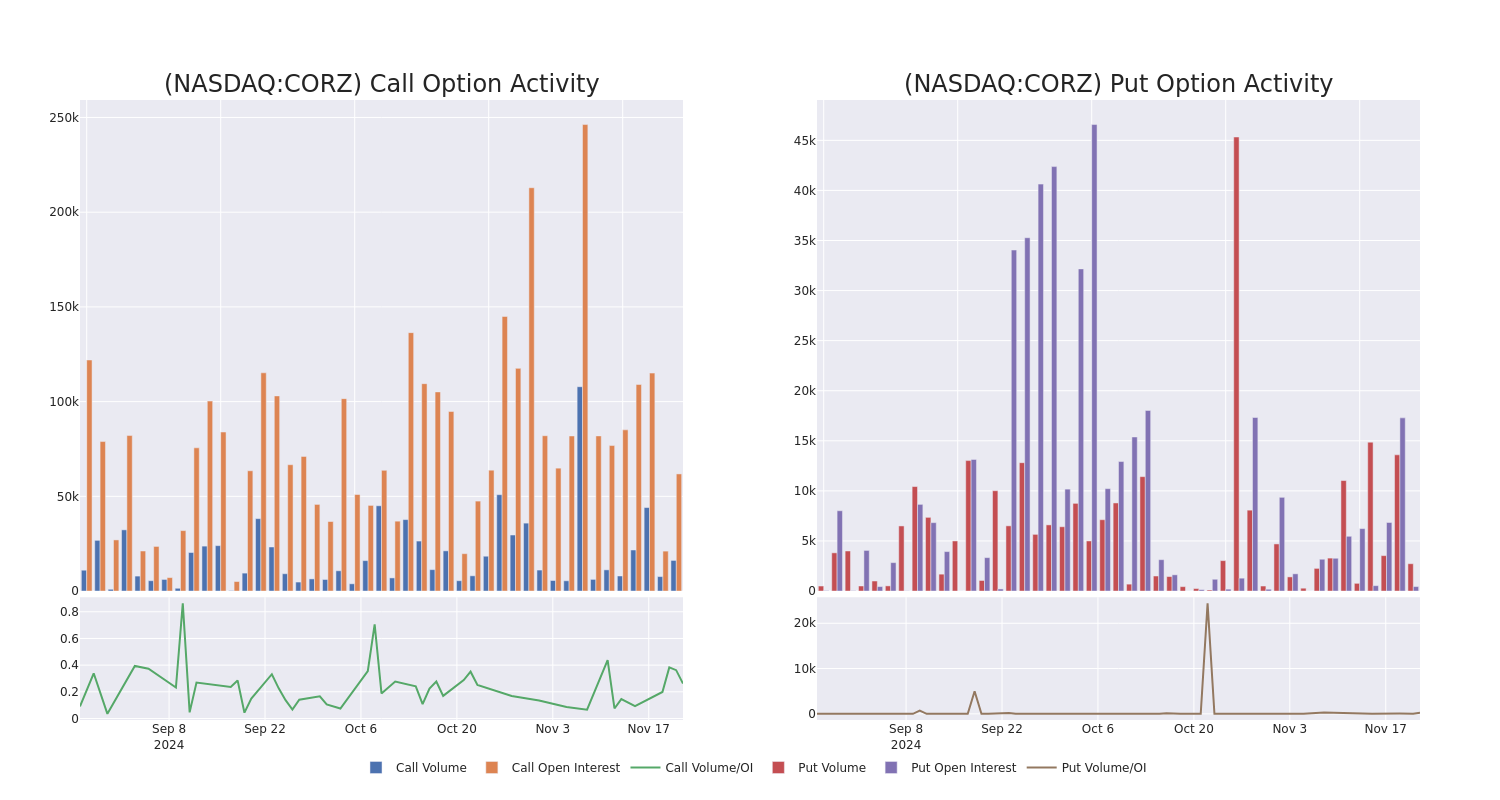

Looking at options history for Core Scientific CORZ we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 64% of the investors opened trades with bullish expectations and 28% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $201,500 and 12, calls, for a total amount of $1,064,776.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $6.0 to $22.0 for Core Scientific over the last 3 months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Core Scientific’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Core Scientific’s substantial trades, within a strike price spectrum from $6.0 to $22.0 over the preceding 30 days.

Core Scientific 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CORZ | PUT | SWEEP | BEARISH | 12/27/24 | $0.55 | $0.35 | $0.35 | $14.50 | $175.5K | 10 | 2.3K |

| CORZ | CALL | TRADE | NEUTRAL | 11/29/24 | $0.35 | $0.25 | $0.3 | $18.50 | $149.8K | 148 | 5.0K |

| CORZ | CALL | SWEEP | BULLISH | 12/20/24 | $3.5 | $3.4 | $3.4 | $14.00 | $139.7K | 26.0K | 2.0K |

| CORZ | CALL | TRADE | BEARISH | 12/20/24 | $3.5 | $3.4 | $3.4 | $14.00 | $129.8K | 26.0K | 915 |

| CORZ | CALL | SWEEP | BULLISH | 03/21/25 | $2.35 | $2.2 | $2.35 | $20.00 | $116.7K | 11.6K | 528 |

About Core Scientific

Core Scientific Inc is engaged in Blockchain and AI Infrastructure, Digital Asset Self-Mining, Premium Hosting, Blockchain Technology, and Artificial Intelligence related services. The business operates in two segments being; Equipment Sales and Hosting which consists of blockchain infrastructure, third-party hosting business and equipment sales to customers. Mining segment consists of digital asset mining for its account. The blockchain business generates revenue from the sale of consumption-based contracts and by providing hosting services. The digital asset mining segment earns revenue from operating a firm’s owned computer equipment as part of a pool of users that process transactions conducted on one or more blockchain networks. In exchange, it receives digital currency assets.

Present Market Standing of Core Scientific

- Trading volume stands at 3,607,522, with CORZ’s price down by -0.26%, positioned at $17.5.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 109 days.

Expert Opinions on Core Scientific

5 market experts have recently issued ratings for this stock, with a consensus target price of $18.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Needham continues to hold a Buy rating for Core Scientific, targeting a price of $18.

* In a cautious move, an analyst from Jefferies downgraded its rating to Buy, setting a price target of $19.

* Consistent in their evaluation, an analyst from B. Riley Securities keeps a Buy rating on Core Scientific with a target price of $17.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Core Scientific, targeting a price of $17.

* An analyst from BTIG has decided to maintain their Buy rating on Core Scientific, which currently sits at a price target of $19.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Core Scientific, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

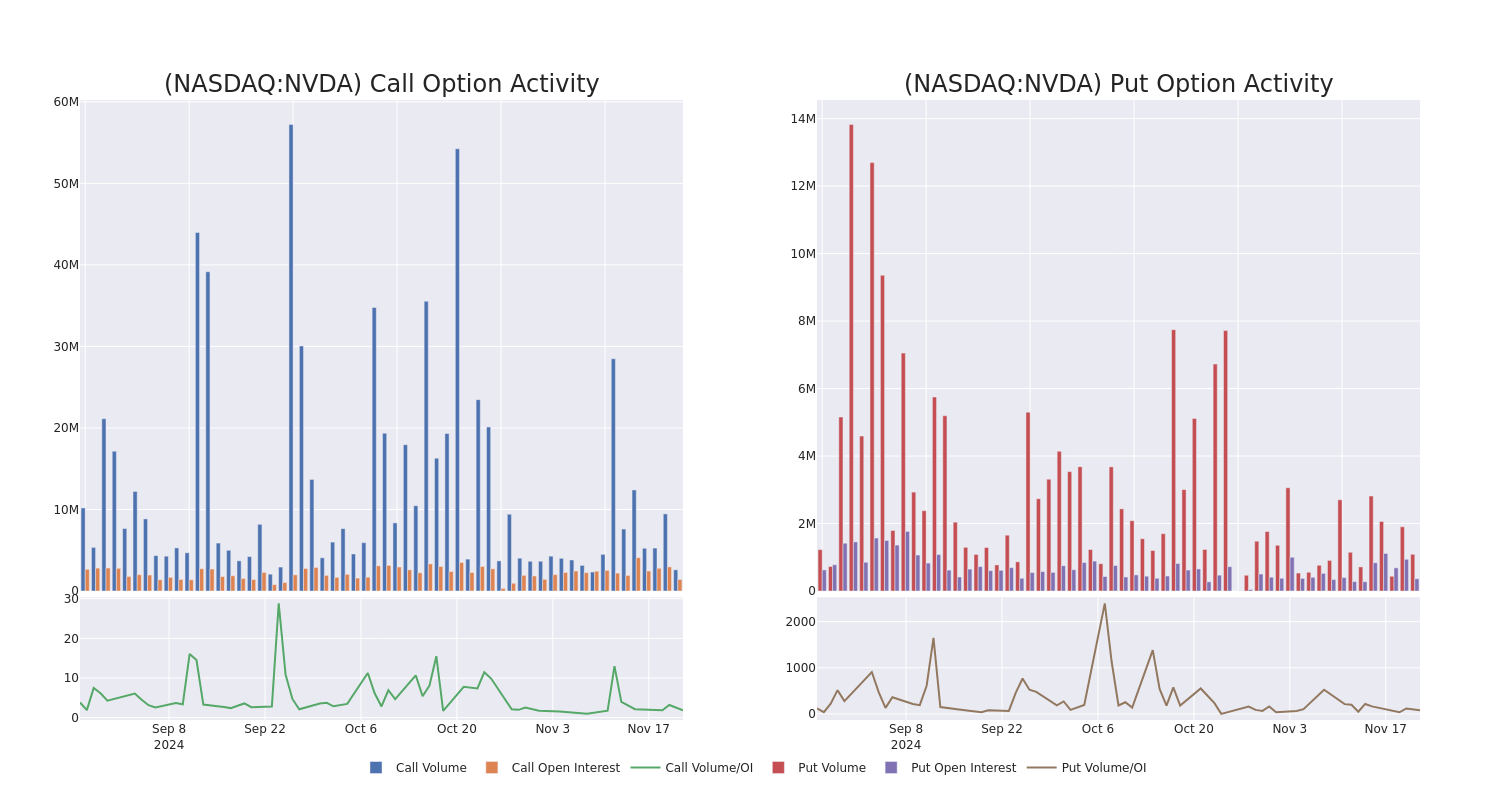

Unpacking the Latest Options Trading Trends in NVIDIA

Investors with a lot of money to spend have taken a bearish stance on NVIDIA NVDA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with NVDA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

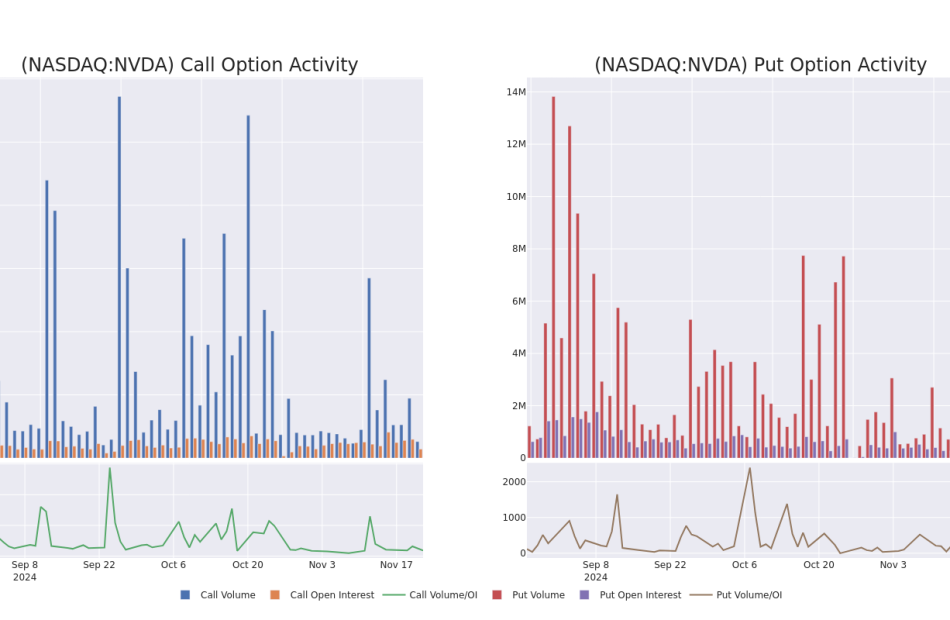

Today, Benzinga‘s options scanner spotted 213 uncommon options trades for NVIDIA.

This isn’t normal.

The overall sentiment of these big-money traders is split between 39% bullish and 51%, bearish.

Out of all of the special options we uncovered, 66 are puts, for a total amount of $3,248,837, and 147 are calls, for a total amount of $8,991,099.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $0.5 to $280.0 for NVIDIA over the last 3 months.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for NVIDIA options trades today is 21214.15 with a total volume of 3,692,097.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for NVIDIA’s big money trades within a strike price range of $0.5 to $280.0 over the last 30 days.

NVIDIA 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | NEUTRAL | 12/06/24 | $2.68 | $2.67 | $2.67 | $147.00 | $135.3K | 5.0K | 3.7K |

| NVDA | CALL | SWEEP | BEARISH | 11/29/24 | $2.75 | $2.74 | $2.75 | $143.00 | $130.3K | 18.5K | 16.0K |

| NVDA | CALL | SWEEP | BEARISH | 11/29/24 | $3.25 | $3.2 | $3.2 | $142.00 | $87.0K | 9.6K | 5.4K |

| NVDA | CALL | SWEEP | BULLISH | 12/27/24 | $4.3 | $4.25 | $4.25 | $150.00 | $86.3K | 15.7K | 3.3K |

| NVDA | CALL | SWEEP | BEARISH | 11/29/24 | $0.72 | $0.7 | $0.7 | $150.00 | $72.8K | 71.2K | 51.9K |

About NVIDIA

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

NVIDIA’s Current Market Status

- Trading volume stands at 138,074,002, with NVDA’s price down by -3.12%, positioned at $142.1.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 89 days.

Professional Analyst Ratings for NVIDIA

In the last month, 5 experts released ratings on this stock with an average target price of $177.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities has revised its rating downward to Buy, adjusting the price target to $190.

* An analyst from Mizuho persists with their Outperform rating on NVIDIA, maintaining a target price of $175.

* An analyst from Raymond James has decided to maintain their Strong Buy rating on NVIDIA, which currently sits at a price target of $170.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on NVIDIA with a target price of $175.

* Reflecting concerns, an analyst from Redburn Atlantic lowers its rating to Buy with a new price target of $178.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NVIDIA options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro stock set to notch 70% weekly gain as company hires new auditor

Super Micro Computer (SMCI) stock continued its rebound Friday, with shares on track to record a weekly gain of more than 70%.

Shares of Super Micro — the AI server maker that uses Nvidia’s (NVDA) chips and has a major deal with Elon Musk’s xAI — rose over 8% in Friday trading to roughly $32. Even with that gain, shares are still far below highs above $120 in March following SMCI’s addition to the S&P 500.

The stock’s rally kicked off Monday in anticipation of Super Micro’s submission of a compliance plan to the Nasdaq (^IXIC) as it looks to avoid delisting. Shares skyrocketed when the company officially announced it had submitted the plan as well as hired a new auditor, BDO. Super Micro’s prior accountant, Ernst & Young, resigned in late October.

Super Micro has been grappling with the fallout from an August report by short seller firm Hindenburg Research, which pointed to alleged accounting malpractices, violations of export controls, and shady relationships between top executives and Super Micro partners. Following the Hindenburg report, Super Micro delayed filing its annual 10-K and most recent quarterly 10-Q reports to the Securities and Exchange Commission, which put the company at risk of being delisted from the Nasdaq. Super Micro is also reportedly being investigated by the Department of Justice.

The deluge of bad news has sent shares tumbling over the last few months. EY’s resignation in particular, pushed Super Micro stock down more than 30% in a single day in late October. The accountant wrote in its resignation letter that it was “unwilling to be associated with the financial statements prepared by [Super Micro] management.”

Adding to its woes, Super Micro’s fiscal first quarter earnings report on Nov. 5 missed Wall Street’s expectations. As Wedbush analyst Matthew Bryson wrote in a note to investors at the time, the company blamed lighter sales on delays of Nvidia’s Blackwell AI chips and issues with its SEC filings. Bryson maintains a neutral rating on the stock and recently lowered his price target for shares to $24 from $32.

Other firms such as Barclays (BCS), Wells Fargo (WFC) and KeyBanc have suspended coverage of the stock.

Super Micro said Monday that it is on track to submit delayed filings to the SEC “and become current with its periodic reports within the discretionary period available to the Nasdaq staff to grant.”

Wedbush’s Bryson wrote in a separate note on Nov. 19 in response to Monday’s news: “We see retaining a new auditor is a significant positive step for SMCI as it resolves perhaps the most substantial concern regarding SMCI’s ability to remain listed…and creates a potential path for SMCI to file its financials and restore NASDAQ compliance.”

ROYAL CANADIAN MINT REPORTS PROFITS AND PERFORMANCE FOR Q3 2024

OTTAWA, ON, Nov. 22, 2024 /PRNewswire/ – The Royal Canadian Mint (the “Mint”) announces its financial results for the third quarter of 2024 that provide insight into its activities, the markets influencing its businesses and its expectations for the next 12 months.

“As the markets continue to change, the Mint is proving its ability to seize on new opportunities thanks to its diversified structure and flexible business strategy” said Marie Lemay, President and CEO of the Royal Canadian Mint.

The financial results should be read in conjunction with the Mint’s annual report available at www.mint.ca . All monetary amounts are expressed in Canadian dollars, unless otherwise indicated.

Financial and Operational Highlights

- The financial results for the third quarter of 2024 were ahead of target and higher than 2023 levels. Higher gold market pricing and foreign circulation volumes combined with lower fixed costs were the main drivers for the quarter over quarter increase. These increases were partially offset by lower than expected bullion volumes from the continued soft demand in the global bullion market. The Mint expects to meet its financial goals for 2024, as set out in its 2024-2028 Corporate Plan, the Mint’s Leadership team continues to actively monitor its status.

- Consolidated revenue decreased to $252.7 million in 2024 (2023 – $360.6 million).

Revenue from the Precious Metals business decreased to $217.6 million in 2024

(2023 – $328.4 million):- Gold bullion volumes decreased 38% quarter over quarter to 106.1 thousand ounces (2023 – 170.1 thousand ounces) while silver bullion volumes decreased 20% to 2.7 million ounces (2023 – 3.4 million ounces).

- Gold and silver market prices increased quarter over quarter by 27% and 23%, respectively.

- Sales of numismatic products decreased 12% quarter over quarter mainly due to the high demand in 2023 for the Queen Elizabeth II’s Reign products.

- Revenue from the Circulation business increased to $35.1 million in 2024

(2023 – $32.2 million):- Revenue from the Foreign Circulation business increased 77% quarter over quarter, a reflection of higher volumes produced and shipped in 2024 as compared to 2023.

- Revenue from Canadian coin circulation products and services decreased 12% quarter over quarter as fewer coins were required to replenish inventories, combined with lower program fees in accordance with the memorandum of understanding with the Department of Finance.

- Overall, operating expenses decreased 27% quarter over quarter to $28.3 million (2023 – $36.0 million) mainly due to planned reductions in consulting and workforce expenses.

Consolidated results and financial performance

(in millions)

|

13 weeks ended |

39 weeks ended |

|||||||||||

|

Change |

Change |

|||||||||||

|

September |

September |

$ |

% |

September |

September 30, 2023 |

$ |

% |

|||||

|

Revenue |

$ |

252.7 |

$ 360.6 |

(107.9) |

(30) |

$ 861.2 |

$ 1,841.8 |

(980.6) |

(53) |

|||

|

Profit (loss) for the period |

$ |

5.7 |

$ (5.8) |

11.5 |

(198) |

$ 24.1 |

$ 15.0 |

9.1 |

61 |

|||

|

Profit (loss) before |

$ |

1.4 |

$ (8.7) |

10.1 |

(116) |

$ 12.3 |

$ 23.4 |

(11.1) |

(47) |

|||

|

Profit (loss) before |

0.6 % |

(2.4) % |

1.4 % |

1.3 % |

||||||||

|

(1) Profit (loss) before income tax and other items is a non-GAAP financial measure. A reconciliation from profit for the period to profit before income tax and other items is included on page 13 of the Mint’s 2024 Third Quarter Report. |

|

(2) Profit (loss) before income tax and other items margin is a non-GAAP financial measure and its calculation is based on profit before income tax and other items. |

|

As at |

||||||||||

|

September 28, 2024 |

December 31, 2023 |

$ Change |

% Change |

|||||||

|

Cash |

$ |

58.4 |

$ |

59.8 |

(1.4) |

(2) |

||||

|

Inventories |

$ |

71.5 |

$ |

68.8 |

2.7 |

4 |

||||

|

Capital assets |

$ |

174.2 |

$ |

173.0 |

1.2 |

1 |

||||

|

Total assets |

$ |

376.8 |

$ |

380.4 |

(3.6) |

(1) |

||||

|

Working capital |

$ |

99.2 |

$ |

97.8 |

1.4 |

1 |

||||

As part of its enterprise risk management program, the Mint continues to actively monitor its global supply chain and logistics networks in support of its continued operations. Despite its best efforts, the Mint expects changes in the macro-economic environment and other external events around the globe to continue to impact its performance in 2024. The Mint continues to mitigate potential risks as they arise through its enterprise risk management process.

To read more of the Mint’s Third Quarter Report for 2024, please visit www.mint.ca.

About the Royal Canadian Mint

The Royal Canadian Mint is the Crown corporation responsible for the minting and distribution of Canada’s circulation coins. The Mint is one of the largest and most versatile mints in the world, producing award-winning collector coins, market-leading bullion products, as well as Canada’s prestigious military and civilian honours. As an established London and COMEX Good Delivery refiner, the Mint also offers a full spectrum of best-in-class gold and silver refining services. As an organization that strives to take better care of the environment, to cultivate safe and inclusive workplaces and to make a positive impact on the communities where it operates, the Mint integrates environmental, social and governance practices in every aspect of its operations.

For more information on the Mint, its products and services, visit www.mint.ca. Follow the Mint on LinkedIn, Facebook and Instagram.

FORWARD LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES

This Earnings Release contains non-GAAP financial measures that are clearly denoted where presented. Non-GAAP financial measures are not standardized under International Financial Reporting Standards (IFRS) and might not be comparable to similar financial measures disclosed by other corporations reporting under IFRS.

This Earnings Release contains forward-looking statements that reflect management’s expectations regarding the Mint’s objectives, plans, strategies, future growth, results of operations, performance, and business prospects and opportunities. Forward-looking statements are typically identified by words or phrases such as “plans”, “anticipates”, “expects”, “believes”, “estimates”, “intends”, and other similar expressions. These forward-looking statements are not facts, but only estimates regarding expected growth, results of operations, performance, business prospects and opportunities (assumptions). While management considers these assumptions to be reasonable based on available information, they may prove to be incorrect. These estimates of future results are subject to a number of risks, uncertainties and other factors that could cause actual results to differ materially from what the Mint expects. These risks, uncertainties and other factors include, but are not limited to, those risks and uncertainties set forth in the Risks to Performance section of the Management Discussion and Analysis in the Mint’s 2023 annual report, as well as in Note 9 – Financial Instruments and Financial Risk Management to the Mint’s Audited Consolidated Financial Statements for the year ended December 31, 2023. The forward-looking statements included in this Earnings Release are made only as of November 20, 2024 and the Mint does not undertake to publicly update these statements to reflect new information, future events or changes in circumstances or for any other reason after this date.

![]() View original content:https://www.prnewswire.com/news-releases/royal-canadian-mint-reports-profits-and-performance-for-q3-2024-302314406.html

View original content:https://www.prnewswire.com/news-releases/royal-canadian-mint-reports-profits-and-performance-for-q3-2024-302314406.html

SOURCE Royal Canadian Mint (RCM)

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Michael Gianoni Executes Sell Order: Offloads $2.37M In Blackbaud Stock

Revealing a significant insider sell on November 21, Michael Gianoni, President and CEO at Blackbaud BLKB, as per the latest SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Thursday outlined that Gianoni executed a sale of 28,571 shares of Blackbaud with a total value of $2,370,648.

Monitoring the market, Blackbaud‘s shares up by 0.01% at $85.38 during Friday’s morning.

Get to Know Blackbaud Better

Founded in 1981, Blackbaud provides software solutions designed to serve the “social good” community, including nonprofits, foundations, corporations, educational institutions, healthcare institutions, and individual change agents. Through M&A and organic product development efforts, the company has also moved into related areas outside core fundraising, notably into K-12 schools. The firm enables more than $100 billion in donations annually across a customer base in excess of 40,000 customers in over 100 countries.

Blackbaud’s Economic Impact: An Analysis

Revenue Growth: Blackbaud displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 3.28%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Interpreting Earnings Metrics:

-

Gross Margin: With a low gross margin of 55.53%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Blackbaud exhibits below-average bottom-line performance with a current EPS of 0.41.

Debt Management: Blackbaud’s debt-to-equity ratio surpasses industry norms, standing at 1.9. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: Blackbaud’s current Price to Earnings (P/E) ratio of 84.52 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 3.97 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Blackbaud’s EV/EBITDA ratio at 20.47 suggests potential undervaluation, falling below industry averages.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Important Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Blackbaud’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

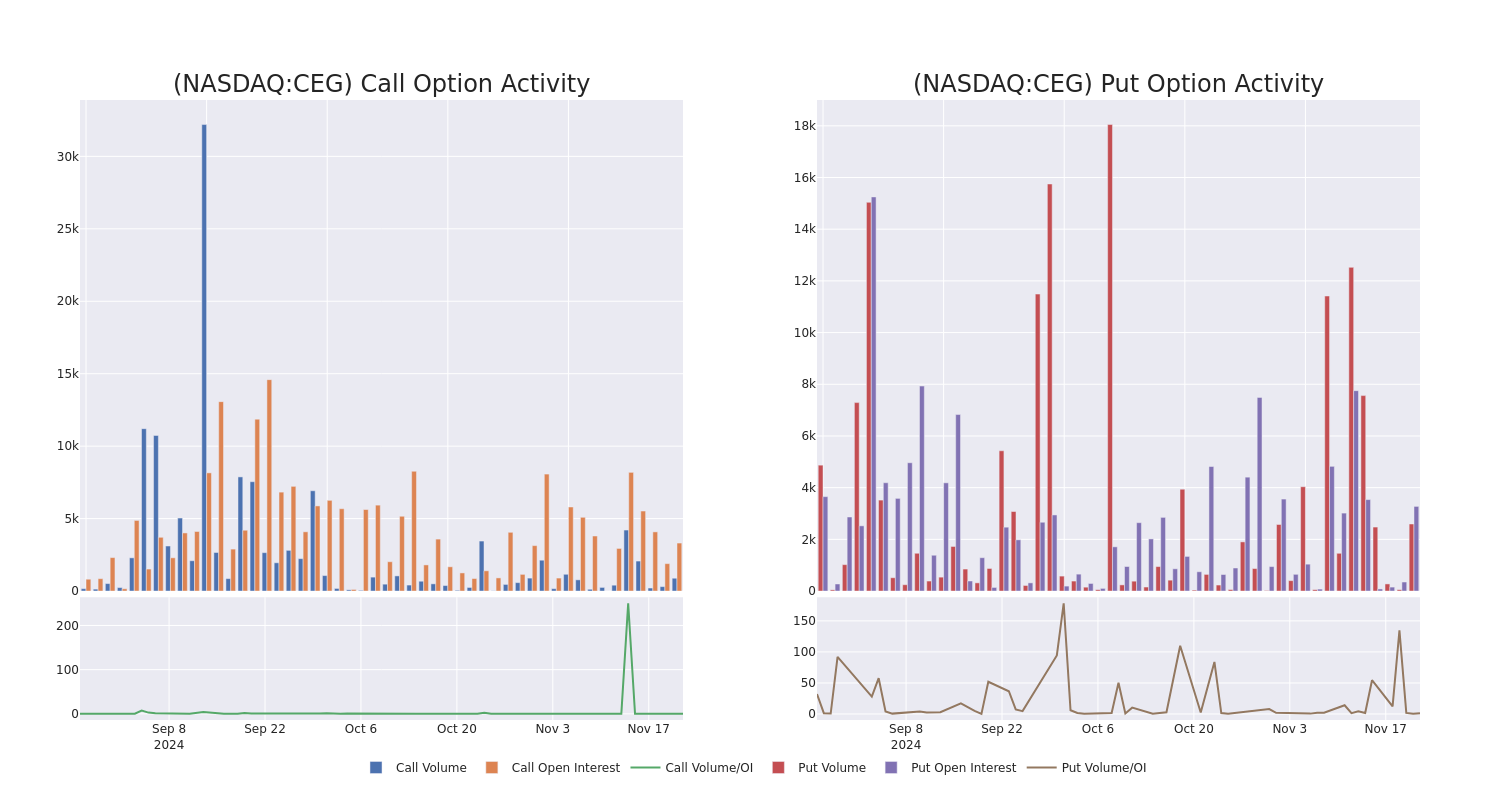

Market Whales and Their Recent Bets on CEG Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Constellation Energy.

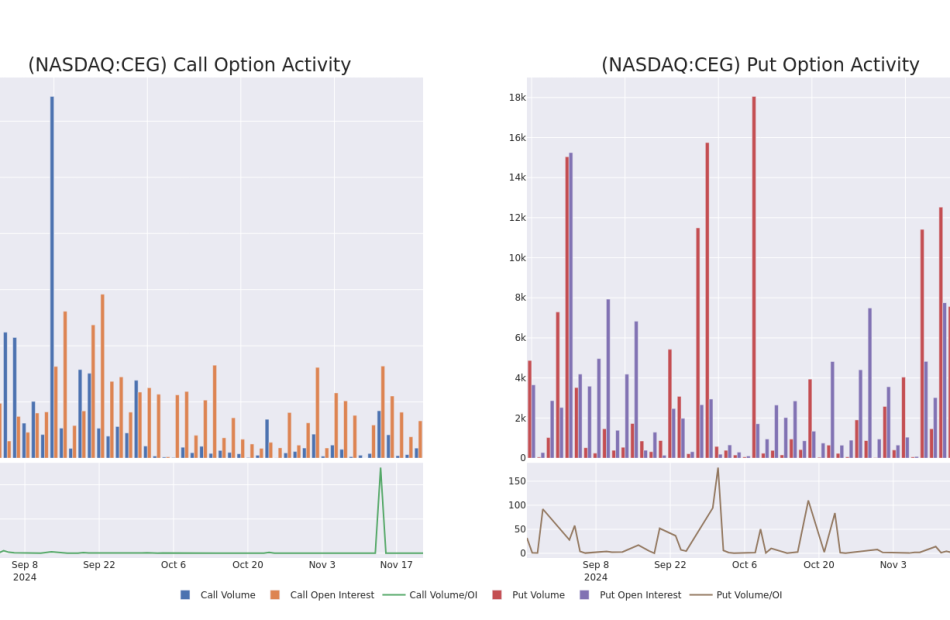

Looking at options history for Constellation Energy CEG we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 54% of the investors opened trades with bullish expectations and 36% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $899,650 and 9, calls, for a total amount of $374,012.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $270.0 for Constellation Energy during the past quarter.

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Constellation Energy’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Constellation Energy’s significant trades, within a strike price range of $100.0 to $270.0, over the past month.

Constellation Energy Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | PUT | TRADE | BULLISH | 01/17/25 | $3.1 | $2.8 | $2.8 | $210.00 | $708.4K | 3.1K | 2.5K |

| CEG | PUT | SWEEP | BEARISH | 04/17/25 | $37.5 | $37.4 | $37.5 | $270.00 | $191.2K | 95 | 60 |

| CEG | CALL | SWEEP | BEARISH | 01/17/25 | $23.4 | $21.6 | $21.96 | $240.00 | $98.8K | 1.2K | 45 |

| CEG | CALL | TRADE | BULLISH | 01/16/26 | $156.5 | $154.5 | $156.5 | $100.00 | $46.9K | 14 | 3 |

| CEG | CALL | SWEEP | BULLISH | 12/20/24 | $18.6 | $18.0 | $18.6 | $240.00 | $40.5K | 1.1K | 354 |

About Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Following our analysis of the options activities associated with Constellation Energy, we pivot to a closer look at the company’s own performance.

Where Is Constellation Energy Standing Right Now?

- With a volume of 1,059,895, the price of CEG is down -0.29% at $251.11.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 95 days.

Professional Analyst Ratings for Constellation Energy

4 market experts have recently issued ratings for this stock, with a consensus target price of $273.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from BMO Capital persists with their Outperform rating on Constellation Energy, maintaining a target price of $291.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Constellation Energy with a target price of $270.

* Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for Constellation Energy, targeting a price of $298.

* An analyst from Mizuho persists with their Neutral rating on Constellation Energy, maintaining a target price of $235.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Constellation Energy options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.