These Analysts Cut Their Forecasts On Warner Music Following Q4 Earnings

Warner Music Group Corp WMG reported downbeat fiscal fourth-quarter 2024 earnings on Thursday.

GAAP EPS of 8 cents missed the analyst consensus estimate of 27 cents. Revenue grew 2.8% year-on-year to $1.63 billion, beating the analyst consensus estimate of $1.59 billion.

Recorded Music revenue grew by 4.0% Y/Y at $1.34 billion in the quarter. Music Publishing revenue decreased by 1.0% Y/Y to $295 million. Digital revenue remained flat Y/Y at $1.07 billion.

Adjusted OIBDA increased by 11.4% compared to the previous year, reaching $353 million, and the margin improved by 170 basis points to 21.7%, driven by strong operating performance and savings from the company’s restructuring plans.

“Our performance this quarter and this year demonstrated our strength and adaptability in a thriving, fast-moving market,” said Robert Kyncl, CEO, Warner Music Group. “We continue to evolve WMG, based on the principle that simplicity and focus drive higher intensity and global impact. This is enhancing our ability to attract original artists and songwriters at all stages of their careers, helping them realize their musical visions, and grow passionate, loyal fanbases.”

Warner Music shares gained 2.7% to trade at $32.01 on Friday.

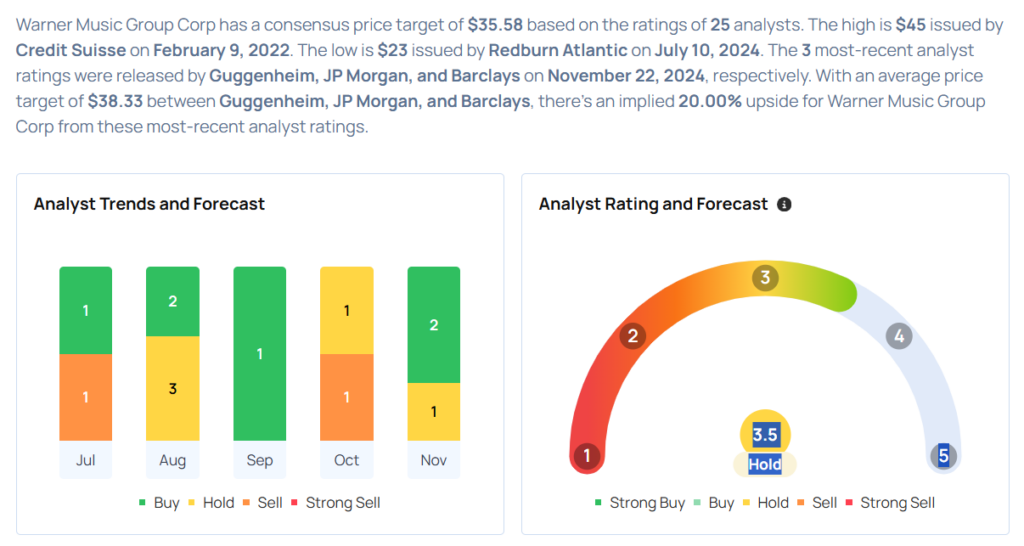

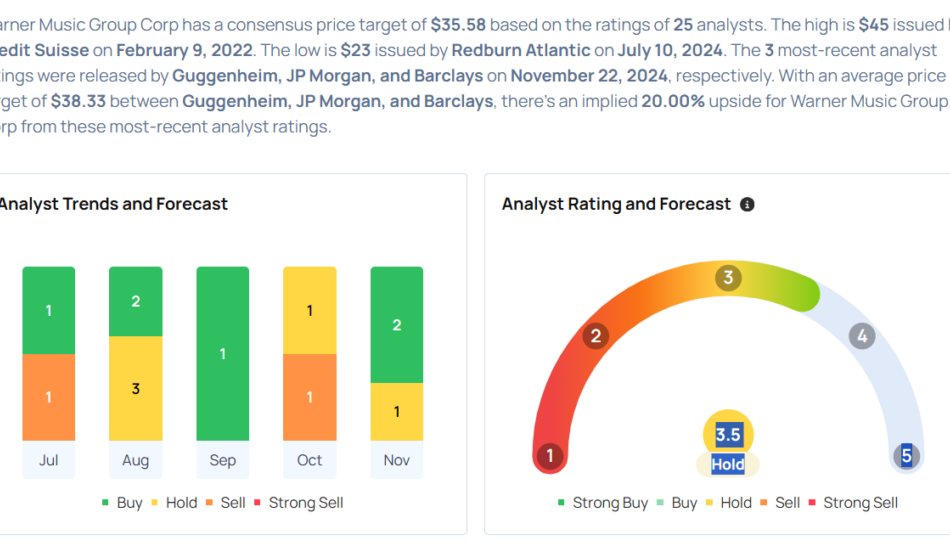

These analysts made changes to their price targets on Warner Music following earnings announcement.

- Barclays analyst Kannan Venkateshwar maintained Warner Music with an Equal-Weight rating and lowered the price target from $32 to $31.

- JP Morgan analyst David Karnovsky maintained the stock with an Overweight and lowered the price target from $41 to $40.

- Guggenheim analyst Michael Morris reiterated Warner Music with a Buy and maintained a $44 price target.

Considering buying WMG stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply