Unpacking the Latest Options Trading Trends in NVIDIA

Investors with a lot of money to spend have taken a bearish stance on NVIDIA NVDA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with NVDA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 213 uncommon options trades for NVIDIA.

This isn’t normal.

The overall sentiment of these big-money traders is split between 39% bullish and 51%, bearish.

Out of all of the special options we uncovered, 66 are puts, for a total amount of $3,248,837, and 147 are calls, for a total amount of $8,991,099.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $0.5 to $280.0 for NVIDIA over the last 3 months.

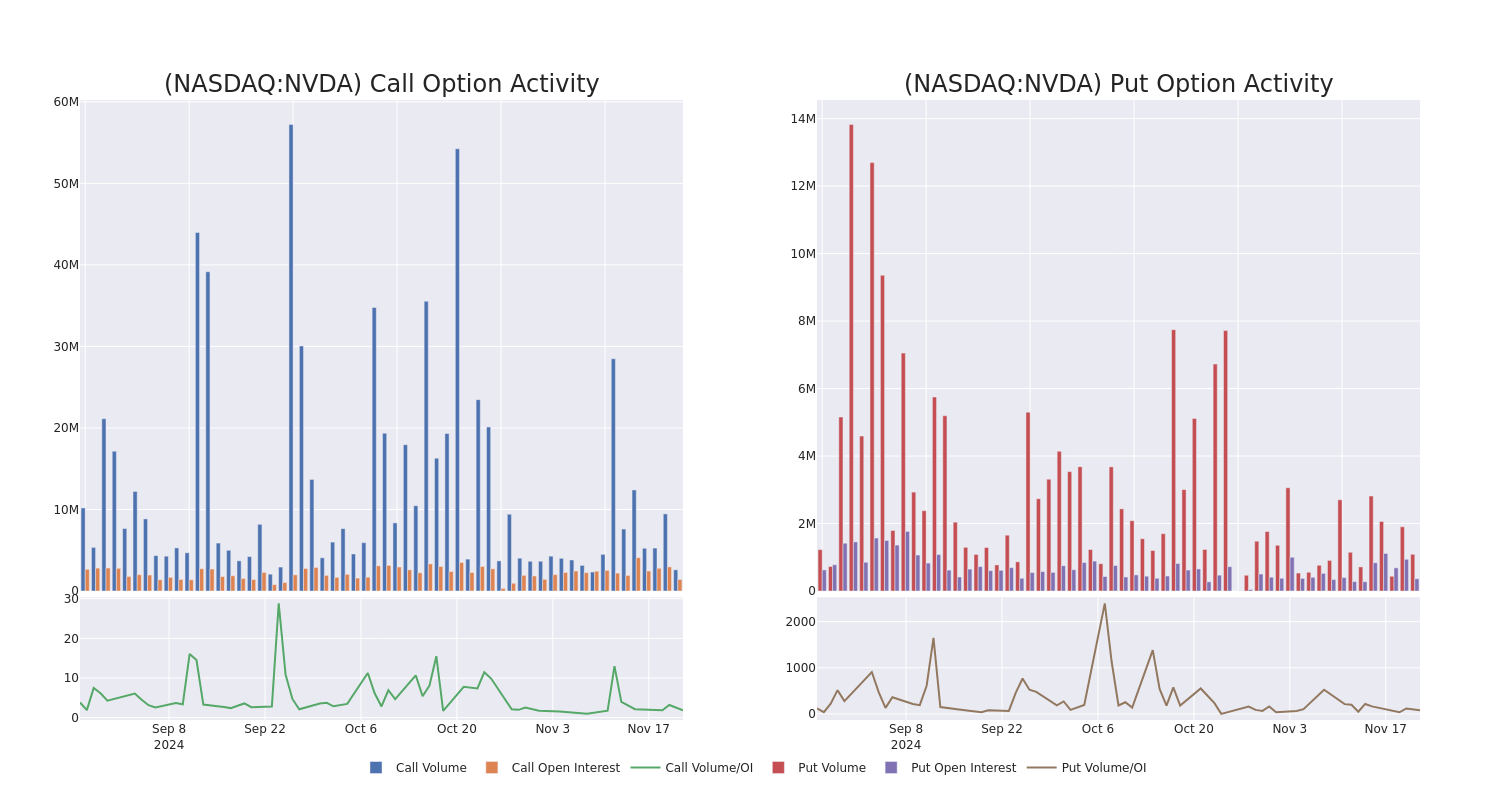

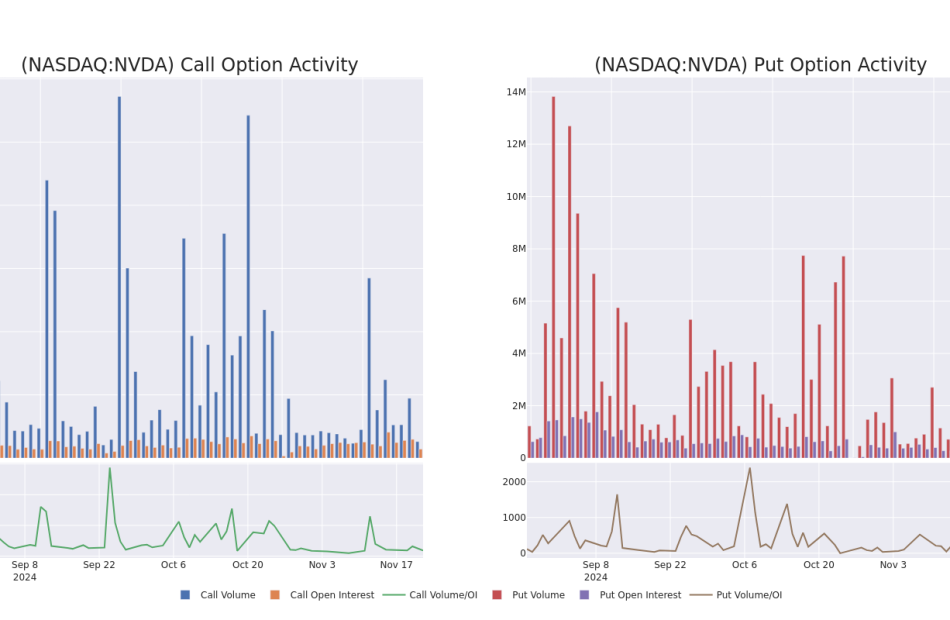

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for NVIDIA options trades today is 21214.15 with a total volume of 3,692,097.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for NVIDIA’s big money trades within a strike price range of $0.5 to $280.0 over the last 30 days.

NVIDIA 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | NEUTRAL | 12/06/24 | $2.68 | $2.67 | $2.67 | $147.00 | $135.3K | 5.0K | 3.7K |

| NVDA | CALL | SWEEP | BEARISH | 11/29/24 | $2.75 | $2.74 | $2.75 | $143.00 | $130.3K | 18.5K | 16.0K |

| NVDA | CALL | SWEEP | BEARISH | 11/29/24 | $3.25 | $3.2 | $3.2 | $142.00 | $87.0K | 9.6K | 5.4K |

| NVDA | CALL | SWEEP | BULLISH | 12/27/24 | $4.3 | $4.25 | $4.25 | $150.00 | $86.3K | 15.7K | 3.3K |

| NVDA | CALL | SWEEP | BEARISH | 11/29/24 | $0.72 | $0.7 | $0.7 | $150.00 | $72.8K | 71.2K | 51.9K |

About NVIDIA

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

NVIDIA’s Current Market Status

- Trading volume stands at 138,074,002, with NVDA’s price down by -3.12%, positioned at $142.1.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 89 days.

Professional Analyst Ratings for NVIDIA

In the last month, 5 experts released ratings on this stock with an average target price of $177.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities has revised its rating downward to Buy, adjusting the price target to $190.

* An analyst from Mizuho persists with their Outperform rating on NVIDIA, maintaining a target price of $175.

* An analyst from Raymond James has decided to maintain their Strong Buy rating on NVIDIA, which currently sits at a price target of $170.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on NVIDIA with a target price of $175.

* Reflecting concerns, an analyst from Redburn Atlantic lowers its rating to Buy with a new price target of $178.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NVIDIA options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply