What's Next: Agilent Technologies's Earnings Preview

Agilent Technologies A is preparing to release its quarterly earnings on Monday, 2024-11-25. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Agilent Technologies to report an earnings per share (EPS) of $1.40.

Investors in Agilent Technologies are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

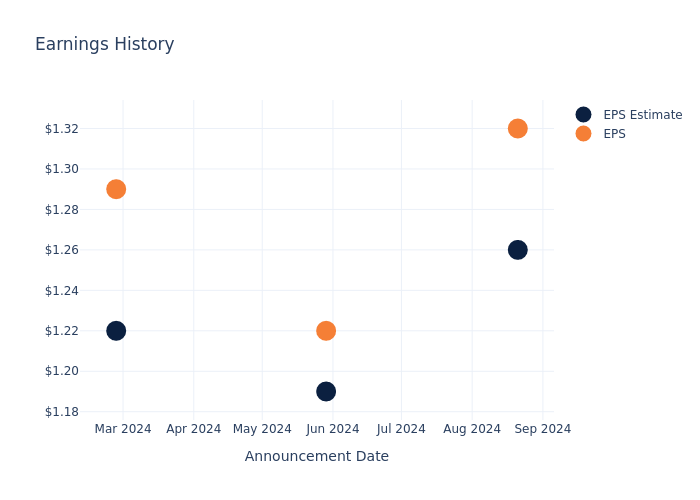

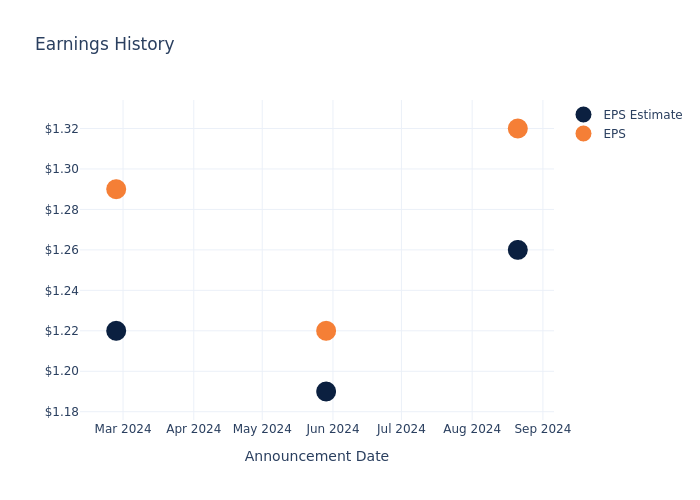

Earnings Track Record

Last quarter the company beat EPS by $0.06, which was followed by a 0.16% increase in the share price the next day.

Here’s a look at Agilent Technologies’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.26 | 1.19 | 1.22 | 1.35 |

| EPS Actual | 1.32 | 1.22 | 1.29 | 1.38 |

| Price Change % | 0.0% | -10.0% | 3.0% | 9.0% |

Market Performance of Agilent Technologies’s Stock

Shares of Agilent Technologies were trading at $132.06 as of November 21. Over the last 52-week period, shares are up 5.86%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Observations about Agilent Technologies

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Agilent Technologies.

Analysts have provided Agilent Technologies with 3 ratings, resulting in a consensus rating of Neutral. The average one-year price target stands at $149.0, suggesting a potential 12.83% upside.

Comparing Ratings Among Industry Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of IQVIA Hldgs, Waters and Illumina, three key industry players, offering insights into their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Outperform trajectory for IQVIA Hldgs, with an average 1-year price target of $261.21, implying a potential 97.8% upside.

- The prevailing sentiment among analysts is an Neutral trajectory for Waters, with an average 1-year price target of $370.0, implying a potential 180.18% upside.

- For Illumina, analysts project an Neutral trajectory, with an average 1-year price target of $173.56, indicating a potential 31.43% upside.

Summary of Peers Analysis

The peer analysis summary provides a snapshot of key metrics for IQVIA Hldgs, Waters and Illumina, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Agilent Technologies | Neutral | -5.62% | $855M | 4.65% |

| IQVIA Hldgs | Outperform | 4.28% | $1.38B | 4.17% |

| Waters | Neutral | 4.02% | $438.65M | 10.71% |

| Illumina | Neutral | -3.49% | $745M | 39.60% |

Key Takeaway:

Agilent Technologies ranks in the middle among peers for Consensus rating. It is at the bottom for Revenue Growth. For Gross Profit, it is at the top. In terms of Return on Equity, Agilent Technologies is at the bottom compared to its peers.

Delving into Agilent Technologies’s Background

Originally spun out of Hewlett-Packard in 1999, Agilent has evolved into a leading life science and diagnostic firm. Today, Agilent’s measurement technologies serve a broad base of customers with its three operating segments: life science and applied tools, cross lab consisting of consumables and services related to life science and applied tools, and diagnostics and genomics. Over half of its sales are generated from the biopharmaceutical, chemical, and advanced materials end markets, which we view as the stickiest end markets, but it also supports clinical lab, environmental, forensics, food, academic, and government-related organizations. The company is geographically diverse, with operations in the US and China representing the largest country concentrations.

Agilent Technologies: A Financial Overview

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Agilent Technologies’s revenue growth over a period of 3 months has faced challenges. As of 31 July, 2024, the company experienced a revenue decline of approximately -5.62%. This indicates a decrease in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Agilent Technologies’s net margin excels beyond industry benchmarks, reaching 17.87%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Agilent Technologies’s ROE stands out, surpassing industry averages. With an impressive ROE of 4.65%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Agilent Technologies’s financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.58%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.5, Agilent Technologies adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Agilent Technologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply