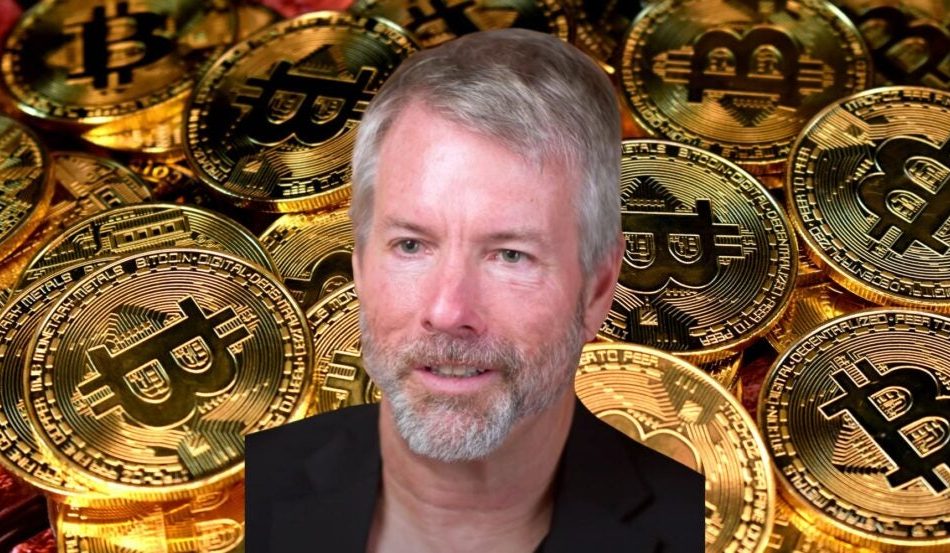

Michael Saylor Reveals MicroStrategy Is 'Making $500M A Day' With Bitcoin: 'May Very Well Be The Most Profitable Company In The US Growing The Fastest Right Now'

MicroStrategy Inc. MSTR co-founder Michael Saylor has revealed that the company is minting $500 million a day as Bitcoin BTC/USD inches closer to $100,000 for the first time in its history.

What Happened: Saylor, who has been all-in on Bitcoin for years now, has revealed an insane statistic – MicroStrategy’s holdings of the top cryptocurrency have appreciated by as much as $5.4 billion over the last two weeks.

In an interview with CNBC, Saylor broke down MicroStrategy’s gains, saying, “We’re making $500 million a day. I’m staring at my screen and we’re selling dollar bills for $3, sometimes a million times a minute.”

To put things into perspective, MicroStrategy’s stock delivered a whopping 97% gain in the last month, while Bitcoin has gained nearly 47%.

Year-to-date, MicroStrategy’s stock has gained over 515% while Bitcoin prices have increased by 122%.

Nvidia, the AI bellwether and the world’s most valuable company by market capitalization, has seen its stock rise by nearly 195% during this period.

“We may very well be the most profitable company in the U.S. growing the fastest right now. There’s not many companies making $500 million a day,” Saylor said.

Why It Matters: The surge in MicroStrategy’s stock is not just a reflection of Bitcoin’s rising value but also highlights the company’s strategic bet on the cryptocurrency.

Research from BitMEX has shown that MicroStrategy is trading at a 256% premium to the net asset value of its Bitcoin holdings, suggesting a significant valuation disparity driven by its aggressive acquisition strategy.

This premium may be influenced by financial regulations that restrict Bitcoin ETF purchases, pushing investors towards MicroStrategy for exposure.

Furthermore, Saylor’s bold prediction that Bitcoin could reach $13 million by 2045 has sparked discussions about the potential economic implications, including massive hyperinflation.

This prediction, if realized, would elevate Bitcoin’s market cap to $250 trillion, dwarfing the current world GDP and global stock markets.

Amidst these developments, Warren Buffett’s decision to hold $325 billion in cash at Berkshire Hathaway has drawn criticism from Saylor, who argues that not investing in Bitcoin is a missed opportunity.

Price Action: At the time of writing, Bitcoin was trading at $98,556, down 0.04% in the last 24 hours, according to Benzinga Pro data.

Read Next:

Photo courtesy: Wikimedia

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply