Should You Buy Lucid Motors While It's Below $2.50?

There’s no question electric vehicles will continue to grow as a percentage of vehicles sold around the world, but that doesn’t mean every EV company is worth buying. It’s difficult to make a sustainable profit in the auto industry, and competition is coming into the market quickly.

Lucid (NASDAQ: LCID) has seen some of these challenges first-hand, which is why the stock is down to $2.01 per share as of Friday’s market close. Is it time to jump on this EV stock below $2.50?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

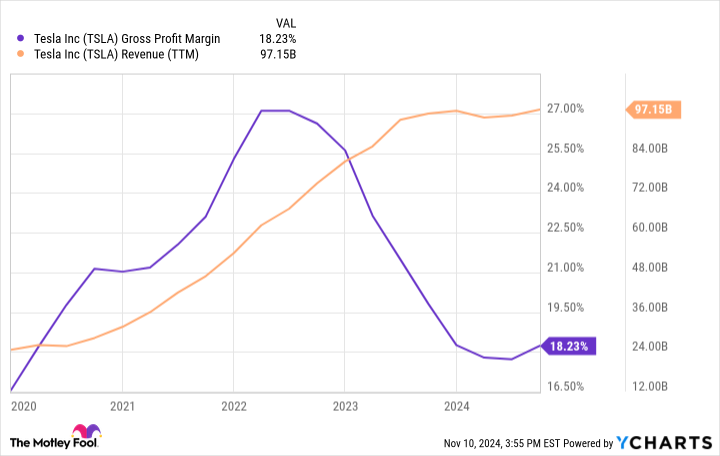

I want to start by looking at Tesla (NASDAQ: TSLA), the company Lucid would most like to be like. Tesla has positive margins and free cash flow, but you can see in the chart below that margins were highest during the pandemic when the supply of vehicles was low. In 2023, the company had to cut prices to maintain sales and hasn’t grown the top line since. Margins were crushed in that time.

This is the challenge for automakers. A hard good like an automobile has high marginal costs, inventory costs are high, and supply and demand are very real dynamics. As the supply of EVs goes up, demand hasn’t kept pace, pushing prices and margins lower.

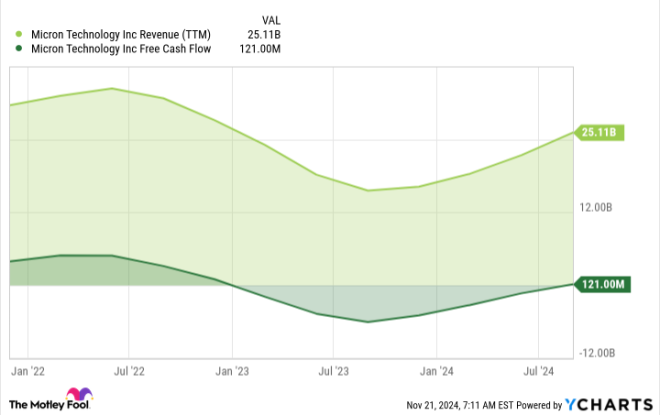

Like most EV makers, Lucid’s challenge isn’t just selling more vehicles; it’s making a profit on the vehicles it sells. You can see below that gross margins are negative 106% and show no signs of an inflection.

Lucid has a couple of problems that don’t seem to be improving. First, its vehicles are expensive, starting at $69,900, which puts them out of reach of the average buyer. That makes it difficult to scale because there’s not enough demand beyond the 9,000 vehicles expected to be produced this year. It’s hard to sell a vehicle for $70,000 when there are options for half that.

The second problem is costs, which haven’t come down nearly fast enough given the company’s scale. Playing in the luxury market is inherently a low-volume market, and if a company can’t make money at small volumes at these price points, it’s a difficult road ahead.

Losses are mounting and investors need to start considering how long Lucid will be able to fund the current level of losses. The conventional wisdom has been that the Saudi Arabia Public Investment Fund (PIF), Lucid’s biggest shareholder, will come to the rescue.

In August, the fund did commit to investing $750 million in preferred shares and $750 million in an unsecured delayed draw term loan facility. That may seem like good news, but these new funds are senior to common shareholders. Lucid could go through bankruptcy, and the PIF could still control the company.

Leave a Reply