We're a High-Income Household. Can We Shield Ourselves from Future Taxes Using a Backdoor Roth?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

A backdoor Roth conversion can save you significantly in future taxes, but at the cost of paying those taxes now. This isn’t always a good deal in the long run.

For example, perhaps you’re married with a combined income of $400,000 per year, putting you and your spouse well above the income limits for contributing to a Roth IRA. However, you can still build an after-tax retirement account by contributing to a traditional IRA and then converting it to a Roth account. This strategy, known as the backdoor Roth IRA, will lead to tax-free withdrawals in retirement but higher income taxes in the years in which the conversions are made.

If you’re considering a backdoor Roth IRA or other strategies to save on taxes, consider talking it over with a financial advisor.

A Roth IRA is a retirement account that’s funded with after-tax contributions. This means that you don’t get any special tax breaks on the money that you contribute. You instead pay taxes on the money up front, before it goes into the account, in exchange for tax-free growth from then on.

This can make Roth portfolios extremely valuable under the right circumstances. For example, say that you contribute $100 to your Roth IRA and it grows to $1,000 by the time you retire. You would have paid taxes on the $100 contribution in exchange for $900 worth of tax-free gains. This is especially the case for someone who expects to be in a higher tax bracket in retirement.

However, the IRS has strict contribution and income limits for Roth IRAs. Annual contributions are capped at $7,000 in 2024 ($8,000 for people 50 and older) – significantly less than the $23,000 you can save in a 401(k) or similar account. These annual limits apply to all IRAs, meaning you can only contribute up to a combined $7,000 in 2024 to your IRAs, regardless of how many traditional and Roth accounts you own.

Roth IRAs also have income limits. In 2024, if your modified adjusted gross income (MAGI) is below $146,000 as an single filer or $230,000 as a married couple filing jointly, you may contribute up to $7,000. However, single filers with a MAGI between $146,000 and $161,000 and married couples with a MAGI between $230,000 and $240,000 can only make a partial Roth contribution. Households earning more than these caps lose the ability to contribute to a Roth IRA altogether.

Consider speaking with a financial advisor if you need guidance on strategically spreading your retirement savings across traditional and Roth IRAs.

Wolfspeed, Inc. Shareholder Alert: Robbins LLP Reminds Investors of the WOLF Securities Class Action

SAN DIEGO, Nov. 24, 2024 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a class action was filed on behalf of all persons and entities that purchased or otherwise acquired Wolfspeed, Inc. WOLF securities between August 16, 2023 and November 6, 2024. Wolfspeed is a global semiconductor company focused on silicon carbide materials and the fabrication of devices for power applications.

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that Wolfspeed, Inc (WOLF) Misled Investors Regarding its Revenue Projections

According to the complaint, defendants provided the public with revenue projections that depended on the Mohawk Valley fabrication facility ramping its production to meet and/or exceed demand for its 200mm wafer product. Defendants provided these overwhelmingly positive statements to investors while, at the same time, concealing material adverse facts concerning the true state of Wolfspeed’s growth potential and, in particular, the operational status and profitability of the Mohawk Valley fabrication facility. First, to meet its publicly stated projections, the Company would have to cancel or otherwise indefinitely suspend planned future projects such as the facility in Saarland, Germany. Second, the Company would have to terminate a significant portion of its workforce (approximately 20%) and shutter the Durham fabrication facility.

Plaintiff alleges that on November 6, 2024, Wolfspeed announced its financial results for the first quarter of fiscal year 2025 and unveiled guidance for the second quarter well below expectations. While defendants had repeatedly claimed that 20% utilization of the Mohawk Valley fabrication facility would result in $100 million revenue out of the facility, defendants now guided to a range 30% to 50% below that mark. The Company attributed its results and lowered guidance to “demand … ramp[ing] more slowly than we originally anticipated” as “EV customers revise their launch time lines as the market works though this transition period.” On this news, Wolfspeed’s stock price fell from $13.71 per share on November 6, 2024, to $8.33 per share on November 7, 2024, a decline of about 39.24%.

What Now: You may be eligible to participate in the class action against Wolfspeed, Inc. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by January 17, 2025. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against Wolfspeed, Inc. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/6e2a3cda-6c15-4240-9c27-2fcf37e35629

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

History Is Useless for Wall Street Pros Betting on Stocks Rally

(Bloomberg) — Investors have a challenge in betting on the usual stock market rally that tends to arrive after a presidential election: With the S&P 500 Index on track for one of its best ever starts to a year, history can’t be a guide this time.

Most Read from Bloomberg

Buying US stocks into year-end following a vote is the classic trading playbook. Historically, the S&P 500 has posted a median return of 5% from Election Day in November to the end of the year, according to data compiled by Deutsche Bank AG. Even the riskiest pockets like small-capitalization companies typically catch a bid in the rising tide.

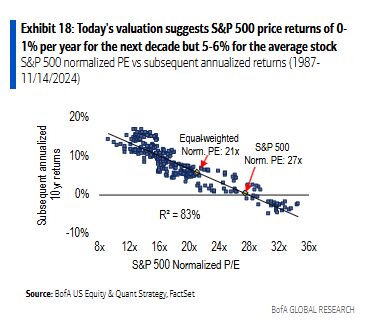

But this is hardly a classic election year. The S&P 500 is up 25% in 2024 after leaping 24% in 2023, putting the index on pace for its first back-to-back years of more than 20% gains since the late 1990s. As a result, share prices are high, with the S&P 500 trading at more than 22 times projected 12-month earnings, compared with an average reading of 18 in the last decade. And positioning data shows traders are already heavily invested in equities.

Meanwhile, familiar foes from the past few years, rising bond yields and the threat of persistent inflation, loom in the background. All of which has the stock market set up for a potentially quiet holiday season — as opposed to the ragers of election years past.

“With valuations elevated and the S&P 500 already near 6,000, the market will creep higher from here,” said Eric Beiley, executive managing director of wealth management at Steward Partners. “But I don’t see a big year-end rally because rising yields will keep investors at bay.”

No Hurry

The Federal Reserve has lowered interest rates twice since September. But recently, central bankers indicated that they aren’t in a hurry to go further.

At the same time, Treasury yields have jumped to multi-month highs after US president-elect Donald Trump’s election victory ignited bets that his economic plans like large import tariffs and mass deportations of low-wage undocumented workers could stoke inflation and hurt growth, possibly reducing the Fed’s scope to cut interest rates. This explains why Wall Street strategists have been dialing back their rate reduction expectations since Trump’s election victory.

Short Sellers Are Back – Flurry Of Big Calls From Muddy Waters, Citron And Others Raises Questions: Why Now?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Investors have been hit with an increased amount of short reports from some of the most well-known names in the space, which could be due to high valuations for stocks or could be coming after the 2024 presidential election results.

What Happened: Over the past three months, big names in the short report space have taken on small and large companies claiming high valuations, accounting irregularities and other reasons that the stocks should trade lower.

Don’t Miss:

Muddy Waters recently issued a short report on e.l.f. Beauty, which was the first report from the short seller in months.

Kerrisdale Capital recently issued a short report on Oklo, its first published report since June.

Hindenburg, who has been issuing short reports on a monthly basis was the talk of the investing world when they took on technology company Super Micro Computer (NASDAQ:SMCI), accusing the company of accounting, governance and compliance problems.

While the call was not popular at the time, given the company’s soaring valuation, the stock is now down 28% over the last month after some of the alleged claims from Hindenburg were amplified with the resignation of the company’s independent auditor.

Citron Research published an update on their Geo Group bullish case in September, the last post made on the company’s website. However, the firm led by Andrew Left has been active on social media, with a post this week announcing the firm had shorted shares of the high-flying software company and Bitcoin (CRYPTO: BTC) holder MicroStrategy Inc (NASDAQ:MSTR).

Trending: Over the last five years, the price of gold has increased by approximately 83% — Investors like Bill O’Reilly and Rudy Giuliani are using this platform to create customized gold IRAs to help shield their savings from inflation and economic turbulence.

The announcement of the short report by Left comes as the investor recently pleaded not guilty to fraud charges in July.

Along with the recent growth of short reports from the firms who hadn’t published in awhile, there are also regular short reports coming monthly from Grizzly Research and bi-weekly reports from The Bear Cave.

Billionaire Israel Englander Increased His Stake In Eli Lilly During the Third Quarter: Should You?

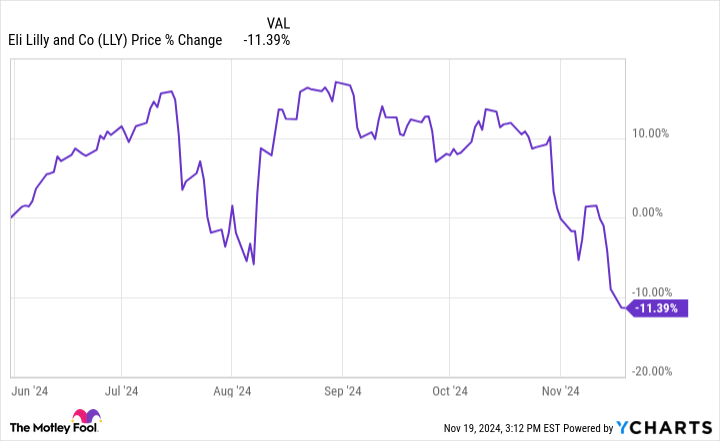

After flying high during the first half of the year, pharmaceutical giant Eli Lilly (NYSE: LLY) has lost some momentum; the company’s shares are down by 11% since June 1. However, the healthcare leader still has plenty of fans on Wall Street, including Israel Englander, the billionaire owner of Millennium Management, a hedge fund.

Millennium Management’s stake in Eli Lilly increased by 86% in the third quarter. Should you follow Englander’s lead and increase your stake (or initiate a position) in Eli Lilly?

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Since June 1, Lilly has earned approval for brand-new medicines, including eczema treatment Ebglyss and a potential blockbuster Alzheimer’s disease medicine, Kisunla. It reported several positive data readouts for its new best-selling medicine tirzepatide. And the company’s second-quarter results came with an upward guidance adjustment.

What, then, is the cause of Lilly’s poor performance in the second half of the year? First, its shares look expensive. Eli Lilly’s forward price-to-earnings ratio was recently 54.8. The average for the S&P 500 is 22, and the healthcare industry’s is only 17.4.

Eli Lilly has been on a tear for a while now, and its shares were bound to face gravity at some point. Some investors likely decided to pocket significant profits before it did.

Second, Lilly’s third-quarter results were below expectations. Revenue grew by 20% year over year to $11.4 billion. That’s not bad by any means, but it wasn’t enough to impress investors, especially considering the company’s valuation. Lilly slightly reducing its guidance for the full year 2024 made things worse, sending the stock off a cliff following its latest quarterly update.

Eli Lilly might or might not rebound by the end of the year. It’s impossible to predict how its shares will perform in the next month, or three, or six. But what if we extend our horizon beyond the next five years? Then we have every reason to think that Lilly can deliver market-beating returns. Let’s consider just three:

First, the company’s tirzepatide — sold under the brand name Mounjaro for diabetes and Zepbound for weight management — is still only getting started. The two brands racked up combined sales of $4.4 billion in the third quarter. Mounjaro was first approved in May 2022, and Zepbound in November 2023.

'Bizarro World' – People Are Really Confused By Elon Musk Praising Argentina's Javier Milei Slashing Import Taxes

Elon Musk sparked confusion online yet again – this time with his take on Argentina’s new import tax cuts. Recently, Argentina’s President-elect Javier Milei announced a major policy change to reduce taxes on imports.

Don’t Miss:

As part of his economic reform plan, Milei wants to make imported goods more affordable. Starting in December, he will raise the tax-free limit on international purchases from $1,000 to $3,000. Personal imports will also get a tariff exemption of up to $400. This move is meant to open up the economy and make things easier for shoppers in Argentina.

Elon Musk seemed to think so. In response to a tweet discussing Milei’s idea, he expressed his support for the tax cut by simply saying, “Good move.”

The tweet caught a lot of attention as many people quickly called Musk out for what they saw as mixed signals – supporting a policy in Argentina that seems opposite to the U.S. import tariffs promoted by Donald Trump, whom Musk has also publicly supported.

For instance, one user tweeted, “You supported the presidential campaign of the guy advocating for the largest tariff hike in modern U.S. history, lmao.” Another wrote, “Import taxes = tariffs. You support cutting them elsewhere and raising them here? Shameful hypocrisy.” Alex Cole added to the discourse, writing, “So removing tariffs is a good move and Donald Trump adding tariffs is also a good move? Bizarro world.”

See Also: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, with minimum investments as low as $100 for properties like the Byer House from Stranger Things.

Different Countries, Different Needs?

Not everyone saw it as straight-up hypocrisy. Some X users argued that Musk’s take could be valid if viewed in the context of Argentina’s economy compared to the U.S.

Argentina is dealing with hyperinflation and a major recession, so reducing import taxes might be a much-needed lifeline to help people afford basic goods. Dan Victor, a CFA, commented, “It’s different for the world’s largest economy compared to one suffering from a deep recession and hyperinflation.”

Another user pointed out that different countries might use different tools for different reasons. “Start by studying comparative economic policy. Then, once you understand that two completely different countries/economies implementing different policies is normal, this should make a little more sense.”

While some felt Musk was inconsistent, others believed his opinion could make sense given the drastically different economic situations of Argentina and the United States. The U.S. has a massive, stable economy, whereas Argentina is struggling to stabilize itself amid economic turmoil.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.