A Closer Look at BlackRock's Options Market Dynamics

High-rolling investors have positioned themselves bearish on BlackRock BLK, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in BLK often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 16 options trades for BlackRock. This is not a typical pattern.

The sentiment among these major traders is split, with 31% bullish and 37% bearish. Among all the options we identified, there was one put, amounting to $28,253, and 15 calls, totaling $1,245,413.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $620.0 to $1060.0 for BlackRock over the last 3 months.

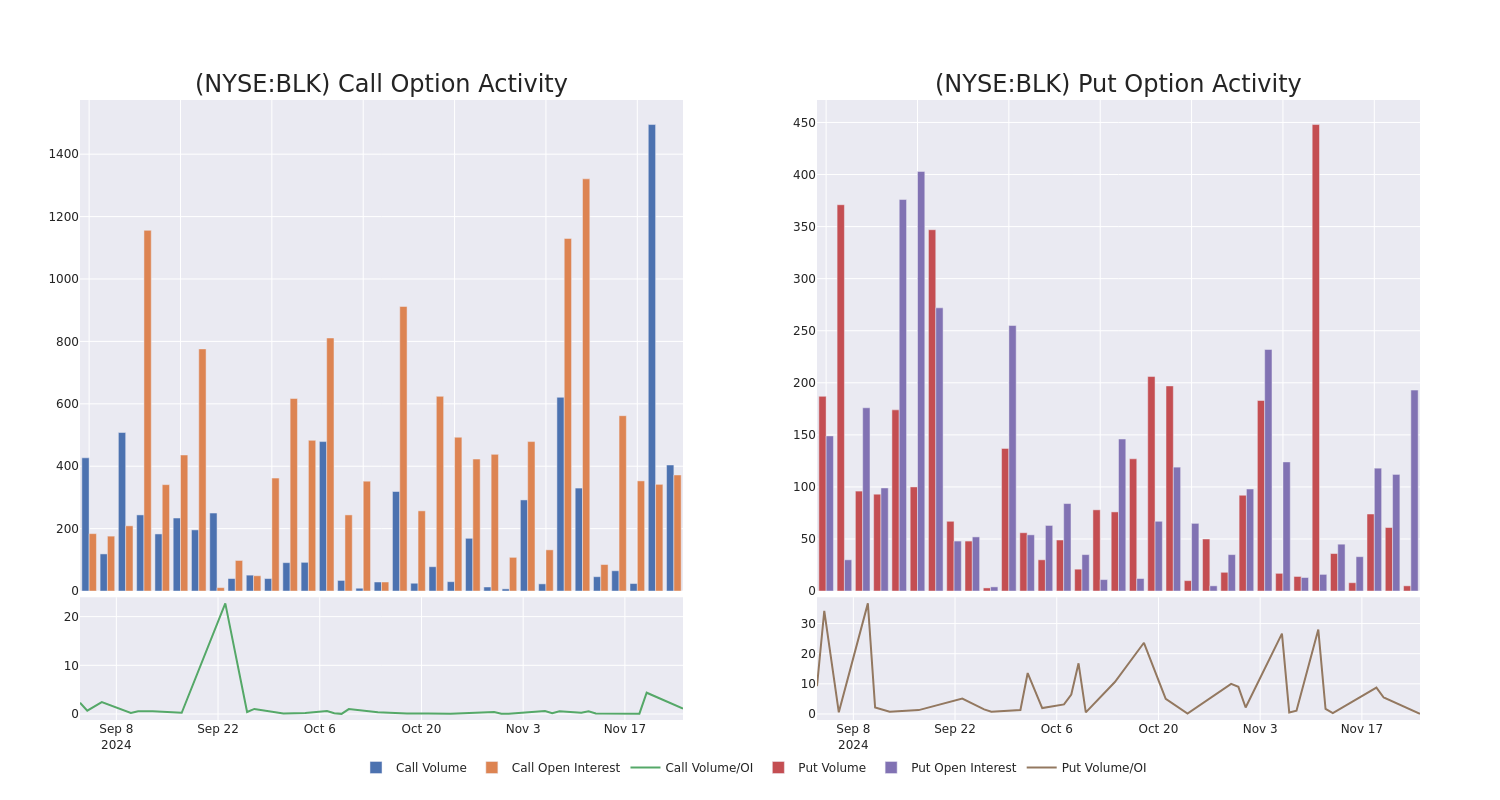

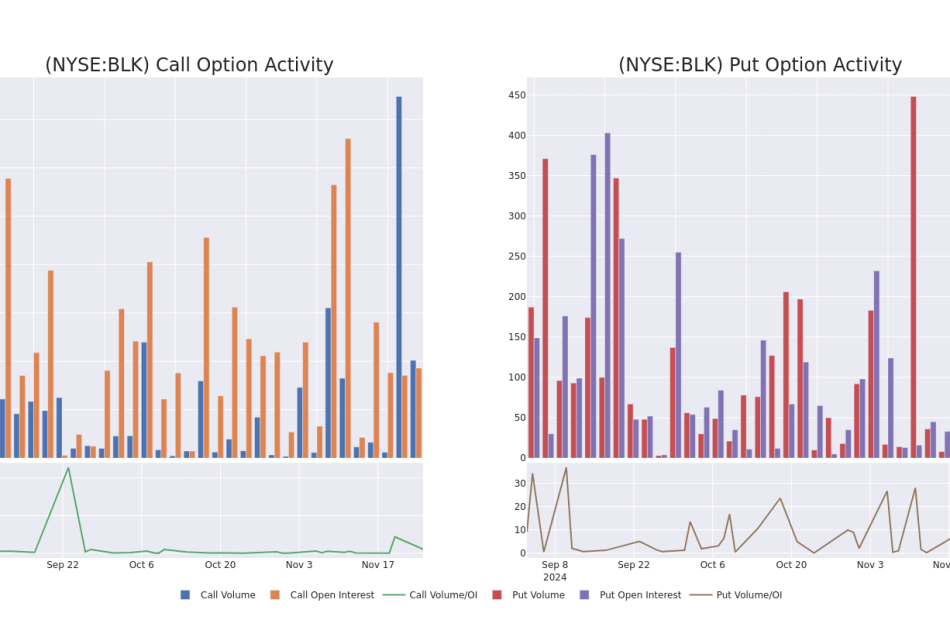

Volume & Open Interest Development

In today’s trading context, the average open interest for options of BlackRock stands at 70.62, with a total volume reaching 409.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in BlackRock, situated within the strike price corridor from $620.0 to $1060.0, throughout the last 30 days.

BlackRock Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BLK | CALL | SWEEP | BEARISH | 12/18/26 | $200.0 | $193.8 | $194.35 | $980.00 | $155.4K | 15 | 27 |

| BLK | CALL | SWEEP | BEARISH | 12/18/26 | $200.0 | $193.8 | $194.21 | $980.00 | $155.3K | 15 | 35 |

| BLK | CALL | SWEEP | BULLISH | 12/18/26 | $194.1 | $191.1 | $193.47 | $980.00 | $135.5K | 15 | 57 |

| BLK | CALL | SWEEP | BEARISH | 12/18/26 | $198.0 | $189.5 | $192.35 | $980.00 | $134.6K | 15 | 76 |

| BLK | CALL | SWEEP | BEARISH | 12/18/26 | $194.6 | $194.5 | $194.21 | $980.00 | $116.5K | 15 | 45 |

About BlackRock

BlackRock is the largest asset manager in the world, with $11.475 trillion in assets under management at the end of September 2024. Its product mix is fairly diverse, with 55% of managed assets in equity strategies, 26% in fixed income, 9% in multi-asset classes, 7% in money market funds, and 3% in alternatives. Passive strategies account for around two thirds of long-term AUM, with the company’s ETF platform maintaining a leading market share domestically and on a global basis. Product distribution is weighted more toward institutional clients, which by our calculations account for around 80% of AUM. BlackRock is geographically diverse, with clients in more than 100 countries and more than one third of managed assets coming from investors domiciled outside the US and Canada.

In light of the recent options history for BlackRock, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of BlackRock

- With a volume of 314,826, the price of BLK is down 0.0% at $1036.46.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 46 days.

What Analysts Are Saying About BlackRock

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1146.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Deutsche Bank has decided to maintain their Buy rating on BlackRock, which currently sits at a price target of $1133.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for BlackRock, targeting a price of $1160.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest BlackRock options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply