A Closer Look at Lumentum Holdings's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bullish stance on Lumentum Holdings.

Looking at options history for Lumentum Holdings LITE we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 75% of the investors opened trades with bullish expectations and 0% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $64,320 and 6, calls, for a total amount of $357,160.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $77.5 to $115.0 for Lumentum Holdings over the last 3 months.

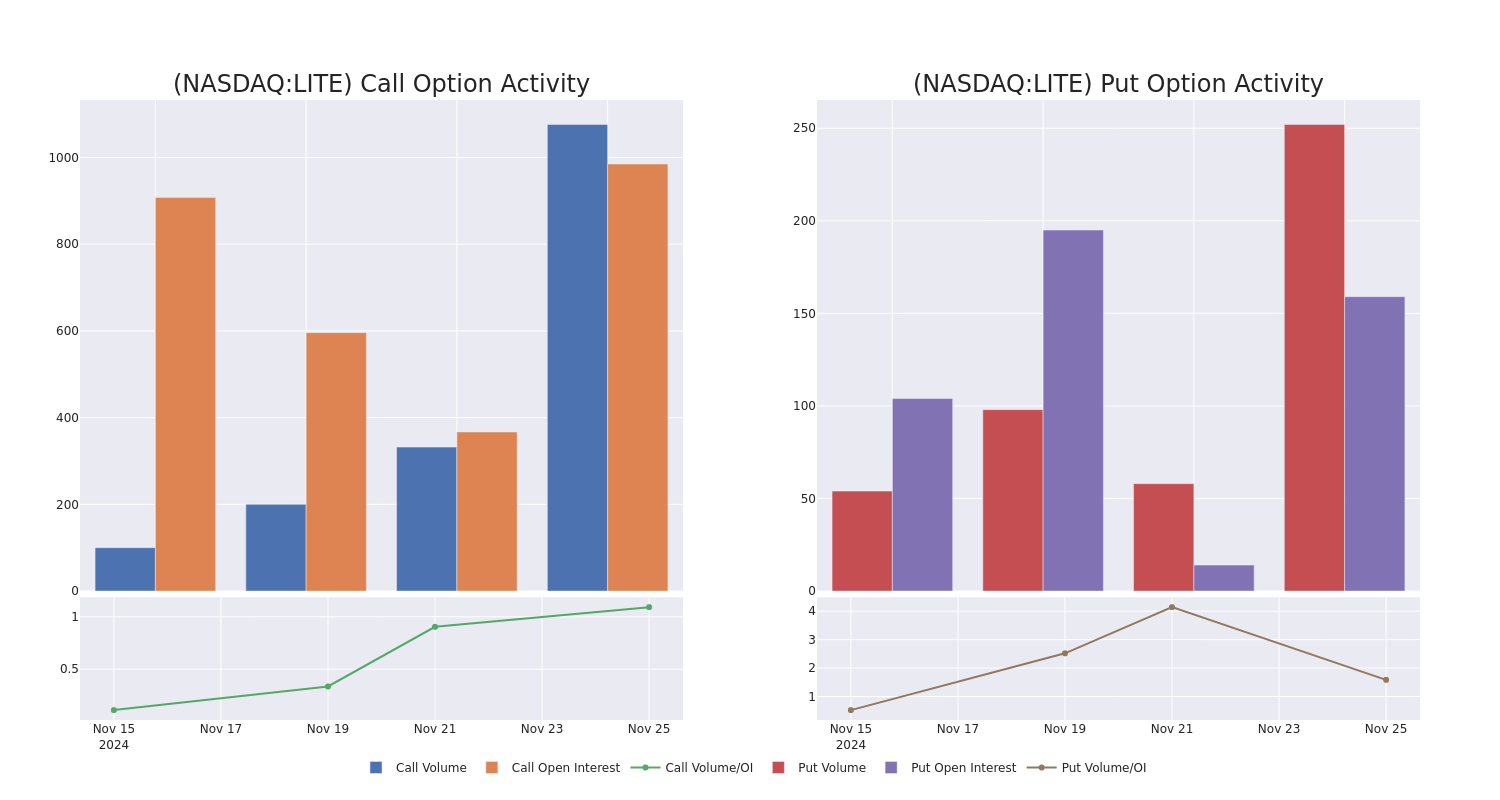

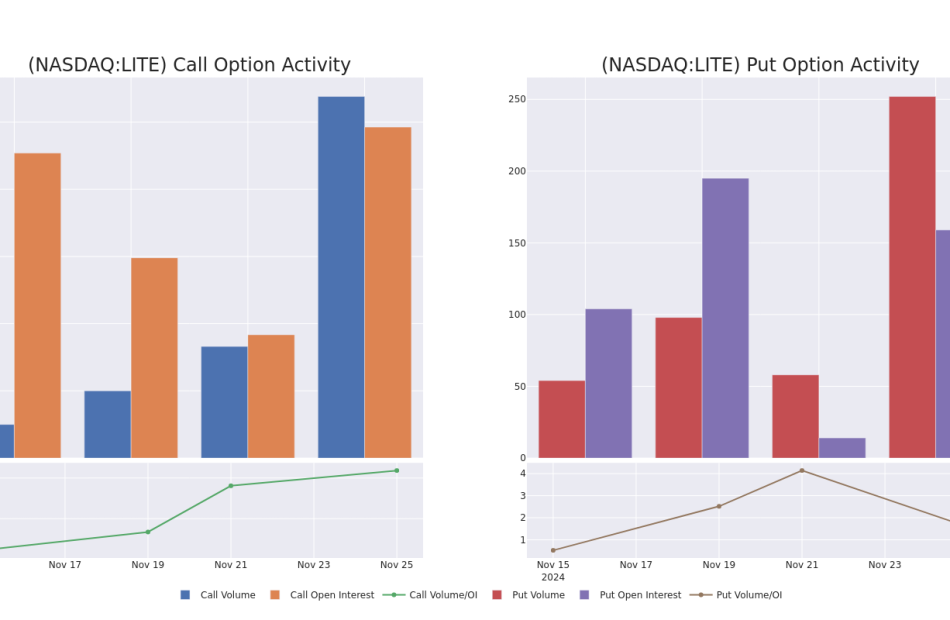

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Lumentum Holdings’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lumentum Holdings’s whale activity within a strike price range from $77.5 to $115.0 in the last 30 days.

Lumentum Holdings Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LITE | CALL | SWEEP | BULLISH | 03/21/25 | $14.4 | $14.1 | $14.2 | $85.00 | $142.0K | 666 | 107 |

| LITE | CALL | TRADE | BULLISH | 03/21/25 | $3.2 | $2.4 | $2.9 | $115.00 | $72.5K | 260 | 250 |

| LITE | CALL | SWEEP | NEUTRAL | 03/21/25 | $8.9 | $8.8 | $8.9 | $95.00 | $48.0K | 59 | 241 |

| LITE | CALL | TRADE | BULLISH | 03/21/25 | $9.1 | $8.8 | $9.0 | $95.00 | $34.2K | 59 | 70 |

| LITE | PUT | SWEEP | BULLISH | 03/21/25 | $4.9 | $4.8 | $4.8 | $77.50 | $33.6K | 159 | 70 |

About Lumentum Holdings

Lumentum Holdings Inc is a California-based technology firm. The company provides two types of optical and photonic products: optical components that are used in telecommunications networking equipment, and commercial lasers for manufacturing, inspection, and life-science lab uses. Its segments are Optical Communications and Commercial Lasers. The firm is also expanding into new optical applications, such as 3-D sensing laser diode for consumer electronics. It generates maximum revenue from the OpComms segment. The OpComms segment products include a wide range of components, modules, and subsystems to support customers including carrier networks for access (local), metro (intracity), long-haul, and submarine (undersea) applications.

Current Position of Lumentum Holdings

- Trading volume stands at 1,924,803, with LITE’s price up by 0.56%, positioned at $89.59.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 73 days.

Professional Analyst Ratings for Lumentum Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $93.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Northland Capital Markets continues to hold a Market Perform rating for Lumentum Holdings, targeting a price of $60.

* An analyst from Raymond James has decided to maintain their Outperform rating on Lumentum Holdings, which currently sits at a price target of $100.

* An analyst from Barclays has decided to maintain their Underweight rating on Lumentum Holdings, which currently sits at a price target of $80.

* Consistent in their evaluation, an analyst from Rosenblatt keeps a Buy rating on Lumentum Holdings with a target price of $110.

* An analyst from Susquehanna has decided to maintain their Positive rating on Lumentum Holdings, which currently sits at a price target of $115.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lumentum Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply