A Glimpse of Urban Outfitters's Earnings Potential

Urban Outfitters URBN is preparing to release its quarterly earnings on Tuesday, 2024-11-26. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Urban Outfitters to report an earnings per share (EPS) of $0.86.

Anticipation surrounds Urban Outfitters’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

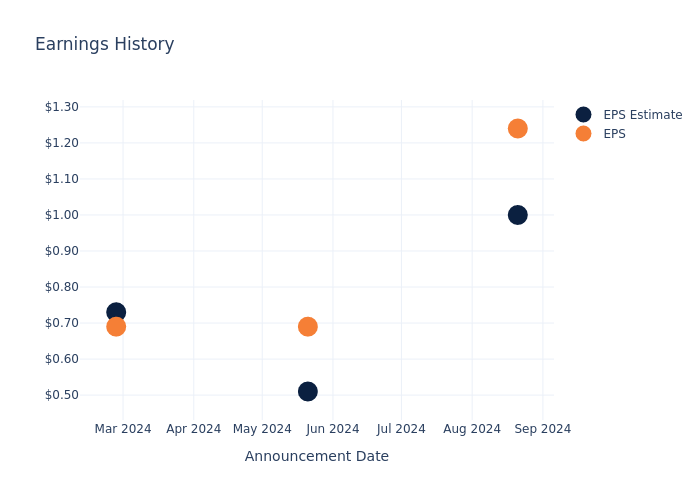

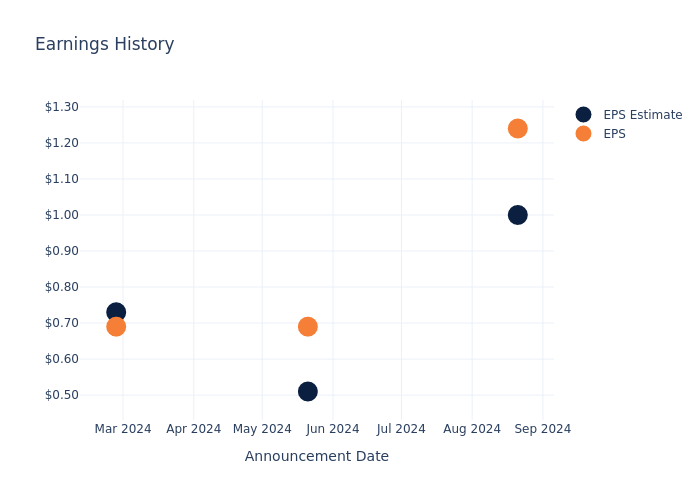

Historical Earnings Performance

The company’s EPS beat by $0.24 in the last quarter, leading to a 9.57% drop in the share price on the following day.

Here’s a look at Urban Outfitters’s past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 1 | 0.51 | 0.73 | 0.82 |

| EPS Actual | 1.24 | 0.69 | 0.69 | 0.88 |

| Price Change % | -10.0% | -5.0% | -13.0% | -12.0% |

Performance of Urban Outfitters Shares

Shares of Urban Outfitters were trading at $38.98 as of November 22. Over the last 52-week period, shares are up 14.54%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on Urban Outfitters

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Urban Outfitters.

Urban Outfitters has received a total of 2 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $43.0, the consensus suggests a potential 10.31% upside.

Peer Ratings Comparison

In this comparison, we explore the analyst ratings and average 1-year price targets of American Eagle Outfitters, Boot Barn Holdings and Victoria’s Secret, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for American Eagle Outfitters, with an average 1-year price target of $25.25, suggesting a potential 35.22% downside.

- For Boot Barn Holdings, analysts project an Buy trajectory, with an average 1-year price target of $171.56, indicating a potential 340.12% upside.

- Victoria’s Secret is maintaining an Neutral status according to analysts, with an average 1-year price target of $27.38, indicating a potential 29.76% downside.

Peer Metrics Summary

The peer analysis summary offers a detailed examination of key metrics for American Eagle Outfitters, Boot Barn Holdings and Victoria’s Secret, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Urban Outfitters | Neutral | 6.27% | $493.29M | 5.34% |

| American Eagle Outfitters | Neutral | 7.51% | $498.90M | 4.48% |

| Boot Barn Holdings | Buy | 13.71% | $152.86M | 2.94% |

| Victoria’s Secret | Neutral | -0.70% | $501M | 7.15% |

Key Takeaway:

Urban Outfitters ranks in the middle among its peers for revenue growth. It is at the bottom for gross profit and return on equity.

Discovering Urban Outfitters: A Closer Look

Founded in 1970, Philadelphia-based Urban Outfitters is an apparel and home goods retailer that operates more than 700 stores and e-commerce in the United States (87.5% of fiscal 2024 sales) and other regions. Its retail nameplates are Urban Outfitters, Free People, FP Movement, and Anthropologie. Retail accounted for 91% of fiscal 2024 revenue, but the firm also sells products through a wholesale operation, owns some restaurants, and operates a clothing rental and resale business called Nuuly (5% of sales). Urban Outfitters primarily markets to young adults and offers products in categories such as apparel (66% of sales), home goods (16% of sales), accessories (13% of sales), and more.

Urban Outfitters’s Financial Performance

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Over the 3 months period, Urban Outfitters showcased positive performance, achieving a revenue growth rate of 6.27% as of 31 July, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Urban Outfitters’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 8.69%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company’s ROE is a standout performer, exceeding industry averages. With an impressive ROE of 5.34%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Urban Outfitters’s ROA stands out, surpassing industry averages. With an impressive ROA of 2.78%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Urban Outfitters’s debt-to-equity ratio is below the industry average. With a ratio of 0.49, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Urban Outfitters visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply