Here's Why Rivian Stock Is a Buy Before Nov. 30

Rivian Automotive (NASDAQ: RIVN) has been an extremely volatile stock since its initial public offering in 2021. Yet volatility can often create incredible buying opportunities. After a recent correction, Rivian stock is now too cheap to ignore. And there’s one major reason to buy before the end of the month. Let’s dive in, and I’ll explain.

The electric vehicle (EV) maker has had a lot of success since launching its first two luxury models: the R1T and R1S. Sales have zoomed from just $1 million in September 2021 to more than $5 billion today.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

This sales trajectory could continue with the launch of three new mass market vehicles: the R2, R3, and R3X. Unlike Rivian’s higher priced current models, these are expected to debut under $50,000. That could push the company to another stage of sizable growth, similar to what the Model 3 and Model Y did for Tesla.

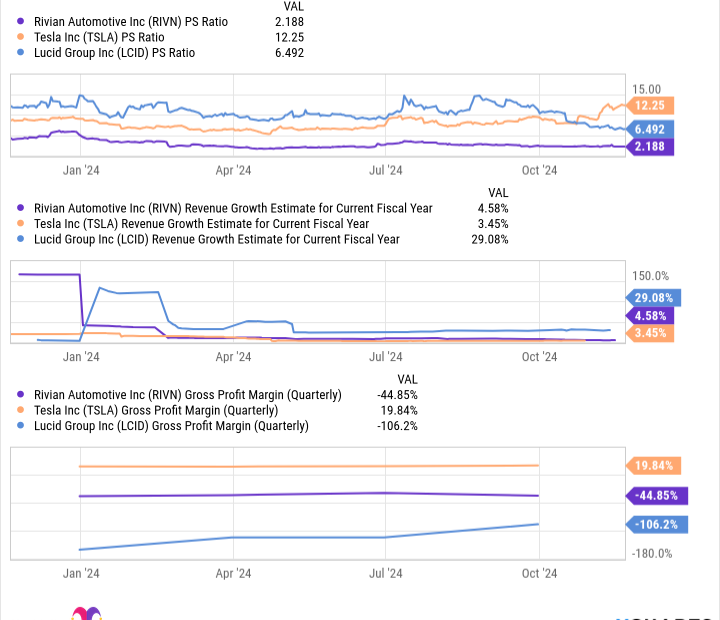

And yet, compared to other EV makers like Tesla and Lucid Group, Rivian trades at a sizable discount, according to several valuation metrics. For example, it trades at just 2.2 times sales — Lucid and Tesla trade at 6.5 and 12.3 times sales, respectively. If Rivian traded in line with these peers, there would be 200% to 600% in potential upside.

And right now, there’s one near-term catalyst that could close the gap quickly. One of the reasons the market remains skeptical is that the company keeps losing tens of thousands of dollars for every vehicle it sells. This means that while sales growth has been impressive in recent years, net losses continue to mount.

That’s also true for other smaller EV manufacturers like Lucid, but scaled-up competitors like Tesla have achieved positive gross margins for years. In an industry rife with bankruptcies, the market clearly wants to see Rivian achieve gross profitability before assigning it a higher valuation, especially given that its sales growth has slowed considerably over the last year.

You wouldn’t know it by Rivian’s dirt-cheap valuation, but the company is poised to flip to gross profitability very soon. If you listen to what management has promised, it should happen this quarter. Should that come to pass, there isn’t much time before this potential becomes a public reality.

Last quarter, Rivian lost around $39,000 per vehicle. That’s up from $32,700 the quarter before. And yet this month, management reiterated that the company was on track to achieve positive gross margins by next quarter. That would be an incredible feat, and the market is reasonably skeptical. But there’s no doubt that Rivian’s share price will likely react very positively should this milestone be reached.

Leave a Reply