Newmont's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bullish stance on Newmont NEM.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with NEM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Newmont.

This isn’t normal.

The overall sentiment of these big-money traders is split between 70% bullish and 20%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $203,670, and 6 are calls, for a total amount of $800,199.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $30.0 and $60.0 for Newmont, spanning the last three months.

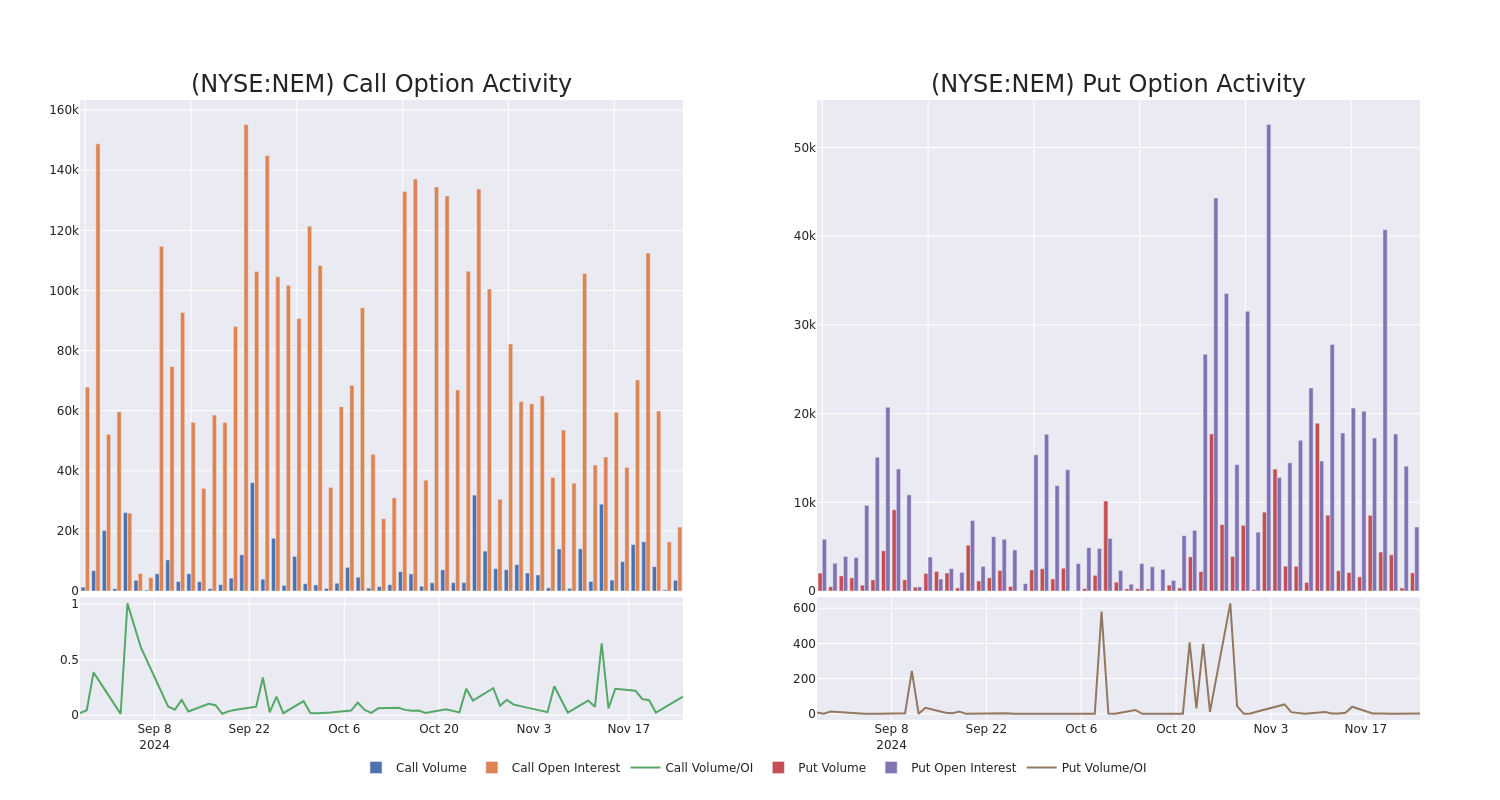

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Newmont options trades today is 3564.38 with a total volume of 5,631.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Newmont’s big money trades within a strike price range of $30.0 to $60.0 over the last 30 days.

Newmont Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEM | CALL | TRADE | BULLISH | 06/20/25 | $3.25 | $3.15 | $3.24 | $45.00 | $324.0K | 1.3K | 1.0K |

| NEM | CALL | SWEEP | BULLISH | 01/16/26 | $7.5 | $7.35 | $7.5 | $40.00 | $269.9K | 4.4K | 440 |

| NEM | CALL | SWEEP | BULLISH | 01/17/25 | $1.8 | $1.75 | $1.8 | $42.50 | $90.0K | 15.2K | 944 |

| NEM | PUT | SWEEP | BEARISH | 03/21/25 | $1.1 | $0.92 | $1.1 | $37.50 | $84.7K | 5.5K | 772 |

| NEM | CALL | SWEEP | BULLISH | 01/15/27 | $11.1 | $9.9 | $11.05 | $37.50 | $56.1K | 130 | 51 |

About Newmont

Newmont is the world’s largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023. Its portfolio includes 17 wholly or majority owned mines and interests in two joint ventures in the Americas, Africa, Australia and Papua New Guinea. The company is expected to produce roughly 5.5 million ounces of gold in 2024 from its core mines and 6.8 million in total. It is likely to sell a number of its higher cost, smaller mines accounting for 20% of forecast sales in 2024. Newmont also produces material amounts of copper, silver, zinc, and lead as byproducts. It had about two decades of gold reserves along with significant byproduct reserves at the end of December 2023.

Where Is Newmont Standing Right Now?

- Trading volume stands at 5,909,976, with NEM’s price down by -2.87%, positioned at $42.13.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 87 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Newmont with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply