The Stock Market Is Doing Something It Does Every 4 Years, but History Says It Signals a Big Move in 2025

The S&P 500 (SNPINDEX: ^GSPC) is widely regarded as the best gauge for the overall U.S. stock market. That’s because it includes 500 large companies that span all 11 stock market sectors, representing approximately 80% of domestic equities by market value. That scope and diversity makes the index a bellwether for U.S. stocks.

The S&P 500 is currently doing something it does every four years: Reacting to the results of another U.S. presidential election. Most investors know election results can influence market sentiment, but what they might not realize is the S&P 500 has typically generated above-average returns during 12-month period following presidential elections, regardless of the results.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Read on to learn more.

The chart below shows how the S&P 500 performed during the 12-month period following U.S. presidential elections during the last four decades. Importantly, presidential elections take place on the first Tuesday following the first Monday in November, so the returns shown in the chart use those Tuesdays as a starting point.

|

Presidential Election |

S&P 500 Return (Next 12 Months) |

|---|---|

|

1984 |

13% |

|

1988 |

23% |

|

1992 |

10% |

|

1996 |

32% |

|

2000 |

(22%) |

|

2004 |

7% |

|

2008 |

4% |

|

2012 |

24% |

|

2016 |

21% |

|

2020 |

38% |

|

Median |

17% |

Data source: YCharts.

As show above, there have been 10 presidential elections in the last four decades, and the S&P 500 returned a median of 17% during the 12 months following those events. For context, the S&P 500 compounded at 9% annually over the entire 40-year period. That means the index has typically generated above-average returns during the 12-month period following presidential elections.

One plausible explanation for that outperformance is excitement about policy changes the winners of the presidential and congressional races discussed during their campaigns. Regardless, we can apply historical data to the current situation to make an educated guess about how the stock market may perform in the coming months.

At the time of writing, the S&P 500 had advanced a little more than 3% since the markets closed on Nov. 5, the day the presidential election took place. If its performance aligns with the historical median, the S&P 500 will return another 14% by November 2025. In other words, history says the stock market could continue climbing higher next year.

SKRR Exploration Inc. Announces TSXV Approval of Consolidation

VANCOUVER, BC, Nov. 25, 2024 /CNW/ – SKRR Exploration Inc. SKRR (FSE: B04Q) (“SKRR” or the “Company“) announces that, further to its news release dated November 19, 2024, the TSX Venture Exchange (the “Exchange“) has approved the consolidation of the Company’s common shares (the “Consolidation“) on the basis of one (1) post-Consolidation common share for every four (4) pre-Consolidation common shares. The Consolidation will be effective at the opening of the market on November 27, 2024 (the “Effective Date“). Pursuant to the provisions of the Business Corporations Act (British Columbia) and the Articles of the Company, the Consolidation was approved by way of resolution passed by the board of directors of the Company.

The Company’s name and trading symbol will remain unchanged following the Consolidation. The new CUSIP number will be 78446Q308 and the new ISIN number will be CA78446Q3089 for the post-Consolidation common shares. The Company currently has 19,375,371 common shares issued and outstanding, and after the Consolidation is effective there will be approximately 4,843,842 common shares issued and outstanding.

Any fractional post-Consolidation share that is less than one-half (1/2) of a share will be cancelled and any fractional post-Consolidation share that is at least or greater than one-half (1/2) of a share will be rounded up to one whole share. Registered shareholders of record as of the Effective Date who hold physical share certificates will receive a letter of transmittal from the Company’s transfer agent, Computershare Investor Services Inc., with instructions on how to exchange for new share certificates representing post-Consolidation shares. Beneficial shareholders who hold their shares through a broker or other intermediary and do not have shares registered in their own names will not be required to complete a letter of transmittal.

About SKRR Exploration Inc.

SKRR is a Canadian-based precious and base metal explorer with properties in Saskatchewan – some of the world’s highest ranked mining jurisdictions. The primary exploration focus is on the Trans-Hudson Corridor in Saskatchewan in search of world class uranium, precious, and base metal deposits. The Trans-Hudson Orogen – although extremely well known in geological terms has been significantly under-explored in Saskatchewan. SKRR is committed to all stakeholders including shareholders, all its partners and the environment in which it operates.

ON BEHALF OF THE BOARD

Sherman Dahl

President & CEO

Tel: 250-558-8340

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains “forward–looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, statements relating to the Consolidation being effected on the stated date, statements relating to the technical, financial and business prospects of the Company, its projects, its goals and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of metals, the ability to achieve its goals, the ability to secure equipment and personnel to carry out work programs, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration results, risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses and those other risks filed under the Company’s profile on SEDAR+ at www.sedarplus.ca. There is a possibility that future exploration, development or mining results will not be consistent with the Company’s expectations. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, failure to secure personnel and equipment for work programs, adverse weather and climate conditions, failure to obtain or maintain all necessary government permits, approvals and authorizations, decrease in the price of gold, copper, uranium and other metals, failure to obtain or maintain community acceptance (including First Nations), increase in costs, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward–looking statements or forward–looking information, except as required by law.

SOURCE SKRR Exploration Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/25/c9341.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/25/c9341.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the Spectacular Vanguard ETF With 45.1% of Its Portfolio Invested in Nvidia, Apple, Microsoft, and Amazon

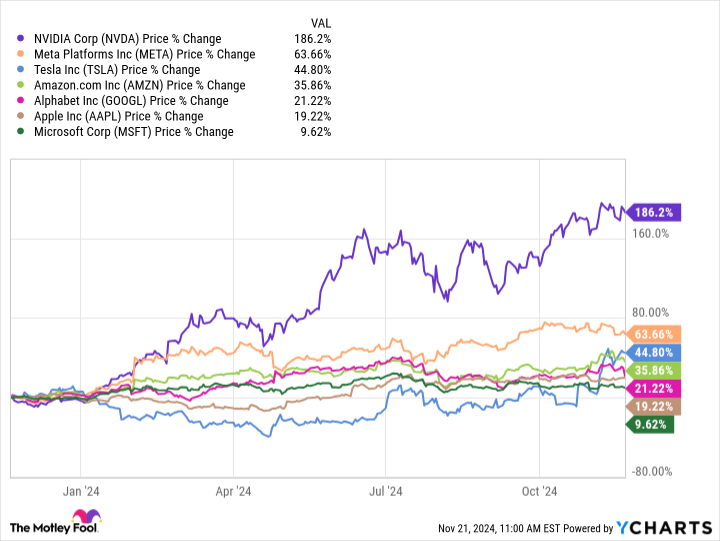

The S&P 500 (SNPINDEX: ^GSPC) index is up by 30% over the past year, and one-fifth of that gain is attributable to a single stock: Nvidia (NASDAQ: NVDA). The chip giant has delivered a return of 186% over the last 12 months, and with a valuation of $3.6 trillion, it represents 7% of the total value of the S&P 500.

But Nvidia isn’t alone. It’s part of a collection of technology giants dubbed the “Magnificent Seven” which have generated an average return of 56% over the past year. The companies have a combined market capitalization of $16.9 trillion, and represent 32.1% of the entire S&P 500.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Simply put, investors who don’t have exposure to the above tech stocks have likely underperformed the broader market. But the good news is that they can get that exposure very easily through an appropriate exchange-traded fund (ETF).

The Vanguard Mega Cap Growth ETF (NYSEMKT: MGK) has nearly half of its portfolio invested in four of America’s largest tech stocks. It consistently outperforms the S&P 500 over the short and long term. Here’s why it’s a great buy for investors of all experience levels.

The Vanguard Mega Cap Growth ETF holds just 71 different stocks. The fund is highly concentrated, with the technology sector representing 61.4% of the value of its portfolio, followed by the consumer discretionary sector at 20.3%.

In fact, its top four holdings alone represent 45.1% of its portfolio, but they are among the top artificial intelligence (AI) powerhouses that practically every investor wants to own.

|

Stock |

Vanguard Mega Cap Growth ETF Weighting |

|---|---|

|

1. Apple (NASDAQ: AAPL) |

13.36% |

|

2. Nvidia |

12.52% |

|

3. Microsoft (NASDAQ: MSFT) |

12.35% |

|

4. Amazon (NASDAQ: AMZN) |

6.82% |

Data source: Vanguard. Portfolio weightings are accurate as of Oct. 31, 2024, and are subject to change.

Apple just rolled out its Apple Intelligence software, which it developed with OpenAI. It delivers a slate of new AI features for owners of the latest iPhones, iPads, and Mac computers, including powerful writing tools that can summarize and generate text content for emails or messages. Apple has over 2.2 billion active devices worldwide, so it could become the biggest distributor of AI to consumers.

Nvidia supplies the most popular data center graphics processing units (GPUs) for developing AI models. The company’s data center revenue generated triple-digit percentage growth in each of the last six quarters because demand continues to outstrip supply. That momentum should continue now that Nvidia is shipping its powerful new Blackwell GPUs, with CEO Jensen Huang recently describing demand as “staggering.”

Trump's Commerce Secretary Pick Howard Lutnick's Fund Owns $1.19B In Nvidia, $804M In Tesla: Here Is A Look At His Portfolio

Howard Lutnick, chief executive officer of Cantor Fitzgerald – which has about $3.53 billion in holdings – has been named as the co-chair of President-elect Donald Trump‘s transition team. Lutnick will lead the U.S. Department of Commerce.

Top Holdings Of Lutnick’s Firm: According to Cantor Fitzgerald’s third-quarter 13F filings, top holdings of the firm include SPDR S&P 500 ETF SPY, Nvidia Corp. NVDA, Tesla Inc. TSLA, GCM Grosvenor Inc.GCMG, and Rumble Inc. RUM.

In the September quarter, Lutnick’s financial services firm purchased about 1.17 million shares of Tesla with 1.74 million put options in Q3. It bumped up its call options by 4,967% to 152,000 shares from the quarter-ended in July. The total value of the fund’s exposure to Tesla stood at $804 million in Q3.

Cantor Fitzgerald also increased its position in Nvidia by 7,015%, compared to the second quarter, with a total holding of 3.56 million shares in Q3. It increased Nvidia puts in Q3 by 1,268% to 5.46 million shares and Nvidia call options by 3,213% to 778,600 shares. The total exposure to Nvidia in value terms stood at $1.192 billion.

The fund had 1.23 million of put options and 600,000 call options on SPDR S&P 500 ETF TR representing a total value of $1.05 billion in Q3. GCM Grosvenor and Rumble reflected 2.1% and 1.2% of the fund’s total holdings, valued at $73.03 million and $42.04 million, respectively.

Why It Matters: Lutnick was also considered as a top pick for the Secretary of Treasury along with Scott Bessent. Tesla CEO and Trump’s Department of Government Efficiency (DOGE) co-lead Elon Musk rallied for Lutnick in a post on his social media platform, X, calling on others to weigh in on the appointment.

However, Bessent was appointed the Treasury Secretary. According to betting markets, Bessent was a frontrunner with an 82% probability of securing the nomination.

The third-quarter 13F filing from Bessent’s Key Square Group fund shows that they have liquidated all their holding in the September quarter.

In the second quarter, the fund had a highly concentrated portfolio, with equal investments in two banking-focused ETFs: the SPDR S&P Regional Banking ETF KRE and the SPDR S&P Bank ETF KBE, each making up 50% of the fund.

Read Next:

Photo courtesy: Cantor Fitzgerald

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hedge funds bet against power and pile into materials, says Goldman Sachs

By Nell Mackenzie

LONDON (Reuters) – Global hedge funds sold U.S. electric and water utilities stocks at the fastest pace in two months while buying U.S. materials stocks such as chemicals, metals and mining as well as paper and forest shares in the week to Friday, Goldman Sachs said.

U.S. utilities shares are now among the most sold U.S. stock sectors in November, showed a note from Goldman Sachs prime brokerage sent to investors on Friday and seen by Reuters on Monday.

The Dow Jones Utility Index which tracks a collection of U.S. utilities stocks rose just over 3% last week and has risen more than 20% so far in 2024.

Most utilities stocks including electric and water were sold except for gas utilities, said the note which tracks weekly hedge fund sales.

Materials was the most net bought U.S. stock sector on Goldman Sachs’ trading desk last week.

Buying spanned the entire stock sector, led by chemicals then metals and mining, as well as paper and forest products, said the bank note.

An S&P index tracking U.S. materials stocks rose 1% in the week ending Friday and has risen over 9% so far in 2024.

Hedge funds have bought materials stocks in three of the last four weeks and the sector is among the most net bought in the United States on Goldman Sachs’ prime brokerage desk, said the bank.

(Reporting by Nell Mackenzie; Editing by Dhara Ranasinghe and Emelia Sithole-Matarise)

Cloud management platform, emma secures $17M in Series A funding

LUXEMBOURG, Nov. 25, 2024 (GLOBE NEWSWIRE) — emma, the innovative cloud management platform transforming how businesses optimize and scale their cloud infrastructure, is today announcing the successful closure of its $17 million Series A funding round. This follows its $6 million Seed Round in March 2023, bringing total funding to $23 million within two years.

The Series A round was led by Smartfin, a leading European venture capital firm, with participation from RTP Global and existing investors. The capital will fuel the expansion of emma’s product development, accelerate go-to-market efforts, and enhance customer success initiatives to meet the growing demand for efficient agnostic cloud management solutions.

Founded in 2019, emma enables organizations to streamline cloud operations, reduce costs, and improve agility through its intuitive platform. The platform combines advanced AI-driven automation, real-time analytics, and comprehensive multicloud management capabilities, allowing teams to gain full visibility and control over their cloud environments. By simplifying complex cloud ecosystems, emma helps businesses optimize workloads, forecast usage, and manage multicloud strategies, enabling more effective resource allocation and financial predictability.

Highlighting emma’s vision for the future of cloud operations, CEO, Dmitry Panenkov commented, “At emma, we’re shaping the future of cloud operations. As businesses grow, they need the freedom to scale across any provider without limitations. We’re building the standards to make cloud-agnostic operations a reality. This funding accelerates our mission to give companies the control and flexibility they need to optimize across all environments.”

The Series A round will allow emma to continue its rapid innovation and bring new features to the platform, including AI accelerators, enhanced security, broader cloud integrations, and more robust automation capabilities. Additionally, the company intends to establish a research and development center at its headquarters in Luxembourg to support product development and address the increasing demands of its growing customer base.

“emma is addressing one of the most critical challenges for modern enterprises: managing and optimizing complex multi-cloud environments,” added Harry Haeck, Partner at Smartfin. “By combining automation, cost visibility, and actionable insights into a single platform, emma offers a unique approach to cloud management, enabling businesses to focus on innovation instead of infrastructure. At Smartfin, we are proud to partner with a transformative company that is leading the way in smarter, more agile cloud strategies for enterprises worldwide.”

Jelmer de Jong, CTO at RTP Global, says: “More businesses are turning to multicloud solutions than ever before as they reassess what is best for their workload. emma’s holistic platform empowers customers to create a cloud environment that best reflects their needs, allowing them to work with any provider and environment without compromise. We see the impact the company is making in the market through the platform’s continued growth since Seed funding and look forward to maintaining our relationship as emma continues to enhance its offering even further.”

After the official product release in 2022, emma has grown its client base across multiple industries, including gaming, fintech, healthcare, and retail, helping organizations of all sizes optimize and enhance the performance of their cloud infrastructure. The new funding will also enable emma to expand its reach into the US market as demand for multicloud management solutions continues to rise.

For more information about emma, visit emma.ms.

About emma:

emma is an end-to-end platform for cloud management, combining a cloud-agnostic approach with comprehensive AI-powered capabilities that empower organizations to access cloud resources by any provider, in any environment without constraints. With emma, organizations can seamlessly navigate between different cloud providers and environments, enhancing performance, optimizing costs and unlocking the full potential of their cloud investments.

About Smartfin:

Smartfin is a European venture and growth capital investor, managing over €600 million in assets and investing in early and growth stage B2B technology companies. Smartfin has an open-ended investment philosophy and invests throughout Europe and the United Kingdom. Smartfin’s team combines a successful venture capital and private equity investment track-record with extensive operational experience in setting up, building, and managing leading international technology companies which differentiates us as an experienced and entrepreneurial, truly hands-on and value-added partner to our portfolio companies. For more info, please visit www.smartfinvc.com.

Media Contact:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's Treasury Secretary Pick Scott Bessent Says A 'Global Economic Reordering' Is On The Way, Argues President-Elect's Policies Will Lead To An 'Economic Lollapalooza'

Donald Trump‘s Treasury Secretary pick Scott Bessent envisions a significant “global economic reordering” and aims to play a role in this transformation.

What Happened: In his first interview since Trump made the announcement, Bessent outlined his policy priorities, focusing on fulfilling tax-cut promises made by Trump. These include making first-term tax reductions permanent and removing taxes on tips, social security benefits, and overtime pay, The Wall Street Journal reported on Monday.

Additionally, Bessent, who will be replacing Janet Yellen after Trump’s induction, plans to implement tariffs and reduce government spending. He emphasized the importance of “maintaining the status of the dollar as the world’s reserve currency.”

Bessent told WSJ that he believes the president-elect’s strategy to extend tax cuts and deregulate parts of the U.S. economy could lead to an “economic lollapalooza.”

He expressed his desire to contribute to this anticipated economic shift, stating, “We are going to have to have some kind of a grand global economic reordering.” Bessent argues he has studied these dynamics and is eager to be involved in shaping the future economic landscape.

Why It Matters: The appointment of Bessent as U.S. Treasury Secretary by the President-elect is a strategic move that has drawn significant attention. Bessent, founder of Key Square Group, was selected over other notable candidates like former Fed Governor Kevin Warsh and private equity executive Marc Rowan. Trump praised Bessent as a leading international investor and strategist.

However, not everyone is optimistic about this choice. Economist Peter Schiff criticized the decision, suggesting that Bessent’s role would involve managing substantial national debt. Schiff humorously referred to him as the “Secretary of the Debt” on social media, highlighting concerns about the financial implications of Trump’s tax cut promises.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Influential Whale Cashes Out $2.7M Worth Of PEPE As Frog-Themed Crypto Takes U-Turn

A whale investor offloaded millions worth of Pepe PEPE/USD as the frog-themed cryptocurrency corrected sharply over the weekend.

What Happened: On-chain tracking platform Spot on Chain reported a massive sale of PEPE by a trader with huge cryptocurrency holdings.

The trader, dubbed “super whale,” sold 74.07 billion PEPE, equivalent to $1.53 million, for 448.1 Ethereum ETH/USD on Sunday. In the last three days, they liquidated a total of 130.2 billion PEPE, amounting to $2.71 million, for 891 Ether.

Despite the massive sale, the whale still holds a staggering 3.241 trillion PEPE, valued at $64.1 million, with a profit of $68.3 million, marking a 12.6X return on investment.

See Also: Dogecoin Foundation Shares Message Against Trump’s Tax Favoritism For US Crypto Firms

Why It Matters: The sale comes amid a price drop in the third-largest meme coin by market capitalization. PEPE retraced as much as 7.7% since Saturday morning and 8.39% over the week.

Large transactions by ‘whales’ or wealthy traders can significantly impact the market, influencing retail to follow suit and causing price swings.

Interestingly, large transaction volume plunged by more than 50% in the last 24 hours, according to IntoTheBlock. Moreover, the balances of long-term PEPE holders increased marginally by 0.3%.

The observations from the aforementioned indicators suggested a probable shift in trading strategy from selling to HODLing.

Price Action: At the time of writing, PEPE was trading at $0.00002038, up marginally by 0.80% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Uxin Reports Unaudited Financial Results for the Quarter Ended September 30, 2024

BEIJING, Nov. 25, 2024 /PRNewswire/ — Uxin Limited (“Uxin” or the “Company”) UXIN, China’s leading used car retailer, today announced its unaudited financial results for the quarter ended September 30, 2024.

Highlights for the Quarter Ended September 30, 2024

- Transaction volume was 7,046 units for the three months ended September 30, 2024, an increase of 25.7% from 5,605 units in the last quarter and an increase of 81.4% from 3,884 units in the same period last year.

- Retail transaction volume was 6,005 units, an increase of 46.8% from 4,090 units in the last quarter and an increase of 162.6% from 2,287 units in the same period last year.

- Total revenues were RMB497.2 million (US$70.9 million) for the three months ended September 30, 2024, an increase of 23.9% from RMB401.2 million in the last quarter and an increase of 39.6% from RMB356.1 million in the same period last year.

- Gross margin was 7.0% for the three months ended September 30, 2024, compared with 6.4% in the last quarter and 6.2% in the same period last year.

- Loss from operations was RMB38.6 million (US$5.5 million) for the three months ended September 30, 2024, compared with RMB62.5 million in the last quarter and RMB66.4 million in the same period last year.

- Non-GAAP adjusted EBITDA[1] was a loss of RMB9.2million (US$1.3 million), compared with a loss of RMB33.9 million in the last quarter and a loss of RMB45.9 million in the same period last year.

Mr. Kun Dai, Founder, Chairman and Chief Executive Officer of Uxin, commented, “We are excited to report another record-breaking quarter. From July to September 2024, our retail transaction volume reached 6,005 units, marking a 47% sequential increase and a 163% year-over-year growth. Our superstore model has proven to be successful, showcasing strong competitiveness and significant growth potential. Customer satisfaction, measured by NPS, has risen to 66, maintaining the highest level in the industry for 11 consecutive quarters. Looking ahead, we will continue to enhance our inventory levels, expand value-added services, and optimize our service network. We anticipate retail transaction volume to be within the range of 7,800 units to 8,100 units from October to December, representing over a 150% year-over-year increase.”

Mr. Dai continued, “Additionally, our expansion into new regions is progressing smoothly. Following our partnership agreement with the Zhengzhou Airport Economic Zone, we are pleased to announce a new collaboration with the Wuhan Municipal Government. Both Zhengzhou and Wuhan are provincial capital cities with about 5 million vehicles each, offering excellent conditions for operating used car superstores. The new superstores in these two cities will continuously drive sales growth and enhance our performance in the coming years.”

Mr. Feng Lin, Chief Financial Officer of Uxin, said: “To better align with customary practices and to synchronize the financial reporting cycles of our parent company and Chinese subsidiary, we have adjusted our fiscal year. After this change, our fiscal year will coincide with the calendar year, running from January 1 to December 31, instead of the previous period from April 1 to March 31. This change aims to make our financial disclosures more accessible and understandable for our investors. Building on this alignment, we delivered robust financial results in the quarter. Total revenues were RMB497 million, with retail vehicle sales revenue reaching RMB444 million, a year-over-year increase of 79%. Our gross margin further improved to 7% compared to the previous quarter. Adjusted EBITDA loss narrowed to RMB 9.2 million, representing an 80% reduction year-over-year. Looking ahead, we are on track to achieve our first positive quarterly EBITDA in the upcoming quarter, a significant milestone in our financial performance. With these strong results, the company is now firmly positioned for sustainable, long-term growth.”

|

[1]This is a non-GAAP measure. We believe non-GAAP measures help investors and users of our financial information understand the effect of adjusting items on our selected reported results and provide alternate measurements of our performance, both in the current period and across periods. See our Financial Supplement, filed as Exhibit 99.1 to our Current Report on Form 6-K on November 25, 2024 with the SEC, “Unaudited Reconciliations of GAAP And Non-GAAP Results” for a reconciliation and additional information on non-GAAP measures. |

Financial Results for the Quarter Ended September 30, 2024

Total revenues were RMB497.2 million (US$70.9 million) for the three months ended September 30, 2024, an increase of 23.9% from RMB401.2 million in the last quarter and an increase of 39.6% from RMB356.1 million in the same period last year. The increases were mainly due to the increase of retail vehicle sales revenue.

Retail vehicle sales revenue was RMB444.4 million (US$63.3 million) for the three months ended September 30, 2024, representing an increase of 36.8% from RMB325.0 million in the last quarter and an increase of 78.5% from RMB248.9 million in the same period last year. For the three months ended September 30, 2024, retail transaction volume was 6,005 units, an increase of 46.8% from 4,090 units in the last quarter and an increase of 162.6% from 2,287 units in the same period last year. The increases in retail vehicle sales revenue were mainly due to the increase of retail transaction volume. By offering superior products and services, the Company’s superstores have built strong customer trust and established Uxin as the leading brand in regional markets, leading to a high in-store customer conversion rate. Additionally, as the overall used car market began to recover starting from mid-year, the Company proactively expanded the inventory size while maintained an inventory turnover rate much faster than the industry average.

Wholesale vehicle sales revenue was RMB37.8 million (US$5.4 million) for the three months ended September 30, 2024, a decrease of 40.8% from RMB63.9 million in the last quarter and a decrease of 61.9% from RMB99.3 million in the same period last year. For the three months ended September 30, 2024, wholesale transaction volume was 1,041 units, representing a decrease of 31.3% from 1,515 units in the last quarter and a decrease of 34.8% from 1,597 units in the same period last year. Wholesale vehicle sales refer to vehicles purchased by the Company from individuals that do not meet the Company’s retail standards and are subsequently sold through online and offline channels. The decreases were mainly due to improved inventory capacity and reconditioning capabilities, and an increased number of acquired vehicles were reconditioned to meet the Company’s retail standards, rather than being sold through wholesale channels.

Other revenue was RMB15.0 million (US$2.1 million) for the three months ended September 30, 2024, compared with RMB12.3 million in the last quarter and RMB7.9 million in the same period last year.

Cost of revenues was RMB462.4 million (US$65.9 million) for the three months ended September 30, 2024, compared with RMB375.6 million in the last quarter and RMB334.0 million in the same period last year.

Gross margin was 7.0% for the three months ended September 30, 2024, compared with 6.4% in the last quarter and 6.2% in the same period last year. Firstly, the Company is increasing the proportion of vehicles acquired directly from individual car owners intending to sell their existing cars, which on average are more profitable compared to other vehicle supply channels. Secondly, the Company is focusing on enhancing the penetration of high-margin value-added services, which will further improve its gross profit margin.

Total operating expenses were RMB84.3 million (US$12.0 million) for the three months ended September 30, 2024.

- Sales and marketing expenses were RMB56.1 million (US$8.0 million) for the three months ended September 30, 2024, a decrease of 5.5% from RMB59.4 million in the last quarter and an increase of 15.7% from RMB48.4 million in the same period last year. Compared with the same period last year, in addition to the increased salaries for the sales teams, the year-over-year increase was also attributed to the increase in right-of-use assets depreciation expenses as a result of relocation to the Company’s Hefei Superstore in September 2023.

- General and administrative expenses were RMB26.1 million (US$3.7 million) for the three months ended September 30, 2024, representing a decrease of 7.3% from RMB28.1 million in the last quarter and a decrease of 25.7% from RMB35.1 million in the same period last year. Due to the execution of multiple rounds of cost-saving and efficiency-enhancing initiatives, salaries and benefits expenses for personnel performing general and administrative functions decreased accordingly.

- Research and development expenses were RMB2.4 million (US$0.3 million) for the three months ended September 30, 2024, representing a decrease of 30.1% from RMB3.4 million in the last quarter and a decrease of 74.4% from RMB9.2 million in the same period last year. The decreases mainly resulted from less IT service acquired by the Company’s research and development functions and decrease in salaries and benefits expenses of employees engaged in these functions.

Other operating income, net was RMB10.8 million (US$1.5 million) for the three months ended September 30, 2024, compared with RMB2.8 million for the last quarter and RMB3.2 million in the same period last year. The increases were mainly due to proceeds from government award.

Loss from operations was RMB38.6 million (US$5.5 million) in the three months ended September 30, 2024, compared with RMB62.5 million for the last quarter and RMB66.4 million in the same period last year.

Interest expenses were RMB24.1 million (US$3.4 million) for the three months ended September 30, 2024, representing an increase of 5.4% from RMB22.9 million in the last quarter and an increase of 212.5% from RMB7.7 million in the same period last year. The year-over-year increase was mainly due to the increase of interest expenses on finance lease liabilities relating to the lease of Changfeng Superstore in September, 2023.

Net loss from operations was RMB59.2 million (US$8.4 million) for the three months ended September 30, 2024, compared with a net loss of RMB49.8 million for the last quarter and net loss of RMB57.1 million for the same period last year.

Non-GAAP adjusted EBITDA was a loss of RMB9.2 million (US$1.3 million) for the three months ended September 30, 2024, compared with a loss of RMB33.9 million in the last quarter and a loss of RMB45.9 million in the same period last year.

Liquidity

As of September 30, 2024, the Company had cash and cash equivalents of RMB29.1 million, compared to RMB23.3 million as of March 31, 2024.

The Company has incurred accumulated and recurring losses from operations, and cash outflows from operating activities. In addition, the Company’s current liabilities exceeded its current assets by approximately RMB403.6 million as of September 30, 2024.

The Company’s ability to continue as a going concern is dependent on management’s ability to increase sales, achieve higher gross profit margin and control operating costs and expenses to reduce the cash that will be used in operating cash flows, and to enter into financing arrangements, including but not limited to renewal of the existing borrowings and obtaining new debt and equity financings. There is uncertainty regarding the implementation of these business and financing plans, which raises substantial doubt about the Company’s ability to continue as a going concern. The accompanying unaudited financial information does not include any adjustment that is reflective of these uncertainties.

Recent Development

Equity Investment Agreement with Wuhan Junshan Urban Asset Operation Co., Ltd.

On October 16, 2024, the Company, through its wholly-owned subsidiary Uxin (Anhui) Industrial Investment Co., Ltd. (“Uxin Anhui”), entered into an equity investment agreement with Wuhan Junshan Urban Asset Operation Co., Ltd. (“Wuhan Junshan”), a company indirectly controlled by Wuhan City Economic & Technological Development Zone, to establish a subsidiary of the Company. Uxin Anhui will contribute RMB66.7 million and Wuhan Junshan will contribute RMB33.3 million, representing approximately 66.7% and 33.3% of the subsidiary’s total registered capital, respectively.

Share Subscription Agreement with Lightwind Global Limited

On November 4, 2024, Uxin announced that, in connection with the memorandum of understanding previously announced on September 13, 2024, the Company has entered into a share subscription agreement (“Share Subscription Agreement”) with Lightwind Global Limited (the “Investor”), an indirect wholly-owned subsidiary of Dida Inc. (HKEX: 2559).

Pursuant to the Share Subscription Agreement, the Company agreed to issue and sell, and the Investor agreed to subscribe for 1,543,845,204 Class A ordinary shares of the Company for an aggregate subscription amount of US$7.5 million, based on a subscription price of US$0.004858 per share. The completion of transaction is subject to the closing conditions set forth in the Share Subscription Agreement.

Change in Fiscal Year

On November 22, 2024, the Company’s Board of Directors has approved a change in the Company’s fiscal year end from March 31 to December 31. The primary purpose of this change is to streamline the Company’s financial reporting with global standards and align with industry practices, enhancing comparability with peers. This adjustment also allows the Company to better synchronize operational planning and reporting cycles with market trends and customer demands, ensuring more effective communication with stakeholders and investors.

The Company will file a transition report on Form 20-F to cover the transition period from April 1, 2024 to December 31, 2024 in due course as required under applicable regulations.

Business Outlook

For the three months ending December 31, 2024, the Company expects its retail transaction volume to be within the range of 7,800 units to 8,100 units. The Company estimates that its total revenues including retail vehicle sales revenue, wholesale vehicle sales revenue and other revenue to be within the range of RMB560 million to RMB580 million. The Company expects its Non-GAAP adjusted EBITDA to be positive. These forecasts reflect the Company’s current and preliminary views on the market and operational conditions, which are subject to changes.

Conference Call

Uxin’s management team will host a conference call on Monday, November 25, 2024, at 8:00 A.M. U.S. Eastern Time (9:00 P.M. Beijing/Hong Kong time on the same day) to discuss the financial results. In advance of the conference call, all participants must use the following link to complete the online registration process. Upon registering, each participant will receive access details for this conference including an event passcode, a unique access PIN, dial-in numbers, and an e-mail with detailed instructions to join the conference call.

Conference Call Preregistration: https://dpregister.com/sreg/10194615/fe03e343b8

A telephone replay of the call will be available after the conclusion of the conference call until December 2, 2024. The dial-in details for the replay are as follows:

|

U.S.: |

+1 877 344 7529 |

|

International: |

+1 412 317 0088 |

|

Replay PIN: |

4912684 |

A live webcast and archive of the conference call will be available on the Investor Relations section of Uxin’s website at http://ir.xin.com.

About Uxin

Uxin is China’s leading used car retailer, pioneering industry transformation with advanced production, new retail experiences, and digital empowerment. We offer high-quality and value-for-money vehicles as well as superior after-sales services through a reliable, one-stop, and hassle-free transaction experience. Under our omni-channel strategy, we are able to leverage our pioneering online platform to serve customers nationwide and establish market leadership in selected regions through offline inspection and reconditioning centers. Leveraging our extensive industry data and continuous technology innovation throughout more than ten years of operation, we have established strong used car management and operation capabilities. We are committed to upholding our customer-centric approach and driving the healthy development of the used car industry.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses certain non-GAAP measures, including Adjusted EBITDA and adjusted net loss from operations per share – basic and diluted, as supplemental measures to review and assess its operating performance. The presentation of the non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. The Company defines Adjusted EBITDA as EBITDA excluding share-based compensation, fair value impact of the issuance of senior convertible preferred shares, foreign exchange (losses)/gains, other income/(expenses), equity in income of affiliates and dividend from long-term investment, net gain from extinguishment of debt. The Company defines adjusted net loss attributable to ordinary shareholders per share – basic and diluted as net loss attributable to ordinary shareholders per share excluding impact of share-based compensation, fair value impact of the issuance of senior convertible preferred shares, deemed dividend to preferred shareholders due to triggering of a down round feature and accretion on redeemable non-controlling interests. The Company presents the non-GAAP financial measures because they are used by the management to evaluate the operating performance and formulate business plans. The Company also believes that the use of the non-GAAP measures facilitates investors’ assessment of its operating performance as this measure excludes certain finance or non-cash items that the Company does not believe directly reflect its core operations. The Company believes that excluding these items enables us to evaluate our performance period-over-period more effectively and relative to our competitors.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools. One of the key limitations of using Adjusted EBITDA is that it does not reflect all items of income and expenses that affect the Company’s operations. Share-based compensation, foreign exchange (losses)/gains and other income/(expenses) have been and may continue to be incurred in the business. Further, the non-GAAP measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited.

The Company compensates for these limitations by reconciling the non-GAAP financial measure to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating the Company’s performance. The Company encourages you to review its financial information in its entirety and not rely on a single financial measure.

Reconciliations of Uxin’s non-GAAP financial measures to the most comparable U.S. GAAP measure are included at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader, except for those transaction amounts that were actually settled in U.S. dollars. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.0176 to US$1.00, representing the index rate as of September 30, 2024 set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Uxin’s strategic and operational plans, contain forward-looking statements. Uxin may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Uxin’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: impact of the COVID-19 pandemic, Uxin’s goal and strategies; its expansion plans; its future business development, financial condition and results of operations; Uxin’s expectations regarding demand for, and market acceptance of, its services; its ability to provide differentiated and superior customer experience, maintain and enhance customer trust in its platform, and assess and mitigate various risks, including credit; its expectations regarding maintaining and expanding its relationships with business partners, including financing partners; trends and competition in China’s used car e-commerce industry; the laws and regulations relating to Uxin’s industry; the general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Uxin’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Uxin does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media enquiries, please contact:

Uxin Limited Investor Relations

Uxin Limited

Email: ir@xin.com

The Blueshirt Group

Mr. Jack Wang

Phone: +86 166-0115-0429

Email: Jack@blueshirtgroup.co

|

Uxin Limited |

||||||||||||

|

Unaudited Consolidated Statements of Comprehensive Loss |

||||||||||||

|

(In thousands except for number of shares and per share data) |

||||||||||||

|

For the three months ended September 30, |

For the six months ended September 30, |

|||||||||||

|

2023 |

2024 |

2023 |

2024 |

|||||||||

|

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|||||||

|

Revenues |

||||||||||||

|

Retail vehicle sales |

248,910 |

444,399 |

63,326 |

435,759 |

769,366 |

109,634 |

||||||

|

Wholesale vehicle sales |

99,335 |

37,826 |

5,390 |

193,982 |

101,723 |

14,495 |

||||||

|

Others |

7,822 |

14,995 |

2,137 |

15,348 |

27,315 |

3,892 |

||||||

|

Total revenues |

356,067 |

497,220 |

70,853 |

645,089 |

898,404 |

128,021 |

||||||

|

Cost of revenues |

(334,033) |

(462,360) |

(65,886) |

(605,414) |

(837,959) |

(119,408) |

||||||

|

Gross profit |

22,034 |

34,860 |

4,967 |

39,675 |

60,445 |

8,613 |

||||||

|

Operating expenses |

||||||||||||

|

Sales and marketing |

(48,443) |

(56,060) |

(7,988) |

(94,991) |

(115,413) |

(16,446) |

||||||

|

General and administrative |

(35,116) |

(26,074) |

(3,716) |

(68,219) |

(54,194) |

(7,723) |

||||||

|

Research and development |

(9,219) |

(2,361) |

(336) |

(18,080) |

(5,741) |

(818) |

||||||

|

Reversal of credit losses, net |

1,141 |

162 |

23 |

1,837 |

162 |

23 |

||||||

|

Total operating expenses |

(91,637) |

(84,333) |

(12,017) |

(179,453) |

(175,186) |

(24,964) |

||||||

|

Other operating income, net |

3,214 |

10,824 |

1,542 |

10,199 |

13,607 |

1,939 |

||||||

|

Loss from operations |

(66,389) |

(38,649) |

(5,508) |

(129,579) |

(101,134) |

(14,412) |

||||||

|

Interest income |

45 |

10 |

1 |

146 |

26 |

4 |

||||||

|

Interest expenses |

(7,710) |

(24,095) |

(3,434) |

(12,829) |

(46,953) |

(6,691) |

||||||

|

Other income |

11,435 |

1,498 |

213 |

13,802 |

2,131 |

304 |

||||||

|

Other expenses |

(378) |

(1,331) |

(190) |

(650) |

(2,131) |

(304) |

||||||

|

Net gain from extinguishment of debt |

– |

– |

– |

– |

35,222 |

5,019 |

||||||

|

Foreign exchange gains |

964 |

969 |

138 |

539 |

1,448 |

206 |

||||||

|

Fair value impact of the issuance of senior convertible |

5,017 |

– |

– |

(31,852) |

– |

– |

||||||

|

Loss before income tax expense |

(57,016) |

(61,598) |

(8,780) |

(160,423) |

(111,391) |

(15,874) |

||||||

|

Income tax expense |

(108) |

– |

– |

(273) |

(38) |

(5) |

||||||

|

Equity in income of affiliates, net of tax |

– |

2,429 |

346 |

– |

2,429 |

346 |

||||||

|

Dividend from long-term investment |

– |

– |

– |

11,970 |

– |

– |

||||||

|

Net loss, net of tax |

(57,124) |

(59,169) |

(8,434) |

(148,726) |

(109,000) |

(15,533) |

||||||

|

Add: net loss/(profit) attribute to redeemable non- |

19 |

(1,668) |

(238) |

21 |

(3,309) |

(472) |

||||||

|

Net loss attributable to UXIN LIMITED |

(57,105) |

(60,837) |

(8,672) |

(148,705) |

(112,309) |

(16,005) |

||||||

|

Deemed dividend to preferred shareholders due to |

(278,800) |

– |

– |

(278,800) |

– |

– |

||||||

|

Net loss attributable to ordinary shareholders |

(335,905) |

(60,837) |

(8,672) |

(427,505) |

(112,309) |

(16,005) |

||||||

|

Net loss |

(57,124) |

(59,169) |

(8,434) |

(148,726) |

(109,000) |

(15,533) |

||||||

|

Foreign currency translation, net of tax nil |

292 |

(6,763) |

(964) |

3,606 |

(7,979) |

(1,137) |

||||||

|

Total comprehensive loss |

(56,832) |

(65,932) |

(9,398) |

(145,120) |

(116,979) |

(16,670) |

||||||

|

Add: net loss/(profit) attribute to redeemable non- |

19 |

(1,668) |

(238) |

21 |

(3,309) |

(472) |

||||||

|

Total comprehensive loss attributable to UXIN |

(56,813) |

(67,600) |

(9,636) |

(145,099) |

(120,288) |

(17,142) |

||||||

|

Net loss attributable to ordinary shareholders |

(335,905) |

(60,837) |

(8,672) |

(427,505) |

(112,309) |

(16,005) |

||||||

|

Weighted average shares outstanding – basic |

1,428,081,692 |

56,418,967,059 |

56,418,967,059 |

1,425,861,229 |

56,415,815,208 |

56,415,815,208 |

||||||

|

Weighted average shares outstanding – diluted |

1,428,081,692 |

56,418,967,059 |

56,418,967,059 |

1,425,861,229 |

56,415,815,208 |

56,415,815,208 |

||||||

|

Net loss per share for ordinary shareholders, basic |

(0.24) |

(0.00) |

(0.00) |

(0.30) |

(0.00) |

(0.00) |

||||||

|

Net loss per share for ordinary shareholders, diluted |

(0.24) |

(0.00) |

(0.00) |

(0.30) |

(0.00) |

(0.00) |

||||||

|

Uxin Limited |

||||||

|

Unaudited Consolidated Balance Sheets |

||||||

|

(In thousands except for number of shares and per share data) |

||||||

|

As of March 31, |

As of September 30, |

|||||

|

2024 |

2024 |

|||||

|

RMB |

RMB |

US$ |

||||

|

ASSETS |

||||||

|

Current assets |

||||||

|

Cash and cash equivalents |

23,339 |

29,094 |

4,146 |

|||

|

Restricted cash |

594 |

674 |

96 |

|||

|

Accounts receivable, net |

2,089 |

2,976 |

424 |

|||

|

Loans recognized as a result of payments under |

– |

– |

– |

|||

|

Other receivables, net of provision for credit losses of |

18,080 |

17,601 |

2,508 |

|||

|

Inventory, net |

110,494 |

182,818 |

26,051 |

|||

|

Prepaid expenses and other current assets |

71,787 |

88,258 |

12,577 |

|||

|

Total current assets |

226,383 |

321,421 |

45,802 |

|||

|

Non-current assets |

||||||

|

Property, equipment and software, net |

74,243 |

69,017 |

9,835 |

|||

|

Long-term investments (i) |

279,300 |

– |

– |

|||

|

Other non-current assets |

268 |

– |

– |

|||

|

Finance lease right-of-use assets, net |

1,339,537 |

1,353,638 |

192,892 |

|||

|

Operating lease right-of-use assets, net |

168,418 |

160,243 |

22,834 |

|||

|

Total non-current assets |

1,861,766 |

1,582,898 |

225,561 |

|||

|

Total assets |

2,088,149 |

1,904,319 |

271,363 |

|||

|

LIABILITIES, MEZZANINE EQUITY AND |

||||||

|

Current liabilities |

||||||

|

Accounts payable |

80,745 |

82,751 |

11,792 |

|||

|

Other payables and other current liabilities |

370,802 |

316,484 |

45,100 |

|||

|

Current portion of operating lease liabilities |

12,310 |

11,402 |

1,625 |

|||

|

Current portion of finance lease liabilities |

51,160 |

182,964 |

26,072 |

|||

|

Short-term borrowing from third parties |

71,181 |

129,423 |

18,443 |

|||

|

Short-term borrowing from related party |

7,000 |

2,000 |

285 |

|||

|

Current portion of long-term debt (i) |

291,950 |

– |

– |

|||

|

Total current liabilities |

885,148 |

725,024 |

103,317 |

|||

|

Non-current liabilities |

||||||

|

Long-term borrowings from related party (iii) |

– |

52,555 |

7,489 |

|||

|

Consideration payable to WeBank (ii) |

– |

34,608 |

4,932 |

|||

|

Finance lease liabilities |

1,191,246 |

1,123,092 |

160,039 |

|||

|

Operating lease liabilities |

154,846 |

149,846 |

21,353 |

|||

|

Total non-current liabilities |

1,346,092 |

1,360,101 |

193,813 |

|||

|

Total liabilities |

2,231,240 |

2,085,125 |

297,130 |

|||

|

Mezzanine equity |

||||||

|

Redeemable non-controlling interests |

149,991 |

153,308 |

21,846 |

|||

|

Total Mezzanine equity |

149,991 |

153,308 |

21,846 |

|||

|

Shareholders’ deficit |

||||||

|

Ordinary shares |

39,806 |

39,816 |

5,674 |

|||

|

Additional paid-in capital |

18,928,837 |

18,960,679 |

2,701,875 |

|||

|

Subscription receivable from shareholders |

(107,879) |

(60,467) |

(8,616) |

|||

|

Accumulated other comprehensive income |

225,090 |

217,111 |

30,938 |

|||

|

Accumulated deficit |

(19,378,705) |

(19,491,014) |

(2,777,450) |

|||

|

Total Uxin’s shareholders’ deficit |

(292,851) |

(333,875) |

(47,579) |

|||

|

Non-controlling interests |

(231) |

(239) |

(34) |

|||

|

Total shareholders’ deficit |

(293,082) |

(334,114) |

(47,613) |

|||

|

Total liabilities, mezzanine equity and shareholders’ |

2,088,149 |

1,904,319 |

271,363 |

|||

|

(i) Long-term borrowing outstanding as of March 31, 2024 was pledged with the equity interest the Group holds in an |

||||||

|

* Share-based compensation charges included are as follows: |

||||||||||||

|

For the three months ended September 30, |

For the six months ended September 30, |

|||||||||||

|

2023 |

2024 |

2023 |

2024 |

|||||||||

|

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|||||||

|

Sales and marketing |

661 |

— |

— |

993 |

136 |

19 |

||||||

|

General and administrative |

12,243 |

13,992 |

1,994 |

21,668 |

25,776 |

3,673 |

||||||

|

Research and development |

885 |

— |

— |

1,279 |

128 |

18 |

||||||

|

Uxin Limited |

||||||||||||

|

Unaudited Reconciliations of GAAP And Non-GAAP Results |

||||||||||||

|

(In thousands except for number of shares and per share data) |

||||||||||||

|

For the three months ended September 30, |

For the six months ended September 30, |

|||||||||||

|

2023 |

2024 |

2023 |

2024 |

|||||||||

|

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|||||||

|

Net loss, net of tax |

(57,124) |

(59,169) |

(8,434) |

(148,726) |

(109,000) |

(15,533) |

||||||

|

Add: Income tax expense |

108 |

– |

– |

273 |

38 |

5 |

||||||

|

Interest income |

(45) |

(10) |

(1) |

(146) |

(26) |

(4) |

||||||

|

Interest expenses |

7,710 |

24,095 |

3,434 |

12,829 |

46,953 |

6,691 |

||||||

|

Depreciation |

6,684 |

15,479 |

2,206 |

13,097 |

32,056 |

4,568 |

||||||

|

EBITDA |

(42,667) |

(19,605) |

(2,795) |

(122,673) |

(29,979) |

(4,273) |

||||||

|

Add: Share-based compensation expenses |

13,789 |

13,992 |

1,994 |

23,940 |

26,040 |

3,710 |

||||||

|

– Sales and marketing |

661 |

– |

– |

993 |

136 |

19 |

||||||

|

– General and administrative |

12,243 |

13,992 |

1,994 |

21,668 |

25,776 |

3,673 |

||||||

|

– Research and development |

885 |

– |

– |

1,279 |

128 |

18 |

||||||

|

Other income |

(11,435) |

(1,498) |

(213) |

(13,802) |

(2,131) |

(304) |

||||||

|

Other expenses |

378 |

1,331 |

190 |

650 |

2,131 |

304 |

||||||

|

Foreign exchange gains |

(964) |

(969) |

(138) |

(539) |

(1,448) |

(206) |

||||||

|

Equity in income of affiliates, net of tax |

– |

(2,429) |

(346) |

– |

(2,429) |

(346) |

||||||

|

Dividend from long-term investment |

– |

– |

– |

(11,970) |

– |

– |

||||||

|

Net gain from extinguishment of debt |

– |

– |

– |

– |

(35,222) |

(5,019) |

||||||

|

Fair value impact of the issuance of senior |

(5,017) |

– |

– |

31,852 |

– |

– |

||||||

|

Non-GAAP adjusted EBITDA |

(45,916) |

(9,178) |

(1,308) |

(92,542) |

(43,038) |

(6,134) |

||||||

|

For the three months ended September 30, |

For the six months ended September 30, |

|||||||||||

|

2023 |

2024 |

2023 |

2024 |

|||||||||

|

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|||||||

|

Net loss attributable to ordinary shareholders |

(335,905) |

(60,837) |

(8,672) |

(427,505) |

(112,309) |

(16,005) |

||||||

|

Add: Share-based compensation expenses |

13,789 |

13,992 |

1,994 |

23,940 |

26,040 |

3,710 |

||||||

|

– Sales and marketing |

661 |

– |

– |

993 |

136 |

19 |

||||||

|

– General and administrative |

12,243 |

13,992 |

1,994 |

21,668 |

25,776 |

3,673 |

||||||

|

– Research and development |

885 |

– |

– |

1,279 |

128 |

18 |

||||||

|

Fair value impact of the issuance of senior |

(5,017) |

– |

– |

31,852 |

– |

– |

||||||

|

Add: accretion on redeemable non-controlling |

– |

1,668 |

238 |

– |

3,318 |

473 |

||||||

|

Deemed dividend to preferred shareholders due |

278,800 |

– |

– |

278,800 |

– |

– |

||||||

|

Non-GAAP adjusted net loss attributable to |

(48,333) |

(45,177) |

(6,440) |

(92,913) |

(82,951) |

(11,822) |

||||||

|

Net loss per share for ordinary shareholders – basic |

(0.24) |

(0.00) |

(0.00) |

(0.30) |

(0.00) |

(0.00) |

||||||

|

Net loss per share for ordinary shareholders – diluted |

(0.24) |

(0.00) |

(0.00) |

(0.30) |

(0.00) |

(0.00) |

||||||

|

Non-GAAP adjusted net loss to ordinary shareholders |

(0.03) |

(0.00) |

(0.00) |

(0.07) |

(0.00) |

(0.00) |

||||||

|

Weighted average shares outstanding – basic |

1,428,081,692 |

56,418,967,059 |

56,418,967,059 |

1,425,861,229 |

56,415,815,208 |

56,415,815,208 |

||||||

|

Weighted average shares outstanding – diluted |

1,428,081,692 |

56,418,967,059 |

56,418,967,059 |

1,425,861,229 |

56,415,815,208 |

56,415,815,208 |

||||||

|

Note: The conversion of Renminbi (RMB) into U.S. dollars (USD) is based on the certified exchange rate of USD1.00 = RMB7.0176 as of September 30, 2024 set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. |

||||||||||||

![]() View original content:https://www.prnewswire.com/news-releases/uxin-reports-unaudited-financial-results-for-the-quarter-ended-september-30-2024-302315172.html

View original content:https://www.prnewswire.com/news-releases/uxin-reports-unaudited-financial-results-for-the-quarter-ended-september-30-2024-302315172.html

SOURCE Uxin Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NIP Group Inc. Reports First Half 2024 Unaudited Financial Results

Net revenues from Events Production Increased by 376.5% YoY

Total operating expenses reduced by 49% YoY, narrowing net loss by 59%

Leveraging core competencies to create an expansive digital entertainment ecosystem with diverse revenue streams.

WUHAN, China, Nov. 25, 2024 (GLOBE NEWSWIRE) — NIP Group Inc. (“NIPG” or the “Company”) NIPG, a leading digital entertainment company, today announced its unaudited financial results for the first half of 2024, demonstrating year-over-year topline growth and narrowing losses as the Company balances growth and profitability by investing in high-growth areas while optimizing costs.

First Six Months of 2024 Financial and Operational Highlights

- Total net revenues for the first half of 2024 were US$39.3 million, compared with US$38.6 million in the same period of 2023.

- Gross profit for the first half of 2024 was US$2.4 million, compared with US$2.3 million in the same period of 2023.

- Net loss for the first half of 2024 was US$4.7 million, compared with US$11.3 million in the same period of 2023.

- Adjusted EBITDA for the first half of 2024 was negative US$2.6 million, compared with negative US$2.7 million in the same period of 2023.

Business Updates

- Completed initial public offering on NASDAQ raising over $20 million of capital in July 2024.

- Launched esports-themed hospitality service through a strategic partnership with Homeinns Hotels Group in August 2024.

- Entered into the game publishing market to create a fully integrated digital entertainment ecosystem in September 2024.

- Acquired Young Will, a leader in teen culture-themed short video content which boasts a following of over 115 million fans across major Chinese social media platforms, to strengthen the Company’s position in talent management in October 2024.

- Facilitating the entry into a term sheet with the Abu Dhabi Investment Office (“ADIO”), marking the Company’s expansion into the Middle East region.

Mario Ho, Chairman and Co-CEO of NIP Group, commented, “The first half of 2024 marked a pivotal phase in our company’s evolution from an esports-focused enterprise to a comprehensive gaming company. We have successfully laid the groundwork for our revenue diversification through strategic initiatives in game publishing, talent management upgrades, and sports-themed hospitality services, while expanding our operations to encompass the Middle East market. Our event production business has demonstrated remarkable growth, achieving a 376.5% revenue increase year-over-year. In talent management, we made the strategic decision to shift away from low-margin platforms, focusing instead on high-performance opportunities that better serve our long-term objectives. These moves reflect our commitment to building a more well-rounded and robust organization. Meanwhile, our recent public listing provides us with enhanced access to capital markets, potentially accelerating our future growth initiatives. Through these strategic shifts, we are maintaining our revenue growth trajectory while expediting our path to profitability.”

Hicham Chahine, Co-CEO of NIP Group, commented, “Looking ahead, we plan on executing several key strategic initiatives through the remainder of the year and through 2025 that will position us for sustainable growth and improved profitability. We are front-loading our staffing and marketing investments in our event production segment, and we expect to realize significant benefits from these economies of scale in 2025 and beyond. Our game publishing division is set to contribute meaningful revenue starting in 2025, and its established profitability will enhance our overall margins. In addition, our recent term sheet with the Abu Dhabi Investment Office will provide crucial subsidies enabling us to not only achieve EBITDA breakeven much earlier than planned, but also accelerate our organic growth and attain the economy of scale for maintaining profitability even after the subsidy expires. We are optimistic about the potential of our new initiatives and are thrilled to see what the future will bring.”

Ben Li, CFO of NIP Group, added, “Our financial results for the first half of 2024 reflect the ongoing strategic transformation of our business. Net revenues maintained stability despite a challenging macro backdrop, primarily driven by significant expansion in our event production segment. This performance demonstrates the initial impact of our business transition initiatives. Notably, we have substantially improved our bottom line, with net losses narrowing from US$11.3 million in the first half of 2023 to US$4.7 million in the first half of 2024. Our balance sheet remains solid, providing us with the financial flexibility to execute our growth strategy while maintaining operational stability. These results underscore the effectiveness of our strategic initiatives and our commitment to balancing topline growth with lasting profitability.”

First Six Months of 2024 Financial Results

Total net revenues

Total net revenues were US$39.3 million for the first half of 2024, compared to US$38.6 million in the same period of 2023.

The following table sets forth a breakdown of the Company’s net revenues by business segments for the period indicated.

| For the Six Months Ended June 30, | ||||||

| 2023 | 2024 | |||||

| US$ | % | US$ | % | |||

| (US$ in thousands, except for %) | ||||||

| Net revenues: | ||||||

| Esports teams operation | 9,849 | 25.5 | 8,782 | 22.3 | ||

| Talent management service | 26,896 | 69.8 | 21,901 | 55.7 | ||

| Event production | 1,818 | 4.7 | 8,662 | 22.0 | ||

| Total | 38,563 | 100.0 | 39,345 | 100.0 | ||

Total net revenues for the first half of 2024 increased by 2.0% to US$39.3 million, compared with US$38.6 million in the same period of 2023.

- Esports teams operation. Net revenues from esports teams operation during the first half of 2024 were US$8.8 million, representing a change of 10.8% from US$9.8 million in the same period of 2023, reflecting the transitory impact of the Company’s shift from IP licensing revenue related to PC and Console games to league revenue share from mobile games.

- Talent management service. Net revenues from talent management services were US$21.9 million during the first half of 2024, representing a change of 18.6% from US$26.9 million in the same period of 2023, reflecting the transitory impact of the Company’s migration from low-performance to high-performance online entertainment platforms.

- Event production. Net revenues from events production increased by 376.5% to US$8.7 million in the first half of 2024, from US$1.8 million in the same period of 2023. The increase was primarily driven by the Company hosting a higher number of events in 2024, due to improved integration of internal and external resources during the period.

- Foreign exchange impact. During the first half of 2024, the Company’s total net revenues were negatively impacted by unfavorable exchange rate movements. The appreciation of the US dollar compared to the RMB has had a negative impact on operations. The functional currency of the company’s PRC subsidiaries is RMB. The company lost approximately 4 percent of the value when sales amount in RMB for the six months ended June 30, 2024, translated into the US dollar.

Cost of revenues

Cost of revenues for the first half of 2024 was US$37.0 million, compared to US$36.3 million in the same period of 2023.

The following table sets forth a breakdown of the Company’s cost of revenues by business segments for the periods indicated.

| For the Six Months Ended June 30, | ||||||

| 2023 | 2024 | |||||

| US$ | % | US$ | % | |||

| (US$ in thousands, except for %) | ||||||

| Cost of revenues: | ||||||

| Esports teams operation | 7,332 | 20.2 | 6,019 | 16.3 | ||

| Talent management service | 27,388 | 75.5 | 23,204 | 62.7 | ||

| Event production | 1,550 | 4.3 | 7,757 | 21.0 | ||

| Total | 36,270 | 100.0 | 36,980 | 100.0 | ||

- Esports teams operation. Cost of revenues from esports teams operation for the first half of 2024 decreased by 17.9% to US$6.0 million, from US$7.3 million in the same period of 2023. The decline was primarily driven by a decrease in IP licensing fees paid to athletes under Ninjas in Pyjamas.

- Talent management service. Cost of revenues from talent management service for the first half of 2024 decreased by 15.3% to US$23.2 million, from US$27.4 million in the same period of 2023. The decrease was mainly due to the decline in livestreaming service fees paid to online entertainers.

- Event production. Cost of revenues from event production for the first half of 2024 increased by 400.5% to US$7.8 million from US$1.6 million in the same period of 2023. The increase was in line with the increase in revenues recognized from the Company’s event production business.

Gross profit

Gross profit for the first half of 2024 was US$2.4 million, compared with US$2.3 million in the same period of 2023. Gross margin for the first half of 2024 was 6.0%, compared with 5.9% in the same period of 2023. The slight increase in gross profit margin was mainly attributable to the increase in event production revenues, which was partially offset by the decline in talent management service revenues.

- Esports teams operation. Esports teams operation gross profit increased to US$2.8 million in the first half of 2024, from US$2.5 million in the same period of 2023. Gross margin increased to 31.5% from 25.6% in the first half of 2023, primarily due to increased revenue from league revenue sharing and athlete transfer and rental fees, which have a higher margin.

- Talent management service. Gross loss from talent management service changed from US$0.5 million in the first half of 2023 to US$1.3 million in the same period of 2024. Gross loss margin expanding from 1.8% in the first half of 2023 to 5.9% in the same period of 2024, primarily due to declining economies of scale.

- Event production. Gross profit from event production increased to US$0.9 million in the first half of 2024, from US$0.3 million in the same period of 2023. Gross profit margin declined from 14.7% in the first half of 2023 to 10.5% in the same period of 2024, mainly due to new large-scale esports events with lower average margins that the Company hosted in the first half of 2024 as well as the Company frontloading staffing and marketing expenses to accelerate the pace towards economy of scale.

Selling and Marketing Expenses

Selling and marketing expenses for the first half of 2024 were US$2.8 million, representing a decrease of 26.7% from US$3.8 million in the same period of 2023. This was mainly attributable to a decrease in marketing and promotion expenses for talent management service, and the decrease in business costs. Selling and marketing expenses as a percentage of net revenues decreased from 9.9% in the first half of 2023 to 7.1% in the same period of 2024, mainly due to improvements in operating efficiency.

General and Administrative Expenses

General and administrative expenses for the first half of 2024 decreased by 56.6% to US$4.7 million, from US$10.8 million in the same period of 2023. The decrease was primarily due to a decline in share-based compensation expenses, as the shares under the Company’s share incentive plans were fully vested in the first half of 2023. General and administrative expenses excluding share-based compensation for management and administrative employees as a percentage of net revenues increased slightly from 11.8% in the first half of 2023 to 11.9% in the same period of 2024.