How Tim Cook's Strategy To Win Over Trump Gave Apple A Competitive Edge, And Why Sundar Pichai, Mark Zuckerberg And Others Might Be Following His Playbook

Apple Inc. AAPL CEO Tim Cook’s approach to building a relationship with Donald Trump during his presidency reportedly gave Cupertino unique advantages over competitors. Other tech leaders may now be taking notes.

What Happened: A report by The Wall Street Journal highlights how Cook navigated Trump’s administration with a direct, focused strategy.

Cook often bypassed lobbyists and government relations executives, opting instead for one-on-one meetings and phone calls with Trump.

He would focus on singular, data-driven points in discussions to influence policy in Apple’s favor.

This approach reportedly helped Apple avoid some of the harsher impacts of Trump’s trade tariffs in 2019 and positioned the company to benefit from the administration’s 2017 tax reforms.

Cook also strategically aligned Apple’s interests with Trump’s agenda, ensuring mutual benefits. For instance, he didn’t refute Trump’s claim of credit for an Austin manufacturing plant that was neither new nor owned by Apple.

The report noted that doing so allowed Trump to appear successful while maintaining Apple’s goodwill.

Leaders of other major companies, including Alphabet Inc. GOOG GOOGL CEO Sundar Pichai and Meta Platforms, Inc.’s META Mark Zuckerberg are reportedly employing similar strategies.

According to the report, executives from Boeing Co. BA and FedEx Corp. FDX have also attempted direct communication with Trump.

Meanwhile, some have reportedly explored leveraging connections through the Department of Government Efficiency (DOGE), a role Trump assigned to Elon Musk after the Tesla Inc. CEO’s vocal support for his campaign.

Why It Matters: Trump previously said that Pichai updated him on trending Google searches and Zuckerberg praised his response to an assassination attempt, showing their efforts to establish rapport.

Since Trump’s victory in the 2024 U.S. Presidential election, both the stock market and the cryptocurrency sector have experienced significant growth.

The S&P 500 has increased by 3.22%, rising from 5,782 on Nov. 5 to 5,969 as of Friday’s close. The SPDR S&P 500 ETF SPY which tracks the S&P 500 Index has had a similar momentum since Trump’s victory, according to data from Benzinga Pro.

During the same period, NASDAQ has risen 2.71% to reach 20,776.23. The Invesco QQQ Trust QQQ which tracks the performance of the Nasdaq-100 Index gained 2.75%.

On the other hand, the overall market cap of the cryptocurrency sector has risen to $3.37 trillion, up 44.63% from $2.33 trillion on Nov. 5.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photos courtesy: Wikimedia and WEF on Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Recycled Plastic Resins Market is Projected to Reach US$ 109.4 Billion with a 8.5% CAGR by 2034 | Fact.MR Report

Rockville, MD, Nov. 25, 2024 (GLOBE NEWSWIRE) — The recycled plastic resins market is expected to grow from US$ 48.4 billion in 2024 to US$ 109.4 billion in 2034. Fact. MR’s extensive study shows that the market will expand at a growth rate of 8.5% from 2024 to 2034.

The growing need for eco-friendly products in various sectors is boosting the recycled plastic resins market. Recycled plastic resins are manufactured from the waste generated by post-industrial and post-consumer plastic products and are used in many end-users like packaging, automotive, and construction sectors and textiles lessening dependency on plastics thereby reducing the carbon footprint of these industries. The growth of these markets is explained to a large extent by the increasing status of the aging population and changes in government policies aimed at cutting plastic waste and encouraging the circular economy.

The trends of both corporations and consumers are inclined to produce greener goods, which leads to the increased demand for recycled plastics in order to avoid sustainability crisis that is the issue of plastic waste. Escalating adoption of new recycling processes, for instance, chemical recycling and developed sorting technologies, enhances the quality of recycled resins, making it possible for them to be used in high-end applications thus boosting the market. Furthermore, recycling resins are less expensive than normal resins leading to increased construction of waste management systems.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10460

Key Takeaways from Market Study:

- Global recycled plastic resins market will grow at a CAGR of 8.5%, reaching US$ 109.4 billion by the end of 2034.

- North America will expand at a CAGR of 8.8% from 2024 to 2034, capturing 24.1% of the market share in 2024 and offering an absolute opportunity of US$ 15.4 billion.

- East Asia will account for 31.6% of market share in 2024, generating an absolute dollar opportunity of US$ 19.6 billion between 2024 and 2034.

- Between 2024 and 2034, by material type the Polyethylene Terephthalate (PET) are expected to produce an absolute dollar opportunity US$ 19.3 billion.

- With a 41.8% market share, by application, packaging segment is estimated to be worth US$ 20.2 billion in 2024.

“Increasing environmental regulations, shift toward sustainable technologies and growing environmental awareness have contributed to the growth of the recycled plastic resins market” says a Fact.MR analyst.

Leading Players Driving Innovation in the Recycled Plastic Resins Market:

Dow; Veolia; Indorama Ventures; Suez; Plastipak Holdings, Inc; Loop Industries; Clean Tech UK Ltd; KW Plastics; CarbonLITE Industries; Custom Polymers; Ultra-Poly Corporation; MBA Polymers Inc; Evergreen Plastics Ltd; Envision Plastics; Merlin Plastics; Alpek Polyester

Market Development:

Key companies involved in recycled plastic resins market are Veolia, Indorama Ventures, Suez, Plastipak Holdings, Inc., Loop Industries, Clean Tech UK Ltd., KW Plastics, CarbonLITE Industries, Custom Polymers, Ultra-Poly Corporation, MBA Polymers Inc., Evergreen Plastics Ltd., Envision Plastics, Merlin Plastics, and Alpek Polyester among others.

These companies are focusing on innovation, sound environmental practices, and strategic partnership building, and expanding their product lines to improve performance and meet growing demand in many industries.

Recycled Plastic Resins Industry News:

- In June 2024, Dow Chemical Co. teamed with RKW Group, a German manufacturer of polyolefin-based films, to debut two new grades of resins under Dow’s Revoloop recycled plastic resin product portfolio, including a resin with up to 100 percent postconsumer recycled (PCR) plastic.

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global recycled plastic resins market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights based on Material Type (Polyethylene Terephthalate (PET), Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), and Others (Acrylonitrile Butadiene Styrene (ABS), Polycarbonate (PC))); Recycling Process (Mechanical Recycling and Chemical Recycling); Source (Bottles, Films & Sheets, Fibers, Foams, and Others (Agricultural Plastics, Medical Plastics)); Application (Packaging, Construction, Automotive, Electrical & Electronics, Textiles, and Others (Medical, Household Products)) across major seven regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa).

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10460

Checkout More Related Studies Published by Fact.MR Research:

The global recycled plastic market is projected to reach US$ 85.18 billion in 2024 and thereafter increase at 7.8% CAGR to end up at US$ 180.51 billion by 2034, as stated in a newly published report by Fact.MR.

The global recycled paper bags market experienced year-on-year (YoY) growth of 4.4% to reach US$ 2.8 billion at the end of 2021. Demand for recycled paper bags from the commercial sector was up by 4.6% and reached US$ 1.9 billion in 2021.

The eco-friendly factor introduced by the recycled leather market and its innovative methods of manufacturing is reducing the environmental pollution. For this reason, it is considered as an ideal product for various applications, thereby increasing the overall market value.

The Europe plastic protective packaging market is projected to grow at the rate of 4.5% to reach a valuation of US$ 6.2 Billion by 2032 from US$ 4 Billion in 2022.

The global glass fibre reinforced plastic (GFRP) products market has reached a valuation of US$ 18.54 billion in 2023 and is projected to climb to US$ 41.92 billion by 2033.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bright Scholar Announces Unaudited Financial Results for the Fourth Quarter and Fiscal Year 2024

Gross Profit from continuing operations increased 7.7% YoY and gross margin from continuing operations grew 2.3 ppts for fiscal year 2024

Management to hold a conference call today at 7:00 a.m. Eastern Time

CAMBRIDGE, England and FOSHAN, China, Nov. 25, 2024 /PRNewswire/ — Bright Scholar Education Holdings Limited (“Bright Scholar,” the “Company,” “we” or “our”) BEDU, a global premier education service company, today announced its unaudited financial results for its fourth quarter and fiscal year 2024 ended August 31, 2024.

FOURTH QUARTER OF FISCAL 2024 FINANCIAL HIGHLIGHTS

- Revenue from continuing operations was RMB358.3 million, compared to RMB442.2 million for the same quarter last fiscal year.

- Revenue from Overseas Schools was RMB185.1 million, representing a 0.2% increase from RMB184.8 million for the same quarter last fiscal year.

- Loss from continuing operations was RMB954.8 million, compared to RMB285.1 million for the same quarter last fiscal year. Adjusted net loss[1] narrowed by 24.3% to RMB92.0 million from RMB121.4 million for the same quarter last fiscal year.

Revenue from continuing operations by Segment

|

(RMB in millions except for

|

For the fourth quarter ended August 31, |

YoY % Change |

% of total |

|

|

2024 |

2023 |

|||

|

Overseas Schools |

185.1 |

184.8 |

0.2 % |

51.7 % |

|

Complementary Education |

129.8 |

161.7 |

-19.7 % |

36.2 % |

|

Domestic Kindergartens & K- |

43.4 |

95.7 |

-54.7 % |

12.1 % |

|

Total |

358.3 |

442.2 |

-19.0 % |

100.0 % |

|

[1]. Adjusted net income/(loss) is defined as net income/(loss) excluding share-based compensation expenses, amortization of intangible assets, tax effect of amortization of intangible assets, impairment loss on goodwill, impairment loss on intangible assets, impairment loss on property and equipment, impairment loss on the long-term investments, and income/(loss) from discontinued operations, net of tax. |

|

[2]. The Complementary Education Services business comprises, overseas study counselling, art training, camps and others. |

|

[3]. The Domestic Kindergartens & K-12 Operation Services business comprises operation services for students of domestic K-12 schools, including catering and procurement services. |

|

For more information on these adjusted financial measures, please see the section captioned “Non-GAAP Financial Measures” and the tables captioned “Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this release. |

FISCAL YEAR 2024 FINANCIAL HIGHLIGHTS

- Revenue from continuing operations was RMB1,755.2 million, compared to RMB1,772.1 million for the last fiscal year.

- Revenue from Overseas Schools was RMB951.2 million, representing an increase of 17.5% from the last fiscal year.

- Gross profit from continuing operations was RMB503.6 million, representing an increase of 7.7% from RMB467.4 million for the last fiscal year. Gross margin from continuing operations increased to 28.7% from 26.4% for the last fiscal year.

- Loss from continuing operations was RMB869.1 million, compared to RMB358.9 million for the last fiscal year. Adjusted net income was RMB1.1 million, compared to adjusted net loss of RMB192.6 for the last fiscal year.

Revenue from continuing operations by Segment

|

(RMB in millions except for

|

For the fiscal year August 31, |

YoY % Change |

% of total |

|

|

2024 |

2023 |

|||

|

Overseas Schools |

951.2 |

809.5 |

17.5 % |

54.2 % |

|

Complementary Education |

495.1 |

519.2 |

-4.7 % |

28.2 % |

|

Domestic Kindergartens & K- |

308.9 |

443.4 |

-30.3 % |

17.6 % |

|

Total |

1,755.2 |

1,772.1 |

-1.0 % |

100.0 % |

MANAGEMENT COMMENTARY

Mr. Robert Niu, Chief Executive Officer of Bright Scholar, commented, “Throughout the year, we bolstered our global business and operations, strengthening our foundation for future advancement. Despite macro challenges, we achieved rapid progress in our overseas business while further enhancing our senior leadership team to help advance our near-term expansion goals in overseas markets. Our Overseas Schools business maintained its double-digit year-over-year revenue growth for the fiscal year. As we focused our resources on strengthening our high-growth core business, we have completed divesting non-core business from our Complementary Education Services segment by the end of the fiscal quarter. Moving into fiscal year 2025, we plan to reinforce our “dual-engine” growth strategy by focusing on the continued expansion of our overseas school business while propelling our global recruitment initiatives for prospective international students. We are well-positioned to drive further expansion and capture more of the sizeable market opportunities that will support our sustainable development over the long term.”

Ms. Cindy Zhang, Chief Financial Officer of Bright Scholar, added, “Ongoing development across our core businesses drove our healthy financial results for the fiscal year. Our total revenues for fiscal year 2024 remained stable year over year, with Overseas Schools revenue increasing by 18%. We continued to streamline our operations and improve operational efficiency. Notably, our gross profit increased by 7.7% and gross margin by 2.3 percentage points year-over-year. Meanwhile, we significantly enhanced our cash position, increasing our cash and cash equivalents and restricted cash by 20% for the fiscal year. Looking ahead, supported by our healthy balance sheet and the effective implementation of our “dual-engine” growth strategy, we are confident we can solidify our competitive edge while also driving long-term growth and profitability.”

UNAUDITED FINANCIAL RESULTS FOR THE FOURTH FISCAL QUARTER ENDED AUGUST 31, 2024

Revenue from Continuing Operations

Revenue was RMB358.3 million, compared to RMB442.2 million for the same quarter last fiscal year.

Overseas Schools: Revenue contribution was RMB185.1 million, representing a 0.2% increase from RMB184.8 million for the same quarter last fiscal year.

Complementary Education Services: Revenue contribution was RMB129.8 million, compared to RMB161.7 million for the same quarter last fiscal year. The decrease was mainly attributable to a reduction in extracurricular programs and study tours.

Domestic Kindergartens & K-12 Operation Services: Revenue contribution was RMB43.4 million, compared to RMB95.7 million for the same quarter last fiscal year.

Cost of Revenue from Continuing Operations

Cost of revenue was RMB322.4 million, or 90.0% of revenue, compared to RMB362.4 million, or 81.9%, for the same quarter last fiscal year.

Gross Profit, Gross Margin and Adjusted Gross Profit from Continuing Operations

Gross profit was RMB35.9 million, compared to RMB79.8 million for the same quarter last fiscal year. Gross margin was 10.0%, compared to 18.1% for the same quarter last fiscal year.

Adjusted gross profit[4] was RMB36.9 million, compared to RMB80.9 million for the same quarter last fiscal year.

Selling, General and Administrative (SG&A) Expenses from Continuing Operations

Total SG&A expenses were RMB119.3 million, representing an 18.3% decrease from RMB146.0 million for the same quarter last fiscal year. This improvement was mainly due to our continuous efforts to streamline our operations and improve operational efficiency in our headquarters.

Operating Loss/Income, Operating Margin and Adjusted Operating Income from Continuing Operations

Operating loss was RMB941.8 million, compared to RMB227.6 million for the same quarter last fiscal year. Operating loss margin was 262.9%, compared to 51.5% for the same quarter last fiscal year.

Adjusted operating loss[5] was RMB78.8 million, compared to RMB64.0 million for the same quarter last fiscal year.

Net Loss and Adjusted Net Income/Loss

Net loss was RMB1,004.7 million, compared to RMB340.3 million for the same quarter last fiscal year.

Adjusted net loss was RMB92.0 million, compared to RMB121.4 million for the same quarter last fiscal year.

Adjusted EBITDA[6]

Adjusted EBITDA loss was RMB81.8 million, compared to RMB55.0 million for the same quarter last fiscal year.

Net Loss per Ordinary Share/ADS and Adjusted Net Earnings/Loss per Ordinary Share/ADS

Basic and diluted net loss per ordinary share attributable to ordinary shareholders from continuing operations were RMB7.90 each, compared to RMB2.41 each for the same quarter last fiscal year.

Basic and diluted net loss per ordinary share attributable to ordinary shareholders from discontinued operations were RMB0.42 each, compared to RMB0.50 each for the same quarter last fiscal year.

Adjusted basic and diluted net loss per ordinary share[7] attributable to ordinary shareholders were RMB0.75 each, compared to RMB1.03 each for the same quarter last fiscal year.

Basic and diluted net loss per ADS attributable to ADS holders from continuing operations were RMB31.60 each, compared to RMB9.64 each for the same quarter last fiscal year.

Basic and diluted net loss per ADS attributable to ADS holders from discontinued operations were RMB1.68 each, compared to RMB2.00 each for the same quarter last fiscal year.

Adjusted basic and diluted net loss per ADS[8] attributable to ADS holders were RMB3.00 each, compared to RMB4.12 each for the same quarter last fiscal year.

UNAUDITED FINANCIAL RESULTS FOR THE FISCAL YEAR ENDED AUGUST 31, 2024

Revenue from Continuing Operations

Revenue was RMB1,755.2 million, compared to RMB1,772.1 million for the last fiscal year.

Overseas Schools: Revenue contribution was RMB951.2 million, representing a 17.5% increase from RMB809.5 million for the last fiscal year. The increase was mainly attributable to increases in both the number of students enrolled and the average tuition fees of overseas schools.

Complementary Education Services: Revenue contribution was RMB495.1 million, compared to RMB519.2 million for the last fiscal year. The decrease was mainly attributable to a reduction in extracurricular programs and study tours.

Domestic Kindergartens & K-12 Operation Services: Revenue contribution was RMB308.9 million, compared to RMB443.4 million for the last fiscal year.

Cost of Revenue from Continuing Operations

Cost of revenue was RMB1,251.6 million, or 71.3% of revenue, compared to RMB1,304.7 million, or 73.6%, for the last fiscal year. The improvement was mainly attributable to cost-saving measures.

Gross Profit, Gross Margin and Adjusted Gross Profit from Continuing Operations

Gross profit was RMB503.6 million, representing a 7.7% increase from RMB467.4 million for the last fiscal year. The increase was mainly attributable to the revenue growth in Overseas Schools. Gross margin increased to 28.7% from 26.4% for the last fiscal year.

Adjusted gross profit was RMB507.8 million, representing a 7.6% increase from RMB471.8 million for the last fiscal year.

Selling, General and Administrative (SG&A) Expenses from Continuing Operations

Total SG&A expenses were RMB469.0 million, representing an 8.1% decrease from RMB510.3 million for the last fiscal year. This improvement was mainly due to our continuous efforts to streamline our global operations and improve operational efficiency in our headquarters.

Operating Loss/Income, Operating Margin and Adjusted Operating Income from Continuing Operations

Operating loss was RMB820.4 million, compared to RMB161.7 million for the last fiscal year. Operating loss margin was 46.7%, compared to 9.1% for the last fiscal year.

Adjusted operating income increased by 856.3% to RMB50.5 million, from RMB5.3 million for the last fiscal year.

Net Loss and Adjusted Net Income/Loss

Net loss was RMB1,032.9 million, compared to RMB386.8 million for the last fiscal year.

Adjusted net income was RMB1.1 million, compared to adjusted net loss of RMB192.6 million for the last fiscal year.

Adjusted EBITDA

Adjusted EBITDA increased by 44.1% to RMB80.7 million, from RMB56.0 million for the last fiscal year.

Net Loss per Ordinary Share/ADS and Adjusted Net Earnings/Loss per Ordinary Share/ADS

Basic and diluted net loss per ordinary share from continuing operations attributable to ordinary shareholders were RMB7.18 each, compared to RMB3.03 each for the last fiscal year.

Basic and diluted net loss per ordinary share from discontinued operations attributable to ordinary shareholders were RMB1.22 each, compared to RMB0.30 each for the last fiscal year.

Adjusted basic and diluted net income per ordinary share attributable to ordinary shareholders were RMB0.04 each, compared to net loss per ordinary share attributable to ordinary shareholders of RMB1.63 each for the last fiscal year.

Basic and diluted net loss per ADS from continuing operations attributable to ADS holders were RMB28.72 each, compared to RMB12.12 each for the last fiscal year.

Basic and diluted net loss per ADS from discontinued operations attributable to ADS holders were RMB4.88 each, compared to RMB1.20 each for the last fiscal year.

Adjusted basic and diluted net income per ADS attributable to ADS holders were RMB0.16 each, compared to net loss per ADS attributable to ADS holders were RMB6.52 each for the last fiscal year.

Cash and Working Capital

As of August 31, 2024, the Company had cash and cash equivalents and restricted cash of RMB505.8 million (US$71.3 million), compared to RMB419.9 million as of August 31, 2023.

|

[4] Adjusted gross profit from continuing operations is defined as gross profit from continuing operations excluding amortization of intangible assets. |

|

[5]. Adjusted operating income/(loss) from continuing operations is defined as operating income/(loss) from continuing operations excluding share-based compensation expenses, amortization of intangible assets, impairment loss on property and equipment, impairment loss on goodwill, impairment loss on intangible assets, and impairment loss on the long-term investments. |

|

[6]. Adjusted EBITDA is defined as net income/(loss) excluding interest income/(expense), net, income tax expense/benefit, depreciation and amortization, share-based compensation expenses, impairment loss on property and equipment, impairment loss on goodwill, impairment loss on intangible assets, impairment loss on the long-term investments and income/(loss) from discontinued operations, net of tax. |

|

[7] Adjusted basic and diluted earnings/(loss) per share is defined as adjusted net income/(loss) attributable to ordinary shareholders (net income/(loss) attributable to ordinary shareholders excluding share-based compensation expenses, amortization of intangible assets, tax effect of amortization of intangible assets, impairment loss on property and equipment, impairment loss on goodwill, impairment loss on intangible assets, impairment loss on the long-term investments and income/(loss) from discontinued operations, net of tax) divided by the weighted average number of basic and diluted ordinary shares. |

|

[8]. Adjusted basic and diluted earnings/(loss) per American Depositary Share (“ADS”) is defined as adjusted net income/(loss) attributable to ADS shareholders (net income/(loss) attributable to ADS shareholders excluding share-based compensation expenses, amortization of intangible assets, tax effect of amortization of intangible assets, impairment loss on property and equipment, impairment loss on goodwill, impairment loss on intangible assets, impairment loss on the long-term investments and income/(loss) from discontinued operations, net of tax) divided by the weighted average number of basic and diluted ADSs. |

CONFERENCE CALL

The Company’s management will host an earnings conference call at 7:00 a.m. U.S. Eastern Time (8:00 p.m. Beijing/Hong Kong Time) on November 25, 2024.

Dial-in details for the earnings conference call are as follows:

Mainland China: 4001-201203

Hong Kong: 800-905945

United States: 1-888-346-8982

International: 1-412-902-4272

Participants should dial in at least 5 minutes before the scheduled start time and ask to be connected to the call for “Bright Scholar Education Holdings Limited.”

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at http://ir.brightscholar.com/.

A replay of the conference call will be accessible after the conclusion of the live call until December 2, 2024, by dialing the following telephone numbers:

United States Toll Free: 1-877-344-7529

International: 1-412-317-0088

Replay Passcode: 7352870

CONVENIENCE TRANSLATION

The Company’s reporting currency is Renminbi (“RMB”). However, periodic reports made to shareholders will include current period amounts translated into U.S. dollars using the prevailing exchange rates at the balance sheet date for the convenience of readers. Translations of balances in the condensed consolidated balance sheets, and the related condensed consolidated statements of operations, and cash flows from RMB into U.S. dollars as of and for the quarter ended August 30, 2024 are solely for the convenience of the readers and were calculated at the rate of US$1.00=RMB7.0900, representing the noon buying rate set forth in the H.10 statistical release of the U.S. Federal Reserve Board on August 30, 2024. No representation is made that the RMB amounts could have been, or could be, converted, realized or settled into US$ at that rate on August 30, 2024, or at any other rate.

NON-GAAP FINANCIAL MEASURES

In evaluating our business, we consider and use certain non-GAAP measures, including primarily adjusted EBITDA, adjusted net income/(loss), adjusted gross profit/(loss), adjusted operating income/(loss), adjusted net earnings/(loss) per share attributable to ordinary shareholders/ADS holders basic and diluted as supplemental measures to review and assess our operating performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. We define adjusted gross profit/(loss) from continuing operations as gross profit/(loss) from continuing operations excluding amortization of intangible assets. We define adjusted EBITDA as net income/(loss) excluding interest income/(expense), net, income tax expense/benefit, depreciation and amortization, share-based compensation expenses, impairment loss on property and equipment, impairment loss on goodwill, impairment loss on intangible assets, impairment loss on the long-term investments and income/(loss) from discontinued operations, net of tax. We define adjusted net income/(loss) as net income/(loss) excluding share-based compensation expenses, amortization of intangible assets, tax effect of amortization of intangible assets, impairment loss on goodwill, impairment loss on intangible assets, impairment loss on property and equipment, impairment loss on the long-term investments, and income/(loss) from discontinued operations, net of tax. We define adjusted operating income/(loss) from continuing operations as operating income/(loss) from continuing operations excluding share-based compensation expenses, amortization of intangible assets, impairment loss on property and equipment, impairment loss on goodwill, impairment loss on intangible assets and impairment loss on the long-term investments. Additionally, we define adjusted net earnings/(loss) per share attributable to ordinary shareholders/ADS holders, basic and diluted, as adjusted net income/(loss) attributable to ordinary shareholders/ADS holders (net income/(loss) to ordinary shareholders/ADS holders excluding share-based compensation expenses, amortization of intangible assets, tax effect of amortization of intangible assets, impairment loss on goodwill, impairment loss on intangible assets,, impairment loss on property and equipment, impairment loss on the long-term investments, and income/(loss) from discontinued operations, net of tax) divided by the weighted average number of basic and diluted ordinary shares or ADSs.

We incur amortization expense of intangible assets related to various acquisitions that have been made in recent years. These intangible assets are valued at the time of acquisition and are then amortized over a period of several years after the acquisition. We believe that exclusion of these expenses allows greater comparability of operating results that are consistent over time for the Company’s newly-acquired and long-held business as the related intangibles do not have significant connection to the growth of the business. Therefore, we provide exclusion of amortization of intangible assets to define adjusted gross profit from continuing operations, adjusted operating income/(loss) from continuing operations, adjusted net income/(loss), and adjusted net earnings/(loss) per share attributable to ordinary shareholders/ADS holders, basic and diluted. In addition, the strategic move to dispose of the non-core businesses is viewed as discontinued operations, which is a non-recurring item. The exclusion facilitates comparisons of our operating performance on a period-to-period basis. Therefore, we provide exclusion of income/(loss) from discontinued operations, net of tax, to define adjusted net income/(loss), adjusted EBITDA, adjusted net earnings/(loss) per share attributable to ordinary shareholders/ADS holders, basic and diluted.

We present the non-GAAP financial measures because they are used by our management to evaluate our operating performance and formulate business plans. Such non-GAAP measures include adjusted EBITDA, adjusted net income/(loss), adjusted gross profit/(loss) from continuing operations, adjusted operating income/(loss) from continuing operations, adjusted net earnings/(loss) per share attributable to ordinary shareholders/ADS holders basic and diluted. Non-GAAP financial measures enable our management to assess our operating results without considering the impact of non-cash charges, including depreciation and amortization and share-based compensation expenses, and without considering the impact of non-operating items such as interest income/(expense), net; income tax expense/benefit; share-based compensation expenses; amortization of intangible assets, tax effect of amortization of intangible assets, and without considering the impact of non-recurring item, i.e. income/(loss) from discontinued operations. We also believe that the use of these non-GAAP measures facilitates investors’ assessment of our operating performance.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools. One of the key limitations of using these non-GAAP financial measures is that they do not reflect all items of income and expense that affect our operations. Interest income/(expense), net; income tax expense/benefit; depreciation and amortization; share-based compensation expense; tax effect of amortization of intangible assets have been and may continue to be incurred in our business and are not reflected in the presentation of these non-GAAP measures, including adjusted EBITDA or adjusted net income/(loss). Further, these non-GAAP measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited.

About Bright Scholar Education Holdings Limited

Bright Scholar is a premier global education service Group. The Company primarily provides quality international education to global students and equips them with the critical academic foundation and skillsets necessary to succeed in the pursuit of higher education.

For more information, please visit: https://ir.brightscholar.com/.

Safe Harbor Statement

This announcement contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, the Company’s business plans and development, which can be identified by terminology such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. Such statements are based upon management’s current expectations and current market and operating conditions and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company’s control, which may cause the Company’s actual results, performance or achievements to differ materially from those in the forward-looking statements. Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange Commission. The Company does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under law.

IR Contact:

Email: BEDU@thepiacentegroup.com

Phone: +86 (10) 6508-0677/ +1-212-481-2050

Media Contact:

Email: media@brightscholar.com

|

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts in thousands) |

|||||

|

As of |

|||||

|

August 31, |

August 31, |

||||

|

2023 |

2024 |

||||

|

RMB |

RMB |

USD |

|||

|

ASSETS |

|||||

|

Current assets |

|||||

|

Cash and cash equivalents |

410,086 |

493,377 |

69,588 |

||

|

Restricted cash |

9,521 |

12,167 |

1,716 |

||

|

Accounts receivable, net |

13,800 |

18,793 |

2,651 |

||

|

Amounts due from related |

183,468 |

14,417 |

2,033 |

||

|

Other receivables, deposits |

116,807 |

123,860 |

17,470 |

||

|

Inventories |

1,183 |

1,160 |

165 |

||

|

Current assets belong to |

192,534 |

– |

– |

||

|

Total current assets |

927,399 |

663,774 |

93,622 |

||

|

Restricted cash – non-current |

250 |

250 |

35 |

||

|

Property and equipment, net |

390,006 |

349,349 |

49,273 |

||

|

Intangible assets, net |

310,022 |

49,598 |

6,995 |

||

|

Goodwill, net |

1,110,802 |

527,297 |

74,372 |

||

|

Long-term investments, net |

32,732 |

24,421 |

3,444 |

||

|

Prepayments for construction |

1,712 |

328 |

46 |

||

|

Deferred tax assets, net |

1,644 |

1,920 |

271 |

||

|

Other non-current assets, net |

9,424 |

9,106 |

1,284 |

||

|

Operating lease right-of-use |

1,490,009 |

1,419,406 |

200,198 |

||

|

Non-current assets belong to |

345,510 |

– |

– |

||

|

Total non-current assets |

3,692,111 |

2,381,675 |

335,918 |

||

|

TOTAL ASSETS |

4,619,510 |

3,045,449 |

429,540 |

||

|

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS-CONTINUED (Amounts in thousands) |

|||||

|

As of |

|||||

|

August 31, |

August 31, |

||||

|

2023 |

2024 |

||||

|

RMB |

RMB |

USD |

|||

|

LIABILITIES AND EQUITY |

|||||

|

Current liabilities |

|||||

|

Accounts payable |

94,481 |

91,843 |

12,954 |

||

|

Amounts due to related parties |

244,259 |

78,365 |

11,053 |

||

|

Accrued expenses and other |

233,053 |

191,222 |

26,971 |

||

|

Income tax payable |

88,460 |

78,986 |

11,140 |

||

|

Contract liabilities – current |

428,617 |

445,715 |

62,865 |

||

|

Refund liabilities – current |

10,129 |

9,872 |

1,392 |

||

|

Operating lease liabilities – |

104,905 |

106,325 |

14,996 |

||

|

Current liabilities belong to |

276,499 |

– |

– |

||

|

Total current liabilities |

1,480,403 |

1,002,328 |

141,371 |

||

|

Non-current contract liabilities |

971 |

866 |

122 |

||

|

Deferred tax liabilities, net |

34,755 |

31,174 |

4,397 |

||

|

Operating lease liabilities – |

1,461,255 |

1,404,973 |

198,163 |

||

|

Non-current liabilities belong to |

70,470 |

– |

– |

||

|

Total non-current liabilities |

1,567,451 |

1,437,013 |

202,682 |

||

|

TOTAL LIABILITIES |

3,047,854 |

2,439,341 |

344,053 |

||

|

EQUITY |

|||||

|

Share capital |

8 |

8 |

1 |

||

|

Additional paid-in capital |

1,697,370 |

1,783,490 |

251,550 |

||

|

Statutory reserves |

20,155 |

16,535 |

2,332 |

||

|

Accumulated other |

172,230 |

191,397 |

26,995 |

||

|

Accumulated deficit |

(473,154) |

(1,474,619) |

(207,986) |

||

|

Shareholders’ equity |

1,416,609 |

516,811 |

72,892 |

||

|

Non-controlling interests |

155,047 |

89,297 |

12,595 |

||

|

TOTAL EQUITY |

1,571,656 |

606,108 |

85,487 |

||

|

TOTAL LIABILITIES AND EQUITY |

4,619,510 |

3,045,449 |

429,540 |

||

|

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Amounts in thousands, except for shares and per share data) |

||||||||||

|

Three Months Ended August 31 |

Year Ended August 31 |

|||||||||

|

2023 |

2024 |

2023 |

2024 |

|||||||

|

RMB |

RMB |

USD |

RMB |

RMB |

USD |

|||||

|

Continuing operations |

||||||||||

|

Revenue |

442,187 |

358,271 |

50,532 |

1,772,127 |

1,755,206 |

247,561 |

||||

|

Cost of revenue |

(362,354) |

(322,407) |

(45,473) |

(1,304,699) |

(1,251,620) |

(176,533) |

||||

|

Gross profit |

79,833 |

35,864 |

5,059 |

467,428 |

503,586 |

71,028 |

||||

|

Selling, general and administrative expenses |

(145,996) |

(119,253) |

(16,820) |

(510,269) |

(469,047) |

(66,156) |

||||

|

Impairment loss on goodwill |

(147,116) |

(593,748) |

(83,744) |

(147,116) |

(593,748) |

(83,744) |

||||

|

Impairment loss on intangible assets |

– |

(258,326) |

(36,435) |

– |

(258,326) |

(36,435) |

||||

|

Impairment loss on property and equipment |

(12,891) |

(6,607) |

(932) |

(12,891) |

(6,607) |

(932) |

||||

|

Impairment loss on the long-term investments |

(2,613) |

– |

– |

(2,613) |

– |

– |

||||

|

Other operating income |

1,162 |

316 |

45 |

43,783 |

3,699 |

522 |

||||

|

Operating loss |

(227,621) |

(941,754) |

(132,827) |

(161,678) |

(820,443) |

(115,717) |

||||

|

Interest income/(expense), net |

2,124 |

392 |

55 |

(5,452) |

(1,315) |

(185) |

||||

|

Investment loss |

(25) |

(182) |

(26) |

(807) |

(2,516) |

(355) |

||||

|

Other expenses |

(4,316) |

(5,591) |

(790) |

(7,380) |

(4,012) |

(567) |

||||

|

Loss before income taxes and share of equity in |

(229,838) |

(947,135) |

(133,588) |

(175,317) |

(828,286) |

(116,824) |

||||

|

Income tax (expense)/ benefit |

(55,301) |

337 |

48 |

(183,208) |

(32,908) |

(4,641) |

||||

|

Share of equity in profit/(loss) of unconsolidated |

61 |

(7,957) |

(1,122) |

(339) |

(7,876) |

(1,111) |

||||

|

Net loss from continuing operations |

(285,078) |

(954,755) |

(134,662) |

(358,864) |

(869,070) |

(122,576) |

||||

|

Loss from discontinued operations, net of tax |

(55,240) |

(49,929) |

(7,042) |

(27,959) |

(163,791) |

(23,102) |

||||

|

Net loss |

(340,318) |

(1,004,684) |

(141,704) |

(386,823) |

(1,032,861) |

(145,678) |

||||

|

Net income/(loss) attributable to non-controlling |

||||||||||

|

Continuing operations |

334 |

(16,761) |

(2,364) |

823 |

(17,296) |

(2,439) |

||||

|

Discontinued operations |

3,957 |

(60) |

(8) |

7,488 |

(19,286) |

(2,720) |

||||

|

Net loss attributable to ordinary shareholders |

||||||||||

|

Continuing operations |

(285,412) |

(937,994) |

(132,298) |

(359,687) |

(851,774) |

(120,137) |

||||

|

Discontinued operations |

(59,197) |

(49,869) |

(7,034) |

(35,447) |

(144,505) |

(20,382) |

||||

|

Net loss per share attributable to |

||||||||||

|

ordinary shareholders |

||||||||||

|

—Basic and diluted |

||||||||||

|

Continuing operations |

(2.41) |

(7.90) |

(1.11) |

(3.03) |

(7.18) |

(1.01) |

||||

|

Discontinued operations |

(0.50) |

(0.42) |

(0.06) |

(0.30) |

(1.22) |

(0.17) |

||||

|

Weighted average shares used in |

||||||||||

|

calculating net loss per ordinary share: |

||||||||||

|

—Basic and diluted |

||||||||||

|

Continuing operations |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

||||

|

Discontinued operations |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

||||

|

Net loss per ADS |

||||||||||

|

—Basic and diluted |

||||||||||

|

Continuing operations |

(9.64) |

(31.60) |

(4.44) |

(12.12) |

(28.72) |

(4.04) |

||||

|

Discontinued operations |

(2.00) |

(1.68) |

(0.24) |

(1.20) |

(4.88) |

(0.68) |

||||

|

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in thousands)

|

||||||

|

Three Months Ended August 31 |

Twelve Months Ended August 31 |

|||||

|

2023 |

2024 |

2023 |

2024 |

|||

|

RMB |

RMB |

USD |

RMB |

RMB |

USD |

|

|

Net cash generated from operating activities |

6,923 |

104,041 |

14,674 |

22,261 |

126,394 |

17,827 |

|

Net cash used in investing activities |

(20,003) |

(128,015) |

(18,056) |

(52,949) |

(98,004) |

(13,823) |

|

Net cash used in financing activities |

(208,397) |

(1,201) |

(169) |

(298,794) |

(85,459) |

(12,053) |

|

Effect of exchange rate changes on cash and cash |

23,319 |

(6,270) |

(884) |

38,934 |

(4,373) |

(617) |

|

Net change in cash and cash equivalents, |

||||||

|

and restricted cash |

(198,158) |

(31,445) |

(4,435) |

(290,548) |

(61,442) |

(8,666) |

|

Cash and cash equivalents, and restricted cash |

||||||

|

at beginning of the period |

765,394 |

537,239 |

75,774 |

857,784 |

567,236 |

80,005 |

|

Cash and cash equivalents, and restricted cash |

||||||

|

at end of the period |

567,236 |

505,794 |

71,339 |

567,236 |

505,794 |

71,339 |

|

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED Reconciliations of GAAP and Non-GAAP Results (Amounts in thousands, except for shares and per share data) |

||||||

|

Three Months Ended August 31 |

Year Ended August 31 |

|||||

|

2023 |

2024 |

2023 |

2024 |

|||

|

RMB |

RMB |

USD |

RMB |

RMB |

USD |

|

|

Gross profit from continuing operations |

79,833 |

35,864 |

5,059 |

467,428 |

503,586 |

71,028 |

|

Add: Amortization of intangible assets |

1,050 |

1,050 |

148 |

4,341 |

4,184 |

590 |

|

Adjusted gross profit from continuing |

80,883 |

36,914 |

5,207 |

471,769 |

507,770 |

71,618 |

|

Operating loss from continuing operations |

(227,621) |

(941,754) |

(132,827) |

(161,678) |

(820,443) |

(115,717) |

|

Add: Share-based compensation expenses |

– |

3,240 |

457 |

– |

8,101 |

1,143 |

|

Add: Amortization of intangible assets |

1,050 |

1,050 |

148 |

4,341 |

4,184 |

590 |

|

Add: Impairment loss on goodwill |

147,116 |

593,748 |

83,744 |

147,116 |

593,748 |

83,744 |

|

Add: Impairment loss on intangible assets |

– |

258,326 |

36,435 |

– |

258,326 |

36,435 |

|

Add: Impairment loss on property and equipment |

12,891 |

6,607 |

932 |

12,891 |

6,607 |

932 |

|

Add: Impairment loss on the long-term investments |

2,613 |

– |

– |

2,613 |

– |

– |

|

Adjusted operating (loss)/income from continuing |

(63,951) |

(78,783) |

(11,111) |

5,283 |

50,523 |

7,127 |

|

Net loss |

(340,318) |

(1,004,684) |

(141,704) |

(386,823) |

(1,032,861) |

(145,678) |

|

Add: Share-based compensation expenses |

– |

3,240 |

457 |

– |

8,101 |

1,143 |

|

Add: Amortization of intangible assets |

1,050 |

1,050 |

148 |

4,341 |

4,184 |

590 |

|

Add: Tax effect of amortization of intangible assets |

(41) |

(209) |

(29) |

(670) |

(833) |

(117) |

|

Add: Impairment loss on goodwill |

147,116 |

593,748 |

83,744 |

147,116 |

593,748 |

83,744 |

|

Add: Impairment loss on intangible assets |

– |

258,326 |

36,435 |

– |

258,326 |

36,435 |

|

Add: Impairment loss on property and equipment |

12,891 |

6,607 |

932 |

12,891 |

6,607 |

932 |

|

Add: Impairment loss on the long-term investments |

2,613

|

– |

– |

2,613 |

– |

– |

|

Less: Loss from discontinued operations, net of tax |

(55,240) |

(49,929) |

(7,042) |

(27,959) |

(163,791) |

(23,102) |

|

Adjusted net (loss)/income |

(121,449) |

(91,993) |

(12,975) |

(192,573) |

1,063 |

151 |

|

Net loss attributable to ordinary shareholders |

(344,608) |

(987,863) |

(139,332) |

(395,134) |

(996,279) |

(140,519) |

|

Add: Share-based compensation expenses |

– |

3,240 |

457 |

– |

8,101 |

1,143 |

|

Add: Amortization of intangible assets |

1,050 |

1,050 |

148 |

4,341 |

4,184 |

590 |

|

Add: Tax effect of amortization of intangible assets |

(41) |

(209) |

(29) |

(670) |

(833) |

(117) |

|

Add: Impairment loss on goodwill |

147,116 |

579,827 |

81,781 |

147,116 |

579,827 |

81,781 |

|

Add: Impairment loss on intangible assets |

– |

258,326 |

36,435 |

– |

258,326 |

36,435 |

|

Add: Impairment loss on property and equipment |

12,891 |

6,607 |

932 |

12,891 |

6,607 |

932 |

|

Add: Impairment loss on the long-term investments |

2,613 |

– |

– |

2,613 |

– |

– |

|

Less: Loss from discontinued operations, net of tax |

(59,197) |

(49,869) |

(7,034) |

(35,447) |

(144,505) |

(20,382) |

|

Adjusted net (loss)/income attributable to |

(121,782) |

(89,153) |

(12,574) |

(193,396) |

4,438 |

627 |

|

Net loss |

(340,318) |

(1,004,684) |

(141,704) |

(386,823) |

(1,032,861) |

(145,678) |

|

Add: Interest expense, net |

(2,124) |

(392) |

(55) |

5,452 |

1,315 |

185 |

|

Add: Income tax expense |

55,301 |

(337) |

(48) |

183,208 |

32,908 |

4,641 |

|

Add: Depreciation and amortization |

14,293 |

11,808 |

1,665 |

63,598 |

48,796 |

6,882 |

|

Add: Share-based compensation expenses |

– |

3,240 |

457 |

– |

8,101 |

1,143 |

|

Add: Impairment loss on goodwill |

147,116 |

593,748 |

83,744 |

147,116 |

593,748 |

83,744 |

|

Add: Impairment loss on intangible assets |

– |

258,326 |

36,435 |

– |

258,326 |

36,435 |

|

Add: Impairment loss on property and equipment |

12,891 |

6,607 |

932 |

12,891 |

6,607 |

932 |

|

Add: Impairment loss on the long-term investments |

2,613 |

– |

– |

2,613 |

– |

– |

|

Less: Loss from discontinued operations, net of tax |

(55,240) |

(49,929) |

(7,042) |

(27,959) |

(163,791) |

(23,102) |

|

Adjusted EBITDA |

(54,988) |

(81,755) |

(11,532) |

56,014 |

80,731 |

11,386 |

|

Weighted average shares used |

||||||

|

in calculating adjusted net (loss)/income per |

||||||

|

—Basic and Diluted |

||||||

|

Continuing operations |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

|

Discontinued operations |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

118,669,795 |

|

Adjusted net (loss)/income per share |

||||||

|

to ordinary shareholders |

||||||

|

—Basic |

(1.03) |

(0.75) |

(0.11) |

(1.63) |

0.04 |

0.01 |

|

—Diluted |

(1.03) |

(0.75) |

(0.11) |

(1.63) |

0.04 |

0.01 |

|

Adjusted net (loss)/income per ADS |

||||||

|

—Basic |

(4.12) |

(3.00) |

(0.44) |

(6.52) |

0.16 |

0.04 |

|

—Diluted |

(4.12) |

(3.00) |

(0.44) |

(6.52) |

0.16 |

0.04 |

![]() View original content:https://www.prnewswire.com/news-releases/bright-scholar-announces-unaudited-financial-results-for-the-fourth-quarter-and-fiscal-year-2024-302315296.html

View original content:https://www.prnewswire.com/news-releases/bright-scholar-announces-unaudited-financial-results-for-the-fourth-quarter-and-fiscal-year-2024-302315296.html

SOURCE Bright Scholar Education Holdings Ltd.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Donald Trump's Win Positive For Financials, Energy Sector As 'Pro-Growth Effects Will Outweigh Inflationary Pressures,' Says Analyst

Donald Trump’s win is positive for the financial and energy sectors as the “pro-growth effects of fiscal stimulus currently outweigh the inflationary risks in the near term” according to an analyst.

What Happened: Mario Georgiou, CFA and executive director, head of investments at InCred Global Wealth U.K., in an exclusive conversation with Benzinga, described tax cuts and deregulation as tailwinds to the markets. He considers inflationary policies such as tariffs and immigration impacts as headwinds, leading to a steepening yield curve, and higher term premiums.

“Financials offer an attractive risk-reward and that this recent post-election rally has room to run,” added Georgiou. According to him “financials are not only well positioned to capture the benefits of the above-mentioned Trump tailwinds, but are also less impacted / would even benefit from the Trump headwinds.”

Despite a few dips, the equity markets have been trading higher than the pre-election levels after President-elect Trump’s victory. The S&P 500 has increased by 3.22%, rising from $5,782.76 on Nov. 5 to $5,969.34 as of Friday’s close. The SPDR S&P 500 ETF SPY which tracks the S&P 500 Index has had a similar momentum, according to data from Benzinga Pro.

Meanwhile, Financial Select Sector SPDR Fund XLF, Vanguard Financials ETF VFH, iShares U.S. Financials ETF IYF, and SPDR S&P Bank ETF KBE, have returned over 30% year-to-date in 2024 outperforming the S&P 500 Index’s 26% run.

Other sectors that Georgiou prefers, include energy. According to him “deregulation supporting oil production and geopolitical risks could sustain elevated oil prices and relative valuations are attractive.”

Even though the energy sector has underperformed the broader markets in 2024, “fundamentally, companies are shareholder friendly with 8-12% shareholder yields, have strong balance sheets with low net debt to EBITDA ratios and high free cash flow yields of 6.50% and above,” he adds.

Invesco S&P 500 Equal Weight ETF RSP, iShares Russell 1000 Value ETF IWD, Vanguard High Dividend Yield Index ETF VYM and ProShares S&P 500 Ex-Energy ETF SPXE have all underperformed the S&P 500 on a year-to-date basis.

Why It Matters: As markets hit their 51st record high of 2024 and the S&P 500 Index crossed 6,000 points, some analysts caution that tariffs could pose risks to equities and suggest that the market may be overvalued.

“The prospect of tariffs isn’t obviously good for equities, while it’s clearly good for the Dollar,” former Goldman Sachs FX strategist and senior fellow at Brookings Institution, Robin Brooks said in an X post. “Markets initially got this wrong, driving stocks up sharply right after Nov. 5,” he added.

However, Georgiou is “cautiously optimistic” about the markets, he said “a neutral to fully invested equity allocation is warranted, with a focus on sectors benefiting from Trump’s policies, whilst always maintaining our core investment principles, which is a focus on fundamentals, quality, and risk management.”

Image via Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Has Nvidia Stock Topped? A Single Metric Offers a Very Clear Answer.

Roughly 30 years ago, the advent of the internet changed the growth trajectory for businesses across the globe. Although it took a few years for the internet to mature as a technology and for businesses to fully understand how to harness its potential, it’s had a notably positive impact on long-term growth trends.

Since the mid-1990s, Wall Street has been waiting patiently for the next leap forward for corporate America. Over the last two years, artificial intelligence (AI) appears to have answered the call.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

AI-driven software and systems have the ability to become more proficient at their assigned tasks, as well as learn new skill sets without human intervention. This capacity to learn and evolve over time is what gives this technology seemingly limitless potential and utility in most industries around the globe.

While the AI ecosystem is vast, which should allow numerous businesses to thrive, no company been a more direct beneficiary of the rise of AI than cutting-edge semiconductor stock Nvidia (NASDAQ: NVDA). Since 2023 began, Nvidia’s market value skyrocketed from $360 billion to north of $3.6 trillion, which makes it the largest publicly traded company, as of this writing.

Less than two years ago, when Nvidia lifted the hood on fiscal 2023 (Nvidia’s fiscal year ends in late January), the company reported $27 billion in full-year sales. In the current fiscal year (2025), it’s pacing closer to $129 billion in full-year revenue, with Wall Street calling for almost $192 billion in sales next year.

This otherworldly growth is a function Nvidia’s AI-graphics processing units (GPUs) being the preferred choice for businesses running high-compute data centers. The analysts at TechInsights pegged Nvidia’s share of GPU shipments to data centers at 98% in 2022 and 2023. Based on the company’s two-year sales ramp, it’d be a fair assumption that Nvidia’s H100 GPU (commonly known as the “Hopper”) and successor Blackwell GPU architecture aren’t having any issues finding buyers.

Nvidia has also been able to take advantage of the law of supply and demand. With orders for the Hopper and next-generation Blackwell chip backlogged, it’s been able to meaningfully increase the price for its hardware. The roughly $30,000 to $40,000 price tag for the Hopper represents a 100% to 300% premium to what Advanced Micro Devices (NASDAQ: AMD) is netting for its MI300X chips for AI-accelerated data centers.

Why Uxin Shares Are Trading Higher; Here Are 20 Stocks Moving Premarket

Shares of Uxin Limited UXIN rose sharply in today’s pre-market trading after the company reported second-quarter financial results.

Uxin posted quarterly sales of $70.85 million, up from $48.80 million in the year-ago period

Uxin shares rose 3% to $6.50 in the pre-market trading session.

Here are some other stocks moving in pre-market trading.

Gainers

- Rigetti Computing, Inc. RGTI gained 59.2% to $2.77 in pre-market trading after climbing around 18% on Friday.

- Quantum Corporation QMCO rose 40.4% to $12.84 in pre-market trading after jumping 127% on Friday.

- KULR Technology Group, Inc. KULR gained 29.8% to $0.5777 in pre-market trading after gaining around 7% on Friday.

- Exicure, Inc. XCUR gained 28.4% to $23.59 in pre-market trading after jumping around 69% on Friday.

- Arqit Quantum Inc. ARQQ gained 22% to $15.76 in pre-market trading after gaining 21% on Friday.

- NOVONIX Limited NVX gained 19.1% to $2.31 in pre-market trading. Novonix secured a 32,000-tonne offtake agreement with Volkswagen’s PowerCo for synthetic graphite supply.

- Quantum Computing Inc. QUBT gained 16.9% to $7.13 in pre-market trading after jumping 28% on Friday.

- Allot Ltd. ALLT climbed 16.7% to $4.94 in pre-market trading. Allot, last week, reported better-than-expected quarterly financial results.

- Lionsgate Studios Corp. LION gained 11.2% to $7.89 in pre-market trading.

Losers

- Akoustis Technologies, Inc. AKTS shares tumbled 37.5% to $0.0629 in pre-market trading

- Aptose Biosciences Inc. APTO shares fell 17.8% to $0.1560 in pre-market trading. Aptose Biosciences shares dipped 22% on Friday after the company announced the pricing of an $8 million public offering.

- X3 Holdings Co., Ltd. XTKG declined 16.6% to $1.76 in pre-market trading.

- NewGenIvf Group Ltd NIVF fell 16.1% to $0.43 in pre-market trading after declining 6% on Friday.

- Elevai Labs Inc. ELAB fell 13.9% to $0.0173 in pre-market trading. Elevai Labs implemented a 1-for-200 reverse stock split to retain Nasdaq listing, reducing shares to 3.07 million.

- Gold Resource Corporation GORO shares fell 13.1% to $0.1368 in pre-market trading after gaining 6% on Friday.

- Digital Brands Group, Inc. DBGI dipped 12.4% to $0.1063 in pre-market trading after falling over 4% on Friday.

- ZIM Integrated Shipping Services Ltd. ZIM shares dipped 6.9% to $22.15 in pre-market trading. ZIM Integrated Shipping Services, last week, reported better-than-expected third-quarter financial results and raised its FY24 adjusted EBIT and EBITDA guidance.

- ChromaDex Corporation CDXC fell 5.9% to $7.00 in pre-market trading.

- Kingsoft Cloud Holdings Limited KC fell 4.3% to $6.90 in today’s pre-market trading after jumping around 25% on Friday. Kingsoft Cloud, last week, reported a fiscal third-quarter 2024 revenue of 1.89 billion Chinese yuan ($268.7 million), up by 16.0% year-on-year, beating the analyst consensus estimate of $247.46 million

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Stock Market Is Doing Something It Does Every 4 Years, but History Says It Signals a Big Move in 2025

The S&P 500 (SNPINDEX: ^GSPC) is widely regarded as the best gauge for the overall U.S. stock market. That’s because it includes 500 large companies that span all 11 stock market sectors, representing approximately 80% of domestic equities by market value. That scope and diversity makes the index a bellwether for U.S. stocks.

The S&P 500 is currently doing something it does every four years: Reacting to the results of another U.S. presidential election. Most investors know election results can influence market sentiment, but what they might not realize is the S&P 500 has typically generated above-average returns during 12-month period following presidential elections, regardless of the results.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Read on to learn more.

The chart below shows how the S&P 500 performed during the 12-month period following U.S. presidential elections during the last four decades. Importantly, presidential elections take place on the first Tuesday following the first Monday in November, so the returns shown in the chart use those Tuesdays as a starting point.

|

Presidential Election |

S&P 500 Return (Next 12 Months) |

|---|---|

|

1984 |

13% |

|

1988 |

23% |

|

1992 |

10% |

|

1996 |

32% |

|

2000 |

(22%) |

|

2004 |

7% |

|

2008 |

4% |

|

2012 |

24% |

|

2016 |

21% |

|

2020 |

38% |

|

Median |

17% |

Data source: YCharts.

As show above, there have been 10 presidential elections in the last four decades, and the S&P 500 returned a median of 17% during the 12 months following those events. For context, the S&P 500 compounded at 9% annually over the entire 40-year period. That means the index has typically generated above-average returns during the 12-month period following presidential elections.

One plausible explanation for that outperformance is excitement about policy changes the winners of the presidential and congressional races discussed during their campaigns. Regardless, we can apply historical data to the current situation to make an educated guess about how the stock market may perform in the coming months.

At the time of writing, the S&P 500 had advanced a little more than 3% since the markets closed on Nov. 5, the day the presidential election took place. If its performance aligns with the historical median, the S&P 500 will return another 14% by November 2025. In other words, history says the stock market could continue climbing higher next year.

SKRR Exploration Inc. Announces TSXV Approval of Consolidation

VANCOUVER, BC, Nov. 25, 2024 /CNW/ – SKRR Exploration Inc. SKRR (FSE: B04Q) (“SKRR” or the “Company“) announces that, further to its news release dated November 19, 2024, the TSX Venture Exchange (the “Exchange“) has approved the consolidation of the Company’s common shares (the “Consolidation“) on the basis of one (1) post-Consolidation common share for every four (4) pre-Consolidation common shares. The Consolidation will be effective at the opening of the market on November 27, 2024 (the “Effective Date“). Pursuant to the provisions of the Business Corporations Act (British Columbia) and the Articles of the Company, the Consolidation was approved by way of resolution passed by the board of directors of the Company.

The Company’s name and trading symbol will remain unchanged following the Consolidation. The new CUSIP number will be 78446Q308 and the new ISIN number will be CA78446Q3089 for the post-Consolidation common shares. The Company currently has 19,375,371 common shares issued and outstanding, and after the Consolidation is effective there will be approximately 4,843,842 common shares issued and outstanding.

Any fractional post-Consolidation share that is less than one-half (1/2) of a share will be cancelled and any fractional post-Consolidation share that is at least or greater than one-half (1/2) of a share will be rounded up to one whole share. Registered shareholders of record as of the Effective Date who hold physical share certificates will receive a letter of transmittal from the Company’s transfer agent, Computershare Investor Services Inc., with instructions on how to exchange for new share certificates representing post-Consolidation shares. Beneficial shareholders who hold their shares through a broker or other intermediary and do not have shares registered in their own names will not be required to complete a letter of transmittal.

About SKRR Exploration Inc.

SKRR is a Canadian-based precious and base metal explorer with properties in Saskatchewan – some of the world’s highest ranked mining jurisdictions. The primary exploration focus is on the Trans-Hudson Corridor in Saskatchewan in search of world class uranium, precious, and base metal deposits. The Trans-Hudson Orogen – although extremely well known in geological terms has been significantly under-explored in Saskatchewan. SKRR is committed to all stakeholders including shareholders, all its partners and the environment in which it operates.

ON BEHALF OF THE BOARD

Sherman Dahl

President & CEO

Tel: 250-558-8340

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains “forward–looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, statements relating to the Consolidation being effected on the stated date, statements relating to the technical, financial and business prospects of the Company, its projects, its goals and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of metals, the ability to achieve its goals, the ability to secure equipment and personnel to carry out work programs, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration results, risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses and those other risks filed under the Company’s profile on SEDAR+ at www.sedarplus.ca. There is a possibility that future exploration, development or mining results will not be consistent with the Company’s expectations. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, failure to secure personnel and equipment for work programs, adverse weather and climate conditions, failure to obtain or maintain all necessary government permits, approvals and authorizations, decrease in the price of gold, copper, uranium and other metals, failure to obtain or maintain community acceptance (including First Nations), increase in costs, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward–looking statements or forward–looking information, except as required by law.

SOURCE SKRR Exploration Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/25/c9341.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/25/c9341.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the Spectacular Vanguard ETF With 45.1% of Its Portfolio Invested in Nvidia, Apple, Microsoft, and Amazon

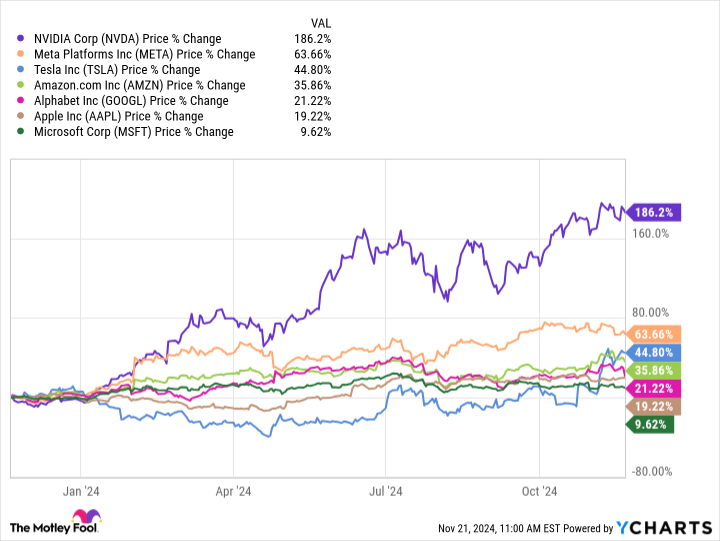

The S&P 500 (SNPINDEX: ^GSPC) index is up by 30% over the past year, and one-fifth of that gain is attributable to a single stock: Nvidia (NASDAQ: NVDA). The chip giant has delivered a return of 186% over the last 12 months, and with a valuation of $3.6 trillion, it represents 7% of the total value of the S&P 500.

But Nvidia isn’t alone. It’s part of a collection of technology giants dubbed the “Magnificent Seven” which have generated an average return of 56% over the past year. The companies have a combined market capitalization of $16.9 trillion, and represent 32.1% of the entire S&P 500.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Simply put, investors who don’t have exposure to the above tech stocks have likely underperformed the broader market. But the good news is that they can get that exposure very easily through an appropriate exchange-traded fund (ETF).

The Vanguard Mega Cap Growth ETF (NYSEMKT: MGK) has nearly half of its portfolio invested in four of America’s largest tech stocks. It consistently outperforms the S&P 500 over the short and long term. Here’s why it’s a great buy for investors of all experience levels.

The Vanguard Mega Cap Growth ETF holds just 71 different stocks. The fund is highly concentrated, with the technology sector representing 61.4% of the value of its portfolio, followed by the consumer discretionary sector at 20.3%.

In fact, its top four holdings alone represent 45.1% of its portfolio, but they are among the top artificial intelligence (AI) powerhouses that practically every investor wants to own.

|

Stock |

Vanguard Mega Cap Growth ETF Weighting |

|---|---|

|

1. Apple (NASDAQ: AAPL) |

13.36% |

|

2. Nvidia |

12.52% |

|

3. Microsoft (NASDAQ: MSFT) |

12.35% |

|

4. Amazon (NASDAQ: AMZN) |

6.82% |

Data source: Vanguard. Portfolio weightings are accurate as of Oct. 31, 2024, and are subject to change.

Apple just rolled out its Apple Intelligence software, which it developed with OpenAI. It delivers a slate of new AI features for owners of the latest iPhones, iPads, and Mac computers, including powerful writing tools that can summarize and generate text content for emails or messages. Apple has over 2.2 billion active devices worldwide, so it could become the biggest distributor of AI to consumers.

Nvidia supplies the most popular data center graphics processing units (GPUs) for developing AI models. The company’s data center revenue generated triple-digit percentage growth in each of the last six quarters because demand continues to outstrip supply. That momentum should continue now that Nvidia is shipping its powerful new Blackwell GPUs, with CEO Jensen Huang recently describing demand as “staggering.”

Trump's Commerce Secretary Pick Howard Lutnick's Fund Owns $1.19B In Nvidia, $804M In Tesla: Here Is A Look At His Portfolio

Howard Lutnick, chief executive officer of Cantor Fitzgerald – which has about $3.53 billion in holdings – has been named as the co-chair of President-elect Donald Trump‘s transition team. Lutnick will lead the U.S. Department of Commerce.

Top Holdings Of Lutnick’s Firm: According to Cantor Fitzgerald’s third-quarter 13F filings, top holdings of the firm include SPDR S&P 500 ETF SPY, Nvidia Corp. NVDA, Tesla Inc. TSLA, GCM Grosvenor Inc.GCMG, and Rumble Inc. RUM.

In the September quarter, Lutnick’s financial services firm purchased about 1.17 million shares of Tesla with 1.74 million put options in Q3. It bumped up its call options by 4,967% to 152,000 shares from the quarter-ended in July. The total value of the fund’s exposure to Tesla stood at $804 million in Q3.