Pinterest's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bullish approach towards Pinterest PINS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PINS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Pinterest. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 44% bearish. Among these notable options, 5 are puts, totaling $341,863, and 4 are calls, amounting to $141,728.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $23.0 to $36.0 for Pinterest over the recent three months.

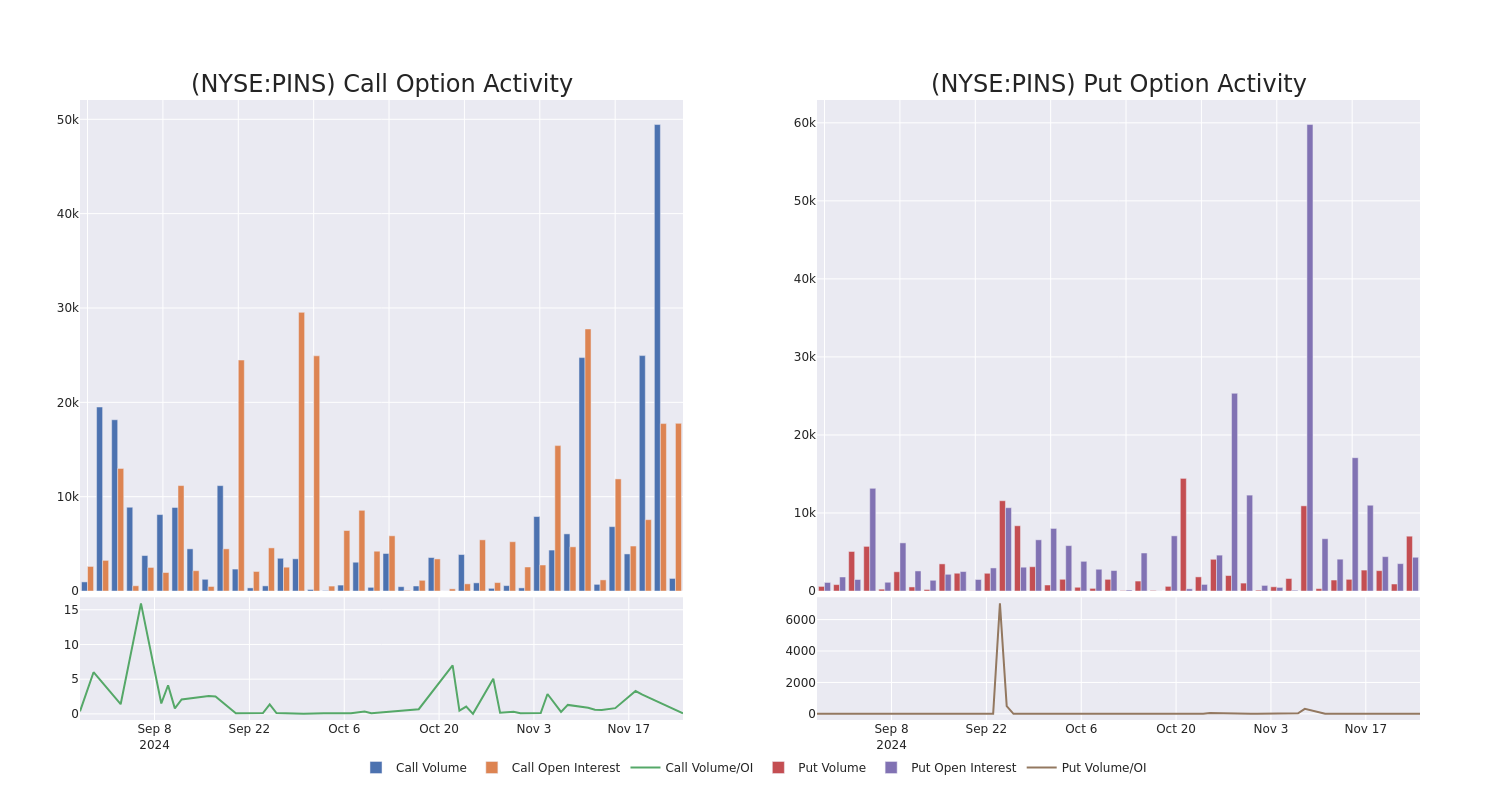

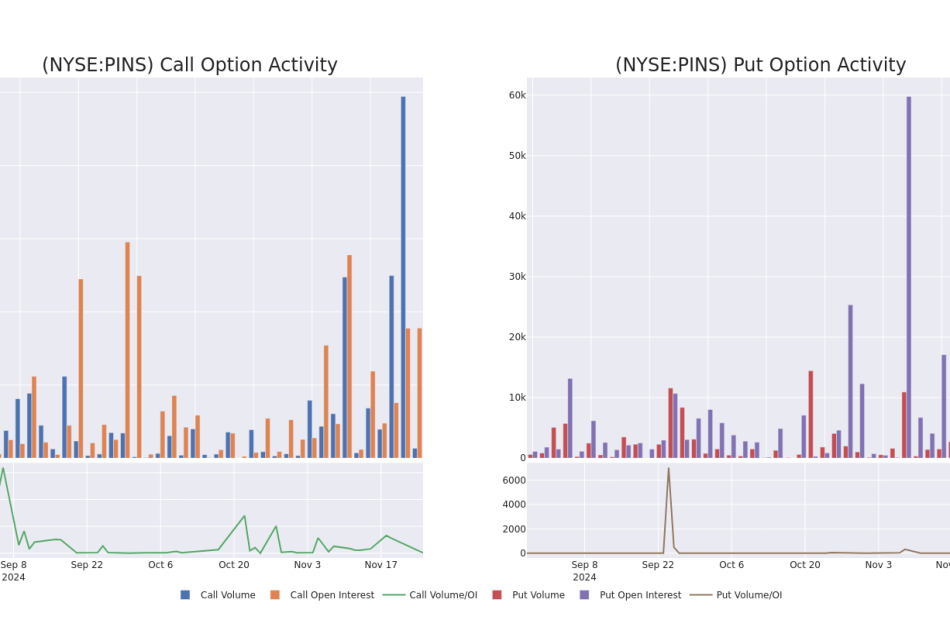

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Pinterest’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Pinterest’s substantial trades, within a strike price spectrum from $23.0 to $36.0 over the preceding 30 days.

Pinterest Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PINS | PUT | TRADE | BULLISH | 01/16/26 | $1.99 | $1.94 | $1.94 | $23.00 | $193.6K | 3.0K | 1.0K |

| PINS | PUT | SWEEP | NEUTRAL | 12/06/24 | $0.27 | $0.2 | $0.23 | $29.00 | $47.4K | 1.1K | 4.0K |

| PINS | CALL | SWEEP | BEARISH | 01/15/27 | $11.8 | $11.75 | $11.75 | $25.00 | $42.3K | 108 | 2 |

| PINS | PUT | SWEEP | BULLISH | 03/21/25 | $6.5 | $6.35 | $6.35 | $36.00 | $38.7K | 136 | 300 |

| PINS | CALL | SWEEP | BEARISH | 01/17/25 | $1.94 | $1.88 | $1.92 | $30.00 | $38.4K | 9.9K | 361 |

About Pinterest

Pinterest is a social media platform with a focus on product and idea discovery. Pinterest users, or pinners, can leverage the platform as they go about gathering ideas on topics such as home improvement, fashion, cooking, and travel. The company has more than 500 million monthly active users, two thirds of whom are female. Pinterest generates revenue by selling digital ads on its platform. While the platform’s user base spans the globe, the vast majority of its revenue stems from ads shown to North American users.

After a thorough review of the options trading surrounding Pinterest, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Pinterest

- With a trading volume of 7,507,801, the price of PINS is up by 1.42%, reaching $30.45.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 73 days from now.

Professional Analyst Ratings for Pinterest

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $36.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Raymond James persists with their Outperform rating on Pinterest, maintaining a target price of $34.

* An analyst from Baird persists with their Outperform rating on Pinterest, maintaining a target price of $36.

* Maintaining their stance, an analyst from Wedbush continues to hold a Neutral rating for Pinterest, targeting a price of $38.

* Showing optimism, an analyst from Wedbush upgrades its rating to Outperform with a revised price target of $38.

* An analyst from JP Morgan persists with their Neutral rating on Pinterest, maintaining a target price of $35.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Pinterest options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply