Spotlight on Datadog: Analyzing the Surge in Options Activity

High-rolling investors have positioned themselves bullish on Datadog DDOG, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DDOG often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 16 options trades for Datadog. This is not a typical pattern.

The sentiment among these major traders is split, with 37% bullish and 37% bearish. Among all the options we identified, there was one put, amounting to $28,125, and 15 calls, totaling $1,025,159.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $185.0 for Datadog over the recent three months.

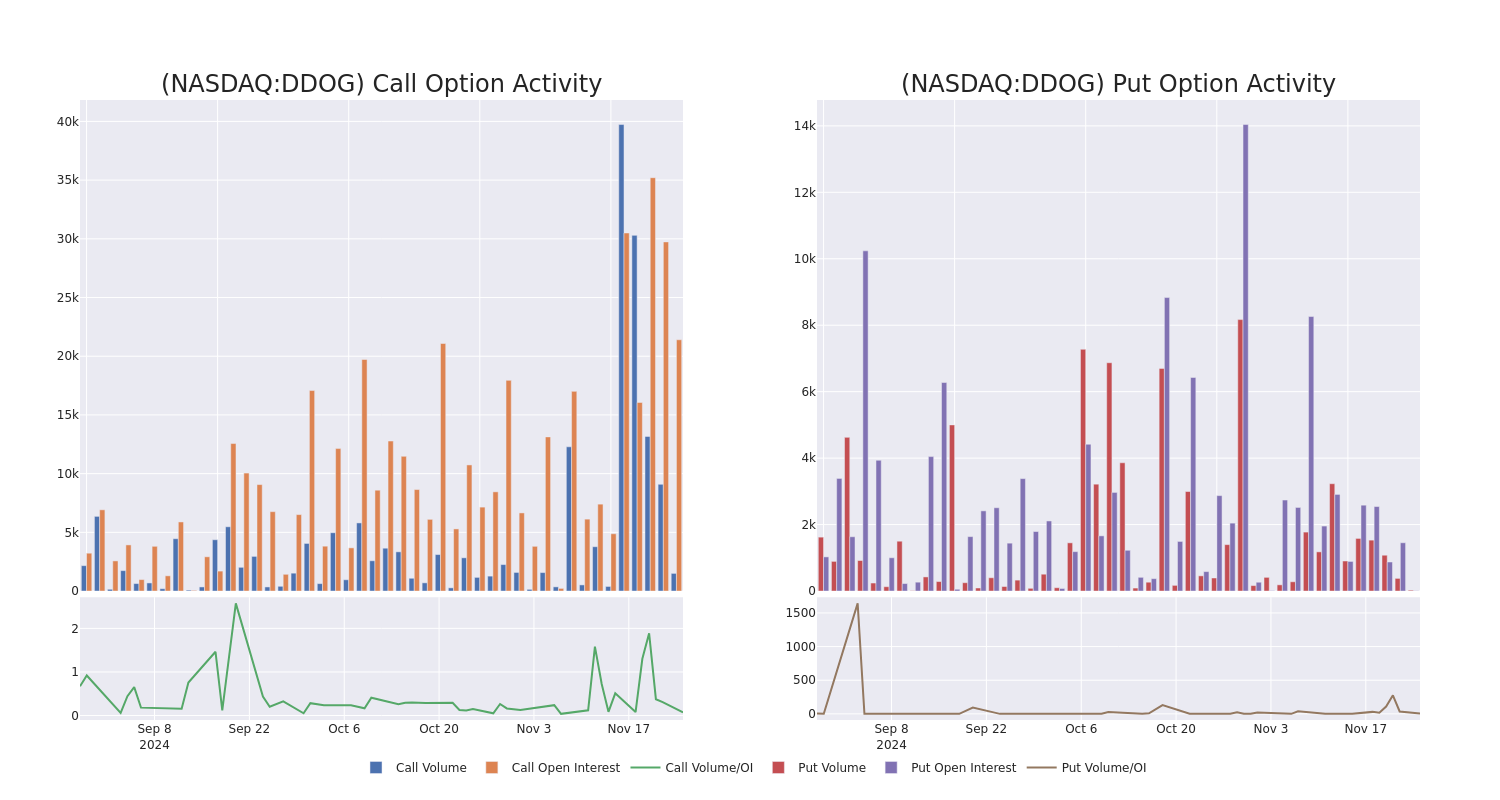

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Datadog’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Datadog’s substantial trades, within a strike price spectrum from $100.0 to $185.0 over the preceding 30 days.

Datadog 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DDOG | CALL | TRADE | BEARISH | 01/03/25 | $15.55 | $13.75 | $13.75 | $144.00 | $137.5K | 100 | 100 |

| DDOG | CALL | TRADE | BULLISH | 01/16/26 | $65.4 | $62.95 | $64.45 | $100.00 | $128.9K | 141 | 27 |

| DDOG | CALL | SWEEP | BEARISH | 01/17/25 | $27.65 | $26.35 | $26.74 | $130.00 | $120.0K | 6.9K | 108 |

| DDOG | CALL | SWEEP | BEARISH | 01/17/25 | $27.55 | $26.4 | $26.75 | $130.00 | $106.7K | 6.9K | 148 |

| DDOG | CALL | TRADE | BULLISH | 01/16/26 | $27.5 | $27.35 | $27.5 | $160.00 | $74.2K | 677 | 0 |

About Datadog

Datadog is a cloud-native company that focuses on analyzing machine data. The firm’s product portfolio, delivered via software as a service, allows a client to monitor and analyze its entire IT infrastructure. Datadog’s platform can ingest and analyze large amounts of machine-generated data in real time, allowing clients to utilize it for a variety of applications throughout their businesses.

In light of the recent options history for Datadog, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Datadog

- Currently trading with a volume of 2,695,586, the DDOG’s price is up by 0.89%, now at $156.22.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 78 days.

What Analysts Are Saying About Datadog

In the last month, 5 experts released ratings on this stock with an average target price of $150.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Rosenblatt persists with their Buy rating on Datadog, maintaining a target price of $148.

* An analyst from Barclays persists with their Overweight rating on Datadog, maintaining a target price of $155.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Datadog with a target price of $165.

* An analyst from Scotiabank persists with their Sector Outperform rating on Datadog, maintaining a target price of $133.

* Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Datadog with a target price of $150.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Datadog, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply