Volkswagen Gets Much-Need Tech, Rivian A Cash Infusion With New JV

Volkswagen VLKAF has boosted its initial investment in American electrical vehicle (EV) maker Rivian RIVN to $5.8 billion, $800 million more than initially planned.

The German automaker decided to increase its initial investment, when the companies launched on November 13 the newly established company, Rivian and VW Group Technology, LLC. The venture, announced in June, will be headquartered in Palo Alto, California, representing a cross-continent effort to advance EV technology.

“The collaboration with Rivian marks the next logical step in our software strategy,” Volkswagen’s CEO Oliver Blume said on November 12. “By leveraging our complementary strengths, we aim to deliver cutting-edge EV solutions at a competitive cost while enhancing the customer experience with state-of-the-art technology.”

The announcement provided a brief surge in Rivian’s stock price, with shares spiking nearly 10% to $12.03 before retracing the entire gain. Following its IPO, Rivian was valued at nearly $88 billion, but it has lost 92% of its market cap owing to the 2022 market downturn, persisting production challenges, and financial losses.

“This collaboration is a critical enabler for accelerating EV adoption,” Rivian’s CEO RJ Scaringe said. “Seeing our technology integrated into vehicles beyond Rivian is a pivotal moment for us and a testament to our innovative capabilities.”

Volkswagen, Rivian Partnership Offers Synergies

For Volkswagen, the partnership offers immediate access to Rivian’s advanced software and zonal electrical hardware.

This expertise would help the German firm adjust to external pressures, including growing Chinese competition and weaker demand that prompted its rival, Ford, to cut 4,000 jobs in Germany and the UK.

Blume said that although the initial focus will be on software development, the scope might expand to include hardware components like battery modules.

For Rivian, the deal brings a vital infusion of capital and manufacturing expertise. Volkswagen’s scale and production capabilities—delivering as many vehicles weekly as Rivian produces annually—are expected to boost Rivian’s operational efficiency.

Venture’s Structure And Objectives

The joint venture will pool expertise from both companies to develop software-defined vehicles (SDVs) and modular electrical architectures.

An initial $1 billion has already been allocated to the venture, with an additional $4.8 billion earmarked through 2027. Investments are tied to milestones, ensuring operational and technical feasibility according to the deal’s terms.

The funding will also support the launch of Rivian’s R2, a compact SUV priced at approximately $45,000, expected to debut in 2026. Volkswagen plans to integrate Rivian’s electrical architecture into its vehicles by 2027, benefiting its global brands, including Audi and Scout.

“The deal mutually benefits both parties: Young Rivian needs capital to offset ongoing free cash burn (around $6 billion in each of the last two years),” Demian Flowers, Financial Markets, S&P Global Mobility, wrote in June when the initial deal was announced. “By contrast, VW needs technology.”

Helping Rivian Overcome Branding Challenges

Consumer Reports recently listed Rivian as one of the worst car brands for 2024, citing reliability concerns despite strong performance in road tests for its R1T pickup and R1S SUV. Moreover, Rivian is losing approximately $33,000 per vehicle sold, with prices starting at around $70,000.

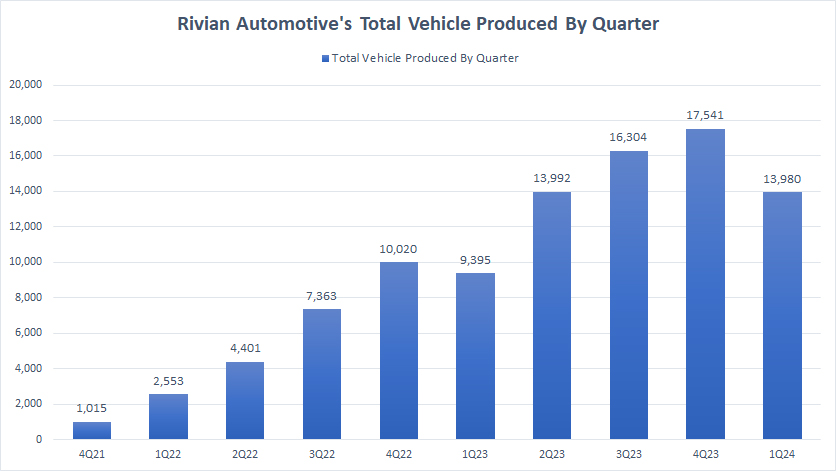

The company has struggled to meet production targets, revising its 2024 guidance from 57,000 vehicles to 47,000-49,000 due to supply chain disruptions.

Despite these setbacks, the management remains optimistic about achieving gross profitability by Q4 2024. The company is banking on higher sales volumes, improved manufacturing efficiency, and regulatory credit sales to offset its losses.

Following the Q3 earnings miss, Wedbush‘s analyst Daniel Ives noted that supply challenges “should be well sorted over the next few quarters as the company is still on track in terms of timing the R2 production launch.” He maintained an Outperform rating with a $20 price target.

Volkswagen Faces Atypical Automotive Slowdown

Meanwhile, Volkswagen’s shares dropped 27% year-to-date, and the company announced the closure of multiple domestic factories for the first time in company history.

Germany’s automotive sector, once a pillar of economic stability, has entered a paradoxical phase. The industry has recently shed approximately 60,000 jobs, yet profits have soared. While vehicle production in Germany has fallen dramatically, from 5.7 million units in 2016 to 4.1 million in 2023, the industry’s profit margins have climbed.

The shift toward luxury vehicles and SUVs, which yield higher returns per unit, has allowed Volkswagen to remain profitable despite selling fewer cars. In 2023 alone, the firm reported €22.5 billion in operating profits, up from €22.1 billion the previous year.

Since 2016, car demand in Europe, particularly Germany, has consistently declined. Geopolitical instability, tariffs, rising inflation, and the transition to electric vehicles have undermined confidence in the German economy.

In 2023, global car sales fell by 2 million units compared to 2018, equivalent to the combined output of Audi and Peugeot globally. Volkswagen, despite its claims of resilience, has not been immune. Excess capacity across its factories, including a now-canceled “Trinity” luxury EV plant, highlights the company’s structural challenges.

An assembly line worker described the growing tension: “We’ve made nothing but concessions over the years. The assembly lines are so regimented that you can’t even blow your nose without getting behind schedule. All this for €27 an hour while executives rake in millions.”

Volkswagen Is Too Big to Fail

Volkswagen’s struggles are deeply intertwined with Germany’s social and political fabric. In September, management scrapped key collective bargaining agreements, including those securing job stability and guaranteeing apprentice hiring. Although framed as cost-saving measures, these moves sparked outrage among workers and unions.

Union representative Daniela Cavallo called out the management. “Volkswagen doesn’t just belong to its shareholders. It belongs to its staff, its history, and the regions it serves. This greed-driven ‘turbo capitalism’ has no place here,” she said.

Meanwhile, Union leader Carsten Büchling warned: “Operational layoffs and plant closures feed the far-right. If workers had more influence over production decisions, these crises could be mitigated.” Recent polls back his warning, showing growing support for the far-right AfD in car-manufacturing regions such as Saxony and Baden-Württemberg, where economic anxiety is high.

The state of Lower Saxony, Volkswagen’s largest public shareholder, has urged management to present alternatives to mass layoffs. Yet executives, led by CEO Blume, have defended the cuts, citing declining demand in Europe and China as evidence of long-term structural issues.

As Germany looks toward the 2025 elections, the disgruntlement of workers at Volkswagen and other major employers could become a notable factor.

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply