Jim Cramer's Apple Endorsement Sparks 'Inverse Cramer' Backlash As Social Media Users Mock His 'Own It' Advice

Financial analyst Jim Cramer‘s recent recommendation to “own” Apple Inc. AAPL stocks has triggered a widespread investor revolt, with social media users loudly proclaiming their intent to do the opposite.

What Happened: CNBC’s “Mad Money” host Cramer’s Monday statement on X, “Apple, own it, don’t trade it!” quickly became a catalyst for what traders call the ‘Inverse Cramer’ phenomenon—a strategy where investors systematically bet against his stock recommendations.

Online commentary ranged from satirical to scathing. One user, Tommy Famous, criticized Cramer as a “financial QVC” who has “led audiences into losses,” suggesting his recommendations are more entertainment than serious financial advice.

Notable social media reactions included Thomas Peters describing it as “a great run” but ultimately follows the Inverse Cramer strategy. Another user humorously suggested it’s time to sell Apple shares. Some users even pledged to switch technology brands in response.

The phenomenon isn’t new. In October 2022, Tuttle Capital launched ETFs specifically designed to track and potentially profit from Cramer’s stock picks—including an “Inverse Cramer” fund that recently announced its shutdown.

Matthew Tuttle, CEO of Tuttle Capital, stated the ETF’s original mission was to “point out the danger of following TV stock pickers” and demonstrate the lack of consistent accountability in financial media recommendations.

It is interesting to note that Cramer also predicted Vice President Kamala Harris‘s victory over now President-elect Donald Trump in the 2024 election on Nov. 4, according to CNBC. “I’m not sure the market’s right about what a Harris presidency would mean for business, but at least now we have a blueprint for what Wall Street thinks it’ll mean,” he said.

Price Action: Apple’s stock closed Monday at $232.87, up 1.31% for the day, with a year-to-date gain of 25.44%, according to data from Benzinga Pro.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Qualcomm’s Takeover Interest in Intel Is Said to Cool

(Bloomberg) — Qualcomm Inc.’s interest in pursuing an acquisition of Intel Corp. has cooled, according to people familiar with the matter, upending what would have likely been one of the largest technology deals of all time.

Most Read from Bloomberg

The complexities associated with acquiring all of Intel has made a deal less attractive to Qualcomm, said some of the people, asking not to be identified discussing confidential matters. It’s always possible Qualcomm looks at pieces of Intel instead or rekindles its interest later, they added.

An Intel takeover would have ranked among the largest acquisitions in history, based on its current market value. A successful deal would’ve marked the biggest purchase of a technology hardware firm, outstrippping Broadcom Inc.’s buyout of software maker VMWare Inc. in 2023. And it could have helped reshape the semiconductor landscape, creating a larger US chip leader at a time global governments are vying to boost domestic supply.

Representatives for Qualcomm and Intel declined to comment.

Qualcomm made a preliminary approach to Intel on a possible takeover, Bloomberg News and other outlets reported in September. It came just weeks after Intel communicated a bruising earnings report where it delivered a disappointing revenue forecast and outlined a 15% reduction in headcount in an effort to “resize and refocus.”

But the transaction faced numerous financial, regulatory and operational hurdles, including the assumption of Intel’s more than $50 billion in debt. It likely would have drawn a lengthy and arduous antitrust review, including in China, which is a key market for both companies.

Qualcomm would have had to handle Intel’s money-losing semiconductor manufacturing unit, a business where it has no experience.

Qualcomm has been looking ahead to new markets — including personal computers, networking and automotive chips — to generate an additional $22 billion in annual revenue by fiscal 2029.

The San Diego-headquartered firm’s chief executive officer, Cristiano Amon, said in a Bloomberg Television interview last week that, “right now, at this time, we have not identified any large acquisition that is necessary for us to execute on this $22 billion.”

‘Better Together’

Intel, which until relatively recently was among the largest chipmakers by value, is in the midst of trying to reinvent itself. Rivals such as Nvidia Corp. have been pulling away in the race to supply chips that can cater to the sheer demand for artificial intelligence.

[Latest] Global Bovine Gelatin Market Size/Share Worth USD 2.92 Billion by 2033 at a 8.67% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Nov. 26, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Bovine Gelatin Market Size, Trends and Insights By Form (Powder, Capsule & Tablets, Liquid), By Type (Type A, Type B), By Nature (Organic, Conventional), By Application (Food and beverages, Cosmetics & personal care, Pharmaceuticals, Others), By Distribution Channel (B2B, B2C, Supermarket/hypermarket, Specialty supplement stores, Drugstore & Pharmacies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

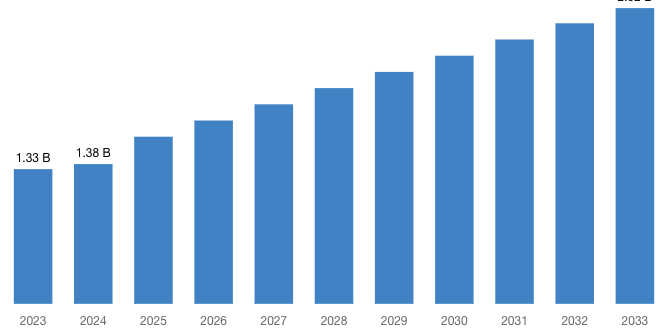

“According to the latest research study, the demand of global Bovine Gelatin Market size & share was valued at approximately USD 1.33 Billion in 2023 and is expected to reach USD 1.38 Billion in 2024 and is expected to reach a value of around USD 2.92 Billion by 2033, at a compound annual growth rate (CAGR) of about 8.67% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Bovine Gelatin Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=54767

Bovine Gelatin Market: Growth Factors and Dynamics

- Increasing Demand in Food and Beverage Industry: Bovine gelatin is widely used in food products like confectionery, dairy, desserts, and beverages due to its functional properties such as gelling, stabilizing, and thickening. The expanding global food and beverage industry drives demand for bovine gelatin.

- Rising Health Consciousness: Consumers are increasingly opting for natural and clean-label ingredients in their food and personal care products. Bovine gelatin, being a natural protein derived from collagen, aligns with the trend towards healthier and more sustainable choices.

- Growing Pharmaceutical Applications: Bovine gelatin is used extensively in the pharmaceutical industry for encapsulation of drugs, vitamins, and nutritional supplements. The increasing prevalence of chronic diseases and the aging population are driving growth in pharmaceutical gelatin applications.

- Expanding Cosmetic and Personal Care Sector: Bovine gelatin finds applications in cosmetics and personal care products such as skin care creams, hair care products, and capsules for beauty supplements. The growing beauty and wellness industry globally contributes to increased demand for bovine gelatin.

- Technological Advancements in Gelatin Production: Innovations in gelatin extraction, purification processes, and product formulations enhance the quality and functionality of bovine gelatin. These advancements cater to diverse industry needs and expand market opportunities.

- Rising Disposable Income and Urbanization: Economic growth, rising disposable incomes, and urbanization lead to increased consumption of processed foods, pharmaceuticals, and personal care products globally. This demographic shift boosts demand for bovine gelatin across various end-use sectors.

- Expanding Applications in Biomedical and Nutraceutical Industries: Bovine gelatin is increasingly used in biomedical applications such as tissue engineering, wound dressing, and drug delivery systems. Additionally, its role in nutraceuticals for joint health and dietary supplements drives market growth.

- Stringent Regulations Favoring Gelatin Usage: Regulatory frameworks promoting the use of gelatin as a safe and natural ingredient in food, pharmaceutical, and cosmetic industries support market expansion. Compliance with quality standards and certifications enhances consumer trust and market acceptance of bovine gelatin products.

Request a Customized Copy of the Bovine Gelatin Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=54767

Bovine Gelatin Market: Merger and New Product Launch

- In April 2023, Darling Ingredients Inc. acquired Gelnex, a top manufacturer of gelatin and collagen products in Brazil. This move helped Darling expand its production capabilities to meet the growing demand for gelatin in the market.

- In July 2022, Perfect Day, a U.S. dairy startup, announced plans to acquire Sterling Biotech, one of the world’s largest gelatin manufacturers, after winning a bid at an auction. Perfect Day bid approximately USD 79.8 million for the Indian gelatin company, positioning itself for future growth opportunities.

- In December 2021, Halavet Foods, a Turkish company, invested USD 25 million to establish a new halal gelatin plant in Turkey. This investment aims to double gelatin exports to North America and support the company’s goal of producing and exporting gelatin and collagen products worth USD 100 million.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 1.38 Billion |

| Projected Market Size in 2033 | USD 2.92 Billion |

| Market Size in 2023 | USD 1.33 Billion |

| CAGR Growth Rate | 8.67% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Form, Type, Nature, Application, Distribution Channel and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Bovine Gelatin report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Bovine Gelatin report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Bovine Gelatin Market Report @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Bovine Gelatin Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Bovine Gelatin Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Disruption in International Trade and Businesses: The COVID-19 pandemic has disrupted global trade and business operations, significantly impacting the bovine gelatin market. Government-imposed restrictions on travel and trade have disrupted supply chains and manufacturing processes, affecting the production and distribution of bovine gelatin products worldwide.

- Demand Fluctuations: The pandemic-induced disruptions have affected various industries that are major consumers of bovine gelatin, such as electronics, automotive, aerospace, and healthcare. Lockdown measures and supply chain interruptions led to reduced manufacturing activities and delayed infrastructure projects, thereby lowering the demand for bovine gelatin in these sectors.

- Regulatory Framework and Market Challenges: The regulatory landscape for bovine gelatin saw changes influenced by the pandemic, including adjustments to safety standards and regulations. Economic uncertainties stemming from the crisis have posed challenges such as increased costs, technical constraints, and workforce shortages, restraining market growth in the bovine gelatin sector.

- Operational Challenges: Health and safety protocols implemented in manufacturing facilities during the pandemic added operational complexities and raised production costs for bovine gelatin manufacturers. Labor shortages due to illness-related absences and quarantine measures further impacted production capacities and efficiency in the market.

- Adaptive Strategies and Innovation Focus: Companies in the bovine gelatin market responded to the pandemic by adopting remote work models, digitalizing sales and marketing efforts, and diversifying supply chain sources to mitigate disruptions. There was also a notable shift towards innovating bovine gelatin products, integrating advanced features to meet evolving market needs and capitalize on emerging opportunities in sectors like smart city projects.

- Technological Advancements: Ongoing advancements in technology, including AI-based applications and enhanced connectivity in traffic management systems, are expanding the scope and applications of bovine gelatin. These innovations are creating new opportunities and driving growth in the market by enhancing product functionalities and meeting increasingly sophisticated consumer demands.

- Automation Trends: The pandemic underscored the importance of automation in manufacturing and urban infrastructure projects, accelerating demand for bovine gelatin in automated systems such as smart traffic management and other smart city initiatives. This trend reflects a broader shift towards reducing reliance on manual labor and increasing efficiency in industrial processes.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Bovine Gelatin Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Bovine Gelatin Market Report @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Key questions answered in this report:

- What is the size of the Bovine Gelatin market and what is its expected growth rate?

- What are the primary driving factors that push the Bovine Gelatin market forward?

- What are the Bovine Gelatin Industry’s top companies?

- What are the different categories that the Bovine Gelatin Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Bovine Gelatin market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Bovine Gelatin Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Bovine Gelatin Market – Regional Analysis

The Bovine Gelatin market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: Bovine gelatin holds a prominent position in North America, where it serves as a crucial ingredient across a wide range of industries. In the food and beverage sector, gelatin is used in confectionery, desserts, and dairy products, benefiting from consumer preferences for natural and functional ingredients. The pharmaceutical industry utilizes gelatin extensively for encapsulating medications and dietary supplements, ensuring controlled release and bioavailability. Additionally, gelatin plays a significant role in the cosmetics industry, where it is used in skincare and hair care products for its film-forming and binding properties. North America’s advanced manufacturing capabilities and stringent regulatory environment further bolster the demand for high-quality gelatin products, driving innovation and market growth.

- Europe: Bovine gelatin enjoys robust demand in Europe, driven by its integral role in the region’s food processing, pharmaceutical, and personal care industries. In food applications, gelatin is valued for its versatile functionalities in products such as yogurts, confectionery, and meat substitutes, aligning with consumer preferences for clean-label and natural ingredients. The pharmaceutical sector relies on gelatin for encapsulating drugs and vitamins, ensuring efficacy and patient compliance. Europe’s emphasis on sustainability and animal welfare influences gelatin sourcing and production practices, with many manufacturers adhering to stringent EU regulations. The region’s commitment to quality and innovation continues to shape the gelatin market, with ongoing advancements in product formulations and applications across various industries.

- Asia-Pacific: The Asia-Pacific region is a pivotal market for bovine gelatin, driven by its thriving food and beverage industry and expanding healthcare sector. Countries like China, India, and Japan lead in gelatin consumption, with applications ranging from traditional food products to modern pharmaceutical formulations. Gelatin’s role in Asia-Pacific extends to cosmetics and personal care products, where it is valued for its skin-enhancing properties and natural origin. Rapid urbanization, changing dietary habits, and increasing disposable incomes contribute to the region’s growing demand for gelatin-based products. Moreover, technological advancements in gelatin processing and rising investments in food safety and quality standards further propel market expansion across Asia-Pacific.

- LAMEA (Latin America, Middle East, and Africa): Bovine gelatin is gaining traction in the LAMEA region as consumer awareness grows about its nutritional benefits and diverse applications. In Latin America, gelatin is used in traditional desserts and candies, while in the Middle East and Africa, it finds applications in pharmaceuticals and health supplements. The expanding food processing sector in Latin America drives demand for gelatin in confectionery and dairy products, catering to a youthful and health-conscious population. Meanwhile, in Africa, gelatin’s use in pharmaceuticals and cosmetics is supported by increasing healthcare expenditures and rising beauty standards. As the region undergoes economic development and urbanization, the demand for gelatin is expected to continue rising, supported by investments in manufacturing infrastructure and regulatory frameworks.

Request a Customized Copy of the Bovine Gelatin Market Report @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Bovine Gelatin Market Size, Trends and Insights By Form (Powder, Capsule & Tablets, Liquid), By Type (Type A, Type B), By Nature (Organic, Conventional), By Application (Food and beverages, Cosmetics & personal care, Pharmaceuticals, Others), By Distribution Channel (B2B, B2C, Supermarket/hypermarket, Specialty supplement stores, Drugstore & Pharmacies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/bovine-gelatin-market/

List of the prominent players in the Bovine Gelatin Market:

- Gelita AG

- Rousselot

- Nitta Gelatin Inc.

- Weishardt Group

- Darling Ingredients Inc.

- Ewald-Gelatine GmbH

- Lapi Gelatine S.p.A.

- Trobas Gelatine B.V.

- Italgelatine S.p.A.

- Junca Gelatines S.L.

- Geltech Co. Ltd.

- Reinert Gruppe Ingredients GmbH

- PB Gelatins GmbH

- Sterling Gelatin

- Gelco S.A.

- Others

Click Here to Access a Free Sample Report of the Global Bovine Gelatin Market @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Asia Pacific Slimming Tea Market: Asia Pacific Slimming Tea Market Size, Trends and Insights By Product Type (Black Tea, Green Tea, Herbal Tea, Others), By Form (Loose Leaf Tea, Tea Bags, Instant Tea, Powdered Tea), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Online, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Global Luxury Food Market: Luxury Food Market Size, Trends and Insights By Type (Vegetarian Food, Poultry, Pork, Meat, Seafood, Others), By Distribution Channel (Online Retailers, Specialty Stores, Supermarkets and Hypermarkets, Gourmet Food Stores, Hotel and Restaurant Supply, Duty-Free Shops, Direct Sales), By End-User (Small Food Chains, High-End Restaurants), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Coffee Capsule Market: Europe Coffee Capsule Market Size, Trends and Insights By Product Type (Traditional Coffee Capsules, Compostable Coffee Capsules, Recyclable Coffee Capsules), By Material Type (Plastic Capsules, Aluminum Capsules, Paper-Based Capsules), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Specialty Stores, Convenience Stores), By Coffee Type (Regular Coffee, Decaffeinated Coffee, Flavored Coffee, Specialty Coffee), By End-User (Residential, Commercial), By Compatibility (Original Line, Vertuo Line, Other Compatible Machines), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Mushroom Market: US Mushroom Market Size, Trends and Insights By Type of Mushroom (Button Mushrooms, Shiitake Mushrooms, Oyster Mushrooms, Portobello Mushrooms, Others), By Form (Fresh Mushrooms, Processed Mushrooms), By End Use (Household Consumption, Food Processing Industry, Pharmaceuticals, Cosmetics and Personal Care Products, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Food Service Providers, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Dietary Supplements Market: Europe Dietary Supplements Market Size, Trends and Insights By Ingredient (Vitamins, Botanicals, Minerals, Protein & Amino Acids, Fibers & Specialty Carbohydrates, Omega Fatty Acids, Probiotics, Prebiotics & Postbiotics, Others), By Form (Tablets, Capsules, Soft gels, Powders, Gummies, Liquids, Others), By Type (Gluten-Free, Non-GMO, Organic, Natural, Vegan, Others), By Application (Energy & Weight Management, General Health, Bone & Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-cancer, Lungs Detox/Cleanse, Skin/ Hair/ Nails, Sexual Health, Brain/Mental Health, Insomnia, Menopause, Anti-aging, Prenatal Health, Others), By End User (Infants, Children, Adults, Pregnant Women, Geriatric, Others), By Distribution Channel (Online, Offline), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Starter Cultures Market: US Starter Cultures Market Size, Trends and Insights By Type (Bacterial Starter Cultures, Yeast Starter Cultures, Mold Starter Cultures, Others), By Application (Dairy Products, Meat Products, Beverages, Bakery Products, Confectionery, Others), By Form (Freeze-Dried Starter Cultures, Directly Inoculated Starter Cultures, Lyophilized Starter Cultures, Others), By End-Use Industry (Food & Beverage Industry, Pharmaceutical Industry, Agriculture, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Non-Alcoholic Beverages Market: US Non-Alcoholic Beverages Market Size, Trends and Insights By Type (Carbonated Soft Drinks (CSD), Bottled Water, Fruit Juices, Energy Drinks, Sports Drinks, Ready-to-Drink (RTD) Tea and Coffee, Functional Beverages, Dairy Alternatives, Others), By Packaging (Cans, Bottles (Plastic/Glass), Cartons, Pouches, Others), By Flavor (Regular/Original, Flavored, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Food Service, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

India Bubble Tea Market: India Bubble Tea Market Size, Trends and Insights By Type (Black Tea, Green Tea, Oolong Tea, White Tea, Herbal Tea), By Milk (Dairy Milk, Non-dairy Milk), By Flavor (Fruit, Taro, Strawberry, Classic, Coffee, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

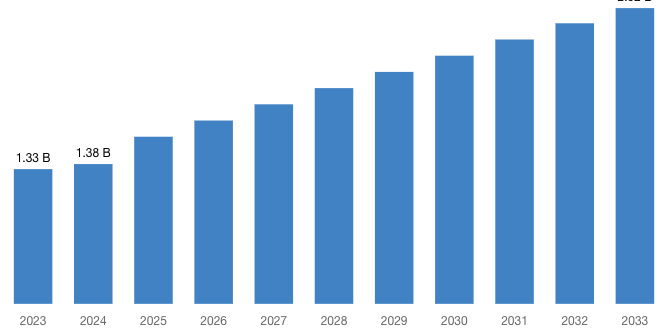

The Bovine Gelatin Market is segmented as follows:

By Form

- Powder

- Capsule & Tablets

- Liquid

By Type

By Nature

By Application

- Food and beverages

- Cosmetics & personal care

- Pharmaceuticals

- Others

By Distribution Channel

- B2B

- B2C

- Supermarket/hypermarket

- Specialty supplement stores

- Drugstore & Pharmacies

- Others

Click Here to Get a Free Sample Report of the Global Bovine Gelatin Market @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Bovine Gelatin Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Bovine Gelatin Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Bovine Gelatin Market? What Was the Capacity, Production Value, Cost and PROFIT of the Bovine Gelatin Market?

- What Is the Current Market Status of the Bovine Gelatin Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Bovine Gelatin Market by Considering Applications and Types?

- What Are Projections of the Global Bovine Gelatin Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Bovine Gelatin Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Bovine Gelatin Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Bovine Gelatin Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Bovine Gelatin Industry?

Click Here to Access a Free Sample Report of the Global Bovine Gelatin Market @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Reasons to Purchase Bovine Gelatin Market Report

- Bovine Gelatin Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Bovine Gelatin Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Bovine Gelatin Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Bovine Gelatin Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Bovine Gelatin market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Bovine Gelatin Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Bovine Gelatin market analysis.

- The competitive environment of current and potential participants in the Bovine Gelatin market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Bovine Gelatin market should find this report useful. The research will be useful to all market participants in the Bovine Gelatin industry.

- Managers in the Bovine Gelatin sector are interested in publishing up-to-date and projected data about the worldwide Bovine Gelatin market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Bovine Gelatin products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Bovine Gelatin Market Report @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Bovine Gelatin Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: President-elect Donald Trump's Plan to Cancel Tax Credits on Electric Vehicles Will Help Tesla

On Aug. 16, 2022, President Joe Biden signed the Inflation Reduction Act (IRA) into law. Although there are many components to the IRA, one of the more prevalent aspects of this piece of legislation revolves around tax credits for electric vehicles (EVs).

Simply put, consumers who purchase a new EV are eligible for a tax credit worth up to $7,500, while used EV purchases are eligible for a credit of up to $4,000. One of the driving forces behind these incentives is to help make EVs more affordable while also creating a more green, sustainable environment.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

However, throughout his campaign President-elect Trump suggested that he may try to remove these EV incentives. On the surface, such a move may seem detrimental to a company such as Tesla (NASDAQ: TSLA) — the de facto poster child for EV manufacturing in America.

While I understand the reasoning behind this logic, my contrarian prediction is that Tesla will actually benefit from the removal of EV tax credits — should President-elect Trump actually pursue this ambition successfully.

Below, I’ll dive into how removing subsidies could impact the EV market and explain why I think Tesla will be just fine in the long run.

Generally speaking, EV adoption is still in its early days. There are only a finite number of companies that are solely focusing on building EVs, such as Tesla and Rivian. Meanwhile, legacy automakers like Ford and General Motors are still very much affiliated with traditional combustion engine cars despite each investing billions into their respective EV roadmap.

The small competitive landscape, coupled with the fact that none of these automakers has achieved mass production — say tens of millions annually — has contributed to high prices in the EV market. For these reasons, EVs are simply out of reach for most consumers — hence, the Biden-Harris administration took action in the form of tax credits to help offset these hefty costs.

Removing subsidies from EVs would make these purchases more expensive. In turn, the EV market could very well witness a sharp decline in consumer demand.

While a drop in demand would likely permeate throughout the entire EV landscape, I see Tesla as far less vulnerable than its peers. Remember, Tesla is already perceived as a premium product. In other words, owning a Tesla is still somewhat of luxury and not exactly a purchase the average consumer can yet afford. For this reason, I don’t think a drop in broader EV demand would make too much of a dent in Tesla’s growth.

Telegram's $1.3B Crypto Windfall Shields Business Amid Pavel Durov's Legal Troubles, Toncoin Emerges As The Golden Goose

Telegram has reported significant financial growth in the first half of 2024, with revenue reaching $525 million, driven by strong performance in cryptocurrency holdings. This is despite ongoing legal challenges facing its CEO, Pavel Durov.

What Happened: Telegram’s financial disclosures indicate that the company has benefited from the rising value of its cryptocurrency holdings, which have grown to $1.3 billion, reported Financial Times, citing the company’s unaudited financial statements.

This increase, along with proceeds from selling Toncoins, has provided a financial cushion for the Dubai-based firm amid Durov’s legal troubles.

In August, Durov was detained by French authorities in Paris, facing preliminary charges related to alleged criminal activities on the platform.

See Also: Weekend Round-Up: AI Dominates Headlines With Nvidia, Elon Musk, And Hollywood’s Big Names

Despite these challenges, Telegram informed investors that the situation has not materially impacted its operations.

The company generated $225 million from a one-time deal involving Toncoin TON/USD, initially developed by Telegram but now managed by an open-source community.

Telegram’s financial statements also show a post-tax profit of $335 million for the first half of the year.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: Telegram’s financial health has been under scrutiny, especially with reports suggesting a loss of $108 million on revenue of $342 million in the previous year.

Despite these challenges, the company has been eyeing a $30 billion IPO in 2026. It remains focused on monetization through ads and premium subscriptions.

A significant portion of Telegram’s revenue, over 40%, is derived from crypto-related operations, including its integrated wallet and sale of collectibles.

This reliance on cryptocurrency has provided a financial buffer amid legal challenges.

Additionally, investments like the $5 million by V3V Ventures in premium Telegram usernames highlight the platform’s potential in the crypto space, as these usernames are seen as valuable assets for building crypto channels.

Price Action: Toncoin is priced at $6.26, reflecting a 2.16% rise over the past 24 hours. However, its trading volume has declined by 15.18%, amounting to $626.53 million at the time of writing, according to data from Benzinga Pro.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

UNIVERSAL HEALTH REALTY INCOME TRUST ANNOUNCES DIVIDEND INCREASE

KING OF PRUSSIA, Pa., Nov. 25, 2024 /PRNewswire/ — Universal Health Realty Income Trust UHT announced today that its Board of Trustees voted to increase the quarterly dividend by $.005 and pay a dividend of $.735 per share on December 31, 2024 to shareholders of record as of December 16, 2024.

Universal Health Realty Income Trust, a real estate investment trust, invests in healthcare and human service-related facilities including acute care hospitals, behavioral healthcare facilities, rehabilitation hospitals, sub-acute care facilities, surgery centers, childcare centers, and medical office buildings. The Trust has seventy-seven investments in twenty-one states.

![]() View original content:https://www.prnewswire.com/news-releases/universal-health-realty-income-trust-announces-dividend-increase-302315702.html

View original content:https://www.prnewswire.com/news-releases/universal-health-realty-income-trust-announces-dividend-increase-302315702.html

SOURCE Universal Health Realty Income Trust

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Larry Summers Warns Trump Policies Could Push Prices Higher Than Biden's Actions: Markets Not A Good Predictor Of Inflation

Former Treasury Secretary Larry Summers predicts potentially significant economic disruption under a potential President-elect Donald Trump‘s administration, cautioning that proposed economic policies could trigger an inflation shock more substantial than recent experiences.

What Happened: In a recent interview, Summers highlighted two primary concerns about the proposed economic agenda: massive demand-side stimulus and substantial supply-side disruptions. The critical components include widespread tax cuts, potential budget deficit expansion, and comprehensive tariff implementations.

“If they were literally implemented, I have little doubt the Trump program is a far larger stimulus to inflation than anything President [Joe] Biden enacted,” Summers told CNN.

“Markets go up, markets go down. Their record in predicting inflation isn’t very good,” Summers said.

Key inflationary risks include:

- Widespread Tax Cuts: Potentially bloating the federal budget deficit

- Across-Board Tariffs: Substantial increases on Chinese goods and imports

- Labor Market Disruptions: Potential massive worker deportations creating labor shortages

Why It Matters: Supporting economic analysis from Goldman Sachs reinforces Summers’ concerns. The investment bank estimates a universal 10% tariff could push inflation back to 3%, raising core personal consumption expenditures inflation by 0.9-1.2 percentage points.

Market indicators currently show resilience. S&P 500 tracked by the SPDR S&P 500 ETF Trust SPY has gained 3.61%, trading at $597.53, while Nasdaq-100 Index tracked by Invesco QQQ Trust, Series 1 QQQ increased 2.92% to $506.59, according to data from Benzinga Pro.

Summers emphasized the potential systemic risks, warning that special economic deals could undermine the rule-based market economy that has historically supported robust U.S. market valuations.

The potential economic shifts come amid a complex fiscal landscape, with the U.S. federal budget deficit projected to reach $1.7 trillion in 2024 and the debt-to-GDP ratio approaching 120%.

Read Next:

Image Via Flickr

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Zoom Changes Name to Emphasize AI Offerings, Gives Sales Forecast

(Bloomberg) — Zoom Video Communications Inc. gave a sales forecast for the current quarter that failed to impress investors who were expecting a bigger boost from the company’s expanded suite of products.

Most Read from Bloomberg

Revenue will be about $1.18 billion in the period ending in January, Zoom said Monday in a statement. Profit, excluding some items, will be $1.29 to $1.30 a share. Analysts, on average, projected adjusted earnings of $1.28 a share on sales of $1.17 billion, according to data compiled by Bloomberg.

The shares declined about 4.5% in extended trading after closing at $89.03 in New York. While Zoom’s outlook met estimates, the stock had gained about 48% since the company’s last earnings report in August on optimism about the new products.

The software maker known for videoconferencing has expanded its suite of tools to offer phone systems, a contact center application and artificial intelligence assistants. In October, Zoom named former Microsoft Corp. executive Michelle Chang as chief financial officer to replace Kelly Steckelberg, who left to join design startup Canva Inc.

Zoom has seen a 59% increase in monthly active users of its AI assistant since the prior quarter, the company said in a presentation to supplement its earnings statement. It also topped 1,250 customers of its contact center application.

While there were “no major issues” with the results, a steep gain for the shares headed into Monday’s earnings means the results may not attract new investors, wrote Tyler Radke, an analyst at Citigroup.

Separately, the company announced it has dropped “video” from its official name and would now be known as Zoom Communications Inc. “Our new name more accurately reflects our expanding scope and plans for long-term growth,” Chief Executive Officer Eric Yuan wrote in a post announcing the change.

In the fiscal third quarter, sales increased 3.6% to $1.18 billion, compared with analysts’ average estimate of $1.16 billion, according to data compiled by Bloomberg. Profit, excluding some items, was $1.38 a share in the period ended Oct. 31.

Enterprise revenue increased 5.8% to $699 million. Zoom said it had 3,995 customers who contributed more than $100,000 over the past year.

An ongoing loss of consumers and small businesses from Zoom has concerned investors, particularly since these customers are typically higher-margin than corporate clients. Average monthly churn in this segment was 2.7% in the quarter, which was better than analysts’ estimates. Sales in the segment was little changed at $479 million. That was Zoom’s lowest-ever online churn, Chang said, according to remarks prepared for the company’s earnings conference call.

Billionaire Bill Ackman Has 15% of His Portfolio in This Magnificent Stock: Time to Buy?

The average investor can find compelling investment ideas by looking at what the big boys are doing. Regulations require larger asset managers to disclose their holdings every quarter, which can provide valuable insights into potential stocks to buy.

One closely watched hedge fund manager is Bill Ackman, who has made a name for himself by making concentrated bets as the head of Pershing Square Capital Management. There’s one business in particular that makes up a huge weighting in the fund.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

As of Sept. 30, Ackman had 15% of its portfolio’s assets (via a combination of two classes of shares) in one magnificent stock. Does this mean it’s time for you to buy?

In early 2023, Ackman and Pershing Square first started buying stock in Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG). The fund initiated a position when the tech giant’s shares fell to an attractive valuation of a forward price-to-earnings (P/E) ratio of around 16. This was a historically cheap price to pay for what Ackman thinks is a world-class enterprise.

He highlighted several reasons for why making this investment was a no-brainer opportunity.

Alphabet benefits from the growth of digital advertising, with its dominant presence in the market. The company’s industry-leading Google Search has unrivaled market share. And with YouTube, Alphabet has another avenue to sell digital advertising. Ackman thinks more money will move over from areas like TV and print ads to the company’s advantage.

Cloud computing is another area that will drive growth for Alphabet. As businesses of all sizes see the need for greater off-premises IT capabilities, Google Cloud has another secular trend propelling it. This segment posted 35% year-over-year revenue growth and a 17% operating margin last quarter. Ackman wouldn’t be surprised to see that margin start to approach what Amazon Web Services boasts, which is now over 38%.

Alphabet is one of the most financially sound companies on the face of the planet. As of Sept. 30, it had a net cash position of $80.9 billion. It also raked in $17.6 billion of free cash flow during the three-month period. This position allows management to aggressively buy back outstanding shares.

When it comes to artificial intelligence, very few businesses are in a better position than Alphabet. When OpenAI released ChatGPT about two years ago, the market initially was worried that it was the beginning of the end of Google Search. “We believe these concerns underestimate Google’s structural leadership position in AI for several key reasons,” Pershing Square’s June 2023 letter reads.

Morning Bid: Trump's tariff post sends markets scrambling

A look at the day ahead in European and global markets from Kevin Buckland

And so it begins.

Trump took to his platform Truth Social late on Monday to threaten 25% tariffs on Mexico and Canada if they don’t better control their borders, and additional tariffs on China.

Asian investors still sipping their morning coffees were suddenly racing to hit the sell button, sending the Mexican peso down more than 2% on the dollar at one point and Japan’s Nikkei almost 2% lower. Automakers were standout losers. Toyota tumbled close to 3% and Nissan nearly 5%.

Most markets regained some composure by midday in Asia but pan-European STOXX 50 futures are still pointing down by about 1%, with traders wary that Europe will soon be in Trump’s cross-hairs.

The episode conjures uncomfortable memories for markets that have got used to reacting to scheduled events such as Fed policy announcements and monthly payrolls reports during Joe Biden’s tenure as president. Now, investors must brace for market-moving Trump posts at any hour, like during his first term in office.

One analyst quipped that it was time to consider downloading Trump’s Truth Social app since X, formerly known as Twitter, is no longer the incoming President’s platform of choice.

But going by Trump’s first term, social media posts and reality haven’t always matched up. There’s still some way to go before Trump takes the oath again in January, meaning sentiment towards Mexico, Canada and other tariff targets could change.

Ultimately, Trump has said many times, he’s all about making deals.

There’s little on the calendar in Europe to distract from Trump’s post, barring some central bank speakers from around the region.

Bank of England chief economist Huw Pill is due at the House of Lords to take questions on Britain’s economic health, or lack of it.

ECB board member Elizabeth McCaul speaks in Frankfurt and peer Mario Centeno presents the Bank of Portugal’s financial stability report.

Riksbank Deputy Governor Anna Seim joins a seminar in Stockholm and Bank of Finland Governor Olli Rehn answers questions in parliament.

Later in the day, the Fed releases minutes of its early November meeting when it cut rates by a quarter point, following the first, super-sized half-point cut of the current easing campaign in September.

Key developments that could influence markets on Tuesday:

– BoE’s Pill in upper house

– ECB’s McCaul and Centeno speak at separate events

– Riksbank’s Seim speaks

– Bank of Finland’s Rehn in parliament