2 High-Yield Dividend Stocks to Buy Now for a Lifetime of Passive Income

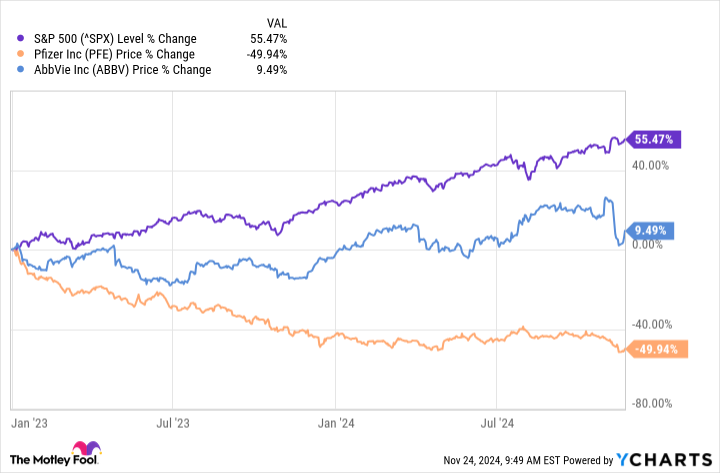

Investors looking for a way to pump up their passive income streams want to turn their attention toward the pharmaceutical industry. From the end of 2022 through Nov. 22, the benchmark S&P 500 index rose by a stunning 55.5%, but many of its drug-selling components haven’t participated in the rally.

Shares of Pfizer (NYSE: PFE) and AbbVie (NYSE: ABBV) have underperformed over the past couple of years, but these dividend payers kept raising their payouts.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

With dividend payouts that have risen much faster than their stock prices, shares of these three drugmakers offer yields that are way above average. Read on to see why there’s a good chance they’ll keep raising your passive income stream throughout retirement.

Shares of Pfizer have lost about half their value since the end of 2022, but its dividend payout has been moving in the opposite direction. Last December, the pharmaceutical giant raised its quarterly payout for the 15th consecutive year.

At recent prices, Pfizer offers a huge 6.5% yield and investors can reasonably expect more dividend payout bumps in the years ahead. Sales of the company’s COVID-19 products probably won’t return to their former glory, but its oncology division is having a terrific year.

Third-quarter sales of cancer therapies shot 31% higher year over year thanks in part to soaring sales of its prostate cancer drug, Xtandi. Xtandi sales will likely continue expanding along with Talzenna. In October, the company announced a significant survival benefit for patients who received Talzenna in combination with Xtandi, versus Xtandi monotherapy, during the Talapro-2 study.

In 2022, Pfizer also used some of its COVID-19 cash to acquire Biohaven and its migraine drug, Nurtec. There have been several new migraine drugs launched over the past five years, but Nurtec is the only one approved for both acute treatment and prevention of migraine headaches.

Nurtec’s unique position is a big advantage for Pfizer. According to management, 85% of primary care clinicians who prescribe new migraine drugs are choosing Nurtec.

This year, Pfizer expects $2.85 per share in adjusted earnings this year at the midpoint of management’s guided range. That’s more than enough to support a dividend payout currently set at an annualized $1.68 per share. With Nurtec, Talzena, and Xtandi driving growth, the drugmaker’s payout could rise steadily for another 15 years.

Leave a Reply