CrowdStrike Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

CrowdStrike Holdings, Inc. CRWD will release earnings results for its third quarter, after the closing bell on Tuesday, Nov. 26.

Analysts expect the Austin, Texas-based bank to report quarterly earnings at 81 cents per share, down from 82 cents per share in the year-ago period. CrowdStrike projects to report revenue of $983.03 million for the recent quarter, compared to $786.01 million a year earlier, according to data from Benzinga Pro.

CrowdStrike has beaten analyst revenue estimates in more than 10 straight quarters.

CrowdStrike shares fell 2.3% to close at $363.68 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Evercore ISI Group analyst Peter Levine maintained an Outperform rating and raised the price target from $325 to $400 on Nov. 25. This analyst has an accuracy rate of 72%.

- Rosenblatt analyst Catharine Trebnick maintained a Buy rating and raised the price target from $325 to $385 on Nov. 25. This analyst has an accuracy rate of 81%.

- Cantor Fitzgerald analyst Yi Fu Lee maintained an Overweight rating and increased the price target from $350 to $370 on Nov. 21. This analyst has an accuracy rate of 73%.

- Stifel analyst Adam Borg maintained a Buy rating and increased the price target from $300 to $375 on Nov. 20. This analyst has an accuracy rate of 78%.

- Truist Securities analyst Joel Fishbein maintained a Buy rating and boosted the price target from $325 to $375 on Nov. 18. This analyst has an accuracy rate of 72%.

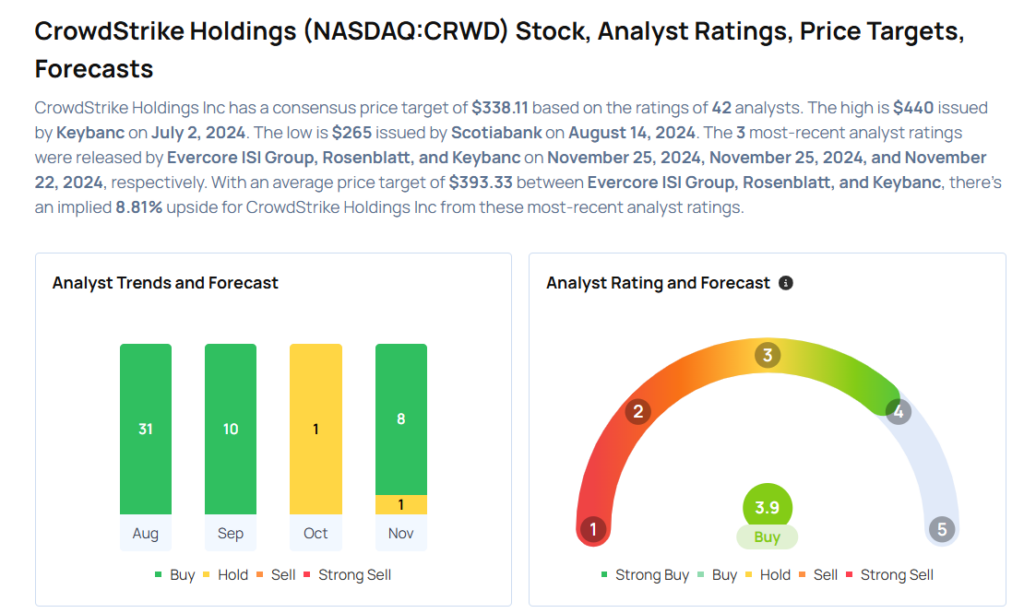

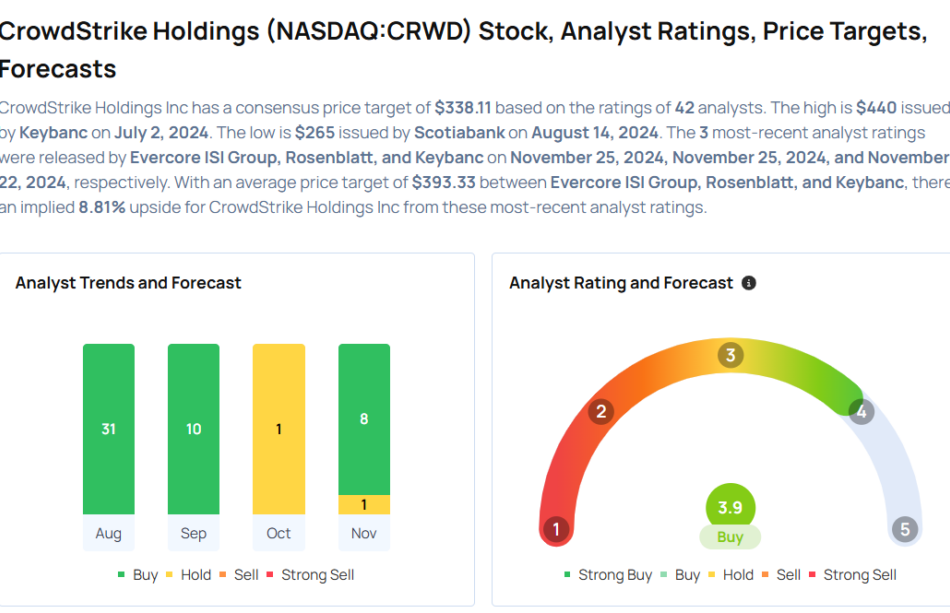

Considering buying CRWD stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply