Market Whales and Their Recent Bets on ADI Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Analog Devices.

Looking at options history for Analog Devices ADI we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $275,604 and 5, calls, for a total amount of $196,440.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $180.0 and $230.0 for Analog Devices, spanning the last three months.

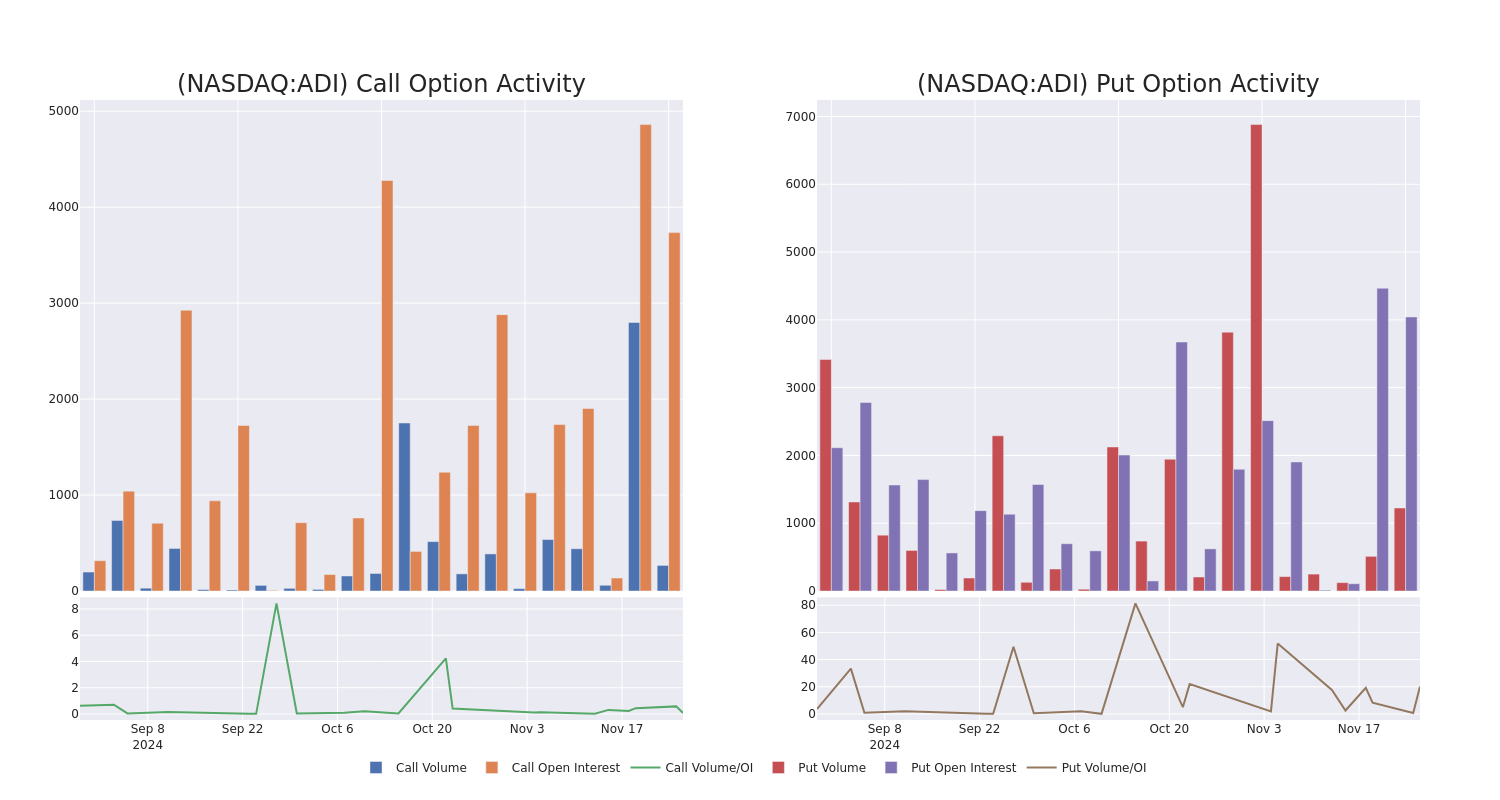

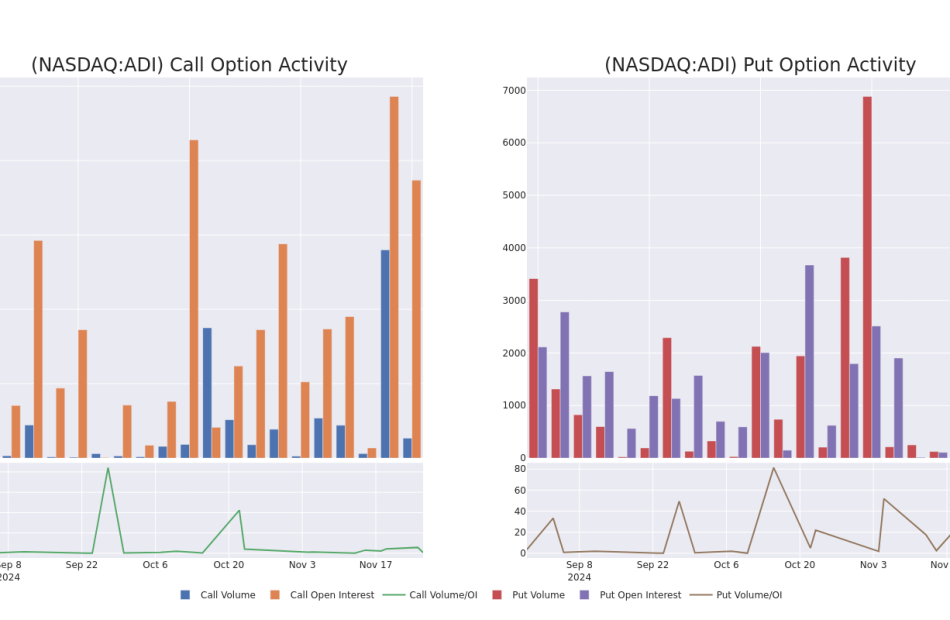

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Analog Devices’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Analog Devices’s substantial trades, within a strike price spectrum from $180.0 to $230.0 over the preceding 30 days.

Analog Devices 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADI | CALL | TRADE | BEARISH | 11/29/24 | $6.9 | $6.5 | $6.5 | $217.50 | $65.0K | 163 | 112 |

| ADI | PUT | TRADE | BULLISH | 06/20/25 | $20.7 | $20.0 | $20.0 | $230.00 | $60.0K | 1.1K | 30 |

| ADI | PUT | SWEEP | BULLISH | 12/20/24 | $2.9 | $2.55 | $2.55 | $210.00 | $47.1K | 1.8K | 501 |

| ADI | PUT | TRADE | BULLISH | 11/29/24 | $4.4 | $4.0 | $4.0 | $222.50 | $40.0K | 166 | 195 |

| ADI | PUT | SWEEP | BULLISH | 02/21/25 | $3.8 | $2.7 | $2.7 | $190.00 | $39.9K | 70 | 200 |

About Analog Devices

Analog Devices is a leading analog, mixed signal, and digital signal processing chipmaker. The firm has a significant market share lead in converter chips, which are used to translate analog signals to digital and vice versa. The company serves tens of thousands of customers, and more than half of its chip sales are made to industrial and automotive end markets. Analog Devices’ chips are also incorporated into wireless infrastructure equipment.

After a thorough review of the options trading surrounding Analog Devices, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Analog Devices

- Currently trading with a volume of 4,673,920, the ADI’s price is down by -3.07%, now at $216.71.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 0 days.

What Analysts Are Saying About Analog Devices

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $220.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Wells Fargo lowers its rating to Equal-Weight with a new price target of $220.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Analog Devices, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply