Elon Musk's Neuralink To Launch New Feasibility Trial With Brain Implant And Robotic Arm

Elon Musk‘s company, Neuralink, is set to initiate a new feasibility trial involving its innovative brain implant technology and a robotic arm. This trial aims to explore the safety and effectiveness of Neuralink’s wireless brain-computer interface and surgical robot.

What Happened: The study, named PRIME, will focus on patients with quadriplegia, enabling them to control external devices through thought, Reuters reported on Tuesday. Neuralink plans to enroll participants from its ongoing PRIME trial into this feasibility study, as mentioned in a post on social media platform X.

Recently, Neuralink received approval from Health Canada to conduct a trial of its device in Canada. Canadian neurosurgeons, in collaboration with Neuralink, have been authorized to recruit six patients with paralysis for the study. In the U.S., Neuralink has already implanted the device in two patients, allowing one to engage in activities such as playing video games and browsing the internet.

The company reports that the device is functioning well in the second patient, who is using it to play video games and learn 3D design. The U.S. FDA and Neuralink have not yet provided further details on the feasibility study.

Why It Matters: The potential of Neuralink’s brain chip technology to transform lives has been a topic of interest since Musk first introduced the concept. As reported in July, Musk envisioned the brain chip offering superhuman abilities, akin to characters from science fiction like Geordi La Forge from Star Trek. The company, founded in 2016, aims to revolutionize the way humans interact with technology and address neurological disorders through brain-computer interfaces (BCIs).

The initial human trials began earlier this year with Noland Arbaugh, a 30-year-old quadriplegic, who received the N1 Implant, allowing him to control a computer cursor with his thoughts.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Groundfloor recognized again by Deloitte, ranking no. 253 on its prestigious Fast 500 Technology List

Groundfloor was also named a finalist for the Benzinga Fintech and IMN Single-Family Awards

ATLANTA, Nov. 25, 2024 /PRNewswire/ — Groundfloor, the award-winning alternative real estate investment platform with over $1.7 billion in investment volume, has once again been named to Deloitte’s prestigious Fast 500 Technology list, ranking No. 253. The annual list honors the 500 fastest-growing technology, media, telecommunications, life sciences, fintech, and energy tech companies in North America. Groundfloor achieved 455% revenue growth over the three-year evaluation period, marking its fourth time receiving this recognition.

This acknowledgment comes during a standout year for Groundfloor, which continues to be honored for its innovation and steady growth. Beyond the Fast 500, Groundfloor was recently named a finalist for the Benzinga Fintech Award in the Alternative Investments category and the IMN Single-Family Awards for Fix & Flip/DSCR Lender of the Year. In 2024, the company also earned spots on the Forbes Fintech 50 for the first time and the Inc. 5000 list for the fifth consecutive year.

“This recognition is another indicator of the groundswell of individual investors who are allocating capital directly to alternative real estate investments,” said co-founder and CEO Brian Dally. “Our unique platform and capital structure has armed Groundfloor with the capacity to grow and build on our track record as a top-tier single family residential housing capital provider and asset manager in the face of challenging interest rate conditions.”

Groundfloor’s momentum in 2024 continued with the launch of several products, including the Flywheel Portfolio introduced last month. A new type of financial product, the Flywheel allows investors to hyper-diversify their alternative real estate investment portfolios by instantly investing into hundreds of real estate loans at once, even down to even fractions of a cent.

For over 11 years, Groundfloor has been at the forefront of transforming real estate investing by making it accessible to everyone, regardless of accreditation status. Real estate has long been the best-performing asset class, yet the most lucrative opportunities were out of reach for most individual investors. Groundfloor changed that by becoming the category creator for private real estate debt investing with its founding in 2013, allowing everyone to participate in high-yield, short-term investments. Today, Groundfloor still offers a minimum investment barrier of just $100 for investors, allowing the company to attract 290,000 registered users and facilitate over $1.7 billion in investments by retail investors. To date, Groundfloor has provided over $1.4 billion in repayments, while rolling out new products like the Flywheel Portfolio that continue to innovate the space—even as competitors falter and in the face of market headwinds. Additionally, Groundfloor offers the industry’s highest levels of transparency and oversight for a private company, operating with disclosures similar to that of a public company.

To learn more about Groundfloor and begin investing, visit Groundfloor.com or download the apps on the Apple App Store or Google Play.

About Groundfloor

Groundfloor is an award-winning fintech company that levels the playing field in financial markets for individual investors. Known for its regulatory prowess and developing completely new financial products for alternative investing, the company was the very first to be qualified to offer direct real estate debt investments for both accredited and non-accredited audiences alike. The company has won numerous awards for its product innovation and growth, including the Forbes Fintech 50 and five years in a row of being on the Inc. 5000 List. Since it launched in 2013, Groundfloor’s investors have consistently seen 10% annualized returns across its short-term investment offerings. For more information or to get started investing fractionally in real estate, visit Groundfloor.com.

Media Contact:

Hela Sheth

hela@katalystcomms.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/groundfloor-recognized-again-by-deloitte-ranking-no-253-on-its-prestigious-fast-500-technology-list-302315473.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/groundfloor-recognized-again-by-deloitte-ranking-no-253-on-its-prestigious-fast-500-technology-list-302315473.html

SOURCE Groundfloor Finance Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow, S&P 500 Reach Fresh Highs: Investor Sentiment Improves, Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed an improvement in the overall market sentiment, while the index remained in the “Greed” zone on Monday.

U.S. stocks settled higher on Friday, with the Dow Jones index and S&P 500 hitting fresh records during the session. Major indices on Wall Street recorded gains last week, with the Dow gaining around 2% and the S&P 500 adding around 1.7%.

Bath & Body Works, Inc. BBWI shares jumped around 16.5% on Monday after the company reported better-than-expected third-quarter results and raised its 2024 outlook.

On the economic data front, the Chicago Fed National Activity Index fell to -0.40 in October compared to -0.27 in the previous month and versus market estimates of -0.20. The Dallas Fed’s Texas manufacturing activity index rose to -2.7 in November compared to a reading of -3 in the previous month and versus market estimates of -2.4.

Most sectors on the S&P 500 closed on a positive note, with real estate, materials, and consumer discretionary stocks recording the biggest gains on Monday. However, energy and information technology stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 440 points to 44,736.57 on Monday. The S&P 500 rose 0.30% to 5,987.37, while the Nasdaq Composite rose 0.27% to close at 19,054.84 during Monday’s session.

Investors are awaiting earnings results from Best Buy Co., Inc. BBY, HP Inc. HPQ, and Dell Technologies Inc. DELL today.

What is CNN Business Fear & Greed Index?

At a current reading of 61.5, the index remained in the “Greed” zone on Monday, versus a prior reading of 60.8.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Paratus Increases Full-Year 2024 Earnings Guidance and Provides Update on Operations in Mexico

HAMILTON, Bermuda, Nov. 26, 2024 /PRNewswire/ — Paratus Energy Services Ltd. PLSV (“Paratus” or the “Company”) announces an upward revision of its full-year 2024 EBITDA guidance and provides commentary on the Company’s rig operations in Mexico, operated through its wholly-owned subsidiary Fontis Holdings Ltd. (“Fontis”).

Following strong operational execution year-to-date, Paratus is raising its full-year 2024 EBITDA guidance to $250-260 million, representing a mid-point increase of $25 million from the previous guidance range of $220-240 million. Further details will be provided on the quarterly earnings call on November 29, 2024.

Paratus has noted recent reports regarding a potential temporary reduction in rig activity in Mexico, and consequently the Company wishes to provide an update as well as clarify the potential financial impact to the Company of such dynamics. The contracts for all of Fontis’ jack-ups with the client permit activity to be temporarily ceased for up to 45 days during the contract term, without revenue being generated during such period. However, any deferred days will extend the contract duration accordingly. Fontis has received notification from its client that the Courageous will temporarily cease operations for 45 days due to delays in the client’s preparatory activities at its next location. Operations at the Courageous’ current location is expected to be completed in early December 2024, upon which the rig will remain in standby at its location. The estimated EBITDA impact of a 45-day deferral through the end of the firm contract period is expected to be approximately $3 million.

Paratus has accommodated and priced such flexibility into its contracts in Mexico to allow its client to execute its operations more efficiently. The Company remains highly focused on supporting its client and continuing to strengthen the long-standing relationship it has had for over a decade, and the Company has taken note of the public comments the client has recently provided about its future plans for operations and payments to its suppliers.

This announcement contains information considered to be inside information pursuant to the EU Market Abuse Regulation and is subject to the disclosure requirements pursuant to Section 5-12 the Norwegian Securities Trading Act. The announcement was published by Baton Haxhimehmedi, CFO of Paratus, on the time and date set out above.

For further information, please contact:

Baton Haxhimehmedi, CFO

Baton.Haxhimehmedi@paratus-energy.com

+47 406 39 083

This information was brought to you by Cision http://news.cision.com

![]() View original content:https://www.prnewswire.com/news-releases/paratus-increases-full-year-2024-earnings-guidance-and-provides-update-on-operations-in-mexico-302316263.html

View original content:https://www.prnewswire.com/news-releases/paratus-increases-full-year-2024-earnings-guidance-and-provides-update-on-operations-in-mexico-302316263.html

SOURCE Paratus Energy Services Ltd

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Best Buy, HP And 3 Stocks To Watch Heading Into Tuesday

With U.S. stock futures trading slightly higher this morning on Tuesday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Best Buy Co., Inc. BBY to report quarterly earnings at $1.29 per share on revenue of $9.63 billion before the opening bell, according to data from Benzinga Pro. Best Buy shares rose 0.4% to $93.37 in after-hours trading.

- Poseida Therapeutics, Inc. PSTX agreed to be acquired by Roche in a $1.5 billion deal. Poseida Therapeutics shares jumped 11.2% to $3.18 in the after-hours trading session.

- Analysts expect HP Inc. HPQ to post quarterly earnings at 93 cents per share on revenue of $13.99 billion. The company will release earnings after the markets close. HP shares fell 0.3% to $39.19 in after-hours trading.

Check out our premarket coverage here

- Zoom Video Communications, Inc. ZM posted better-than-expected results for its third quarter and raised its guidance for the full year. Zoom reported third-quarter revenue of $1.18 billion, beating the consensus estimate of $1.16 billion. The communications company reported third-quarter adjusted earnings of $1.38 per share, beating analyst estimates of $1.31 per share. Zoom shares fell 5.6% to $84.09 in the after-hours trading session.

- Analysts expect Dell Technologies Inc. DELL to report quarterly earnings at $2.05 per share on revenue of $24.65 billion after the closing bell. Dell shares fell 0.8% to $143.00 in after-hours trading.

Check This Out:

Photo courtesy: Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett just published a mini letter about his plans to give his billions away, his kids — and how lucky he's been

-

Warren Buffett said he would gift Berkshire stock worth $1.2 billion to family foundations.

-

The investor also wrote a mini letter to shareholders that was almost 1,500 words.

-

Buffett spoke about his estate planning, his children, his luck in life, and philanthropy.

Warren Buffett surprised shareholders on Monday with a nearly 1,500-word letter alongside his usual Thanksgiving gift to four of his family’s foundations.

The famed investor and Berkshire Hathaway CEO said he would soon convert 1,600 of his Class A shares into 2.4 million Class B shares, worth about $1.2 billion.

He pledged to distribute 1.5 million of those shares to the Susan Thompson Buffett Foundation — named after his late wife — and 300,000 shares to each of his three kids’ foundations: the Sherwood Foundation, the Howard G. Buffett Foundation, and NoVo Foundation.

In his unexpected missive to Berkshire shareholders, Buffett said the gifts would reduce his personal stockpile to 206,363 A shares, worth $149 billion. He’s now given away 56.6% of his shares since pledging 99% of them in 2006 to good causes.

The “Oracle of Omaha” said he and Susan Thompson Buffett owned 508,998 A shares at the time of her death in 2004.

All else being equal, if Buffett still owned all those shares, they’d be worth $367 billion. That would make him the world’s richest man and wealthier than Elon Musk, who’s estimated to be worth $348 billion, per the Bloomberg Billionaires Index.

Buffett said his late wife’s estate was worth about $3 billion and 96% of that went into the pair’s foundation. She bequeathed $10 million to their three children — Howard, Susie, and Peter — which was “the first large gift we had given to any of them,” he said.

“These bequests reflected our belief that hugely wealthy parents should leave their children enough so they can do anything but not enough that they can do nothing,” Buffett wrote.

The legendary stock picker reiterated his comments earlier this year that he now believes his kids are ready to handle the vast responsibility of distributing his Berkshire shares, which make up 99.5% of his wealth.

But he acknowledged that his children, now in their late 60s and early 70s, might be unable to deploy his fortune before they die. “And tomorrow’s decisions are likely to be better made by three live and well-directed brains than by a dead hand,” Buffett wrote.

“As such, three potential successor trustees have been designated. Each is well known to my children and makes sense to all of us. They are also somewhat younger than my children,” Buffett said, adding that they’re “on the waitlist” and that he hoped his children could disburse all his assets.

Roche to acquire US firm Poseida Therapeutics in $1.5 billion deal

ZURICH (Reuters) -Switzerland’s Roche will acquire U.S. biopharma firm Poseida Therapeutics in a cash deal worth up to $1.5 billion, the companies said on Tuesday.

Poseida is to be bought at $9 per share in cash, and stockholders will also receive a non-tradeable contingent value right for up to $4 per share if specific milestones are met, taking the deal value to up to around $1.5 billion.

It is expected to close in the first quarter of 2025.

“We have worked closely with Roche through our collaboration focused on hematologic malignancies, and we are excited to join Roche to work as colleagues together across our pipeline and future programs,” said Kristin Yarema, president and CEO of the San Diego-based Poseida, in a statement.

Poseida and its employees will join Roche as part of the Swiss firm’s pharmaceuticals division, Poseida said.

The acquisition will establish a new capability for Roche in allogeneic cell therapy, with opportunities focused on CAR-T programs covered by existing collaboration between Poseida and Roche in hematologic malignancies, the U.S. firm said.

It will include CAR-T programs for solid tumours and autoimmune diseases, along with Poseida’s genetic engineering platform and related pre-clinical medicines, it added.

(Writing by Dave Graham; Editing by Tom Hogue and Miranda Murray)

Jim Cramer's Apple Endorsement Sparks 'Inverse Cramer' Backlash As Social Media Users Mock His 'Own It' Advice

Financial analyst Jim Cramer‘s recent recommendation to “own” Apple Inc. AAPL stocks has triggered a widespread investor revolt, with social media users loudly proclaiming their intent to do the opposite.

What Happened: CNBC’s “Mad Money” host Cramer’s Monday statement on X, “Apple, own it, don’t trade it!” quickly became a catalyst for what traders call the ‘Inverse Cramer’ phenomenon—a strategy where investors systematically bet against his stock recommendations.

Online commentary ranged from satirical to scathing. One user, Tommy Famous, criticized Cramer as a “financial QVC” who has “led audiences into losses,” suggesting his recommendations are more entertainment than serious financial advice.

Notable social media reactions included Thomas Peters describing it as “a great run” but ultimately follows the Inverse Cramer strategy. Another user humorously suggested it’s time to sell Apple shares. Some users even pledged to switch technology brands in response.

The phenomenon isn’t new. In October 2022, Tuttle Capital launched ETFs specifically designed to track and potentially profit from Cramer’s stock picks—including an “Inverse Cramer” fund that recently announced its shutdown.

Matthew Tuttle, CEO of Tuttle Capital, stated the ETF’s original mission was to “point out the danger of following TV stock pickers” and demonstrate the lack of consistent accountability in financial media recommendations.

It is interesting to note that Cramer also predicted Vice President Kamala Harris‘s victory over now President-elect Donald Trump in the 2024 election on Nov. 4, according to CNBC. “I’m not sure the market’s right about what a Harris presidency would mean for business, but at least now we have a blueprint for what Wall Street thinks it’ll mean,” he said.

Price Action: Apple’s stock closed Monday at $232.87, up 1.31% for the day, with a year-to-date gain of 25.44%, according to data from Benzinga Pro.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Qualcomm’s Takeover Interest in Intel Is Said to Cool

(Bloomberg) — Qualcomm Inc.’s interest in pursuing an acquisition of Intel Corp. has cooled, according to people familiar with the matter, upending what would have likely been one of the largest technology deals of all time.

Most Read from Bloomberg

The complexities associated with acquiring all of Intel has made a deal less attractive to Qualcomm, said some of the people, asking not to be identified discussing confidential matters. It’s always possible Qualcomm looks at pieces of Intel instead or rekindles its interest later, they added.

An Intel takeover would have ranked among the largest acquisitions in history, based on its current market value. A successful deal would’ve marked the biggest purchase of a technology hardware firm, outstrippping Broadcom Inc.’s buyout of software maker VMWare Inc. in 2023. And it could have helped reshape the semiconductor landscape, creating a larger US chip leader at a time global governments are vying to boost domestic supply.

Representatives for Qualcomm and Intel declined to comment.

Qualcomm made a preliminary approach to Intel on a possible takeover, Bloomberg News and other outlets reported in September. It came just weeks after Intel communicated a bruising earnings report where it delivered a disappointing revenue forecast and outlined a 15% reduction in headcount in an effort to “resize and refocus.”

But the transaction faced numerous financial, regulatory and operational hurdles, including the assumption of Intel’s more than $50 billion in debt. It likely would have drawn a lengthy and arduous antitrust review, including in China, which is a key market for both companies.

Qualcomm would have had to handle Intel’s money-losing semiconductor manufacturing unit, a business where it has no experience.

Qualcomm has been looking ahead to new markets — including personal computers, networking and automotive chips — to generate an additional $22 billion in annual revenue by fiscal 2029.

The San Diego-headquartered firm’s chief executive officer, Cristiano Amon, said in a Bloomberg Television interview last week that, “right now, at this time, we have not identified any large acquisition that is necessary for us to execute on this $22 billion.”

‘Better Together’

Intel, which until relatively recently was among the largest chipmakers by value, is in the midst of trying to reinvent itself. Rivals such as Nvidia Corp. have been pulling away in the race to supply chips that can cater to the sheer demand for artificial intelligence.

[Latest] Global Bovine Gelatin Market Size/Share Worth USD 2.92 Billion by 2033 at a 8.67% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

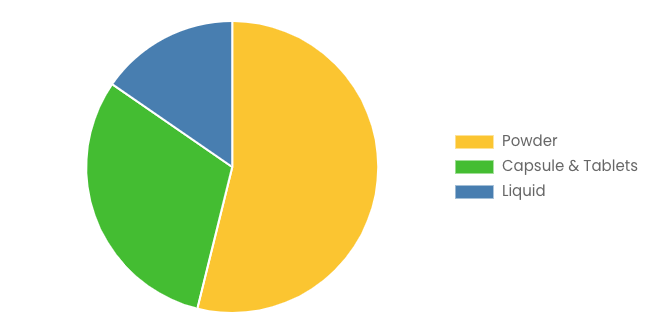

Austin, TX, USA, Nov. 26, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Bovine Gelatin Market Size, Trends and Insights By Form (Powder, Capsule & Tablets, Liquid), By Type (Type A, Type B), By Nature (Organic, Conventional), By Application (Food and beverages, Cosmetics & personal care, Pharmaceuticals, Others), By Distribution Channel (B2B, B2C, Supermarket/hypermarket, Specialty supplement stores, Drugstore & Pharmacies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

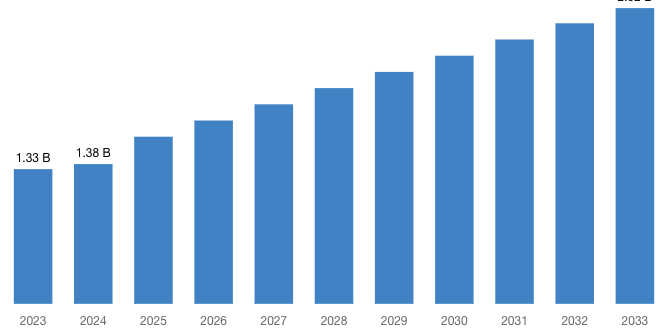

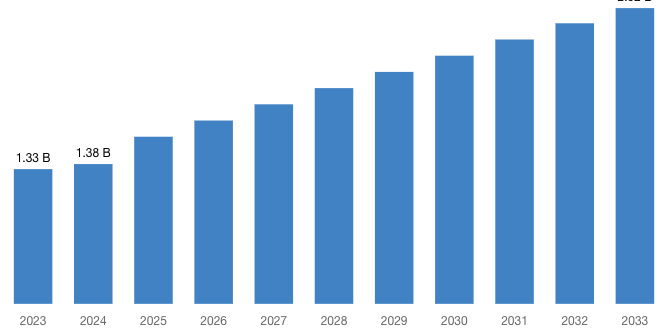

“According to the latest research study, the demand of global Bovine Gelatin Market size & share was valued at approximately USD 1.33 Billion in 2023 and is expected to reach USD 1.38 Billion in 2024 and is expected to reach a value of around USD 2.92 Billion by 2033, at a compound annual growth rate (CAGR) of about 8.67% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Bovine Gelatin Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=54767

Bovine Gelatin Market: Growth Factors and Dynamics

- Increasing Demand in Food and Beverage Industry: Bovine gelatin is widely used in food products like confectionery, dairy, desserts, and beverages due to its functional properties such as gelling, stabilizing, and thickening. The expanding global food and beverage industry drives demand for bovine gelatin.

- Rising Health Consciousness: Consumers are increasingly opting for natural and clean-label ingredients in their food and personal care products. Bovine gelatin, being a natural protein derived from collagen, aligns with the trend towards healthier and more sustainable choices.

- Growing Pharmaceutical Applications: Bovine gelatin is used extensively in the pharmaceutical industry for encapsulation of drugs, vitamins, and nutritional supplements. The increasing prevalence of chronic diseases and the aging population are driving growth in pharmaceutical gelatin applications.

- Expanding Cosmetic and Personal Care Sector: Bovine gelatin finds applications in cosmetics and personal care products such as skin care creams, hair care products, and capsules for beauty supplements. The growing beauty and wellness industry globally contributes to increased demand for bovine gelatin.

- Technological Advancements in Gelatin Production: Innovations in gelatin extraction, purification processes, and product formulations enhance the quality and functionality of bovine gelatin. These advancements cater to diverse industry needs and expand market opportunities.

- Rising Disposable Income and Urbanization: Economic growth, rising disposable incomes, and urbanization lead to increased consumption of processed foods, pharmaceuticals, and personal care products globally. This demographic shift boosts demand for bovine gelatin across various end-use sectors.

- Expanding Applications in Biomedical and Nutraceutical Industries: Bovine gelatin is increasingly used in biomedical applications such as tissue engineering, wound dressing, and drug delivery systems. Additionally, its role in nutraceuticals for joint health and dietary supplements drives market growth.

- Stringent Regulations Favoring Gelatin Usage: Regulatory frameworks promoting the use of gelatin as a safe and natural ingredient in food, pharmaceutical, and cosmetic industries support market expansion. Compliance with quality standards and certifications enhances consumer trust and market acceptance of bovine gelatin products.

Request a Customized Copy of the Bovine Gelatin Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=54767

Bovine Gelatin Market: Merger and New Product Launch

- In April 2023, Darling Ingredients Inc. acquired Gelnex, a top manufacturer of gelatin and collagen products in Brazil. This move helped Darling expand its production capabilities to meet the growing demand for gelatin in the market.

- In July 2022, Perfect Day, a U.S. dairy startup, announced plans to acquire Sterling Biotech, one of the world’s largest gelatin manufacturers, after winning a bid at an auction. Perfect Day bid approximately USD 79.8 million for the Indian gelatin company, positioning itself for future growth opportunities.

- In December 2021, Halavet Foods, a Turkish company, invested USD 25 million to establish a new halal gelatin plant in Turkey. This investment aims to double gelatin exports to North America and support the company’s goal of producing and exporting gelatin and collagen products worth USD 100 million.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 1.38 Billion |

| Projected Market Size in 2033 | USD 2.92 Billion |

| Market Size in 2023 | USD 1.33 Billion |

| CAGR Growth Rate | 8.67% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Form, Type, Nature, Application, Distribution Channel and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Bovine Gelatin report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Bovine Gelatin report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Bovine Gelatin Market Report @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Bovine Gelatin Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Bovine Gelatin Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Disruption in International Trade and Businesses: The COVID-19 pandemic has disrupted global trade and business operations, significantly impacting the bovine gelatin market. Government-imposed restrictions on travel and trade have disrupted supply chains and manufacturing processes, affecting the production and distribution of bovine gelatin products worldwide.

- Demand Fluctuations: The pandemic-induced disruptions have affected various industries that are major consumers of bovine gelatin, such as electronics, automotive, aerospace, and healthcare. Lockdown measures and supply chain interruptions led to reduced manufacturing activities and delayed infrastructure projects, thereby lowering the demand for bovine gelatin in these sectors.

- Regulatory Framework and Market Challenges: The regulatory landscape for bovine gelatin saw changes influenced by the pandemic, including adjustments to safety standards and regulations. Economic uncertainties stemming from the crisis have posed challenges such as increased costs, technical constraints, and workforce shortages, restraining market growth in the bovine gelatin sector.

- Operational Challenges: Health and safety protocols implemented in manufacturing facilities during the pandemic added operational complexities and raised production costs for bovine gelatin manufacturers. Labor shortages due to illness-related absences and quarantine measures further impacted production capacities and efficiency in the market.

- Adaptive Strategies and Innovation Focus: Companies in the bovine gelatin market responded to the pandemic by adopting remote work models, digitalizing sales and marketing efforts, and diversifying supply chain sources to mitigate disruptions. There was also a notable shift towards innovating bovine gelatin products, integrating advanced features to meet evolving market needs and capitalize on emerging opportunities in sectors like smart city projects.

- Technological Advancements: Ongoing advancements in technology, including AI-based applications and enhanced connectivity in traffic management systems, are expanding the scope and applications of bovine gelatin. These innovations are creating new opportunities and driving growth in the market by enhancing product functionalities and meeting increasingly sophisticated consumer demands.

- Automation Trends: The pandemic underscored the importance of automation in manufacturing and urban infrastructure projects, accelerating demand for bovine gelatin in automated systems such as smart traffic management and other smart city initiatives. This trend reflects a broader shift towards reducing reliance on manual labor and increasing efficiency in industrial processes.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Bovine Gelatin Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Bovine Gelatin Market Report @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Key questions answered in this report:

- What is the size of the Bovine Gelatin market and what is its expected growth rate?

- What are the primary driving factors that push the Bovine Gelatin market forward?

- What are the Bovine Gelatin Industry’s top companies?

- What are the different categories that the Bovine Gelatin Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Bovine Gelatin market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Bovine Gelatin Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Bovine Gelatin Market – Regional Analysis

The Bovine Gelatin market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: Bovine gelatin holds a prominent position in North America, where it serves as a crucial ingredient across a wide range of industries. In the food and beverage sector, gelatin is used in confectionery, desserts, and dairy products, benefiting from consumer preferences for natural and functional ingredients. The pharmaceutical industry utilizes gelatin extensively for encapsulating medications and dietary supplements, ensuring controlled release and bioavailability. Additionally, gelatin plays a significant role in the cosmetics industry, where it is used in skincare and hair care products for its film-forming and binding properties. North America’s advanced manufacturing capabilities and stringent regulatory environment further bolster the demand for high-quality gelatin products, driving innovation and market growth.

- Europe: Bovine gelatin enjoys robust demand in Europe, driven by its integral role in the region’s food processing, pharmaceutical, and personal care industries. In food applications, gelatin is valued for its versatile functionalities in products such as yogurts, confectionery, and meat substitutes, aligning with consumer preferences for clean-label and natural ingredients. The pharmaceutical sector relies on gelatin for encapsulating drugs and vitamins, ensuring efficacy and patient compliance. Europe’s emphasis on sustainability and animal welfare influences gelatin sourcing and production practices, with many manufacturers adhering to stringent EU regulations. The region’s commitment to quality and innovation continues to shape the gelatin market, with ongoing advancements in product formulations and applications across various industries.

- Asia-Pacific: The Asia-Pacific region is a pivotal market for bovine gelatin, driven by its thriving food and beverage industry and expanding healthcare sector. Countries like China, India, and Japan lead in gelatin consumption, with applications ranging from traditional food products to modern pharmaceutical formulations. Gelatin’s role in Asia-Pacific extends to cosmetics and personal care products, where it is valued for its skin-enhancing properties and natural origin. Rapid urbanization, changing dietary habits, and increasing disposable incomes contribute to the region’s growing demand for gelatin-based products. Moreover, technological advancements in gelatin processing and rising investments in food safety and quality standards further propel market expansion across Asia-Pacific.

- LAMEA (Latin America, Middle East, and Africa): Bovine gelatin is gaining traction in the LAMEA region as consumer awareness grows about its nutritional benefits and diverse applications. In Latin America, gelatin is used in traditional desserts and candies, while in the Middle East and Africa, it finds applications in pharmaceuticals and health supplements. The expanding food processing sector in Latin America drives demand for gelatin in confectionery and dairy products, catering to a youthful and health-conscious population. Meanwhile, in Africa, gelatin’s use in pharmaceuticals and cosmetics is supported by increasing healthcare expenditures and rising beauty standards. As the region undergoes economic development and urbanization, the demand for gelatin is expected to continue rising, supported by investments in manufacturing infrastructure and regulatory frameworks.

Request a Customized Copy of the Bovine Gelatin Market Report @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Bovine Gelatin Market Size, Trends and Insights By Form (Powder, Capsule & Tablets, Liquid), By Type (Type A, Type B), By Nature (Organic, Conventional), By Application (Food and beverages, Cosmetics & personal care, Pharmaceuticals, Others), By Distribution Channel (B2B, B2C, Supermarket/hypermarket, Specialty supplement stores, Drugstore & Pharmacies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/bovine-gelatin-market/

List of the prominent players in the Bovine Gelatin Market:

- Gelita AG

- Rousselot

- Nitta Gelatin Inc.

- Weishardt Group

- Darling Ingredients Inc.

- Ewald-Gelatine GmbH

- Lapi Gelatine S.p.A.

- Trobas Gelatine B.V.

- Italgelatine S.p.A.

- Junca Gelatines S.L.

- Geltech Co. Ltd.

- Reinert Gruppe Ingredients GmbH

- PB Gelatins GmbH

- Sterling Gelatin

- Gelco S.A.

- Others

Click Here to Access a Free Sample Report of the Global Bovine Gelatin Market @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Asia Pacific Slimming Tea Market: Asia Pacific Slimming Tea Market Size, Trends and Insights By Product Type (Black Tea, Green Tea, Herbal Tea, Others), By Form (Loose Leaf Tea, Tea Bags, Instant Tea, Powdered Tea), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Online, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Global Luxury Food Market: Luxury Food Market Size, Trends and Insights By Type (Vegetarian Food, Poultry, Pork, Meat, Seafood, Others), By Distribution Channel (Online Retailers, Specialty Stores, Supermarkets and Hypermarkets, Gourmet Food Stores, Hotel and Restaurant Supply, Duty-Free Shops, Direct Sales), By End-User (Small Food Chains, High-End Restaurants), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Coffee Capsule Market: Europe Coffee Capsule Market Size, Trends and Insights By Product Type (Traditional Coffee Capsules, Compostable Coffee Capsules, Recyclable Coffee Capsules), By Material Type (Plastic Capsules, Aluminum Capsules, Paper-Based Capsules), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Specialty Stores, Convenience Stores), By Coffee Type (Regular Coffee, Decaffeinated Coffee, Flavored Coffee, Specialty Coffee), By End-User (Residential, Commercial), By Compatibility (Original Line, Vertuo Line, Other Compatible Machines), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Mushroom Market: US Mushroom Market Size, Trends and Insights By Type of Mushroom (Button Mushrooms, Shiitake Mushrooms, Oyster Mushrooms, Portobello Mushrooms, Others), By Form (Fresh Mushrooms, Processed Mushrooms), By End Use (Household Consumption, Food Processing Industry, Pharmaceuticals, Cosmetics and Personal Care Products, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Food Service Providers, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Dietary Supplements Market: Europe Dietary Supplements Market Size, Trends and Insights By Ingredient (Vitamins, Botanicals, Minerals, Protein & Amino Acids, Fibers & Specialty Carbohydrates, Omega Fatty Acids, Probiotics, Prebiotics & Postbiotics, Others), By Form (Tablets, Capsules, Soft gels, Powders, Gummies, Liquids, Others), By Type (Gluten-Free, Non-GMO, Organic, Natural, Vegan, Others), By Application (Energy & Weight Management, General Health, Bone & Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-cancer, Lungs Detox/Cleanse, Skin/ Hair/ Nails, Sexual Health, Brain/Mental Health, Insomnia, Menopause, Anti-aging, Prenatal Health, Others), By End User (Infants, Children, Adults, Pregnant Women, Geriatric, Others), By Distribution Channel (Online, Offline), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Starter Cultures Market: US Starter Cultures Market Size, Trends and Insights By Type (Bacterial Starter Cultures, Yeast Starter Cultures, Mold Starter Cultures, Others), By Application (Dairy Products, Meat Products, Beverages, Bakery Products, Confectionery, Others), By Form (Freeze-Dried Starter Cultures, Directly Inoculated Starter Cultures, Lyophilized Starter Cultures, Others), By End-Use Industry (Food & Beverage Industry, Pharmaceutical Industry, Agriculture, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Non-Alcoholic Beverages Market: US Non-Alcoholic Beverages Market Size, Trends and Insights By Type (Carbonated Soft Drinks (CSD), Bottled Water, Fruit Juices, Energy Drinks, Sports Drinks, Ready-to-Drink (RTD) Tea and Coffee, Functional Beverages, Dairy Alternatives, Others), By Packaging (Cans, Bottles (Plastic/Glass), Cartons, Pouches, Others), By Flavor (Regular/Original, Flavored, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Food Service, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

India Bubble Tea Market: India Bubble Tea Market Size, Trends and Insights By Type (Black Tea, Green Tea, Oolong Tea, White Tea, Herbal Tea), By Milk (Dairy Milk, Non-dairy Milk), By Flavor (Fruit, Taro, Strawberry, Classic, Coffee, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Bovine Gelatin Market is segmented as follows:

By Form

- Powder

- Capsule & Tablets

- Liquid

By Type

By Nature

By Application

- Food and beverages

- Cosmetics & personal care

- Pharmaceuticals

- Others

By Distribution Channel

- B2B

- B2C

- Supermarket/hypermarket

- Specialty supplement stores

- Drugstore & Pharmacies

- Others

Click Here to Get a Free Sample Report of the Global Bovine Gelatin Market @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Bovine Gelatin Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Bovine Gelatin Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Bovine Gelatin Market? What Was the Capacity, Production Value, Cost and PROFIT of the Bovine Gelatin Market?

- What Is the Current Market Status of the Bovine Gelatin Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Bovine Gelatin Market by Considering Applications and Types?

- What Are Projections of the Global Bovine Gelatin Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Bovine Gelatin Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Bovine Gelatin Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Bovine Gelatin Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Bovine Gelatin Industry?

Click Here to Access a Free Sample Report of the Global Bovine Gelatin Market @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

Reasons to Purchase Bovine Gelatin Market Report

- Bovine Gelatin Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Bovine Gelatin Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Bovine Gelatin Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Bovine Gelatin Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Bovine Gelatin market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Bovine Gelatin Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Bovine Gelatin market analysis.

- The competitive environment of current and potential participants in the Bovine Gelatin market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Bovine Gelatin market should find this report useful. The research will be useful to all market participants in the Bovine Gelatin industry.

- Managers in the Bovine Gelatin sector are interested in publishing up-to-date and projected data about the worldwide Bovine Gelatin market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Bovine Gelatin products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Bovine Gelatin Market Report @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Bovine Gelatin Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/bovine-gelatin-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.