Economist Steve Hanke Brushes Off Trump Economic Worries As 'Nonsense,' Predicts Fed Will Bring Prices Below 2% In 2025

Contrary to growing concerns about potential inflationary pressures under President-elect Donald Trump‘s administration, top economist Steve Hanke dismisses fears of a significant price surge, citing monetary policy and money supply as critical factors.

What Happened: In a recent interview with CNBC, Hanke argued that the inflation trajectory depends more on Federal Reserve actions than proposed economic policies. “All this talk about Trump’s policies causing inflation to kick up again is just nonsense,” Hanke stated.

Hanke highlighted a critical economic indicator: the U.S. money supply, which has contracted since 2022. Historically, such contractions have preceded economic downturns. “The money supply is growing at 2.6% year-over-year, below my golden growth rate of 6%,” he explained.

The economist predicts inflation will fall below the Fed’s 2% target in 2025, challenging warnings from economists like former Treasury Secretary Larry Summers, who anticipates potential inflationary risks from proposed tax cuts and trade policies.

Why It Matters: Hanke praised the potential administration’s focus on economic deregulation, suggesting it could enhance GDP growth without triggering significant inflation. He referenced Scott Bessent, Trump’s potential Treasury Secretary pick, who has proposed strategies to mitigate potential inflationary impacts.

Market indicators currently show resilience. S&P 500 tracked by the SPDR S&P 500 ETF Trust SPY has gained 3.61% since Nov. 5, trading at $597.53 on Monday, while Nasdaq-100 Index tracked by Invesco QQQ Trust, Series 1 QQQ increased 2.92% during the same period to $506.59, data from Benzinga Pro.

The potential economic shifts come amid a complex fiscal landscape, with the U.S. federal budget deficit projected to reach $1.7 trillion in 2024 and the debt-to-GDP ratio approaching 120%.

Read Next:

Image Via Flickr

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Scheduled For November 26, 2024

Companies Reporting Before The Bell

• Icecure Medical ICCM is projected to report quarterly loss at $0.08 per share on revenue of $708 thousand.

• Tsakos Energy Navigation TEN is projected to report quarterly earnings at $0.66 per share on revenue of $164.00 million.

• Manchester United MANU is expected to report quarterly loss at $0.29 per share on revenue of $194.49 million.

• Best Buy Co BBY is projected to report quarterly earnings at $1.29 per share on revenue of $9.63 billion.

• Kohl’s KSS is likely to report quarterly earnings at $0.27 per share on revenue of $3.71 billion.

• JM Smucker SJM is estimated to report quarterly earnings at $2.51 per share on revenue of $2.26 billion.

• Dick’s Sporting Goods DKS is expected to report quarterly earnings at $2.69 per share on revenue of $3.03 billion.

• Analog Devices ADI is projected to report quarterly earnings at $1.64 per share on revenue of $2.41 billion.

• Titan Machinery TITN is projected to report quarterly earnings at $0.05 per share on revenue of $675.30 million.

• Embecta EMBC is projected to report quarterly earnings at $0.36 per share on revenue of $276.88 million.

• Ucloudlink Group UCL is expected to report quarterly earnings at $0.07 per share on revenue of $26.70 million.

• Zhihu ZH is estimated to report earnings for its third quarter.

• Macy’s M is expected to report quarterly loss at $0.01 per share on revenue of $4.72 billion.

• Burlington Stores BURL is estimated to report quarterly earnings at $1.55 per share on revenue of $2.56 billion.

• H World Group HTHT is estimated to report quarterly earnings at $0.69 per share on revenue of $933.86 million.

• Cadeler CDLR is likely to report earnings for its third quarter.

• Abercrombie & Fitch ANF is projected to report quarterly earnings at $2.22 per share on revenue of $1.18 billion.

• American Woodmark AMWD is projected to report quarterly earnings at $2.37 per share on revenue of $458.29 million.

• Cheche Group CCG is projected to report earnings for its third quarter.

• MediWound MDWD is projected to report quarterly loss at $0.44 per share on revenue of $6.01 million.

Companies Reporting After The Bell

• JOYY YY is expected to report quarterly earnings at $0.92 per share on revenue of $562.00 million.

• Iris Energy IREN is estimated to report quarterly loss at $0.07 per share on revenue of $54.75 million.

• 3D Sys DDD is expected to report quarterly loss at $0.09 per share on revenue of $113.65 million.

• Guess GES is expected to report quarterly earnings at $0.37 per share on revenue of $747.44 million.

• Pinstripes Holdings PNST is projected to report quarterly loss at $0.21 per share on revenue of $30.59 million.

• Urban Outfitters URBN is likely to report quarterly earnings at $0.85 per share on revenue of $1.34 billion.

• Nordstrom JWN is estimated to report quarterly earnings at $0.22 per share on revenue of $3.35 billion.

• CrowdStrike Holdings CRWD is estimated to report quarterly earnings at $0.81 per share on revenue of $983.03 million.

• Dell Technologies DELL is estimated to report quarterly earnings at $2.06 per share on revenue of $24.72 billion.

• Nutanix NTNX is likely to report quarterly earnings at $0.32 per share on revenue of $572.16 million.

• Arrowhead Pharma ARWR is expected to report quarterly loss at $0.92 per share on revenue of $58.91 million.

• Autodesk ADSK is likely to report quarterly earnings at $2.12 per share on revenue of $1.56 billion.

• Workday WDAY is projected to report quarterly earnings at $1.76 per share on revenue of $2.13 billion.

• Ambarella AMBA is expected to report quarterly earnings at $0.04 per share on revenue of $79.03 million.

• Yxt.Com Group Holding YXT is likely to report earnings for its third quarter.

• Noah Holdings NOAH is estimated to report earnings for its third quarter.

• PagerDuty PD is projected to report quarterly earnings at $0.17 per share on revenue of $116.39 million.

• HP HPQ is expected to report quarterly earnings at $0.93 per share on revenue of $14.00 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

UCLOUDLINK GROUP INC. Announces Unaudited Third Quarter 2024 Financial Results

HONG KONG, Nov. 26, 2024 (GLOBE NEWSWIRE) — UCLOUDLINK GROUP INC. (“UCLOUDLINK” or the “Company”) UCL, the world’s first and leading mobile data traffic sharing marketplace, today announced its unaudited financial results for the three months ended September 30, 2024.

Third Quarter 2024 Financial Highlights

- Total revenues were US$25.2 million, representing an increase of 5.6% from US$23.9 million in the third quarter of 2023.

- Gross profit was US$12.19 million, representing a decrease of 0.1% from US$12.21 million in the third quarter of 2023.

- Income from operations was US$3.3 million, compared to US$3.3 million in the third quarter of 2023.

- Net income was US$3.4 million, compared to US$3.5 million in the third quarter of 2023.

- Adjusted net income (non-GAAP) was US$3.7 million, compared to US$3.8 million in the third quarter of 2023.

- Adjusted EBITDA (non-GAAP) was US$4.4 million, compared to US$4.1 million in the third quarter of 2023.

Third Quarter 2024 Operational Highlights

- Total data consumed in the third quarter through the Company’s platform was 44,994 terabytes (7,755 terabytes procured by the Company and 37,239 terabytes procured by our business partners), representing a decrease of 3.5% from 46,630 terabytes in the third quarter of 2023.

- Average daily active terminals in the third quarter were 320,452 (20,177 owned by the Company and 300,275 owned by our business partners), representing a decrease of 1.4% from 325,078 in the third quarter of 2023. 55.4% of daily active terminals were from uCloudlink 1.0 international data connectivity services and 44.6% of daily active terminals were from uCloudlink 2.0 local data connectivity services during the third quarter of 2024. Average daily data usage per terminal was 1.52 GB in September 2024.

- As of September 30, 2024, the Company had served 2,759 business partners in 61 countries and regions. The Company had 183 patents with 158 approved and 25 pending approval, while the pool of SIM cards was from 389 MNOs globally as of September 30, 2024.

Executive Commentary

Mr. Chaohui Chen, Director and Chief Executive Officer of UCLOUDLINK, said, “Revenues were in-line with our expectations during the third quarter of 2024, increasing 5.6% year-over-year to US$25.2 million as we drive growth momentum. Our financial position remains solid, with a net income reaching US$3.4 million and a positive net cash inflow from operations of US$2.0 million. Our 1.0 international data connectivity services business continued to grow, with full-speed 5G network coverage increasing to 75 countries and regions, fueled by the recovery of international travel and increasing demand across key markets. We further consolidated our leading position in the roaming market and expanded our market share in mainland China and Japan.”

“Following the introduction of our GlocalMe Life products series at Viva Technology in May and their commercial launch in July 2024, we further enhanced our market exposure by attending other leading global expos such as Travel Meet Asia, Pet & Vet Expo, and IFA Berlin 2024. Additionally, we made breakthroughs in developing retail channels, signing with one of North America’s largest airport retail channels to make UniCord, RoamPlug, and KeyTracker, among other products, available at airports across the U.S. We will develop strategic partnerships with other key channel partners across the U.S. and Europe in the coming quarters. In terms of GlocalMe SIM, we continued to expand the market presence of over-the-air (OTA) SIM as more users resubscribed to our data plan service, paving the way for our innovative “ALL SIM” solutions. Our innovative “ALL SIM” solution is under commercial testing and is expected to commercially launch in the near future. In terms of GlocalMe IoT, we are leveraging our soft cloud SIM technology, which is compatible with various chipset platforms, to engage with several leading manufacturers in the security camera, dashboard camera, and related sectors. Some products with our embedded technology are already in small-scale commercial application, demonstrating the strength and capabilities of our solutions to a broader audience in the Internet of Things (IoT) industry.”

“Looking ahead, we will continue to leverage GlocalMe Life, GlocalMe SIM, GlocalMe IoT and their integrated innovative core HyperConn and cloud SIM solutions, to expand our global presence and cooperate with additional business partners and channels. This will allow us to scale up and diversify our end user base in the future. This transition will diversify our revenue streams from primarily mobile data traffic solutions to a mix of value-added services and mobile data traffic solutions, and will drive the ongoing consolidation and development of our GlocalMe ecosystem, positioning UCLOUDLINK as a leading global mobile data traffic sharing marketplace while creating long-term sustainable value for our shareholders.”

Third Quarter 2024 Financial Results

Revenues

Total Revenues were US$25.2 million, representing an increase of 5.6% from US$23.9 million in the same period of 2023.

- Revenues from services were US$17.3 million, representing an increase of 3.9% from US$16.6 million in the same period of 2023. This increase was primarily attributable to increases in revenues from data connectivity services and from PaaS and SaaS services.

- Revenues from data connectivity services were US$14.0 million, representing an increase of 1.9% from US$13.8 million in the same period of 2023. This increase was primarily attributable to (i) an increase in revenues from international data connectivity services to US$11.5 million in the third quarter of 2024 from US$11.4 million in the same period of 2023, as the recovery of international travel accelerated, and (ii) an increase in revenues from local data connectivity services to US$2.5 million in the third quarter of 2024 from US$2.4 million in the same period of 2023, as the Company continued to develop the local data connectivity services business.

- Revenues from PaaS and SaaS services were US$3.0 million, representing an increase of 29.1% from US$2.3 million in the same period of 2023. This increase was primarily attributable to business partners increasingly utilizing PaaS and SaaS services to enhance operational efficiency.

- Revenues from sales of products were US$7.9 million, representing an increase of 9.3% from US$7.3 million in the same period of 2023. This increase was primarily attributable to the increase of US$2.4 million in sales of data related products, which was partially offset by the decrease of US$1.7 million in sales of terminals.

- Geographic Distribution

During the third quarter of 2024, as a percentage of our total revenues, Japan contributed 46.6%, mainland China contributed 27.8%, North America contributed 12.8%, and other countries and regions contributed the remaining 12.8%, compared to 44.2%, 17.2%, 26.3% and 12.3%, respectively, in the same period of 2023.

Cost of Revenues

Cost of revenues was US$13.0 million, representing an increase of 11.5% from US$11.7 million in the same period of 2023. This increase was primarily due to an increase in cost of products sold.

- Cost of services was US$6.9 million, representing a decrease of 5.5% from US$7.3 million in the same period of 2023.

- Cost of products sold was US$6.1 million, representing an increase of 40.4% from US$4.4 million in the same period of 2023, primarily due to product mix.

Gross Profit

Overall gross profit was US$12.19 million, compared to US$12.21 million in the same period of 2023. Overall gross margin was 48.4% in the third quarter of 2024, compared to 51.2% in the same period of 2023.

Gross profit on services was US$10.4 million, compared to US$9.3 million in the same period of 2023. Gross margin on services was 60.0% in the third quarter of 2024, compared to 55.9% in the same period of 2023.

Gross profit on sales of products was US$1.8 million, compared to US$2.9 million in the same period of 2023. Gross margin on sales of products was 23.1% in the third quarter of 2024, compared to 40.1% in the same period of 2023.

Operating Expenses

Total operating expenses were US$10.0 million, compared to US$9.2 million in the same period of 2023.

- Research and development expenses were US$1.4 million, representing a decrease of 10.3% from US$1.6 million in the same period of 2023, primarily attributable to a decrease of US$0.3 million in staff costs, which was partially offset by an increase of US$0.2 million in professional service fees.

- Sales and marketing expenses were US$5.4 million, representing an increase of 41.5% from US$3.8 million in the same period of 2023, primarily due to an increase of US$1.2 million in promotional fees and an increase of US$0.2 million in staff costs.

- General and administrative expenses were US$3.2 million, representing a decrease of 16.2% from US$3.8 million in the same period of 2023, primarily attributable to decreases of US$0.7 million in staff costs and US$0.2 million in share-based compensation expenses, which was partially offset by an increase of US$0.2 million in professional service fees.

Income from Operations

Income from operations was US$3.3 million, compared to US$3.3 million in the same period of 2023.

Adjusted EBITDA (Non-GAAP)

Adjusted EBITDA (Non-GAAP), which excludes the impact of share-based compensation, fair value gain/loss in other investments, share of profit/loss in equity method investment, net of tax, interest expense, income tax expenses and depreciation and amortization, was US$4.4 million, compared to US$4.1 million in the same period of 2023.

Net Interest Expenses

Net interest expenses were US$0.03 million, compared to US$0.01 million in the same period of 2023.

Net Income

Net income was US$3.4 million, compared to US$3.5 million in the same period of 2023.

Adjusted Net Income (Non-GAAP)

Adjusted net income, which excludes the impact of share-based compensation, fair value gain/loss in other investments and share of profit/loss in equity method investment, net of tax, was US$3.7 million, compared to US$3.8 million in the same period of 2023.

Basic and Diluted Earnings per ADS

Basic and diluted earnings per ADS attributable to ordinary shareholders were US$0.09 in the third quarter of 2024, compared to US$0.09 in the same period of 2023.

Cash and Cash Equivalents and Short-Term Deposits

As of September 30, 2024, the Company had cash and cash equivalents of US$27.7 million, compared to US$26.8 million as of June 30, 2024. This increase was primarily attributable to the net inflow of US$2.0 million from operations and net proceeds of US$1.1 million from bank borrowings, which were partially offset by a repayment of US$1.8 million for bank borrowings and a cash outflow of US$1.1 million for procurement of property and equipment.

Capital Expenditures (“CAPEX”)

CAPEX was US$1.1 million, compared to US$0.8 million in the same period of 2023.

Business Outlook

For the fourth quarter of 2024, UCLOUDLINK expects total revenues to be between US$25.0 million and US$30.0 million, representing an increase of 15.2% to 38.2% compared to the same period of 2023.

The above outlook is based on current market conditions and reflects the Company’s preliminary estimates of market and operating conditions and customer demand.

Non-GAAP Financial Measures

To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States, or GAAP, this press release presents, adjusted net income/(loss) and adjusted EBITDA, as supplemental measures to review and assess the Company’s operating performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. Adjusted net income/(loss) is defined as net income/(loss) excluding share-based compensation, fair value gain/loss in other investments and share of profit/loss in equity method investment, net of tax. Adjusted EBITDA is defined as net income/(loss) excluding share-based compensation, fair value gain/loss in other investments, share of profit/loss in equity method investment, net of tax, interest expense, income tax expenses and depreciation and amortization.

The Company believes that adjusted net income/(loss) and adjusted EBITDA help identify underlying trends in its business that could otherwise be distorted by the effect of certain expenses that are included in income/(loss) from operations and net income/(loss). The Company believes that adjusted net income/(loss) and adjusted EBITDA provide useful information about its operating results, enhance the overall understanding of its past performance and future prospects and allow for greater visibility with respect to key metrics used by its management in its financial and operational decision-making.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non- GAAP financial measures have limitations as analytical tools. One of the key limitations of using adjusted net income/(loss) and adjusted EBITDA is that they do not reflect all items of income and expense that affect the Company’s operations. Share-based compensation, fair value gain/loss in other investments and share of profit/loss in equity method investment, net of tax, have been and may continue to be incurred in the Company’s business and is not reflected in the presentation of adjusted net income/(loss). Further, the non-GAAP financial measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited.

The Company compensate for these limitations by reconciling the non-GAAP financial measure to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating its performance. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure.

Reconciliation of each of these non-GAAP financial measures to the most directly comparable GAAP financial measure is set forth at the end of this release.

Conference Call

The Company will host a conference call to discuss its financial results at 8:30 a.m. U.S. Eastern Time on Tuesday, November 26, 2024 (9:30 p.m. Beijing Time on the same day).

Listeners may access the call by dialing:

| International: | +1-412-902-4272 |

| US (Toll Free): | +1-888-346-8982 |

| UK (Toll Free): | 0-800-279-9489 |

| UK (Local Toll): | 0-207-544-1375 |

| Mainland China (Toll Free): | 400-120-1203 |

| Hong Kong (Toll Free): | 800-905-945 |

| Hong Kong (Local Toll): | +852-3018-4992 |

| Singapore (Toll Free): | 800-120-6157 |

| Australia (Toll Free): | 1-800-121301 |

Participants should dial in at least 10 minutes before the scheduled start time and ask to be connected to the call for “UCLOUDLINK GROUP INC.”

Additionally, a live and archived webcast of the conference call will be available at https://ir.ucloudlink.com.

A telephone replay will be available one hour after the end of the conference until December 3, 2024 by dialing:

| US (Toll Free): | +1-877-344-7529 |

| International: | +1-412-317-0088 |

| Canada (Toll Free): | 855-669-9658 |

| Replay Passcode: | 4843023 |

About UCLOUDLINK GROUP INC.

UCLOUDLINK is the world’s first and leading mobile data traffic sharing marketplace, pioneering the sharing economy business model for the telecommunications industry. The Company’s products and services deliver unique value propositions to mobile data users, handset and smart-hardware companies, mobile virtual network operators (MVNOs) and mobile network operators (MNOs). Leveraging its innovative cloud SIM technology and architecture, the Company has redefined the mobile data connectivity experience by allowing users to gain access to mobile data traffic allowance shared by network operators on its marketplace, while providing reliable connectivity, high speeds and competitive pricing.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. Among other things, the financial guidance and quotations from management in this announcement, as well as UCLOUDLINK’s strategic and operational plans, contain forward-looking statements. UCLOUDLINK may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including but not limited to statements about UCLOUDLINK’s beliefs and expectations, are forward-looking statements. Forward looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: UCLOUDLINK’s strategies; UCLOUDLINK’s future business development, financial condition and results of operations; UCLOUDLINK’s ability to increase its user base and usage of its mobile data connectivity services, and improve operational efficiency; competition in the global mobile data connectivity service industry; changes in UCLOUDLINK’s revenues, costs or expenditures; governmental policies and regulations relating to the global mobile data connectivity service industry, general economic and business conditions globally and in China; the impact of the COVID-19 pandemic to UCLOUDLINK’s business operations and the economy in China and elsewhere generally; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in the Company’s filings with the Securities and Exchange Commission. All information provided in this press release and in the attachments is as of the date of the press release, and UCLOUDLINK undertakes no duty to update such information, except as required under applicable law.

For more information, please contact:

| UCLOUDLINK GROUP INC. UNAUDITED CONSOLIDATED BALANCE SHEETS (In thousands of US$, except for share and per share data) |

|||||

| As of December 31, | As of September | ||||

| 2023 | 30, 2024 | ||||

| ASSETS | |||||

| Current assets | |||||

| Cash and cash equivalents | 23,371 | 27,678 | |||

| Accounts receivable, net | 6,489 | 7,982 | |||

| Inventories | 2,183 | 2,085 | |||

| Prepayments and other current assets | 6,416 | 6,348 | |||

| Other investments | 7,613 | 6,973 | |||

| Amounts due from related parties | 2,945 | 472 | |||

| Total current assets | 49,017 | 51,538 | |||

| Non-current assets | |||||

| Prepayments | 228 | – | |||

| Long-term investments | 1,956 | 1,966 | |||

| Property and equipment, net | 2,433 | 4,235 | |||

| Right-of-use assets, net | 2,321 | 1,520 | |||

| Intangible assets, net | 652 | 555 | |||

| Total non-current assets | 7,590 | 8,276 | |||

| TOTAL ASSETS | 56,607 | 59,814 | |||

| LIABILITIES | |||||

| Current liabilities | |||||

| Short term borrowings | 5,297 | 3,996 | |||

| Accrued expenses and other liabilities | 24,755 | 23,192 | |||

| Accounts payable | 5,314 | 6,976 | |||

| Amounts due to related parties | 1,250 | 531 | |||

| Contract liabilities | 1,425 | 991 | |||

| Operating lease liabilities | 1,082 | 1,015 | |||

| Total current liabilities | 39,123 | 36,701 | |||

| Non-current liabilities | |||||

| Operating lease liabilities | 1,286 | 566 | |||

| Other non-current liabilities | 145 | 102 | |||

| Total non-current liabilities | 1,431 | 668 | |||

| TOTAL LIABILITIES | 40,554 | 37,369 | |||

| SHAREHOLDERS’ EQUITY | |||||

| Class A ordinary shares | 13 | 13 | |||

| Class B ordinary shares | 6 | 6 | |||

| Additional paid-in capital | 240,137 | 241,156 | |||

| Accumulated other comprehensive income | 2,463 | 1,776 | |||

| Accumulated losses | (226,566 | ) | (220,506 | ) | |

| TOTAL SHAREHOLDERS’ EQUITY | 16,053 | 22,445 | |||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 56,607 | 59,814 | |||

| UCLOUDLINK GROUP INC. UNAUDITED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands of US$, except for share and per share data) |

||||||||||||

| For the three months ended | For the nine months ended | |||||||||||

| September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

|||||||||

| Revenues | 23,863 | 25,192 | 63,846 | 65,675 | ||||||||

| Revenues from services | 16,631 | 17,285 | 43,643 | 44,987 | ||||||||

| Sales of products | 7,232 | 7,907 | 20,203 | 20,688 | ||||||||

| Cost of revenues | (11,656 | ) | (13,002 | ) | (33,173 | ) | (32,488 | ) | ||||

| Cost of services | (7,326 | ) | (6,921 | ) | (18,355 | ) | (17,287 | ) | ||||

| Cost of products sold | (4,330 | ) | (6,081 | ) | (14,818 | ) | (15,201 | ) | ||||

| Gross profit | 12,207 | 12,190 | 30,673 | 33,187 | ||||||||

| Research and development expenses | (1,600 | ) | (1,436 | ) | (4,457 | ) | (4,404 | ) | ||||

| Sales and marketing expenses | (3,786 | ) | (5,356 | ) | (10,223 | ) | (13,698 | ) | ||||

| General and administrative expenses | (3,824 | ) | (3,206 | ) | (11,125 | ) | (9,890 | ) | ||||

| Other income/(expense), net | 322 | 1,148 | (423 | ) | 908 | |||||||

| Income from operations | 3,319 | 3,340 | 4,445 | 6,103 | ||||||||

| Interest income | 12 | 11 | 36 | 51 | ||||||||

| Interest expenses | (25 | ) | (42 | ) | (105 | ) | (145 | ) | ||||

| Income before income tax | 3,306 | 3,309 | 4,376 | 6,009 | ||||||||

| Income tax (expense)/credit | (23 | ) | 2 | (67 | ) | (66 | ) | |||||

| Share of profit in equity method investment, net of tax | 202 | 80 | 333 | 117 | ||||||||

| Net income | 3,485 | 3,391 | 4,642 | 6,060 | ||||||||

| Attributable to: | ||||||||||||

| Equity holders of the Company | 3,485 | 3,391 | 4,642 | 6,060 | ||||||||

| Earnings per share for Class A and Class B ordinary shares | ||||||||||||

| Basic | 0.01 | 0.01 | 0.01 | 0.02 | ||||||||

| Diluted | 0.01 | 0.01 | 0.01 | 0.02 | ||||||||

| Earnings per ADS (10 Class A shares equal to 1 ADS) | ||||||||||||

| Basic | 0.09 | 0.09 | 0.13 | 0.16 | ||||||||

| Diluted | 0.09 | 0.09 | 0.13 | 0.16 | ||||||||

| Shares used in earnings per Class A and Class B ordinary share computation: | ||||||||||||

| Basic | 372,334,114 | 377,117,817 | 370,796,417 | 375,798,078 | ||||||||

| Diluted | 372,334,114 | 377,117,817 | 370,796,417 | 375,798,078 | ||||||||

| Net income | 3,485 | 3,391 | 4,642 | 6,060 | ||||||||

| Other comprehensive income, net of tax | ||||||||||||

| Foreign currency translation adjustment | (200 | ) | (828 | ) | 1,111 | (687 | ) | |||||

| Total comprehensive income | 3,285 | 2,563 | 5,753 | 5,373 | ||||||||

| UCLOUDLINK GROUP INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands of US$) |

||||||||||||

| For the three months ended | For the nine months ended | |||||||||||

| September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

|||||||||

| Net cash generated from operating activities | 2,765 | 1,989 | 7,820 | 8,646 | ||||||||

| Net cash used in investing activities | (834 | ) | (992 | ) | (1,511 | ) | (3,178 | ) | ||||

| Net cash used in financing activities | (252 | ) | (704 | ) | (394 | ) | (1,329 | ) | ||||

| Increase in cash and cash equivalents | 1,679 | 293 | 5,915 | 4,139 | ||||||||

| Cash and cash equivalents at beginning of the period | 18,628 | 26,831 | 14,921 | 23,371 | ||||||||

| Effect of exchange rates on cash and cash equivalents | (51 | ) | 554 | (580 | ) | 168 | ||||||

| Cash and cash equivalents at end of the period | 20,256 | 27,678 | 20,256 | 27,678 | ||||||||

| UCLOUDLINK GROUP INC. UNAUDITED RECONCILIATIONS OF NON-GAAP AND GAAP RESULTS (In thousands of US$) |

||||||||||||

| For the three months ended | For the nine months ended | |||||||||||

| September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

|||||||||

| Reconciliation of Net Income to Adjusted Net Income | ||||||||||||

| Net income | 3,485 | 3,391 | 4,642 | 6,060 | ||||||||

| Add: share-based compensation | 520 | 250 | 2,854 | 1,019 | ||||||||

| fair value (gain)/loss in other investments | (12 | ) | 141 | 272 | 639 | |||||||

| Less: share of profit in equity method investment, net of tax | (202 | ) | (80 | ) | (333 | ) | (117 | ) | ||||

| Adjusted net income | 3,791 | 3,702 | 7,435 | 7,601 | ||||||||

| For the three months ended | For the nine months ended | |||||||||||

| September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

|||||||||

| Reconciliation of Income to Adjusted EBITDA | ||||||||||||

| Net income | 3,485 | 3,391 | 4,642 | 6,060 | ||||||||

| Add: | ||||||||||||

| Interest expense | 25 | 42 | 105 | 145 | ||||||||

| Income tax expense/(credit) | 23 | (2 | ) | 67 | 66 | |||||||

| Depreciation and amortization | 303 | 665 | 750 | 1,604 | ||||||||

| EBITDA | 3,836 | 4,096 | 5,564 | 7,875 | ||||||||

| Add: share-based compensation | 520 | 250 | 2,854 | 1,019 | ||||||||

| fair value (gain)/loss in other investments | (12 | ) | 141 | 272 | 639 | |||||||

| Less: share of profit in equity method investment, net of tax | (202 | ) | (80 | ) | (333 | ) | (117 | ) | ||||

| Adjusted EBITDA | 4,142 | 4,407 | 8,357 | 9,416 | ||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dimethyl Carbonate (DMC) Market is Likely to reach USD 1,969.38 Million at a Steady CAGR of 6.3% during the Forecast Period 2024 to 2032

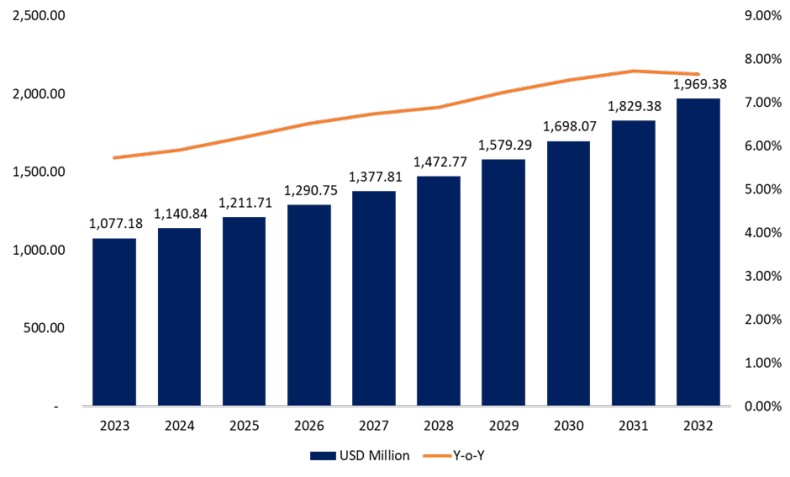

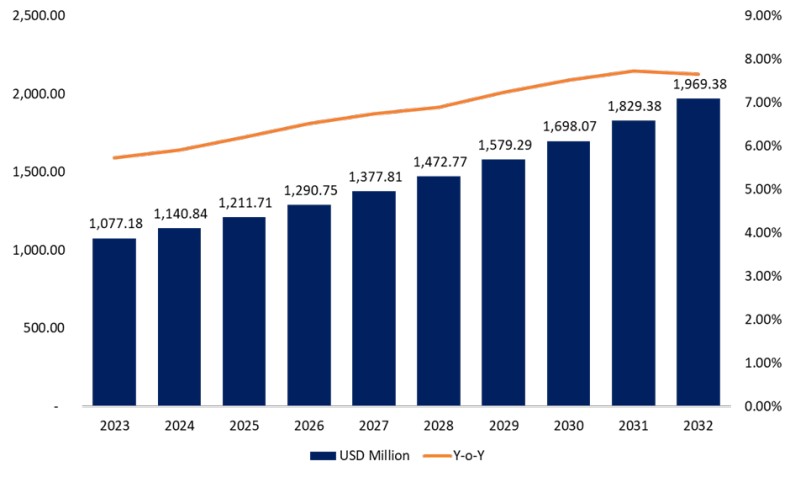

Gondia, India, Nov. 26, 2024 (GLOBE NEWSWIRE) — As per the report published by IMIR Research Pvt. Ltd. In 2023, the Global Dimethyl Carbonate (DMC) Market was valued at USD 1,077.18 Million and is expected to reach USD 1,969.38 Million at the CAGR of 6.3% during 2024-2032.

The global dimethyl carbonate (DMC) market is expected to have vast growth prospects soon. Its demand would be highly increased for varied applications, such as electronics, pharmaceuticals, automobiles, and coatings, considering its properties as a non-toxic and environment-friendly solvent, fuel additive, and reagent. The market has also gained importance as an intermediate in the production of polycarbonate resins and lithium-ion batteries, which are used in most modern electronics and electric vehicles (EVs). The DMC market is expected to grow at a compound annual growth rate (CAGR) of more than 6% over the forecast period, thus being a dynamic and high-potential sector in the global chemicals industry.

Our Report will help you understand the consumer behavior analysis towards the products and raw material across different age group.

To get the Detailed Data on Consumer Behavior: https://www.intellectualmarketinsights.com/download-sample/IMI-004031

Figure: Global Dimethyl Carbonate (DMC) Market, 2020-2032, (USD Million)

Expansion of the Electronics and EV Sectors

Rapid expansion in the electronics and electric vehicle sectors are key drivers of demand for DMC worldwide. DMC is critical in the production of electrolytes for lithium-ion batteries, which power most electronic devices and electric vehicles. Strong pressure from the governments and the industries to embrace clean energy and sustainable transportation has significantly increased, which in turn increases the demand for lithium-ion batteries and consequently DMC. The production of batteries in the Asia-Pacific region is especially driving this market hugely, mainly from China, South Korea, and Japan.

Adoption in Pharmaceutical and Agrochemical Sectors

Apart from the conventional application, DMC is increasingly being applied as an intermediate for organic compounds synthesis in the pharmaceutical and agrochemical industries. The application of DMC as a methylating agent for pharmaceutical products encourages the production of APIs, which is a vital industry because of the need for health and management of diseases. The agrochemical industry, which is mainly devoted to crop protection and yield increase, therefore, presents an additional avenue for further growth with its role in synthesizing active compounds.

Competitive Landscape

The DMC market is highly competitive at the global level, where the players are working on strategic alliances, capacity expansions, and R&D to strengthen their market position. Some of the companies that are prominent in the DMC market include UBE Industries, Shandong Shida Shenghua Chemical Group, Merck KGaA, BASF SE, HaiKe Chemical Group, and Kowa Company Ltd. These players are investing in advanced production technologies that improve efficiency and reduce costs, promoting the use of sustainable production methods. Many of them are also actively searching for partnerships as they aim to develop carbon-neutral DMC synthesis methods while keeping within the objectives for sustainability and regulatory compliance.

Get sample copy of this premium report: https://www.intellectualmarketinsights.com/download-sample/IMI-004031

Recent Developments in the DMC Market

- Expansion and Diversification of Product Lines: A few major players of this market are investing significantly to expand their production facilities in China and Japan in order to gain from growing demand of DMC by the large-growth segments of battery and electronics. An example here would be Shandong Shida Shenghua Chemical, who has invested heavily in the production facilities in line with the enormous growth being witnessed from the demand of DMC in lithium-ion battery applications.

- Research into Carbon-Neutral DMC Production: As environmental concerns and issues continue to rise, companies such as BASF SE and Merck KGaA are working on creating eco-friendly DMC production. They are doing this by capturing carbon dioxide. This is in line with the shift of the industries towards sustainable production and has kept these companies ahead of other market players.

- Strategic Collaborations with Battery Manufacturers: The importance of DMC in battery manufacturing has led many companies to collaborate with battery manufacturers to ensure a stable supply of high-purity DMC for electrolyte production. This is particularly prevalent in the Asia-Pacific region, where demand for lithium-ion batteries continues to rise.

Market Segmentations

| By Grade | By Application | By End-Use Industry |

|

|

To get the Detailed Data on Demand and Supply Buying This Research Report:

The dimethyl carbonate (DMC) market in major regions of the world is growing significantly, and it is largely driven by the Asia-Pacific region, as the region witness’s strong demand from electronics, automotive, and battery sectors in China, Japan, and South Korea. The North American region also is growing significantly due to electric vehicles, energy storage, and eco-friendly solvent applications. The DMC demand in the European region is driven by stringent environmental regulations and an emphasis on sustainable production, particularly in the automotive and coatings segments. The market is further broadened by emerging markets from Latin America and Middle East & Africa. They come because of surging industrialization, an increase in automotive products, and use in more pharmaceuticals and agrochemicals.

Key Players and Competitor

- Shandong Haike Chemical Industry Group Co. Ltd.

- Kowa American Corp.

- Shandong Wells Chemicals Co. Ltd.

- Qingdao Aspirit Chemical Co. Ltd.

- Shandong Feiyang Chemical Co. Ltd.

- Haike Chemical Group

- Kindun Chemical Co.Limited

- Hefei TNJ Chemical Industry Co.Ltd.

- Arrow Chemical Group Corp.

- Dongying City Longxing Chemical Co. Ltd.

- Hebei New Chaoyang Chemical Stock Co.Ltd.

- Shandong Depu Chemical Industry Science & Technology Co. Ltd.

- Dongying Hi-tech Spring Chemical Industry Co. Ltd

- Aarsha Chemicals Private Limited

- Tongling Jintai Chemical Industrial

- UBE Industries

- Tangshan Chaoyang Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- Tokyo Chemical Industry Co. Ltd.

- Merck KGaA

- Linyi Evergreen Chemical Co. Ltd.

- Akzo Nobel N.V.

- Alfa Aesar

- Taizhou Lingyu Chemical Co. Ltd.

- Sigma-Aldrich Co. LLC

- Dongying Jintan Chemical Co. Ltd.

- Luxi Chemical Group Co.Ltd.

- Dongying Xinyuan Chemical Co. Ltd.

- Dongying City Shuangma Chemical Co. Ltd.

- Dongying Dafeng Chemical Co. Ltd.

Buy Now: https://www.intellectualmarketinsights.com/checkout/IMI-004031?currency=1

Regional Snapshots

By region, Insights into the markets in North America, Europe, Asia-Pacific, Latin America and MEA are provided by the study. Asia-Pacific countries, which are holding the major share in the current market, countries such as China, Japan, and South Korea are setting the trends. The Asian-Pacific is influenced by the strong manufacturing in this region because of the huge manufacturing sector, wherein all the regions manufacture electronic equipment, automobile parts, and renewable source of energy systems. There is a very high growth in the application of energy storage systems and increased electric vehicle production in the Asia-Pacific region; thus, the requirement for DMC specifically lithium-ion is exponentially increasing in this category. There is also China’s pursuit for renewable energy and clean technologies, leading to the growth of consumption for battery electrolytes as well as other industrial applications.

North America also emerges as a growth driver for DMC. The demand for DMC in the automobile and electronic sectors is increasingly growing in the US and Canada. The significant demand for electric vehicles in the US market creates a new trend of demand for lithium-ion batteries, which become one of the major users of DMC in EVs and other storage systems of renewable energy sources. This also goes in quite well with the developing culture of embracing DMC for production purposes in various industries; that is, to give some examples, plastics’ and paint and coatings ‘solver’.

The second is Europe, with Germany, France, and the U.K. being the main drivers of growth in that region, thanks to their emphasis on sustainable technology and green energy. Strong environmental policy in Europe has been laid down by the European Union through strict regulations on emissions and promoting electric mobility in the automotive and renewable sectors, which have led to the integration of DMC. The push for a circular economy, ensuring materials get reused and recycled, boosts DMC demand for greener solvents in pharmaceuticals, agrochemicals, and coatings in Europe.

The demand for sustainable solutions in the global scenario will create a gradual growth market in regions such as Latin America and the Middle East & Africa, primarily due to growing industrial activities and renewable energy investments. In total, the DMC market grows in tandem with clean energy, electric mobility, and sustainable industrial practices worldwide.

Get Access of this Report: https://www.intellectualmarketinsights.com/report/dimethyl-carbonate-market-growth-and-trends/imi-004031

About Us:

IMIR® Market Research Pvt Ltd.

Intellectual Market Insights Research is a market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including, Semiconductor, aerospace, Automation, Agriculture, Food & Beverages, Automotive, Chemicals and Materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports.

IMIR has the distinguished objective of providing optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact Us:

Follow Us: LinkedIn

Email: sales@intellectualmarketinsights.com

Call Us: +1 (814) 487 8486

Contact Data Managing Director: Digvijay Chakravarty | Email: digvijay.c@intellectualmarketinsights.com Call us: +1 (814) 487 8486, +919764079503

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kohl's Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

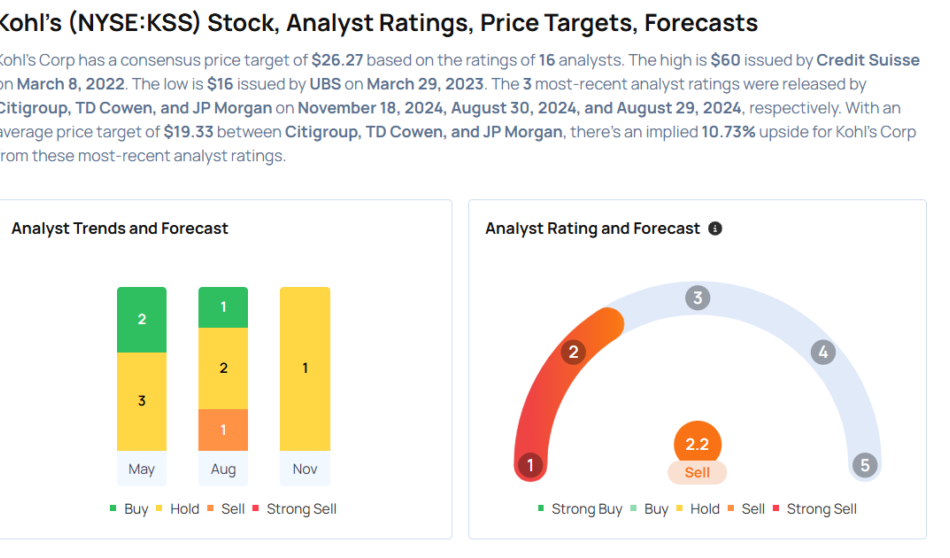

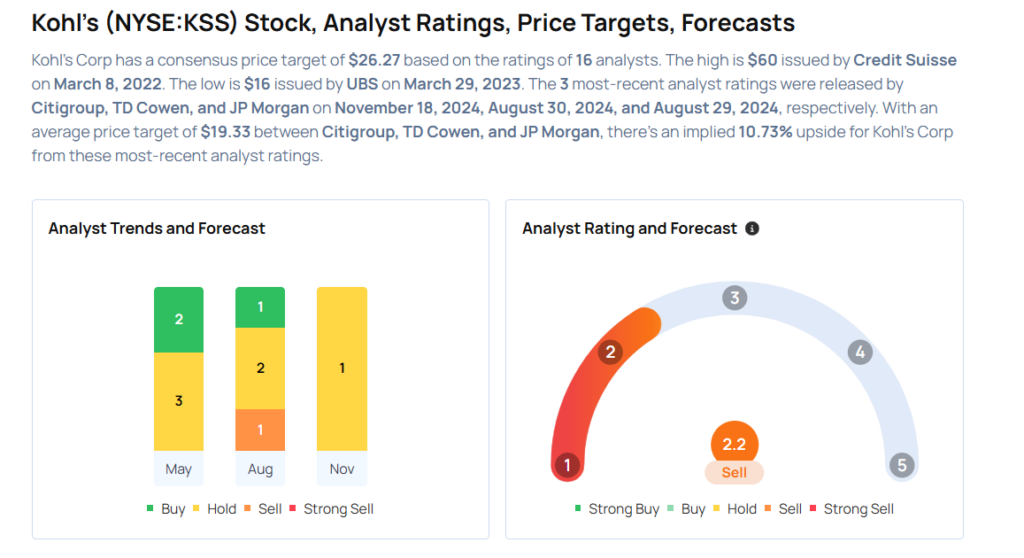

Kohl’s Corporation KSS will release earnings results for the third quarter, before the opening bell on Tuesday, Nov. 26.

Analysts expect Kohl’s to report quarterly earnings at 27 cents per share. That’s down from 54 cents per share a year ago. The Menomonee Falls, Wisconsin-based company projects to report quarterly revenue of $3.71 billion, compared to $3.84 billion a year earlier, according to data from Benzinga Pro.

On Monday, Kohl’s said Chief Executive Officer Tom Kingsbury plans to step down as CEO, effective Jan. 15, 2025.

Kohl’s shares gained 7.7% to close at $18.34 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company </em></a> in the recent period.

- Citigroup analyst Paul Lejuez maintained a Neutral rating and cut the price target from $19 to $18 on Nov. 18. This analyst has an accuracy rate of 64%.

- JP Morgan analyst Matthew Boss downgraded the stock from Neutral to Underweight with a price target of $19 on Aug. 29. This analyst has an accuracy rate of 67%.

- Evercore ISI Group analyst Michael Binetii maintained an In-Line rating and cut the price target from $22 to $20 on Aug. 29. This analyst has an accuracy rate of 65%.

- Baird analyst Mark Altschwager maintained an Outperform rating and slashed the price target from $27 to $25 on Aug. 29. This analyst has an accuracy rate of 68%.

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating with a price target of $23 on Aug. 28. This analyst has an accuracy rate of 60%.

Considering buying KSS stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk's Neuralink To Launch New Feasibility Trial With Brain Implant And Robotic Arm

Elon Musk‘s company, Neuralink, is set to initiate a new feasibility trial involving its innovative brain implant technology and a robotic arm. This trial aims to explore the safety and effectiveness of Neuralink’s wireless brain-computer interface and surgical robot.

What Happened: The study, named PRIME, will focus on patients with quadriplegia, enabling them to control external devices through thought, Reuters reported on Tuesday. Neuralink plans to enroll participants from its ongoing PRIME trial into this feasibility study, as mentioned in a post on social media platform X.

Recently, Neuralink received approval from Health Canada to conduct a trial of its device in Canada. Canadian neurosurgeons, in collaboration with Neuralink, have been authorized to recruit six patients with paralysis for the study. In the U.S., Neuralink has already implanted the device in two patients, allowing one to engage in activities such as playing video games and browsing the internet.

The company reports that the device is functioning well in the second patient, who is using it to play video games and learn 3D design. The U.S. FDA and Neuralink have not yet provided further details on the feasibility study.

Why It Matters: The potential of Neuralink’s brain chip technology to transform lives has been a topic of interest since Musk first introduced the concept. As reported in July, Musk envisioned the brain chip offering superhuman abilities, akin to characters from science fiction like Geordi La Forge from Star Trek. The company, founded in 2016, aims to revolutionize the way humans interact with technology and address neurological disorders through brain-computer interfaces (BCIs).

The initial human trials began earlier this year with Noland Arbaugh, a 30-year-old quadriplegic, who received the N1 Implant, allowing him to control a computer cursor with his thoughts.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Groundfloor recognized again by Deloitte, ranking no. 253 on its prestigious Fast 500 Technology List

Groundfloor was also named a finalist for the Benzinga Fintech and IMN Single-Family Awards

ATLANTA, Nov. 25, 2024 /PRNewswire/ — Groundfloor, the award-winning alternative real estate investment platform with over $1.7 billion in investment volume, has once again been named to Deloitte’s prestigious Fast 500 Technology list, ranking No. 253. The annual list honors the 500 fastest-growing technology, media, telecommunications, life sciences, fintech, and energy tech companies in North America. Groundfloor achieved 455% revenue growth over the three-year evaluation period, marking its fourth time receiving this recognition.

This acknowledgment comes during a standout year for Groundfloor, which continues to be honored for its innovation and steady growth. Beyond the Fast 500, Groundfloor was recently named a finalist for the Benzinga Fintech Award in the Alternative Investments category and the IMN Single-Family Awards for Fix & Flip/DSCR Lender of the Year. In 2024, the company also earned spots on the Forbes Fintech 50 for the first time and the Inc. 5000 list for the fifth consecutive year.

“This recognition is another indicator of the groundswell of individual investors who are allocating capital directly to alternative real estate investments,” said co-founder and CEO Brian Dally. “Our unique platform and capital structure has armed Groundfloor with the capacity to grow and build on our track record as a top-tier single family residential housing capital provider and asset manager in the face of challenging interest rate conditions.”

Groundfloor’s momentum in 2024 continued with the launch of several products, including the Flywheel Portfolio introduced last month. A new type of financial product, the Flywheel allows investors to hyper-diversify their alternative real estate investment portfolios by instantly investing into hundreds of real estate loans at once, even down to even fractions of a cent.

For over 11 years, Groundfloor has been at the forefront of transforming real estate investing by making it accessible to everyone, regardless of accreditation status. Real estate has long been the best-performing asset class, yet the most lucrative opportunities were out of reach for most individual investors. Groundfloor changed that by becoming the category creator for private real estate debt investing with its founding in 2013, allowing everyone to participate in high-yield, short-term investments. Today, Groundfloor still offers a minimum investment barrier of just $100 for investors, allowing the company to attract 290,000 registered users and facilitate over $1.7 billion in investments by retail investors. To date, Groundfloor has provided over $1.4 billion in repayments, while rolling out new products like the Flywheel Portfolio that continue to innovate the space—even as competitors falter and in the face of market headwinds. Additionally, Groundfloor offers the industry’s highest levels of transparency and oversight for a private company, operating with disclosures similar to that of a public company.

To learn more about Groundfloor and begin investing, visit Groundfloor.com or download the apps on the Apple App Store or Google Play.

About Groundfloor

Groundfloor is an award-winning fintech company that levels the playing field in financial markets for individual investors. Known for its regulatory prowess and developing completely new financial products for alternative investing, the company was the very first to be qualified to offer direct real estate debt investments for both accredited and non-accredited audiences alike. The company has won numerous awards for its product innovation and growth, including the Forbes Fintech 50 and five years in a row of being on the Inc. 5000 List. Since it launched in 2013, Groundfloor’s investors have consistently seen 10% annualized returns across its short-term investment offerings. For more information or to get started investing fractionally in real estate, visit Groundfloor.com.

Media Contact:

Hela Sheth

hela@katalystcomms.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/groundfloor-recognized-again-by-deloitte-ranking-no-253-on-its-prestigious-fast-500-technology-list-302315473.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/groundfloor-recognized-again-by-deloitte-ranking-no-253-on-its-prestigious-fast-500-technology-list-302315473.html

SOURCE Groundfloor Finance Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow, S&P 500 Reach Fresh Highs: Investor Sentiment Improves, Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed an improvement in the overall market sentiment, while the index remained in the “Greed” zone on Monday.

U.S. stocks settled higher on Friday, with the Dow Jones index and S&P 500 hitting fresh records during the session. Major indices on Wall Street recorded gains last week, with the Dow gaining around 2% and the S&P 500 adding around 1.7%.

Bath & Body Works, Inc. BBWI shares jumped around 16.5% on Monday after the company reported better-than-expected third-quarter results and raised its 2024 outlook.

On the economic data front, the Chicago Fed National Activity Index fell to -0.40 in October compared to -0.27 in the previous month and versus market estimates of -0.20. The Dallas Fed’s Texas manufacturing activity index rose to -2.7 in November compared to a reading of -3 in the previous month and versus market estimates of -2.4.

Most sectors on the S&P 500 closed on a positive note, with real estate, materials, and consumer discretionary stocks recording the biggest gains on Monday. However, energy and information technology stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 440 points to 44,736.57 on Monday. The S&P 500 rose 0.30% to 5,987.37, while the Nasdaq Composite rose 0.27% to close at 19,054.84 during Monday’s session.

Investors are awaiting earnings results from Best Buy Co., Inc. BBY, HP Inc. HPQ, and Dell Technologies Inc. DELL today.

What is CNN Business Fear & Greed Index?

At a current reading of 61.5, the index remained in the “Greed” zone on Monday, versus a prior reading of 60.8.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Paratus Increases Full-Year 2024 Earnings Guidance and Provides Update on Operations in Mexico

HAMILTON, Bermuda, Nov. 26, 2024 /PRNewswire/ — Paratus Energy Services Ltd. PLSV (“Paratus” or the “Company”) announces an upward revision of its full-year 2024 EBITDA guidance and provides commentary on the Company’s rig operations in Mexico, operated through its wholly-owned subsidiary Fontis Holdings Ltd. (“Fontis”).

Following strong operational execution year-to-date, Paratus is raising its full-year 2024 EBITDA guidance to $250-260 million, representing a mid-point increase of $25 million from the previous guidance range of $220-240 million. Further details will be provided on the quarterly earnings call on November 29, 2024.

Paratus has noted recent reports regarding a potential temporary reduction in rig activity in Mexico, and consequently the Company wishes to provide an update as well as clarify the potential financial impact to the Company of such dynamics. The contracts for all of Fontis’ jack-ups with the client permit activity to be temporarily ceased for up to 45 days during the contract term, without revenue being generated during such period. However, any deferred days will extend the contract duration accordingly. Fontis has received notification from its client that the Courageous will temporarily cease operations for 45 days due to delays in the client’s preparatory activities at its next location. Operations at the Courageous’ current location is expected to be completed in early December 2024, upon which the rig will remain in standby at its location. The estimated EBITDA impact of a 45-day deferral through the end of the firm contract period is expected to be approximately $3 million.

Paratus has accommodated and priced such flexibility into its contracts in Mexico to allow its client to execute its operations more efficiently. The Company remains highly focused on supporting its client and continuing to strengthen the long-standing relationship it has had for over a decade, and the Company has taken note of the public comments the client has recently provided about its future plans for operations and payments to its suppliers.

This announcement contains information considered to be inside information pursuant to the EU Market Abuse Regulation and is subject to the disclosure requirements pursuant to Section 5-12 the Norwegian Securities Trading Act. The announcement was published by Baton Haxhimehmedi, CFO of Paratus, on the time and date set out above.

For further information, please contact:

Baton Haxhimehmedi, CFO

Baton.Haxhimehmedi@paratus-energy.com

+47 406 39 083

This information was brought to you by Cision http://news.cision.com

![]() View original content:https://www.prnewswire.com/news-releases/paratus-increases-full-year-2024-earnings-guidance-and-provides-update-on-operations-in-mexico-302316263.html

View original content:https://www.prnewswire.com/news-releases/paratus-increases-full-year-2024-earnings-guidance-and-provides-update-on-operations-in-mexico-302316263.html

SOURCE Paratus Energy Services Ltd

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Best Buy, HP And 3 Stocks To Watch Heading Into Tuesday

With U.S. stock futures trading slightly higher this morning on Tuesday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Best Buy Co., Inc. BBY to report quarterly earnings at $1.29 per share on revenue of $9.63 billion before the opening bell, according to data from Benzinga Pro. Best Buy shares rose 0.4% to $93.37 in after-hours trading.

- Poseida Therapeutics, Inc. PSTX agreed to be acquired by Roche in a $1.5 billion deal. Poseida Therapeutics shares jumped 11.2% to $3.18 in the after-hours trading session.

- Analysts expect HP Inc. HPQ to post quarterly earnings at 93 cents per share on revenue of $13.99 billion. The company will release earnings after the markets close. HP shares fell 0.3% to $39.19 in after-hours trading.

Check out our premarket coverage here

- Zoom Video Communications, Inc. ZM posted better-than-expected results for its third quarter and raised its guidance for the full year. Zoom reported third-quarter revenue of $1.18 billion, beating the consensus estimate of $1.16 billion. The communications company reported third-quarter adjusted earnings of $1.38 per share, beating analyst estimates of $1.31 per share. Zoom shares fell 5.6% to $84.09 in the after-hours trading session.

- Analysts expect Dell Technologies Inc. DELL to report quarterly earnings at $2.05 per share on revenue of $24.65 billion after the closing bell. Dell shares fell 0.8% to $143.00 in after-hours trading.

Check This Out:

Photo courtesy: Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.