2 High-Yield Dividend Stocks to Buy Now for a Lifetime of Passive Income

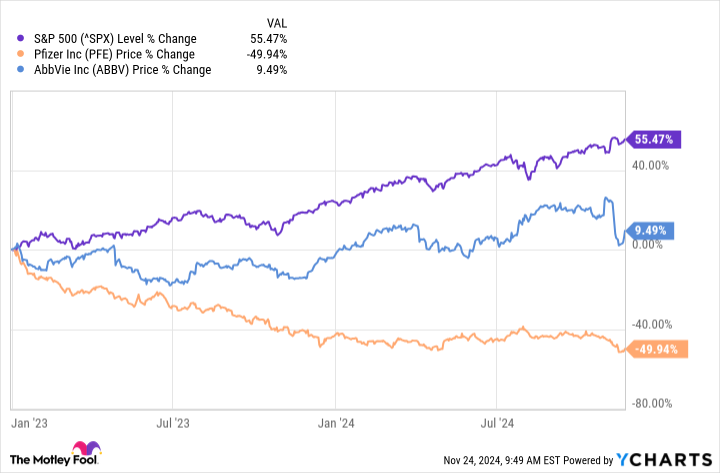

Investors looking for a way to pump up their passive income streams want to turn their attention toward the pharmaceutical industry. From the end of 2022 through Nov. 22, the benchmark S&P 500 index rose by a stunning 55.5%, but many of its drug-selling components haven’t participated in the rally.

Shares of Pfizer (NYSE: PFE) and AbbVie (NYSE: ABBV) have underperformed over the past couple of years, but these dividend payers kept raising their payouts.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

With dividend payouts that have risen much faster than their stock prices, shares of these three drugmakers offer yields that are way above average. Read on to see why there’s a good chance they’ll keep raising your passive income stream throughout retirement.

Shares of Pfizer have lost about half their value since the end of 2022, but its dividend payout has been moving in the opposite direction. Last December, the pharmaceutical giant raised its quarterly payout for the 15th consecutive year.

At recent prices, Pfizer offers a huge 6.5% yield and investors can reasonably expect more dividend payout bumps in the years ahead. Sales of the company’s COVID-19 products probably won’t return to their former glory, but its oncology division is having a terrific year.

Third-quarter sales of cancer therapies shot 31% higher year over year thanks in part to soaring sales of its prostate cancer drug, Xtandi. Xtandi sales will likely continue expanding along with Talzenna. In October, the company announced a significant survival benefit for patients who received Talzenna in combination with Xtandi, versus Xtandi monotherapy, during the Talapro-2 study.

In 2022, Pfizer also used some of its COVID-19 cash to acquire Biohaven and its migraine drug, Nurtec. There have been several new migraine drugs launched over the past five years, but Nurtec is the only one approved for both acute treatment and prevention of migraine headaches.

Nurtec’s unique position is a big advantage for Pfizer. According to management, 85% of primary care clinicians who prescribe new migraine drugs are choosing Nurtec.

This year, Pfizer expects $2.85 per share in adjusted earnings this year at the midpoint of management’s guided range. That’s more than enough to support a dividend payout currently set at an annualized $1.68 per share. With Nurtec, Talzena, and Xtandi driving growth, the drugmaker’s payout could rise steadily for another 15 years.

Billionaire Israel Englander Sold 90% of His Palantir Stock and Is Buying an AI Stock Partnered With Amazon and Google

Billionaire Israel Englander is the founder and CEO of Millennium Management, the second-most profitable hedge fund in history as measured by net gains since inception, according to LCH Investments. That makes him a good case study for investors.

Englander sold 4.5 million shares of Palantir (NYSE: PLTR) during the third quarter, reducing his stake by 90%. Meanwhile, he also bought 2.5 million shares of Pinterest (NYSE: PINS), a company that has partnered with Amazon and Alphabet‘s Google to boost ad demand on its social platform. That increased Millennium’s stake in Pinterest by 310%.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Englander’s trades align with Wall Street’s outlook. Specifically, Palantir has a median target price of $38 per share, which implies 41% downside from its current share price of $64. But Pinterest has a median target of $40 per share, which implies 33% upside from its current share price of $30.

Here’s what investors should know about Pinterest.

Pinterest is a social media company focused on inspiration rather than communication. Its platform leans on artificial intelligence (AI) to help users discover new ideas and products that range from recipes and tutorials to food and fashion. Pinterest generates revenue through advertising. And while its user base is much smaller than that of Meta Platforms, it still ranks among the 15 largest ad tech companies worldwide.

Pinterest earlier this year introduced new AI tools for advertisers. One such tool — Performance+ — leans on generative AI to enhance product images with backgrounds tailored to users’ tastes. Likewise, Performance+ leans on AI to streamline campaign creation and improve outcomes. CEO Bill Ready said, “Our AI investments are driving results by powering better personalized experiences and greater performance for advertisers.”

Pinterest reported solid financial results in Q3, beating estimates on the top and bottom lines. Monthly active users rose 11% to 537 million, and engagement improved across all three major geographic regions. In turn, revenue increased 18% to $898 million, and non-GAAP net income increased 43% to $0.40 per share.

However, Pinterest’s guidance disappointed Wall Street. Revenue is projected to increase 16% in Q4, while analysts had anticipated 17% revenue growth. But management attributed that sequential slow down to softness among food and beverage advertisers that are navigating macroeconomic headwinds, which are ultimately a temporary problem.

MicroStrategy, Coinbase, And Other Bitcoin-Linked Stocks Tumble As BTC's March To $100,000 Stalls

Bitcoin-related stocks saw a decline in Tuesday’s pre-market trading as Bitcoin’s price slipped from its recent highs. The cryptocurrency’s rally appears to be losing steam after nearing the significant $100,000 milestone.

What Happened: Bitcoin, often dubbed “King Crypto,” was trading at $93,590.38 at 5:00 AM Eastern Time. A prominent trader has warned that if Bitcoin fails to break through the $100,000 resistance level, it could experience a significant correction, potentially dropping to $85,600 in a worst-case scenario.

As Bitcoin’s momentum seems to be waning, stocks tied to the cryptocurrency also face declines. As per Benzinga Pro, MARA Holdings Inc MARA dropped by 3.63%, MicroStrategy Inc MSTR fell by 3.33%, and Coinbase Global Inc COIN decreased by 3.40% in pre-market trading on Tuesday.

Why It Matters: The recent dip in Bitcoin’s price comes amid a broader cooling of bullish sentiment in the cryptocurrency market. According to Santiment data, the enthusiasm that fueled a prolonged rally since September is waning, especially for major cryptocurrencies like Bitcoin and Ethereum.

Adding to the concerns, a crypto analyst known for accurately predicting the 2022 market crash has warned that Bitcoin may be approaching a local top. The analyst, known as Capo, has highlighted indicators such as overextended bullish sentiment and diminishing momentum as signs that a correction could be imminent.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Ole Andreas Halvorsen Dumped Viking's Entire Stake in Broadcom in Favor of a Globally Dominant Company That's Risen Nearly 2,400% Since Its IPO

In case you missed it, one of the most important data releases of the entire quarter occurred on Nov. 14. While most investors were honing in on earnings releases and the October inflation report, institutional investors were filing Form 13F with the Securities and Exchange Commission.

A 13F is a required filing for institutional investors with at least $100 million in assets under management (AUM) that clues investors into which stocks these top-tier money managers bought and sold in the latest quarter (in this case, the September-ended quarter). Though 13F’s have their flaws — since they’re filed up to 45 days after the end of a quarter, they may present stale holding data for active hedge funds — they still provide invaluable insight into which stocks, industries, sectors, and trends have the interest of Wall Street’s greatest asset managers.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

While Warren Buffett is the most-prominent billionaire money manager on Wall Street, he’s far from the only billionaire that investors closely track. For instance, Ole Andreas Halvorsen of Viking Global Investors was overseeing $27.4 billion spread across 83 stocks at the end of September. Halvorsen and his team tend to be fairly active, with a focus on the financial, technology, and healthcare sectors.

What’s perhaps most noteworthy about Halvorsen’s third-quarter trading activity is that he disposed of one of Wall Street’s hottest artificial intelligence (AI) stocks and absolutely piled into a premier financial company that’s skyrocketed since its initial public offering (IPO) in 2008.

Though ringing the register on profitable positions is nothing new for Halvorsen’s fund, it may still come as a surprise that Viking Global’s brightest minds chose to sell all 2,930,970 shares of AI networking colossus Broadcom (NASDAQ: AVGO) during the third quarter.

The excitement surrounding Broadcom’s opportunity in the AI arena is thick enough to cut with a knife. The analysts at PwC believe artificial intelligence will add $15.7 trillion to the global economy by 2030, and Broadcom’s networking solutions have quickly leaped to the front of the pack in enterprise data centers.

Last year, it introduced the Jericho3-AI fabric, which is capable of connecting up to 32,000 graphics processing units (GPUs) in AI-accelerated data centers. Broadcom’s tools are designed to maximize the computing potential of GPUs and minimize tail latency. The latter is particularly important for AI-driven software and systems that depend on split-second decision-making.

The Stock Market Could Rise or Fall Sharply Tomorrow (Nov. 27). Here's Why

The S&P 500 (SNPINDEX: ^GSPC) has rocketed 25% in 2024, putting the broad-based index on pace for one of its strongest annual performances of the 21st century. Factors contributing to that upside include enthusiasm about artificial intelligence, strong corporate earnings, and encouraging economic data.

The Federal Reserve’s recent pivot to interest rate cuts has also bolstered investor sentiment. Policymakers raised the federal funds rate at the fastest pace in decades to stamp out fierce inflation post-pandemic. That benchmark interest rate ultimately reached its highest level in two decades before the Federal Reserve shifted to rate cuts in September 2024.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Lower interest rates stimulate the economy by encouraging consumer spending and businesses investments. Policymakers have already cut rates by three-quarters of a percentage point, and the market anticipates another quarter-point cut when the Federal Open Market Committee meets in December, according to CME Group‘s FedWatch tool.

That puts the stock market in a precarious position. Expectations regarding rate cuts could change based on an important economic data point that will be published on Wednesday, Nov. 27. That means tomorrow could be a big day for the stock market.

Most investors are probably familiar with the Consumer Price Index (CPI), which measures inflation based on the spending patterns of consumers in urban or metropolitan areas. But the Federal Reserve prefers another measure of inflation known as the Personal Consumption Expenditure (PCE) price index.

The PCE price index provides a more comprehensive view of pricing pressures across the economy. It covers rural and urban consumers, and also accounts for spending made on consumers’ behalf, such as healthcare expenses paid for by employers and government programs like Medicare and Medicaid.

The Bureau of Economic Analysis will publish the PCE price index reading for October before the stock market opens on Wednesday, Nov. 27. Economists generally expect PCE inflation to remain stable at 2.1%, which would be identical to the September reading. But some experts are skeptical because CPI inflation accelerated to 2.6% in October, up from 2.4% in September.

If the PCE price index reading for October shows a similar acceleration in inflation, the odds that policymakers cut interest rates at the December meeting will plummet. And the stock market would probably decline sharply as investors process the news.

Why Poseida Therapeutics Shares Are Trading Higher By 219%; Here Are 20 Stocks Moving Premarket

Shares of Poseida Therapeutics, Inc. PSTX rose sharply in today’s pre-market trading after the company agreed to be acquired by Roche in a $1.5 billion deal.

Poseida Therapeutics shares jumped 218.8% to $9.12 in the pre-market trading session.

Here are some other stocks moving in pre-market trading.

Gainers

- ZenaTech, Inc. ZENA gained 61.5% to $10.37 in pre-market trading after climbing around 259% on Monday.

- T Stamp Inc. IDAI rose 52.8% to $0.2750 in pre-market trading.

- Spectral AI, Inc. MDAI gained 33.6% to $1.7500 in pre-market trading after gaining around 10% on Monday.

- Channel Therapeutics Corporation CHRO gained 22.7% to $0.7400 in pre-market trading after declining around 9% on Monday.

- Hesai Group HSAI climbed 20% to $5.70 in pre-market trading after the company posted upbeat quarterly sales.

- Semtech Corporation SMTC gained 18% to $63.06 in pre-market trading after the company reported better-than-expected third-quarter financial results and issued fourth-quarter guidance with its midpoint above estimates.

- SEALSQ Corp LAES gained 16.9% to $0.5499 in pre-market trading after gaining 4% on Monday.

- Onconetix, Inc. ONCO gained 14.9% to $0.9179 in pre-market trading after dipping around 27% on Monday.

- Woodward, Inc. WWD gained 10.7% to $198.55 in pre-market trading after the company reported better-than-expected quarterly EPS and sales.

Losers

- Alector, Inc. ALEC shares tumbled 31.3% to $2.72 in pre-market trading after the company announced that the INVOKE-2 Phase 2 clinical trial evaluating the safety and efficacy of AL002 in individuals with early Alzheimer’s disease failed to meet its primary endpoint.

- Leslie’s, Inc. LESL shares fell 18.5% to $2.86 in pre-market trading after the company reported worse-than-expected fourth-quarter adjusted EPS and sales.

- Quantum Corporation QMCO shares fell 16% to $18.29 in pre-market trading. Quantum shares jumped 138% on Monday after Amazon announced it has launched its Quantum Embark Program.

- YXT.COM Group Holding Limited YXT fell 14.6% to $2.52 in pre-market trading.

- Procaps Group SA PROC declined 12.6% to $1.11 in pre-market trading after surging 38% on Monday.

- Kingsoft Cloud Holdings Limited KC shares dipped 10.5% to $6.22 in pre-market trading.

- Quantum Computing Inc. QUBT fell 8.1% to $7.07 in pre-market trading. Quantum Computing shares jumped 26% on Monday after AWS announced Quantum Embark program.

- Electrovaya Inc. ELVA fell 8.1% to $2.50 in pre-market trading after gaining 13% on Monday.

- Zoom Video Communications, Inc. ZM fell 7.8% to $82.02 in today’s pre-market trading. Zoom Video posted better-than-expected results for its third quarter and raised its guidance for the full year.

- Wearable Devices Ltd. WLDS dipped 5.8% to $2.60 in pre-market trading after jumping over 46% on Monday.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ultimate Contrarian Michael Burry, Who Correctly Called the Housing Crisis in 2008, Is Now Piling Into 3 Stocks That Could Struggle Under a Trump Administration

Last week, fund managers of a certain size disclosed their stock holdings for the third quarter ending on Sept. 30. Fund managers are required to do this 45 days after the close of each quarter in a 13F form filed with the Securities and Exchange Commission (SEC). Professional investors have years if not decades of experience so they have been through different markets and cycles. They also likely have the returns to back it up. One investor who filed their 13F form is Michael Burry of Scion Asset Management. Burry is a famous contrarian investor who correctly called the housing downturn of 2008. Now, he’s piling into a group of stocks that may not perform well under a Trump administration. Is the contrarian investor onto something?

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Burry was always poised to be an accomplished individual. He almost became a neurosurgeon. He was pre-med at the University of California, Los Angeles, and then got his MD from Vanderbilt. He started his residency at the Stanford University Medical Center but did not finish because his investing hobby quickly became a full-time job.

Burry posted his investment ideas online and quickly became a must-follow in the early days of the internet. He is typically a value investor and tries to find stocks trading below their intrinsic value. Burry eventually left Stanford to launch his own Hedge Fund, Scion Capital, which found early success. A few years before the Great Recession, Burry dug into the subprime mortgage market, believing the boom was unsustainable and that the bubble would soon collapse. He took bets on his thesis by getting major Wall Street banks to sell him credit default swaps on mortgage bonds.

While his thesis took a while to play out, Burry would eventually score hundreds of millions in profits. Burry supposedly made $100 million for himself and $700 million for his investors. The movie The Big Short portrays the story of Burry and others who shorted the housing market leading up to the Great Recession.

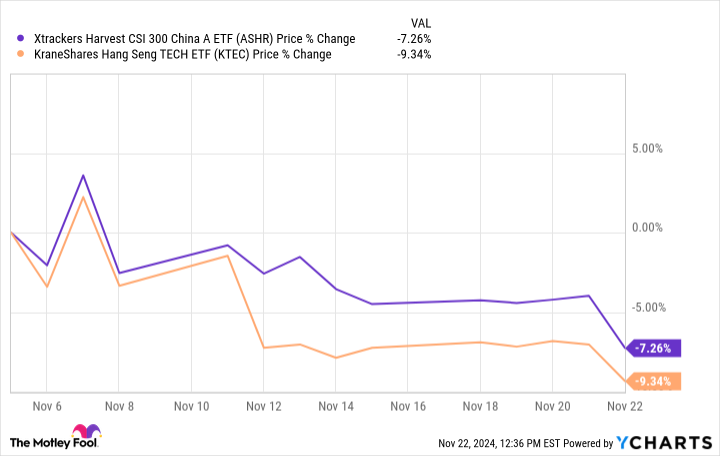

Today, Burry runs his own fund called Scion Asset Management, which only owns eight stocks. In the third quarter, Scion significantly increased its position in several Chinese stocks that he already owned coming into the quarter:

-

JD.com (NASDAQ: JD): Burry doubled his stake in the large Chinese e-commerce giant to 500,000 shares for a total value of roughly $20 million.

-

Baidu (NASDAQ: BIDU): Burry increased his stake by 67% in the artificial intelligence and search engine company and now owns 125,000 shares valued at roughly $13.2 million.

-

Alibaba (NYSE: BABA): Burry also increased his stake in another large Chinese e-commerce giant by 29% and now owns 200,000 shares valued at more than $21 million.

'Altseason Storm' Is Intensifying, Says Prominent Crypto Trader, Ethereum Begins Rally To $6K As Bitcoin Consolidates

Cryptocurrency markets are on the cusp of a potentially transformative period, with leading analysts forecasting a significant surge in alternative cryptocurrencies driven by complex economic indicators and market sentiment.

What Happened: Mikybull, a prominent crypto trader, offered an intricate market perspective on X, emphasizing that if Bitcoin BTC/USD continues hovering around the $95,000-$94,000 range, alternative cryptocurrencies will likely experience substantial performance.

He boldly proclaimed that the “Altcoins dominance” has climbed above the trend ribbon, signaling an impending outperformance in the coming weeks.

The trader further predicted that Ethereum‘s ETH/USD next rally to $6,000 has already commenced, suggesting that the “Altseason storm” is about to reach its next intensity level. This forecast comes amid a dynamic market landscape where cryptocurrencies are responding to nuanced economic signals.

Michaël van de Poppe, another crypto analyst, provided deeper insights into Ethereum’s remarkable performance. He highlighted a “massive bullish divergence” in Ethereum’s market behavior, directly linking its outperformance to dropping government bond yields.

Poppe emphasized that the sole reason for Ethereum’s significant movement is the impact of yield markets, creating a complex interplay between traditional financial instruments and digital assets.

Looking ahead, Poppe anticipates that the upcoming Labor Market Week could be pivotal. He suggests that potentially weak labor market data might prompt the Federal Reserve to implement more rate cuts, consequently driving down yields and potentially propelling Ethereum’s valuation.

Why It Matters: Current market data from the CME FedWatch tool indicates shifting rate cut probabilities. The likelihood of a rate cut at the Dec. 18 Federal Reserve meeting has decreased to 55.9% from 74.6% a month ago, with the current federal funds rate sitting between 450-475 basis points.

The cryptocurrency landscape has witnessed notable movements, with Ethereum breaking past $3,500 for the first time in four months. This rally triggered strong inflows into Ether spot exchange-traded funds, totaling $283,000, while Bitcoin ETFs experienced outflows exceeding $684 million.

Traders define “Altcoin Season” as a period when 75% of alternative cryptocurrencies outperform Bitcoin—a threshold that indicators suggest that the market may be rapidly approaching.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If You'd Invested $3,733 in Realty Income Stock 10 Years Ago, Here's How Much You'd Have Today

Realty Income (NYSE: O) is a wealth-creating machine. The real estate investment trust (REIT) dishes out a growing stream of dividend income. On top of that, its stock has steadily grown in value. These two value drivers have added up to a very attractive total return over the past decade.

Here’s a look at how much money an investor would have today if they spent $3,733 to buy 100 shares about 10 years ago.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Realty Income pays a steadily rising monthly dividend. The REIT has raised its dividend payment 127 times since its initial public market listing in 1994, including the past 108 quarters in a row. Because of that, investors have collected a growing stream of dividend income over the past decade.

An investor who purchased 100 shares 10 years ago would have initially received about $219 in dividend income during the first year based on its payment at the time. That’s a nearly 5.9% dividend yield on an initial investment. That income stream would have steadily grown, reaching its current annualized level of $308. That’s a 40% increase from the initial annual level. They would have collected a cumulative $3,077 in dividends during that decade. Meanwhile, the initial investment now yields 8.2%.

That income is only part of the return. Shares of Realty Income have steadily appreciated as the REIT invested in expanding its portfolio of income-producing properties, which has increased its funds from operations (FFO) per share by around 5% per year. That has helped grow the REIT’s share price by over 50%. As a result, the initial investment is now worth about $5,742. That’s in addition to getting more than 80% of the initial investment back in dividend income. Add it up, and the 100-share purchase would have grown from $3,733 to $8,819 in total value. That investment is also throwing off about $310 (and growing) of annual dividend income.

Realty Income is a slow and steady wealth creator that generates a growing stream of dividend income from an increasingly more valuable investment.

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $869,885!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

Cathie Wood Bets On Thriving IPO Market Under Trump: 'Will Give…Liquidity Events That They Have Not Enjoyed During The Last Four Years'

In a recent investor webinar, Cathie Wood shared her perspective on how a potential second term for Donald Trump might influence the IPO market.

What Happened: Wood expressed optimism about the future direction of the market.

“If the market continues to move forward in the way we believe it will…we believe that the IPO market will open up and that will give us a chance, lots of opportunities to diversify our portfolios and it will give our venture funds liquidity events that they have not enjoyed during the last four years,” she said.

Her comments, made during a session released on Friday, come at a time when the market is experiencing increased volatility that anticipated the effect of a second term of Trump on the Wall Street.

See Also: GOP Megadonor Ken Griffin Is ‘Open To The Possibility’ Of Selling Minority Stake In Citadel

Why It Matters: Wood’s comments contrast that of investor Chamath Palihapitiya who feels that there won’t be the mega IPOs expected.

“The IPO market is what the IPO market is. And if the 10 year is back to 4.5-5%, that’s not a compelling strategy for some SaaS company or some internet business that didn’t take an opportunity to go public when rates were at zero. So if you just look mathematically at what the actual fair value of these companies should be, I don’t know, it’s not like such a great IPO market,” he said during one of the recent episodes of the All-In Podcast.

Investors are keenly observing which of Trump’s campaign promises might translate into policy actions. While some pledges, like reducing corporate taxes and deregulation, could benefit the economy and stock prices, others, such as strict immigration policies and high tariffs, might pose economic challenges.

Former Treasury Secretary Larry Summers has warned that Trump’s proposed economic policies could lead to significant economic disruption. In a recent interview, Summers expressed concerns about the potential for a massive demand-side stimulus and substantial supply-side disruptions. He emphasized that if implemented, Trump’s program could result in a larger inflation stimulus than any measures enacted by President Joe Biden.

Price Action: Meanwhile, S&P 500 and NASDAQ tracked by SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust, Series 1 QQQ have gained 2.88% and 2.26% respectively, in the month of November.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Ark Invest

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.