Behind The Numbers: The Real Market Value Of Leading Crypto Exchanges

Calculation of top cryptocurrency exchanges’ market capitalisation and virtual value.

Have you ever wondered how much your favourite crypto exchange is really worth?

The majority of crypto operators are non-public, i.e., they are not listed on stock. Nevertheless, there is but one crypto exchange, whose net worth is publicly available – Coinbase.

This leads to a logical question: can the worths of other exchanges be calculated in relation to Coinbase’s, since its value is known?

For the first time ever, the analysis is diving deep into the approaches to answer this burning question, using pure arithmetical evaluation and a full-fledged estimate of both tangible and intangible metrics.

Disclaimer: the article is presenting a possible logic that may or may not be utilised in calculating the exchanges’ virtual capitalisations. While based upon verified data, Coinbase is discussed and compared to performance of non-public excanges, with extensive market speculation throughout, hence, the results of the calculation do not represent the factual exchanges’ market capitalisation and value.

Note: the data below, as well as the basis for the Exchanges’ Trust and Value Index, is relevant as of November 20, 2024.

Ratioed Evaluation of Exchange’s Virtual Capitalisation

As of November 20, 2024, the market cap of Coinbase totalled $81.26 billion.

One of the approaches to attempt a calculation of a metric that is proposed to be entitled as the cryptocurrency exchange’s Virtual Capitalisation – counting up ratios for the core exchange’s metrics that best represent its net worth in comparison with Coinbase:

- Average daily trading volume;

- Web traffic;

- User count;

- Exchange token’s market capitalization.

To carry out the formula, the research segments 7 popular cryptocurrency exchanges, differing in size and potential value:

- Binance

- Bybit

- OKX

- Kraken

- WhiteBIT

- Gate.io

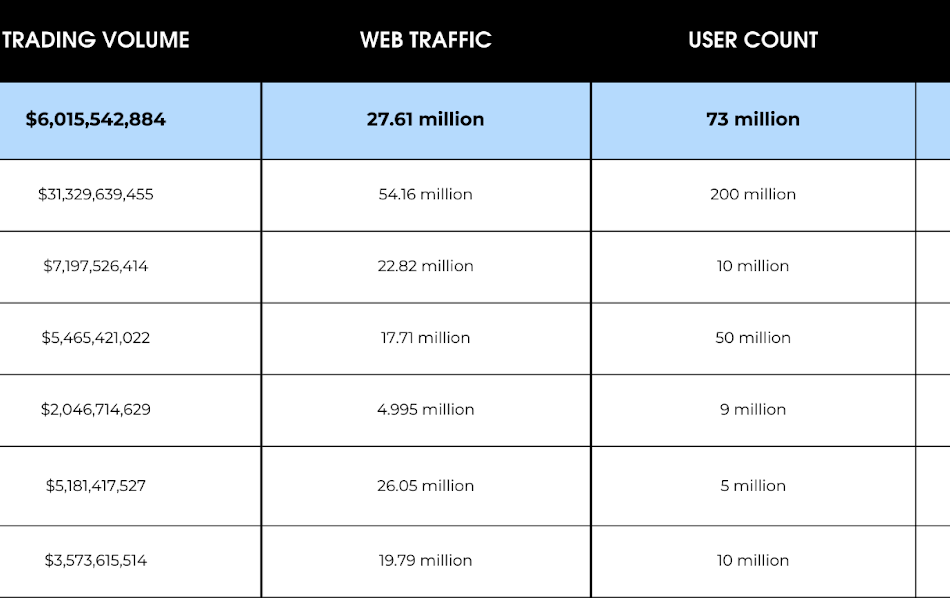

According to the data and information from CoinGecko, CoinGlass, SimilarWeb, and exchanges’ official statements, the following statistic is available:

The worth of each exchange will be calculated separately based on one of the metrics – all in order to receive an estimated range.

Ultimate calculations bring the following results:

Exchanges’ Trust and Value Index

While the arithmetic metrics seem enough to calculate the exchange’s virtual worth, it is the trust and value where the essence lies.

To receive a comprehensive outlook on exchanges market position, the Exchanges’ Trust and Value Index is introduced.

Exchanges’ Trust and Value Index is an analytical framework that will help better evaluate both the financial health and trustworthiness of the exchange.

The Methodology of the Index is represented in numerical format, ranging from 1 to 10, where 10 is the best score, while 1 is the worst.

The index is evaluated upon six core metrics: transparency, activity, capital, security, compliance, and proof of reserves.

The Transparency metric in the “Exchanges’ Value and Trust Index” measures how openly an exchange operates, particularly in terms of sharing information about its financial status, operations, and decision-making processes.

Activity measures the organic traffic and user count of a cryptocurrency exchange, delivering relevant insights on the operational performance. This metric is evaluated upon self-reported audience and web traffic.

The Capital metric evaluates the financial strength and liquidity of a cryptocurrency exchange. It is based upon total trading volume and futures trading open interest (OI).

The Security metric evaluates how well a cryptocurrency exchange protects user funds, data, and overall platform integrity. It is scrutinised through anti-money laundering (AML) activity, Cryptocurrency Security Standard (CCSS) validity, history of security accidents, and custody of assets.

The Compliance refers to how well a cryptocurrency exchange adheres to legal and regulatory standards. It is estimated upon the legality of operations, sanctions compliance, and Financial Action Task Force (FATF) frameworks integration.

Results:

When evaluating cryptocurrency exchanges through the lens of the Index, distinct differences emerge.

In terms of transparency, Binance, Coinbase, Kraken, and others make their top management and proof of reserves public, while platforms like OKX offer transparency through third-party audits or partnerships.

For activity, Binance leads the pack with over 200 million active users, alongside significant web traffic. Coinbase follows with 73 million users, while Bybit (10 million) trails behind. WhiteBIT, while smaller, still reports 5 million users.

The capital held and traded on these platforms differs significantly, while Coinbase’s ($6 billion), OKX’s ($5.4 billion), and WhiteBIT’s ($5.1 billion) daily trading volumes are almost identical. Binance and Bybit dominate the pack with $31 billion and $7 billion trading volume respectively.

Compliance is another crucial factor where exchanges diverge. OKX, Coinbase, and Bybit maintain FATF compliance, with Coinbase’s strict adherence to U.S. regulations standing out.

In terms of proof of reserves, WhiteBIT relies on third-party audits while keeping the reserves private in terms of security. Binance, OKX, and others offer public transparency, while Bybit, Kraken, and Coinbase provide access to reserves on a personalized basis.

What Exchanges’ Trust and Value Index Means For Crypto Exchange Value

The outputs of the Exchange’s Trust and Value Index prove: crypto exchange’s value goes beyond the ratio calculations.

Trust is often as valuable as liquidity, hence this index helps to quantify not just the financial value of an exchange but its long-term viability and user confidence.

Ultimately, the essence of an exchange’s value does not lie in the numbers. It is determined by not just where an exchange stands today, but its potential to succeed – or fail – in the future.

Image Credit: Shutterstock, CoinGecko, CoinGlass, SimilarWeb, and exchanges’ official statements

This post was authored by an external contributor and does not represent Benzinga’s opinions and has not been edited for content. This contains sponsored content and is for informational purposes only and not intended to be investing advice. Cryptocurrency is a volatile market; do your independent research and only invest what you can afford to lose. New token launches and small market capitalization coins are inherently more risky than large cap cryptocurrencies. These tokens are subject to larger liquidity and market risks.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply