North America Household Appliance Market Set to Hit US$13.9 Billion by 2034: Smart Tech & Eco-Friendly Trends Lead the Way | Transparency Market Research

Wilmington, Delaware, United States, Transparency Market Research, Inc., Nov. 27, 2024 (GLOBE NEWSWIRE) — The North American household appliance market (北米家電市場), valued at US$ 8.1 billion in 2023, is on a robust growth trajectory, with an expected CAGR of 5.2% from 2024 to 2034. The market is projected to reach US$ 13.9 billion by 2034, driven by the growing adoption of smart home technologies and the increasing consumer demand for sustainable and energy-efficient appliances.

Smart Technology Integration: A Key Growth Driver

One of the biggest catalysts for market expansion in North America is the integration of smart technology in household appliances. As the demand for smart homes grows, consumers are increasingly seeking appliances that seamlessly integrate into their home automation systems. From smart refrigerators and IoT-enabled ovens to washing machines and dishwashers, connected appliances offer greater convenience, efficiency, and remote control through smartphones, voice assistants like Amazon Alexa or Google Assistant, or a central home hub.

This trend of smart living is not only transforming how consumers interact with everyday appliances but is also improving the overall user experience. Smart features such as energy-saving modes, remote monitoring, and voice-activated controls are expected to lead the market’s growth in the coming years.

Request a Sample PDF of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86400

Sustainability and Eco-friendliness: A Strong Consumer Focus

Alongside technological advancements, sustainability is another driving force behind the North American household appliance market’s growth. With growing concerns over environmental impact, consumers are increasingly prioritizing eco-friendly, energy-efficient products. They’re looking for appliances that not only meet strict energy standards but also use recyclable materials and have a low carbon footprint.

Manufacturers are responding to this shift by developing products designed to reduce energy consumption and lower environmental impact. Appliances that offer both sustainability and advanced smart features are expected to capture the largest market share as consumers become more conscious of their environmental footprint.

Market Segmentation: Diverse Product Categories Driving Growth

By Product Type

Pedestal Fans

- Less than $50

- $50–$150

- $150–$250

- More than $250

Electric Indoor Space Heaters

- Ceramic

- Fan & Forced Air

- Radiant & Infrared

- Others (Oil Filled, Propane, etc.)

Blenders

- Small Blenders:

- Up to 500 ml

- 500 ml to 1000 ml

- Large Blenders:

- 1–2 Liters

- 2–3 Liters

- 3–4 Liters

- 4–5 Liters

Humidifiers

- Small Room Humidifiers (Under 300 sq. ft.)

- Medium Room Humidifiers (300–600 sq. ft.)

- Large Room Humidifiers (600–1000 sq. ft.)

- Extra-Large Room or Whole House Humidifiers (1000–2400+ sq. ft.)

Electric Mops

- Flat Type

- Spiral Type

- Others (Roller, etc.)

Food Waste Disposers

- Dry Grind Method:

- Less than 1000 ml

- 1000–2000 ml

- 2000–3000 ml

- Wet Grind Method:

- Less than 1000 ml

- 1000–2000 ml

- 2000–3000 ml

By Distribution Channel

D2C (Direct-to-Consumer)

Online

- General E-commerce Websites

- Specialty Websites

Offline

- Hypermarkets/Supermarkets

- Brand Stores

- Multi-brand Stores

- Other Retail Stores

Get Customized Insights & Analysis for Your Business Needs: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86400

As smart technology and eco-friendly solutions gain more traction, we can expect products with advanced energy-saving features and remote control capabilities to lead the charge in this market.

Key Players Shaping the North American Household Appliance Market

The North American household appliance market is home to several major players who are driving innovation in both smart technology and sustainability:

- Whirlpool Corporation: Continues to enhance its smart appliance portfolio with energy-efficient refrigerators, washing machines, and smart ovens that integrate seamlessly with home automation systems.

- Samsung Electronics: A leader in the smart appliance revolution, Samsung’s SmartThings Hub connects various home appliances, offering enhanced control and convenience for consumers.

- LG Electronics: Capitalizing on the smart technology trend, LG’s ThinQ AI-powered appliances allow consumers to monitor and control their household devices through voice commands or mobile apps.

- Bosch and Electrolux: Both companies are responding to the growing demand for energy-efficient and smart appliances that prioritize sustainability, ensuring that consumers have access to eco-conscious products.

These companies are investing heavily in research and development to improve product features, particularly in the areas of energy efficiency, sustainability, and smart functionality. In addition, strategies such as mergers, acquisitions, and partnerships are helping these players expand their product portfolios and strengthen their positions in the market.

Buy This Premium Research Report Now to Get Detailed Analysis: https://www.transparencymarketresearch.com/checkout.php?rep_id=86400<ype=S

Regional Insights: U.S. and Canada Lead the Charge

The United States and Canada are the dominant players in the North American household appliance market, both witnessing substantial investments in smart appliance technologies. The U.S. market, with its large consumer base, is particularly lucrative for companies focused on IoT integration and smart home solutions. Canada, with its growing interest in sustainable living and smart technologies, is also expected to experience significant growth in the coming years.

Looking Ahead: Strong Growth Prospects for the North America Household Appliance Market

The future of the North American household appliance market is promising, with smart technology and sustainability driving substantial growth. As the demand for connected, energy-efficient, and durable household appliances rises, companies that innovate and adapt to consumer needs will have significant opportunities to expand their market share.

With the market expected to reach US$ 13.9 billion by 2034, the North American household appliance industry is set for a transformative period, driven by smart home integration and eco-friendly innovation.

Browse More Trending Research Reports in Consumer Goods Market

- Automotive Exhaustive System Market (Marché Des Systèmes d’Échappement Automobiles): Market size is expected to reach a value of US$ 46.6 Bn by the end of 2034.

- EV Platform Market (EVプラットフォーム市場): EV Platform Market size is expected to reach a value of US$ 91.5 Bn by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter | Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Scheduled For November 27, 2024

Companies Reporting Before The Bell

• Codere Online Luxembourg CDRO is projected to report quarterly earnings at $0.01 per share on revenue of $49.81 million.

• CollPlant Biotechnologies CLGN is likely to report quarterly loss at $0.37 per share on revenue of $730 thousand.

• QuantaSing Group QSG is likely to report quarterly earnings at $0.27 per share on revenue of $134.60 million.

• Frontline FRO is projected to report quarterly earnings at $0.45 per share on revenue of $361.42 million.

• Golden Ocean Group GOGL is likely to report quarterly earnings at $0.33 per share on revenue of $196.25 million.

• 111 YI is expected to report earnings for its third quarter.

• Arbe Robotics ARBE is likely to report quarterly loss at $0.11 per share on revenue of $450 thousand.

• X Financial XYF is likely to report earnings for its third quarter.

• BOS Better Online Solns BOSC is expected to report earnings for its third quarter.

Companies Reporting After The Bell

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Michael Saylor's MicroStrategy Plunges 23% In 5 Sessions While Bitcoin Slips Under 6%: Gary Black Quips 'Don't Say I Didn't Warn You'

MicroStrategy Inc. MSTR has become the epicenter of intense market speculation following a dramatic 23.64% stock decline over the past five sessions, while Bitcoin BTC/USD experienced a 5.52% drop during the same period.

What Happened: Prominent investment analyst Gary Black of The Future Fund LLC raised alarm bells about MicroStrategy’s valuation, arguing that the company’s stock price “makes no sense.” Black’s analysis suggests the stock should be valued at around $105 per share—approximately 75% lower than its current trading price.

“Don’t say I didn’t warn you,” Black wrote.

The company, led by CEO Michael Saylor, currently holds 386,700 Bitcoin, valued at $35.4 billion. With a market capitalization of $81.5 billion, MicroStrategy continues to trade at roughly 2.3 times the current value of its Bitcoin holdings.

The Kobeissi Letter highlighted unprecedented retail investor activity, noting that on a single Wednesday last week, retail investors purchased approximately $42 million of MSTR stock.

This marked the largest daily retail purchase on record, with total retail investment approaching $100 million for the week. The stock experienced extraordinary trading dynamics, with last week seeing $136 billion in trading volume—exceeding even Amazon Inc. AMZN, despite AMZN having a market cap nearly 29 times larger.

Why It Matters: Standard Chartered analyst Geoffrey Kendrick provided critical market insights, suggesting Bitcoin may test support zones between $85,000 and $88,700. His year-end price target remains $125,000, with a long-term projection of $200,000 by the end of 2025.

MicroStrategy’s investment approach involves a cyclical strategy of borrowing money through convertible notes, purchasing Bitcoin, driving price appreciation, selling shares at a premium, and reinvesting in more Bitcoin.

Analysts are questioning the sustainability of this model, particularly whether Saylor can continue raising debt to purchase Bitcoin and if institutional and retail investor enthusiasm will persist.

Bitcoin’s recent pullback from near $100,000 to around $93,440 reflects broader market uncertainties, including reduced U.S. Treasury term premiums, upcoming options expirations, and institutional repositioning.

Price Action: Bitcoin was trading at $93,433 at the time of writing, up by 0.80% in the last 24 hours.

According to Benzinga Pro data, the consensus price target for MicroStrategy is $449.50. The highest price target is $690, while the lowest is $140, implying a potential 54.56% upside based on the most recent analyst ratings.

Read Next:

Image Via Shutetsrtock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GOGL – Third Quarter 2024 Results

Hamilton, Bermuda, November 27, 2024 – Golden Ocean Group Limited (NASDAQ/OSE: GOGL) (the “Company” or “Golden Ocean”), the world’s largest listed owner of large size dry bulk vessels, today announced its unaudited results for the quarter ended September 30, 2024.

Highlights

- Net income of $56.3 million and earnings per share of $0.28 (basic) for the third quarter of 2024, compared to net income of $62.5 million and earnings per share of $0.31 (basic) for the second quarter of 2024.

- Adjusted EBITDA of $124.4 million for the third quarter of 2024, compared to $120.3 million for the second quarter of 2024.

- Adjusted net income of $66.7 million for the third quarter of 2024, compared to $63.4 million for the second quarter of 2024.

- Reported TCE rates for Capesize and Panamax vessels of $28,295 per day and $16,361 per day, respectively, and $23,726 per day for the entire fleet in the third quarter of 2024.

- Entered into agreements to sell one Newcastlemax vessel and one Panamax vessel for a total net consideration of $56.8 million.

- Announced the renewal of its share buy-back program for an additional 12 months.

- Entered into a $150 million facility to refinance six Newcastlemax vessels, at highly attractive terms.

- Estimated TCE rates, inclusive of charter coverage calculated on a load-to-discharge basis, are approximately:

- $26,300 per day for 82% of Capesize available days and $14,600 per day for 83% of Panamax available days for the fourth quarter of 2024.

- $21,060 per day for 27% of Capesize available days and $17,500 per day for 15% of Panamax available days for the first quarter of 2025.

- Announced a cash dividend of $0.30 per share for the third quarter of 2024, which is payable on or about December 18, 2024, to shareholders of record on December 9, 2024. Shareholders holding the Company’s shares through Euronext VPS may receive this cash dividend later, on or about December 20, 2024.

Peder Simonsen, Interim Chief Executive Officer and Chief Financial Officer, commented:

“Golden Ocean delivered strong performance with achieved market rates significantly above the indexes for the third quarter. This is attributable to our modern, fuel-efficient fleet, strong commercial capabilities, and industry leading low cash-break-even. We continue to execute on our strategy of divesting older and less efficient tonnage at attractive valuations. The macro and geopolitical environment creates volatility in the financial markets and freight market impacting sentiment, despite healthy trading volumes across all commodities. Looking ahead, the freight market is expected to benefit with tonne-mile growth, with the strong iron ore and bauxite exports out of Brazil and Guinea to Asia being the main driver. Combined with a healthy vessel supply outlook we remain optimistic for the years to come. With a modern fleet and strong balance sheet, Golden Ocean is well positioned to generate strong cash flow and attractive returns to our shareholders.”

The Board of Directors

Golden Ocean Group Limited

Hamilton, Bermuda

November 27, 2024

Questions should be directed to:

Peder Simonsen: Interim Chief Executive Officer and Chief Financial Officer, Golden Ocean Management AS

+47 22 01 73 40

The full report is available in the link below.

Forward-Looking Statements

Matters discussed in this earnings report may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995, or the PSLRA, provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

The Company is taking advantage of the safe harbor provisions of the PSLRA and is including this cautionary statement in connection therewith. This document and any other written or oral statements made by the Company or on its behalf may include forward-looking statements, which reflect the Company’s current views with respect to future events and financial performance. This earnings report includes assumptions, expectations, projections, intentions and beliefs about future events. These statements are intended as “forward-looking statements.” The Company cautions that assumptions, expectations, projections, intentions and beliefs about future events may and often do vary from actual results and the differences can be material. When used in this document, the words “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “targets,” “projects,” “likely,” “will,” “would,” “could” and similar expressions or phrases may identify forward-looking statements.

The forward-looking statements in this report are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. Although the Company believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond the Company’s control, the Company cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. As a result, you are cautioned not to rely on any forward-looking statements.

In addition to these important factors and matters discussed elsewhere herein, important factors that, in the Company’s view, could cause actual results to differ materially from those discussed in the forward-looking statements, include among other things: general market trends in the dry bulk industry, which is cyclical and volatile, including fluctuations in charter hire rates and vessel values; a decrease in the market value of the Company’s vessels; changes in supply and demand in the dry bulk shipping industry, including the market for the Company’s vessels and the number of newbuildings under construction; delays or defaults in the construction of the Company’s newbuilding could increase the Company’s expenses and diminish the Company’s net income and cash flows; an oversupply of dry bulk vessels, which may depress charter rates and profitability; the Company’s future operating or financial results; the Company’s continued borrowing availability under the Company’s debt agreements and compliance with the covenants contained therein; the Company’s ability to procure or have access to financing, the Company’s liquidity and the adequacy of cash flows for the Company’s operations; the failure of the Company’s contract counterparties to meet their obligations, including changes in credit risk with respect to the Company’s counterparties on contracts; the loss of a large customer or significant business relationship; the strength of world economies; the volatility of prevailing spot market and charter-hire charter rates, which may negatively affect the Company’s earnings; the Company’s ability to successfully employ the Company’s dry bulk vessels and replace the Company’s operating leases on favorable terms, or at all; changes in the Company’s operating expenses and voyage costs, including bunker prices, fuel prices (including increased costs for low sulfur fuel), drydocking, crewing and insurance costs; the adequacy of the Company’s insurance to cover the Company’s losses, including in the case of a vessel collision; vessel breakdowns and instances of offhire; the Company’s ability to fund future capital expenditures and investments in the construction, acquisition and refurbishment of the Company’s vessels (including the amount and nature thereof and the timing of completion of vessels under construction, the delivery and commencement of operation dates, expected downtime and lost revenue); risks associated with any future vessel construction or the purchase of second-hand vessels; effects of new products and new technology in the Company’s industry, including the potential for technological innovation to reduce the value of the Company’s vessels and charter income derived therefrom; the impact of an interruption or failure of the Company’s information technology and communications systems, including the impact of cybersecurity threats and data security breaches, upon the Company’s ability to operate; potential liability from safety, environmental, governmental and other requirements and potential significant additional expenditures (by the Company and the Company’s customers) related to complying with such regulations; changes in governmental rules and regulations or actions taken by regulatory authorities and the impact of government inquiries and investigations; the arrest of the Company’s vessels by maritime claimants; government requisition of the Company’s vessels during a period of war or emergency; the Company’s compliance with complex laws, regulations, including environmental laws and regulations and the U.S. Foreign Corrupt Practices Act of 1977; potential difference in interests between or among certain members of the Board of Directors, executive officers, senior management and shareholders; the Company’s ability to attract, retain and motivate key employees; work stoppages or other labor disruptions by the Company’s employees or the employees of other companies in related industries; potential exposure or loss from investment in derivative instruments; stability of Europe and the Euro or the inability of countries to refinance their debts; inflationary pressures and the central bank policies intended to combat overall inflation and rising interest rates and foreign exchange rates; fluctuations in currencies; the impact that any discontinuance, modification or other reform or the establishment of alternative reference rates have on the Company’s floating interest rate debt instruments; acts of piracy on ocean-going vessels, public health threats, terrorist attacks and international hostilities and political instability; potential physical disruption of shipping routes due to accidents, climate-related (acute and chronic), political instability, terrorist attacks, piracy, international sanctions or international hostilities, including the developments in the Ukraine region and in the Middle East, including the conflicts in Israel and Gaza, and the Houthi attacks in the Red Sea; general domestic and international political and geopolitical conditions or events, including any further changes in U.S. trade policy that could trigger retaliatory actions by affected countries; the impact of adverse weather and natural disasters; the impact of increasing scrutiny and changing expectations from investors, lenders and other market participants with respect to the Company’s Environmental, Social and Governance policies; changes in seaborne and other transportation; the length and severity of epidemics and pandemics and governmental responses thereto and the impact on the demand for seaborne transportation in the dry bulk sector; impacts of supply chain disruptions and market volatility surrounding impacts of the Russian-Ukrainian conflict and the developments in the Middle East; fluctuations in the contributions of the Company’s joint ventures to the Company’s profits and losses; the potential for shareholders to not be able to bring a suit against us or enforce a judgement obtained against us in the United States; the Company’s treatment as a “passive foreign investment company” by U.S. tax authorities; being required to pay taxes on U.S. source income; the Company’s operations being subject to economic substance requirements; the Company potentially becoming subject to corporate income tax in Bermuda in the future; the volatility of the stock price for the Company’s common shares, from which investors could incur substantial losses, and the future sale of the Company’s common shares, which could cause the market price of the Company’s common shares to decline; and other important factors described from time to time in the reports filed by the Company with the U.S. Securities and Exchange Commission, including the Company’s most recently filed Annual Report on Form 20-F for the year ended December 31, 2023.

The Company cautions readers of this report not to place undue reliance on these forward-looking statements, which speak only as of their dates. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events. These forward-looking statements are not guarantees of the Company’s future performance, and actual results and future developments may vary materially from those projected in the forward-looking statements.

This information is subject to the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Doors & Windows Market Estimated to Reach $244.21 billion by 2029 Globally, at a CAGR of 4.1%, says MarketsandMarkets™

Delray Beach, FL, Nov. 27, 2024 (GLOBE NEWSWIRE) — The Doors & Windows Market is projected to grow from USD 199.47 billion in 2024 to USD 244.21 billion by 2029, at a CAGR of 4.1% during the forecast period, as per the recent study by MarketsandMarkets. Doors & Windows are essential in various industries, by providing access and security while controlling airflow and privacy. Usually, doors & windows are made of wood, metal, and plastic and their primary function is to offer security and enhance aesthetic appeal, while controlling airflow, light, sound, and privacy, among other functionalities. The increased urbanization and population demand for both new construction and renovation projects, as more people migrate to urban areas for better employment and living conditions, there is a notable rise in the construction of residential buildings, commercial spaces, and public infrastructure, significantly boosting the demand for high-performance doors & windows.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=144722093

Browse in-depth TOC on “Doors & Windows Market”

335 – Market Data Tables

54 – Figures

272 – Pages

List of Key Players in Doors & Windows Market:

- ASSA ABLOY (Sweden)

- LIXIL Corporation (Japan)

- Cornerstone Building Brands, Inc. (US)

- JELD-WEN, Inc. (US)

- YKK AP Inc. (Japan)

- Masonite (US)

- PELLA CORPORATION (US)

- Schüco International KG (Germany)

- ANDERSEN CORPORATION (US)

- PGT INNOVATIONS (US)

Drivers, Restraints, Opportunities and Challenges in Doors & Windows Market:

- Driver: Improvement in the Housing Market

- Restraint: Elevated Expenses Linked to Advanced Doors & Windows and Environmental Challenges

- Opportunity: Increasing Demands from Emerging Markets

- Challenge: Challenges in the Supply Chain

Get Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=144722093

Based on product, Windows is the largest product segment of the doors & windows market.

Windows is the leading product segment in the doors & windows market format. The dominance is due to the outstanding properties of windows, which impart energy efficiency, technology incorporation, and enhanced aesthetics among other unique functionalities during use. Windows are so popular because of their demand for energy-efficient solutions, such as low E glass, thermal break frame, double & triple glazing, as well as the use of smart glass technology, which has boosted the expansion of the window segment

Based on Construction type, Swinging accounts for the 2nd largest construction segment of the doors & windows market.

Swinging accounts for the 2nd largest construction segment of doors & windows, with their hinged function, provide a traditional and adaptable solution for a variety of buildings & architectural designs. Suitable for residential, commercial, and industrial spaces these systems dominate the other construction types by various factors including convenience, security, and versatility. Recent advances in swinging doors & windows including improvements in weather stripping, multi-point locking systems, and energy-efficient glazing alternatives have enhanced insulation and reduced heat loss. These doors & windows are manufactured using materials like wood, metal, plastic, and others. This construction type is preferred due to its outstanding wear resistance, flexibility, and strength properties that withstand general environmental factors such as moisture, fire resistance, or chemicals. Growing demand from residential, commercial, and industrial buildings & architecture will continue to boost sales of swinging doors & windows owing to their wide-ranging applications and effective performance in varied scenarios.

Based on Material, Metal accounts for the 2nd largest material segment of the doors & windows market.

Metal accounts for the 2nd largest material segment of doors & windows. Metal doors and windows, notably those made of steel and aluminum, have long been praised for their strength, security, and aesthetics. Metal doors & windows dominate the other material types for various reasons, such as strength, durability, security, fire resistance, and weather resistance. Aluminum window frames are becoming increasingly popular in residential markets due to their durability, low maintenance requirements, and ability to be customized. The growing trend towards sustainability fuels the growth of the metal segment in the doors & windows market. Given the growing emphasis on sustainability in construction and a shift towards eco-conscious consumer choices, there’s a rising demand for doors and windows made from recycled or environmentally friendly materials. Aluminum, a highly recyclable metal, offers a sustainable solution to meet this demand. Therefore, there exists tremendous potential for growth in the doors & windows market due to its contributions towards enhancing the performance of metal doors & windows across multiple industries. Additionally, metal doors & windows are more commonly used in the industrial sector to withstand challenging environments.

Get 10% Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=144722093

Based on the End-Use Industry, Residential accounts for the largest end-use segment of the doors & windows market.

Residential accounts for the largest end-use segment of the doors & windows. The residential sector is one of the biggest end-use industries for doors & windows. The increased focus on security, energy- efficiency, aesthetic appeal, and technology integration has been fueling the growth of doors & windows in the residential sector. The homeowners place more emphasis on energy efficiency and sustainability, the demand for modern, energy-efficient doors & windows grows. When housing markets improve, the doors & windows market benefits greatly, as there is a higher demand for both new construction and renovation projects. New housing structures require a large number of doors and windows, and homeowners are more eager to upgrade their buildings, increasing remodeling projects. This increases the demand for a wide range of door and window solutions, from basic versions to high-quality, energy-efficient alternatives.

Based on Region, Asia Pacific accounts for the largest segment of the doors & windows market.

The doors & windows market has been categorized into several key regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Among these, Asia Pacific notably dominated the market in 2023 in terms of value. The Asia Pacific region dominates the doors & windows market both in terms of volume and value. The doors & windows market is poised for significant growth, particularly in the Asia Pacific, Middle East, and South American regions. The market for doors & windows in Asia Pacific is in a state of growth with a high demand from countries like China and India. These countries are experiencing rapid industrialization and urbanization processes which are driving the demand for new buildings & architecture for all sectors such as residential, commercial, and industrial. Additionally, rigorous regulations on energy efficiency and sustainability are fueling demand for energy-efficient doors & windows. Also, the rising consumer consciousness of environment-friendly solutions is driving manufacturers to develop doors & windows with recyclable materials, thereby contributing to the growth of the market. Therefore, Asia Pacific especially China and India has emerged as a major production and consumption region of doors & windows in the near future.

Browse Adjacent Markets: Building & Construction Market Research Reports & Consulting

Related Reports:

- Refractories Market – Global Forecast to 2029

- Ammonia Market – Global Forecast to 2029

- Ammonium Sulfate Market – Global Forecast to 2029

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prospera Energy Inc. Announces Q3 2024 Financial Results

CALGARY, Alberta, Nov. 27, 2024 (GLOBE NEWSWIRE) — Prospera Energy Inc. TSX (“Prospera” or the “Corporation“)

Prospera Energy Inc. PEI (“Prospera” or the “Company”) is pleased to announce its operating and financial results for the three and nine months ended September 30th, 2024. Selected financial and operating information should be read in conjunction with Prospera’s unaudited consolidated financial statements and related management’s discussion and analysis (“MD&A”) for the three and nine months ended September 30, 2024. These filings are available on SEDAR+ at www.sedarplus.ca.

Financial & Operational Highlights

| (expressed in $, except number of shares) | Q3 2024 | Q3 2023 | YTD 2024 | YTD 2023 | |||

| P&NG sales revenue | 4,727,708 | 3,920,428 | 13,807,274 | 8,524,001 | |||

| Income (loss) for the period | (1,285,725 | ) | 71,011 | (1,827,016 | ) | (2,279,541 | ) |

| Income (loss) per share | (0.00 | ) | 0.00 | (0.00 | ) | (0.01 | ) |

| Funds flow provided by (used in) operations | 651,692 | 1,099,567 | 2,828,098 | 279,465 | |||

| Net cash flows provided by (used in) operating activities | (3,927,657 | ) | 4,237,560 | (3,275,900 | ) | (2,515,610 | ) |

| Net cash per share – operating activities | (0.01 | ) | 0.01 | (0.01 | ) | (0.01 | ) |

| Weighted average number of shares – basic | 426,954,797 | 385,599,221 | 424,797,150 | 341,460,783 |

Operating Netback

| Q3 2024 | Q3 2023 | YTD 2024 | YTD 2023 | ||||||

| P&NG sales revenue ($) | 4,727,708 | 3,920,428 | 13,807,274 | 8,524,001 | |||||

| Royalties ($) | (490,330 | ) | (424,448 | ) | (1,105,956 | ) | (955,682 | ) | |

| Operating costs ($) | (2,496,800 | ) | (1,978,034 | ) | (6,841,939 | ) | (5,479,529 | ) | |

| Operating netback ($) | 1,740,578 | 1,517,946 | 5,859,379 | 2,088,790 | |||||

| Per BOE, except total BOE sales volumes | Q3 2024 | Q3 2023 | YTD 2024 | YTD 2023 | |||||

| P&NG sales revenue ($) | 79.39 | 82.15 | 76.23 | 72.36 | |||||

| Royalties ($) | (8.23 | ) | (8.89 | ) | (6.11 | ) | (8.11 | ) | |

| Operating costs ($) | (41.93 | ) | (41.45 | ) | (37.78 | ) | (46.52 | ) | |

| Operating netback per BOE ($) | 29.23 | 31.81 | 32.35 | 17.73 |

Sales Volumes

| Q3 2024 | Q3 2023 | YTD 2024 | YTD 2023 | ||||||

| Oil and condensate (bbls) | 58,785 | 42,595 | 171,835 | 110,488 | |||||

| Natural gas (mcf) | 4,529 | 30,716 | 55,696 | 43,763 | |||||

| Total BOE | 59,548 | 47,723 | 181,117 | 117,788 | |||||

| Liquids composition | 99% | 89% | 95% | 94% | |||||

| Oil and condensate bbls per day | 639 | 463 | 627 | 405 | |||||

| Natural gas mcf per day | 49 | 334 | 203 | 160 | |||||

| Total BOE per day | 647 | 519 | 661 | 431 |

Selected Financial Information

| (expressed in $, except shares outstanding) | September 30, 2024 | December 31, 2023 | ||

| Current assets | 9,072,026 | 4,433,398 | ||

| Current liabilities | 17,816,441 | 21,910,157 | ||

| Working capital | (8,744,415 | ) | (17,476,759 | ) |

| Property and equipment | 48,630,094 | 39,331,690 | ||

| Total assets | 61,754,512 | 49,168,314 | ||

| Non-current financial liabilities | 21,957,983 | 9,245,121 | ||

| Share capital | 31,201,163 | 30,516,664 | ||

| Total common shares outstanding | 426,954,767 | 421,191,515 |

Q3 Highlights:

During the third quarter of 2024, Prospera successfully completed the following strategic objectives:

- Executed a successful multi-well drilling program in the company’s Brooks light/medium oil property, in turn adding significant production and reserve value.

- Acquired an additional 10% working interest in the company’s core Saskatchewan properties (Cuthbert, Luseland & Hearts Hill) from a working interest partner in exchange for full settlement of the partner’s accounts receivable balance. As a result of this working interest acquisition, Prospera’s corporate weighted average working interest increased to an average of 95% in its core Saskatchewan assets.

- Closed term debt financing of $11 million in July 2024, providing strategic funding for the company’s development and optimization programs.

Operational highlights for the quarter are as follows:

- PEI realized average net sales of 647 boe/d in Q3 2024, an increase of 25% from Q3 2023 net sales of 519 boe/d. The increase was due to additional production realized from the 2023 and 2024 development programs and the increased working interest in PEI’s core Saskatchewan properties.

- Due to higher production levels, PEI realized a 21% increase in sales revenue to $4,727,708 in Q3 2024 compared to $3,920,428 in Q3 2023, despite a decrease in sales price decrease to $79.39/boe in Q3 2024, compared to $82.15/boe in Q3 2023.

- Consequently, the higher working interest attributed to an increase in operating costs totalling $2,496,800 in Q3 2024 compared to $1,978,034 in Q3 2023, however, operating costs per boe remained flat at $41.93/boe in Q3 2024 compared to $41.45/boe in Q3 2023.

- PEI earned an operating netback of $1,740,578 ($29.23/boe) in Q3 2024 compared to $1,517,946 ($31.81/boe) in Q3 2023 and $5,859,379 ($32.35/boe) in YTD 2024 as compared to $2,088,790 ($17.73/boe) in YTD 2023.

- As of September 30, 2024, Prospera reduced its accounts payable arrears by $4 million to $16.5 million, compared to $20.5 million on December 31, 2023. This has resulted in the improvement of company financial health, including a decrease in working capital deficit to $8.7 million at September 30, 2024, compared to $17.5 million at December 31, 2023.

About Prospera

Prospera Energy Inc. is a publicly traded Canadian energy company specializing in the exploration, development, and production of crude oil and natural gas. Headquartered in Calgary, Alberta, Prospera is dedicated to optimizing recovery from legacy fields using environmentally safe and efficient reservoir development methods and production practices. The company’s core properties are strategically located in Saskatchewan and Alberta, including Cuthbert, Luseland, Heart Hills, Red Earth, and Pouce Coupe. Prospera Energy Inc. is listed on the TSX Venture Exchange under the symbol PEI and the U.S. OTC Market under GXRFF.

For Further Information:

Shawn Mehler, PR

Email: Investors@prosperaenergy.com

Website: www.prosperaenergy.com

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the future operations of the Corporation and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “will,” “may,” “should,” “anticipate,” “expects” and similar expressions. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding future plans and objectives of the Corporation, are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

Although Prospera believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Prospera can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), commodity price and exchange rate fluctuations and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Prospera. As a result, Prospera cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward- looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and Prospera does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Surge In Bitcoin, Dogecoin And Other Cryptos Boosting Home Ownership Among Low-Income Americans, Says Treasury Department

The rise in prices of cryptocurrencies like Bitcoin BTC/USD, Dogecoin DOGE/USD, and others may have enabled lower-income households to take out new mortgages to purchase property, a new study revealed.

What Happened: A paper by the U.S. Treasury’s Office of Financial Research has identified a correlation between the surge in cryptocurrency investments and an increase in debt, particularly mortgages, in areas with high exposure to cryptocurrencies.

Data showed that for low-income households in high-crypto exposure zip codes, the mortgage holder rate nearly quadrupled from 4.1% in January 2020 to 15.4% in January 2024. Additionally, the average balance per mortgage increased by over 150% from $171,773 in 2020 to $443,123.

“This indicates that low-income households may be using cryptocurrency gains to take out new mortgages and take out larger mortgages,” the study said.

The study also found that the average income of the cohort was $40,664 in January 2024, indicating a mortgage debt-to-income ratio of 0.53, well above the recommended benchmark of 0.36.

“It is particularly concerning because higher debt-to-income ratios are positively correlated with future default rates, especially during periods of turmoil such as the 2008 financial crisis,” the study stated.

That said, higher leverage among these groups hasn’t resulted in higher delinquency rates as of Q1 2024. On the contrary, delinquency on debt dropped the most among low-income households.

Mortgage delinquency dropped by 4.2% among low-income households in high-crypto exposure areas compared to 3.8% in low-crypto areas.

It’s worth noting that during the period between January 2020 and January 2024, the total cryptocurrency market capitalization increased by 737%, from roughly $197 billion to $1.65 trillion.

Additionally, major coins like Bitcoin BTC/USD have leaped 355%, more than fourfold, in the said time period.

An August report disclosed that U.S. consumers are becoming more receptive to cryptocurrency, with fewer than 1% now dismissing it as a “fad,” a significant drop from previous years.

Enthusiasts have placed high hopes in President-elect Donald Trump, who enthusiastically supported cryptocurrencies during his election campaign and is speculated to create the first-ever White House role dedicated to cryptocurrency policy.

Price Action: At the time of writing, Bitcoin was trading at $93,246.09, up 0.77% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

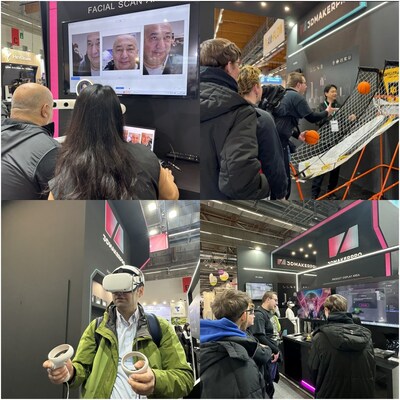

3DMakerpro Debuts Eagle Spatial Scanner at Formnext 2024, Announces Sponsorship of Singapore Centre for 3D Printing

FRANKFURT, Germany, Nov. 27, 2024 /PRNewswire/ — 3DMakerpro, a trailblazer in consumer-friendly 3D scanning technology, made a remarkable impression at Formnext 2024, the leading international trade fair for Additive Manufacturing and industrial 3D Printing, held from November 19-22. At the event, 3DMakerpro unveiled its latest innovation, the Eagle spatial scanner, which captivated attendees with its cutting-edge features.

The Eagle is designed to capture 3D data of spaces and rooms. It offers a seamless blend of consumer-grade technology that integrates LiDAR and image sensors. Equipped with a built-in battery, this cutting-edge product is a versatile tool for a wide range of applications such as reverse engineering, digital twinning, extended reality (XR), high-precision mapping, and 3D printing. The Eagle is anticipated to hit the market in December, promising to set new standards in spatial scanning technology.

At Formnext 2024, 3DMakerpro products’ capabilities were dynamically showcased. Jonathan Levi, the founder of The Next Layer, a content creation platform specializing in 3D printing and 3D modelling, conducted live scanning demonstrations with 3DMakerpro Moose 3D Scanner. These demonstrations offered attendees a firsthand experience of Moose’s impressive functionality.

Adding to the event’s intellectual appeal, Professor Paulo Bartolo from Nanyang Technological University, Singapore (NTU Singapore), who is also the Executive Director of Singapore Centre for 3D Printing (SC3DP), delivered insightful talks, highlighting the transformative potential of 3D scanning technology.

3DMakerpro also curated various engaging activities designed to captivate and involve visitors. These include 3D scanning demonstrations, immersive VR experiences, and facial scanning experiences, turning its exhibition booth into a hub of activity and innovation.

In addition to showcasing its groundbreaking technology, at the Makers Night – 3DMakerpro VIP Gala held on November 20 in Frankfurt, 3DMakerpro signed a partnership agreement with NTU Singapore and announced an exciting new sponsorship for the SC3DP. The SC3DP is a premier research institution funded by the National Research Foundation, and supported by NTU Singapore, Economic Development Board, and industry partners. The centre is dedicated to advancing additive manufacturing technologies and promoting their adoption across industries.

This strategic partnership emphasizes the transformative role of 3D scanning in education, reverse engineering, and healthcare. By offering workshops and training, 3DMakerpro and SC3DP aim to integrate advanced scanning technologies into academic and professional settings, fostering innovation and practical applications in industrial and medical fields through demonstration projects and real-world case studies.

About 3DMakerpro

3DMakerpro, a distinguished overseas brand under Shenzhen Jimuyida Technology Co., Ltd., was established in 2015 as a prominent provider of 3D solutions. We specialize in offering cutting-edge 3D scanning devices. Our mission is to deliver professional-grade and user-friendly scanners, empowering individuals to craft their immersive 3D world. With a dedicated team exceeding 100 R&D experts, we have independently developed industry-leading software algorithms, including the multi-spectral projection system, visual tracking, no-marking registration algorithm, and automatic model processing. 3DMakerpro is committed to pioneering innovation in the realm of 3D technology.

Website: https://store.3dmakerpro.com/

Facebook: https://www.facebook.com/3DMakerProCares

Instagram: https://www.instagram.com/official3dmakerpro

X: https://twitter.com/3DMakerPro

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/3dmakerpro-debuts-eagle-spatial-scanner-at-formnext-2024-announces-sponsorship-of-singapore-centre-for-3d-printing-302317302.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/3dmakerpro-debuts-eagle-spatial-scanner-at-formnext-2024-announces-sponsorship-of-singapore-centre-for-3d-printing-302317302.html

SOURCE 3DMakerpro

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wilks Development Acquires Class-A Office Building One Ridgmar Centre, Plans $9 Million Renovation

The developer adds 177,199 SF building to its expanding portfolio.

FORT WORTH, Texas, Nov. 26, 2024 /PRNewswire/ — Fort Worth-based real estate developer Wilks Development announced the acquisition of One Ridgmar Centre, a 10-story, 177,199 square feet Class-A office tower in West Fort Worth.

Wilks Development plans to immediately invest $1 million in renovations, with an additional $8 million slated for improvements over the next five years. Initial improvements will focus on the roof and HVAC systems, followed by enhancements to the common areas.

“We are enthusiastic to add One Ridgmar to our portfolio and bring significant upgrades and enhancements that will ensure it meets the evolving needs of current and future tenants,” said Kyle Wilks, President and CEO of Wilks Development.

The property, currently at 68% occupancy—below the average for office buildings in Fort Worth—has already seen a boost in leasing activity. At closing, Wilks Development secured over 30,000 square feet of new leases. Among the new tenants is Fort Worth-based Equify Financial, LLC, a national equipment lender serving the construction, energy, and transportation industries.

“While the building is currently below the city’s average occupancy, we have a proven track record of successfully revitalizing and leasing properties. With our team’s expertise in repositioning assets and our commitment to meaningful improvements, we are confident that One Ridgmar will achieve full occupancy in the near future,” Wilks added.

Built in 1986, One Ridgmar Centre was most recently owned by Holt Lunsford, who purchased it in 2017.

Wilks Development, which is also renovating the historic Fort Worth Public Market and in horizontal construction on Firefly Park in Frisco, owns and operates over 1.6 million square feet of commercial space, encompassing both developed and upcoming projects. Its diverse portfolio spans office, retail, and industrial properties across North and West Texas, Oklahoma, and Pennsylvania, along with several multifamily and hospitality assets.

About Wilks Development

Wilks Development is a visionary leader in Texas real estate development and investment, committed to creating exceptional spaces that enrich the lives of communities. Founded in 2012 by brothers and third-generation masons Kyle and Josh Wilks, along with their cousin Jess Green, Wilks Development has built a diverse portfolio that includes sturdy stone storefronts, vibrant multi-family communities, sleek commercial offices, and thriving, walkable neighborhoods.

As an intentional and innovative company, Wilks Development continues to pioneer with a focus on sustainable growth and community enhancement, ensuring that every project contributes positively to the areas it serves. For more information about Wilks Development, visit our website at wilksdevelopment.com or follow us on LinkedIn, Facebook, and Instagram at @wilksdevelopment.

Contact: Nicole Ellis, Wilks Development

Telephone: 817-720-0821 or 209-327-6343

Email: nicole.ellis@wilksdevelopment.com

![]() View original content:https://www.prnewswire.com/news-releases/wilks-development-acquires-class-a-office-building-one-ridgmar-centre-plans-9-million-renovation-302316719.html

View original content:https://www.prnewswire.com/news-releases/wilks-development-acquires-class-a-office-building-one-ridgmar-centre-plans-9-million-renovation-302316719.html

SOURCE Wilks Development

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Immunovia Publishes Interim Report for January-September 2024

LUND, Sweden, Nov. 27, 2024 /PRNewswire/ —

July-September 2024

- Net sales, which for the quarter only included royalties, amounted to 235 KSEK (488).

- Net earnings amounted to -51.1 MSEK (-38.6).

- Earnings per share before and after dilution were -0.73 SEK (-0.91).

- Cash flow from operating activities amounted to -21.2 MSEK (-35.6).

- Cash and cash equivalents at end of period amounted to 54.2 MSEK (106.7)

- New lab staffed and fully operational after rapid implementation and validation was announced on July 2.

- Detailed discovery study results for the company’s next-generation early detection test for pancreatic cancer were presented at the PancreasFest 2024 Annual Meeting on July 25.

- Completion of the development of the pancreatic cancer detection test after substantially increasing test accuracy was announced on August 1.

- Filing of a US provisional patent application to protect its next-generation test was announced on August 2.

- Immunovia’s next generation test to be included in a large study of pancreatic cysts funded by the US National Institutes of Health, was announced August 5.

- On August 6 Immunovia announced final terms of rights issue and on August 12 the prospectus in connection with forthcoming rights issue was published.

- On September 2 the preliminary outcome off the rights issue was published and on September 3 the final outcome in rights issue was announced.

- On September 12 Immunovia carried out a directed issue of units to guarantors in connection with the completed rights issue.

- Data from the model development study was presented at the 2024 AACR Advances in Pancreatic Cancer medical conference, which was announced on September 16.

- On September 30 the company informed on the change in number of shares and votes in Immunovia AB.

Significant events after the period

- October 2 the company informed that the company has completed the analytical validation of its next-generation test designed to detect early-stage pancreatic cancer, which demonstrated excellent results, reinforcing the reliability and robustness of the test.

- The successful acquisition of all blood samples required to clinically validate its next-generation test for pancreatic cancer was announced on October 6.

- On the November 7 Immunovia presented an update from the model development study on its next-generation test at the annual meeting of the PRECEDE Consortium, a collaboration of 51 pancreatic centers worldwide.

- On November 15, the Company presented the model-development study results at a meeting of the Collaborative Group of the Americas—Inherited Gastrointestinal Cancers.

CEO’s comments

ON PLAN FOR A US MARKET INTRODUCTION IN 2025

Q3 marked another quarter of strong performance as we continued to achieve our goals and deliver on milestones. As previously reported, the analytical validation proved our next-generation test to be accurate, stable and precise. The test development will culminate with the clinical validation, which will read out in Q4. Looking ahead to 2025, we will transition from focusing on research and development to commercializing the new test and generating further clinical evidence.

WE ACHIEVED OUR Q3 GOALS AND ARE MAKING EXCELLENT PROGRESS IN Q4

We closed a successful rights issue in which Investors subscribed to over 90% of the units offered, significantly exceeding expectations. This high level of participation enhances our chances for a very successful outcome for our TO2 and TO3 warrants in January and April 2025, respectively. Assuming the same level of participation in the warrants offering as in the rights issue in total would give us more than 12 months of runway and enable us to pursue our 2025 goals, outlined below.

We took important steps to validate the performance of our new test in Q3. Through the analytical validation, we have confirmed the technical performance of our next-generation test in measuring the target proteins. We also obtained blood samples from over 200 pancreatic cancer patients and more than 800 high-risk individuals for the next step: the clinical validation of the test. Securing over a thousand samples on such short timing was possible thanks to our strong relationships with experts at leading pancreatic cancer programs. We were also the first diagnostics company to receive blood samples from the PRECEDE Consortium.

Clinical validation is our key focus in Q4. The study is well underway, with our lab team in Research Triangle Park, North Carolina, analyzing hundreds of samples. We expect to complete the study and announce results in December 2024.

OUR PLAN FOR 2025 IS CLEAR AND FOCUSED

Looking forward to 2025, we will focus on the following goals:

- Execute on a targeted introduction of the next-generation test in the US.

- Complete additional clinical studies needed to secure reimbursement.

- Secure a strategic partner at the appropriate time to expand commercial reach and accelerate market penetration.

- Ensure sufficient resources for the targeted launch and additional clinical studies.

We will execute a targeted launch of the next-generation test in the second half of 2025. We expect to conduct a targeted launch of the next-generation test in the United States in the second half of 2025. The test will be launched as a lab-developed test (LDT) and all samples will be processed at our lab in Research Triangle Park, USA.

Our objective for the initial launch phase is to demonstrate physician and patient demand. The key measure of success will be test adoption and volume at targeted pancreatic centers. This will support our efforts to secure a strategic partner. It will also bolster our reimbursement efforts as payers want to see evidence that clinicians are using the test.

We expect reimbursement of the test to come in 2026 after payer review of published clinical study results. At launch, we will likely pursue a patient-pay model in which patients will be asked to pay a portion of the normal cost of the test.

Since revenue per test will be very limited in 2025, we will pursue a targeted, limited scale, cost-effective launch. Immunovia will employ a small sales team focused on the top high-risk surveillance programs for pancreatic cancer. Their goal will be to drive trial and adoption of the test at these expert centers, creating advocacy among the key opinion leaders in pancreatic cancer. We expect the broader selling effort to be executed later by a strategic partner, deploying a much larger sales team to expand reach and drive volume among pancreatologists, interventional endoscopists, gastroenterologists and genetic counselors.

We will conduct additional clinical studies required by US payers. We will conduct two additional clinical validity studies in the high-risk hereditary patient population in the first half of 2025. We will then investigate additional high-risk groups, including individuals with new-onset diabetes, chronic pancreatitis, and pancreatic cysts. Fortunately, we expect to conduct this clinical program quickly and at a reasonable cost by utilizing Immunovia biobank samples, plus samples from pancreatic cancer centers where we have strong relationships. Further, as announced in August 2024, Immunovia’s next-generation test will be studied as part of a National Institutes of Health (US) clinical program in pancreatic cyst patients.

We will pursue a strategic partner to drive commercialization of the test. Lessons from the IMMray PanCan-d launch made it clear we need a strategic partner to help commercialize our next-generation test. Partnering with a diagnostics company with a large sales force will enable us to drive more test volume, sooner and at a lower cost. Over the last 18 months, we have established relationships with more than a dozen promising prospective partners, holding regular update meetings. After successful completion of the clinical validation study we will share study results with them.

We will be intentional about the timing of any partnership. We will develop the product and clinical portfolio far enough to secure attractive terms. We will diligently pursue a strategic partner in the coming quarters and strike an agreement when timing is optimal.

We are well positioned to fund activities for the next twelve months and will strategically manage capital needs. In 2025 we will shift spending from research and product development to clinical studies and a targeted introduction of the test in the US. We will strategically evaluate the optimal timing and vehicles to fund these operating expenses beyond the next twelve months.

The Immunovia team is committed to rewarding our shareholders. I want to emphasize how committed we are as a team to seeing Immunovia succeed. This is a passionate, dedicated, resilient group of people and I’m incredibly proud to see their hard work paying off. I believe deeply in what we are doing. As evidence of my belief and engagement, I purchased 1,470,588 units in the rights issue, 140 percent of my pro rata share of the issue.

I welcome your input and feedback on how we achieve our goals and deliver value for shareholders. Contact me at info@immunovia.com with questions or suggestions. Also, please follow and connect with us on LinkedIn https://www.linkedin.com/company/immunovia-ab/. This platform provides an excellent opportunity for me to share information with you beyond our quarterly reports and press releases.

November 27, 2024

Jeff Borcherding, CEO and President

Immunovia AB

For more information, please contact:

Jeff Borcherding

CEO and President

jeff.borcherding@immunovia.com

Karin Almqvist Liwendahl

Chief Financial Officer

karin.almqvist.liwendahl@immunovia.com

+46 70 911 56 08

The information in this report is information that Immunovia AB is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out above, at 08:30 am CET on November 27, 2024.

Conference call

Immunovia will hold a webcast tele conference at 15:00 pm CET on November 27 with President and CEO Jeff Borcherding and CFO Karin Almqwist Liwendahl.

To take part of the presentation, please dial one of the numbers or watch via the web link below.

Sweden: +46 8 5051 0031

United Kingdom: +44 207 107 06 13

United States: +1 631 570 56 13

Link to the webcast: https://access.creomediamanager.com/registration/0cb413c2-e586-432a-8ccd-449b18e56ee0?ref=https%3A%2F%2Fcreo-live.creomediamanager.com%2F0cb413c2-e586-432a-8ccd-449b18e56ee0

Immunovia in brief

Immunovia AB is a diagnostic company whose mission is to increase survival rates for patients with pancreatic cancer through early detection. Immunovia is focused on the development and commercialization of simple blood-based testing to detect proteins and antibodies that indicate a high-risk individual has developed pancreatic cancer.

Immunovia collaborates and engages with healthcare providers, leading experts and patient advocacy groups to make its test available to individuals at increased risk for pancreatic cancer.

USA is the world’s largest market for detection of pancreatic cancer. The company estimates that in the USA, 1.8 million individuals are at high-risk for pancreatic cancer and could benefit from annual surveillance testing.

Immunovia’s shares (IMMNOV) are listed on Nasdaq Stockholm. For more information, please visit www.immunovia.com

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/immunovia-publishes-interim-report-for-january-september-2024-302317296.html

View original content:https://www.prnewswire.com/news-releases/immunovia-publishes-interim-report-for-january-september-2024-302317296.html

SOURCE Immunovia AB

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.