3DMakerpro Debuts Eagle Spatial Scanner at Formnext 2024, Announces Sponsorship of Singapore Centre for 3D Printing

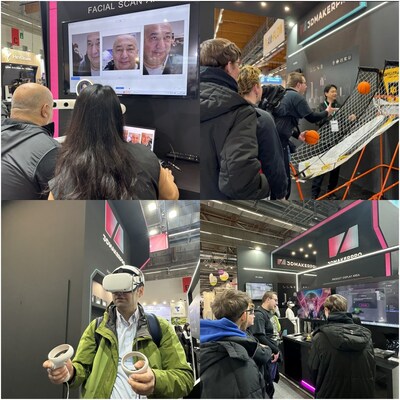

FRANKFURT, Germany, Nov. 27, 2024 /PRNewswire/ — 3DMakerpro, a trailblazer in consumer-friendly 3D scanning technology, made a remarkable impression at Formnext 2024, the leading international trade fair for Additive Manufacturing and industrial 3D Printing, held from November 19-22. At the event, 3DMakerpro unveiled its latest innovation, the Eagle spatial scanner, which captivated attendees with its cutting-edge features.

The Eagle is designed to capture 3D data of spaces and rooms. It offers a seamless blend of consumer-grade technology that integrates LiDAR and image sensors. Equipped with a built-in battery, this cutting-edge product is a versatile tool for a wide range of applications such as reverse engineering, digital twinning, extended reality (XR), high-precision mapping, and 3D printing. The Eagle is anticipated to hit the market in December, promising to set new standards in spatial scanning technology.

At Formnext 2024, 3DMakerpro products’ capabilities were dynamically showcased. Jonathan Levi, the founder of The Next Layer, a content creation platform specializing in 3D printing and 3D modelling, conducted live scanning demonstrations with 3DMakerpro Moose 3D Scanner. These demonstrations offered attendees a firsthand experience of Moose’s impressive functionality.

Adding to the event’s intellectual appeal, Professor Paulo Bartolo from Nanyang Technological University, Singapore (NTU Singapore), who is also the Executive Director of Singapore Centre for 3D Printing (SC3DP), delivered insightful talks, highlighting the transformative potential of 3D scanning technology.

3DMakerpro also curated various engaging activities designed to captivate and involve visitors. These include 3D scanning demonstrations, immersive VR experiences, and facial scanning experiences, turning its exhibition booth into a hub of activity and innovation.

In addition to showcasing its groundbreaking technology, at the Makers Night – 3DMakerpro VIP Gala held on November 20 in Frankfurt, 3DMakerpro signed a partnership agreement with NTU Singapore and announced an exciting new sponsorship for the SC3DP. The SC3DP is a premier research institution funded by the National Research Foundation, and supported by NTU Singapore, Economic Development Board, and industry partners. The centre is dedicated to advancing additive manufacturing technologies and promoting their adoption across industries.

This strategic partnership emphasizes the transformative role of 3D scanning in education, reverse engineering, and healthcare. By offering workshops and training, 3DMakerpro and SC3DP aim to integrate advanced scanning technologies into academic and professional settings, fostering innovation and practical applications in industrial and medical fields through demonstration projects and real-world case studies.

About 3DMakerpro

3DMakerpro, a distinguished overseas brand under Shenzhen Jimuyida Technology Co., Ltd., was established in 2015 as a prominent provider of 3D solutions. We specialize in offering cutting-edge 3D scanning devices. Our mission is to deliver professional-grade and user-friendly scanners, empowering individuals to craft their immersive 3D world. With a dedicated team exceeding 100 R&D experts, we have independently developed industry-leading software algorithms, including the multi-spectral projection system, visual tracking, no-marking registration algorithm, and automatic model processing. 3DMakerpro is committed to pioneering innovation in the realm of 3D technology.

Website: https://store.3dmakerpro.com/

Facebook: https://www.facebook.com/3DMakerProCares

Instagram: https://www.instagram.com/official3dmakerpro

X: https://twitter.com/3DMakerPro

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/3dmakerpro-debuts-eagle-spatial-scanner-at-formnext-2024-announces-sponsorship-of-singapore-centre-for-3d-printing-302317302.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/3dmakerpro-debuts-eagle-spatial-scanner-at-formnext-2024-announces-sponsorship-of-singapore-centre-for-3d-printing-302317302.html

SOURCE 3DMakerpro

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wilks Development Acquires Class-A Office Building One Ridgmar Centre, Plans $9 Million Renovation

The developer adds 177,199 SF building to its expanding portfolio.

FORT WORTH, Texas, Nov. 26, 2024 /PRNewswire/ — Fort Worth-based real estate developer Wilks Development announced the acquisition of One Ridgmar Centre, a 10-story, 177,199 square feet Class-A office tower in West Fort Worth.

Wilks Development plans to immediately invest $1 million in renovations, with an additional $8 million slated for improvements over the next five years. Initial improvements will focus on the roof and HVAC systems, followed by enhancements to the common areas.

“We are enthusiastic to add One Ridgmar to our portfolio and bring significant upgrades and enhancements that will ensure it meets the evolving needs of current and future tenants,” said Kyle Wilks, President and CEO of Wilks Development.

The property, currently at 68% occupancy—below the average for office buildings in Fort Worth—has already seen a boost in leasing activity. At closing, Wilks Development secured over 30,000 square feet of new leases. Among the new tenants is Fort Worth-based Equify Financial, LLC, a national equipment lender serving the construction, energy, and transportation industries.

“While the building is currently below the city’s average occupancy, we have a proven track record of successfully revitalizing and leasing properties. With our team’s expertise in repositioning assets and our commitment to meaningful improvements, we are confident that One Ridgmar will achieve full occupancy in the near future,” Wilks added.

Built in 1986, One Ridgmar Centre was most recently owned by Holt Lunsford, who purchased it in 2017.

Wilks Development, which is also renovating the historic Fort Worth Public Market and in horizontal construction on Firefly Park in Frisco, owns and operates over 1.6 million square feet of commercial space, encompassing both developed and upcoming projects. Its diverse portfolio spans office, retail, and industrial properties across North and West Texas, Oklahoma, and Pennsylvania, along with several multifamily and hospitality assets.

About Wilks Development

Wilks Development is a visionary leader in Texas real estate development and investment, committed to creating exceptional spaces that enrich the lives of communities. Founded in 2012 by brothers and third-generation masons Kyle and Josh Wilks, along with their cousin Jess Green, Wilks Development has built a diverse portfolio that includes sturdy stone storefronts, vibrant multi-family communities, sleek commercial offices, and thriving, walkable neighborhoods.

As an intentional and innovative company, Wilks Development continues to pioneer with a focus on sustainable growth and community enhancement, ensuring that every project contributes positively to the areas it serves. For more information about Wilks Development, visit our website at wilksdevelopment.com or follow us on LinkedIn, Facebook, and Instagram at @wilksdevelopment.

Contact: Nicole Ellis, Wilks Development

Telephone: 817-720-0821 or 209-327-6343

Email: nicole.ellis@wilksdevelopment.com

![]() View original content:https://www.prnewswire.com/news-releases/wilks-development-acquires-class-a-office-building-one-ridgmar-centre-plans-9-million-renovation-302316719.html

View original content:https://www.prnewswire.com/news-releases/wilks-development-acquires-class-a-office-building-one-ridgmar-centre-plans-9-million-renovation-302316719.html

SOURCE Wilks Development

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Immunovia Publishes Interim Report for January-September 2024

LUND, Sweden, Nov. 27, 2024 /PRNewswire/ —

July-September 2024

- Net sales, which for the quarter only included royalties, amounted to 235 KSEK (488).

- Net earnings amounted to -51.1 MSEK (-38.6).

- Earnings per share before and after dilution were -0.73 SEK (-0.91).

- Cash flow from operating activities amounted to -21.2 MSEK (-35.6).

- Cash and cash equivalents at end of period amounted to 54.2 MSEK (106.7)

- New lab staffed and fully operational after rapid implementation and validation was announced on July 2.

- Detailed discovery study results for the company’s next-generation early detection test for pancreatic cancer were presented at the PancreasFest 2024 Annual Meeting on July 25.

- Completion of the development of the pancreatic cancer detection test after substantially increasing test accuracy was announced on August 1.

- Filing of a US provisional patent application to protect its next-generation test was announced on August 2.

- Immunovia’s next generation test to be included in a large study of pancreatic cysts funded by the US National Institutes of Health, was announced August 5.

- On August 6 Immunovia announced final terms of rights issue and on August 12 the prospectus in connection with forthcoming rights issue was published.

- On September 2 the preliminary outcome off the rights issue was published and on September 3 the final outcome in rights issue was announced.

- On September 12 Immunovia carried out a directed issue of units to guarantors in connection with the completed rights issue.

- Data from the model development study was presented at the 2024 AACR Advances in Pancreatic Cancer medical conference, which was announced on September 16.

- On September 30 the company informed on the change in number of shares and votes in Immunovia AB.

Significant events after the period

- October 2 the company informed that the company has completed the analytical validation of its next-generation test designed to detect early-stage pancreatic cancer, which demonstrated excellent results, reinforcing the reliability and robustness of the test.

- The successful acquisition of all blood samples required to clinically validate its next-generation test for pancreatic cancer was announced on October 6.

- On the November 7 Immunovia presented an update from the model development study on its next-generation test at the annual meeting of the PRECEDE Consortium, a collaboration of 51 pancreatic centers worldwide.

- On November 15, the Company presented the model-development study results at a meeting of the Collaborative Group of the Americas—Inherited Gastrointestinal Cancers.

CEO’s comments

ON PLAN FOR A US MARKET INTRODUCTION IN 2025

Q3 marked another quarter of strong performance as we continued to achieve our goals and deliver on milestones. As previously reported, the analytical validation proved our next-generation test to be accurate, stable and precise. The test development will culminate with the clinical validation, which will read out in Q4. Looking ahead to 2025, we will transition from focusing on research and development to commercializing the new test and generating further clinical evidence.

WE ACHIEVED OUR Q3 GOALS AND ARE MAKING EXCELLENT PROGRESS IN Q4

We closed a successful rights issue in which Investors subscribed to over 90% of the units offered, significantly exceeding expectations. This high level of participation enhances our chances for a very successful outcome for our TO2 and TO3 warrants in January and April 2025, respectively. Assuming the same level of participation in the warrants offering as in the rights issue in total would give us more than 12 months of runway and enable us to pursue our 2025 goals, outlined below.

We took important steps to validate the performance of our new test in Q3. Through the analytical validation, we have confirmed the technical performance of our next-generation test in measuring the target proteins. We also obtained blood samples from over 200 pancreatic cancer patients and more than 800 high-risk individuals for the next step: the clinical validation of the test. Securing over a thousand samples on such short timing was possible thanks to our strong relationships with experts at leading pancreatic cancer programs. We were also the first diagnostics company to receive blood samples from the PRECEDE Consortium.

Clinical validation is our key focus in Q4. The study is well underway, with our lab team in Research Triangle Park, North Carolina, analyzing hundreds of samples. We expect to complete the study and announce results in December 2024.

OUR PLAN FOR 2025 IS CLEAR AND FOCUSED

Looking forward to 2025, we will focus on the following goals:

- Execute on a targeted introduction of the next-generation test in the US.

- Complete additional clinical studies needed to secure reimbursement.

- Secure a strategic partner at the appropriate time to expand commercial reach and accelerate market penetration.

- Ensure sufficient resources for the targeted launch and additional clinical studies.

We will execute a targeted launch of the next-generation test in the second half of 2025. We expect to conduct a targeted launch of the next-generation test in the United States in the second half of 2025. The test will be launched as a lab-developed test (LDT) and all samples will be processed at our lab in Research Triangle Park, USA.

Our objective for the initial launch phase is to demonstrate physician and patient demand. The key measure of success will be test adoption and volume at targeted pancreatic centers. This will support our efforts to secure a strategic partner. It will also bolster our reimbursement efforts as payers want to see evidence that clinicians are using the test.

We expect reimbursement of the test to come in 2026 after payer review of published clinical study results. At launch, we will likely pursue a patient-pay model in which patients will be asked to pay a portion of the normal cost of the test.

Since revenue per test will be very limited in 2025, we will pursue a targeted, limited scale, cost-effective launch. Immunovia will employ a small sales team focused on the top high-risk surveillance programs for pancreatic cancer. Their goal will be to drive trial and adoption of the test at these expert centers, creating advocacy among the key opinion leaders in pancreatic cancer. We expect the broader selling effort to be executed later by a strategic partner, deploying a much larger sales team to expand reach and drive volume among pancreatologists, interventional endoscopists, gastroenterologists and genetic counselors.

We will conduct additional clinical studies required by US payers. We will conduct two additional clinical validity studies in the high-risk hereditary patient population in the first half of 2025. We will then investigate additional high-risk groups, including individuals with new-onset diabetes, chronic pancreatitis, and pancreatic cysts. Fortunately, we expect to conduct this clinical program quickly and at a reasonable cost by utilizing Immunovia biobank samples, plus samples from pancreatic cancer centers where we have strong relationships. Further, as announced in August 2024, Immunovia’s next-generation test will be studied as part of a National Institutes of Health (US) clinical program in pancreatic cyst patients.

We will pursue a strategic partner to drive commercialization of the test. Lessons from the IMMray PanCan-d launch made it clear we need a strategic partner to help commercialize our next-generation test. Partnering with a diagnostics company with a large sales force will enable us to drive more test volume, sooner and at a lower cost. Over the last 18 months, we have established relationships with more than a dozen promising prospective partners, holding regular update meetings. After successful completion of the clinical validation study we will share study results with them.

We will be intentional about the timing of any partnership. We will develop the product and clinical portfolio far enough to secure attractive terms. We will diligently pursue a strategic partner in the coming quarters and strike an agreement when timing is optimal.

We are well positioned to fund activities for the next twelve months and will strategically manage capital needs. In 2025 we will shift spending from research and product development to clinical studies and a targeted introduction of the test in the US. We will strategically evaluate the optimal timing and vehicles to fund these operating expenses beyond the next twelve months.

The Immunovia team is committed to rewarding our shareholders. I want to emphasize how committed we are as a team to seeing Immunovia succeed. This is a passionate, dedicated, resilient group of people and I’m incredibly proud to see their hard work paying off. I believe deeply in what we are doing. As evidence of my belief and engagement, I purchased 1,470,588 units in the rights issue, 140 percent of my pro rata share of the issue.

I welcome your input and feedback on how we achieve our goals and deliver value for shareholders. Contact me at info@immunovia.com with questions or suggestions. Also, please follow and connect with us on LinkedIn https://www.linkedin.com/company/immunovia-ab/. This platform provides an excellent opportunity for me to share information with you beyond our quarterly reports and press releases.

November 27, 2024

Jeff Borcherding, CEO and President

Immunovia AB

For more information, please contact:

Jeff Borcherding

CEO and President

jeff.borcherding@immunovia.com

Karin Almqvist Liwendahl

Chief Financial Officer

karin.almqvist.liwendahl@immunovia.com

+46 70 911 56 08

The information in this report is information that Immunovia AB is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out above, at 08:30 am CET on November 27, 2024.

Conference call

Immunovia will hold a webcast tele conference at 15:00 pm CET on November 27 with President and CEO Jeff Borcherding and CFO Karin Almqwist Liwendahl.

To take part of the presentation, please dial one of the numbers or watch via the web link below.

Sweden: +46 8 5051 0031

United Kingdom: +44 207 107 06 13

United States: +1 631 570 56 13

Link to the webcast: https://access.creomediamanager.com/registration/0cb413c2-e586-432a-8ccd-449b18e56ee0?ref=https%3A%2F%2Fcreo-live.creomediamanager.com%2F0cb413c2-e586-432a-8ccd-449b18e56ee0

Immunovia in brief

Immunovia AB is a diagnostic company whose mission is to increase survival rates for patients with pancreatic cancer through early detection. Immunovia is focused on the development and commercialization of simple blood-based testing to detect proteins and antibodies that indicate a high-risk individual has developed pancreatic cancer.

Immunovia collaborates and engages with healthcare providers, leading experts and patient advocacy groups to make its test available to individuals at increased risk for pancreatic cancer.

USA is the world’s largest market for detection of pancreatic cancer. The company estimates that in the USA, 1.8 million individuals are at high-risk for pancreatic cancer and could benefit from annual surveillance testing.

Immunovia’s shares (IMMNOV) are listed on Nasdaq Stockholm. For more information, please visit www.immunovia.com

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/immunovia-publishes-interim-report-for-january-september-2024-302317296.html

View original content:https://www.prnewswire.com/news-releases/immunovia-publishes-interim-report-for-january-september-2024-302317296.html

SOURCE Immunovia AB

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

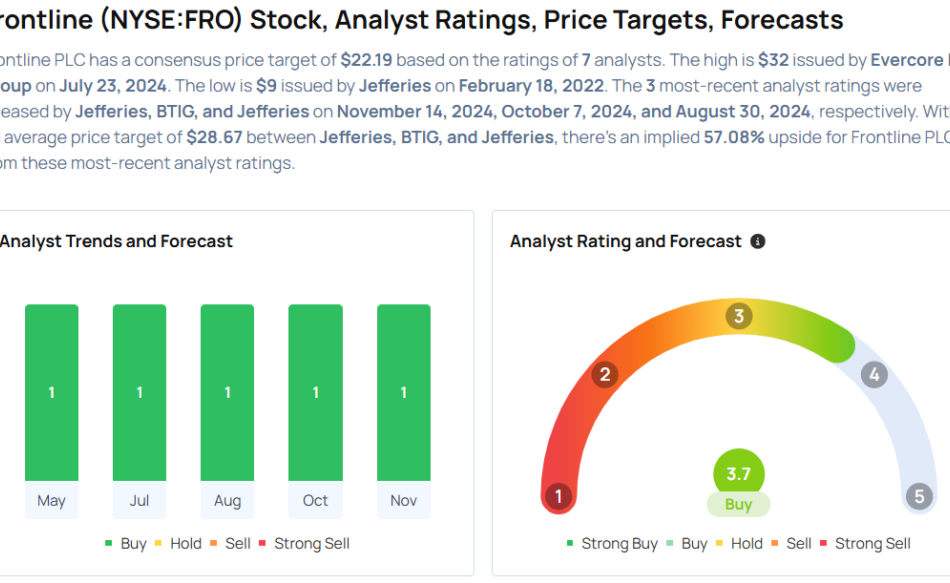

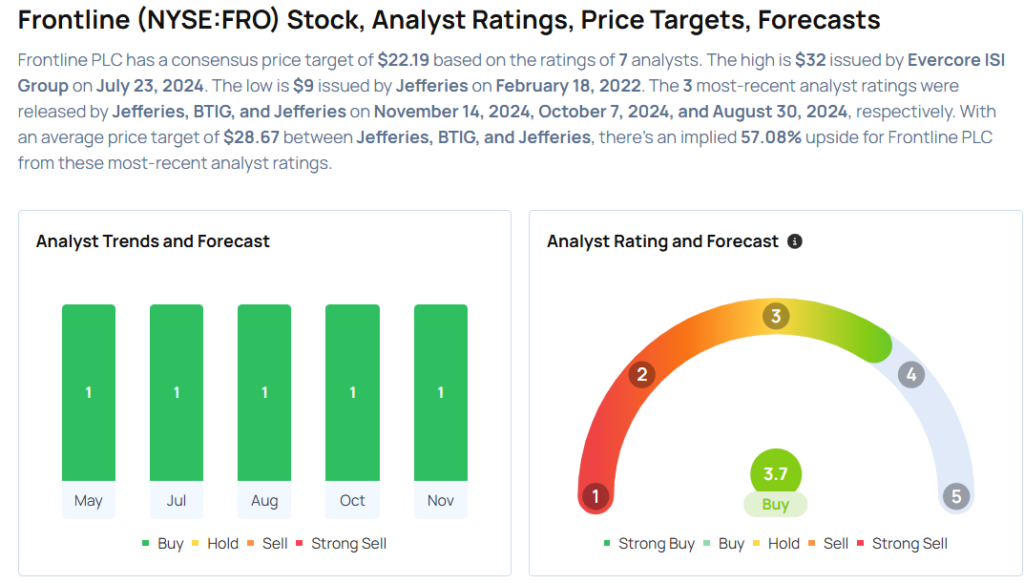

Frontline Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Frontline plc FRO will release earnings results for the third quarter, before the opening bell on Wednesday, Nov. 27.

Analysts expect Frontline to report quarterly earnings at 38 cents per share. That’s up from 36 cents per share a year ago. The Limassol, Cyprus-based company projects to report quarterly revenue of $317.59 million, compared to $232.03 million a year earlier, according to data from Benzinga Pro.

On Aug. 30, Frontline reported better-than-expected second-quarter sales results.

Frontline shares fell 5% to close at $18.07 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Jefferies analyst Omar Nokta maintained a Buy rating and cut the price target from $30 to $26 on Nov. 14. This analyst has an accuracy rate of 70%.

- BTIG analyst Gregory Lewis upgraded the stock from Neutral to Buy with a price target of $30 on Oct. 7. This analyst has an accuracy rate of 76%.

- Evercore ISI Group analyst Jonathan Chappell maintained an Outperform rating and cut the price target from $33 to $32 on July 23. This analyst has an accuracy rate of 70%.

- JP Morgan analyst Samuel Bland maintained a Neutral rating and cut the price target from $23 to $22.3 on March 1. This analyst has an accuracy rate of 72%.

- Deutsche Bank analyst Amit Mehrotra upgraded the stock from Hold to Buy with a price target of $26 on Jan. 9. This analyst has an accuracy rate of 72%.

Considering buying FRO stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

HP, CrowdStrike And 3 Stocks To Watch Heading Into Wednesday

With U.S. stock futures trading mixed this morning on Wednesday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Frontline Plc. FRO to report quarterly earnings at 45 cents per share on revenue of $361.42 million before the opening bell, according to data from Benzinga Pro. Frontline shares rose 1.1% to $18.26 in after-hours trading.

- HP Inc. HPQ reported in-line earnings for its fourth quarter, while sales topped estimates. HP said it expects first-quarter adjusted earnings of between 70 cents and 76 cents per share, versus the 85 cent estimate, and fiscal 2025 earnings of between $3.45 and $3.75 per share, versus the $3.60 estimate. HP shares fell 7.4% to $36.19 in the after-hours trading session.

- Analysts are expecting Golden Ocean Group Limited GOGL to post quarterly earnings at 32 cents per share on revenue of $195.75 million. The company will release earnings before the markets open. Golden Ocean shares gained 0.4% to $10.90 in after-hours trading.

Check out our premarket coverage here

- Dell Technologies Inc. DELL reported better-than-expected earnings for its third quarter, while sales missed estimates. The company reported quarterly earnings of $2.15 per share, which beat the analyst consensus estimate of $2.05. Quarterly revenue came in at $24.37 billion, which missed the consensus estimate of $24.65 billion and is an increase over revenue of $22.25 billion from the same period last year. Dell shares tumbled 11.3% to $125.75 in the after-hours trading session.

- CrowdStrike Holdings Inc CRWD posted upbeat results for its third quarter. The company said it expects fourth-quarter revenue to be between $1.029 billion and $1.035 billion versus estimates of $1.03 billion. The company anticipates fourth-quarter adjusted earnings of 84 cents to 86 cents per share versus estimates of 86 cents per share. CrowdStrike shares fell 5.7% to $343.38 in the after-hours trading session.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Could Surge To $500K Amid DeFi Boom, Trump's Pledge To Establish A BTC Strategic Reserve, Says Cardano Founder Charles Hoskinson

Cardano ADA/USD founder Charles Hoskinson, a co-founder of Ethereum ETH/USD, predicted Bitcoin BTC/USD could surge to between $250,000 and $500,000 within the next 12 to 24 months, citing growing institutional investment and emerging decentralized finance opportunities.

What Happened: In a recent livestream from Colorado, Hoskinson emphasized Bitcoin’s transformative potential, describing it as more than just a cryptocurrency but a strategic asset for governments and institutions worldwide.

Hoskinson has deep roots in the cryptocurrency ecosystem and highlighted Bitcoin’s evolution from a “dormant project” to a potentially revolutionary financial technology.

The cryptocurrency veteran believes Bitcoin’s ecosystem could experience unprecedented growth, particularly with the development of DeFi layers that could dramatically expand its utility.

He stated that “governments are considering Bitcoin as a strategic reserve asset,” drawing a parallel to gold’s historical role as a store of value. Hoskinson predicted that “Bitcoin-based DeFi will surpass all other ecosystems within 24 to 36 months.”

In a keynote speech at a Bitcoin conference in Nashville, Tennessee, this past July, President-elect Donald Trump pledged to establish the United States as the “crypto capital of the planet” and indicated plans to create a Bitcoin strategic reserve utilizing the cryptocurrency held by the government.

See Also: Crypto’s Next Mega-Rocket? Analyst Forecasts Insane 2725%-6600% Surge For This Coin

Why It Matters: The prediction comes amid a volatile cryptocurrency landscape. Recent data shows Bitcoin experiencing significant price fluctuations, with long-term holders offloading 728,000 coins in the past 30 days—the largest sell-off since April.

Despite short-term volatility, market analysts remain cautiously optimistic. Haider Rafique, Global Chief Marketing Officer at OKX exchange, noted the significant profit potential for investors, with the average holding price around $30,000.

While bullish on Bitcoin, Hoskinson remains committed to Cardano’s role in the broader cryptocurrency ecosystem. He positioned Cardano as a “spiritual successor to Bitcoin” and emphasized the importance of creating hybrid applications that integrate Bitcoin functionality, showcasing his continued innovation in the blockchain space.

Price Action: Bitcoin the leading cryptocurrency by market capitalization, is currently trading at $93,201.11. The price has risen by 1.74% over the past 24 hours and 0.63% over the last seven days, according to Benzinga Pro data.

Read Next:

Image via Pexels

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analysis-Investors cling to crash protection despite sizzling US stock market rally

By Saqib Iqbal Ahmed

NEW YORK (Reuters) – Demand for options protection against an equity market crash is rising, even as a post-election rally takes U.S. stocks to record highs.

Worries over the possibility of a contested election dissipated following President-elect Donald Trump’s victory earlier this month, helping the S&P 500 climb to an all-time high. The Cboe Volatility Index, one measure of investor anxiety, closed near a post-election low of 14.10 on Tuesday.

But several barometers gauging uptake for protection against extreme market swings – such as the Nations TailDex Index and Cboe Skew – are picking up. While the rise in these indexes does not necessarily mean investors expect catastrophic events, they suggest elevated caution in the face of several weighty risks, including the potential of an inflationary snap-back to ructions in global trade next year.

One such risk came to the fore late on Monday, when Trump pledged big tariffs on Canada, Mexico and China – detailing how he will implement campaign promises that could trigger trade wars.

Though U.S. stocks largely shrugged off the comments, Trump’s broadside evoked flashbacks to the trade-fueled market swings that took place during his first term, bolstering the case for portfolio hedging.

Amy Wu Silverman, RBC Capital Markets head of derivatives strategy, said investors are guarding against so-called fat tail risks, options parlance for higher expected probabilities of extreme market moves.

“While investors broadly remain long equities, the tails are fatter,” she said. “This is partly from a rise in geopolitical risk premium and certainly potential policy risk as Trump returns to the presidency and potentially enacts tariffs and other measures.”

The Nations TailDex Index, an options-based index that measures the cost of hedging against an outsized move in the SPDR S&P 500 ETF Trust, has risen to 13.64, double its post-election low of 6.68. The index is higher now than it has been about 70% of the time over the past year.

Cboe Skew index, another index that indicates the market’s perception of the likelihood of extreme price movements, on Monday closed at a two-month high of 167.28.

VIX call options, which offer protection against a market sell-off, also shows some of this demand to protect against “tail risks.” VIX three-month call skew – a barometer of the strength of demand for these contracts – is hovering near the highest level in over five years, according to an analysis by Susquehanna Financial Group.

“The general idea is there is an 80-95% chance of pretty low volatility, that’s why the VIX is relatively low, but there’s just more of a tail event being factored in,” said Chris Murphy, co-head of derivative strategy at Susquehanna.

Dow, S&P 500 Settle At Record Highs, Best Buy Reports Weaker Than Expected Earnings: Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed a slight improvement in the overall market sentiment, while the index remained in the “Greed” zone on Tuesday.

U.S. stocks settled higher on Tuesday, with the Dow Jones index and S&P 500 surging to fresh record levels during the session.

Dick’s Sporting Goods Inc. DKS reported upbeat earnings for its third quarter. Kohl’s Corporation KSS reported worse-than-expected third-quarter results, cut its FY24 EPS guidance, and projected a net sales decrease of 7%-8%. Best Buy Co., Inc BBY reported weaker-than-expected earnings for its fiscal 2025 third quarter.

On the economic data front, the S&P CoreLogic Case-Shiller home price index rose 4.6% year-over-year in September versus a 5.2% increase in August. Sales of new single-family homes in the U.S. dipped by 17.3% to an annualized rate of 610,000 in October.

Most sectors on the S&P 500 closed on a positive note, with utilities, communication services, and consumer discretionary stocks recording the biggest gains on Tuesday. However, energy and materials stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 124 points to 44,860.31 on Tuesday. The S&P 500 rose 0.57% to 6,021.63, while the Nasdaq Composite rose 0.63% to close at 19,175.58 during Tuesday’s session.

Investors are awaiting earnings results from Frontline plc FRO and Golden Ocean Group Limited GOGL today.

What is CNN Business Fear & Greed Index?

At a current reading of 64.4, the index remained in the “Greed” zone on Tuesday, versus a prior reading of 64.2.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

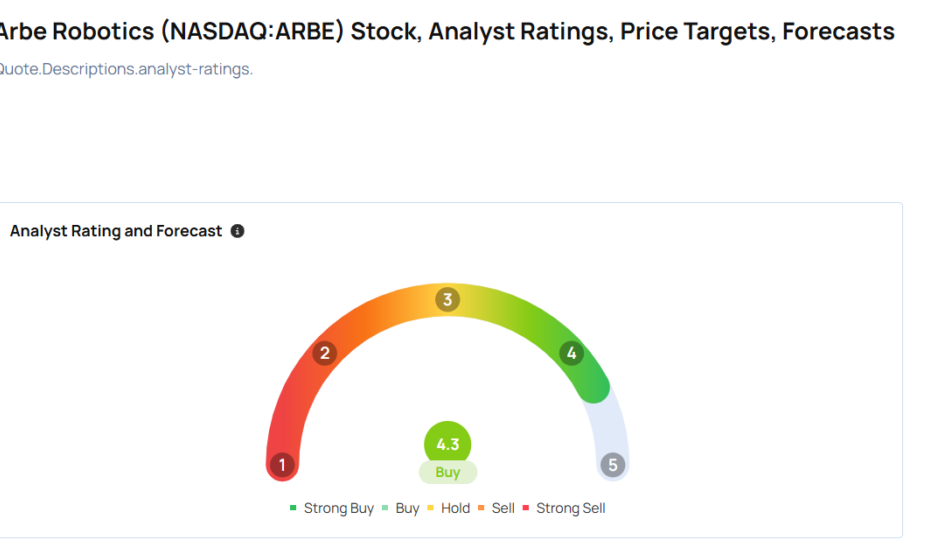

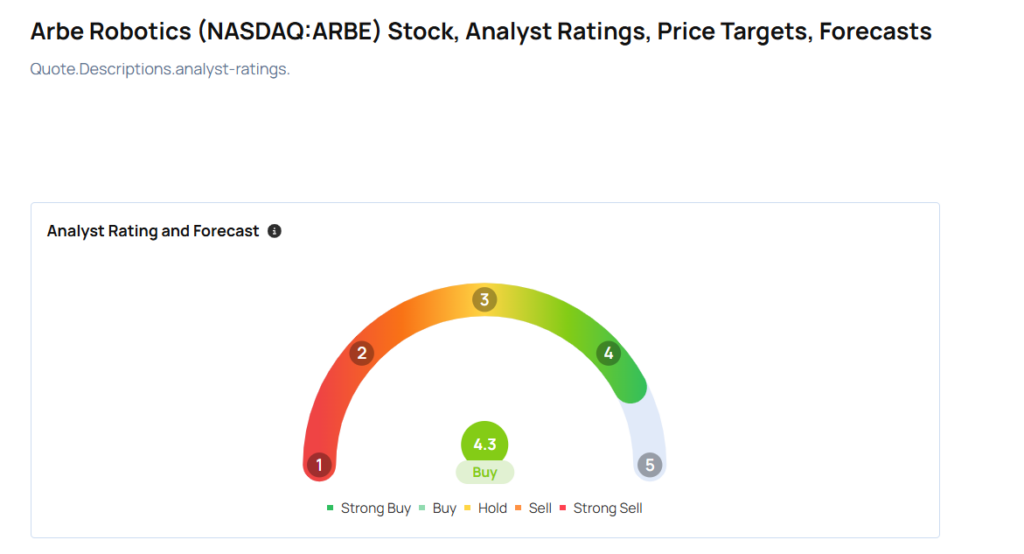

Top Wall Street Forecasters Revamp Arbe Robotics Price Expectations Ahead Of Q3 Earnings

Arbe Robotics Ltd. ARBE will release earnings results for its third quarter, before the opening bell on Wednesday, Nov. 27.

Analysts expect the Tel Aviv-Yafo, Israel-based bank to report a quarterly loss at 11 cents per share, versus a year-ago loss of 10 cents per share. Arbe Robotics projects to report revenue of $450 thousand for the recent quarter, compared to $479 thousand a year earlier, according to data from Benzinga Pro.

On Nov. 4, Arbe Robotics announced the closing of up to $49 million public offering.

Arbe Robotics shares fell 1% to close at $1.91 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Roth MKM analyst Suji Desilva maintained a Buy rating and cut the price target from $4 to $2 on March 8. This analyst has an accuracy rate of 75%.

- Wells Fargo analyst Gary Mobley maintained an Overweight rating and slashed the price target from $5 to $4 on March 8. This analyst has an accuracy rate of 71%.

Considering buying ARBE stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FRO – Third Quarter and Nine Months 2024 Results

FRONTLINE PLC REPORTS RESULTS FOR THE THIRD QUARTER ENDED SEPTEMBER 30, 2024

Frontline plc (the “Company”, “Frontline,” “we,” “us,” or “our”), today reported unaudited results for the three and nine months ended September 30, 2024:

Highlights

- Profit of $60.5 million, or $0.27 per share for the third quarter of 2024.

- Adjusted profit of $75.4 million, or $0.34 per share for the third quarter of 2024.

- Declared a cash dividend of $0.34 per share for the third quarter of 2024.

- Reported revenues of $490.3 million for the third quarter of 2024.

- Achieved average daily spot time charter equivalent earnings (“TCEs”)1 for VLCCs, Suezmax tankers and LR2/Aframax tankers in the third quarter of $39,600, $39,900 and $36,000 per day, respectively.

- Sold its oldest Suezmax tanker, built in 2010, for a net sales price of $48.5 million and delivered the vessel to its new owner in October 2024. The transaction generated net cash proceeds of $36.5 million after repayment of existing debt.

- Fully repaid the shareholder loan with Hemen Holding Limited, the Company’s largest shareholder (“Hemen”) and the $275.0 million senior unsecured revolving credit facility with an affiliate of Hemen for an aggregate amount of $470.0 million in the second, third and fourth quarters of 2024.

- Entered into a sale-and-leaseback agreement in an amount of up to $512.1 million to refinance 10 Suezmax tankers. The refinancing is expected to generate net cash proceeds of approximately $101.0 million in the fourth quarter of 2024.

Lars H. Barstad, Chief Executive Officer of Frontline Management AS, commented:

“The third quarter of 2024 performed in line with seasonal expectations, as oil demand slowed over the summer months and domestic demand by oil exporting countries in the Middle East increased. We continue to sail in a troubled geopolitical landscape and with lower year-on-year demand in Asia, and especially China, the tanker markets have yet to experience the seasonal upswing into winter. The increase in sanctioned oil trade and movement of illicit barrels have negatively impacted our trade environment. However, global oil demand is still growing, and with limited new tanker capacity coming, Frontline continues to profit as we run our cost-efficient operation and modern fleet. It will be interesting to see how the tanker market, including the trade of oil and energy, is impacted by politics as we approach 2025.”

Inger M. Klemp, Chief Financial Officer of Frontline Management AS, added:

“In 2024 we have optimized the capital structure of the Company by refinancing debt of 36 vessels, which has extended maturities and improved margins, divesting eight older vessels and the subsequent repayment of the Hemen shareholder loan and the $275.0 million senior unsecured revolving credit facility with an affiliate of Hemen in an aggregate amount of $470.0 million. We continue to focus on maintaining our competitive cost structure, breakeven levels and solid balance sheet to ensure that we are well positioned to generate significant cash flow and create value for our shareholders.”

Average daily TCEs and estimated cash breakeven rates

| ($ per day) | Spot TCE | Spot TCE currently contracted | % Covered | Estimated average daily cash breakeven rates for the next 12 months | ||||

| 2024 | Q3 2024 | Q2 2024 | Q4 2023 | 2023 | Q4 2024 | 2024 | ||

| VLCC | 45,800 | 39,600 | 49,600 | 42,300 | 50,300 | 44,300 | 77% | 29,600 |

| Suezmax | 43,800 | 39,900 | 45,600 | 45,700 | 52,600 | 39,600 | 70% | 23,400 |

| LR2 / Aframax | 47,800 | 36,000 | 53,100 | 42,900 | 46,800 | 34,800 | 60% | 22,000 |

We expect the spot TCEs for the full fourth quarter of 2024 to be lower than the spot TCEs currently contracted, due to the impact of ballast days during the fourth quarter of 2024. See Appendix 1 for further details.

The Board of Directors

Frontline plc

Limassol, Cyprus

November 26, 2024

Ola Lorentzon – Chairman and Director

John Fredriksen – Director

Ole B. Hjertaker – Director

James O’Shaughnessy – Director

Steen Jakobsen – Director

Cato Stonex – Director

Questions should be directed to:

Lars H. Barstad: Chief Executive Officer, Frontline Management AS

+47 23 11 40 00

Inger M. Klemp: Chief Financial Officer, Frontline Management AS

+47 23 11 40 00

Forward-Looking Statements

Matters discussed in this report may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements, which include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

Frontline plc and its subsidiaries, or the Company, desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. This report and any other written or oral statements made by us or on our behalf may include forward-looking statements, which reflect our current views with respect to future events and financial performance and are not intended to give any assurance as to future results. When used in this document, the words “believe,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “plan,” “potential,” “will,” “may,” “should,” “expect” and similar expressions, terms or phrases may identify forward-looking statements.

The forward-looking statements in this report are based upon various assumptions, including without limitation, management’s examination of historical operating trends, data contained in our records and data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

In addition to these important factors and matters discussed elsewhere herein, important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include:

- the strength of world economies;

- fluctuations in currencies and interest rates, including inflationary pressures and central bank policies intended to combat overall inflation and rising interest rates and foreign exchange rates;

- the impact that any discontinuance, modification or other reform or the establishment of alternative reference rates have on the Company’s floating interest rate debt instruments;

- general market conditions, including fluctuations in charter hire rates and vessel values;

- changes in the supply and demand for vessels comparable to ours and the number of newbuildings under construction;

- the highly cyclical nature of the industry that we operate in;

- the loss of a large customer or significant business relationship;

- changes in worldwide oil production and consumption and storage;

- changes in the Company’s operating expenses, including bunker prices, dry docking, crew costs and insurance costs;

- planned, pending or recent acquisitions, business strategy and expected capital spending or operating expenses, including dry docking, surveys and upgrades;

- risks associated with any future vessel construction;

- our expectations regarding the availability of vessel acquisitions and our ability to complete vessel acquisition transactions as planned;

- our ability to successfully compete for and enter into new time charters or other employment arrangements for our existing vessels after our current time charters expire and our ability to earn income in the spot market;

- availability of financing and refinancing, our ability to obtain financing and comply with the restrictions and other covenants in our financing arrangements;

- availability of skilled crew members and other employees and the related labor costs;

- work stoppages or other labor disruptions by our employees or the employees of other companies in related industries;

- compliance with governmental, tax, environmental and safety regulation, any non-compliance with U.S. or European Union regulations;

- the impact of increasing scrutiny and changing expectations from investors, lenders and other market participants with respect to our ESG policies;

- Foreign Corrupt Practices Act of 1977 or other applicable regulations relating to bribery;

- general economic conditions and conditions in the oil industry;

- effects of new products and new technology in our industry, including the potential for technological innovation to reduce the value of our vessels and charter income derived therefrom;

- new environmental regulations and restrictions, whether at a global level stipulated by the International Maritime Organization, and/or imposed by regional or national authorities such as the European Union or individual countries;

- vessel breakdowns and instances of off-hire;

- the impact of an interruption in or failure of our information technology and communications systems, including the impact of cyber-attacks upon our ability to operate;

- potential conflicts of interest involving members of our board of directors and senior management;

- the failure of counter parties to fully perform their contracts with us;

- changes in credit risk with respect to our counterparties on contracts;

- our dependence on key personnel and our ability to attract, retain and motivate key employees;

- adequacy of insurance coverage;

- our ability to obtain indemnities from customers;

- changes in laws, treaties or regulations;

- the volatility of the price of our ordinary shares;

- our incorporation under the laws of Cyprus and the different rights to relief that may be available compared to other countries, including the United States;

- changes in governmental rules and regulations or actions taken by regulatory authorities;

- government requisition of our vessels during a period of war or emergency;

- potential liability from pending or future litigation and potential costs due to environmental damage and vessel collisions;

- the arrest of our vessels by maritime claimants;

- general domestic and international political conditions or events, including “trade wars”;

- any further changes in U.S. trade policy that could trigger retaliatory actions by the affected countries;

- potential disruption of shipping routes due to accidents, environmental factors, political events, public health threats, international hostilities including the ongoing developments in the Ukraine region and the developments in the Middle East, including the armed conflict in Israel and the Gaza Strip, acts by terrorists or acts of piracy on ocean-going vessels;

- the length and severity of epidemics and pandemics and their impacts on the demand for seaborne transportation of crude oil and refined products;

- the impact of port or canal congestion;

- business disruptions due to adverse weather, natural disasters or other disasters outside our control; and

- other important factors described from time to time in the reports filed by the Company with the Securities and Exchange Commission.

We caution readers of this report not to place undue reliance on these forward-looking statements, which speak only as of their dates. These forward-looking statements are no guarantee of our future performance, and actual results and future developments may vary materially from those projected in the forward-looking statements.

This information is subject to the disclosure requirements pursuant to Section 5-12 the Norwegian Securities Trading Act.

1 This press release describes Time Charter Equivalent earnings and related per day amounts and spot TCE currently contracted, which are not measures prepared in accordance with IFRS (“non-GAAP”). See Appendix 1 for a full description of the measures and reconciliation to the nearest IFRS measure.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.