HP, CrowdStrike And 3 Stocks To Watch Heading Into Wednesday

With U.S. stock futures trading mixed this morning on Wednesday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Frontline Plc. FRO to report quarterly earnings at 45 cents per share on revenue of $361.42 million before the opening bell, according to data from Benzinga Pro. Frontline shares rose 1.1% to $18.26 in after-hours trading.

- HP Inc. HPQ reported in-line earnings for its fourth quarter, while sales topped estimates. HP said it expects first-quarter adjusted earnings of between 70 cents and 76 cents per share, versus the 85 cent estimate, and fiscal 2025 earnings of between $3.45 and $3.75 per share, versus the $3.60 estimate. HP shares fell 7.4% to $36.19 in the after-hours trading session.

- Analysts are expecting Golden Ocean Group Limited GOGL to post quarterly earnings at 32 cents per share on revenue of $195.75 million. The company will release earnings before the markets open. Golden Ocean shares gained 0.4% to $10.90 in after-hours trading.

Check out our premarket coverage here

- Dell Technologies Inc. DELL reported better-than-expected earnings for its third quarter, while sales missed estimates. The company reported quarterly earnings of $2.15 per share, which beat the analyst consensus estimate of $2.05. Quarterly revenue came in at $24.37 billion, which missed the consensus estimate of $24.65 billion and is an increase over revenue of $22.25 billion from the same period last year. Dell shares tumbled 11.3% to $125.75 in the after-hours trading session.

- CrowdStrike Holdings Inc CRWD posted upbeat results for its third quarter. The company said it expects fourth-quarter revenue to be between $1.029 billion and $1.035 billion versus estimates of $1.03 billion. The company anticipates fourth-quarter adjusted earnings of 84 cents to 86 cents per share versus estimates of 86 cents per share. CrowdStrike shares fell 5.7% to $343.38 in the after-hours trading session.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Could Surge To $500K Amid DeFi Boom, Trump's Pledge To Establish A BTC Strategic Reserve, Says Cardano Founder Charles Hoskinson

Cardano ADA/USD founder Charles Hoskinson, a co-founder of Ethereum ETH/USD, predicted Bitcoin BTC/USD could surge to between $250,000 and $500,000 within the next 12 to 24 months, citing growing institutional investment and emerging decentralized finance opportunities.

What Happened: In a recent livestream from Colorado, Hoskinson emphasized Bitcoin’s transformative potential, describing it as more than just a cryptocurrency but a strategic asset for governments and institutions worldwide.

Hoskinson has deep roots in the cryptocurrency ecosystem and highlighted Bitcoin’s evolution from a “dormant project” to a potentially revolutionary financial technology.

The cryptocurrency veteran believes Bitcoin’s ecosystem could experience unprecedented growth, particularly with the development of DeFi layers that could dramatically expand its utility.

He stated that “governments are considering Bitcoin as a strategic reserve asset,” drawing a parallel to gold’s historical role as a store of value. Hoskinson predicted that “Bitcoin-based DeFi will surpass all other ecosystems within 24 to 36 months.”

In a keynote speech at a Bitcoin conference in Nashville, Tennessee, this past July, President-elect Donald Trump pledged to establish the United States as the “crypto capital of the planet” and indicated plans to create a Bitcoin strategic reserve utilizing the cryptocurrency held by the government.

See Also: Crypto’s Next Mega-Rocket? Analyst Forecasts Insane 2725%-6600% Surge For This Coin

Why It Matters: The prediction comes amid a volatile cryptocurrency landscape. Recent data shows Bitcoin experiencing significant price fluctuations, with long-term holders offloading 728,000 coins in the past 30 days—the largest sell-off since April.

Despite short-term volatility, market analysts remain cautiously optimistic. Haider Rafique, Global Chief Marketing Officer at OKX exchange, noted the significant profit potential for investors, with the average holding price around $30,000.

While bullish on Bitcoin, Hoskinson remains committed to Cardano’s role in the broader cryptocurrency ecosystem. He positioned Cardano as a “spiritual successor to Bitcoin” and emphasized the importance of creating hybrid applications that integrate Bitcoin functionality, showcasing his continued innovation in the blockchain space.

Price Action: Bitcoin the leading cryptocurrency by market capitalization, is currently trading at $93,201.11. The price has risen by 1.74% over the past 24 hours and 0.63% over the last seven days, according to Benzinga Pro data.

Read Next:

Image via Pexels

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analysis-Investors cling to crash protection despite sizzling US stock market rally

By Saqib Iqbal Ahmed

NEW YORK (Reuters) – Demand for options protection against an equity market crash is rising, even as a post-election rally takes U.S. stocks to record highs.

Worries over the possibility of a contested election dissipated following President-elect Donald Trump’s victory earlier this month, helping the S&P 500 climb to an all-time high. The Cboe Volatility Index, one measure of investor anxiety, closed near a post-election low of 14.10 on Tuesday.

But several barometers gauging uptake for protection against extreme market swings – such as the Nations TailDex Index and Cboe Skew – are picking up. While the rise in these indexes does not necessarily mean investors expect catastrophic events, they suggest elevated caution in the face of several weighty risks, including the potential of an inflationary snap-back to ructions in global trade next year.

One such risk came to the fore late on Monday, when Trump pledged big tariffs on Canada, Mexico and China – detailing how he will implement campaign promises that could trigger trade wars.

Though U.S. stocks largely shrugged off the comments, Trump’s broadside evoked flashbacks to the trade-fueled market swings that took place during his first term, bolstering the case for portfolio hedging.

Amy Wu Silverman, RBC Capital Markets head of derivatives strategy, said investors are guarding against so-called fat tail risks, options parlance for higher expected probabilities of extreme market moves.

“While investors broadly remain long equities, the tails are fatter,” she said. “This is partly from a rise in geopolitical risk premium and certainly potential policy risk as Trump returns to the presidency and potentially enacts tariffs and other measures.”

The Nations TailDex Index, an options-based index that measures the cost of hedging against an outsized move in the SPDR S&P 500 ETF Trust, has risen to 13.64, double its post-election low of 6.68. The index is higher now than it has been about 70% of the time over the past year.

Cboe Skew index, another index that indicates the market’s perception of the likelihood of extreme price movements, on Monday closed at a two-month high of 167.28.

VIX call options, which offer protection against a market sell-off, also shows some of this demand to protect against “tail risks.” VIX three-month call skew – a barometer of the strength of demand for these contracts – is hovering near the highest level in over five years, according to an analysis by Susquehanna Financial Group.

“The general idea is there is an 80-95% chance of pretty low volatility, that’s why the VIX is relatively low, but there’s just more of a tail event being factored in,” said Chris Murphy, co-head of derivative strategy at Susquehanna.

Dow, S&P 500 Settle At Record Highs, Best Buy Reports Weaker Than Expected Earnings: Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed a slight improvement in the overall market sentiment, while the index remained in the “Greed” zone on Tuesday.

U.S. stocks settled higher on Tuesday, with the Dow Jones index and S&P 500 surging to fresh record levels during the session.

Dick’s Sporting Goods Inc. DKS reported upbeat earnings for its third quarter. Kohl’s Corporation KSS reported worse-than-expected third-quarter results, cut its FY24 EPS guidance, and projected a net sales decrease of 7%-8%. Best Buy Co., Inc BBY reported weaker-than-expected earnings for its fiscal 2025 third quarter.

On the economic data front, the S&P CoreLogic Case-Shiller home price index rose 4.6% year-over-year in September versus a 5.2% increase in August. Sales of new single-family homes in the U.S. dipped by 17.3% to an annualized rate of 610,000 in October.

Most sectors on the S&P 500 closed on a positive note, with utilities, communication services, and consumer discretionary stocks recording the biggest gains on Tuesday. However, energy and materials stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 124 points to 44,860.31 on Tuesday. The S&P 500 rose 0.57% to 6,021.63, while the Nasdaq Composite rose 0.63% to close at 19,175.58 during Tuesday’s session.

Investors are awaiting earnings results from Frontline plc FRO and Golden Ocean Group Limited GOGL today.

What is CNN Business Fear & Greed Index?

At a current reading of 64.4, the index remained in the “Greed” zone on Tuesday, versus a prior reading of 64.2.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

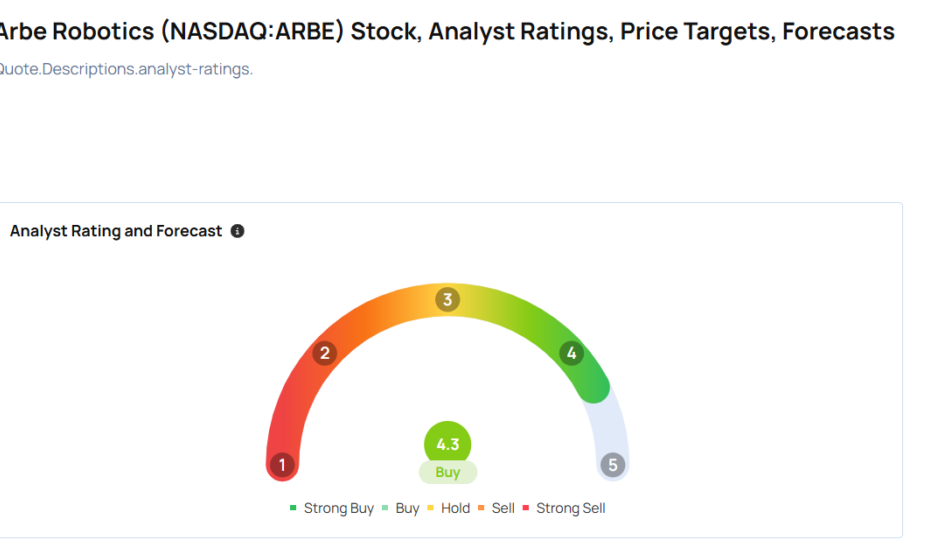

Top Wall Street Forecasters Revamp Arbe Robotics Price Expectations Ahead Of Q3 Earnings

Arbe Robotics Ltd. ARBE will release earnings results for its third quarter, before the opening bell on Wednesday, Nov. 27.

Analysts expect the Tel Aviv-Yafo, Israel-based bank to report a quarterly loss at 11 cents per share, versus a year-ago loss of 10 cents per share. Arbe Robotics projects to report revenue of $450 thousand for the recent quarter, compared to $479 thousand a year earlier, according to data from Benzinga Pro.

On Nov. 4, Arbe Robotics announced the closing of up to $49 million public offering.

Arbe Robotics shares fell 1% to close at $1.91 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

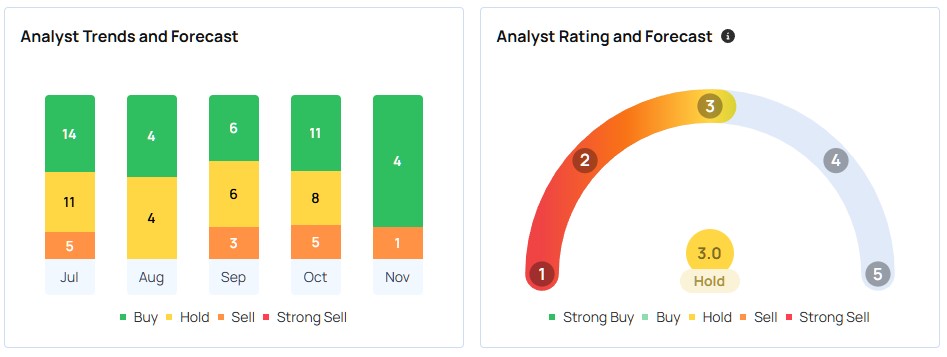

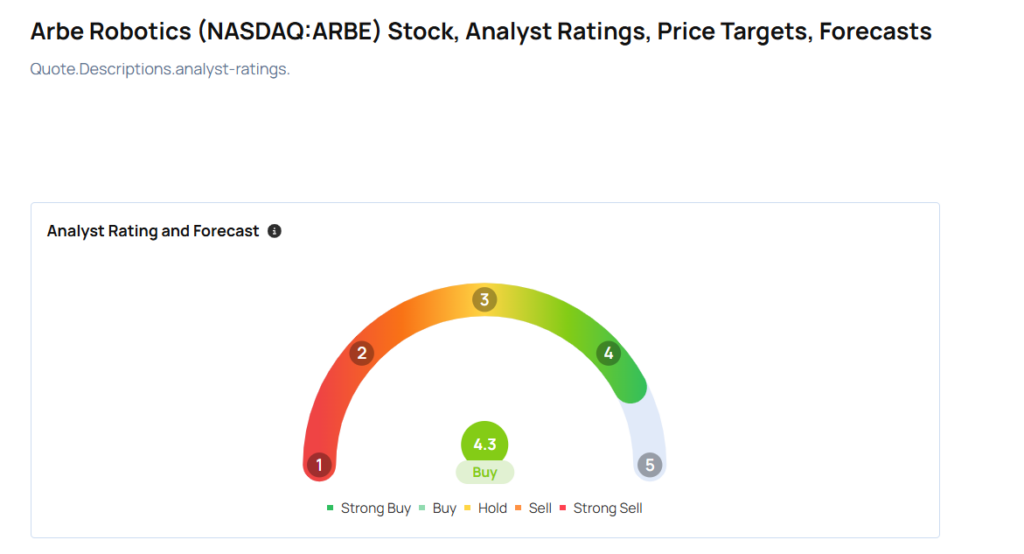

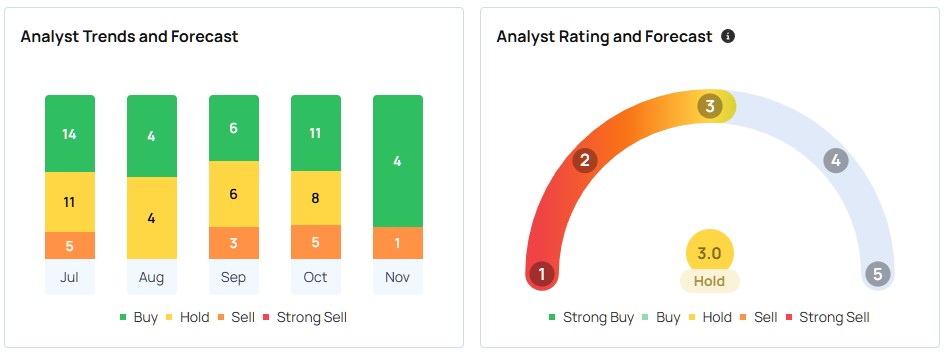

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Roth MKM analyst Suji Desilva maintained a Buy rating and cut the price target from $4 to $2 on March 8. This analyst has an accuracy rate of 75%.

- Wells Fargo analyst Gary Mobley maintained an Overweight rating and slashed the price target from $5 to $4 on March 8. This analyst has an accuracy rate of 71%.

Considering buying ARBE stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FRO – Third Quarter and Nine Months 2024 Results

FRONTLINE PLC REPORTS RESULTS FOR THE THIRD QUARTER ENDED SEPTEMBER 30, 2024

Frontline plc (the “Company”, “Frontline,” “we,” “us,” or “our”), today reported unaudited results for the three and nine months ended September 30, 2024:

Highlights

- Profit of $60.5 million, or $0.27 per share for the third quarter of 2024.

- Adjusted profit of $75.4 million, or $0.34 per share for the third quarter of 2024.

- Declared a cash dividend of $0.34 per share for the third quarter of 2024.

- Reported revenues of $490.3 million for the third quarter of 2024.

- Achieved average daily spot time charter equivalent earnings (“TCEs”)1 for VLCCs, Suezmax tankers and LR2/Aframax tankers in the third quarter of $39,600, $39,900 and $36,000 per day, respectively.

- Sold its oldest Suezmax tanker, built in 2010, for a net sales price of $48.5 million and delivered the vessel to its new owner in October 2024. The transaction generated net cash proceeds of $36.5 million after repayment of existing debt.

- Fully repaid the shareholder loan with Hemen Holding Limited, the Company’s largest shareholder (“Hemen”) and the $275.0 million senior unsecured revolving credit facility with an affiliate of Hemen for an aggregate amount of $470.0 million in the second, third and fourth quarters of 2024.

- Entered into a sale-and-leaseback agreement in an amount of up to $512.1 million to refinance 10 Suezmax tankers. The refinancing is expected to generate net cash proceeds of approximately $101.0 million in the fourth quarter of 2024.

Lars H. Barstad, Chief Executive Officer of Frontline Management AS, commented:

“The third quarter of 2024 performed in line with seasonal expectations, as oil demand slowed over the summer months and domestic demand by oil exporting countries in the Middle East increased. We continue to sail in a troubled geopolitical landscape and with lower year-on-year demand in Asia, and especially China, the tanker markets have yet to experience the seasonal upswing into winter. The increase in sanctioned oil trade and movement of illicit barrels have negatively impacted our trade environment. However, global oil demand is still growing, and with limited new tanker capacity coming, Frontline continues to profit as we run our cost-efficient operation and modern fleet. It will be interesting to see how the tanker market, including the trade of oil and energy, is impacted by politics as we approach 2025.”

Inger M. Klemp, Chief Financial Officer of Frontline Management AS, added:

“In 2024 we have optimized the capital structure of the Company by refinancing debt of 36 vessels, which has extended maturities and improved margins, divesting eight older vessels and the subsequent repayment of the Hemen shareholder loan and the $275.0 million senior unsecured revolving credit facility with an affiliate of Hemen in an aggregate amount of $470.0 million. We continue to focus on maintaining our competitive cost structure, breakeven levels and solid balance sheet to ensure that we are well positioned to generate significant cash flow and create value for our shareholders.”

Average daily TCEs and estimated cash breakeven rates

| ($ per day) | Spot TCE | Spot TCE currently contracted | % Covered | Estimated average daily cash breakeven rates for the next 12 months | ||||

| 2024 | Q3 2024 | Q2 2024 | Q4 2023 | 2023 | Q4 2024 | 2024 | ||

| VLCC | 45,800 | 39,600 | 49,600 | 42,300 | 50,300 | 44,300 | 77% | 29,600 |

| Suezmax | 43,800 | 39,900 | 45,600 | 45,700 | 52,600 | 39,600 | 70% | 23,400 |

| LR2 / Aframax | 47,800 | 36,000 | 53,100 | 42,900 | 46,800 | 34,800 | 60% | 22,000 |

We expect the spot TCEs for the full fourth quarter of 2024 to be lower than the spot TCEs currently contracted, due to the impact of ballast days during the fourth quarter of 2024. See Appendix 1 for further details.

The Board of Directors

Frontline plc

Limassol, Cyprus

November 26, 2024

Ola Lorentzon – Chairman and Director

John Fredriksen – Director

Ole B. Hjertaker – Director

James O’Shaughnessy – Director

Steen Jakobsen – Director

Cato Stonex – Director

Questions should be directed to:

Lars H. Barstad: Chief Executive Officer, Frontline Management AS

+47 23 11 40 00

Inger M. Klemp: Chief Financial Officer, Frontline Management AS

+47 23 11 40 00

Forward-Looking Statements

Matters discussed in this report may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements, which include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

Frontline plc and its subsidiaries, or the Company, desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. This report and any other written or oral statements made by us or on our behalf may include forward-looking statements, which reflect our current views with respect to future events and financial performance and are not intended to give any assurance as to future results. When used in this document, the words “believe,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “plan,” “potential,” “will,” “may,” “should,” “expect” and similar expressions, terms or phrases may identify forward-looking statements.

The forward-looking statements in this report are based upon various assumptions, including without limitation, management’s examination of historical operating trends, data contained in our records and data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

In addition to these important factors and matters discussed elsewhere herein, important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include:

- the strength of world economies;

- fluctuations in currencies and interest rates, including inflationary pressures and central bank policies intended to combat overall inflation and rising interest rates and foreign exchange rates;

- the impact that any discontinuance, modification or other reform or the establishment of alternative reference rates have on the Company’s floating interest rate debt instruments;

- general market conditions, including fluctuations in charter hire rates and vessel values;

- changes in the supply and demand for vessels comparable to ours and the number of newbuildings under construction;

- the highly cyclical nature of the industry that we operate in;

- the loss of a large customer or significant business relationship;

- changes in worldwide oil production and consumption and storage;

- changes in the Company’s operating expenses, including bunker prices, dry docking, crew costs and insurance costs;

- planned, pending or recent acquisitions, business strategy and expected capital spending or operating expenses, including dry docking, surveys and upgrades;

- risks associated with any future vessel construction;

- our expectations regarding the availability of vessel acquisitions and our ability to complete vessel acquisition transactions as planned;

- our ability to successfully compete for and enter into new time charters or other employment arrangements for our existing vessels after our current time charters expire and our ability to earn income in the spot market;

- availability of financing and refinancing, our ability to obtain financing and comply with the restrictions and other covenants in our financing arrangements;

- availability of skilled crew members and other employees and the related labor costs;

- work stoppages or other labor disruptions by our employees or the employees of other companies in related industries;

- compliance with governmental, tax, environmental and safety regulation, any non-compliance with U.S. or European Union regulations;

- the impact of increasing scrutiny and changing expectations from investors, lenders and other market participants with respect to our ESG policies;

- Foreign Corrupt Practices Act of 1977 or other applicable regulations relating to bribery;

- general economic conditions and conditions in the oil industry;

- effects of new products and new technology in our industry, including the potential for technological innovation to reduce the value of our vessels and charter income derived therefrom;

- new environmental regulations and restrictions, whether at a global level stipulated by the International Maritime Organization, and/or imposed by regional or national authorities such as the European Union or individual countries;

- vessel breakdowns and instances of off-hire;

- the impact of an interruption in or failure of our information technology and communications systems, including the impact of cyber-attacks upon our ability to operate;

- potential conflicts of interest involving members of our board of directors and senior management;

- the failure of counter parties to fully perform their contracts with us;

- changes in credit risk with respect to our counterparties on contracts;

- our dependence on key personnel and our ability to attract, retain and motivate key employees;

- adequacy of insurance coverage;

- our ability to obtain indemnities from customers;

- changes in laws, treaties or regulations;

- the volatility of the price of our ordinary shares;

- our incorporation under the laws of Cyprus and the different rights to relief that may be available compared to other countries, including the United States;

- changes in governmental rules and regulations or actions taken by regulatory authorities;

- government requisition of our vessels during a period of war or emergency;

- potential liability from pending or future litigation and potential costs due to environmental damage and vessel collisions;

- the arrest of our vessels by maritime claimants;

- general domestic and international political conditions or events, including “trade wars”;

- any further changes in U.S. trade policy that could trigger retaliatory actions by the affected countries;

- potential disruption of shipping routes due to accidents, environmental factors, political events, public health threats, international hostilities including the ongoing developments in the Ukraine region and the developments in the Middle East, including the armed conflict in Israel and the Gaza Strip, acts by terrorists or acts of piracy on ocean-going vessels;

- the length and severity of epidemics and pandemics and their impacts on the demand for seaborne transportation of crude oil and refined products;

- the impact of port or canal congestion;

- business disruptions due to adverse weather, natural disasters or other disasters outside our control; and

- other important factors described from time to time in the reports filed by the Company with the Securities and Exchange Commission.

We caution readers of this report not to place undue reliance on these forward-looking statements, which speak only as of their dates. These forward-looking statements are no guarantee of our future performance, and actual results and future developments may vary materially from those projected in the forward-looking statements.

This information is subject to the disclosure requirements pursuant to Section 5-12 the Norwegian Securities Trading Act.

1 This press release describes Time Charter Equivalent earnings and related per day amounts and spot TCE currently contracted, which are not measures prepared in accordance with IFRS (“non-GAAP”). See Appendix 1 for a full description of the measures and reconciliation to the nearest IFRS measure.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SMCI Stock Slumps 10% As Loan Agreements With Banks End Amid Ongoing Nasdaq Challenges

Super Micro Computer Inc. SMCI experienced a significant stock decline on Tuesday, shedding 10.4% after announcing the termination of two critical loan agreements with major financial institutions.

What Happened: The company disclosed in a Securities and Exchange Commission filing that it had prepaid and terminated loan agreements with Cathay Bank and Bank of America N.A. on Nov 20. This move comes amid ongoing challenges with Nasdaq listing requirements and delayed financial reporting.

SMCI, a prominent server manufacturer known for its AI system infrastructure supporting NVIDIA Corp.‘s NVDA chips, has been navigating a turbulent financial period. The company recently faced a potential delisting threat after failing to meet Nasdaq’s filing requirements.

See Also: JD Vance’s Investment Playbook Has Bitcoin And ETFs: Here’s What Else The VP-Elect Is Betting On

Why It Matters: The stock experienced a dramatic rally, surging 65% in a single week. Shares rose from $20.03 on Nov 18 to $33.15 on Nov. 22, attempting to recover from a six-month slump that previously erased nearly 60% of its value.

With a market capitalization of $17.39 billion, the company maintains a relatively low price-to-earnings ratio of 17.15.

Super Micro Computer has hired a new independent auditor and committed to filing its earnings report soon.

Price Action: As of the latest trading session, the stock is priced at $34.42, reflecting a decline of 10.40% on Tuesday. Despite the recent drop, the stock has experienced a year-to-date gain of 20.54%, according to data from Benzinga Pro.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

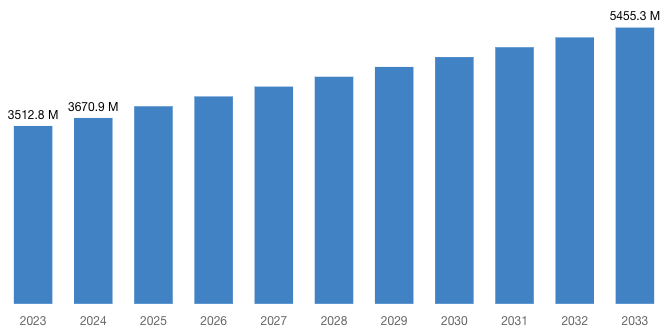

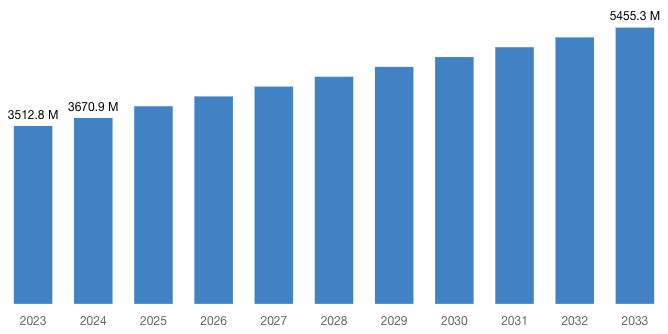

[Latest] Global Point of Care Glucose Testing Market Size/Share Worth USD 5,455.3 Million by 2033 at a 4.5% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

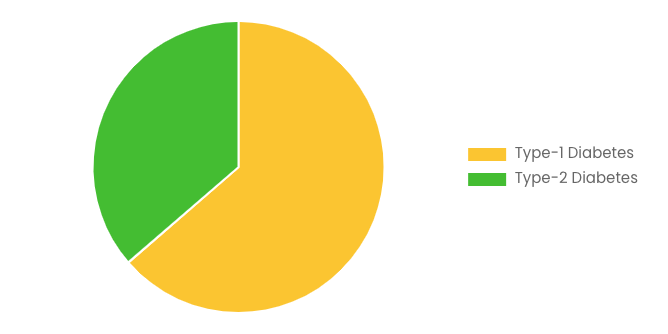

Austin, TX, USA, Nov. 27, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Point of Care Glucose Testing Market Size, Trends and Insights By Product (Accu Check Aviva Meter, Onetouch Verio Flex, i-STAT, Bayer CONTOUR Blood Glucose Monitoring System, Freestyle Lite, True Metrix, Accu-Chek Inform II, StatStrip, Others), By Technology (Glucose Oxidase Based Testing, Glucose Dehydrogenase Based Testing, Others), By Application (Type-1 Diabetes, Type-2 Diabetes), By End Users (Hospitals and Clinics, Home Care Settings, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Point-of-Care Glucose Testing Market size & share was valued at approximately USD 3,512.8 Million in 2023 and is expected to reach USD 3,670.9 Million in 2024 and is expected to reach a value of around USD 5,455.3 Million by 2033, at a compound annual growth rate (CAGR) of about 4.5% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Point-of-Care Glucose Testing Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=54643

Point-of-Care Glucose Testing Market: Growth Factors and Dynamics

- Rising Prevalence of Diabetes: The increasing incidence of diabetes worldwide is a major driver for the point-of-care glucose testing market. As diabetes management requires regular monitoring of blood glucose levels, there is a growing demand for convenient and accessible testing solutions, driving market growth.

- Technological Advancements: Ongoing advancements in point-of-care glucose testing technologies, such as continuous glucose monitoring (CGM) systems and miniaturized glucometers, enhance accuracy, ease of use, and data accessibility. These innovations attract both healthcare professionals and patients, fostering market expansion.

- Growing Adoption of Self-Monitoring: The shift towards patient-centered care and self-management of chronic conditions, including diabetes, is driving the demand for point-of-care glucose testing devices. Patients increasingly prefer self-monitoring solutions that offer real-time data and empower them to make informed decisions about their health.

- Increasing Awareness and Screening Programs: Public health initiatives aimed at diabetes prevention, early detection, and management contribute to market growth. Awareness campaigns, screening programs, and healthcare policies promoting regular blood glucose monitoring drive the adoption of point-of-care testing devices in various healthcare settings.

- Expanding Geriatric Population: The aging population, particularly in developed regions, drives market growth as older adults are at a higher risk of developing diabetes and require frequent monitoring of blood glucose levels. The increasing geriatric population creates a sustained demand for point-of-care glucose testing devices and services.

- Shift towards Homecare Settings: The preference for home-based healthcare solutions and the COVID-19 pandemic’s impact on healthcare delivery has accelerated the adoption of point-of-care glucose testing in homecare settings. Patients value the convenience, privacy, and safety of self-monitoring devices, driving market expansion beyond traditional clinical settings.

- Integration of Digital Health Solutions: Increasing integration of point-of-care glucose testing devices with digital health platforms and mobile applications enhances data management, analysis, and remote monitoring capabilities. This integration allows healthcare providers to track patients’ glucose levels in real time, offer personalized recommendations, and intervene promptly, driving market growth and improving patient outcomes.

- Focus on Preventive Healthcare: Growing emphasis on preventive healthcare, driven by rising healthcare costs and the burden of chronic diseases, fuels the demand for point-of-care glucose testing. Early detection of abnormal glucose levels enables timely interventions, lifestyle modifications, and disease management strategies, contributing to improved population health outcomes and driving market expansion.

Request a Customized Copy of the Point-of-Care Glucose Testing Market Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=54643

Point-of-Care Glucose Testing Market: Partnership and Acquisitions

- In 2024, DexCom introduced its real-time continuous glucose monitoring (CGM) system, Dexcom ONE+, in Spain, Belgium, and Poland. The device was also launched on February 12. Dexcom plans to expand its availability to the Middle East, Africa, and additional European countries shortly.

- In 2023, Avricore Health and Ascensia Diabetes Care announced a partnership to integrate blood glucose monitoring (BGM) into point-of-care testing. The collaboration aims to incorporate Contour Next-Gen and Contour Next One BGM systems into Avricore’s HealthTab PCOT platform for enhanced healthcare solutions.

- In 2021, EKF Diagnostics launched the STAT-Site WB handheld analyzer globally, providing rapid -ketone and glucose measurements from whole blood within seconds. This reagent-free analyzer delivers quantitative results for -ketones and glucose in just 10 seconds and 5 seconds, respectively, enhancing efficiency in blood glucose management.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 3,670.9 Million |

| Projected Market Size in 2033 | USD 5,455.3 Million |

| Market Size in 2023 | USD 3,512.8 Million |

| CAGR Growth Rate | 4.5% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Product, Technology, Application, End Users and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Point-of-Care Glucose Testing report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Point-of-Care Glucose Testing report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Point-of-Care Glucose Testing Market Report @ https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

Point-of-Care Glucose Testing Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Point-of-Care Glucose Testing Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Disruption in Healthcare Services: During the COVID-19 pandemic, healthcare systems faced significant disruptions, with resources diverted to manage the outbreak. Non-urgent medical appointments and routine screenings, including glucose testing, were postponed or canceled, leading to a temporary decline in demand for point-of-care glucose testing devices and services.

- Shift in Patient Behavior: Fear of contracting the virus and lockdown measures led to changes in patient behavior, including reluctance to visit healthcare facilities for routine check-ups and tests. This resulted in reduced utilization of point-of-care glucose testing devices, particularly in clinical settings, impacting market demand.

- Telehealth and Remote Monitoring: Increased adoption of telehealth and remote monitoring solutions facilitated the continuity of glucose monitoring during the pandemic. Healthcare providers and patients embraced virtual consultations and remote monitoring platforms, ensuring ongoing management of diabetes and driving demand for point-of-care glucose testing devices.

- Homecare Solutions: The pandemic accelerated the shift towards home-based healthcare solutions, including point-of-care glucose testing devices. Patients increasingly relied on self-monitoring devices to manage their diabetes from the comfort and safety of their homes, driving market demand and innovation in homecare glucose testing solutions.

- Resumption of Routine Healthcare Services: As healthcare systems adapted to the challenges posed by the pandemic, routine healthcare services, including glucose testing, gradually resumed. Healthcare facilities implemented safety protocols to mitigate the risk of virus transmission, restoring patient confidence and utilization of point-of-care glucose testing devices.

- Focus on Chronic Disease Management: The COVID-19 pandemic underscored the importance of chronic disease management, including diabetes, in safeguarding public health. Healthcare providers and policymakers prioritized initiatives to address chronic disease burden, driving investment in point-of-care glucose testing solutions and promoting their integration into comprehensive disease management programs.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Point-of-Care Glucose Testing Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Point-of-Care Glucose Testing Market Report @ https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

Key questions answered in this report:

- What is the size of the Point-of-Care Glucose Testing market and what is its expected growth rate?

- What are the primary driving factors that push the Point-of-Care Glucose Testing market forward?

- What are the Point-of-Care Glucose Testing Industry’s top companies?

- What are the different categories that the Point-of-Care Glucose Testing Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Point-of-Care Glucose Testing market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Point-of-Care Glucose Testing Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

Point-of-Care Glucose Testing Market – Regional Analysis

The Point-of-Care Glucose Testing Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: North America sees a trend towards increased adoption of advanced point-of-care glucose testing technologies, such as continuous glucose monitoring (CGM) systems, driven by a strong emphasis on patient-centered care and healthcare innovation. Additionally, there is a growing focus on integration with electronic health records (EHR) systems and telemedicine platforms to enhance data accessibility and remote patient monitoring capabilities, aligning with the region’s healthcare digitization efforts.

- Europe: In Europe, the trend towards sustainability and environmental responsibility influences the point-of-care glucose testing market. There is a growing demand for eco-friendly and recyclable materials in device manufacturing, driven by stringent regulatory standards and consumer preferences for sustainable healthcare solutions. Additionally, there is an increasing emphasis on interoperability and data sharing among healthcare providers to facilitate seamless patient care coordination across borders.

- Asia-Pacific: The Asia-Pacific region experiences a trend towards greater accessibility and affordability of point-of-care glucose testing devices, particularly in emerging economies. Manufacturers are focusing on developing cost-effective and user-friendly devices tailored to the needs of diverse patient populations. Additionally, there is a growing trend towards telehealth and mHealth solutions, leveraging mobile technologies to extend healthcare services to remote and underserved areas, driving market expansion.

- LAMEA (Latin America, Middle East, and Africa): In LAMEA, the trend towards market expansion is driven by initiatives to strengthen healthcare infrastructure and improve access to healthcare services. Governments and healthcare organizations are investing in point-of-care testing programs to address the burden of chronic diseases, including diabetes, in the region. There is also a growing trend towards public-private partnerships and collaborations to overcome resource constraints and enhance healthcare delivery capabilities.

Request a Customized Copy of the Point-of-Care Glucose Testing Market Report @ https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Point-of-Care Glucose Testing Market Size, Trends and Insights By Product (Accu Check Aviva Meter, Onetouch Verio Flex, i-STAT, Bayer CONTOUR Blood Glucose Monitoring System, Freestyle Lite, True Metrix, Accu-Chek Inform II, StatStrip, Others), By Technology (Glucose Oxidase Based Testing, Glucose Dehydrogenase Based Testing, Others), By Application (Type-1 Diabetes, Type-2 Diabetes), By End Users (Hospitals and Clinics, Home Care Settings, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

List of the prominent players in the Point-of-Care Glucose Testing Market:

- Abbott Laboratories

- Hoffmann-La Roche Ltd.

- Ascensia Diabetes Care Holdings AG

- Dexcom Inc.

- Medtronic plc

- LifeScan Inc. (A Johnson & Johnson Company)

- Becton Dickinson and Company

- Acon Laboratories Inc.

- Nova Biomedical Corporation

- ARKRAY Inc.

- Trividia Health Inc.

- PTS Diagnostics

- Nipro Diagnostics Inc.

- Ypsomed Holding AG

- Sanofi S.A.

- Others

Click Here to Access a Free Sample Report of the Global Point-of-Care Glucose Testing Market @ https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

US Epilepsy Drugs Market: US Epilepsy Drugs Market Size, Trends and Insights By Seizure Type (Focal seizures, Generalized seizures, Non-epileptic seizures, Others), By Drugs Generation (First Generation Drugs, Second Generation Drugs, Third Generation Drugs), By Distribution Channel (Hospital Pharmacies, Drug Stores and Retail Pharmacies, Online Providers, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Pharmaceutical Membrane Filtration Market: Pharmaceutical Membrane Filtration Market Size, Trends and Insights By Product (Membrane Filters, Systems, Other Products), By Technique (Microfiltration, Ultrafiltration, Nanofiltration, Other Techniques), By Application (Final Product Processing, Raw Material Filtration, Cell Separation, Water Purification, Air Purification), By Type (Sterile Filtration, Non-Sterile Filtration), By Scale of Operation (Manufacturing-Scale Operation, Pilot-Scale Operation, R&D-Scale Operation), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Injectable Drug Delivery Devices Market: Injectable Drug Delivery Devices Market Size, Trends and Insights By Device Type (Conventional Drug Delivery Devices, Advanced Drug Delivery Devices, Prefilled Syringes, Injectable Pens, Auto Injectors, Needle-free Injectors, Others), By Therapeutic Application (Cardiovascular Disease, Autoimmune Disorders, Diabetes, Oncology, Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Drug Stores, Online Pharmacies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Dental Digital X-ray Market: Dental Digital X-ray Market Size, Trends and Insights By Product (Digital X-ray Systems, Analog X-ray Systems), By Type (Extraoral X-ray Systems, Panoramic/Cephalometric Systems, Cone-Beam Computed Tomography (CBCT) Systems, Intraoral X-ray Systems, Digital Sensors, Photostimulable Phosphor (PSP) Systems, Hybrid X-ray Systems), By Roast Level (Diagnostic, Therapeutic, Cosmetic, Forensic), By End User (Hospitals, Dental Clinics, Ambulatory Surgical Centers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Medical Aesthetics Market: US Medical Aesthetics Market Size, Trends and Insights By Product Type (Aesthetic Laser Devices, Energy Devices, Body Contouring Devices, Facial Aesthetic Devices, Aesthetic Implants, Skin Aesthetic Devices), By Application (Anti-Aging and Wrinkles, Facial and Skin Rejuvenation, Breast Enhancement, Body Shaping and Cellulite, Tattoo Removal, Vascular Lesions, Sears, Pigment Lesions, Reconstructive, Psoriasis and Vitiligo, Others), By End User (Cosmetic Centers, Dermatology Clinics, Hospitals, Medical Spas, Beauty Centers, Others), By Distribution Channel (Direct Sale, Retail Sales, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Health Care Ecosystem Market: US Health Care Ecosystem Market Size, Trends and Insights By Healthcare Services (Hospitals, Clinics and Outpatient Centers, Diagnostic Laboratories, Pharmacies, Ambulatory Surgical Centers, Rehabilitation Centers, Others), By Healthcare IT Solutions (Electronic Health Records (EHR) Systems, Practice Management Software, Telemedicine and Remote Patient Monitoring, Healthcare Analytics, Revenue Cycle Management, Others), By Medical Devices and Equipment (Diagnostic Equipment, Therapeutic Equipment, Monitoring Devices, Surgical Instruments, Personal Protective Equipment (PPE), Others), By Healthcare Specializations (Primary Care, Specialty Care, Preventive Care, Emergency Care, Palliative Care, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Chiropractic Market: Europe Chiropractic Market Size, Trends and Insights By Type of Service (Chiropractic Adjustments, Spinal Manipulation Therapy, Therapeutic Massage, Rehabilitation Exercises, Lifestyle Counseling, Others), By Age Group (Pediatric Chiropractic Care, Adult Chiropractic Care, Geriatric Chiropractic Care), By Medical Condition (Back Pain, Neck Pain, Headaches/Migraines, Sports Injuries, Joint Pain, Posture Correction, Others), By Practice Setting (Private Chiropractic Clinics, Hospital-based Chiropractic Centers, Integrated Healthcare Facilities, Corporate Wellness Programs, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Microfluidics Market: US Microfluidics Market Size, Trends and Insights By Product Type (Microfluidic-based devices, Microfluidic Components, Material), By Application (In-vitro Diagnostics, Pharmaceutical & Life Science Research and Manufacturing, Therapeutics), By End User (Hospitals & Diagnostic Centers, Academic & Research Institutes, Pharmaceutical and biotechnology Companies), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Point-of-Care Glucose Testing Market is segmented as follows:

By Product

- Accu Check Aviva Meter

- Onetouch Verio Flex

- i-STAT

- Bayer CONTOUR Blood Glucose Monitoring System

- Freestyle Lite

- True Metrix

- Accu-Chek Inform II

- StatStrip

- Others

By Technology

- Glucose Oxidase Based Testing

- Glucose Dehydrogenase Based Testing

- Others

By Application

- Type-1 Diabetes

- Type-2 Diabetes

By End Users

- Hospitals and Clinics

- Home Care Settings

- Others

Click Here to Get a Free Sample Report of the Global Point-of-Care Glucose Testing Market @ https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Point-of-Care Glucose Testing Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Point-of-Care Glucose Testing Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Point-of-Care Glucose Testing Market? What Was the Capacity, Production Value, Cost and PROFIT of the Point-of-Care Glucose Testing Market?

- What Is the Current Market Status of the Point-of-Care Glucose Testing Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Point-of-Care Glucose Testing Market by Considering Applications and Types?

- What Are Projections of the Global Point-of-Care Glucose Testing Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Point-of-Care Glucose Testing Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Point-of-Care Glucose Testing Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Point-of-Care Glucose Testing Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Point-of-Care Glucose Testing Industry?

Click Here to Access a Free Sample Report of the Global Point-of-Care Glucose Testing Market @ https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

Reasons to Purchase Point-of-Care Glucose Testing Market Report

- Point-of-Care Glucose Testing Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Point-of-Care Glucose Testing Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Point-of-Care Glucose Testing Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Point-of-Care Glucose Testing Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Point-of-Care Glucose Testing market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Point-of-Care Glucose Testing Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Point-of-Care Glucose Testing market analysis.

- The competitive environment of current and potential participants in the Point-of-Care Glucose Testing market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Point-of-Care Glucose Testing market should find this report useful. The research will be useful to all market participants in the Point-of-Care Glucose Testing industry.

- Managers in the Point-of-Care Glucose Testing sector are interested in publishing up-to-date and projected data about the worldwide Point-of-Care Glucose Testing market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Point-of-Care Glucose Testing products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Point-of-Care Glucose Testing Market Report @ https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Point-of-Care Glucose Testing Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/point-of-care-glucose-testing-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'Historic Win For Crypto:' Court Overturns Treasury Sanctions On Tornado Cash, Associated Token Skyrockets 430%

In a big legal win for the cryptocurrency industry, a U.S. appeals court has overturned sanctions imposed by the Treasury Department on popular cryptocurrency mixer, Tornado Cash, causing the price of the associated coin to zoom 430%.

What Happened: A three-judge panel from the Fifth Circuit Appeals Court in New Orleans on Tuesday concluded that the Office of Foreign Assets Control (OFAC) had exceeded its authority, reversing a lower court’s decision and granting a partial summary judgment in favor of Tornado Cash users.

The judges ruled that Tornado Cash’s immutable smart contracts do not qualify as property under the International Emergency Economic Powers Act (IEEPA)—a federal law that grants sweeping powers to the president to control economic transactions—as they cannot be owned or controlled.

“We hold that Tornado Cash’s immutable smart contracts (the lines of privacy-enabling software code) are not the “property” of a foreign national or entity, meaning (1) they cannot be blocked under IEEPA, and (2) OFAC overstepped its congressionally defined authority,” Circuit Judge Don Willett wrote in the judgment.

The Treasury Department didn’t immediately return Benzinga’s request for comment.

See Also: Crypto’s Next Mega-Rocket? Analyst Forecasts Insane 2725%-6600% Surge For This Coin

The ruling was cheered by influential names in the industry like Coinbase CEO Brian Armstrong and the company’s Chief Legal Officer Paul Grewal who described it as a “historic win for crypto.”

“Proud of this outcome. The courts ruled in our favor that the Treasury Department cannot sanction open-source code.

Hayden Adams, Founder of Uniswap Labs, the firm behind the leading decentralized exchange Uniswap UNI/USD, said, “Holy sh*t. Immutable smart contracts just beat the Treasury Department in court.”

Why It Matters: The ruling followed a turbulent period for Tornado Cash, which was blacklisted by the department in 2022, making it illegal for U.S. citizens, residents, and companies to use the platform.

In August 2023, the platform’s founders, Roman Storm and Roman Semenov, were indicted for allegedly laundering over $1 billion through the cryptocurrency mixer, including funds from the notorious North Korean cybercrime group, Lazarus Group.

Critics argued that Tornado Cash is software, not an individual and that the Treasury had overstepped its authority by sanctioning the mixing service. This sentiment was echoed by Vivek Ramaswamy, a prominent member of the incoming Donald Trump administration, who argued that penalizing an entire protocol was “illegal and unconstitutional.”

For the curious, a cryptocurrency tumbler, also known as a mixer, is a service that mixes cryptocurrency funds to make them harder to trace. The goal is to improve the anonymity of cryptocurrencies, especially Bitcoin BTC/USD, whose public ledgers are otherwise easily available.

Price Action: Following the ruling, the price of the associated token Tornado Cash TORN/USD exploded 430%, according to data from Benzinga Pro.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Sweetens Referral Program, Allowing Customers To Earn Up To $10,000 As Elon Musk's EV Giant Races To 500K Q4 Delivery Target

Tesla Inc. TSLA on Tuesday revamped its referral program across North America, as it looks to race to its delivery target of 515,000 vehicles in the fourth quarter.

What Happened: Tesla’s updated referral program includes enhanced discounts and rewards, with specific incentives for the Cybertruck.

The changes were announced via one of Tesla’s official accounts on X.

Customers can earn $1,000 for each successful referral, while the new buyer can receive up to $2,000 off a new Tesla.

Additionally, those who take delivery before the end of 2024 will benefit from three months of free FSD (Supervised) and unlimited Supercharging.

See Also: Tesla, Rivian Signal End To 4-Year Legal Battle Over Alleged Trade Secrets Theft

The program applies to the Model S, Model 3, Model X, Model Y, and Cybertruck.

Buyers of the Model S, Model X, and Cybertruck can enjoy a $2,000 discount, while Model 3 and Model Y buyers are eligible for a $1,000 discount in the U.S.

Referrers in the U.S. can earn up to $10,000 via referrals, while Canadian participants can earn up to CAD13,000. Participants also have a chance to win an invitation to a future Tesla event.

Why It Matters: Tesla’s enhanced referral program is part of a broader strategy to boost sales in the fourth quarter. The company recently started offering unlimited overnight charging via the Tesla Electric service, down from $15 a month, aiming to attract more buyers.

This follows discounts of up to $4,000 on select Model 3 and Model Y vehicles to avoid a decline in annual deliveries.

Despite these efforts, analysts predict that Tesla’s Q4 deliveries will set new records but may not prevent a yearly sales decline. The potential removal of the $7,500 EV tax credit by the incoming Trump administration could further affect Tesla’s sales, as highlighted by Gary Black, who warns of significant earnings impact if the credit is cut.

Price Action: Tesla stock declined marginally by 0.1% on Tuesday to close at $338.23 but gained 0.6% in after-hours trading. Year-to-date, Tesla shares are up 36.2%, according to Benzinga Pro data.

According to Benzinga Pro data, the consensus rating from analysts is “Neutral” for the Tesla stock. The highest price target is $400, while the consensus price target is 232.20, implying a 45% downside.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Tesla

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.