Nvidia CEO Jensen Huang Says This Is the "Next Wave of AI" — and He Singled Out 1 Potential Big Winner Other Than Nvidia

If you want to learn where artificial intelligence (AI) could be heading, you’ll probably want to pay attention to Nvidia (NASDAQ: NVDA) CEO Jensen Huang. After all, Huang’s company is arguably the most important player in the AI world right now. Nvidia’s graphics processing units (GPUs) remain the gold standard for powering large-scale AI models.

So what does Huang think about the future of AI? He recently discussed the “next wave of AI” — and singled out one potential big winner other than Nvidia.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

In Nvidia’s third-quarter earnings conference call on Nov. 20, Huang stated, “The next wave of AI are [sic] enterprise AI and industrial AI.” He added, “Enterprise AI is in full throttle.” What exactly are these next big things for AI that Huang mentioned?

Enterprise AI is the use of AI technologies to help organizations increase productivity, improve customer service, reduce costs, gain competitive advantages, and spur innovation. Alphabet‘s Google Cloud unit argues, “Enterprise AI goes beyond simple automation. It involves using AI to solve complex business problems that require human-like intelligence, such as understanding customer behavior, optimizing logistics, or detecting fraud.”

Industrial AI is similar to Enterprise AI but is specific to manufacturing. It involves using AI technologies in industrial applications such as robotics and supply chain management.

As you might expect since Huang referenced enterprise AI and industrial AI, Nvidia markets products for both areas. The company’s AI Enterprise is a cloud platform that supports the development and deployment of AI agents and generative AI applications. Nvidia Omniverse helps customers build, train, and deploy industrial AI models and robotics.

Huang highlighted several customers who are using Nvidia AI Enterprise to develop AI-powered agents and copilots. He also stated, “Consulting leaders like Accenture (NYSE: ACN) and Deloitte are taking Nvidia AI to the world’s enterprises.”

The Nvidia CEO then expounded on Accenture’s initiatives in enterprise AI. He noted that Accenture has launched a new business unit with roughly 30,000 professionals trained in Nvidia’s AI technology. This group will help roll out Nvidia AI Enterprise across the world.

Accenture is also using enterprise AI internally. Huang mentioned the consulting company’s efforts to use AI agents in marketing campaigns. He said Accenture is reducing manual steps in these campaigns by 25% to 35%.

Brain Fingerprint Technology Market Projected to Reach USD 6,177.77 Million by 2032

Gondia, India, Nov. 27, 2024 (GLOBE NEWSWIRE) — The global Brain Fingerprint Technology market size is projected to be worth around USD 6,177.77 Million by 2032 and growing at a CAGR of 6.3% between 2024 and 2032 Report published by IMIR Market Research Pvt. Ltd. Report featuring the companies Brainwave Science, Brain Fingerprinting Laboratories, Brainwave Science, LABORATORIES, BRAINCO, NEUROLOGIC RESEARCH, STOTT INTERNATIONAL, BRAINWAVES, COGNISURE, NEUFLEX NEUROTECHNOLOGY, AXILUM INC, BRAIN DYNAMICS, NEUROTECHNOLOGY SOLUTIONS, BRAINLOCK, COGNISCAN, NEUROLEX, IMENDI NEUROSCIENCE, NEUROSIGN GMBH, COGNISAFE, BRAINCO JAPAN, NEUROSK, MENTALINK

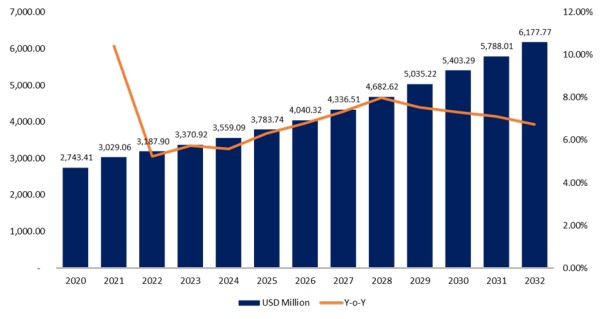

As per the latest research report published by IMIR Market Research, In 2023, the Brain Fingerprint Technology Market was valued at USD 3,370.92 Million and is expected to reach USD 6,177.77 Million by 2032 at the CAGR of 6.3% during 2024-2032.

The Brain Fingerprint Technology is a computer-based test that identifies, documents, and provides evidence of a crime. Additionally, it is frequently used to identify people who belong to oppressive psychological cells. This approach calculates electrical brain waves by evaluating the acknowledgment of natural increases in response to diverse data or information presented on a computer screen.

To get the Detailed Data on Consumer Behavior and Market Now: https://www.intellectualmarketinsights.com/download-sample/IMI-008367

Figure: Global Brain Fingerprint Technology Market, 2020-2032, (USD Million)

Our Report will help you understand the consumer behavior analysis towards the products and raw material across different age group.

The demand for improved security has been steadily increasing due to the growing population and ongoing conflict over scarce resources. The growing need to combat high crime rates and terrorist attacks is also anticipated to fuel market expansion in the future years. However, concerns over test accuracy and the high technology’s deployment costs are anticipated to slow industry expansion soon. Brain fingerprinting uses intellectual brain reactions; it is unaffected by emotional responses and does not depend on the subject’s feelings. It enables the identification of people who have experience in banking, finance, or communications and who have ties to anti-terrorist organizations or actions. Technology meets a vital need for law enforcement, investigators, partnerships, wrongfully accused people, crime victims, and innocent suspects.

According to the National Renewable Energy Laboratory (NREL), battery storage systems can offer several ancillary services to the grid, such as voltage control, frequency regulation, and peak shaving. Grid Modernization and Resilience Grid modernization, increasing adoption of electric vehicles, and increasing investments across the globe will boost the growth for Brain Fingerprint Technology market.

Market Drivers

Advancements in Neuroscience and Neuroimaging Technologies

Advances in neuroscience, EEG technology, and neuroimaging greatly improved the accuracy and practicality of BFT. Modern EEG hardware is now more precise, portable, and efficient compared with old generations and the systems now incorporated into BFT can detect brainwave patterns much more accurately, thereby raising their reliability for real-world applications. Miniaturization efforts led to compact EEG devices that can be applied in a variety of contexts that are not limited to a controlled laboratory environment and, therefore, they improve access and flexibility of deployment. Signal processing improvements further enhance the capability of BFT to capture subtle neural responses under dynamic conditions. Advancements in data analysis algorithms and machine learning algorithms continually improve comprehension and interpretation of complex brainwave data and detect them more accurately and with fewer false positives than before. This has further increased the adoption of BFT across national security, law enforcement, corporate, and forensic applications requiring objective and reliable truth verification. The interest by private companies and government bodies in BFT is growing steadily.

Market Opportunities

Expansion in National Security and Counterterrorism

Governments and agencies are increasingly looking at BFT as a strategic tool to improve their counterterrorism and national security systems. This is because the measures that BFT takes for concealed knowledge evaluate involuntary responses of the brain to any stimulus offered, which makes it highly effective in determining whether an individual possesses access to certain relevant knowledge linked to criminal or terrorist activity. It would be a very valuable asset for high-value security screenings, capable of testing the knowledge or intentions of individuals in sensitive situations like border control, airport screenings, and intelligence interrogations. New global threats to security create several possible future needs for effective non-invasive tools for early risk detection. BFT’s ability to objectively and reliably reveal hidden information positions it as a highly promising solution within this context. Most countries are thus likely to invest in advanced security technologies like BFT, and application of the technology in national security and counterterrorism thereby will be a massive area of growth in the coming years.

Buy this premium report: https://www.intellectualmarketinsights.com/checkout/IMI-008367?currency=1

Market Restraining Factors

Ethical and Privacy Concerns as Major Restraints in Brain Fingerprint Technology Adoption

Brain fingerprinting technology has deep ethical and privacy concerns because it can track unknown knowledge through involuntary brain responses. Such novel technology raises more questions than answers regarding the eventual misuse of the technology especially since it controls access to private thoughts without explicit consent from the subject. This would position it in criminal investigation and security screenings situations where it could misuse the rights and autonomy of any individual. Involuntary mind-reading scenarios evoke unease in the public and regulatory agencies primarily working to protect private information. There are several speculations that BFT may find utilization other than what it is aimed for, like any system applied with unauthorized surveillance or privacy breaches. These fears from the public and the regulatory agencies represent a tough environmental challenge for widespread application of the technology because of concerns on privacy breach that threatens organizations to implement it. Although BFT holds the benefits of security and truth verification, it is yet to be accepted by the masses if proper ethical guidelines and regulations were not followed during its development phase. Hence, serious ethical and privacy concerns will need to be tackled to make BFT adoption responsible and to gain the trust of the public.

Market Segmentations

- Based on Equipment

- Personal Computer

- Data Acquisition Board

- Graphics Card

- Sensors

- Four-Channel Electroencephalography (EEG) Amplifier System

- Based on Technique

- Brain Fingerprinting Testing

- Scientific Procedure

- Computer Controlled

- Based on Application

- National Security

- Medical Diagnosis

- Advertising

- Criminal Justice

Regional Analysis

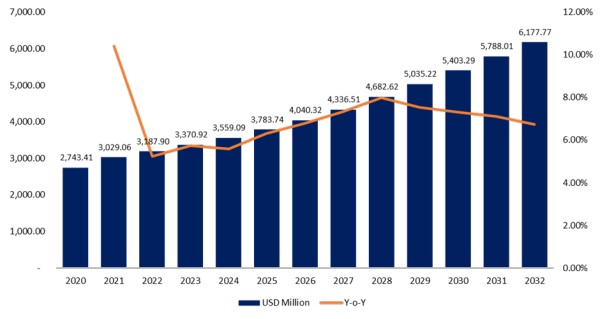

In 2023, in the Brain Fingerprinting Technology market, the brain fingerprinting testing category had a major share and is projected to continue its dominance over the forecast period. Moreover, the scientific procedures category is projected to witness the fastest growth in the coming years.

To ascertain whether a subject’s memory contains specific information related to crime or terrorism, brain fingerprinting, a scientific method, examines brain waves. For instance, the findings of a Brain Fingerprinting Test will reveal different patterns if a person has knowledge of sensitive information concerning criminal conduct that has been used by police during interrogations.

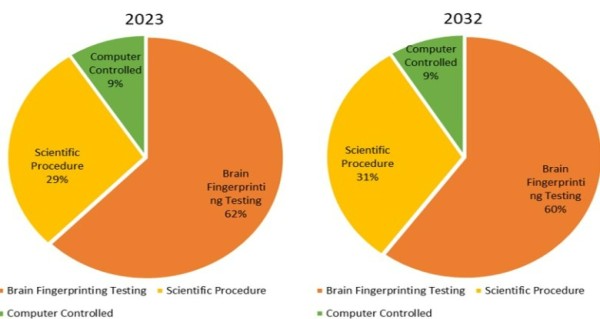

On the basis of regions, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. The global Brain Fingerprint Technology market is highly fragmented, with different regions leading the way in terms of innovation, deployment, and policy support.

North America is expected to be the largest market for Brain Fingerprint Technology during the forecast period Due to the rising number of criminal cases in this region. For instance, 21,570 murder cases were reported in the United States in 2020. The use of brain fingerprinting on suspects in crimes is done with the judge’s approval. The use of Brain Fingerprint Technology has been encouraged by the local government and legal systems, which has helped the market expand there.

On the other hand, The Asia-Pacific region is expected to experience rapid expansion in the brain fingerprinting industry. The region’s developing economies are aiding the market expansion in this region. For instance, India was the second nation after the United States to adopt brain fingerprinting for crime detection and the first to convict an accused based on evidence from such devices. Over the anticipated timeframe, it is anticipated that similar acceptance of this technique by other nations in this region will spur the development of Brain Fingerprint Technology.

To understand the Detailed Country and Regional Market Trend, Visit: https://www.intellectualmarketinsights.com/report/brain-fingerprint-technology-market-size-and-share-analysis/imi-008367

Key Players and Competitor

- Brainwave Science

- Brain Fingerprinting Laboratories

- LABORATORIES (USA)

- BRAINCO (USA)

- NEUROLOGIC RESEARCH (USA)

- STOTT INTERNATIONAL (CANADA)

- BRAINWAVES (ISRAEL)

- COGNISURE (ISRAEL)

- NEUFLEX NEUROTECHNOLOGY (CANADA)

- AXILUM INC. (CANADA)

- BRAIN DYNAMICS (AUSTRALIA)

- NEUROTECHNOLOGY SOLUTIONS (NETHERLANDS)

- BRAINLOCK (UK)

- COGNISCAN (UK)

- NEUROLEX (SWITZERLAND)

- IMENDI NEUROSCIENCE (FRANCE)

- NEUROSIGN GMBH (AUSTRIA)

- COGNISAFE (CHINA)

- BRAINCO JAPAN (JAPAN)

- NEUROSKY (SOUTH KOREA)

- MENTALINK (RUSSIA)

Get Access of this Report: https://www.intellectualmarketinsights.com/report/brain-fingerprint-technology-market-size-and-share-analysis/imi-008367

About Us:

IMIR® Market Research Pvt Ltd.

Intellectual Market Insights Research is a market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including, Semiconductor, aerospace, Automation, Agriculture, Food & Beverages, Automotive, Chemicals and Materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports.

IMIR has the distinguished objective of providing optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact Us:

Digvijay Chakravarty | digvijay.C@intellectualmarketinsights.com

Follow Us: LinkedIn

Email: sales@intellectualmarketinsights.com

Call Us: +1 (814) 487 8486

Contact Data Contact Data Managing Director: Digvijay Chakravarty | Email: digvijay.c@intellectualmarketinsights.com Call us: +1 (814) 487 8486, +919764079503

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Noah's 3Q2024 Earnings Showcase Robust Overseas Growth

SHANGHAI, Nov. 27, 2024 /PRNewswire/ — Noah Holdings Limited (“Noah” or “the Company”) NOAH, a leading and pioneer wealth management service provider offering comprehensive advisory services on global investment and asset allocation primarily for Mandarin-speaking high-net-worth investors, today announced its unaudited financial results for the third quarter of 2024.

The Company generated solid sequential growth in both overseas net revenues and operating income, highlighting the effectiveness of its international expansion. Noah unveiled its new brands to serve overseas Mandarin-speaking clients during the quarter, including its wealth management division, Ark Wealth Management; its asset management division, Olive Asset Management; and its comprehensive services division, Glory Family Heritage. Additionally, Noah remains committed to prioritizing shareholder interests and delivering sustained returns once the window opens for the US$50 million share repurchase program it announced at the end of August.

Financial Results Breakdown

In the third quarter of 2024, net revenues were RMB 683.7 million (US$ 97.4 million), an 11.0% sequential increase, driven primarily by growth in the Company’s overseas business.

Net revenues from overseas were RMB 376.9 million (US$ 53.7 million), an increase of 28.9% year-over-year and 35.3% sequentially. Overseas revenues accounted for over 55.1% of net revenues during the quarter, underscoring Noah’s expanding global presence and unique competitive advantage in serving Mandarin-speaking high-net-worth investors.

Income from operations was RMB 240.8 million (US$ 34.3 million), effectively flat when compared to the same period last year and a notable increase of 79.7% sequentially, primarily due to various cost control initiatives and ongoing efforts to optimize its corporate structure, service quality, and operational efficiency. Operating margin recovered to 35.2%, an increase of 13.5% sequentially.

Global Strategy Driving Sustainable Growth

In the third quarter, and in response to evolving macroeconomic conditions, Noah accelerated its overseas expansion by gradually rolling out wealth management services targeting key markets such as Southeast Asia, Japan, Canada, the United States, and Europe. The Company also deepened collaborations with leading global financial institutions, launching a series of innovative products and services, further boosting its global market competitiveness and influence.

This quarter, Noah also expanded its team of overseas relationship managers to 146, a significant 89.6% year-on-year increase. This growing team significantly strengthens its overseas professional service capabilities and lays a solid foundation for sustainable growth going forward.

Share Repurchase Program Reflects Confidence in the Future

In late August 2024, Noah Holdings’ Board of Directors authorized a US$50 million share repurchase program, allowing the Company to buy back its American depository shares or ordinary shares over a two-year period. This underscores the Company’s commitment to enhancing shareholder value and confidence in its long-term growth prospects. Share repurchases are expected to begin when the next buyback window opens.

“Noah’s third quarter results highlight the progress our global expansion is making and our ability to adapt to evolving market dynamics,” said Noah’s CEO, Mr. Yin Zhe. “At the same time, we have been working to improve our overall global compliance framework and professional service capabilities. We believe the overseas wealth management needs of Mandarin-speaking clients remain inadequately addressed. In response, we continue to actively expand our international business by increasing the number of local branches, strengthening our team of overseas relationship managers, and enhancing our online services capabilities to improve the quality of our offerings. We believe our stock remains undervalued and does not fully reflect our growth prospects, robust balance sheet, and cash reserves, as well as the special bond with Mandarin-speaking high-net-worth investors around the world. This share buyback reflects our confidence in the future as we expand internationally and drive long-term sustainable growth going forward.”

Outlook

Looking ahead, Noah remains committed to monitoring international market dynamics and evolving client needs while optimizing its global asset allocation strategies and service models. The Company will also continue to strengthen compliance and risk management capabilities to ensure steady business growth.

By fostering innovation and professional expertise, Noah aims to deliver comprehensive, high-quality wealth management services to global Mandarin-speaking high-net-worth clients, driving sustainable growth and maximizing long-term value.

Ms. Wang Jingbo, Noah’s Co-Founder and Chairwoman, added, “Noah’s future presents both opportunities and challenges. By adhering to our client-centric philosophy, we will continue refining our products and services to foster deeper client satisfaction and loyalty. At the same time, we will strengthen collaborations with leading global financial institutions, driving innovation and development to ensure Noah remains at the forefront of the global wealth management industry.”

About Noah Holdings Limited

Noah Holdings Limited NOAH HKEX: 6686)) is a leading wealth management service provider in China, offering comprehensive global investment and asset allocation advisory services to high-net-worth investors.

Noah’s wealth management business primarily distributes private equity, secondary market funds, mutual funds, and other products denominated in RMB and other currencies. Through its extensive global network, the Company provides tailored financial solutions and meets clients’ international investment needs via offices in Hong Kong SAR, Taiwan region, Japan, New York, Silicon Valley, and Singapore.

Through its affiliate Gopher Asset Management, Noah manages private equity, public securities, real estate, multi-strategy, and other investments denominated in RMB and other currencies. Noah also offers additional services.

For more information, visit Noah’s official website at ir.noahgroup.com.

Noah Holdings: in_communication@noahgroup.com

![]() View original content:https://www.prnewswire.com/news-releases/noahs-3q2024-earnings-showcase-robust-overseas-growth-302317402.html

View original content:https://www.prnewswire.com/news-releases/noahs-3q2024-earnings-showcase-robust-overseas-growth-302317402.html

SOURCE Noah Holdings Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MicroStrategy Surges 8% In Wednesday Pre-Market: What's Going On?

In a notable rebound, MicroStrategy Inc. experienced an 8.03% rise in pre-market trading on Wednesday following the slow recovery of Bitcoin BTC/USD. This comes after a significant 12.33% drop and closing at $353.69 the previous day, as per Benzinga Pro.

What Happened: On Wednesday, at 6:00 AM ET, Bitcoin was trading around $93,789.55 after dropping to $92,000 levels on Tuesday. Consecutively, MicroStrategy, with a holding of 386,700 Bitcoins valued at $35.4 billion, experienced an upward tick in its pre-market activity.

The company, under the leadership of CEO Michael Saylor, has been a focal point of market speculation due to a 23.64% decline in its stock over the past five sessions. This period also saw a 5.52% decrease in Bitcoin.

Analysts are questioning the sustainability of the company’s strategy which involves borrowing through convertible notes to buy Bitcoin, then selling shares at a premium to reinvest in more Bitcoin.

Last week marked a record for retail investment in MicroStrategy, with nearly $100 million invested and trading volume reaching $136 billion, surpassing even Amazon Inc. AMZN.

Based on the ratings of 12 analysts, MicroStrategy has a consensus price target of $449.5 The high is $690 issued by BTIG on Dec. 11, 2023. The low is $140 issued by Jefferies on Nov. 10, 2022.

The average price target of $563.33 between TD Cowen, Barclays, and Benchmark implies a 41.90% upside for MicroStrategy.

Why It Matters: MicroStrategy’s recent $3 billion offering of 0% convertible senior notes due 2029 has intrigued investors. These notes, offering no interest, were quickly snapped up by institutional buyers, indicating strong market interest despite the lack of traditional returns. The notes’ high conversion rate and potential equity upside have been attractive to investors.

However, the company’s stock has been under scrutiny. Gary Black of The Future Fund LLC has raised concerns about MicroStrategy’s valuation, suggesting it should be significantly lower than its current price. Black’s analysis points to a potential overvaluation, with a suggested price of $105 per share, which is about 75% lower than its current trading price.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo by JOCA_PH on Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

China's robotaxi startup Pony AI raises $260 million in US IPO

(Reuters) -Pony AI said on Wednesday it had raised $260 million in its U.S. initial public offering, valuing the China-based robotaxi company at around $4.55 billion.

It sold 20 million American depositary shares in the offering priced to investors at $13 each, the high-end of its targeted range.

Pony AI’s listing may show how U.S. investors approach China-based companies under Donald Trump’s administration, especially as the two biggest economies in the world vie for dominance in high-stakes industries such as autonomous driving.

The company is set to join a growing cohort of China-based firms tapping U.S. capital markets following the resolution of a longstanding accounting dispute between the two countries.

Other China-based companies, including EV maker Zeekr and peer self-driving tech firm WeRide, also went public in the U.S. earlier in the year. Zeekr is trading 6.5% higher than its IPO price, while WeRide is up nearly 13%.

The Toyota Motor-backed company’s valuation has come down from the $8.5 billion two years ago.

But the automotive sector’s focus on disruptive technologies has led to interest from investors like Uber, who Bloomberg News reported as planning to invest in the IPO.

Pony AI, which will begin trading on the Nasdaq later on Wednesday, also raised an additional $153.4 million in concurrent private placement.

Goldman Sachs, BofA Securities, Deutsche Bank, Huatai Securities and Tiger Brokers were the underwriters for the IPO.

(Reporting by Niket Nishant and Manya Saini in Bengaluru; Editing by Shilpi Majumdar and Tasim Zahid)

Is a Bitcoin Sell-Off Imminent? History Suggests a Very Clear Answer.

The world’s largest cryptocurrency is Bitcoin, (CRYPTO: BTC) with a market valuation of nearly $1.9 trillion. And as of this writing, the price per Bitcoin isn’t far from $100,000 — it’s a value that many didn’t think was possible, especially just a couple of years ago.

Then again, other investors predicted a price of $100,000 for Bitcoin a long time ago. In short, Bitcoin is a polarizing subject. Many smart people maintain that the cryptocurrency will eventually become worthless. On the other side of the debate is MicroStrategy found and executive chairman, Michael Saylor, who believes Bitcoin will be worth a stunning $13 million per coin by 2045.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

So, is a Bitcoin sell-off imminent or is it on its way to more life-changing gains? Well, this cryptocurrency has followed a very predictable pattern during the past decade. And this historical pattern suggests what’s in store for 2025.

Bitcoin is a digital currency and transactions are consequently digital as well. Therefore, the system requires computers to process transactions. And independent third parties use their equipment to voluntarily do this. The process is called mining and they volunteer their services because they’re paid in Bitcoin.

How much do Bitcoin miners get paid? Without going too deep in the weeds, the protocol establishes a certain amount of pay for a certain amount of work. But about every four years, the payments get cut in half. This is known as the Bitcoin halving event.

I’ll momentarily explain why the halving event has historically affected Bitcoin’s price — that’s the more important thing to take away from this discussion. But for now, allow me to simply explain how the halving event has affected the price.

The table below shows the returns for Bitcoin during the calendar year two years before the halving, the year right before the halving, the year of the halving, and the year immediately after a halving. As you can see, the historical pattern is quite clear.

|

Bitcoin Halving Year |

2 Years Before |

Year Before |

Year of |

Year After |

|---|---|---|---|---|

|

2016 |

(15%) |

34% |

124% |

1,369% |

|

2020 |

(73%) |

92% |

303% |

60% |

|

2024 |

(64%) |

155% |

132%* |

TBD |

Percentage return data from StatMuse. *Returns as of 11/25/24, according to YCharts.

When it comes to the regular cycle, Bitcoin has made big gains the year before, the year of, and the year after a halving event. The other year of the four-year cycle represents a down year.

CrowdStrike Stock's Technical Analysis Shows Bullish Trend As It Navigates July Fallout To Deliver Record Q3 Revenue: Here's More

Shares of CrowdStrike Holdings Inc CRWD closed at $364.3 apiece on Tuesday and fell by more than 5% in premarket trading on Wednesday.

Technical analysis pointed towards a bullish trend after the Texas-based cybersecurity technology company reported its third-quarter earnings.

What Happened: Despite the fallout from a faulty software update in July, the company reported its highest-ever revenue in the third quarter, surpassing the $1 billion mark, beating the consensus estimate of $982.36 million, curated by Benzinga.

Technical Analysis: From a technical perspective, the analysis of daily moving averages shows support for the CrowdStrike stock.

Despite falling over 5% in premarket trading on Wednesday, at $344 a piece, CrowdStrike’s stock is above its 20, 50, and 200-day simple moving averages, suggesting a largely bullish trend.

On the other hand, investors can also benefit from some potential selling opportunities – the relative strength index of 68.19 suggests CrowdStrike stock is near the “overbought” territory.

See Also: JD Vance’s Investment Playbook Has Bitcoin And ETFs: Here’s What Else The VP-Elect Is Betting On

Why It Matters: Even though the third-quarter non-GAAP earnings beat estimates, according to the GAAP measures in the company’s press release, it reported a net loss of $16.8 million, as compared to an income of $26.7 million in the third quarter of the previous fiscal.

Additionally, the third-quarter GAAP loss from operations was reported at $55.7 million, compared to income of $3.2 million in the third quarter of fiscal 2024.

The July disruption resulted in flight cancellations globally and impacted sectors such as banking, healthcare, and hospitality. Delta Air Lines Inc. DAL sued the company last month, estimating that the outage cost it $500 million.

To this, the chief financial officer Burt W. Podbere, said, “We expect Q4 free cash flow to reflect a significantly more pronounced July 19 impact in comparison to Q3.”

Analyst Views: According to Benzinga Pro data, CrowdStrike has a consensus price target of $338.11 apiece based on the ratings of 42 analysts.

The high is $440 per share issued by Keybanc on July 2 and the low is $265 apiece issued by Scotiabank on Aug. 14.

The average price target of $393.33 between Evercore ISI Group, Rosenblatt, and Keybanc, implies a 14.67% upside for CrowdStrike.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Plant Extract Market to Surpass US$106.6 Billion by 2034, Driven by Sustainability and Innovation | Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc.-, Nov. 27, 2024 (GLOBE NEWSWIRE) — The global plant extract market (marché des extraits de plantes), valued at US$35.8 billion in 2023, is on track to achieve a CAGR of 10.5% from 2024 to 2034, reaching an impressive US$106.6 billion by the end of 2034. This growth is fueled by increasing consumer demand for natural, sustainable, and clean-label products across various industries, including food & beverages, cosmetics, pharmaceuticals, and dietary supplements.

Plant extracts are widely recognized for their natural bioactive properties and are increasingly being incorporated into formulations for food, beverages, cosmetics, and dietary supplements. Additionally, their applications in pharmaceutical industries are growing due to their therapeutic benefits, such as antimicrobial, anti-inflammatory, and antioxidant properties.

Request a PDF Sample – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=16280

Key Market Drivers: A Growing Shift Toward Sustainability, Health & Innovation

Sustainability continues to play a crucial role in shaping the plant extract market. With growing awareness of eco-friendly and clean-label practices, companies are innovating to meet consumer demand for ethically sourced and minimally processed ingredients. Regions like the U.S., Europe, and Asia-Pacific are leading the charge, with robust investments in R&D and cutting-edge extraction technologies.

The plant extract market is flourishing due to multiple driving factors:

- Clean-label Products: Growing consumer demand for natural and minimally processed ingredients is pushing manufacturers to use plant-based extracts.

- Health-conscious Trends: Rising awareness of plant-based diets and functional foods has elevated the demand for extracts with nutritional and medicinal properties.

- Technological Advancements: Innovations in extraction methods, including supercritical CO₂ extraction and green chemistry, are enhancing product quality and sustainability.

In the cosmetics industry, plant extracts with antimicrobial properties and active ingredients are enabling formulators to develop versatile, natural solutions. Meanwhile, in the food and beverage sector, these extracts enhance flavors and nutrition while aligning with consumer preferences for non-GMO and organic products.

Competitive Landscape: Key Players Focus on Innovation

Leading companies are leveraging innovation and strategic collaborations to capitalize on this growth opportunity:

- ADM: Recently expanded its portfolio with advanced oleoresins and essential oils, addressing the rising demand in food and pharmaceutical applications.

- Symrise: Focused on enhancing extraction methods and sustainable sourcing to meet consumer demand for clean-label flavor solutions in Europe and North America.

- Givaudan: Partnered with emerging startups to develop innovative plant extraction technologies aimed at reducing environmental impact.

- Kangcare Bioindustry Co., Ltd.: Increased its market share in Asia-Pacific, particularly in Japan and Korea, by introducing high-potency dietary supplements.

For more insights on Market trends, opportunities, and competitive strategies, get a customized research report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=16280

Industry players are aligning with sustainability goals, leveraging technology, and exploring emerging markets for growth.

Current Trends in the Plant Extract Market

Several key trends are shaping the future of the market:

- Sustainability Focus: Producers are adopting eco-friendly sourcing and manufacturing methods to meet global sustainability goals.

- Innovative Applications: From natural flavorings in food to active compounds in pharmaceuticals and cosmetics, the applications of plant extracts continue to expand.

- Regional Growth: Emerging markets in Asia-Pacific and Latin America are providing significant opportunities due to abundant raw materials and rising consumer awareness.

Emerging Markets and Opportunities

While North America and Europe remain the largest markets, emerging regions like Asia-Pacific and Latin America offer lucrative growth opportunities. In Japan and South Korea, dietary supplements enriched with plant extracts are gaining popularity due to a strong emphasis on preventive health. Similarly, ASEAN countries are witnessing increased demand for plant-based cosmetics and functional foods.

Market Segmentation

By Type:

- Essential Oils

- Oleoresins

- Flavonoids

- Alkaloids

- Carotenoids

- Others

By Application:

- Food & Beverages

- Cosmetics

- Pharmaceuticals

- Dietary Supplements

- Others

Regional Focus:

- North America: U.S., Canada

- Europe: Germany, U.K., France, Italy, Spain

- Asia-Pacific: Japan, China, India, South Korea, ASEAN

- Latin America: Brazil, Mexico

- Middle East & Africa: GCC, South Africa

Emerging Markets: Asia-Pacific and Latin America Take Center Stage

The Asia-Pacific region, with countries such as Japan, South Korea, and India, is witnessing rapid growth driven by the adoption of dietary supplements and natural cosmetics. Additionally, Latin America, led by Brazil and Mexico, offers untapped potential due to the region’s vast biodiversity and increasing focus on plant-based innovations.

Buy This Premium Research Report Now: https://www.transparencymarketresearch.com/checkout.php?rep_id=16280<ype=S

Technological Advancements Driving Growth

Advances in extraction technologies are improving the efficiency and sustainability of plant extract production. Key innovations include:

- Supercritical CO2 Extraction: Enabling high-yield, solvent-free extraction for essential oils and oleoresins.

- Green Chemistry: Supporting the development of eco-friendly products with minimal environmental impact.

- Nanotechnology: Enhancing bioavailability and potency of plant-based ingredients in pharmaceuticals and cosmetics.

Looking Ahead: A Promising Future

As consumer demand for natural and sustainable products continues to rise, the plant extract market is set to become a cornerstone of innovation in food, cosmetics, and pharmaceuticals. With the market expected to reach US$106.6 billion by 2034, companies that invest in sustainability, advanced technologies, and strategic regional expansion will secure a competitive edge.

Browse More Trending Research Reports in Chemicals and Materials

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Ken Griffin Sold 91% of Citadel's Stake in Palantir and Nearly Tripled His Position in This Cutting-Edge Artificial Intelligence (AI) Stock

This has been a busy month on the news front for Wall Street. Between Election Day, earnings season, and the October inflation report, investors haven’t been hurting for catalysts. But among these various data releases, you might have missed what’s arguably the most important of them all — the Nov. 14 deadline to file Form 13F with the Securities and Exchange Commission for the September-ended quarter.

A 13F is a required filing no later than 45 calendar days following the end to a quarter for institutional investors with at least $100 million in assets under management. These filings offer investors a concise snapshot of which stocks Wall Street’s most-famous money managers have been buying and selling.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Although investors eagerly wait for the curtain to lift on Warren Buffett’s trading activity at Berkshire Hathaway, he’s far from the only billionaire who’s overseen big-time returns on Wall Street. For instance, investors also tend to pay close attention to Ken Griffin at Citadel, who oversees the most-profitable hedge fund since inception.

Citadel operates an active fund that almost always hedges its common-stock position with put and call options, and may have other positions (short positions, as well as options held short) that don’t show up in a 13F filing.

But among the countless trades made by Griffin’s hedge fund during the third quarter, two stand out.

Arguably one of the hottest artificial intelligence (AI) stocks on the planet right now is cloud data-mining specialist Palantir Technologies (NYSE: PLTR). Shares of Palantir have skyrocketed by 791% on a trailing-two-year basis, as of this writing on Nov. 23, with the company’s market cap briefly tipping the scales at $150 billion last week.

Yet in spite of these otherworldly gains, billionaire Ken Griffin disposed of 91% of the Palantir common shares Citadel’s hedge fund held during the September-ended quarter. There were also corresponding increases in put and call options held by Citadel for Palantir, which hedges against its common-stock position.

Before digging into the catalysts that might coerce a billionaire money manager and their team to sell shares of Palantir, it’s important to first understand the bull thesis.

The wind in Palantir’s sails is its irreplaceability at scale. The company’s AI-inspired Gotham platform is used by federal governments to plan and execute missions, as well as gather copious amounts of data. Meanwhile, its AI- and machine learning-powered Foundry platform helps businesses make sense of their data. No other company comes close to offering the breadth of services that Palantir can, which leads to highly predictable operating cash flow quarter after quarter.

JPMorgan upgrades Mexican equities on U.S. growth, downgrades Brazil

(Reuters) – JPMorgan upgraded Mexican equities to “overweight” from “neutral” on the back of strong U.S. growth, but cut Brazilian equities citing slower growth in China amid emerging pressures from President-elect Donald Trump’s tariff policy.

“Good US growth continues to support Mexican consumers through remittances, at the same time that a weaker MXN increases the purchasing power of these dollars,” said JPMorgan strategist Emy Shayo Cherman.

“There is a pretty high correlation between Mexican and US industrial production,” added Cherman in a note dated Tuesday.

J.P.Morgan downgraded Brazilian equities to “neutral” from “overweight.”

Weaker growth in China, the world’s second largest economy could hurt Brazil through lower commodity prices, given the Latin American country is a major soy exporter.

Trump, who takes office on Jan. 20, said he would impose a 25% tariff on imports from Canada and Mexico until they clamped down on drugs and migrants crossing the border. He also outlined “an additional 10% tariff, above any additional tariffs” on imports from China.

Monetary policy outlook by the central banks of both countries could also impact equity markets, JPMorgan said. Brazil is expected to extend rate hikes into 2025, which could hurt corporate earnings growth, while Mexico’s central bank is projected to continue easing going into next year.

Latin American equity markets have underperformed this year. In dollar terms, Brazil’s MSCI index has stumbled 23% since the start of the year, while peer Mexico has wiped out more than 28% That compares to a more than 6% gain in the wider MSCI emerging market equity index.

“We give Mexico the benefit of the doubt, but will be closely monitoring developments, especially on the institutional reform side, which remains the key risk,” J.P.Morgan added.

(Reporting by Siddarth S in Bengaluru, editing by Karin Strohecker)