Billionaires Are Buying Up Beaten-Down Pfizer Stock. Should You Follow Their Lead?

Nobody can predict the future, but it’s not hard to imagine increasing pharmaceutical sales. In 2022, prescription drug spending in the U.S. climbed more than 8% to reach $406 billion. It’s a lot but still less than one-third of the amount soaked up by American hospitals.

It might not feel like it when you pay the bill, but prescription drugs give healthcare systems a tremendous return on their investment. With this in mind, it’s no wonder billionaires are buying up shares of one of America’s largest pharmaceutical companies, Pfizer (NYSE: PFE).

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

In the third quarter, Jeff Yass and the Susquehanna fund he manages raised its Pfizer stake to 10.3 million shares. Igor Tulchinsky more than doubled the size of WorldQuant Millennium Advisors’ Pfizer stake by purchasing 1.2 million shares.

Tulchinsky and Yass make lots of bets every quarter, and many of them don’t work out. Before blindly following these billionaires, let’s look at some of the reasons Pfizer’s stock price has fallen about 49% since the end of 2022.

Shares of Pfizer have been under pressure because the company is getting close to some patent cliffs. The main patent protecting Eliquis, a drug it markets in partnership with Bristol Myers Squibb, expires in 2026.

Sales of the next-generation blood thinner are still on the rise and responsible for about 9% of total revenue. Pfizer has settled with several drug manufacturers that will hold off launching generic versions of Eliquis until April 1, 2028. In the meantime, it could lose exclusivity for Ibrance in the U.S. market in 2027.

Ibrance sales are responsible for about 6% of total revenue, and a loss of exclusivity is only part of the problem. The blockbuster breast cancer treatment is already losing market share to similar drugs from Novartis and Eli Lilly, called Kisqali and Verzenio, respectively. Sales of these competitors bounded forward, but Q3 Ibrance sales fell 10% year over year.

Pfizer’s prostate cancer treatment, Xtandi, earned approval to treat early-stage prostate cancer patients in 2023. Q3 sales shot 28% higher to $561 million, but these gains could evaporate in a few short years. The main U.S. patent protecting Xtandi’s exclusivity expires in 2027.

Drug patents don’t last very long compared to other forms of intellectual property. Big pharmaceutical companies like Pfizer constantly funnel profits from their present blockbusters toward the next generation of products.

Warren Buffett's Smartest Move in Q3, According to Wall Street

Warren Buffett told Berkshire Hathaway shareholders in 2022 that anyone advising their kids on how to “make money per point of IQ and per erg of energy, tell them to go to Wall Street.” That doesn’t necessarily mean Buffett thinks Wall Street is full of high-IQ individuals, though. The legendary investor also said he’d bet on monkeys making stock picks before he’d bet on Wall Street.

But what does Wall Street think about Buffett’s recent investing moves? Analysts seem to view one of his trades in the third quarter as especially smart.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Before we get to what Wall Street thinks was Buffett’s smartest move in Q3, I have to point out that analysts disagreed with most of Buffett’s recent trades. That’s because Buffett sold more stocks than he bought — and Wall Street thinks most of those stocks will rise over the next 12 months.

For example, analysts don’t seem to be on board with Buffett’s decision to sell another 100 million shares of Apple. Thirty-two of the 47 analysts surveyed by LSEG in November rate the iPhone maker as either a “buy” or a “strong buy.” The average 12-month price target for Apple reflects an upside potential of around 5%.

Wall Street doesn’t agree with Buffett’s Q3 sales of Nu Holding or Ulta Beauty, either. The consensus price target for Nu is 12% above its current share price, while the consensus target for Ulta is roughly 9.5% above its current share price.

However, analysts were generally in alignment with a few of Buffett’s Q3 decisions. The agreement was primarily centered on the stocks the “Oracle of Omaha” bought rather than the ones he sold.

As a case in point, Berkshire Hathaway increased its position in SiriusXM Holdings (NASDAQ: SIRI) by 7.35 million shares in Q3. Some of this was due to the merger between SiriusXM and Liberty Media’s Sirius XM interests, in which Berkshire previously owned stakes. After the end of Q3, though, Buffett bought more shares of SiriusXM.

Wall Street clearly favors these moves. The average analysts’ 12-month price target for SiriusXM still reflects an upside potential of around 8% even after the stock has jumped close to 13% since the end of Q3.

Analysts like Buffett’s purchase of Domino’s Pizza, too. He initiated a new position in the pizza company in Q3, buying almost 1.28 million shares. Domino’s stock has risen roughly 9% since the end of the quarter, but the consensus price target is still nearly 2.5% above the current share price.

Pharmaceutical Contract Development and Manufacturing Market to Witness 6.9% CAGR by 2031 | SkyQuest Technology

Westford, USA, Nov. 27, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that pharmaceutical contract development and manufacturing market size will attain the value of USD 222.87 Billion by 2031, with a CAGR of 6.9% during the forecast period (2024-2031). The market is expanding rapidly due to mounting pressure on key players, challenges in market growth, difficulties in the pharmaceutical industry’s development process, an increasing number of patents expiring and an increase in the prevalence of chronic diseases. Governments around the world are placing more emphasis on improving the quality of life for the geriatric population, which is leading to an increase in geriatric drug clinical trials, increased attention to domestic active API manufacturers even in developed nations, and the establishment of contract manufacturing organizations (CMOs) in emerging economies. In the coming years, these trends are most likely to drive demand in the global market. In addition, increasing demand from the oncology sector is driving the expansion of pharmaceutical contract development and manufacturing industry globally.

Request your free sample PDF of the report today: https://www.skyquestt.com/sample-request/pharmaceutical-contract-development-and-manufacturing-market

Browse in-depth TOC on “Pharmaceutical Contract Development and Manufacturing Market ”

- Pages – 242

- Tables – 63

- Figures – 75

Pharmaceutical Contract Development and Manufacturing Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 122.25 Billion |

| Estimated Value by 2031 | USD 222.87 Billion |

| Growth Rate | Poised to grow at a CAGR of 6.9% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Service, End user and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the world |

| Report Highlights | Increasing Number of Patents Expiring |

| Key Market Opportunities | Expansion in Emerging Markets and Rising Focus on Specialty Drugs |

| Key Market Drivers | Increase in the Prevalence of Chronic Diseases |

Pharmaceutical Contract Development and Manufacturing Market Segmental Analysis

Base on service, The pharmaceutical contract development and manufacturing market is anticipated to be dominated by the pharmaceutical manufacturing services segment in 2022. The huge market share of this sector is related to the expanding need for the industry to lower manufacturing costs, the expanding demand for high-quality bulk manufacturing, and the expanding need for generic medications. However, it is anticipated that during the projected period, the category for biologics manufacturing services will develop at the highest CAGR.

Base on end user, Large firms, small & mid-size companies, and generic pharmaceutical companies make up the three segments of the industry based on end users. The market is anticipated to be dominated by large companies in 2022. The significant market share of this sector is linked to the rising global demand from businesses, the growing demand for cutting-edge production techniques and technologies, and the pharmaceutical industry’s ongoing efforts to cut production costs.

Pharmaceutical Manufacture Segment to Dominate Due to Expanding Relevance of Quality Dosage

As per the pharmaceutical contract development and manufacturing market outlook, the market is expected to be dominated by the pharmaceutical manufacture segment in 2023. The largest market share in this segment is related to the expanding need of industry to reduce operating costs and the demand for the expanding relevance of quality dosage.

For a tailored report, contact us to request a free customization: https://www.skyquestt.com/speak-with-analyst/pharmaceutical-contract-development-and-manufacturing-market

Small and Mid-size Pharmaceutical Companies Segment is Growing Due to Rising Investments in Niche and Specialty Drugs

Small and mid-size pharmaceutical companies are the fastest growing segment in the market as they increasingly rely on outsourcing to access advanced technologies and large-scale manufacturing capabilities they lack. CDMOs enable these companies to bring products to market without incurring significant infrastructure costs, fostering innovation in niche and specialty segments.

North America is Dominating Due to Expanding Demand for Generic Medicine and Biologics

The pharmaceutical contract development and manufacturing market is anticipated to be dominated by the North America region. This region’s largest segment is primarily driven by the expanding demand for generic medicine and biologics, CDMO consolidation and rising need for biosimilars due to patent expiry. Furthermore, the focus on pharmaceutical and biotechnology research by organizations has made the contract manufacturing business in North America extremely competitive.

Drivers

- Growing Demand for Outsourcing Pharmaceutical Manufacturing

- Rising Biopharmaceutical and Biosimilar Production

- Advancements in Drug Delivery Technologies

Restraints

- High Initial Investment and Operational Costs

- Stringent Regulatory Requirements

- Supply Chain Disruptions

Prominent Players in Pharmaceutical Contract Development and Manufacturing Market

- Catalent

- Patheon

- Lonza Group AG

- Thermo Fisher Scientific, Inc.

- Boehringer Ingelheim GmbH

- Evonik Industries AG

- Recipharm AB

- Vetter Pharma International GmbH

- WuXi AppTec Co. Ltd.

- Famar Health Care Services

- Almac Group

- Jubilant Life Sciences Limited

- Samsung BioLogics

- PRA Health Sciences

- Cambrex Corporation

- Ajinomoto Bio-Pharma Services

- Syneos Health

- Mylan N.V.

- AMRI Global

- Baxter BioPharma Solutions

Purchase now to gain valuable insights and stay informed: https://www.skyquestt.com/buy-now/pharmaceutical-contract-development-and-manufacturing-market

Key Questions Answered in Pharmaceutical Contract Development and Manufacturing Market Report

- Which region has the biggest share in the market?

- Who are the key players in the market?

- Which is the fastest growing region in the market?

- What are the key restraints of the market?

This report provides the following insights:

Analysis of key drivers (growing demand for outsourcing pharmaceutical manufacturing), restraints (high initial investment and operational costs), opportunities (expansion in emerging markets and rising focus on specialty drugs) influencing the growth of pharmaceutical contract development and manufacturing market.

- Market Dynamics: Comprehensive information about the various products offered by the dominant players in the pharmaceutical contract development and manufacturing market.

- Product Development/Innovation: An overview of emerging trends, R&D activities and product launches in the pharmaceutical contract development and manufacturing market.

- Market Growth: Detailed information on profitable growing industries.

- Market Trends: Complete information about new products, emerging geographical areas and recent developments in the market.

- Competitive Analysis: An in-depth analysis of the market segments, growth strategies, revenue analysis, and products of the key market players

To read the full report, please visit: https://www.skyquestt.com/report/pharmaceutical-contract-development-and-manufacturing-market

Related Reports:

Medical Terminology Software Market Set to Grow at 19.4% CAGR Through 2031

Light Therapy Market Set to Grow at 4.6% CAGR Through 2031

Biological Safety Cabinet Market Set to Grow at 8.30% CAGR Through 2031

Fitness Tracker Market Set to Grow at 6.60% CAGR Through 2031

Therapeutic Vaccines Market Set to Grow at 10.5% CAGR Through 2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pharmaceutical Contract Development and Manufacturing Market to Witness 6.9% CAGR by 2031 | SkyQuest Technology

Westford, USA, Nov. 27, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that pharmaceutical contract development and manufacturing market size will attain the value of USD 222.87 Billion by 2031, with a CAGR of 6.9% during the forecast period (2024-2031). The market is expanding rapidly due to mounting pressure on key players, challenges in market growth, difficulties in the pharmaceutical industry’s development process, an increasing number of patents expiring and an increase in the prevalence of chronic diseases. Governments around the world are placing more emphasis on improving the quality of life for the geriatric population, which is leading to an increase in geriatric drug clinical trials, increased attention to domestic active API manufacturers even in developed nations, and the establishment of contract manufacturing organizations (CMOs) in emerging economies. In the coming years, these trends are most likely to drive demand in the global market. In addition, increasing demand from the oncology sector is driving the expansion of pharmaceutical contract development and manufacturing industry globally.

Request your free sample PDF of the report today: https://www.skyquestt.com/sample-request/pharmaceutical-contract-development-and-manufacturing-market

Browse in-depth TOC on “Pharmaceutical Contract Development and Manufacturing Market ”

- Pages – 242

- Tables – 63

- Figures – 75

Pharmaceutical Contract Development and Manufacturing Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 122.25 Billion |

| Estimated Value by 2031 | USD 222.87 Billion |

| Growth Rate | Poised to grow at a CAGR of 6.9% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Service, End user and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the world |

| Report Highlights | Increasing Number of Patents Expiring |

| Key Market Opportunities | Expansion in Emerging Markets and Rising Focus on Specialty Drugs |

| Key Market Drivers | Increase in the Prevalence of Chronic Diseases |

Pharmaceutical Contract Development and Manufacturing Market Segmental Analysis

Base on service, The pharmaceutical contract development and manufacturing market is anticipated to be dominated by the pharmaceutical manufacturing services segment in 2022. The huge market share of this sector is related to the expanding need for the industry to lower manufacturing costs, the expanding demand for high-quality bulk manufacturing, and the expanding need for generic medications. However, it is anticipated that during the projected period, the category for biologics manufacturing services will develop at the highest CAGR.

Base on end user, Large firms, small & mid-size companies, and generic pharmaceutical companies make up the three segments of the industry based on end users. The market is anticipated to be dominated by large companies in 2022. The significant market share of this sector is linked to the rising global demand from businesses, the growing demand for cutting-edge production techniques and technologies, and the pharmaceutical industry’s ongoing efforts to cut production costs.

Pharmaceutical Manufacture Segment to Dominate Due to Expanding Relevance of Quality Dosage

As per the pharmaceutical contract development and manufacturing market outlook, the market is expected to be dominated by the pharmaceutical manufacture segment in 2023. The largest market share in this segment is related to the expanding need of industry to reduce operating costs and the demand for the expanding relevance of quality dosage.

For a tailored report, contact us to request a free customization: https://www.skyquestt.com/speak-with-analyst/pharmaceutical-contract-development-and-manufacturing-market

Small and Mid-size Pharmaceutical Companies Segment is Growing Due to Rising Investments in Niche and Specialty Drugs

Small and mid-size pharmaceutical companies are the fastest growing segment in the market as they increasingly rely on outsourcing to access advanced technologies and large-scale manufacturing capabilities they lack. CDMOs enable these companies to bring products to market without incurring significant infrastructure costs, fostering innovation in niche and specialty segments.

North America is Dominating Due to Expanding Demand for Generic Medicine and Biologics

The pharmaceutical contract development and manufacturing market is anticipated to be dominated by the North America region. This region’s largest segment is primarily driven by the expanding demand for generic medicine and biologics, CDMO consolidation and rising need for biosimilars due to patent expiry. Furthermore, the focus on pharmaceutical and biotechnology research by organizations has made the contract manufacturing business in North America extremely competitive.

Drivers

- Growing Demand for Outsourcing Pharmaceutical Manufacturing

- Rising Biopharmaceutical and Biosimilar Production

- Advancements in Drug Delivery Technologies

Restraints

- High Initial Investment and Operational Costs

- Stringent Regulatory Requirements

- Supply Chain Disruptions

Prominent Players in Pharmaceutical Contract Development and Manufacturing Market

- Catalent

- Patheon

- Lonza Group AG

- Thermo Fisher Scientific, Inc.

- Boehringer Ingelheim GmbH

- Evonik Industries AG

- Recipharm AB

- Vetter Pharma International GmbH

- WuXi AppTec Co. Ltd.

- Famar Health Care Services

- Almac Group

- Jubilant Life Sciences Limited

- Samsung BioLogics

- PRA Health Sciences

- Cambrex Corporation

- Ajinomoto Bio-Pharma Services

- Syneos Health

- Mylan N.V.

- AMRI Global

- Baxter BioPharma Solutions

Purchase now to gain valuable insights and stay informed: https://www.skyquestt.com/buy-now/pharmaceutical-contract-development-and-manufacturing-market

Key Questions Answered in Pharmaceutical Contract Development and Manufacturing Market Report

- Which region has the biggest share in the market?

- Who are the key players in the market?

- Which is the fastest growing region in the market?

- What are the key restraints of the market?

This report provides the following insights:

Analysis of key drivers (growing demand for outsourcing pharmaceutical manufacturing), restraints (high initial investment and operational costs), opportunities (expansion in emerging markets and rising focus on specialty drugs) influencing the growth of pharmaceutical contract development and manufacturing market.

- Market Dynamics: Comprehensive information about the various products offered by the dominant players in the pharmaceutical contract development and manufacturing market.

- Product Development/Innovation: An overview of emerging trends, R&D activities and product launches in the pharmaceutical contract development and manufacturing market.

- Market Growth: Detailed information on profitable growing industries.

- Market Trends: Complete information about new products, emerging geographical areas and recent developments in the market.

- Competitive Analysis: An in-depth analysis of the market segments, growth strategies, revenue analysis, and products of the key market players

To read the full report, please visit: https://www.skyquestt.com/report/pharmaceutical-contract-development-and-manufacturing-market

Related Reports:

Medical Terminology Software Market Set to Grow at 19.4% CAGR Through 2031

Light Therapy Market Set to Grow at 4.6% CAGR Through 2031

Biological Safety Cabinet Market Set to Grow at 8.30% CAGR Through 2031

Fitness Tracker Market Set to Grow at 6.60% CAGR Through 2031

Therapeutic Vaccines Market Set to Grow at 10.5% CAGR Through 2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Frontenac Mortgage Investment Corporation Announces the Appointment of Chief Executive Officer and Resignation of Director

SHARBOT LAKE, ON, Nov. 26, 2024 /CNW/ –

Appointment of Chief Executive Officer

Frontenac Mortgage Investment Corporation (“FMIC” or the “Company“) today announced the appointment of Wayne Robinson to serve as Chief Executive Officer of the Company, effective immediately.

Wayne Robinson founded the Robinson Group (W.A. Robinson Asset Management Ltd., Pillar Financial Services Inc. and FMIC) in 1980, previously serving as Chief Executive Officer of FMIC from its founding until 2014.

Resignation of Director

FMIC also announced today that Ryan Seeds has tendered his resignation as a director and chair of the board of directors of the Company (the “Board“) effective November 22, 2024. FMIC thanks Mr. Seeds for his valuable contributions during his tenure at the Company and wishes him all the best in his future endeavours.

The remaining members of the Board, Eric Dinelle, Meghan Davis and Ryan Wykes, will continue to supervise the management of the business and affairs of the Company.

More information about FMIC is available under FMIC’s profile on SEDAR+ at www.sedarplus.ca.

SOURCE Frontenac Mortgage Investment Corporation

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/26/c1880.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/26/c1880.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mortgage and refinance rates today, November 27, 2024: Rates barely move

After dropping yesterday, mortgage rates have hardly budged today. According to Zillow, the 30-year fixed rate and 15-year fixed rate have both increased by just one basis point to 6.45% and 5.82%, respectively.

So far, this week is a good example of what we may experience for the next few months: fairly stagnant mortgage rates with occasional spikes and falls. Rather than attempting to time the housing market, focus on preparing financially to buy a home and house hunting when it makes the most sense for your stage in life.

Dig deeper: When will mortgage rates go down? A look at 2024 and 2025.

Here are the current mortgage rates, according to the latest Zillow data:

-

30-year fixed: 6.45%

-

20-year fixed: 6.24%

-

15-year fixed: 5.82%

-

5/1 ARM: 6.60%

-

7/1 ARM: 6.69%

-

30-year VA: 5.85%

-

15-year VA: 5.44%

-

5/1 VA: 6.15%

-

30-year FHA: 5.58%

Remember, these are the national averages and rounded to the nearest hundredth.

Learn more: 5 strategies for getting the lowest mortgage rates

These are today’s mortgage refinance rates, according to the latest Zillow data:

-

30-year fixed: 6.53%

-

20-year fixed: 6.35%

-

15-year fixed: 5.90%

-

5/1 ARM: 6.05%

-

7/1 ARM: 6.55%

-

30-year VA: 5.89%

-

15-year VA: 5.80%

-

5/1 VA: 5.51%

Again, the numbers provided are national averages rounded to the nearest hundredth. Mortgage refinance rates are often higher than rates when you buy a house, although that’s not always the case.

Use Yahoo Finance’s free mortgage calculator to see how various interest rates and term lengths will impact your monthly mortgage payment. It also shows how the home price and down payment amount play into things.

Our calculator includes homeowners insurance and property taxes in your monthly payment estimate. You even have the option to enter costs for private mortgage insurance (PMI) and homeowners’ association dues if those apply to you. These details result in a more accurate monthly payment estimate than if you simply calculated your mortgage principal and interest.

There are two main advantages to a 30-year fixed mortgage: Your payments are lower, and your monthly payments are predictable.

A 30-year fixed-rate mortgage has relatively low monthly payments because you’re spreading your repayment out over a longer period of time than with, say, a 15-year mortgage. Your payments are predictable because, unlike with an adjustable-rate mortgage (ARM), your rate isn’t going to change from year to year. Most years, the only things that might affect your monthly payment are any changes to your homeowners insurance or property taxes.

The main disadvantage to 30-year fixed mortgage rates is mortgage interest — both in the short and long term.

A 30-year fixed term comes with a higher rate than a shorter fixed term, and it’s higher than the intro rate to a 30-year ARM. The higher your rate, the higher your monthly payment. You’ll also pay much more in interest over the life of your loan due to both the higher rate and the longer term.

The pros and cons of 15-year fixed mortgage rates are basically swapped from the 30-year rates. Yes, your monthly payments will still be predictable, but another advantage is that shorter terms come with lower interest rates. Not to mention, you’ll pay off your mortgage 15 years sooner. So you’ll save potentially hundreds of thousands of dollars in interest over the course of your loan.

However, because you’re paying off the same amount in half the time, your monthly payments will be higher than if you choose a 30-year term.

Dig deeper: 15-year vs. 30-year mortgages

Adjustable-rate mortgages lock in your rate for a predetermined amount of time, then change it periodically. For example, with a 5/1 ARM, your rate stays the same for the first five years and then goes up or down once per year for the remaining 25 years.

The main advantage is that the introductory rate is usually lower than what you’ll get with a 30-year fixed rate, so your monthly payments will be lower. (Current average rates don’t reflect this, though — fixed rates are actually lower. Talk to your lender before deciding between a fixed or adjustable rate.)

With an ARM, you have no idea what mortgage rates will be like once the intro-rate period ends, so you risk your rate increasing later. This could ultimately end up costing more, and your monthly payments are unpredictable from year to year.

But if you plan to move before the intro-rate period is over, you could reap the benefits of a low rate without risking a rate increase down the road.

Learn more: Adjustable-rate vs. fixed-rate mortgage

The national average 30-year mortgage rate is 6.45% right now, according to Zillow. But keep in mind that averages can vary depending on where you live. For example, if you’re buying in a city with a high cost of living, rates could be even higher.

Mortgage rates aren’t necessarily expected to go down before the end of 2024. They’ll probably decrease in 2025, but as the country awaits how Trump’s presidency will affect the economy, it’s unclear how significantly rates could drop next year.

Mortgage rates have mostly been rising over the last two months, though they’re still lower than this time last year.

In many ways, securing a low mortgage refinance rate is similar to when you bought your home. Try to improve your credit score and lower your debt-to-income ratio (DTI). Refinancing into a shorter term will also land you a lower rate, though your monthly mortgage payments will be higher.

3 Top Tech Stocks to Buy Right Now

The best technology stocks rarely come cheap in bull markets. But despite the broader market hovering near its all-time high, a handful of high-quality companies’ stocks have stumbled, for reasons ranging from regulatory scrutiny to geopolitical fears. What do they all have in common? These companies dominate their respective industries.

That doesn’t guarantee their future success, but with some great stocks, the only times you’ll have a shot at buying in on the cheap will come when short-term adversity strikes.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Below are three top-notch technology stocks currently in the bargain bin because they carry some extra baggage. All three companies are positioned for long-term growth that more than justifies their current valuations. Consider buying them while they’re down because they probably won’t stay so cheap once the storm clouds clear away.

Since the company lost an antitrust lawsuit in early August, there’s been a lot of noise around internet search giant Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG). Regulators are pushing for a forced sale of its Google Chrome web browser and for rules against deals that protect its video platform YouTube and artificial intelligence (AI) app Gemini from competition.

Alphabet makes most of its money from digital ads it displays with Google Search results and in videos on YouTube, so the thought that competitive pressure might rise on its ad business has kept the stock down. Alphabet now trades at a forward P/E of just 20 times expected earnings, a bargain for a company that analysts estimate will grow its earnings by an average of 17% to 18% over the next three to five years.

Changes are coming to Alphabet, but investors might be overreacting. Chrome’s value in a sale has been estimated to be as high as $20 billion, which would be a nice influx of cash for Alphabet. And the proposed restrictions might reduce the tilt of the playing field, but Google could stay a big winner anyway. Meanwhile, Alphabet’s cloud business is becoming an increasingly important part of the company. Investors may look back at this period of uncertainty about Alphabet’s future as a buying opportunity.

The United States and China are locked in an AI battle that has put ASML Holding (NASDAQ: ASML) in a precarious position. The Dutch company is the world’s only manufacturer of the extreme ultraviolet lithography (EUV) machines capable of producing the types of high-end chips that AI applications require. The U.S. is pressuring ASML, the Netherlands, and the European Union to block sales of those machines to China, which has been an important market for ASML.

Chlorpropham Market is Set to Reach US$ 147.2 Million with a CAGR of 4.1% by 2034

Rockville, MD, Nov. 27, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global chlorpropham market is estimated to reach a valuation of US$ 98.5 million in 2024 and is expected to grow at a CAGR of 4.1% during the forecast period of (2024 to 2034).

Chlorpropham serves as a selective herbicide and plant growth regulator, finding its primary application in agriculture, especially for the suppression of sprouts in stored potatoes. The global market for chlorpropham has witnessed consistent growth, driven by the rising demand for prolonged shelf life of harvested crops and an escalating need for efficient weed control across various types of cultivation.

The increasing population, demand for food, and urgent need for yield and quality improvement in crops are the key drivers of the market. On the other hand, increasing regulatory scrutiny, and an observable shift towards organic farming are acting as challenges for the market.

The market is segmented based on application herbicide, sprout inhibitor, crop type potatoes, other root vegetables, and by geography. Developing sophisticated agricultural techniques, North America and Europe are two of the leading markets, while Asia-Pacific will potentially register a remarkable growth rate in the chlorpropham market. Development of eco-friendly formulation and increased adoption in emerging economies, as they develop respective agricultural sectors, are some of the future trends in the chlorpropham market.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=8222

Key Takeaways from Market Study

- The global chlorpropham market is projected to grow at 4.1% CAGR and reach US$ 147.2 million by 2034

- The market created an opportunity of US$ 48.7 million between 2024 to 2034

- North America is a prominent region that is estimated to hold a market share of 30.6% in 2024

- Concentrate form segment is estimated to grow at a CAGR of 4.0% creating an absolute $ opportunity of US$ 33.2 million between 2024 and 2034

- North America and East Asia are expected to create an absolute $ opportunity of US$ 28.5 million collectively

“The chlorpropham market is very resilient, considering various regulatory challenges in light of growing concern about food security worldwide. However, the industry will have to negotiate a changing landscape as consumers increasingly look for greener alternatives. Key players in this dynamic agricultural sector should focus on developing environmentally friendly formulations and diversifying applications to sustain growth.” says a Fact.MR analyst.

Leading Players Driving Innovation in the Chlorpropham Market:

Molecor Tecnología; Wavin B.V.; Polypipe Group plc; Pipelife International; Vinidex; Ori-Plast Limited; JM Eagle; Iplex Pipelines; Other Prominent Players

Country-specific Perspectives

The chlorpropham market in the United States is expected to reach US$ 348.9 million in 2024 and grow at a compound annual growth rate (CAGR) of 4.8% through 2034, creating an absolute opportunity of US$ 210.4 million.

Numerous aspects of the US food industry and agricultural environment contribute to the widespread use of chlorpropham in the country. First of all, the United States is a major grower of potatoes, and large amounts of these potatoes require long-term storage to meet demand throughout the year. Chlorpropham is applied under ideal conditions thanks to the country’s advanced cold storage infrastructure, which increases its efficacy.

Chlorpropham’s sustained acceptance is further bolstered by its incorporation into standard potato storage management procedures and growers’ familiarity with its use. Additionally, chlorpropham’s ability to prolong storage life while preserving crop quality aligns with the year-round demand for fresh food in the US market.

Chlorpropham Industry News:

- In April 2024, BASF is updating its production capacities for a number of chemical segments, including chlorpropham, and updating its Chloroformates and Acid Chlorides Plant at the Ludwigshafen Site in Germany. Additionally, this will help customers in Europe flourish.

- Bayer announced in February 2024 that it intended to restructure its line of herbicide products, including chlorpropham, to conform to regulatory requirements and sustainability goals. The business works hard to reduce its negative effects on the environment while maintaining the effectiveness of its products.

- The Dow Chemical Company developed its herbicides with a focus on chlorpropham in March 2024. The majority of the work has been focused on enhancing application effectiveness while reducing environmental impact at the same time.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=8222

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global chlorpropham market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of by form (concentrate, liquid), by application (terrestrial food crops, nonfood crops, ornamentals crops), across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Checkout More Related Studies Published by Fact.MR Research:

According to the new market research report by Fact.MR, the global lens cleaning product market is estimated to touch US$ 13.86 billion in 2024. Sales are evaluated to increase at 3.8% CAGR to reach a valuation of US$ 20.12 billion by the end of 2034.

According to the latest study released by Fact.MR, the global cathode active material market has been projected to rise from a size of US$ 29.85 billion in 2024 to US$ 49.55 billion by the end of 2034. Demand is evaluated to increase at a CAGR of 5.2% between 2024 and 2034.

The global natural zeolite market is estimated to generate a turnover of US$ 13.25 billion in 2024 and is further forecasted to advance at a CAGR of 3.1% to reach a value of US$ 17.98 billion by the end of 2034.

The global calcined alumina market is analyzed at a value of US$ 2.9 billion in 2024 and is projected to reach a size of US$ 5.14 billion by 2034. Worldwide demand is forecasted to advance at a CAGR of 5.9% from 2024 to 2034.

The global cold flow improvers market was valued at US$ 869.5 million in 2024 and has been forecast to expand at a noteworthy CAGR of 6.4% to end up at US$ 1,616.9 million by 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia CEO Jensen Huang Says This Is the "Next Wave of AI" — and He Singled Out 1 Potential Big Winner Other Than Nvidia

If you want to learn where artificial intelligence (AI) could be heading, you’ll probably want to pay attention to Nvidia (NASDAQ: NVDA) CEO Jensen Huang. After all, Huang’s company is arguably the most important player in the AI world right now. Nvidia’s graphics processing units (GPUs) remain the gold standard for powering large-scale AI models.

So what does Huang think about the future of AI? He recently discussed the “next wave of AI” — and singled out one potential big winner other than Nvidia.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

In Nvidia’s third-quarter earnings conference call on Nov. 20, Huang stated, “The next wave of AI are [sic] enterprise AI and industrial AI.” He added, “Enterprise AI is in full throttle.” What exactly are these next big things for AI that Huang mentioned?

Enterprise AI is the use of AI technologies to help organizations increase productivity, improve customer service, reduce costs, gain competitive advantages, and spur innovation. Alphabet‘s Google Cloud unit argues, “Enterprise AI goes beyond simple automation. It involves using AI to solve complex business problems that require human-like intelligence, such as understanding customer behavior, optimizing logistics, or detecting fraud.”

Industrial AI is similar to Enterprise AI but is specific to manufacturing. It involves using AI technologies in industrial applications such as robotics and supply chain management.

As you might expect since Huang referenced enterprise AI and industrial AI, Nvidia markets products for both areas. The company’s AI Enterprise is a cloud platform that supports the development and deployment of AI agents and generative AI applications. Nvidia Omniverse helps customers build, train, and deploy industrial AI models and robotics.

Huang highlighted several customers who are using Nvidia AI Enterprise to develop AI-powered agents and copilots. He also stated, “Consulting leaders like Accenture (NYSE: ACN) and Deloitte are taking Nvidia AI to the world’s enterprises.”

The Nvidia CEO then expounded on Accenture’s initiatives in enterprise AI. He noted that Accenture has launched a new business unit with roughly 30,000 professionals trained in Nvidia’s AI technology. This group will help roll out Nvidia AI Enterprise across the world.

Accenture is also using enterprise AI internally. Huang mentioned the consulting company’s efforts to use AI agents in marketing campaigns. He said Accenture is reducing manual steps in these campaigns by 25% to 35%.

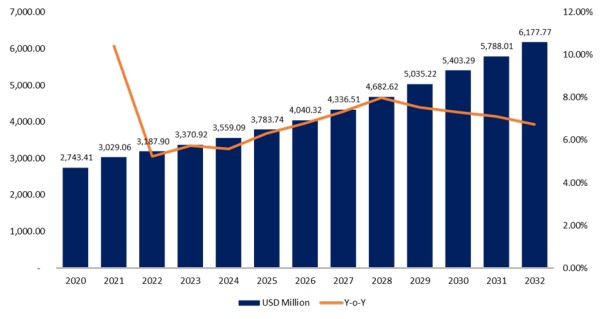

Brain Fingerprint Technology Market Projected to Reach USD 6,177.77 Million by 2032

Gondia, India, Nov. 27, 2024 (GLOBE NEWSWIRE) — The global Brain Fingerprint Technology market size is projected to be worth around USD 6,177.77 Million by 2032 and growing at a CAGR of 6.3% between 2024 and 2032 Report published by IMIR Market Research Pvt. Ltd. Report featuring the companies Brainwave Science, Brain Fingerprinting Laboratories, Brainwave Science, LABORATORIES, BRAINCO, NEUROLOGIC RESEARCH, STOTT INTERNATIONAL, BRAINWAVES, COGNISURE, NEUFLEX NEUROTECHNOLOGY, AXILUM INC, BRAIN DYNAMICS, NEUROTECHNOLOGY SOLUTIONS, BRAINLOCK, COGNISCAN, NEUROLEX, IMENDI NEUROSCIENCE, NEUROSIGN GMBH, COGNISAFE, BRAINCO JAPAN, NEUROSK, MENTALINK

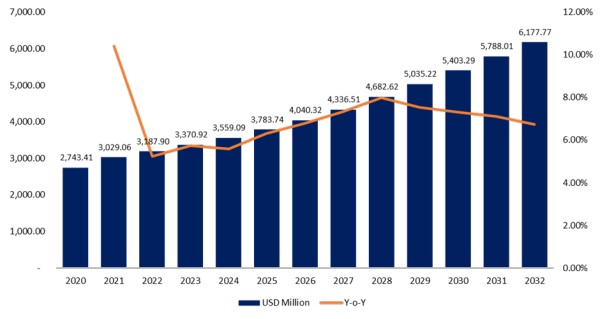

As per the latest research report published by IMIR Market Research, In 2023, the Brain Fingerprint Technology Market was valued at USD 3,370.92 Million and is expected to reach USD 6,177.77 Million by 2032 at the CAGR of 6.3% during 2024-2032.

The Brain Fingerprint Technology is a computer-based test that identifies, documents, and provides evidence of a crime. Additionally, it is frequently used to identify people who belong to oppressive psychological cells. This approach calculates electrical brain waves by evaluating the acknowledgment of natural increases in response to diverse data or information presented on a computer screen.

To get the Detailed Data on Consumer Behavior and Market Now: https://www.intellectualmarketinsights.com/download-sample/IMI-008367

Figure: Global Brain Fingerprint Technology Market, 2020-2032, (USD Million)

Our Report will help you understand the consumer behavior analysis towards the products and raw material across different age group.

The demand for improved security has been steadily increasing due to the growing population and ongoing conflict over scarce resources. The growing need to combat high crime rates and terrorist attacks is also anticipated to fuel market expansion in the future years. However, concerns over test accuracy and the high technology’s deployment costs are anticipated to slow industry expansion soon. Brain fingerprinting uses intellectual brain reactions; it is unaffected by emotional responses and does not depend on the subject’s feelings. It enables the identification of people who have experience in banking, finance, or communications and who have ties to anti-terrorist organizations or actions. Technology meets a vital need for law enforcement, investigators, partnerships, wrongfully accused people, crime victims, and innocent suspects.

According to the National Renewable Energy Laboratory (NREL), battery storage systems can offer several ancillary services to the grid, such as voltage control, frequency regulation, and peak shaving. Grid Modernization and Resilience Grid modernization, increasing adoption of electric vehicles, and increasing investments across the globe will boost the growth for Brain Fingerprint Technology market.

Market Drivers

Advancements in Neuroscience and Neuroimaging Technologies

Advances in neuroscience, EEG technology, and neuroimaging greatly improved the accuracy and practicality of BFT. Modern EEG hardware is now more precise, portable, and efficient compared with old generations and the systems now incorporated into BFT can detect brainwave patterns much more accurately, thereby raising their reliability for real-world applications. Miniaturization efforts led to compact EEG devices that can be applied in a variety of contexts that are not limited to a controlled laboratory environment and, therefore, they improve access and flexibility of deployment. Signal processing improvements further enhance the capability of BFT to capture subtle neural responses under dynamic conditions. Advancements in data analysis algorithms and machine learning algorithms continually improve comprehension and interpretation of complex brainwave data and detect them more accurately and with fewer false positives than before. This has further increased the adoption of BFT across national security, law enforcement, corporate, and forensic applications requiring objective and reliable truth verification. The interest by private companies and government bodies in BFT is growing steadily.

Market Opportunities

Expansion in National Security and Counterterrorism

Governments and agencies are increasingly looking at BFT as a strategic tool to improve their counterterrorism and national security systems. This is because the measures that BFT takes for concealed knowledge evaluate involuntary responses of the brain to any stimulus offered, which makes it highly effective in determining whether an individual possesses access to certain relevant knowledge linked to criminal or terrorist activity. It would be a very valuable asset for high-value security screenings, capable of testing the knowledge or intentions of individuals in sensitive situations like border control, airport screenings, and intelligence interrogations. New global threats to security create several possible future needs for effective non-invasive tools for early risk detection. BFT’s ability to objectively and reliably reveal hidden information positions it as a highly promising solution within this context. Most countries are thus likely to invest in advanced security technologies like BFT, and application of the technology in national security and counterterrorism thereby will be a massive area of growth in the coming years.

Buy this premium report: https://www.intellectualmarketinsights.com/checkout/IMI-008367?currency=1

Market Restraining Factors

Ethical and Privacy Concerns as Major Restraints in Brain Fingerprint Technology Adoption

Brain fingerprinting technology has deep ethical and privacy concerns because it can track unknown knowledge through involuntary brain responses. Such novel technology raises more questions than answers regarding the eventual misuse of the technology especially since it controls access to private thoughts without explicit consent from the subject. This would position it in criminal investigation and security screenings situations where it could misuse the rights and autonomy of any individual. Involuntary mind-reading scenarios evoke unease in the public and regulatory agencies primarily working to protect private information. There are several speculations that BFT may find utilization other than what it is aimed for, like any system applied with unauthorized surveillance or privacy breaches. These fears from the public and the regulatory agencies represent a tough environmental challenge for widespread application of the technology because of concerns on privacy breach that threatens organizations to implement it. Although BFT holds the benefits of security and truth verification, it is yet to be accepted by the masses if proper ethical guidelines and regulations were not followed during its development phase. Hence, serious ethical and privacy concerns will need to be tackled to make BFT adoption responsible and to gain the trust of the public.

Market Segmentations

- Based on Equipment

- Personal Computer

- Data Acquisition Board

- Graphics Card

- Sensors

- Four-Channel Electroencephalography (EEG) Amplifier System

- Based on Technique

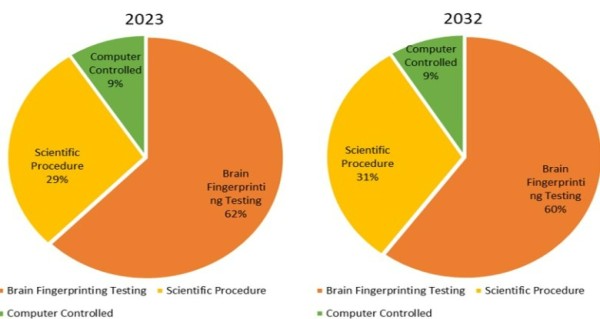

- Brain Fingerprinting Testing

- Scientific Procedure

- Computer Controlled

- Based on Application

- National Security

- Medical Diagnosis

- Advertising

- Criminal Justice

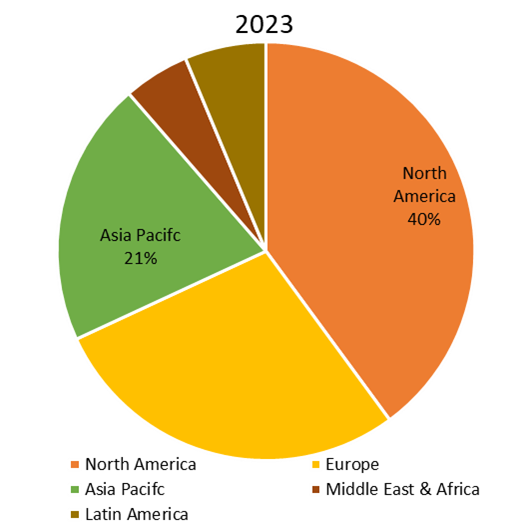

Regional Analysis

In 2023, in the Brain Fingerprinting Technology market, the brain fingerprinting testing category had a major share and is projected to continue its dominance over the forecast period. Moreover, the scientific procedures category is projected to witness the fastest growth in the coming years.

To ascertain whether a subject’s memory contains specific information related to crime or terrorism, brain fingerprinting, a scientific method, examines brain waves. For instance, the findings of a Brain Fingerprinting Test will reveal different patterns if a person has knowledge of sensitive information concerning criminal conduct that has been used by police during interrogations.

On the basis of regions, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. The global Brain Fingerprint Technology market is highly fragmented, with different regions leading the way in terms of innovation, deployment, and policy support.

North America is expected to be the largest market for Brain Fingerprint Technology during the forecast period Due to the rising number of criminal cases in this region. For instance, 21,570 murder cases were reported in the United States in 2020. The use of brain fingerprinting on suspects in crimes is done with the judge’s approval. The use of Brain Fingerprint Technology has been encouraged by the local government and legal systems, which has helped the market expand there.

On the other hand, The Asia-Pacific region is expected to experience rapid expansion in the brain fingerprinting industry. The region’s developing economies are aiding the market expansion in this region. For instance, India was the second nation after the United States to adopt brain fingerprinting for crime detection and the first to convict an accused based on evidence from such devices. Over the anticipated timeframe, it is anticipated that similar acceptance of this technique by other nations in this region will spur the development of Brain Fingerprint Technology.

To understand the Detailed Country and Regional Market Trend, Visit: https://www.intellectualmarketinsights.com/report/brain-fingerprint-technology-market-size-and-share-analysis/imi-008367

Key Players and Competitor

- Brainwave Science

- Brain Fingerprinting Laboratories

- LABORATORIES (USA)

- BRAINCO (USA)

- NEUROLOGIC RESEARCH (USA)

- STOTT INTERNATIONAL (CANADA)

- BRAINWAVES (ISRAEL)

- COGNISURE (ISRAEL)

- NEUFLEX NEUROTECHNOLOGY (CANADA)

- AXILUM INC. (CANADA)

- BRAIN DYNAMICS (AUSTRALIA)

- NEUROTECHNOLOGY SOLUTIONS (NETHERLANDS)

- BRAINLOCK (UK)

- COGNISCAN (UK)

- NEUROLEX (SWITZERLAND)

- IMENDI NEUROSCIENCE (FRANCE)

- NEUROSIGN GMBH (AUSTRIA)

- COGNISAFE (CHINA)

- BRAINCO JAPAN (JAPAN)

- NEUROSKY (SOUTH KOREA)

- MENTALINK (RUSSIA)

Get Access of this Report: https://www.intellectualmarketinsights.com/report/brain-fingerprint-technology-market-size-and-share-analysis/imi-008367

About Us:

IMIR® Market Research Pvt Ltd.

Intellectual Market Insights Research is a market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including, Semiconductor, aerospace, Automation, Agriculture, Food & Beverages, Automotive, Chemicals and Materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports.

IMIR has the distinguished objective of providing optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact Us:

Digvijay Chakravarty | digvijay.C@intellectualmarketinsights.com

Follow Us: LinkedIn

Email: sales@intellectualmarketinsights.com

Call Us: +1 (814) 487 8486

Contact Data Contact Data Managing Director: Digvijay Chakravarty | Email: digvijay.c@intellectualmarketinsights.com Call us: +1 (814) 487 8486, +919764079503

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.