What's Going On With Tesla's Chinese Rival NIO Stock Today?

NIO Inc. NIO shares are trading higher in the premarket session on Wednesday.

The EV manufacturer reportedly prepares to open its first Nio House in the United Arab Emirates (UAE) on November 28, reported CnEV Post. This marks NIO’s entry into the Middle East and North Africa (MENA) market.

CEO William Li shared the news in a Weibo video, revealing he is on his way to Abu Dhabi for the opening event. The Abu Dhabi Nio House, already conducting sales and deliveries, is NIO’s flagship showroom concept, featuring a two-story layout with a vehicle display area and an exclusive space for Nio owners.

NIO’s vehicles are currently available in five European markets: Norway, Germany, the Netherlands, Sweden, and Denmark, the report read.

According to Benzinga Pro, NIO stock has lost over 40% in the past year. Investors can gain exposure to the stock via Invesco Golden Dragon China ETF PGJ.

Also Read: Mexican Peso, Canadian Dollar Slide As Ackman Says Trump Will Use Tariffs ‘As A Weapon’

This week, Goldman Sachs analyst Tina Hou downgraded NIO from Neutral to Sell and lowered the price target from $4.80 to $3.90, citing competitive pressures and a difficult path to profitability ahead.

The analyst notes NIO is unfavorably positioned heading into 2025 given the slow production ramp of Onvo and the company’s limited new model pipeline.

Recently, NIO guided deliveries of 72,000–75,000 units for the fourth quarter, or a 43.9% – 49.9% year-over-year increase.

The company expects fourth-quarter revenue of $2.804 billion – $2.904 billion, representing 15.0% – 19.2% year-over-year growth.

Price Action: NIO shares are trading higher by 2.55% to $4.410 premarket at last check Wednesday.

Read Next:

Photo via Shutterstock.

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

5.7% CAGR, Interventional Radiology Market size to Hit USD 45,615.68 Million by 2032

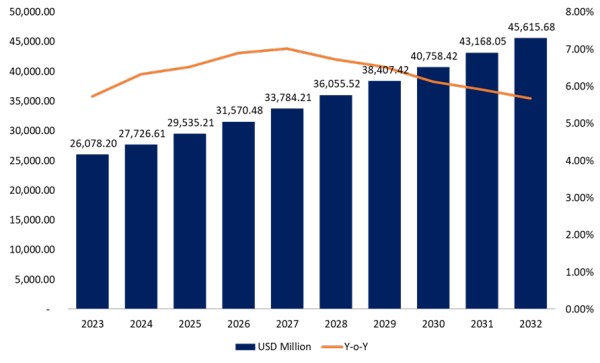

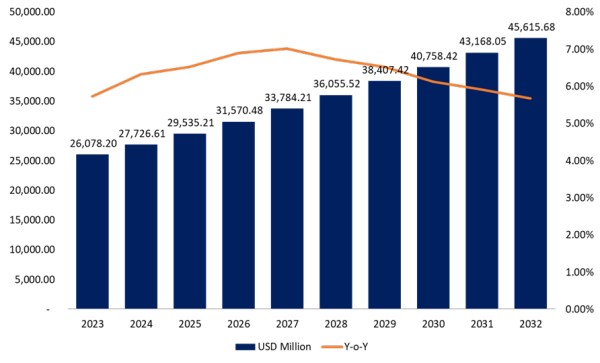

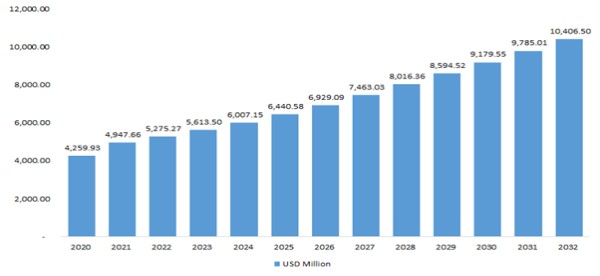

Gondia, India, Nov. 27, 2024 (GLOBE NEWSWIRE) — In 2023, the Global Interventional Radiology Market was valued at USD 26,078.20 Million and is expected to reach USD 45,615.68 Million at the CAGR of 5.7% during 2024-2032 Report Published Study by IMIR Research Pvt. Ltd.

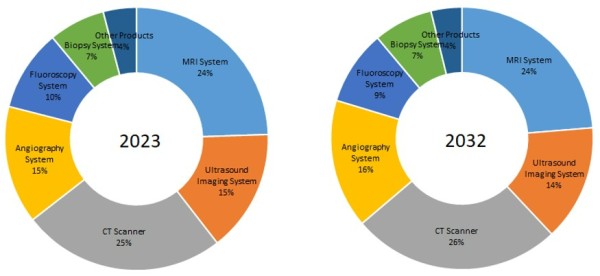

The interventional radiology market is growing at a very high rate due to advancements in imaging technology and the increasing demand for minimally invasive procedures. The major product categories in the interventional radiology market are MRI systems, ultrasound imaging systems, CT scanners, angiography systems, fluoroscopy systems, biopsy systems, and other specialized equipment. They are used in a range of procedures such as angiography, angioplasty, embolization, biopsy, vertebroplasty, thrombolysis, and nephrostomy placement. Applications include oncology, cardiology, urology & nephrology, gastroenterology, and many other medical specialties, of which oncology and cardiology are the largest because of the higher prevalence of cancer and cardiovascular diseases.

Our Report will help you understand the consumer behavior analysis towards the products and raw material across different age group.

To get the Detailed Data on Consumer Behavior of this report: https://www.intellectualmarketinsights.com/download-sample/IMI-005021

Figure: Global Interventional Radiology Market, 2023-2032, (USD Million)

Get Sample copy of this premium report: https://www.intellectualmarketinsights.com/download-sample/IMI-005021

Summary

| Parameter | Description |

| Market Size | 2023: USD 26,078.20 Million 2032: USD 45,615.68 Million |

| CAGR | 6.4% |

| Key Market Drivers | Technological Advancements Rising Prevalence of Chronic Diseases Growing Preference for Minimally Invasive Procedures Aging Population |

| Key Market Restraints | High Costs of Equipment Lack of Skilled Professionals |

| Key Market Opportunities | Integration of Artificial Intelligence Expansion of Telemedicine |

To get the Detailed Data and Market Buy Full Report Now: https://www.intellectualmarketinsights.com/report/interventional-radiology-market-research-current-trends-and-growth/imi-005021

- Technological Advancement

This interventional radiology industry is in turn undergoing vast change through technological improvement, significant growth is being achieved due to advancements in technology, a subfield of the specialty known as radiology called interventional radiology or IR uses minimally invasive, image-guided technologies to detect and treat myriad conditions, technological developments related to these advancements extend both the range and safety while enhancing patient outcomes for patients undergoing IR procedures, leading further to their increased utilization.

- Rising Prevalence of Chronic Diseases

The interventional radiology market is going to expand rapidly due to the increased prevalence of chronic disease. The growing prevalence of chronic diseases such as cancers, neurological diseases, and cardiovascular problems is raising alarm with a rapidly ageing population with increasing sedentary behaviors and changes in dietary practices across the world. Such diseases are usually diagnosed with the aid of interventional radiology that requires even minimum invasive interventions.

Market Segmentation:

Because of Technology, the market is segmented into Catheters, Stents, Inferior Vena Cava (IVC) Filters, Hemodynamic Flow Alteration (HFA) Devices, Angioplasty Balloons, Thrombectomy Systems, Embolization Devices, and Biopsy Needles, Accessories, Others.

MRI (Magnetic Resonance Imaging) plays an important role in interventional radiology because it can achieve better resolutions of soft tissues, organs and blood arteries without resorting to ionizing radiation. Some of the drivers for the demand in MRI machines include growing preference for non-invasive diagnostic measures. Technological advances of recent times mainly include stronger field strength magnets 3T and above and fMRI functional MRI.

Based on procedure, the market is segmented into angioplasty, angiography, biopsy and drainage, embolization, thrombolysis, vertebroplasty, nephrostomy, and others.

Figure: Global Interventional Radiology Market for Angioplasty, 2020-2032

The market is divided into cardiology, urology and nephrology, oncology, gastroenterology, and others based on application. One of the most significant drivers for the interventional radiology market is the oncology segment because of the increasing prevalence of cancer worldwide. According to the World Health Organization, cancer has become one of the leading causes of death worldwide, which calls for more effective and less invasive treatment methods.

To get Detailed Data Buying This Research Report:

Regional Analysis

The interventional radiology market is dominated by North America, primarily the United States and Canada. These regions are endowed with well-developed health care infrastructures, large healthcare spending, and advanced R&D skills. Also, several prominent market players, technological innovation, and favorable reimbursement policies have favored the growth of the market. Growing cases of chronic diseases like cardiovascular diseases and cancer are increasing the demand for the least invasive interventional radiology procedures. The use of innovation such as image-guided therapies and embolization procedures in the region fuels market growth.

By region, Insights into the markets in North America, Europe, Asia-Pacific, Latin America and MEA are provided by the study. North America is the current market leader, due to well-endowed healthcare facilities, a continuous rising demand for minimally invasive procedures, and good investments in health technology. Among the key factors attributed to the increased demand for these procedures in the US include an ageing population along with higher cancer and heart-related diseases cases, meaning the IR procedures, namely, tumour ablation as well as angioplasty are highly demanding. Reimbursement policies being favourable together with the presence of highly esteemed manufacturers of IR equipment’s increase the region’s potential growth.

Reasonable healthcare systems plus more and more focus is there for minimally invasive methods of treatments. Germany, France, and the United Kingdom take the lead in that position with government initiatives facilitating medical imaging technologies. Its key area of interest-also is in the treatments related to cancer, whereby various IR procedures like chemoembolization as well as radiofrequency ablation are increasingly performed across these locations. Healthcare spending may still present a barrier to further expansion of the market in many parts of Europe, however.

Asia Pacific is expected to experience the highest growth of the IR market due to rising health expenditures, growth in population, and increasing awareness regarding the benefits of IR. There are a lot of investments going on within China, India, and Japan to strengthen the infrastructure of healthcare facilities. Such investments have specific objectives-improve cancer care and cardiac care. For instance, the incidence of liver cancer in China has sparked a demand for interventional oncology procedures, ablation, and embolization. Rapid urbanization and economic development, coupled with rising disposable incomes, contribute to the demand for IR as more patients seek the least invasive treatment options within these emerging markets.

Latin America, as well as Middle East & Africa, are growth geographies for IR, even though at a slower rate of growth because of scarce medical infrastructure and resultant economic issues. Latin America-specifically Brazil and Mexico-indicates more potential for IR growth on account of increased investments in more healthcare facilities and slow transit toward advanced treatments. The IR market is expanding further in the UAE and Saudi Arabia due to governments’ efforts to enhance healthcare services. However, economic disparities as well as an absence of skilled professionals limit the widespread use of IRs in these regions.

Overall regional distribution for the global IR market mirrors a mix of healthcare development, economic growth, and demographics across the regions, affecting growth and adoption in all regions.

Key Players and Competitor

- Agfa-Gevaert Group

- Canon Medical Systems Corporation

- Carestream Health Inc.

- Cook

- Esaote SPA

- Fujifilm Corporation

- GE Healthcare

- Hologic, Inc.

- Koninklijke Philips N. V

- Olympus Corporation

- Samsung Healthcare (Samsung Electronics Co., Ltd.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shimadzu Corporation

- Siemens Healthineers

- Teleflex Incorporated

In November 2022, Canon decided to establish an entirely new subsidiary, which would be called Canon Healthcare USA, INC. Canon boosted the development of medical business by expanding its position in the American medical market

In June 2022, Siemens Healthineers introduced the Symbia Pro.specta, a SPECT/CT system that has received both the CE mark and FDA clearance. This system integrates advanced SPECT and CT imaging technologies. Notable features include a low-dose CT capable of capturing up to 64 slices, offering impressive detail in imaging.

Get Access of this Report: https://www.intellectualmarketinsights.com/report/interventional-radiology-market-research-current-trends-and-growth/imi-005021

About Us:

IMIR® Market Research Pvt Ltd.

Intellectual Market Insights Research is a market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including, Semiconductor, aerospace, Automation, Agriculture, Food & Beverages, Automotive, Chemicals and Materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports.

IMIR has the distinguished objective of providing optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact Us:

Digvijay Chakravarty | digvijay.C@intellectualmarketinsights.com

Follow Us: LinkedIn

Email: sales@intellectualmarketinsights.com

Call Us: +1 (814) 487 8486

Contact Data Managing Director: Digvijay Chakravarty | Email: digvijay.c@intellectualmarketinsights.com Call us: +1 (814) 487 8486, +919764079503

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hesai Zooms Ahead In Third Quarter, Setting Stage For Milestone Year

Key Takeaways:

- Hesai’s third quarter revenue rose 21.1% year-on-year to 540 million yuan ($76.9 million), surpassing the top end of its earlier guidance.

- The company could generate $100 million in fourth-quarter revenue and achieve non-GAAP profitability for 2024, hoping it can become the first profitable automotive LiDAR firm

By Teri Yu

In the fast-evolving and highly competitive autonomous driving sensor technology market, Hesai Group HSAI is driving ahead with rapid growth and a clear path toward profitability. As the world’s largest supplier of light detection and ranging (LiDAR) technology for automotive and robotic applications, Hesai is capitalizing on its market leadership to advance the mainstream adoption of autonomous and assisted driving technologies and position itself as a sustainable business in the long term.

The company’s third-quarter results, released Tuesday, showcased strong double-digit revenue growth of 21% year-on-year to 540 million yuan ($76.9 million), up from 445.6 million yuan a year earlier, driven by surging demand for its advanced driver assistance system (ADAS) LiDAR products in China. Even more notable, Hesai’s shipments soared 183% year-on-year in the latest quarter as the company ramps up partnerships with global automotive giants.

“We are thrilled to share that our business continues to thrive and advance on a strong growth path,” said David Li, Hesai’s co-founder and CEO. “This quarter, we have made significant strides in the ADAS market, securing new design wins, partnerships, and development programs with key players.”

Hesai’s growth story hinges on its ability to combine technical innovation with operational efficiency. Its ADAS LiDAR shipments reached 134,208 units in the third quarter, marking its second consecutive quarter of nearly 50% sequential growth and an increase of 183% year-on-year. Its ADAS LiDAR shipments accounted for 97% of that total, more than tripling to 129,913.

Achieving economies of scale has become one of the biggest challenges for autonomous driving sensor technology companies, which must compete with numerous rivals to convince car makers to use their products in mass-produced models. Hesai is on the road to meeting that goal, and has halved its losses to 70.4 million yuan in the latest quarter from 141.8 million yuan a year earlier.

The company’s stock jumped 44% on Tuesday after the announcement.

The race to dominance in the global LiDAR market depends largely on who can partner with the most carmakers, often new energy vehicle (NEV) brands. On that front, Hesai boasts a roster of leading Chinese clients like Li Auto, Baidu and Geely. Its roster of partners expanded further in the third quarter to include SAIC Volkswagen, Leapmotor, a premium EV brand backed by a leading Chinese automotive group, and one of Japan’s top-three OEMs, setting the stage for future growth outside its home market.

Hesai is already a dominant automotive LiDAR supplier globally with 37% market share, according to Yole Intelligence. It made additional progress during the quarter on this front by delivering sample products to a leading automotive OEM. The company is also a global leader in Level 4 (L4) autonomous driving LiDAR, which represents near-fully autonomous driving, with 74% market share and nine out of the 10 leading autonomous driving companies from that segment using its products. International sales beyond China account for nearly half of Hesai’s revenue with over 47% of sales from international clients last year.

$100 Million Revenue Milestone

As Hesai continues to make strong progress, the company is targeting $100 million in revenue for the current quarter, powered by a projected 200,000-unit shipment milestone, which is equivalent to its total shipments in the entire previous year. Hesai is also on the brink of another major milestone, forecasting a net profit of $20 million and positive operating cash flow in the fourth quarter, which would secure full-year profitability on a non-GAAP basis. Such a milestone could pave the way for sustained profitability and growth, a rare achievement in the automotive LiDAR industry.

“This anticipated explosive growth underscores our momentum as we drive toward a landmark fiscal year finish, positioning us as the first autonomous LiDAR company worldwide to achieve this remarkable milestone,” said Andrew Fan, Hesai’s newly appointed CFO.

Hesai is riding the crest of a booming global autonomous driving market that’s projected to grow from $1.92 trillion in 2023 to $13.63 trillion by 2030, according to Fortune Business Insights.

The company’s LiDAR systems, which use light to gauge the location of objects in ADAS-equipped and self-driving cars, are already being used in a wide range of vehicles from robotaxis to consumer electric vehicles (EVs) and even robotrucks and robo-sweepers.

China is leading the global push for autonomous driving technology with pilot programs across the country already in operation or in planning. For its latest initiative launched in June, the central government selected 20 cities to participate in a pilot program aimed at developing cutting-edge roadside infrastructure and a cloud-based control platform for smart connected vehicles. Most of China’s leading autonomous driving companies are using Hesai technology to pursue their goals, including Baidu Apollo, AutoX, and WeRide.

Outperforming Industry Metrics

While the global autonomous market is crowded, Hesai outperforms most of its domestic and global peers in terms of key metrics like revenue, gross margin, cash flow and cash reserves, by pairing technical innovation with cost controls.

Even so, the stock trades at a relatively low price-to-sales (P/S) ratio of 2.39 — a significant discount compared to competitors RoboSense at 4.63 and Luminar at 3.63.

Analysts are largely positive about Hesai’s ability to expand globally and further improve its financials as it secures more mass production partnerships with both Chinese and international automakers. The company’s in-house manufacturing and R&D integration, along with its proprietary technology, are also considered competitive advantages.

Investors appear positive, too, with seven of eight analysts surveyed by Yahoo Finance now rating the company a “buy” or “strong buy,” suggesting they believe the stock is undervalued.

Established in Silicon Valley in 2014, Hesai quickly gained recognition for its product performance, quality and cost effectiveness, and its LiDAR products were quickly adopted by several top autonomous driving companies. It made headlines in early 2023 when its $190 million Nasdaq IPO was not only one of the largest listings by a Chinese company in New York in more than two years, but also one of the first by a Chinese autonomous driving concept company.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Perineal Care Market Set to Reach US$ 1.88 Billion by 2034, Growing at 4.6% CAGR | Fact.MR Report

Rockville, MD, Nov. 27, 2024 (GLOBE NEWSWIRE) — Rising prevalence of chronic bladder-related diseases is the driving force behind the increasing use of perineal care products. As per this new study by Fact.MR, the global perineal care market is calculated to reach a value of US$ 1.2 billion in 2024 and thereafter increase at a steady CAGR of 4.6% CAGR from 2024 to 2034.

Market players are benefiting from the rising global healthcare spending, as consumers and healthcare providers are investing in better products and services. Diabetes and obesity are examples of long-term conditions that can cause complications and necessitate specialized perineal care if complications arise.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10045

Patients frequently require perineal care after being admitted to hospitals and long-term care facilities, which in turn is driving up demand for related goods and services. These conditions are becoming more common worldwide, contributing to the growth of the perineal care market.

There is an increase in sales of perineal care products in developing countries due to rapidly improving healthcare infrastructure. The rising incidence of chronic bladder diseases, such as kidney disease, endocrine and urological disorders, and bladder cancer, is gradually fueling sales of perineal care products. An increase in the number of patients exhibiting the previously mentioned indications is leading to disorders associated with incontinence.

Key Takeaways from the Market Study:

Key Takeaways from the Market Study:

- Sales of perineal care products across the world are set to reach US$ 1.2 billion in 2024.

- The market is forecasted to touch US$ 1.89 billion by the end of 2034.

- The perineal care market in the United States is estimated at US$ 333 million in 2024.

- Japan is set to occupy 6% share of the East Asia market in 2024.

- The market in China is estimated to reach US$ 59 million in 2024.

- The North American market is forecasted to expand at a CAGR of 4% from 2024 to 2034.

“North America and East Asia to be key business destinations and together account for around 50% share of the global perineal care market,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Perineal Care Market:

Key industry participants like 3M Company, Medline Industries, Inc., GOJO Industries, Inc., Sage Products, LLC (Stryker Corporation), Cardinal Health, Inc., ConvoTec Group Plc., Smith and Nephew Plc., Coloplast A/S, Essity Aktiebolag (SCA Hygiene AB), etc. are driving the perineal care industry.

Cultural Stereotypes Surrounding Management of Problems Related to Perineal Care

Social stigmas and cultural preconceptions around discussing and treating perineal care issues are preventing people from looking for the right products or services, which is impeding the market’s growth. Although regulatory standards guarantee the safety and quality of products, manufacturers may face difficulties due to strict regulations. This is limiting creativity and raising the time and expense needed to introduce new products in the market.

Perineal Care Industry News:

- In January 2024, Bemis, a leading manufacturer of toilet seats and bidet products, unveiled three new innovations: The Bemis Living App, the Bio Bidet BB-1200 Bidet Toilet Seat, and the Empower Clean Care System. These solutions enhance user experience by enabling customization, ease of adjustment, and control of bidet functions via iOS or Android devices.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10045

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the perineal care market for 2018 to 2023 and forecast statistics for 2024 to 2034.

The study divulges the perineal care market based on product type (barriers, cleansers, washcloths) and distribution channel (institutional sales, retail sales), across six major regions of the world (North America, Latin America, Europe, East Asia, South Asia & Oceania, and MEA).

Check out More Related Studies Published by Fact.MR Research:

Anti-aging and anti-wrinkle products market has reached a valuation of US$ 12.5 billion in 2023 and is expected to reach a market size of US$ 23 billion by the end of 2033. The market is forecasted to expand at a CAGR of 6.3% from 2023 to 2033.

Skin imaging system market is set to be valued at US$ 249.6 million and is forecasted to expand at a CAGR of 6.9% to reach US$ 486.7 million by the end of 2034.

Pregnancy point of care testing market is valued at US$ 1.5 billion in 2023 and is forecasted to secure US$ 2.33 billion in revenue by 2033-end.

Skincare devices market analysis is expected to be valued at US$ 43.48 Billion by 2032, growing at a12% CAGR.

Skin rejuvenation devices market recorded sales of US$ 1.92 billion in 2022. The market is predicted to advance at a CAGR of 8.9% and reach in an industry size of US$ 4.93 billion by 2033-end.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team : sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NurExone Reports Third Quarter 2024 Financial Results and Provides Corporate Update

TORONTO and HAIFA, Israel, Nov. 27, 2024 (GLOBE NEWSWIRE) — NurExone Biologic Inc. NRX NRXBF (Germany: J90) (the “Company” or “NurExone“), a pioneering biopharmaceutical company developing regenerative medicine therapies, is pleased to announce its financial and operational results for the three and nine months ended September 30, 2024, the highlights of which are included in this news release. The Company’s complete set of condensed interim consolidated financial statements for the three and nine months ended September 30, 2024, and accompanying management’s discussion and analysis for the period can be accessed by visiting the Company’s website at www.nurexone.com and its profile page on SEDAR+ at www.sedarplus.ca.

Key Business Highlights

- In July 2024 and September 2024, the Company generated gross proceeds of C$143,172.05 through the issuance of 409,063 common shares upon the exercise of warrants at price of C$0.35 per common share which were issued in the Company’s January 2024 private placement.

- On August 1, 2024, the Company engaged Allele Capital Partners, LLC, an independently owned capital markets advisory firm based in the United States, for investor relations services.

- On September 26, 2024, the Company closed the first tranche of its non-brokered private placement through the issuance of 2,927,541 units at a price of C$0.55 per unit, resulting in aggregate gross proceeds of C$1,610,147.55. Each unit consisted of one common share and one common share purchase warrant, with each warrant entitling the holder thereof to purchase one additional common share at a price of C$0.70 per common share for a period of 36 months, subject to acceleration, as more particularly set out in the Company’s September 26, 2024 press release.

- On November 1, 2024, the Company closed the final tranche of its non-brokered private placement through the issuance of 231,818 units at a price of C$0.55 per unit, resulting in aggregate gross proceeds of C$127,499.90.

- On November 1, 2024, the Company engaged Independent Trading Group and Oak Hill Financial Inc. to provide market-making, business, and capital markets advisory services.

- On November 13, 2024, the Company announced that the European Medicines Agency granted Orphan Medicinal Product Designation for the Company’s ExoPTEN therapy, marking a significant step towards making this potential treatment available for acute spinal cord injury patients across Europe.

Third Quarter Fiscal 2024 Financial Results

- Research and development expenses, net, were US$0.50 million in the third quarter of 2024, compared to US$0.40 million in the same quarter in 2023. The increase was primarily due to higher subcontractor and materials expenses of US$0.15 million, partially offset by a governmental grant receipt of US$0.05 million.

- General and administrative expenses were US$0.78 million in the third quarter of 2024, compared to US$0.76 million in the same period in 2023. The rise was mainly attributed to an increase in non-cash costs associated with granted stock options of US$0.17, partially offset by professional and legal services expenses of US$0.15 million.

- Finance income was US$0.04 million in the third quarter of 2024, compared to finance income of US$0.01 million in the same period in 2023, primarily due to income from bank interest and financing exchange rate adjustments.

- The net loss for the third quarter of 2024 was US$1.25 million, compared to a net loss of US$1.16 million in the same quarter of 2023.

As of September 30, 2024, the Company held cash and cash equivalents totaling US$2.52 million, an increase from US$0.54 million as of December 31, 2023. The Company’s working capital also improved to US$2.39 million, up from US$0.07 million at the end of 2023. The increase in cash was primarily driven by the successful completion of private placements in January and September 2024, which generated gross proceeds of approximately US$2.68 million, as well as the exercise of warrants during 2024, yielding an additional US$3.30 million. These inflows were partially offset by a cash outflow of US$3.61 million related to operational activities.

As of September 30, 2024, the Company had an accumulated deficit of US$17.55 million, compared to US$14.06 million as of December 31, 2023.

Eran Ovadya, NurExone’s Chief Financial Officer, stated: “Our latest financial performance reflects our commitment to advancing ExoPTEN to clinical trials, while streamlining operations and optimizing our business strategy to drive sustainable growth and secure long-term success.”

Growth Outlook for 2024-2025

According to Chief Executive Officer Dr. Lior Shaltiel, “NurExone is making significant strides on the path towards human trials, including the receipt of Orphan Drug Status for ExoPTEN in Europe, the successful transfer of key manufacturing processes to a Good Manufacturing Practice-compliant facility – an essential step toward clinical trials and commercial production. These efforts are being strengthened by our consultant, Dr. Yona Geffen, a highly respected expert who has successfully guided companies through the regulatory landscape to commercialization. In parallel, the Company is collaborating with the Goldschleger Eye Institute at Sheba Medical Center, ranked by Newsweek as one of the top ten hospitals in the world, to study ExoPTEN for its potential in a second commercial market, the multi-billion-dollar glaucoma market(1), with promising preliminary results.”

About NurExone Biologic Inc.

NurExone Biologic Inc. is a TSX Venture Exchange (“TSXV“) listed pharmaceutical company that is developing a platform for biologically-guided exosome-based therapies to be delivered, non-invasively, to patients who have suffered Central Nervous System injuries. The Company’s first product, ExoPTEN for acute spinal cord injury, was proven to recover motor function in 75% of laboratory rats when administered intranasally. ExoPTEN has been granted Orphan Drug Designation by the FDA. The NurExone platform technology is expected to offer novel solutions to drug companies interested in noninvasive targeted drug delivery for other indications.

For additional information, please visit www.nurexone.com or follow NurExone on LinkedIn, Twitter, Facebook, or YouTube.

For more information, please contact:

Dr. Lior Shaltiel

Chief Executive Officer and Director

Phone: +972-52-4803034

Email: info@nurexone.com

Oak Hill Financial Inc.

2 Bloor Street, Suite 2900

Toronto, Ontario M4W 3E2

Investor Relations – Canada

Phone: +1-647-479-5803

Email: info@oakhillfinancial.ca

Dr. Eva Reuter

Investment Relation – Germany

Phone: +49-69-1532-5857

Email: e.reuter@dr-reuter.eu

Allele Capital Partners

Investment Relation – US

Phone: +1 978-857-5075

Email: aeriksen@allelecapital.com

FORWARD-LOOKING STATEMENTS

This press release contains certain “forward-looking statements”, that reflect the Company’s current expectations and projections about its future results. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. Forward-looking statements in this press release include, but are not limited to, statements relating to the receipt of the Orphan Medicinal Product Designation having the intended benefits and incentives on the Company and its business as set out herein; the potential glaucoma market; the Company having adequate financing through the end of the year and well into 2025; the Company entering the European market and bringing its products to patients across Europe; the Company’s latest financial performance positioning it for sustained growth and long-term success; the Company making significant strides on the path towards human trials with assistance from Dr. Yona Geffen; the Company collaborating with the Goldschleger Eye Institute at Sheba Medical Center to study ExoPTEN for its potential in a second commercial market, the multi-billion-dollar glaucoma market, with promising preliminary results; and the NurExone platform technology offering novel solutions to drug companies interested in noninvasive targeted drug delivery for other indications.

These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof. In developing the forward-looking statements in this press release, we have applied several material assumptions, including the general business and economic conditions of the industries and countries in which we operate; the general market conditions; the ability to secure additional funding; partnerships having their intended impact on the Company and its business; patents safeguarding NurExone’s technology; the Company’s drug products having its intended benefits and effects; the Company making progress through new partnerships and technologies to move towards commercialization of their products; the Company’s intellectual property and technology being novel and inventive; the intellectual property having the intended impact on the Company and its business; exosomes becoming an ideal and natural choice for drug delivery; the Company making advancements in the manufacturing process of exosomes; exosomes holding immense promise for regenerative medicine; the Company’s preclinical and clinical testing will yield their intended results; the Company will proceed to clinical trials on the timelines setout herein; the Company will have sufficient funding for its operations; the Company will enter into new partnerships and/or licensing agreements; the receipt of the Orphan Medicinal Product Designation having the intended benefits and incentives on the Company and its business as set out herein; the Company will enter the European market and bring its products to patients across Europe; the Company being able to make significant strides on the path towards human trials with assistance from Dr. Yona Geffen; the Company being able to collaborate with the Goldschleger Eye Institute at Sheba Medical Center to study ExoPTEN for its potential in a second commercial market, the multi-billion-dollar glaucoma market, with promising preliminary results; the glaucoma market will grow; the Company will have adequate financing through the end of the year and well into 2025; the Company will position itself for sustained growth and long-term success; and the NurExone platform technology being able to offer novel solutions to drug companies interested in noninvasive targeted drug delivery for other indications.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These risks and uncertainties include, but are not limited to risks related to the Company’s early stage of development; lack of revenues to date; government regulation; market acceptance for its products; rapid technological change; dependence on key personnel; protection of the Company’s intellectual property; dependence on the Company’s strategic partners; the fact that preclinical drug development is uncertain, and the drug product candidates of the Company may never advance to clinical trials and/or on the timelines set out herein; the fact that results of preclinical studies and early-stage clinical trials may not be predictive of the results of later stage clinical trials; the uncertain outcome, cost, and timing of product development activities, preclinical studies and clinical trials of the Company; the uncertain clinical development process, including the risk that clinical trials may not have an effective design or generate positive results; the potential inability to obtain or maintain regulatory approval of the drug product candidates of the Company; the introduction of competing drugs that are safer, more effective or less expensive than, or otherwise superior to, the drug product candidates of the Company; the initiation, conduct, and completion of preclinical studies and clinical trials may be delayed, adversely affected or impacted by unforeseen issues; the potential inability to obtain adequate financing; the potential inability to obtain or maintain intellectual property protection for the drug product candidates of the Company; the Company being unable to have sustained growth and/or continued success; risks that the Company’s intellectual property and technology won’t have the intended impact on the Company and/or its business; the Company’s inability to realize upon partnerships; risks that the Company will not have adequate financing through the end of the year and/or well into 2025; risks that the Company will be unable to position itself for sustained growth and long-term success; the receipt of the Orphan Medicinal Product Designation not having the intended benefits and incentives on the Company and its business as set out herein; the Company not entering the European market and bringing its products to patients across Europe; risk that the Company will not make significant strides on the path towards human trials with assistance from Dr. Yona Geffen; risk that the Company will not collaborate with the Goldschleger Eye Institute at Sheba Medical Center to study ExoPTEN for its potential in a second commercial market, the multi-billion-dollar glaucoma market, with promising preliminary results already available; risk that the NurExone platform technology will be unable to offer novel solutions to drug companies interested in noninvasive targeted drug delivery for other indications; and the risks discussed under the heading “Risk Factors” on pages 44 to 51 of the Company’s Annual Information Form dated August 27, 2024, a copy of which is available under the Company’s SEDAR+ profile at www.sedarplus.ca. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this press release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this press release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

___________________________

(1) Global Glaucoma Treatment Market Analysis by Spherical Insights LLP

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

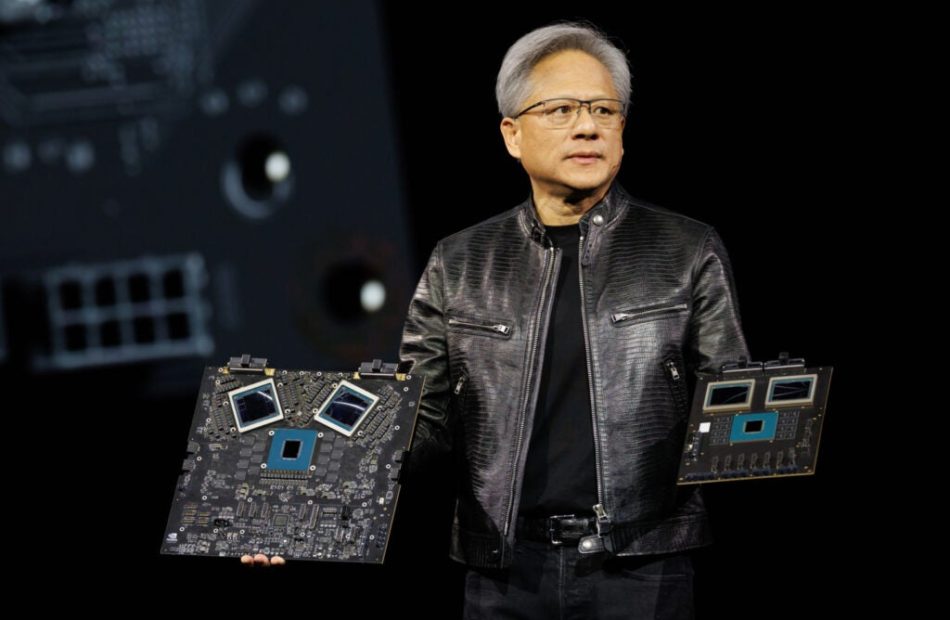

Nvidia's Journey To The Top With $3.5 Trillion Market Capitalization: How The AI Chip Giant Transformed Post-COVID

Nvidia Corp. NVDA, under CEO Jensen Huang, has reached a staggering $3.53 trillion market capitalization today, establishing itself as a leader in gaming, data centers, and artificial intelligence (AI).

Let’s explore how Nvidia evolved from its pre-pandemic foundation to become a dominant force in the post-COVID tech landscape.

Pre-COVID: Building A Strong Foundation

Before the pandemic, Nvidia was already a major player in the technology sector, thanks to its dominance in graphics processing units (GPUs). Its GeForce GPUs were the gold standard for gamers.

At the same time, Nvidia began expanding its data center footprint with products like the A100 GPUs, laying the groundwork for its eventual pivot to AI and high-performance computing.

Financially, Nvidia’s performance in 2020 reflected the challenges of the pre-COVID market. The company reported $10.92 billion in revenue, a 7% decline from the previous year.

Nvidia’s stock price saw a remarkable 119% increase in 2020, closing the year at $13.02 per share.

Nvidia also launched its Turing and Ampere architectures, which introduced capabilities like real-time ray tracing and enhanced AI processing.

But the real game-changer would prove to be its $7 billion purchase of Mellanox Technologies in 2020, marking Nvidia’s move into high-performance computing and networking solutions.

See Also: Nvidia Blackwell Supplier Vishay Intertechnology Likey To See Upside Courtesy Of AI Frenzy: Analyst

Navigating COVID-19: Challenges And Strategic Adjustments

Global supply chain disruptions and an unprecedented surge in demand for GPUs exposed vulnerabilities in Nvidia’s production capabilities.

At the time, the company’s CFO, Colette Kress, acknowledged that supply chain constraints were a persistent issue, particularly during the cryptocurrency mining boom and the launch of the GeForce RTX 30 Series GPUs.

Nvidia responded to these challenges by collaborating with manufacturing partners to increase production.

The company also prioritized the production of chips for AI and data center applications, seizing the opportunity presented by rising AI demand.

Post-COVID Growth: Accelerating Through The AI Revolution

The launch of its Ampere architecture in 2020 was a turning point, enabling Nvidia to capture the growing demand for AI-driven technologies. It also acquired Cumulus Networks to strengthen its networking capabilities.

Nvidia’s investments in AI extended to healthcare, with the $100 million Cambridge-1 supercomputer project in the U.K., which supported advanced medical research.

These moves reflected a shift in Nvidia’s priorities, as the company embraced AI and data centers as core growth drivers.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Technological Breakthroughs And Market Leadership

Nvidia’s dominance in AI and computing was further solidified with the 2024 launch of its Blackwell microarchitecture.

The company also expanded its capabilities in generative AI through partnerships, such as its collaboration with Getty Images in 2023 to develop a new AI tool.

By 2024, Nvidia introduced NVLM 1.0, a family of large language models that underscored its leadership in AI innovation.

Nvidia’s GPUs also became indispensable for companies like Oracle and Tesla, which were reportedly competing for access to its H100 chips.

Milestones And Market Impact

In 2023, the company’s valuation crossed $1 trillion. By June 2024, Nvidia reached the $3 trillion mark. Currently, its market cap stands at $3.53 trillion.

Earlier this month, Nvidia reported third-quarter revenue of $35.1 billion, marking a 94% year-over-year increase and surpassing the Street consensus estimate of $33.12 billion, according to Benzinga Pro.

Nvidia projected its fourth-quarter revenue to be approximately $37.5 billion, with a margin of plus or minus 2%.

Price Action: Nvidia’s stock rose 0.66% on Tuesday, closing at $136.91. Year-to-date, Nvidia shares have surged an impressive 184.24%, significantly outperforming the Nasdaq 100 index’s 26.47% gain over the same period.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Nvidia

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Goodfood Reports Fiscal Year and Fourth Quarter 2024 Results with Net sales of $153 million and $34 million, Gross Profit of $63 million and $13 million and Adjusted EBITDA¹ of $9 million and $0.5 million, respectively

- Record annual results in key profitability metrics with gross margin2 of 41.2%, an improvement of 2.4% compared to last fiscal year and adjusted free cash flow1 of $8 million, an improvement of 12 million compared to the same period last year

- Net sales of $34 million in the fourth quarter of 2024, with gross profit of $13 million and gross margin2 of 38.1%

- Net loss of $3 million, adjusted EBITDA margin1 of 1% and adjusted EBITDA1 of $0.5 million in the fourth quarter of 2024

- Cash flows used in operating activities of $1 million and adjusted free cash flow1 was negative $1 million for the fourth quarter of 2024, with an ending cash balance at $24 million, only slightly down compared to last year, driven primarily by debt reduction, with total net debt to adjusted EBITDA1 at 2.49 compared to 4.44 last year

- The recently announced Genuine Tea acquisition marks the launch of Goodfood’s next stage of growth by beginning to build a portfolio of leading next-generation direct-to-consumer businesses and brands

MONTREAL, Nov. 27, 2024 (GLOBE NEWSWIRE) — Goodfood Market Corp. (“Goodfood“, “the Company“, “us” or “we“) FOOD, a leading Canadian online meal solutions company, today announced financial results for the fourth quarter and Fiscal 2024, ended September 7, 2024.

“Our full-year results demonstrate the strength of our financial performance in Fiscal 2024, with record adjusted free cash flow1 of $8 million and a gross margin2 surpassing 41%,” said Jonathan Ferrari, Chief Executive Officer of Goodfood. “Focused execution on operational efficiency, disciplined cost management and unit economics improvement have driven record adjusted EBITDA1 of $9 million for the year. With improved cash flow and profitability, we have in turn significantly reduced our net debt and net leverage1, enhancing our financial position. The margin improvement and resulting higher cash flows cement our focus on continuing to strengthen our financial performance to deliver improved profitability and value to our shareholders.”

“These results are also a testament to the dedication and commitment of the entire Goodfood team throughout the year,” Ferrari continued. “Every employee has worked with determination to help further solidify our balance sheet and position us well to expand our market reach, innovate our product offering, and maintain our focus on delivering value to customers across Canada. With the recent launch of our Value Plan containing delicious classic recipes under $10 per serving, and with new collaborations with renowned chefs, our teams are creating delightful new meals for every Canadian, every day. The recently announced acquisition of Genuine Tea also marks the beginning of our new phase of growth, consisting of building a portfolio of next-generation businesses and brands by providing direct-to-consumer entrepreneurs with a platform to scale. We are pleased to have added a high-potential brand that aligns with our growth strategy and deepens customer engagement and look forward to building on this first acquisition.”

RESULTS OF OPERATIONS – FISCAL 2024 AND 2023

The following table sets forth the components of the Company’s consolidated statement of loss and comprehensive loss:

(In thousands of Canadian dollars, except per share and percentage information)

| For the 53 and 52 week periods ended | September 7, 2024 |

September 2, 2023 |

($) | (%) | ||||||||

| Net sales | $ | 152,838 | $ | 168,558 | $ | (15,720 | ) | (9 | )% | |||

| Cost of goods sold | 89,860 | 103,178 | (13,318 | ) | (13 | )% | ||||||

| Gross profit | $ | 62,978 | $ | 65,380 | $ | (2,402 | ) | (4 | )% | |||

| Gross margin | 41.2 | % | 38.8 | % | N/A | 2.4 p.p. | ||||||

| Selling, general and administrative expenses | 54,843 | 65,867 | (11,024 | ) | (17 | )% | ||||||

| Depreciation and amortization | 7,381 | 10,837 | (3,456 | ) | (32 | )% | ||||||

| Reorganization and other related net gains | (1,327 | ) | (468 | ) | (859 | ) | 184 | % | ||||

| Net finance costs | 5,514 | 5,668 | (154 | ) | (3 | )% | ||||||

| Loss before income taxes | $ | (3,433 | ) | $ | (16,524 | ) | $ | 13,091 | (79 | )% | ||

| Deferred income tax recovery | – | (61 | ) | 61 | (100 | )% | ||||||

| Net loss, being comprehensive loss | $ | (3,433 | ) | $ | (16,463 | ) | $ | 13,030 | (79 | )% | ||

| Basic and diluted loss per share | $ | (0.05 | ) | $ | (0.22 | ) | $ | 0.17 | (77 | )% | ||

VARIANCE ANALYSIS FOR FISCAL 2024 COMPARED TO FISCAL 2023

- The decrease in net sales is primarily driven by a decrease in the number of active customers1, as we continue to focus on attracting and retaining customers that provide higher gross margins and by changing customer behaviours. This decrease is partially offset by an increase in average basket size as a result of more portions being added per order and pricing optimizations, increased variety in the meal-kit offering as well as the additional week of operations. This net sales decrease is also explained by the Company’s decision to discontinue its on-demand offering in Fiscal 2023.

- The decrease in gross profit primarily resulted from a decrease in net sales as well as higher credit and incentives as a percentage of net sales partially offset by lower food, production and fulfilment costs driven by improved inventory management reducing waste, lower production labour cost and lower packaging and shipping costs. Gross margin increased mainly due to operational efficiencies driving lower food, production and fulfilment costs, as well as pricing optimization, partially offset by an increase in credits and incentives as a percentage of net sales.

- The decrease in selling, general and administrative expenses is primarily due to lower wages and salaries, marketing spend, software expenses, audit fees, utilities, maintenance and insurance expenses driven primarily by the Company’s costs saving initiatives. The decrease was partially offset by the additional week of operations. Selling, general and administrative expenses as a percentage of net sales decreased from 39.1% to 35.9% even with lower net sales.

- The decrease in depreciation and amortization expense is mainly due to the reduction in right-of-use assets following exiting facilities as part of the Company’s costs reduction initiatives as well as the derecognition of a right-of-use asset and fixed assets pursuant to a sublease agreement and depreciation.

- The increase in reorganization and other related net gains is primarily explained by the net gain on reversal of impairment resulting from a sublease agreement concluded in Fiscal 2024.

- The decrease in net finance costs is mainly due to lower interest expense on lease obligations in relation to the Company’s costs saving, lower interest on debt as a result of a lower debt balance as well as lower debt renewal fees in Fiscal 2024 partially offset by higher interest expense on debentures in relation to the Company’s $30 million convertible debentures issued in February 2023.

- The decrease in net loss is mainly due to lower wages and salaries in cost of goods sold and in selling, general and administrative expenses as well as lower depreciation and amortization, lower food costs, marketing spend and audit fees, utilities, maintenance and insurance expenses partially offset by a lower sales base.

RESULTS OF OPERATIONS – FOURTH QUARTER OF FISCAL 2024 AND 2023

The following table sets forth the components of the Company’s consolidated statement of loss and comprehensive loss:

(In thousands of Canadian dollars, except per share and percentage information)

| For the 14 and 13 weeks periods ended | September 7, 2024 |

September 2, 2023 |

($) | (%) | ||||||||

| Net sales | $ | 34,063 | $ | 37,228 | $ | (3,165 | ) | (9 | )% | |||

| Cost of goods sold | 21,072 | 23,007 | (1,935 | ) | (8 | )% | ||||||

| Gross profit | $ | 12,991 | $ | 14,221 | $ | (1,230 | ) | (9 | )% | |||

| Gross margin | 38.1 | % | 38.2 | % | N/A | (0.1) p.p. | ||||||

| Selling, general and administrative expenses | 12,762 | 13,793 | (1,031 | ) | (7 | )% | ||||||

| Depreciation and amortization | 1,879 | 2,006 | (127 | ) | (6 | )% | ||||||

| Reorganization and other related costs | 34 | 812 | (778 | ) | (96 | )% | ||||||

| Net finance costs | 1,476 | 1,299 | 177 | 14 | % | |||||||

| Net loss, being comprehensive loss | $ | (3,160 | ) | $ | (3,689 | ) | $ | 529 | (14 | )% | ||

| Basic and diluted loss per share | $ | (0.05 | ) | $ | (0.05 | ) | $ | – | N/A | |||

VARIANCE ANALYSIS FOR THE FOURTH QUARTER OF 2024 COMPARED TO FOURTH QUARTER OF 2023

- The decrease in net sales is primarily driven by the decrease in the number of active customers, as we continue to focus on customers providing stronger unit economics, as well as an increase in credits and incentives. This decrease was partially offset by an increase in average basket size as a result of more portions being added per order, pricing optimizations and increased variety in the meal-kit offering as well as the additional week of operations.

- The decrease in gross profit is driven mainly by a decrease in net sales as well as higher credit and incentives as a percentage of net sales mostly offset by lower production costs as a result of lower labour and food costs. Gross margin remained flat compared to the same quarter last year.

- The decrease in selling, general and administrative expenses is primarily due to lower wages and salaries, software expenses and marketing spend driven primarily by the Company’s costs saving initiatives. In addition, this decrease was partially offset by an additional week of operations. Selling, general and administrative expenses as a percentage of net sales increased from 37.1% to 37.5%.

- The decrease in reorganization and other related costs is explained by the finalization of the Company’s cost saving initiatives during Fiscal 2023.

- The slight improvement in net loss is mainly the result of lower wages and salaries in cost of goods sold and selling, general and administrative expenses as well as operational efficiencies reducing production and fulfilment costs. This improvement can also be explained by lower reorganization and other related costs mostly offset by a lower net sales base.

METRICS AND NON-IFRS FINANCIAL MEASURES–RECONCILIATION

ADJUSTED GROSS PROFIT1 AND ADJUSTED GROSS MARGIN1

The reconciliation of gross profit to adjusted gross profit and adjusted gross margin is as follows:

(In thousands of Canadian dollars, except percentage information)

| For the 14 and 13 weeks ended |

For the 53 and 52 weeks ended |

|||||||||||

| September 7, 2024 |

September 2, 2023 |

September 7, 2024 |

September 2, 2023 |

|||||||||

| Gross profit | $ | 12,991 | $ | 14,221 | $ | 62,978 | $ | 65,380 | ||||

| Discontinuance of products related to on-demand offering | – | – | – | 1,273 | ||||||||

| Adjusted gross profit | $ | 12,991 | $ | 14,221 | $ | 62,978 | $ | 66,653 | ||||

| Net sales | $ | 34,063 | $ | 37,228 | $ | 152,838 | $ | 168,558 | ||||

| Gross margin | 38.1 | % | 38.2 | % | 41.2 | % | 38.8 | % | ||||

| Adjusted gross margin (%) | 38.1 | % | 38.2 | % | 41.2 | % | 39.5 | % | ||||

For the 14 weeks ended September 7, 2024, adjusted gross profit decreased by $1.2 million while adjusted gross margin remained flat with a narrow decrease of 0.1 percentage points compared to the same quarter last year. The slight change in adjusted gross margin is explained by an increase in credits and incentives as a percentage of net sales mostly offset by operational efficiencies driving lower production costs resulting from lower production labour and packaging costs as well as pricing optimization.

For the 53 weeks ended September 7, 2024, the adjusted gross profit decreased by $3.7 million primarily due to a decrease in net sales partially offset by lower cost of goods sold mainly in food costs, production and fulfillment costs. The increase in adjusted gross margin of 1.7 percentage points can be explained by lower production labour costs, food costs and shipping costs driven mainly by production efficiencies, lower last-mile shipping costs as well as pricing optimization. This improvement was partially offset by an increase in credits and incentives as a percentage of net sales.

EBITDA1, ADJUSTED EBITDA1 AND ADJUSTED EBITDA MARGIN1

The reconciliation of net loss to EBITDA, adjusted EBITDA and adjusted EBITDA margin is as follows:

(In thousands of Canadian dollars, except percentage information)

| For the 14 and 13 weeks ended |

For the 53 and 52 weeks ended |

|||||||||||

| September 7, 2024 |

September 2, 2023 |

September 7, 2024 |

September 2, 2023 |

|||||||||

| Net loss | $ | (3,160 | ) | $ | (3,689 | ) | $ | (3,433 | ) | $ | (16,463 | ) |

| Net finance costs | 1,476 | 1,299 | 5,514 | 5,668 | ||||||||

| Depreciation and amortization | 1,879 | 2,006 | 7,381 | 10,837 | ||||||||

| Deferred income tax recovery | – | – | – | (61 | ) | |||||||

| EBITDA | $ | 195 | $ | (384 | ) | $ | 9,462 | $ | (19 | ) | ||

| Share-based payments expense | 231 | 278 | 879 | 3,909 | ||||||||

| Discontinuance of products related to on-demand offering | – | – | – | 1,273 | ||||||||

| Reorganization and other related costs (gains) | 34 | 812 | (1,327 | ) | (468 | ) | ||||||

| Other costs | 49 | – | 49 | – | ||||||||

| Adjusted EBITDA | $ | 509 | $ | 706 | $ | 9,063 | $ | 4,695 | ||||

| Net sales | $ | 34,063 | $ | 37,228 | $ | 152,838 | $ | 168,558 | ||||

| Adjusted EBITDA margin (%) | 1.5 | % | 1.9 | % | 5.9 | % | 2.8 | % | ||||

For the 14 weeks ended September 7, 2024, adjusted EBITDA margin decreased by 0.4 percentage points compared to the same quarter last year mainly driven by lower net sales mostly offset by lower general and administrative expenses as a percentage of net sales. Overall, Adjusted EBITDA decreased by $0.2 million this quarter compared to the same quarter last year.

For the 53 weeks ended September 7, 2024, adjusted EBITDA margin improved by 3.1 percentage points compared to the corresponding period in 2023 mainly driven by stronger adjusted gross margin as well as lower selling, general and administrative expenses as a percentage of net sales as a result of the Company’s cost savings measures which reduced wages and salaries, utilities, maintenance and software expenses. This improvement was partially offset by lower net sales. Overall, Adjusted EBITDA increased by $4.4 million for the 53 weeks ended September 7, 2024, compared to the same period last year.

FREE CASH FLOW1 AND ADJUSTED FREE CASH FLOW1

The reconciliation of net cash flows from operating activities to free cash flow and adjusted free cash flow is as follows:

(In thousands of Canadian dollars)

| For the 14 and 13 weeks ended |

For the 53 and 52 weeks ended |

|||||||||||

| September 7, 2024 |

September 2, 2023 |

September 7, 2024 |

September 2, 2023 |

|||||||||

| Net cash (used in) provided by operating activities | $ | (932 | ) | $ | (1,958 | ) | $ | 7,494 | $ | (9,350 | ) | |

| Additions to fixed assets | (5 | ) | (18 | ) | (49 | ) | (716 | ) | ||||

| Additions to intangible assets | (165 | ) | (197 | ) | (578 | ) | (1,019 | ) | ||||

| Free cash flow | $ | (1,102 | ) | $ | (2,173 | ) | $ | 6,867 | $ | (11,085 | ) | |

| Payments related to discontinuance of products related to on-demand offering | – | 7 | – | 319 | ||||||||

| Payments made to reorganization and other related costs | – | 1,047 | 736 | 6,275 | ||||||||

| Adjusted free cash flow | $ | (1,102 | ) | $ | (1,119 | ) | $ | 7,603 | $ | (4,491 | ) | |

For the 14 weeks ended September 7, 2024, adjusted free cash flow remained flat compared to the same period last year mainly driven by lower net loss after non-cash items and reorganization and other related costs.

For the 53 weeks ended September 7, 2024, adjusted free cash flow was $7.6 million compared to negative $4.5 million in the same period last year. This is an improvement of $12.1 million compared to the corresponding period in 2023 mainly driven by improved profitability through lower net loss as a result of improved adjusted gross margin and lower selling, general and administrative expenses. The improvement can also be explained by a favorable change in non-cash working capital due to a positive change in accounts and other receivables due to timing of government refunds as well as in accounts payable and accrued liabilities resulting from timing of supplier payments.

TOTAL NET DEBT TO ADJUSTED EBITDA1

(In thousands of Canadian dollars, except ratio information)

| September 7, 2024 |

September 2, 2023 |

|||

| Debt | $ | 1,138 | $ | 4,036 |

| Convertible debentures, liability component, including current portion | 45,405 | 41,752 | ||

| Total debt | $ | 46,543 | $ | 45,788 |

| Cash and cash equivalents | 24,010 | 24,925 | ||

| Total net debt | $ | 22,533 | $ | 20,863 |

| Adjusted EBITDA (last four quarters) | $ | 9,063 | $ | 4,695 |

| Total net debt to adjusted EBITDA | 2.49 | 4.44 | ||

Goodfood’s total net debt increased by $1.7 million and its total net debt to adjusted EBITDA ratio was of 2.49, compared to 4.44 last year. This improvement is mainly explained by the Company’s stronger 12 months results.

FINANCIAL OUTLOOK

Goodfood’s core purpose is to create experiences that spark joy and help our community live longer on a healthier planet. As a food brand with a strong following from Canadians coast to coast, we are focused on growing the Goodfood brand through our meal solutions including meal kits and prepared meals, with a range of exciting Goodfood branded add-ons to complete a unique food experience for customers.

We believe there is runway for additional penetration of meal kits into Canadian households, as evidenced by 2024 industry research estimating Canadian meal kit household penetration to reach 4.2% by 2029 (up from current 3.5%), implying a compound annual gross rate (CAGR) in the high single digit percentage points through 2029 (see Goodfood’s 2024 Annual Information Form for additional information and details).

Before scaling our efforts to endeavour to capture an outsized share of the Canadian meal solutions market, our focus has been and continues to be on further improving and growing cash flows. We are pleased to have now reported seven consecutive quarters of positive adjusted EBITDA1, which on a last four quarters basis amounts to $9.1 million. The substantial rise in adjusted EBITDA1 has led to significant adjusted free cash flow1 improvement which has now been positive in four of our last six quarters. These results help position Goodfood to fund its growth with internally generated cash flows.

To grow our customer base, we first aimed to build customer acquisition cost efficiencies. We have also made and continue to make investments in our digital product to elevate the customer experience by reducing friction and enhancing ease of use. Combined with reactivations of previous Goodfood members, these initiatives have driven a double-digit percentage reduction of our customer acquisition costs year-over-year and improved the profitability and unit economics of customers.

To capture more of Canadian’s food wallet, we have increasingly enhanced product variety as a driver of order frequency. In addition to launching our VIP program, which rewards high-frequency customers, we have increased the diversity of our recipe and ingredient offering to provide additional choices to enhance order rate. With a focus on Better-for-You products like organic chicken breasts, organic lean ground beef, bison, sustainably raised steelhead trout, ground turkey and paleo and keto meals, combined with exciting partnerships with first-rate restaurants and chefs, we plan on offering a growing and mouth-watering selection to customers to drive consistently increasing order frequency. Also, to capture customers increasingly looking for value, we have launched a new set of Value Meals starting at $9.99 a portion and we are testing various plan adjustments to attract a broader set of customers to our delicious meals.

Still, the dollar-value of the baskets our customers are building is also increasing and we are building a differentiated set of meal kits, ready-to-eat meals and grocery add-ons to provide Canadians with an exciting online meal solutions option and increasingly capture a larger share of their food wallet. In addition, we have provided and continue to provide more choice of proteins to our customers, with the launch of upsells and customization within our meal-kit recipes allowing customers to swap or double the proteins included in their chosen recipes. With these initiatives, we aim to provide customers with an array of options to easily make their meals better and their baskets bigger.

We are also continuously looking to enhance our sustainability initiatives by prioritizing planet-friendly options. Not only do we offer perfectly portioned ingredients to reduce food waste, we also constantly look to simplify our supply chain by removing middlemen from farm to kitchen table. This year, we are also aiming to offset carbon emissions on deliveries and introducing packaging innovations that have helped us to remove the equivalent of 2.4 million plastic bags annually from our deliveries. Our goal is clear, build a business that helps our customers live healthier lives on a healthier planet. (See Goodfood’s 2024 Annual Information Form for additional information and details on Goodfood’s partnership with Carbonzero and its Fiscal 2023 Greenhouse Gas Emissions Inventory).

In addition to focusing on these key pillars of top-line growth, we are increasingly considering various other growth avenues, including acquisitions.

Our strategic execution to drive profitability and cash flows continues to position us for growth and profitability, underpinned by consistent improvement in adjusted EBITDA1 and cash flows. Coupled with our unrelenting focus on nurturing our customer relationships, profitable growth remains our top priority. The Goodfood team is fully focused on building and growing Canada’s most loved millennial food brand.

TRENDS AND SEASONALITY

The Company’s net sales and expenses are impacted by seasonality. During the winter holiday season and the summer season, the Company anticipates net sales to be lower as a higher proportion of customers elect to skip their delivery. The Company generally anticipates the number of active customers to be lower during these periods. During periods with significantly colder or warmer weather, the Company anticipates packaging costs to be higher due to the additional packaging required to maintain food freshness and quality.

CONFERENCE CALL

Goodfood will hold a conference call to discuss these results on November 27, 2024 at 8:00AM Eastern Time. Interested parties can join the call by dialing 1 800 717 1738, (Toronto or overseas) or 1 514 400 3792, elsewhere in North America). To access the webcast and view the presentation, click on this link: https://www2.makegoodfood.ca/en/investisseurs/evenements

Parties unable to call in at this time may access a recording by calling 1 888 660 6264 and entering the playback passcode 12890#. This recording will be available until December 4, 2024.

A full version of the Company’s Management’s Discussion and Analysis (MD&A) and Consolidated Financial Statements for the 14 weeks and 53 weeks ended September 7, 2024, will be posted on the Company’s SEDAR+ profile, accessible at http://www.sedarplus.ca later today.

METRICS AND NON-IFRS FINANCIAL MEASURES

Certain metrics and non-IFRS financial measures included in this news release do not have standardized definitions prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other companies. They are provided as additional information to complement IFRS measures and to provide a further understanding of the Company’s results of operations from our perspective. For a more complete description of these measures and a reconciliation of Goodfood’s non-IFRS financial measures to financial results, please see Goodfood’s Management’s Discussion and Analysis for the 14 weeks and 53 weeks ended September 7, 2024.

Goodfood’s definition of the metrics and non-IFRS financial measures are as follows:

- An active customer is a customer that has placed an order within the last three months. For greater certainty, an active customer is only accounted for once, although different products and multiple orders might have been purchased within a quarter. While the active customers metric is not an IFRS or non-IFRS financial measure, and, therefore, does not appear in, and cannot be reconciled to a specific line item in the Company’s consolidated financial statements, we believe that the active customers metric is a useful metric for investors because it is indicative of potential future net sales. The Company reports the number of active customers at the beginning and end of the period, rounded to the nearest thousand.

- Adjusted gross profit is defined as gross profit excluding the impact of the discontinuance of products related to Goodfood On-Demand offering pursuant to the Company’s costs saving initiatives. Adjusted gross margin is defined as the percentage of adjusted gross profit to net sales. The Company uses adjusted gross profit and adjusted gross margin to measure its performance from one period to the next excluding the variation caused by the items described above. Adjusted gross profit and adjusted gross margin are non-IFRS financial measures. We believe that these metrics are useful measures of financial performance to assess how efficiently the Company uses its resources to service its customers as well as to assess underlying trends in our ongoing operations without the variations caused by the impacts of strategic initiatives such as the items described above and facilitates the comparison across reporting periods.

- EBITDA is defined as net income or loss before net finance costs, depreciation and amortization and income taxes. Adjusted EBITDA is defined as EBITDA excluding share-based payments expense, the impact of the inventories write-downs due to the discontinuance of products related to Goodfood On-Demand offering, impairment and reversal of impairment of non-financial assets and reorganization and other related (gains) costs pursuant to the Company’s costs saving initiatives as well as other costs incurred in pursuit of acquisitions. Adjusted EBITDA margin is defined as the percentage of adjusted EBITDA to net sales. EBITDA, adjusted EBITDA, and adjusted EBITDA margin are non-IFRS financial measures. We believe that EBITDA, adjusted EBITDA, and adjusted EBITDA margin are useful measures of financial performance to assess the Company’s ability to seize growth opportunities in a cost-effective manner, to finance its ongoing operations and to service its debt. They also allow comparisons between companies with different capital structures. We also believe that these metrics are useful measures of financial performance to assess underlying trends in our ongoing operations without the variations caused by the impacts of the items described above and facilitates the comparison across reporting periods.

- Free cash flow is defined as net cash provided by or used in operating activities less additions to fixed assets and additions to intangible assets. This measure allows the Company to assess its financial strength and liquidity as well as to assess how much cash is generated and available to invest in growth opportunities, to finance its ongoing operations and to service its debt. It also allows comparisons between companies with different capital structures. Adjusted free cash flow is defined as free cash flow excluding cash payments made to costs related to reorganization activities as well as other costs incurred in pursuit of acquisitions. We believe that adjusted free cash flow is a useful measure when comparing between companies with different capital structures by removing variations caused by the impacts of the items described above. We also believe that this metric is a useful measure of financial and liquidity performance to assess underlying trends in our ongoing operations without the variations caused by the impacts of the items described above and facilitates the comparison across reporting periods.

- Total net debt to adjusted EBITDA (also named net leverage) is calculated as total net debt divided by the last four quarters adjusted EBITDA. Total net debt consists of debt and the liability component of the convertible debentures less cash and cash equivalents. We believe that total net debt to adjusted EBITDA is a useful metric to assess the Company’s ability to manage debt and liquidity.

- Please refer to the “Metrics and non-IFRS financial measures – reconciliation” and the “Liquidity and capital resources” sections of the MD&A for a reconciliation of these non-IFRS financial measures to the most comparable IFRS financial measures.

ABOUT GOODFOOD

Goodfood FOOD is a leading digitally native meal solutions brand in Canada, delivering fresh meals and add-ons that make it easy for customers from across Canada to enjoy delicious meals at home every day. The Goodfood team is building Canada’s most loved millennial food brand, with the mission to create experiences that spark joy and help our community live longer on a healthier planet. Goodfood customers have access to uniquely fresh and delicious products, as well as exclusive pricing, made possible by its world-class culinary team and direct-to-consumer infrastructures and technology. Goodfood is passionate about connecting its partner farms and suppliers to its customers’ kitchens while eliminating food waste and costly retail overhead. The Company’s administrative offices are based in Montreal, Quebec, with production facilities located in the provinces of Quebec and Alberta.

Except where otherwise indicated, all amounts in this news release are expressed in Canadian dollars.

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking information includes, but is not limited to, information with respect to our objectives and the strategies to achieve these objectives, as well as information with respect to our beliefs, plans, expectations, anticipations, assumptions, estimates and intentions, including, without limitation, statements in the “Financial Outlook” section of the MD&A. This forward-looking information is identified by the use of terms and phrases such as “may”, “would”, “should”, “could”, “expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”, “believe”, and “continue”, as well as the negative of these terms and similar terminology, including references to assumptions, although not all forward-looking information contains these terms and phrases. Forward-looking information is provided for the purposes of assisting the reader in understanding the Company and its business, operations, prospects and risks at a point in time in the context of historical trends, current condition and possible future developments and therefore the reader is cautioned that such information may not be appropriate for other purposes.