Wall Street's Most Accurate Analysts Give Their Take On 3 Real Estate Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

Piedmont Office Realty Trust, Inc. PDM

- Dividend Yield: 5.11%

- Baird analyst Dave Rodgers maintained an Outperform rating and raised the price target from $10 to $11 on Nov. 1. This analyst has an accuracy rate of 68%.

- Truist Securities analyst Michael Lewis reiterated a Buy rating and increased the price target from $10 to $11 on Aug. 14. This analyst has an accuracy rate of 71%.

- Recent News: On Oct. 24, Piedmont Office Realty posted downbeat quarterly results.

- Benzinga Pro’s real-time newsfeed alerted to latest PDM news

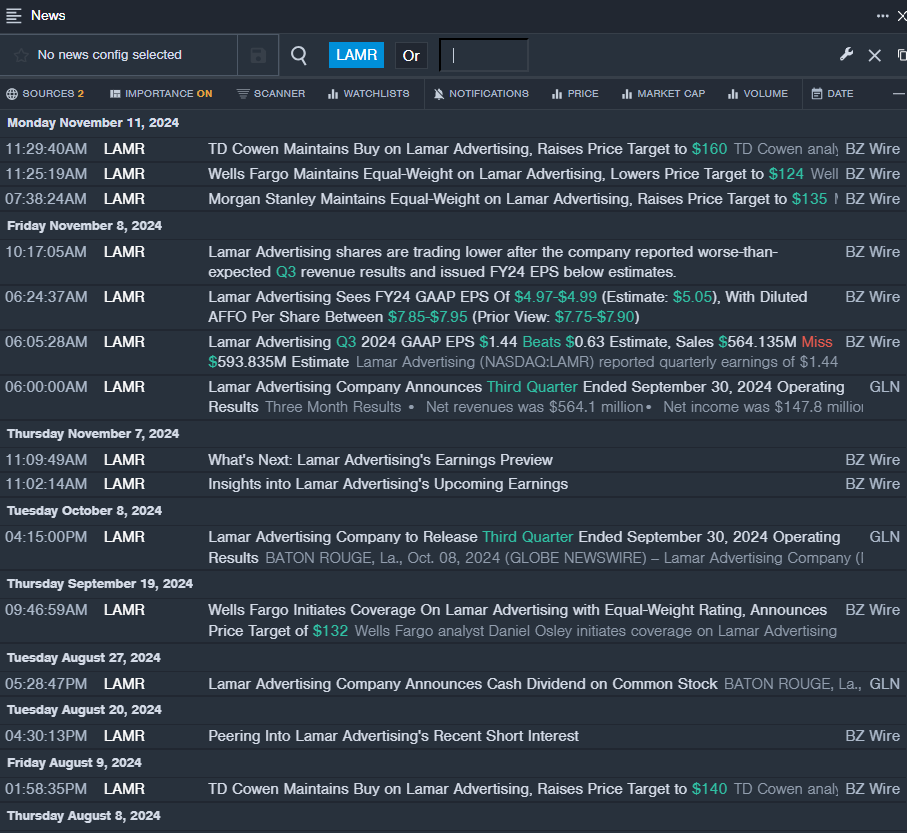

Lamar Advertising Company LAMR

- Dividend Yield: 4.21%

- TD Cowen analyst Lance Vitanza maintained a Buy rating and raised the price target from $142 to $160 on Nov. 11. This analyst has an accuracy rate of 83%.

- Morgan Stanley analyst Benjamin Swinburne maintained an Equal-Weight rating and raised the price target from $125 to $135 on Nov. 11. This analyst has an accuracy rate of 75%.

- Recent News: On Nov. 8, Lamar Advertising reported worse-than-expected third-quarter revenue results and issued FY24 EPS below estimates.

- Benzinga Pro’s real-time newsfeed alerted to latest LAMR news

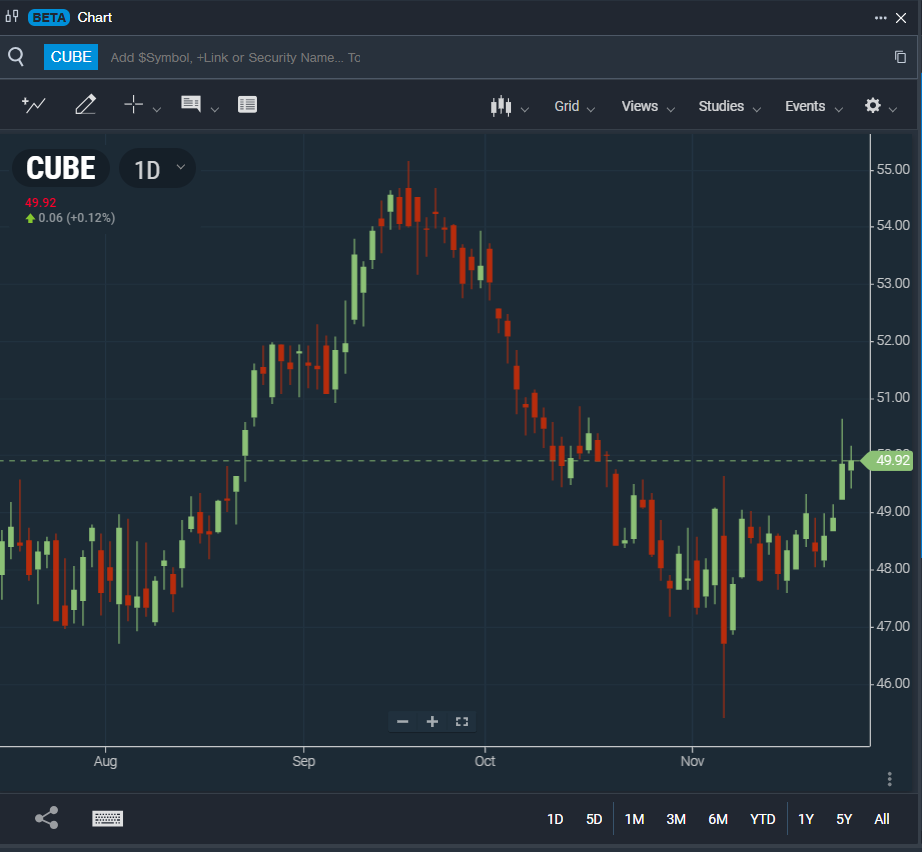

CubeSmart CUBE

- Dividend Yield: 4.09%

- RBC Capital analyst BradHeffern maintained an Outperform rating and cut the price target from $56 to $53 on Nov. 4. This analyst has an accuracy rate of 63%.

- Wells Fargo analyst Eric Luebchow maintained an Equal-Weight rating and raised the price target from $48 to $50 on Oct. 21. This analyst has an accuracy rate of 67%.

- Recent News: On Oct. 31, CubeSmart posted upbeat quarterly sales.

- Benzinga Pro’s charting tool helped identify the trend in CUBE stock.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Previous Post

Autonomous Construction Equipment Market worth $9.77 billion by 2030, Globally, at a CAGR of 14.2%, says MarketsandMarkets™

Next Post

Leave a Reply