Falcon Oil & Gas Ltd. – Filing of Interim Financial Statements

FALCON OIL & GAS LTD.

(“Falcon” or “Company“)

Filing of Interim Financial Statements

28 November 2024 – Falcon Oil & Gas Ltd. FOFOG) announces that it has filed its interim financial statements for the three and nine months ended 30 September 2024 and the accompanying Management’s Discussion and Analysis (“MD&A“).

The following should be read in conjunction with the complete unaudited unreviewed interim financial statements and the accompanying MD&A for the three and nine months ended 30 September 2024, which are available on the Canadian System for Electronic Document Analysis and Retrieval (“SEDAR+”) at www.sedarplus.ca and on Falcon’s website at www.falconoilandgas.com

2024 financial highlights and other financial updates

- Debt free with cash of $10 million at 30 September 2024 (31 December 2023: $8 million).

- Continued focus on cost management and the efficient operation of the portfolio.

Ends.

CONTACT DETAILS:

| Falcon Oil & Gas Ltd. | |

| Philip O’Quigley, CEO | +353 87 814 7042 |

| Anne Flynn, CFO | +353 1 676 9162 |

Cavendish Capital Markets Limited (NOMAD & Broker)

| Neil McDonald / Adam Rae | +44 131 220 9771 |

Interim Condensed Consolidated Statement of Operations and Comprehensive Loss

(Unaudited)

| Three months ended 30 September 2024 $’000 |

Three months ended 30 September 2023 $’000 |

Nine months ended 30 September 2024 $’000 |

Nine months ended 30 September 2023 $’000 |

|

| Revenue | ||||

| Oil and natural gas revenue | – | – | – | – |

| – | – | – | – | |

| Expenses | ||||

| Exploration and evaluation expenses | (44) | (39) | (130) | (129) |

| General and administrative expenses | (523) | (739) | (1,601) | (1,914) |

| Foreign exchange gain | 91 | 38 | 133 | 85 |

| (476) | (740) | (1,598) | (1,958) | |

| Results from operating activities | (476) | (740) | (1,598) | (1,958) |

| Finance income | 365 | 43 | 193 | 155 |

| Finance expense | (132) | (352) | (393) | (647) |

| Net finance income / (expense) | 233 | (309) | (200) | (492) |

| Loss and comprehensive loss for the period | (243) | (1,049) | (1,798) | (2,450) |

| Loss and comprehensive loss attributable to: | ||||

| Equity holders of the company | (247) | (1,046) | (1,798) | (2,444) |

| Non-controlling interests | 4 | (3) | – | (6) |

| Loss and comprehensive loss for the period | (243) | (1,049) | (1,798) | (2,450) |

| Loss per share attributable to equity holders of the company: | ||||

| Basic and diluted | (0.000 cent) | (0.001 cent) | (0.002 cent) | (0.002 cent) |

Interim Condensed Consolidated Statement of Financial Position

(Unaudited)

| At 30 September 2024 $’000 |

At 31 December 2023 $’000 |

||

| Assets | |||

| Non-current assets | |||

| Exploration and evaluation assets | 50,721 | 51,287 | |

| Property, plant and equipment | – | 2 | |

| Trade and other receivables | 26 | 26 | |

| Restricted cash | 2,199 | 2,176 | |

| 52,946 | 53,491 | ||

| Current assets | |||

| Cash and cash equivalents | 9,965 | 7,992 | |

| Trade and other receivables | 946 | 54 | |

| 10,911 | 8,046 | ||

| Total assets | 63,857 | 61,537 | |

| Equity and liabilities | |||

| Equity attributable to owners of the parent | |||

| Share capital | 406,690 | 402,120 | |

| Contributed surplus | 47,444 | 47,379 | |

| Retained deficit | (408,995) | (407,197) | |

| 45,139 | 42,302 | ||

| Non-controlling interests | 697 | 697 | |

| Total equity | 45,836 | 42,999 | |

| Liabilities | |||

| Non-current liabilities | |||

| Decommissioning provision | 16,679 | 16,204 | |

| 16,679 | 16,204 | ||

| Current liabilities | |||

| Accounts payable and accrued expenses | 1,342 | 2,334 | |

| 1,342 | 2,334 | ||

| Total liabilities | 18,021 | 18,538 | |

| Total equity and liabilities | 63,857 | 61,537 |

Interim Condensed Consolidated Statement of Cash Flow

(Unaudited)

| Nine months ended 30 September | |||

| 2024 $’000 |

2023 $’000 |

||

| Cash flows from operating activities | |||

| Net loss for the period | (1,798) | (2,450) | |

| Adjustments for: | |||

| Share based compensation | 65 | 276 | |

| Depreciation | 2 | 3 | |

| Net finance expense | 200 | 482 | |

| Effect of exchange rates on operating activities | (133) | (85) | |

| Change in non-cash working capital: | |||

| Increase in trade and other receivables | (893) | (19) | |

| Increase / (decrease) in accounts payable and accrued expenses | 920 | (36) | |

| Net cash used in operating activities | (1,637) | (1,829) | |

| Cash flows from investing activities | |||

| Interest received | 31 | 165 | |

| Proceeds from sale of ORRIs | 4,000 | – | |

| Exploration and evaluation assets | (5,153) | (647) | |

| Net cash used in investing activities | (1,122) | (482) | |

| Cash flows from financing activities | |||

| Net proceeds from equity raised | 4,570 | – | |

| Net cash generated from financing activities | 4,570 | – | |

| Change in cash and cash equivalents | 1,811 | (2,311) | |

| Effect of exchange rates on cash and cash equivalents | 162 | (320) | |

| Cash and cash equivalents at beginning of period | 7,992 | 16,785 | |

| Cash and cash equivalents at end of period | 9,965 | 14,154 | |

All dollar amounts in this document are in United States dollars “$”, except as otherwise indicated.

About Falcon Oil & Gas Ltd.

Falcon Oil & Gas Ltd is an international oil & gas company engaged in the exploration and development of unconventional oil and gas assets, with the current portfolio focused in Australia, South Africa and Hungary. Falcon Oil & Gas Ltd is incorporated in British Columbia, Canada and headquartered in Dublin, Ireland with a technical team based in Budapest, Hungary.

For further information on Falcon Oil & Gas Ltd. please visit www.falconoilandgas.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain information in this press release may constitute forward-looking information. This information is based on current expectations that are subject to significant risks and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. Falcon assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward looking-statements unless and until required by securities laws applicable to Falcon. Additional information identifying risks and uncertainties is contained in Falcon’s filings with the Canadian securities regulators, which filings are available at www.sedarplus.ca

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Middle East ESG Reporting and Data Summit 2024 Kicks Off Today in Dubai

NEW YORK, Nov. 28, 2024 (GLOBE NEWSWIRE) — (Via ESG News) ESG News announces that the 2nd Edition of the Middle East ESG Reporting & Data Summit will convene today, 28th November 2024 at the Hyatt Regency Dubai Creek Heights, bringing together thought leaders and professionals at the forefront of ESG (Environmental, Social, and Governance) practices. The event is set to address critical trends, regulatory developments, and innovative solutions shaping sustainable business strategies across the region.

Registration Link: The 2nd Edition of the Middle East ESG Reporting & Data Summit

This summit will feature an impressive line-up of speakers representing renowned organizations committed to advancing sustainability. Among the distinguished speakers are Kelly Timmins from Atlantis Dubai, Sameera Fernandes from Century Financial, and Majd Fayyad of the Dubai Supreme Council of Energy. Other notable speakers include Dr. Jacinta Dsiva of SEE Global Research, Maali Khader from Schema Sustainability Advisory, and Zeina AlHashmi of Expo City Dubai, all contributing their unique perspectives on responsible business practices and ESG integration.

In support of the event, numerous partners and sponsors have come forward, reflecting the growing interest in and commitment to sustainable practices in the Middle East. StepChange, My ESG Planet by RGBSi and Innova Beyond ESGEO are key sponsors who share a vision of enhancing ESG frameworks in the region. Additionally, supporting partners such as Cognitud, Fanda, Chiltern TMC, and Sustainable Square provide invaluable backing to ensure the success of the summit. The event’s academic and media partnerships, including SP Jain School of Global Management.

Adding to the summit’s value, ESG News joins as the exclusive media partner. With its dedication to highlighting pivotal environmental and governance efforts, ESG News ensures global visibility for the summit’s discourse. This partnership underscores the summit’s mission to amplify innovative solutions and foster collaboration among key stakeholders in the ESG ecosystem.

As ESG strategies become imperative for sustainable growth, the Middle East ESG Reporting & Data Summit 2024 offers an unparalleled platform for learning, networking, and shaping the region’s future sustainability agenda. Secure your participation today to be part of this transformative journey.

*Special consideration to event producer Clerisy Global

For more information or partnership inquiries, contact:

events@esgnews.com

More Coverage on the Middle East ESG Reporting & Data Summit

Stay up to date with the latest ESG trends, events, and news at ESG News

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5a90a440-854f-4da0-83c6-097779df38ca

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microsoft's Xbox Game Store For Android 'Ready To Go Live,' Says Executive, But Legal Standoff With Google Halts Launch

Microsoft Corp. MSFT has developed its Xbox game store for Android but remains unable to launch the service due to ongoing legal complications, the company revealed Wednesday.

What Happened: Xbox executive Sarah Bond explained that while the game store functionality is complete, a recent court order preventing changes to Alphabet Inc. GOOGL GOOGL subsidiary Google’s Play Store has halted its implementation.

In a Bluesky post, Bond noted the store is “ready to go live” but awaits a final court decision.

The delay stems from a temporary administrative stay granted by Judge James Donato in a case challenging Google’s app store monopoly. Google maintains that Microsoft has always been able to offer game purchases through its Android app but has chosen not to do so.

The standoff highlights ongoing tensions in the mobile app ecosystem, with Microsoft seeking more flexibility in-app distribution. The company’s Xbox App already offers cloud gaming features, but direct game purchases remain blocked.

Google spokesperson Dan Jackson argued that the court order and rushed implementation could compromise the Play Store’s security infrastructure, according to The Verge report. Microsoft has not specified exact barriers preventing the store’s launch beyond the legal constraints.

Microsoft and Google did not immediately respond to Benzinga’s request for a statement.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: This development comes amid broader regulatory scrutiny of big technology companies. The U.S. Federal Trade Commission is reportedly investigating Microsoft’s market practices in cloud computing and artificial intelligence, signaling increased regulatory attention on tech giants’ competitive strategies.

Google’s legal battle centers around Epic Games‘ allegations of monopolistic practices in its Android Play Store, where the tech giant charges a 30% commission on in-app purchases. Epic Games, the maker of Fortnite, initiated the lawsuit after its app was removed from the Play Store in 2020 for bypassing Google’s payment system.

Epic claimed that the commission stifles competition and inflates costs for developers and consumers. A jury ruled last year that Google had illegally monopolized app distribution and payment systems on Android, prompting a court order for significant changes to the Play Store’s structure.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Photo courtesy: Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Toyota's global output declines for ninth straight month in October

TOKYO (Reuters) – Toyota Motor’s global output dropped for a ninth consecutive month in October, dragged lower by big falls in production in the United States and China but the decline was mild compared to previous months.

The world’s biggest automaker also logged its first rise in five months for global sales, which grew 1.4% to 903,103 vehicles, a record for the month of October.

Toyota said on Thursday it produced 893,164 vehicles globally, down 0.8%. That compares with an 8% fall in September.

Production in the United States tumbled 13%, hurt by a four-month production halt of SUV models Grand Highlander and Lexus TX due to an airbag issue. Production of the models resumed on Oct. 21 and output at the automaker’s Indiana plant is expected to return to normal in January.

In China, where competition against local brands remains intense, output slid 9%. Toyota also produced 13% fewer cars in Thailand amid soft demand.

In Japan, which accounts for about a third of Toyota’s worldwide output, production climbed 8%, bouncing back from weak numbers a year ago when an accident at a supplier’s facility led to a partial production halt at multiple plants.

In Canada and Mexico, output for the automaker was up 2% for both countries.

The production and sales figures include vehicles from Toyota’s luxury Lexus brand but exclude group companies Hino and Daihatsu.

(Reporting by Kantaro Komiya; Editing by Edwina Gibbs)

Joe Rogan's Bitcoin Pile Has Grown Over 30000% In Value, But He Hasn't Sold: Conviction-Based HODLing Or Has The Podcast King Lost His Keys?

Joe Rogan has become one of the world’s most successful podcasters in recent years, with influential figures like tech mogul Elon Musk, boxing legend Mike Tyson, renowned whistleblower Edward Snowden, and President-elect Donald Trump appearing on his “The Joe Rogan Experience” show.

But aside from a plethora of topics he enjoys discussing, Rogan has also exhibited significant interest in Bitcoin BTC/USD, the world’s largest cryptocurrency, and even holds some in his portfolio.

What happened: Way back in April 2024, Rogan publicly shared details of his Bitcoin address.

Looking up the address on mempool—a site that tracks Bitcoin transactions and block movements 24×7—revealed a balance of 5.243 BTCs, translating to $502,011 at current market prices.

The fascinating bit was that Rogan hasn’t spent any Bitcoin in over a decade. Exactly 10 years ago, the value of his stash was $1,645, reflecting a mammoth 30417.4% upside.

Analysis of the balance history revealed a gradual increase in holdings beginning in late April, around the time he went public with his address.

By December of the same year, the balance had risen to 5, after which it began to plateau. Since then, it stabilized around the 5.24 level.

While HODLing for such long periods could imply Rogan’s conviction on Bitcoin’s potential, other observers had different explanations.

Bitcoin technologist Jameson Lopp said in a February X post, “How much you wanna bet he lost the key?”

Another user, Daniel Brr, urged Rogan to hand over the Bitcoins to charity if the amount isn’t too significant for him.

“Seems like he just forgot people gave him BTC at that address and doesn’t care either way, so I think it would be better to give it to charity than eventually losing track of it,” Brr added.

Why It Matters: While Rogan may be unmindful of his Bitcoin stash, his faith in the apex cryptocurrency hasn’t shaken.

In an episode of The Joe Rogan Experience podcast with OpenAI co-founder Sam Altman, Rogan called Bitcoin the “real fascinating cryptocurrency” and one with the most likelihood of becoming a “universal viable currency.”

Rogan first mentioned Bitcoin on his podcast more than 10 years ago, in 2013. At that time, the digital asset traded at $123. The rest, as they say, is history.

Price Action: At the time of writing, Bitcoin was trading at $95,524.55, up 2.77% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

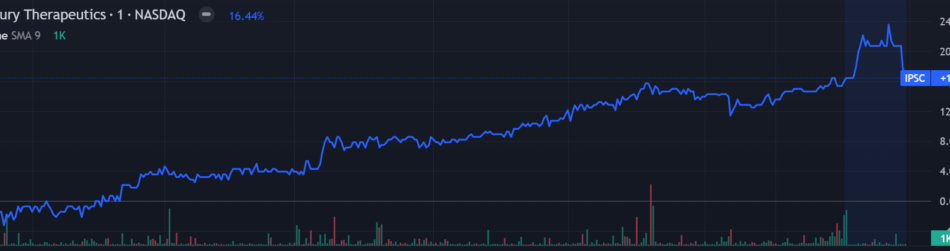

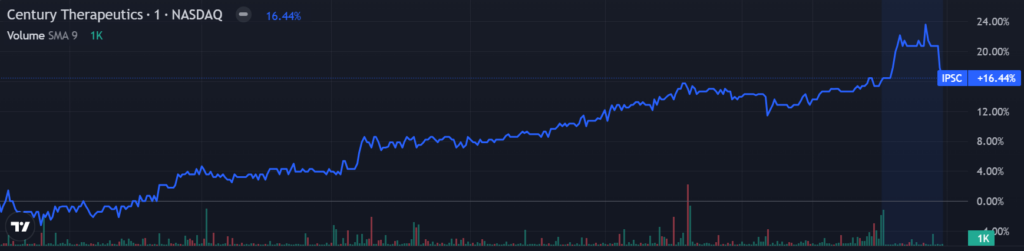

Century Therapeutics Stages Highest Single Day Move In 11 Months As Casdin Capital Bumps Its Stake To 5.4%

Shares of Century Therapeutics Inc IPSC zoomed by 20.74% to $1.63 per share on Wednesday, which is the highest price move in nearly a month since Oct. 1. The shares also rose the most in over 11 months since Dec. 6, 2023, in a single day.

What Happened: On Wednesday, Casdin Capital acquired an additional 1,380,000 shares in Century Therapeutics raising its stake by nearly 43% in the biotechnology company, as per an SEC filing.

After the transaction, Casdin Capital owns a total of 4,592,316 shares, or 5.4% in Century Therapeutics. According to the filing, Century shares were acquired for $1.35 apiece. Century Therapeutics represents 0.12% of Casdin’s portfolio after the transaction.

Why It Matters: Century shares jumped by nearly 21%, the most in a single day since Dec. 6, 2023, when it had jumped by 36% after the transaction.

Casdin Capital, LLC, a New York-based investment firm, specializes in biotechnology investments. With a $1.5 billion equity portfolio, its top holdings include BioLife Solutions Inc (BLFS) and Sarepta Therapeutics Inc (SRPT).

Image via Unsplash

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Caballeta Bio Shares Surge The Most In 23 Months In A Single Day As It Unveils Plan To Meet FDA By 2025 For Systemic Sclerosis Drug Trial

Shares of Caballeta Bio Inc CABA rose by 24.38% to $3.01 apiece on Wednesday and advanced by 4.65% to $3.15 per share in after-hours trading, following an update on their Systemic Sclerosis drug trial.

What Happened: The company anticipates meeting the U.S. Food and Drug Administration in 2025 to discuss potential registrational trial designs, as per a statement by DelveInsight Business Research.

The report highlighted that Caballeta showcased positive clinical safety and efficacy data presented at the American College of Rheumatology Convergence 2024. The Systemic Sclerosis drug trial is ongoing with 16 patients with 10 patients dosed as of Nov. 12, 2024.

Why It Matters: The shares rose over the $3 per share mark for the first time on Wednesday in the last two weeks since Nov. 15. Also, the shares rose the most over 24% in a single day for the first time in two years since Dec. 14, 2022.

Cabaletta Bio is dedicated to developing engineered T-cell therapies to offer lasting, potentially curative treatments for autoimmune diseases. Their CABA platform includes both chimeric antigen receptor T cells and their proprietary chimeric autoantibody receptor T cells, designed to target autoimmune conditions.

Image via Unsplash

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lina Khan-Headed FTC Approves Probe Into Microsoft's Cloud And AI Practices Amid Antitrust Scrutiny: Report

Microsoft Corp. MSFT is confronting a federal investigation that could reshape the technology industry’s competitive landscape, with regulators examining the company’s potentially anticompetitive practices in cloud computing and artificial intelligence markets.

What Happened: The U.S. Federal Trade Commission has initiated a broad investigative effort focusing on Microsoft’s licensing strategies and market conduct, particularly within its Azure cloud service ecosystem. Reuters report, which cited sources, reveals that the probe extends beyond traditional technological assessments, delving into intricate questions about market power and consumer choice.

The probe, approved by FTC Chair Lina Khan before her anticipated departure, centers on allegations that Microsoft is exploiting its market power to restrict customer mobility between cloud platforms.

Tech industry observers note the investigation represents a significant moment for Microsoft, traditionally viewed as more collaborative compared to other Big Tech entities.

Microsoft did not immediately respond to Benzinga‘s request for comment.

The investigation emerges against a backdrop of intensifying regulatory scrutiny of Big Tech companies. While firms like Meta Platforms META, Apple Inc. AAPL, and Amazon.com Inc. AMZN have faced similar antitrust challenges, Microsoft has traditionally navigated these waters with greater apparent ease.

What Happened: Regulatory challenges are emerging across multiple technological fronts, with NetChoice and other industry groups highlighting potential barriers that might prevent customers from seamlessly transitioning between cloud platforms.

The timing of the probe adds complexity, occurring during a potential presidential transition that could dramatically alter enforcement priorities.

Price Action: Microsoft stock closed at $422.99 on Wednesday, down 1.17% for the day. In after-hours trading, the stock dipped further 0.24%. Year-to-date, Microsoft has gained 14.05%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ISMG Broadens Global Cybersecurity Presence with Strategic Investment in Nullcon

Princeton, NJ November 28, 2024 –(PR.com)– ISMG proudly announces a pivotal investment in Nullcon, a leading global conference renowned for its significant contributions to the cybersecurity community. This strategic move is part of ISMG’s broader initiative to enhance its influence and deepen its impact within the global cybersecurity ecosystem, spanning APAC, Europe and the Americas.

Founded in 2010, Nullcon has evolved from a local meetup into an internationally acclaimed conference, attracting thousands of cybersecurity professionals, researchers and government officials. The event is celebrated for its rigorous focus on emerging threats, zero-day vulnerabilities and innovative defense strategies. With hands-on training sessions, technical workshops and interactive discussions, Nullcon fosters an environment where knowledge sharing is paramount, enabling attendees to stay at the forefront of cybersecurity advancements.

Through this partnership, Nullcon will play a crucial role in ISMG’s mission to foster robust dialogue among cybersecurity stakeholders worldwide. The event provides a diverse spectrum of educational opportunities that emphasize both technical proficiency and strategic risk management, significantly enhancing ISMG’s leadership in global cybersecurity education.

“Amid the complex landscape of cyberthreats, our commitment to continuous education and proactive community engagement within the cybersecurity sector is paramount,” stated Sanjay Kalra, CEO of ISMG. “For over 18 years, ISMG has been at the forefront of cybersecurity dialogue, building a robust ecosystem that empowers professionals through education and shared knowledge. Nullcon, with its rich history of fostering cutting-edge research and community engagement, is a cornerstone in this endeavor. Established as a leading platform for cybersecurity innovation, the event enables professionals to engage in deep, impactful discussions, sharpen their technical skills, and explore innovative solutions to contemporary challenges. Together, we are strengthening the fabric of the cybersecurity community and equipping it to face the evolving threats of tomorrow.”

The current global shortfall in cybersecurity expertise – estimated at 3.4 million professionals according to the ISC2 Cybersecurity Workforce Study – underscores the urgency for comprehensive training and education. ISMG’s investment in Nullcon is directly aimed at addressing this gap. Through the event, they provide cutting-edge training and foster a community that is well-equipped to handle the complexities of modern cybersecurity threats.

“Our partnership with ISMG marks a transformative chapter, not only for us but for the global cybersecurity community. Nullcon has been a catalyst for change since 2010 and has significantly advanced the discourse around security,” said Antriksh Shah, founder of Nullcon. “By leveraging ISMG’s extensive network and its 18 years of industry leadership, we can expand our reach and impact, bringing our proven track record of innovation and community building to a worldwide audience. This collaboration is more than a partnership; it’s a beacon for the future of cybersecurity, guiding professionals toward excellence in a world where technological advancements are perpetual and the need for robust security measures is greater than ever.”

ISMG’s partnership with Nullcon expands its overall global event offerings, which already include 400+ roundtables, summits and custom events. This strategic investment strengthens all affiliated entities’ presence around the world, enhancing its ability to deliver advanced cybersecurity training and foster industry collaboration across the board.

Through strategic investments in Nullcon, ISMG is setting new standards in cybersecurity education and community engagement. They are creating a robust platform for the exchange of knowledge and ideas that will define the future of cybersecurity practices globally.

About ISMG

Information Security Media Group (ISMG) is the world’s largest media organization devoted solely to cybersecurity, information technology, artificial intelligence and operational technology. Each of our 38 media properties provides education, research and news that is specifically tailored to key vertical sectors including banking, healthcare and the public sector; geographies from North America to Southeast Asia; and topics such as data breach prevention, cyber risk assessment, OT security, AI and fraud. Our annual global summit series connects senior security professionals with industry thought leaders to find actionable solutions for pressing cybersecurity challenges.

About Nullcon

Nullcon came into existence in 2010 and is managed and marketed by Payatu Technologies Pvt. Ltd. With the advent of cutting-edge technologies, security is crucial as technology brings a myriad of threats along. Nullcon is an extensive platform for the exchange of information about zero-day vulnerabilities, latest attack vectors and other cyberthreats. Here, security researchers and experts from various fields discuss information security, along with showcasing multiple offensive and defensive security technologies.

About ISMG Events

ISMG Events is a premier platform for security professionals and practitioners worldwide. Our global, annual events bring together the ISMG Events Community, comprising over 40,000 members, to exchange knowledge, insights, and best practices in the field of cybersecurity. The cornerstone of our event portfolio is the ISMG Global Summit Series. These summits take place both virtually and in-person, offering participants a diverse range of topics to explore. In addition to our Global Summit Series, ISMG Events hosts exclusive Executive Roundtables and Custom events.

Contact Information:

Information Security Media Group (ISMG)

Merllyne Nesakumaran

+1-609-356-1499

Contact via Email

https://ismg.io/

Read the full story here: https://www.pr.com/press-release/926150

Press Release Distributed by PR.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CT Real Estate Investment Trust Announces Renewal of Normal Course Issuer Bid

TORONTO, Nov. 27, 2024 /CNW/ – CRT – CT Real Estate Investment Trust (“CT REIT”) announced today that the Toronto Stock Exchange (“TSX”) has accepted CT REIT’s notice of intention to proceed with a normal course issuer bid (the “2024-25 NCIB”).

Under the 2024-25 NCIB, CT REIT may, during the 12-month period commencing November 29, 2024 and ending November 28, 2025, purchase up to 1,875,000 CT REIT trust units (“Units”), representing approximately 1.73% of its 108,695,207 issued and outstanding Units as at November 15, 2024. Based on the average daily trading volume on the TSX of 158,985 during the last six months, daily purchases will be limited to 39,746 Units, other than purchases made under block purchase exemptions.

Purchases of Units under the 2024-25 NCIB will be made in open market transactions, at the prevailing market price at the time of purchase, through the facilities of the TSX, through alternative Canadian trading systems or by such other means as may be permitted under applicable securities laws. CT REIT may also purchase Units through private agreements if it receives an issuer bid exemption order permitting it to make such purchases. Any purchases of Units made by way of private agreements may be at a discount to the prevailing market price as provided in the relevant issuer bid exemption order. CT REIT’s previous NCIB, in respect of which CT REIT sought and received approval from the TSX, authorized the purchase of up to 3,500,000 Units and will expire on November 28, 2024 (the “2023-24 NCIB”). A total of 875,468 Units were repurchased through the facilities of the TSX and alternative Canadian trading systems at a volume weighted average price of C$13.4959 per Unit under the 2023-24 NCIB for a total cost of $11.8 million, including commissions.

Decisions regarding the timing of future purchases of Units will be based on market conditions, Unit price and other factors. CT REIT will not be obligated to acquire any Units under the 2024-25 NCIB, and CT REIT may elect to suspend or discontinue the 2024-25 NCIB at any time. Units purchased under the 2024-25 NCIB will be cancelled. CT REIT believes that the market price of Units could be such that their purchase by it under the NCIB may be an attractive and appropriate use of corporate funds. In effect, the 2024-25 NCIB will provide CT REIT with an incremental capital allocation tool that will allow it to prudently and selectively, in appropriate circumstances, take action in support of unitholder value.

In connection with the 2024-25 NCIB, CT REIT has entered into an automatic securities purchase plan (the “ASPP”) with CT REIT’s designated broker to allow for the purchase of Units at times when CT REIT ordinarily would not be active in the market due to its own internal trading blackout periods and insider trading rules. Purchases under the ASPP will be made by CT REIT’s designated broker based upon parameters set by CT REIT when it is not in possession of any material non-public information about itself or its securities, and in accordance with the terms of the ASPP. The ASPP has been entered into in accordance with the requirements of applicable Canadian securities laws and stock exchange rules.

Forward-Looking Statements

This press release contains forward-looking statements and information that reflect management’s current expectations concerning the timing, methods and quantity of any purchases of Units under the NCIB. Forward-looking statements are provided for the purposes of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of our future outlook, anticipated events or results and our operating environment, and such information may not be appropriate for other purposes. Forward-looking information contained herein is based on reasonable assumptions, estimates, analyses, beliefs and opinions of management as of the date hereof made in light of factors that management believes to be relevant and reasonable at the date such information is provided. By its very nature, forward-looking information requires the use of estimates and assumptions and is subject to inherent risks and uncertainties that could cause actual results to differ materially from management’s expectations and plans as set forth in such forward-looking information. For more information on the risks, uncertainties and assumptions that could cause CT REIT’s actual results to differ from current expectations, refer to CT REIT’s public filings available at https://www.sedarplus.ca and at http://www.ctreit.com. CT REIT does not undertake to update any forward-looking information, whether written or oral, that may be made from time to time by it or on its behalf, to reflect new information, future events or otherwise, except as is required by applicable securities laws.

About CT Real Estate Investment Trust

CT REIT is an unincorporated, closed-end real estate investment trust formed to own income-producing commercial properties located primarily in Canada. Its portfolio is comprised of over 370 properties totalling more than 30 million square feet of GLA, consisting primarily of net lease single-tenant retail properties located across Canada. Canadian Tire Corporation, Limited is CT REIT’s most significant tenant. For more information, visit ctreit.com.

SOURCE CT Real Estate Investment Trust (CT REIT)

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/27/c2267.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/27/c2267.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.