Earnings Scheduled For November 28, 2024

Companies Reporting Before The Bell

• Rush Street Interactive RSI is expected to report quarterly earnings at $0.13 per share on revenue of $304.70 million.

Companies Reporting After The Bell

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

China's Robotaxi Firm Pony AI Looks To Diversify Supply Chain After Nasdaq Debut, Growing Competition With Tesla, Waymo, And Amazon

Pony AI PONY CEO James Peng emphasized the company’s strategic focus on supply chain diversification and international market expansion following its Nasdaq debut, as the autonomous driving technology firm navigates ongoing U.S.-China tensions.

What Happened: “For us, it’s nothing new. We have dealt with this for quite some time already,” Peng told Bloomberg Television on Thursday, addressing potential chip export restrictions.

“Our strategy was and remains to be, we will diversify our supply chain,” Peng stated. “As more and more manufacturing of chips are coming out of China or rest of the world, we’ll try to have more diversified supply chain to further de-risk from geopolitical tensions.”

The company plans to strengthen its presence in markets outside the United States, particularly in South Korea, Singapore, and the Middle East.

Why It Matters: Despite opening at the IPO price of $13, Pony AI shares closed their first trading day at $12.00, down 7.69%. The stock showed signs of recovery in after-hours trading, climbing 2.75% to $12.33.

Pony AI, which debuted on the Nasdaq amid U.S.-China tensions, globally competes with leaders like Tesla Inc. TSLA, Waymo part of Alphabet Inc. GOOGL GOOG, and General Motors Co. GM-backed Cruise in the autonomous driving space.

Tesla is advancing its robotaxi ambitions with its FSD fleet, while Waymo operates commercial services in Phoenix and San Francisco, with plans for Los Angeles. Cruise is scaling urban operations, and players like Amazon.com Inc.‘s AMZN Zoox and Aurora Innovation AUR target niche solutions.

With over 250 robotaxis and 190 robotrucks in China, Pony AI seeks to reduce reliance on single markets, focusing on South Korea, Singapore, and the Middle East to diversify and counter geopolitical risks.

Goldman Sachs, Merrill Lynch, and Deutsche Bank are serving as lead underwriters for the IPO, which is scheduled to close on Friday.

Read Next:

Photo courtesy: Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

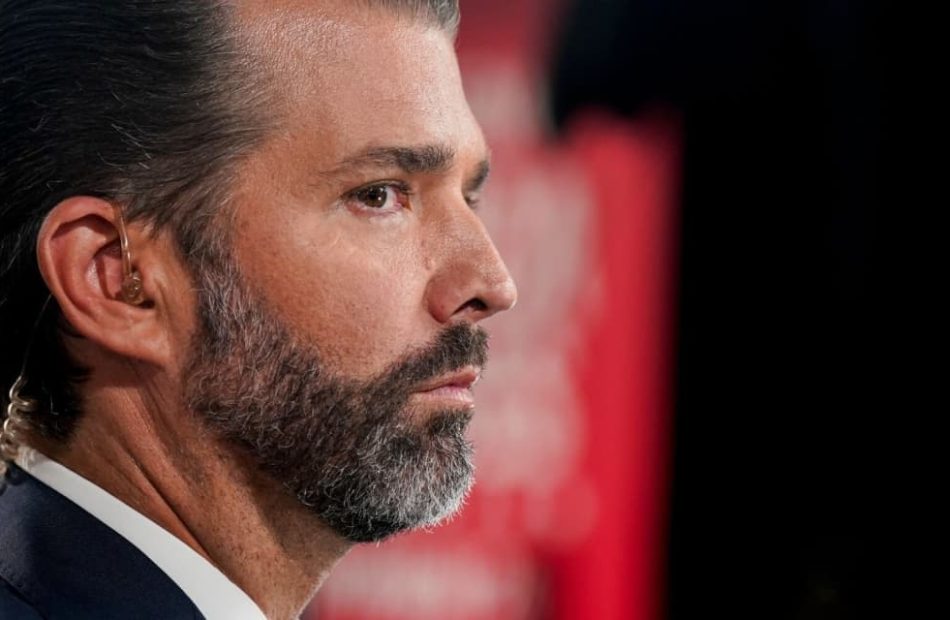

Unusual Machines CEO: Donald Trump Jr. Advisory Role Isn’t About Political Connections

Drone-parts maker Unusual Machines UMAC 84.51%increase; green up pointing triangle says Donald Trump Jr.’s advisory role is about the president-elect’s son’s business network, not his political connections.

News of Trump Jr. being named an advisor to the Orlando, Fla., company sent shares surging Wednesday. The stock, which early in the trading session had more than doubled, was recently up 50%, to $8.07, and on pace for a record close after debuting on public markets earlier this year.

Copyright ©2024 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Unaudited interim results for the three-and nine-month periods ended 30 September 2024

Unaudited interim results for the three-and nine-month periods ended 30 September 2024

Serabi (SRBSBISRBIF, the Brazilian focused gold mining and development company, is pleased to release its unaudited interim results for the three and nine-month periods ended 30 September 2024.

A copy of the full interim statements together with commentary can be accessed on the Company’s website using the following link:– https://bit.ly/3Z8CJiX

“This has been another excellent quarter for Serabi, in particular for cash generation, said Clive Line, Serabi’s CFO. “The cash balance at the end of September was $20.0 million with $8.0 million generated during the quarter. EBITDA of $11.7 million for the quarter brings EBITDA for the year to date to a total of $24.7 million, a 42 per cent improvement compared with the second quarter.

“We benefited from inventory realisation to the sum of approximately $3.0M, boosting quarter sales, and whilst I do not expect similar additional inventory sales for Q4, I do anticipate cash growth to continue to the end of the year notwithstanding the cyclical effects of tax payments and 13th salary accruals that are due. The ability of the business to produce healthy cash flow is being further supported by the Coringa classification plant which is now operational and in the final stages of commissioning. We are already passing run of mine ore through this plant and will also start to work our way through the lower grade stockpiles that have been accumulated at Coringa. As a result of processing this stockpiled material we hope that this final quarter will continue the pattern of increasing production quarter on quarter that we have so far experienced in 2024.

“During the quarter we announced the results of the Preliminary Economic Assessment for Coringa which indicate an average project AISC of $1,241 over the project life from 1 January 2025 onwards. The full NI 43-101 compliant Technical Report was published on 21 November 2024.”

Financial Highlights (all currency amounts are expressed in US Dollars unless otherwise stated)

- Gold production for the first nine months of 2024 of 27,499 ounces (2023: 25,262 ounces).

- Cash held on 30 September 2024 of $20.0 million (31 December 2023: $11.6 million including US$0.6 million relating to the exploration alliance with Vale).

- EBITDA for the nine-month period of $24.7 million (2023: $8.8 million).

- Post-tax profit for the nine-month period of $17.8 million (2023: $4.6 million),

- Profit per share of 23.55 cents compared with a profit per share of 6.10 cents for the same nine month period of 2023.

- Net cash inflow from operations for the nine-month period (after mine development expenditure of US$4.9 million) of US$18.2 million (2023: US$10.7 million inflow, after mine development expenditure of US$2.6 million).

- Average gold price of US$2,338 per ounce received on gold sales during the nine month period (2023: US$1,940).

- Cash Cost for the nine month period to 30 September 2024 of US$1,405 per ounce (nine months 2023: US$1,253 per ounce).

- All-In Sustaining Cost for the nine-month period to 30 September 2024 of US$1,790 per ounce (nine months 2023: US$1,553 per ounce).

Overview of the financial results

In the first nine months of 2024, the Group has reported revenue and operating costs related to the sale of 28,912 ounces in the period (27,499 ounces produced). This compares to sales reported of only 23,733 ounces in the first nine months of 2023. Reported revenues and costs reflect the ounces sold in each period and as a result total costs for the nine-month period are significantly higher than for the corresponding period of 2023.

During the month of January 2024, the Group also completed and drew down a new US$5 million loan with Itaú Bank in Brazil. This new arrangement has an interest coupon of 8.47 per cent and is repayable as a bullet payment on 6 January 2025. This replaced a similar loan arranged with Santander Bank in Brazil that was repaid during the month of February 2024.

Final commissioning of the ore sorter and crushing plant for Coringa is almost complete, with the crushing plant operational during October and the ore-sorter starting up during November. During the remainder of the fourth quarter in addition to passing run of mine ore extracted from Coringa, the Company will also be processing some of the lower grade material that has been stockpiled at Coringa providing an additional boost to gold production in the remainder of the fourth quarter.

Key Financial Information

| SUMMARY FINANCIAL STATISTICS FOR THE THREE-AND NINE MONTHS ENDING 30 SEPTEMBER 2024 | ||||||

| 9 months to 30 September 2024 US$ (unaudited) |

9 months to 30 September 2023 US$ (unaudited) |

3 months to 30 September 2024 US$ (unaudited) |

3 months to 30 September 2023 US$ (unaudited) |

|||

| Revenue | 70,290,641 | 47,897,264 | 27,626,034 | 17,373,682 | ||

| Cost of sales | (39,840,803) | (34,405,882) | (14,160,734) | (13,341,448) | ||

| Gross operating profit | 30,449,838 | 13,491,382 | 13,465,300 | 4,032,234 | ||

| Administration and share based payments | (5,728,359) | (4,702,467) | (1,719,359) | (1,864,200) | ||

| EBITDA | 24,721,479 | 8,788,915 | 11,745,941 | 2,168,034 | ||

| Depreciation and amortisation charges | (3,297,323) | (3,409,994) | (1,056,517) | (1,384,957) | ||

| Operating profit before finance and tax | 21,424,156 | 5,378,921 | 10,689,424 | 783,077 | ||

| Profit after tax | 17,837,221 | 4,620,779 | 8,615,387 | (359,112) | ||

| Earnings per ordinary share (basic) | 23.55c | 6.10c | 11.38c | 0.47c | ||

| Average gold price received (US$/oz) | US$2,338 | US$1,940 | US$2,478 | US$1,930 | ||

| As at 30 September 2024 US$ (unaudited) |

As at 31 December 2023 US$ (audited) |

|||

| Cash and cash equivalents | 20,029,407 | 11,552,031 | ||

| Net funds (after finance debt obligations) | 14,007,367 | 5,148,947 | ||

| Net assets | 103,439,147 | 92,792,049 | ||

| Cash Cost and All-In Sustaining Cost (“AISC”) | ||||

| 9 months to 30 September 2024 |

9 months to 30 September 2023 |

12 months to 31 December 2023 | ||

| Gold production for cash cost and AISC purposes | 27,499 ozs | 25,262 ozs | 33,152 ozs | |

| Total Cash Cost of production (per ounce) | US$1,405 | US$1,253 | US$1,300 | |

| Total AISC of production (per ounce) | US$1,790 | US$1,553 | US$1,635 |

Engage Investor Presentation – 3 December 2024

Shareholders and investors are advised that Mike Hodgson, Chief Executive Officer of the Company will provide a live interactive presentation via the Engage Investor platform, on the 3rd of December at 2:30pm GMT.

Serabi Gold plc welcomes all current shareholders and interested investors to join and encourages investors to pre-submit questions. Investors can also submit questions at any time during the live presentation.

Investors can sign up to Engage Investor at no cost and follow Serabi Gold plc from their personalised investor hub.

Shareholders and investors can register interest in this event using the following link – https://engageinvestor.news/SRB_Ei

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 as it forms part of UK Domestic Law by virtue of the European Union (Withdrawal) Act 2018.

The person who arranged for the release of this announcement on behalf of the Company was Clive Line, Director.

Enquiries

SERABI GOLD plc

Michael Hodgson t +44 (0)20 7246 6830

Chief Executive m +44 (0)7799 473621

Clive Line t +44 (0)20 7246 6830

Finance Director m +44 (0)7710 151692

Andrew Khov m +1 647 885 4874

Vice President, Investor Relations &

Business Development

e contact@serabigold.com

BEAUMONT CORNISH Limited

Nominated Adviser & Financial Adviser

Roland Cornish / Michael Cornish t +44 (0)20 7628 3396

PEEL HUNT LLP

Joint UK Broker

Ross Allister t +44 (0)20 7418 9000

TAMESIS PARTNERS LLP

Joint UK Broker

Charlie Bendon/ Richard Greenfield t +44 (0)20 3882 2868

CAMARCO

Financial PR – Europe

Gordon Poole / Emily Hall t +44 (0)20 3757 4980

HARBOR ACCESS

Financial PR – North America

Jonathan Patterson / Lisa Micali t +1 475 477 9404

Copies of this announcement are available from the Company’s website at www.serabigold.com.

Forward-looking statements

Certain statements in this announcement are, or may be deemed to be, forward looking statements. Forward looking statements are identified by their use of terms and phrases such as ‘‘believe”, ‘‘could”, “should” ‘‘envisage”, ‘‘estimate”, ‘‘intend”, ‘‘may”, ‘‘plan”, ‘‘will” or the negative of those, variations or comparable expressions, including references to assumptions. These forward-looking statements are not based on historical facts but rather on the Directors’ current expectations and assumptions regarding the Company’s future growth, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities. Such forward looking statements reflect the Directors’ current beliefs and assumptions and are based on information currently available to the Directors. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements including risks associated with vulnerability to general economic and business conditions, competition, environmental and other regulatory changes, actions by governmental authorities, the availability of capital markets, reliance on key personnel, uninsured and underinsured losses and other factors, many of which are beyond the control of the Company. Although any forward-looking statements contained in this announcement are based upon what the Directors believe to be reasonable assumptions, the Company cannot assure investors that actual results will be consistent with such forward looking statements.

Qualified Persons Statement

The scientific and technical information contained within this announcement has been reviewed and approved by Michael Hodgson, a Director of the Company. Mr Hodgson is an Economic Geologist by training with over 35 years’ experience in the mining industry. He holds a BSc (Hons) Geology, University of London, a MSc Mining Geology, University of Leicester and is a Fellow of the Institute of Materials, Minerals and Mining and a Chartered Engineer of the Engineering Council of UK, recognizing him as both a Qualified Person for the purposes of Canadian National Instrument 43-101 and by the AIM Guidance Note on Mining and Oil & Gas Companies dated June 2009.

Notice

Beaumont Cornish Limited, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority, is acting as nominated adviser to the Company in relation to the matters referred herein. Beaumont Cornish Limited is acting exclusively for the Company and for no one else in relation to the matters described in this announcement and is not advising any other person and accordingly will not be responsible to anyone other than the Company for providing the protections afforded to clients of Beaumont Cornish Limited, or for providing advice in relation to the contents of this announcement or any matter referred to in it.

Neither the Toronto Stock Exchange, nor any other securities regulatory authority, has approved or disapproved of the contents of this news release.

See www.serabigold.com for more information and follow us on twitter @Serabi_Gold

The following information, comprising, the Income Statement, the Group Balance Sheet, Group Statement of Changes in Shareholders’ Equity, and Group Cash Flow, is extracted from the unaudited interim financial statements for the three and nine months to 30 September 2024.

Statement of Comprehensive Income

For the three and nine-month periods ended 30 September 2024.

| For the three months ended 30 September |

For the nine months ended 30 September |

||||

| 2024 | 2023 | 2024 | 2023 | ||

| (expressed in US$) | Notes | (unaudited) | (unaudited) | (unaudited) | (unaudited) |

| CONTINUING OPERATIONS | |||||

| Revenue | 27,626,034 | 17,373,682 | 70,290,641 | 47,897,264 | |

| Cost of sales | (14,160,734) | (11,769,256) | (39,840,803) | (32,463,690) | |

| Stock impairment provision | — | — | — | (370,000) | |

| Depreciation and amortisation charges | 2 | (1,056,517) | (2,957,149) | (3,297,323) | (4,982,186) |

| Total cost of sales | (15,217,251) | (14,726,405) | (43,138,126) | (37,815,876) | |

| Gross profit | 12,408,783 | 2,647,277 | 27,152,515 | 10,081,388 | |

| Administration expenses | (1,679,357) | (1,934,235) | (5,484,788) | (4,834,129) | |

| Share-based payments | (65,010) | (52,151) | (183,902) | (138,017) | |

| Gain on disposal of assets | 25,008 | 122,186 | (59,669) | 269,679 | |

| Operating profit | 10,689,424 | 783,077 | 21,424,156 | 5,378,921 | |

| Other income – exploration receipts | 3 | __ | 1,992,344 | 351,186 | 3,042,879 |

| Other expenses – exploration expenses | 3 | __ | (1,856,520) | (317,746) | (2,876,431) |

| Foreign exchange gain/(loss) | 129,429 | (43,421) | (690,927) | 56,645 | |

| Finance expense | 4 | (127,729) | (381,478) | (438,032) | (500,588) |

| Finance income | 4 | 109,262 | 199,792 | 345,727 | 703,823 |

| Profit/(loss) before taxation | 10,800,386 | 693,794 | 20,674,364 | 5,805,249 | |

| Income tax expense | 5 | (2,184,999) | (1,052,906) | (2,837,143) | (1,184,470) |

| Profit/(loss) after taxation | 8,615,387 | (359,112) | 17,837,221 | 4,620,779 | |

| Other comprehensive income (net of tax) | |||||

| Exchange differences on translating foreign operations | 808,689 | (2,952,047) | (7,374,025) | 1,751,104 | |

| Total comprehensive profit/(loss) for the period(1) | 9,424,076 | (3,311,159) | 10,463,196 | 6,371,883 | |

| Profit/(loss) per ordinary share (basic) | 6 | 11.38c | (0.47c) | 23.55c | 6.10c |

| Profit/(loss) per ordinary share (diluted) | 6 | 11.38c | (0.47c) | 23.55c | 6.10c |

(1) The Group has no non-controlling interest and all profits are attributable to the equity holders of the Parent Company

Balance Sheet as at 30 September 2024

| (expressed in US$) | As at 30 September 2024 (unaudited) |

As at 30 September 2023 (unaudited) |

As at 31 December 2023 (audited) |

||

| Non-current assets | |||||

| Deferred exploration costs | 20,211,858 | 19,775,603 | 20,499,257 | ||

| Property, plant and equipment | 56,310,566 | 49,107,705 | 53,340,903 | ||

| Right of use assets | 4,928,263 | 5,214,315 | 5,316,330 | ||

| Deferred taxes | 7,110,445 | 1,520,710 | 4,653,063 | ||

| Taxes receivable | 1,903,307 | 3,891,201 | 1,791,983 | ||

| Total non-current assets | 90,464,439 | 79,509,534 | 85,601,536 | ||

| Current assets | |||||

| Inventories | 12,338,958 | 9,819,171 | 12,797,951 | ||

| Trade and other receivables | 2,100,956 | 1,579,886 | 2,858,072 | ||

| Derivative financial assets | — | 197,864 | 115,840 | ||

| Prepayments and accrued income | 1,633,602 | 1,750,470 | 2,320,256 | ||

| Cash and cash equivalents | 20,029,407 | 15,352,099 | 11,552,031 | ||

| Total current assets | 36,102,923 | 28,699,490 | 29,644,150 | ||

| Current liabilities | |||||

| Trade and other payables | 10,672,705 | 7,798,873 | 8,626,292 | ||

| Interest bearing liabilities | 5,886,714 | 6,211,791 | 6,403,084 | ||

| Accruals | 431,716 | 593,435 | 649,225 | ||

| Total current liabilities | 16,991,135 | 14,604,099 | 15,678,601 | ||

| Net current assets | 19,111,788 | 14,095,391 | 13,965,549 | ||

| Total assets less current liabilities | 109,576,227 | 93,604,925 | 99,567,085 | ||

| Non-current liabilities | |||||

| Trade and other payables | 3,676,181 | 3,884,102 | 3,960,920 | ||

| Interest bearing liabilities | 135,326 | 304,262 | 150,224 | ||

| Deferred tax liability | — | 130,967 | — | ||

| Provisions | 2,325,573 | 1,252,631 | 2,663,892 | ||

| Total non-current liabilities | 6,137,080 | 5,571,962 | 6,775,036 | ||

| Net assets | 103,439,147 | 88,032,963 | 92,792,049 | ||

| Equity | |||||

| Share capital | 11,213,618 | 11,213,618 | 11,213,618 | ||

| Share premium reserve | 36,158,068 | 36,158,068 | 36,158,068 | ||

| Option reserve | 359,475 | 116,246 | 175,573 | ||

| Other reserves | 17,609,380 | 16,167,780 | 15,960,006 | ||

| Translation reserve | (69,154,766) | (64,525,667) | (61,780,741) | ||

| Retained surplus | 107,253,372 | 88,902,918 | 91,065,525 | ||

| Equity shareholders’ funds | 103,439,147 | 88,032,963 | 92,792,049 |

Statements of Changes in Shareholders’ Equity

For the nine-month period ended 30 September 2024

| (expressed in US$) | |||||||

| (unaudited) | Share capital |

Share premium |

Share option reserve | Other reserves (1) | Translation reserve | Retained Earnings | Total equity |

| Equity shareholders’ funds at 31 December 2022 | 11,213,618 | 36,158,068 | 1,324,558 | 14,459,255 | (66,276,771) | 84,644,335 | 81,523,063 |

| Foreign currency adjustments | — | — | — | — | 1,751,104 | — | 1,751,104 |

| Profit for the period | — | — | — | — | — | 4,620,779 | 4,620,779 |

| Total comprehensive income for the period | — | — | — | — | 1,751,104 | 4,620,779 | 6,371,883 |

| Transfer to taxation reserve | — | — | — | 1,708,525 | — | (1,708,525) | — |

| Share Options Expired | — | — | (1,346,329) | — | — | 1,346,329 | — |

| Share incentives expense | — | — | 138,017 | — | — | — | 138,017 |

| Equity shareholders’ funds at 30 September 2023 |

11,213,618 | 36,158,068 | 116,246 | 16,167,780 | (64,525,667) | 88,902,918 | 88,032,963 |

| Foreign currency adjustments | — | — | — | — | 2,744,926 | — | 2,744,926 |

| Profit for the period | — | — | — | — | — | 1,954,833 | 1,954,833 |

| Total comprehensive income for the period | — | — | — | — | 2,744,926 | 1,954,833 | 4,699,759 |

| Transfer to taxation reserve | — | — | — | (207,774) | — | 207,774 | — |

| Share Options Expired | — | — | — | — | — | — | — |

| Share incentives expense | — | — | 59,327 | — | — | — | 59,327 |

| Equity shareholders’ funds at 31 December 2023 | 11,213,618 | 36,158,068 | 175,573 | 15,960,006 | (61,780,741) | 91,065,525 | 92,792,049 |

| Foreign currency adjustments | — | — | — | — | (7,374,025) | — | (7,374,025) |

| Profit for the period | — | — | — | — | — | 17,837,221 | 17,837,221 |

| Total comprehensive income for the period | — | — | — | — | (7,374,025) | 17,837,221 | 10,463,196 |

| Transfer to taxation reserve | — | — | — | 1,649,374 | — | (1,649,374) | — |

| Share incentives expense | — | — | 183,902 | — | — | — | 183,902 |

| Equity shareholders’ funds at 30 September 2024 |

11,213,618 | 36,158,068 | 359,475 | 17,609,380 | (69,154,766) | 107,253,372 | 103,439,147 |

(1) Other reserves comprise a merger reserve of US$361,461 and a taxation reserve of US$17,247,919 (31 December 2023: merger reserve of US$361,461 and a taxation reserve of US$15,598,545).

Condensed Consolidated Cash Flow Statement

For the three and nine-month periods ended 30 September 2024

| For the three months ended 30 September |

For the nine months ended 30 September |

||||

| 2024 | 2023 | 2024 | 2023 | ||

| (expressed in US$) | (unaudited) | (unaudited) | (unaudited) | (unaudited) | |

| Post tax profit/(loss) for period | 8,615,387 | (359,112) | 17,837,221 | 4,620,779 | |

| Depreciation – plant, equipment and mining properties | 1,056,517 | 2,957,149 | 3,297,323 | 4,982,186 | |

| Provision for inventory impairment | — | — | — | 370,000 | |

| Gain on asset disposals | (25,008) | (122,186) | 59,669 | (269,679) | |

| Net financial expense | (110,962) | 225,107 | 749,792 | (259,880) | |

| Provision for taxation | 2,184,999 | 1,052,906 | 2,837,143 | 1,184,470 | |

| Share-based payments | 65,010 | 52,151 | 183,902 | 138,017 | |

| Taxation paid | (347,589) | (415,722) | (789,287) | (811,612) | |

| Interest paid | (10,091) | (22,900) | (39,599) | (408,714) | |

| Foreign exchange (loss) / gain | (291,702) | (45,098) | (343,986) | (117,170) | |

| Changes in working capital | |||||

| Decrease/(increase) in inventories | 217,474 | (696,001) | (1,049,888) | (696,782) | |

| Decrease/(increase)/decrease in receivables, prepayments and accrued income | 1,238,492 | (1,477) | (1,002,244) | 2,763,565 | |

| Increase/(decrease) in payables, accruals and provisions | 979,209 | 1,550,835 | 1,384,012 | 1,798,796 | |

| Net cash inflow from operations | 13,571,736 | 4,175,652 | 23,124,058 | 13,293,976 | |

| Investing activities | |||||

| Purchase of property, plant and equipment and assets in construction | (2,219,242) | (706,419) | (6,231,132) | (1,686,505) | |

| Mine development expenditure | (1,977,182) | (1,274,305) | (4,913,351) | (2,613,395) | |

| Geological exploration expenditure | (922,400) | (101,611) | (1,835,856) | (459,035) | |

| Pre-operational project costs | (393,044) | — | (865,728) | — | |

| Proceeds from sale of assets | 21,474 | 123,408 | 73,955 | 314,923 | |

| Interest received | 109,262 | 101,574 | 338,895 | 181,373 | |

| Net cash outflow on investing activities | (5,381,132) | (1,857,353) | (13,433,217) | (4,262,639) | |

| Financing activities | |||||

| Receipt of short-term loan | — | — | 5,000,000 | 5,000,000 | |

| Repayment of short-term loan | — | — | (5,000,000) | (5,096,397) | |

| Payment of finance lease liabilities | (210,366) | (295,583) | (708,816) | (906,565) | |

| Net cash (outflow) / inflow from financing activities | (210,366) | (295,583) | (708,816) | (1,002,962) | |

| Net increase / (decrease) in cash and cash equivalents | 7,980,238 | 2,022,716 | 8,982,025 | 8,028,375 | |

| Cash and cash equivalents at beginning of period | 12,041,017 | 13,285,447 | 11,552,031 | 7,196,313 | |

| Exchange difference on cash | 8,152 | 43,936 | (504,649) | 127,411 | |

| Cash and cash equivalents at end of period | 20,029,407 | 15,352,099 | 20,029,407 | 15,352,099 | |

Notes

- Basis of preparation

1. Basis of preparation

These interim condensed consolidated financial statements are for the three and nine month periods ended 30 September 2024. Comparative information has been provided for the unaudited three and nine month periods ended 30 September 2023 and, where applicable, the audited twelve month period from 1 January 2023 to 31 December 2023. These condensed consolidated financial statements do not include all the disclosures that would otherwise be required in a complete set of financial statements and should be read in conjunction with the 2023 annual report.

The condensed consolidated financial statements for the periods have been prepared in accordance with International Accounting Standard 34 “Interim Financial Reporting” and the accounting policies are consistent with those of the annual financial statements for the year ended 31 December 2023 and those envisaged for the financial statements for the year ending 31 December 2024.

The interim financial information has not been audited and does not constitute statutory accounts as defined in Section 434 of the Companies Act 2006. Whilst the financial information included in this announcement has been compiled in accordance with International Financial Reporting Standards (“IFRS”) this announcement itself does not contain sufficient financial information to comply with IFRS. The Group statutory accounts for the year ended 31 December 2023 prepared in accordance with international accounting standards in conformity with the requirements of the Companies Act 2006 have been filed with the Registrar of Companies. The auditor’s report on these accounts was unqualified. The auditor’s report did not contain a statement under Section 498 (2) or 498 (3) of the Companies Act 2006.

Accounting standards, amendments and interpretations effective in 2024

The Group has not adopted any standards or interpretations in advance of the required implementation dates.

The following Accounting Standards have not yet been ratified in UK law but are expected to be ratified during 2024. The Group expects to make appropriate compliant disclosures in its Annual Report for the year needed 31 December 2024.

| IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information | |

| IFRS S2 Climate-related Disclosures |

Amendments IAS 1 – Classification of Liabilities as Current or Non-Current and Non Current Liabilities with Covenants

The IASB issued amendments to IAS 1 Presentation of Financial Statements (“IAS 1”). The amendments clarify that the classification of liabilities as current or non-current is based on rights that are in existence at the end of the reporting period. Classification is unaffected by the entity’s expectation or events after the reporting date. Covenants of loan arrangements will affect the classification of a liability as current or non-current if the entity must comply with a covenant either before or at the reporting date, even if the covenant is only tested for compliance after the reporting date. There was no significant impact on the Company’s consolidated interim financial statements as a result of the adoption of these amendments.

Management do not consider that the following other amendments to existing standards are applicable to the current operations of the Group or will have any material impact on the financial statements.

| Lease Liability in a Sale and Leaseback (amendments to IFRS 16) | |

| Supplier Finance Arrangements (amendments to IAS 7 and IFRS 17)) |

Certain new accounting standards and interpretations have been published that are not mandatory for the current period and have not been early adopted. These standards are not expected to have a material impact on the Company’s current or future reporting periods.

These financial statements do not constitute statutory accounts as defined in Section 434 of the Companies Act 2006.

(i) Going concern

On 30 September 2024 the Group held cash of US$20.03 million which represents an increase of US$8.45 million compared to 31 December 2023.

On 7 January 2024, the Group completed a US$5.0 million unsecured loan arrangement with Itaú Bank in Brazil. The loan is repayable as a bullet payment on 6 January 2025 and carries an interest coupon of 8.47 per cent. The proceeds raised from the loan are being used for working capital and secure adequate liquidity to repay a similar arrangement which was repaid on 22 February 2024.

Management prepares, for Board review, regular updates of its operational plans and cash flow forecasts based on their best judgement of the expected operational performance of the Group and using economic assumptions that the Directors consider are reasonable in the current global economic climate. The current plans assume that during 2024 the Group will continue gold production from its Palito Complex operation as well as increase production from the Coringa mine and will be able to increase gold production to exceed the levels of 2023.

The Directors will limit the Group’s discretionary expenditures, when necessary, to manage the Group’s liquidity.

The Directors acknowledge that the Group remains subject to operational and economic risks and any unplanned interruption or reduction in gold production or unforeseen changes in economic assumptions may adversely affect the level of free cash flow that the Group can generate on a monthly basis. The Directors have a reasonable expectation that, after taking into account reasonably possible changes in trading performance, and the current macroeconomic situation, the Group has adequate resources to continue in operational existence for the foreseeable future. Thus, they continue to adopt the going concern basis of accounting in preparing the Financial Statements.

2. Depreciation and amortisation

Whilst the Coringa Gold Project has been in production for some time, it is still in a development and ramp-up stage and has not yet attained the operational scale that the Board considers is required to be considered in Commercial Production. As a result no amortisation charge in respect of the underlying mine asset costs has been reflected in the financial statements to date.

3. Other Income and Expenses

Under the copper exploration alliance with Vale announced on 10 May 2023, the related exploration activities undertaken by the Group under the management of a working committee (comprising representatives from Vale and Serabi), were funded in their entirety by Vale during Phase 1 of the programme. Following the completion of Phase 1, Vale advised the Group, in April 2024, that it did not wish to continue the exploration alliance.

Exploration and development of copper deposits is not the core activity of the Group and further funding beyond the Phase 1 commitment would be required before a judgment could be made as to a project being commercially viable. There is a significant cost involved in developing new copper deposits and it is unlikely that, without the financial support of a partner, the Group would independently seek to develop a copper project in preference to any of its existing gold projects and discoveries. As a result, both the funding received from Vale and the related exploration expenditures has been recognised through the income statement. As this is not a principal business activity of the Group these receipts and expenditures are classified as other income and other expenses.

4. Finance expense and income

| 3 months ended 30 September 2024 (unaudited) |

3 months ended 30 September 2023 (unaudited) |

9 months ended 30 September 2024 (unaudited) |

9 months ended 30 September 2023 (unaudited) |

|

| US$ | US$ | US$ | US$ | |

| Loss on revaluations of hedging derivatives | — | (226,883) | — | — |

| Interest expense on short term loan | (93,486) | (106,197) | (335,563) | (349,515) |

| Interest expense on trade finance | (22,120) | (24,267) | (54,333) | (66,158) |

| Interest expense on finance leases | — | — | — | — |

| Total Financial expense | (12,123) | (24,131) | (48,136) | (84,915) |

| (127,729) | (381,478) | (438,032) | (500,588) | |

| Gain on revaluation of hedging derivatives | — | — | — | 385,512 |

| Realised gain on hedging derivatives | — | 98,217 | 6,832 | 136,938 |

| Interest income | 109,262 | 101,575 | 338,895 | 181,373 |

| Total Financial income | 109,262 | 199,792 | 345,727 | 703,823 |

| Net finance (expense) / income | (18,467) | (181,686) | (92,305) | 203,235 |

5. Taxation

The Group has recognised a deferred tax asset to the extent that the Group has reasonable certainty as to the level and timing of future profits that might be generated and against which the asset may be recovered. The deferred tax liability arising on unrealised exchange gains has been eliminated in the nine-month period to 30 September 2024 reflecting the movement in the Brazilian Real exchange rate at the end of the period and resulting in deferred tax income of US$946,220 (nine months to 30 September 2023 – income of US$23,113).

The Group has also incurred a tax charge in Brazil for the six-month period of US$3,783,403 (nine months to 30 September 2023 tax charge – US$1,207,583).

6. Earnings per Share

| 6 months ended 30 June 2024 (unaudited) |

6 months ended 30 June 2023 (unaudited) |

3 months ended 30 June 2024 (unaudited) |

3 months ended 30 June 2023 (unaudited) |

|

| Profit/(loss) attributable to ordinary shareholders (US$) | 8,615,387 | (359,112) | 17,837,221 | 4,620,779 |

| Weighted average ordinary shares in issue | 75,734,551 | 75,734,551 | 75,734,551 | 75,734,551 |

| Basic profit/(loss) per share (US cents) | 11.38c | (0.47c) | 23.55c | 6.10c |

| Diluted ordinary shares in issue (1) | 75,734,551 | 75,734,551 | 75,734,551 | 75,734,551 |

| Diluted profit/(loss) per share (US cents) | 11.38c | (0.47c) | 23.55c | 6.10c |

(1) On 30 September 2024 there were 2,814,541 conditional share awards in issue (30 September 2023 – 2,075,400). These are subject to performance conditions which may or not be fulfilled in full or in part. These CSAs have not been included in the calculation of the diluted earnings per share.

7. Post balance sheet events

There has been no item, transaction or event of a material or unusual nature likely, in the opinion of the Directors of the Company to affect significantly the continuing operation of the entity, the results of these operations, or the state of affairs of the entity in future financial periods.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Stock Market Open Today? A Quick Guide To Markets, Banking Hours And What's Closed On Thanksgiving Day 2024

Major U.S. indices declined to close lower on Wednesday as the markets headed into the Thanksgiving holiday. Banks, post offices, shipping services, stock markets and all the other over-the-counter markets like bond markets will be closed on Thursday.

What Happened: Despite the holiday, Dow Jones futures will continue trading over the day. Stock exchanges worldwide including Shanghai, Hong Kong, Tokyo, Mumbai, and London would continue to operate. Also, U.S. stock exchanges will re-open on Friday to close early by 1:00 p.m. ET.

Additionally, Walmart, Target and Costco stores will be closed because of the festive celebrations.

Thanksgiving week tends to be historically bullish. However, the S&P 500 Index has gained 0.98% in the last five days, but the Nasdaq 100 Index has slipped by 0.15% in the same period. Russell 2000 Index and NYSE Composite Index on the other hand rose by 4.06% and 2.33% respectively in the last five sessions.

Are Banks Open?

Major financial institutions including Wells Fargo, Bank of America, JPMorgan Chase, and TD Bank will close their branches for the festival.

Federal Reserve banks will also shut operations for the holiday. Customers should verify specific branch hours through their bank’s website or mobile app.

Significance Of The Holiday

Thanksgiving Day is an annual national holiday in the United States and Canada commemorating the harvest and the blessings from the past year.

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Falcon Oil & Gas Ltd. – Filing of Interim Financial Statements

FALCON OIL & GAS LTD.

(“Falcon” or “Company“)

Filing of Interim Financial Statements

28 November 2024 – Falcon Oil & Gas Ltd. FOFOG) announces that it has filed its interim financial statements for the three and nine months ended 30 September 2024 and the accompanying Management’s Discussion and Analysis (“MD&A“).

The following should be read in conjunction with the complete unaudited unreviewed interim financial statements and the accompanying MD&A for the three and nine months ended 30 September 2024, which are available on the Canadian System for Electronic Document Analysis and Retrieval (“SEDAR+”) at www.sedarplus.ca and on Falcon’s website at www.falconoilandgas.com

2024 financial highlights and other financial updates

- Debt free with cash of $10 million at 30 September 2024 (31 December 2023: $8 million).

- Continued focus on cost management and the efficient operation of the portfolio.

Ends.

CONTACT DETAILS:

| Falcon Oil & Gas Ltd. | |

| Philip O’Quigley, CEO | +353 87 814 7042 |

| Anne Flynn, CFO | +353 1 676 9162 |

Cavendish Capital Markets Limited (NOMAD & Broker)

| Neil McDonald / Adam Rae | +44 131 220 9771 |

Interim Condensed Consolidated Statement of Operations and Comprehensive Loss

(Unaudited)

| Three months ended 30 September 2024 $’000 |

Three months ended 30 September 2023 $’000 |

Nine months ended 30 September 2024 $’000 |

Nine months ended 30 September 2023 $’000 |

|

| Revenue | ||||

| Oil and natural gas revenue | – | – | – | – |

| – | – | – | – | |

| Expenses | ||||

| Exploration and evaluation expenses | (44) | (39) | (130) | (129) |

| General and administrative expenses | (523) | (739) | (1,601) | (1,914) |

| Foreign exchange gain | 91 | 38 | 133 | 85 |

| (476) | (740) | (1,598) | (1,958) | |

| Results from operating activities | (476) | (740) | (1,598) | (1,958) |

| Finance income | 365 | 43 | 193 | 155 |

| Finance expense | (132) | (352) | (393) | (647) |

| Net finance income / (expense) | 233 | (309) | (200) | (492) |

| Loss and comprehensive loss for the period | (243) | (1,049) | (1,798) | (2,450) |

| Loss and comprehensive loss attributable to: | ||||

| Equity holders of the company | (247) | (1,046) | (1,798) | (2,444) |

| Non-controlling interests | 4 | (3) | – | (6) |

| Loss and comprehensive loss for the period | (243) | (1,049) | (1,798) | (2,450) |

| Loss per share attributable to equity holders of the company: | ||||

| Basic and diluted | (0.000 cent) | (0.001 cent) | (0.002 cent) | (0.002 cent) |

Interim Condensed Consolidated Statement of Financial Position

(Unaudited)

| At 30 September 2024 $’000 |

At 31 December 2023 $’000 |

||

| Assets | |||

| Non-current assets | |||

| Exploration and evaluation assets | 50,721 | 51,287 | |

| Property, plant and equipment | – | 2 | |

| Trade and other receivables | 26 | 26 | |

| Restricted cash | 2,199 | 2,176 | |

| 52,946 | 53,491 | ||

| Current assets | |||

| Cash and cash equivalents | 9,965 | 7,992 | |

| Trade and other receivables | 946 | 54 | |

| 10,911 | 8,046 | ||

| Total assets | 63,857 | 61,537 | |

| Equity and liabilities | |||

| Equity attributable to owners of the parent | |||

| Share capital | 406,690 | 402,120 | |

| Contributed surplus | 47,444 | 47,379 | |

| Retained deficit | (408,995) | (407,197) | |

| 45,139 | 42,302 | ||

| Non-controlling interests | 697 | 697 | |

| Total equity | 45,836 | 42,999 | |

| Liabilities | |||

| Non-current liabilities | |||

| Decommissioning provision | 16,679 | 16,204 | |

| 16,679 | 16,204 | ||

| Current liabilities | |||

| Accounts payable and accrued expenses | 1,342 | 2,334 | |

| 1,342 | 2,334 | ||

| Total liabilities | 18,021 | 18,538 | |

| Total equity and liabilities | 63,857 | 61,537 |

Interim Condensed Consolidated Statement of Cash Flow

(Unaudited)

| Nine months ended 30 September | |||

| 2024 $’000 |

2023 $’000 |

||

| Cash flows from operating activities | |||

| Net loss for the period | (1,798) | (2,450) | |

| Adjustments for: | |||

| Share based compensation | 65 | 276 | |

| Depreciation | 2 | 3 | |

| Net finance expense | 200 | 482 | |

| Effect of exchange rates on operating activities | (133) | (85) | |

| Change in non-cash working capital: | |||

| Increase in trade and other receivables | (893) | (19) | |

| Increase / (decrease) in accounts payable and accrued expenses | 920 | (36) | |

| Net cash used in operating activities | (1,637) | (1,829) | |

| Cash flows from investing activities | |||

| Interest received | 31 | 165 | |

| Proceeds from sale of ORRIs | 4,000 | – | |

| Exploration and evaluation assets | (5,153) | (647) | |

| Net cash used in investing activities | (1,122) | (482) | |

| Cash flows from financing activities | |||

| Net proceeds from equity raised | 4,570 | – | |

| Net cash generated from financing activities | 4,570 | – | |

| Change in cash and cash equivalents | 1,811 | (2,311) | |

| Effect of exchange rates on cash and cash equivalents | 162 | (320) | |

| Cash and cash equivalents at beginning of period | 7,992 | 16,785 | |

| Cash and cash equivalents at end of period | 9,965 | 14,154 | |

All dollar amounts in this document are in United States dollars “$”, except as otherwise indicated.

About Falcon Oil & Gas Ltd.

Falcon Oil & Gas Ltd is an international oil & gas company engaged in the exploration and development of unconventional oil and gas assets, with the current portfolio focused in Australia, South Africa and Hungary. Falcon Oil & Gas Ltd is incorporated in British Columbia, Canada and headquartered in Dublin, Ireland with a technical team based in Budapest, Hungary.

For further information on Falcon Oil & Gas Ltd. please visit www.falconoilandgas.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain information in this press release may constitute forward-looking information. This information is based on current expectations that are subject to significant risks and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. Falcon assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward looking-statements unless and until required by securities laws applicable to Falcon. Additional information identifying risks and uncertainties is contained in Falcon’s filings with the Canadian securities regulators, which filings are available at www.sedarplus.ca

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Middle East ESG Reporting and Data Summit 2024 Kicks Off Today in Dubai

NEW YORK, Nov. 28, 2024 (GLOBE NEWSWIRE) — (Via ESG News) ESG News announces that the 2nd Edition of the Middle East ESG Reporting & Data Summit will convene today, 28th November 2024 at the Hyatt Regency Dubai Creek Heights, bringing together thought leaders and professionals at the forefront of ESG (Environmental, Social, and Governance) practices. The event is set to address critical trends, regulatory developments, and innovative solutions shaping sustainable business strategies across the region.

Registration Link: The 2nd Edition of the Middle East ESG Reporting & Data Summit

This summit will feature an impressive line-up of speakers representing renowned organizations committed to advancing sustainability. Among the distinguished speakers are Kelly Timmins from Atlantis Dubai, Sameera Fernandes from Century Financial, and Majd Fayyad of the Dubai Supreme Council of Energy. Other notable speakers include Dr. Jacinta Dsiva of SEE Global Research, Maali Khader from Schema Sustainability Advisory, and Zeina AlHashmi of Expo City Dubai, all contributing their unique perspectives on responsible business practices and ESG integration.

In support of the event, numerous partners and sponsors have come forward, reflecting the growing interest in and commitment to sustainable practices in the Middle East. StepChange, My ESG Planet by RGBSi and Innova Beyond ESGEO are key sponsors who share a vision of enhancing ESG frameworks in the region. Additionally, supporting partners such as Cognitud, Fanda, Chiltern TMC, and Sustainable Square provide invaluable backing to ensure the success of the summit. The event’s academic and media partnerships, including SP Jain School of Global Management.

Adding to the summit’s value, ESG News joins as the exclusive media partner. With its dedication to highlighting pivotal environmental and governance efforts, ESG News ensures global visibility for the summit’s discourse. This partnership underscores the summit’s mission to amplify innovative solutions and foster collaboration among key stakeholders in the ESG ecosystem.

As ESG strategies become imperative for sustainable growth, the Middle East ESG Reporting & Data Summit 2024 offers an unparalleled platform for learning, networking, and shaping the region’s future sustainability agenda. Secure your participation today to be part of this transformative journey.

*Special consideration to event producer Clerisy Global

For more information or partnership inquiries, contact:

events@esgnews.com

More Coverage on the Middle East ESG Reporting & Data Summit

Stay up to date with the latest ESG trends, events, and news at ESG News

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5a90a440-854f-4da0-83c6-097779df38ca

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microsoft's Xbox Game Store For Android 'Ready To Go Live,' Says Executive, But Legal Standoff With Google Halts Launch

Microsoft Corp. MSFT has developed its Xbox game store for Android but remains unable to launch the service due to ongoing legal complications, the company revealed Wednesday.

What Happened: Xbox executive Sarah Bond explained that while the game store functionality is complete, a recent court order preventing changes to Alphabet Inc. GOOGL GOOGL subsidiary Google’s Play Store has halted its implementation.

In a Bluesky post, Bond noted the store is “ready to go live” but awaits a final court decision.

The delay stems from a temporary administrative stay granted by Judge James Donato in a case challenging Google’s app store monopoly. Google maintains that Microsoft has always been able to offer game purchases through its Android app but has chosen not to do so.

The standoff highlights ongoing tensions in the mobile app ecosystem, with Microsoft seeking more flexibility in-app distribution. The company’s Xbox App already offers cloud gaming features, but direct game purchases remain blocked.

Google spokesperson Dan Jackson argued that the court order and rushed implementation could compromise the Play Store’s security infrastructure, according to The Verge report. Microsoft has not specified exact barriers preventing the store’s launch beyond the legal constraints.

Microsoft and Google did not immediately respond to Benzinga’s request for a statement.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: This development comes amid broader regulatory scrutiny of big technology companies. The U.S. Federal Trade Commission is reportedly investigating Microsoft’s market practices in cloud computing and artificial intelligence, signaling increased regulatory attention on tech giants’ competitive strategies.

Google’s legal battle centers around Epic Games‘ allegations of monopolistic practices in its Android Play Store, where the tech giant charges a 30% commission on in-app purchases. Epic Games, the maker of Fortnite, initiated the lawsuit after its app was removed from the Play Store in 2020 for bypassing Google’s payment system.

Epic claimed that the commission stifles competition and inflates costs for developers and consumers. A jury ruled last year that Google had illegally monopolized app distribution and payment systems on Android, prompting a court order for significant changes to the Play Store’s structure.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Photo courtesy: Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Toyota's global output declines for ninth straight month in October

TOKYO (Reuters) – Toyota Motor’s global output dropped for a ninth consecutive month in October, dragged lower by big falls in production in the United States and China but the decline was mild compared to previous months.

The world’s biggest automaker also logged its first rise in five months for global sales, which grew 1.4% to 903,103 vehicles, a record for the month of October.

Toyota said on Thursday it produced 893,164 vehicles globally, down 0.8%. That compares with an 8% fall in September.

Production in the United States tumbled 13%, hurt by a four-month production halt of SUV models Grand Highlander and Lexus TX due to an airbag issue. Production of the models resumed on Oct. 21 and output at the automaker’s Indiana plant is expected to return to normal in January.

In China, where competition against local brands remains intense, output slid 9%. Toyota also produced 13% fewer cars in Thailand amid soft demand.

In Japan, which accounts for about a third of Toyota’s worldwide output, production climbed 8%, bouncing back from weak numbers a year ago when an accident at a supplier’s facility led to a partial production halt at multiple plants.

In Canada and Mexico, output for the automaker was up 2% for both countries.

The production and sales figures include vehicles from Toyota’s luxury Lexus brand but exclude group companies Hino and Daihatsu.

(Reporting by Kantaro Komiya; Editing by Edwina Gibbs)

Joe Rogan's Bitcoin Pile Has Grown Over 30000% In Value, But He Hasn't Sold: Conviction-Based HODLing Or Has The Podcast King Lost His Keys?

Joe Rogan has become one of the world’s most successful podcasters in recent years, with influential figures like tech mogul Elon Musk, boxing legend Mike Tyson, renowned whistleblower Edward Snowden, and President-elect Donald Trump appearing on his “The Joe Rogan Experience” show.

But aside from a plethora of topics he enjoys discussing, Rogan has also exhibited significant interest in Bitcoin BTC/USD, the world’s largest cryptocurrency, and even holds some in his portfolio.

What happened: Way back in April 2024, Rogan publicly shared details of his Bitcoin address.

Looking up the address on mempool—a site that tracks Bitcoin transactions and block movements 24×7—revealed a balance of 5.243 BTCs, translating to $502,011 at current market prices.

The fascinating bit was that Rogan hasn’t spent any Bitcoin in over a decade. Exactly 10 years ago, the value of his stash was $1,645, reflecting a mammoth 30417.4% upside.

Analysis of the balance history revealed a gradual increase in holdings beginning in late April, around the time he went public with his address.

By December of the same year, the balance had risen to 5, after which it began to plateau. Since then, it stabilized around the 5.24 level.

While HODLing for such long periods could imply Rogan’s conviction on Bitcoin’s potential, other observers had different explanations.

Bitcoin technologist Jameson Lopp said in a February X post, “How much you wanna bet he lost the key?”

Another user, Daniel Brr, urged Rogan to hand over the Bitcoins to charity if the amount isn’t too significant for him.

“Seems like he just forgot people gave him BTC at that address and doesn’t care either way, so I think it would be better to give it to charity than eventually losing track of it,” Brr added.

Why It Matters: While Rogan may be unmindful of his Bitcoin stash, his faith in the apex cryptocurrency hasn’t shaken.

In an episode of The Joe Rogan Experience podcast with OpenAI co-founder Sam Altman, Rogan called Bitcoin the “real fascinating cryptocurrency” and one with the most likelihood of becoming a “universal viable currency.”

Rogan first mentioned Bitcoin on his podcast more than 10 years ago, in 2013. At that time, the digital asset traded at $123. The rest, as they say, is history.

Price Action: At the time of writing, Bitcoin was trading at $95,524.55, up 2.77% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.