Emulsifiers Market for Personal Care Applications to Reach $3.0 Billion by 2034, Fueled by Demand for Sustainable and Natural Ingredients | TMR

Wilmington, Delaware, Transparency Market Research Inc.-, Nov. 28, 2024 (GLOBE NEWSWIRE) — The global emulsifiers market for personal care applications (パーソナルケア用途向け乳化剤市場), valued at $1.5 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of 6.6% between 2024 and 2034, reaching $3.0 billion by 2034. This growth is driven by the increasing demand for eco-friendly, sustainable, and bio-based emulsifiers, as well as a rise in the innovation of personal care products.

Emulsifiers play a critical role in personal care formulations by creating stable mixtures of water and oil. They are essential in products like lotions, shampoos, and moisturizers, and their demand is rising due to a growing shift toward natural, organic, and clean-label personal care products. Consumers are increasingly seeking products that are free of synthetic chemicals, and this has led to the increased use of bio-based emulsifiers made from renewable resources such as plant oils and polysaccharides.

Request your complimentary sample report today! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86370

Key Market Drivers

- Green Chemistry and Bio-based Products

-

- Consumers are opting for clean-label products, driving the use of bio-based emulsifiers. These ingredients are derived from renewable, sustainable sources and are biodegradable, making them environmentally friendly.

- Green chemistry principles are becoming more important in personal care product formulations, focusing on reducing environmental impact while maintaining product efficacy.

- Innovation in Personal Care

-

- Emulsifiers are key to the development of multifunctional personal care products such as 2-in-1 cleansers and hybrid skincare formulas. This has led to increased demand for high-performance emulsifiers that can stabilize complex formulations.

- The rise of niche personal care categories such as anti-aging products, sensitive skin solutions, and vegan cosmetics is driving the demand for customized emulsifiers.

- Regulatory Push for Natural Ingredients

-

- Increasing regulations and certifications for natural and organic personal care products in regions like Europe and North America are encouraging manufacturers to adopt bio-based emulsifiers.

- Certifications like ECOCERT and COSMOS for organic products are influencing the growth of the market, as consumers prefer products with these labels.

Market Segmentation

The emulsifiers market for personal care applications is segmented based on type, ionic nature, and application:

- By Type:

-

- Glyceryl Stearate, Lecithin, Polysorbates, Polyglycerol Esters, and others are common emulsifiers used in personal care products. Lecithin is particularly favored for its natural origins in organic cosmetics.

- By Ionic Nature:

-

- Anionic and Non-Ionic emulsifiers are commonly used in skin cleansers and shampoos. Cationic emulsifiers are preferred for their conditioning properties in haircare products.

- By Application:

-

- Major applications include skin cleansers, shampoos, hair conditioners, moisturizers, and other personal care products such as shaving creams and antiperspirants.

Get a Custom Research Report at https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86370

Regional Insights

- North America and Europe lead the market, driven by strict regulatory frameworks that encourage the use of bio-based and natural emulsifiers.

- Asia Pacific is expected to witness significant growth, particularly in countries like China and India, where rising disposable income and increasing awareness of personal care are driving demand.

- Latin America and the Middle East & Africa are emerging markets with untapped growth potential, especially in the natural cosmetics segment.

Competitive Landscape

Key players in the emulsifiers market for personal care applications include BASF SE, Dow, DuPont, Kerry Group, Evonik Industries AG, and Clariant. These companies are focusing on innovation and strategic investments to meet the growing demand for natural, sustainable emulsifiers.

- BASF SE and Dow are leading the way in developing bio-based emulsifiers and other sustainable personal care ingredients. Both companies are investing in eco-friendly solutions and expanding their product portfolios.

- Clariant is focusing on green surfactants and emulsifiers to reduce the environmental footprint of personal care products.

- Evonik Industries is leveraging advanced biotechnological processes to improve the production efficiency and purity of emulsifiers used in cosmetics.

Broader Trends in the Chemicals and Materials Industry

Across the chemicals and materials industry, sustainability continues to be a major focus. Companies are increasingly adopting bio-based and biodegradable ingredients not just in personal care, but also in packaging, coatings, and adhesives. This shift towards sustainability is reshaping various markets, including emulsifiers.

Technological advancements are also playing a key role in driving growth in the emulsifiers market. Innovations such as nanotechnology are improving the delivery and effectiveness of emulsifiers in personal care formulations. These advancements enhance the bioavailability of ingredients in products like skincare creams and hair conditioners.

Mergers and acquisitions are another notable trend in the chemicals sector, as companies seek to strengthen their portfolios in bio-based and specialty ingredients. This consolidation is expected to continue, providing players with the resources to innovate and expand into emerging markets.

Challenges and Opportunities

While the market for bio-based emulsifiers is growing, there are several challenges to overcome. One major challenge is the higher cost of bio-based emulsifiers compared to traditional synthetic alternatives. However, as consumer demand for sustainable products rises, companies are finding ways to improve production efficiency, which could help lower costs in the future.

Supply chain issues, particularly in sourcing natural raw materials like lecithin and palm oil, can also disrupt production. However, these challenges also present opportunities for companies to explore new sources of sustainable ingredients and invest in local sourcing to ensure a steady supply.

Emerging markets in Asia-Pacific and Latin America present significant growth opportunities, driven by increased demand for personal care products and a rising middle class. Additionally, the growing trend toward vegan and organic cosmetics provides companies with opportunities to develop new emulsifier solutions tailored to these product categories.

Looking Ahead

The emulsifiers market for personal care applications is poised for continued growth as consumers increasingly demand sustainable, natural, and multifunctional products. With the market expected to reach $3.0 billion by 2034, companies that invest in bio-based emulsifiers, sustainable sourcing, and innovative product development will be well-positioned to capture a significant share of the market.

In conclusion, the emulsifiers market for personal care applications is at a turning point, with sustainability, innovation, and consumer demand for natural ingredients driving its growth. The market is set to expand significantly in the coming years, offering opportunities for both established companies and new entrants to capitalize on the rising demand for eco-friendly personal care products.

For more insights into market trends, competitive strategies, and emerging opportunities, buy this research report from Transparency Market Research: https://www.transparencymarketresearch.com/checkout.php?rep_id=86370<ype=S

Trending Research Reports in the Chemicals and Materials Industry

- Shape Memory Foam Market (形の記憶泡の市場): Estimated to advance at a CAGR of 12.9% from 2024 to 2034 and reach US$ 52.9 Bn by the end of 2034

- U.S. Acoustics Market (Marché Américain de l’Acoustique): Projected to grow at a CAGR of 5.2% from 2024 to 2034 and reach US$ 2.3 Bn by the end of 2034

Top of Form

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Intel Stock a Buy Now?

It’s been a tough year for Intel (NASDAQ: INTC). Its stock price has been essentially cut in half since Jan. 1 and it was booted out of the Dow Jones Industrial Average index in November. To add insult to injury, the company Intel tried to buy in 2005, Nvidia, has gone on to become the second-largest company in the world (based on market cap) and replaced it in the Dow.

But a new year is just around the corner, and with it comes the potential for change. Is Intel poised to rebound in 2025?

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

A quick look at Intel’s Q3 numbers shows why the stock has been struggling. The chipmaker saw a 6% year-over-year decline in sales while flipping from adjusted earnings per share (EPS) of $0.41 last year to a per-share loss of $0.46 this year. The semiconductor company’s biggest issue is its third-party foundry business, which it launched in 2021 to help drive growth. Instead, it has been piling up losses.

In Q3, its foundry business saw revenue decline by 8% year over year to $4.4 billion, while the division’s operating losses ballooned to $5.8 billion from $1.8 billion a year ago. The results included a $3.1 billion impairment charge. But even without the impairment, the loss still would have jumped to $2.7 billion.

Moving forward, the company is working to turn its foundry business into an independent subsidiary, which it thinks will help better serve customers and allow for outside funding. It could also be a precursor to the company eventually looking to spin off the business.

Intel expects the foundry business’s operating loss to improve next year as it moves to new nodes with better cost structures and realizes cost savings from its restructuring plans. However, the business got some bad potential news when The New York Times reported that the Biden administration was looking to reduce the $8.5 billion CHIPs Act grant the company was supposed to receive, while awarding rival Taiwan Semiconductor Manufacturing a $6.6 billion grant to build foundries in the U.S. It was revealed on Tuesday that Intel will actually get $7.86 billion. The slightly lower amount was on top of the $3.3 billion Intel has already been awarded through a Department of Defense contract that used CHIPs Act funding.

Outside of its foundry business, Intel’s other businesses have been a mixed bag. On the positive front, its data center and artificial intelligence (AI) segment performed well last quarter, with revenue increasing 9% year over year to $3.3 billion. This is well below the growth of most companies in the data center space, and the company said its Gaudi 3 AI accelerator would not meet 2024 revenue targets.

Is Pfizer Stock in Trouble?

One stock that just can’t seem to catch a break of late is Pfizer (NYSE: PFE). Even though it posted some decent earnings numbers, investors can’t shake the fear that the business is facing daunting headwinds that could send its $145 billion valuation lower in the months and years ahead. And while the markets have done well overall, shares of Pfizer are down some 11% this year.

Is the healthcare stock in big trouble and headed for a greater decline, or are investors perhaps a bit too bearish on the business right now?

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Given how well Pfizer has performed in recent years due to its COVID-19 vaccine and pill (its revenue topped $100 billion in 2022), for many investors, it’s still seen as a stock whose best days may be behind it. Demand for its COVID vaccine is waning, significantly, and some investors may worry about a potential change in vaccine policy under the incoming Trump administration.

There’s no denying that the recent election results do appear to be weighing on investors, as Pfizer’s stock has hit a new low since then. Today, the stock is trading at a heavily discounted forward price-to-earnings multiple (based on analyst estimates) of less than 9, which suggests that investors are feeling a bit concerned about Pfizer’s future.

Through the first nine months of the year, Pfizer has generated revenue of $45.9 billion, up 2% overall. While that seems modest, it’s not a bad growth rate when you factor in a steep decline from COVID vaccine sales. Comirnaty, the company’s COVID vaccine, has generated sales of less than $2 billion, which represents a year-over-year decline of 66%.

Stronger results from its specialty care and oncology segments have helped Pfizer overcome headwinds from the vaccine side of its operations.

There could be greater declines in vaccine and COVID sales in the future for Pfizer, regardless of government policy. And that’s because attitudes have shifted in recent years, some people have become more skeptical about vaccines, and unless COVID becomes a significant health concern again, sales could continue to decline. But given the stock’s depressed valuation, I believe those risks have already been priced into its share price.

At this stage, if you’re investing in Pfizer, it’s because you’re optimistic about its growth opportunities outside vaccine-related revenue. The big growth opportunity may be in oncology, especially with Pfizer investing $43 billion to acquire Seagen, which makes antibody-drug conjugates that are more targeted treatment options than chemotherapy. Pfizer has been acquiring multiple businesses in recent years, and with a more diverse pipeline of drugs, those moves can offset the effects that looming patent cliffs and the decline in COVID sales will have on its operations in the long run.

Thanksgiving Day 2024: Is Stock Market Open Today? A Quick Guide To Markets, Banking Hours And What's Closed

Major U.S. indices declined to close lower on Wednesday as the markets headed into the Thanksgiving holiday. Banks, post offices, shipping services, stock markets and all the other over-the-counter markets like bond markets will be closed on Thursday.

What Happened: Despite the holiday, Dow Jones futures will continue trading over the day. Stock exchanges worldwide including Shanghai, Hong Kong, Tokyo, Mumbai, and London would continue to operate. Also, U.S. stock exchanges will re-open on Friday to close early by 1:00 p.m. ET.

Additionally, Walmart, Target and Costco stores will be closed because of the festive celebrations.

Thanksgiving week tends to be historically bullish. However, the S&P 500 Index has gained 0.98% in the last five days, but the Nasdaq 100 Index has slipped by 0.15% in the same period. Russell 2000 Index and NYSE Composite Index on the other hand rose by 4.06% and 2.33% respectively in the last five sessions.

Are Banks Open?

Major financial institutions including Wells Fargo, Bank of America, JPMorgan Chase, and TD Bank will close their branches for the festival.

Federal Reserve banks will also shut operations for the holiday. Customers should verify specific branch hours through their bank’s website or mobile app.

Significance Of The Holiday

Thanksgiving Day is an annual national holiday in the United States and Canada commemorating the harvest and the blessings from the past year.

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Coherent Market Insights: Laboratory Supplies Market Poised to hit $67.43 Billion by 2031

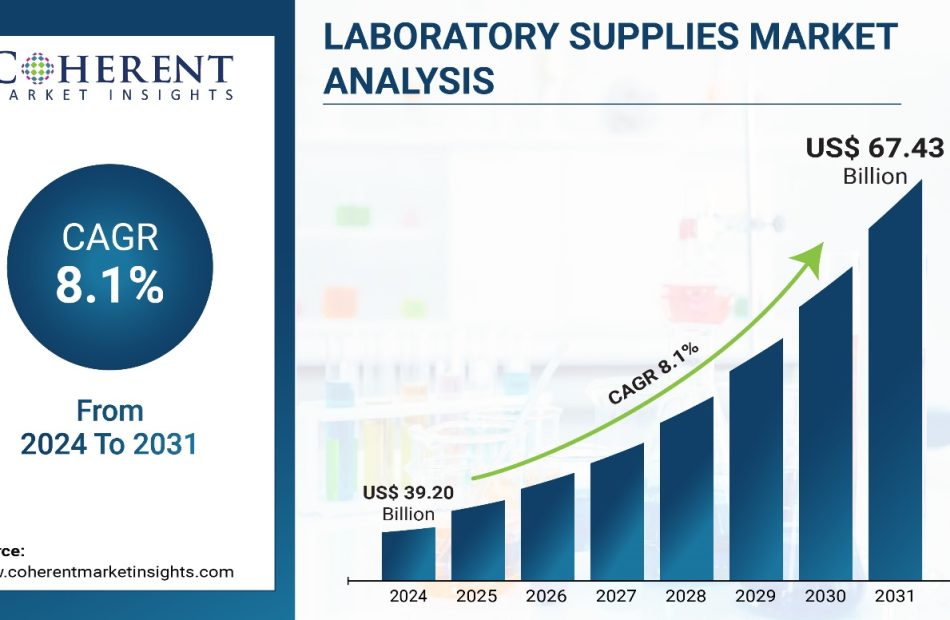

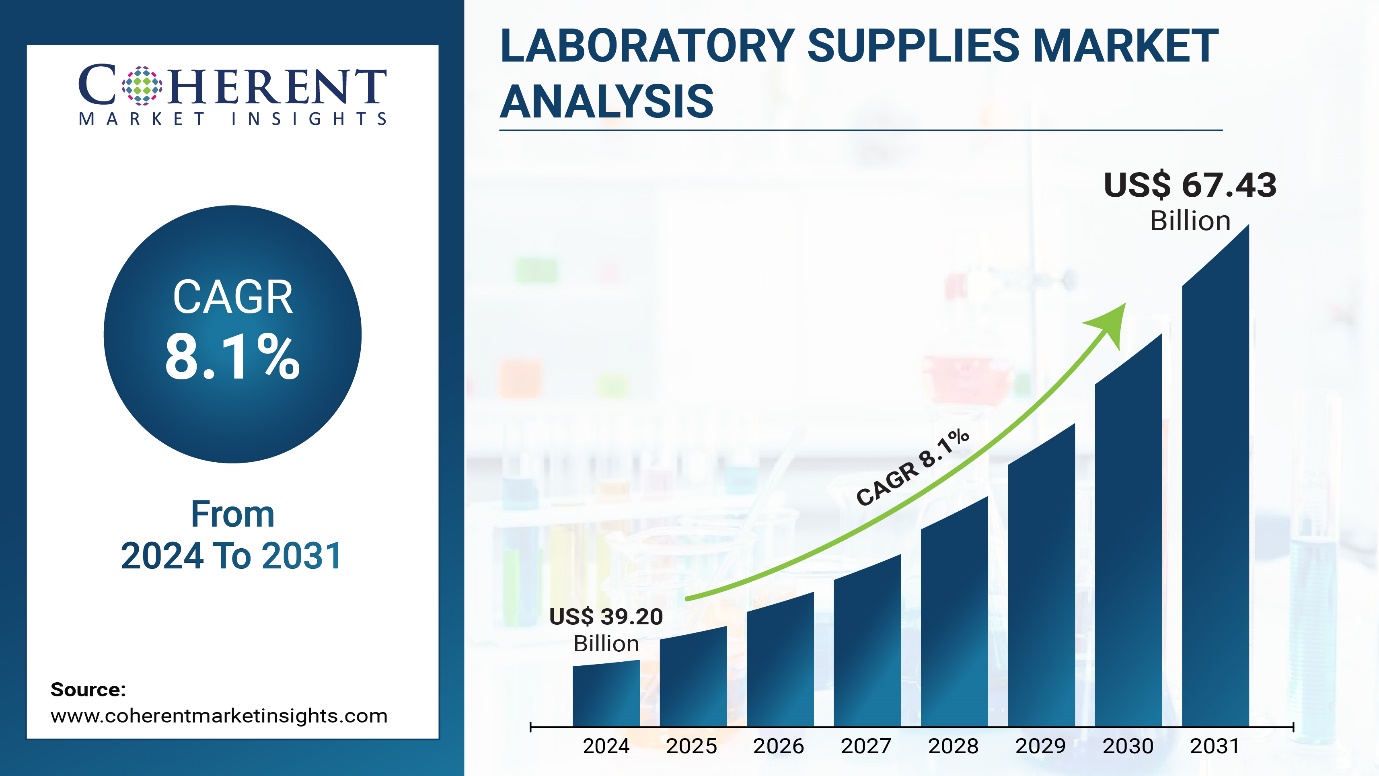

Burlingame, Nov. 28, 2024 (GLOBE NEWSWIRE) — According to Coherent Market Insights, the global laboratory supplies market size is estimated to be valued at USD 39.20 billion in 2024 and is expected to surpass USD 67.43 billion by 2031, growing at a CAGR of 8.1% from 2024 to 2031.

Rising pharmaceutical and biotechnology research and development (R&D) activities around the world fuels market growth. Pharmaceutical companies are focusing on developing new drug molecules. It has significantly boosted demand for various laboratory consumables. Rising incidences of chronic diseases has accelerated clinical diagnostics, drug discovery, and life science research. This has propelled sales of equipment, disposables, and reagents in the global market.

Market Trends:

Growing demand for plastic consumables and automated liquid handling systems will aid in promoting growth. Plastic consumables account for a major share in terms of both value and volume. This is attributed to advantages offered by plastic such as lightweight, chemical resistance, transparency, and flexibility.

Request a Sample Copy of the Report @ https://www.coherentmarketinsights.com/insight/request-sample/7220

Automation reduces manual errors and improves productivity of high-throughput screening in pharmaceutical laboratories. Key market players are focusing on developing innovative automated liquid handling equipment with advanced features to gain competitive edge.

Market Opportunities:

The laboratory equipment segment is expected to account for the major share in the market in 2024. The advanced laboratory equipment helps to reduce errors, save time, and allow for unattended operation. They offer high precision and accuracy for testing. This has increased their demand significantly in clinical and research laboratories.

The disposable segment includes disposable pipette tips, tubes, bottles, gloves, masks, and other items. These have single use and help avoid cross-contamination. With the COVID pandemic, the use of disposables has increased substantially in clinical testing. Their low cost advantage has also boosted their adoption.

Laboratory Supplies Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $39.20 billion |

| Estimated Value by 2031 | $67.43 billion |

| Growth Rate | Poised to grow at a CAGR of 8.1% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product Type, By End User |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Growing demand for laboratory testing • Advances in medical technology |

| Restraints & Challenges | • High costs associated with technologically advanced instruments • Stringent regulations |

Key Market Takeaways

The global laboratory supplies market is anticipated to witness a CAGR of 8.1% during the forecast period 2024-2031. Growth is driven by increasing R&D expenditure and rising focus on drug discovery.

Immediate Delivery Available | Buy This Premium Research Report @ https://www.coherentmarketinsights.com/insight/buy-now/7220

By product, the equipment segment is expected to hold the dominant position owing to its high accuracy and efficiency benefits. Within this segment, centrifuges are expected to remain the most popular sub-segment.

By end user, the clinical testing laboratories segment is expected to hold the dominant position over the forecast period. This is due to growing patient pool and diagnostic requirements.

North America is expected to hold the dominant position over the forecast period. This is owing to presence of leading players and higher healthcare expenditure.

Competitor Insights

– Bio-Rad Laboratories, Inc.

– Bruker Corporation

– Danaher Corporation

– Fujifilm Holdings Corporation

– Agilent Technologies, Inc.

– PerkinElmer Inc.

– Shimadzu Corporation

– Thermo Fisher Scientific, Inc.

– Waters Corporation

– Eppendorf AG

– Becton

– Dickinson and Company

– Merck KGaA

– Sartorius AG

– VWR International

– GE Healthcare

– Abbott Laboratories

– Charles River Laboratories

– MilliporeSigma.

Recent Developments:

In September 2022, Shimadzu Europe GmbH announced the ORXross Fourier-transform infrared spectrophotometer. It delivers high-performance capabilities, including exceptional measurement speed and user-friendliness.

In March 2022, Precisa Gravimetrics AG introduced the halo series of advanced UV-Vis spectrophotometers, model GB 30.

Ask For Customization @ https://www.coherentmarketinsights.com/insight/request-customization/7220

Detailed Segmentation-

By Product:

- Equipment

- Incubators

- Laminar Flow Hood

- Micro Manipulation Systems

- Centrifuges

- Lab Air Filtration System

- Scopes

- Sonicators & Homogenizers

- Autoclaves & Sterilizers

- Spectrophotometer & Microarray Equipment

- Others

- Disposables

- Pipettes

- Tips

- Tubes

- Cuvettes

- Dishes

- Gloves

- Masks

- Cell Imaging Consumables

- Cell Culture Consumables

By End User:

- Clinical Testing Labs

- Pharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutes

- Others

By Region:

- North America

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

More Trending Latest Report by Coherent Market Insights:

Global laboratory proficiency testing market is expected to reach US$ 2.11 billion by 2030, from US$ 1.29 billion in 2023, exhibiting a CAGR of 7.3% during the forecast period.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here Are Billionaire Bill Ackman's 5 Biggest Stock Holdings

Billionaire Bill Ackman has established a name for himself as an outspoken investor who takes activist stances through his hedge fund, Pershing Square Capital Management. Unlike many other hedge fund managers, who invest in thousands of stocks and often have huge teams buying and selling, Ackman’s fund has a small number of stocks at any given time in which it takes a significant position. Right now, it has only 11 stocks. These are the top five.

What stands out in Ackman’s portfolio is the emphasis on strong consumer brands. Its top holding, though, as of the third quarter, is Brookfield Corporation (NYSE: BN). Brookfield is kind of like a holding company. It offers wealth management services, and it also operates businesses involved in infrastructure, energy, real estate, and other industrial services. Ackman first took a position in Brookfield in the second quarter, and it accounts for 14% of the portfolio as of the third quarter.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The second-largest holding is longtime fund favorite Hilton Worldwide Holdings (NYSE: HLT), which was the largest position last quarter. In third place is Chipotle Mexican Grill (NYSE: CMG), which was the top holding for a long time. Ackman hasn’t lost confidence in Chipotle — he increased his position by nearly 3,400% in the first quarter. But he has since added other stocks, notably Brookfield and Nike (which is the sixth-largest position and so didn’t make this list). Chipotle has also lost value over the past few months, accounting for its lesser portion of the fund’s overall value.

Rounding out the top five are Restaurant Brands International (NYSE: QSR) and Howard Hughes Holdings (NYSE: HHH), both of which are longtime holdings. Restaurant Brands owns brands like Burger King and Popeye’s, and Howard Hughes is a real estate company.

Since Pershing Square has such a limited group of stocks, each of these companies accounts for a similar amount of the total, and the value of the fund they represent can easily fluctuate based on price movements.

Before you buy stock in Brookfield Corporation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Corporation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Coherent MI: Pressure Transducer Market Size to Hit $29.8 Billion by 2031

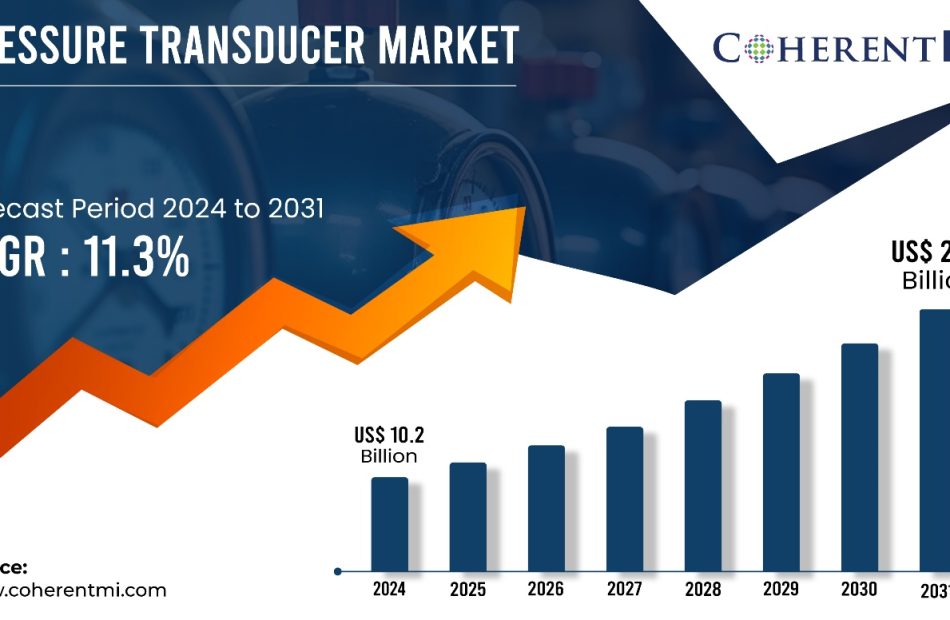

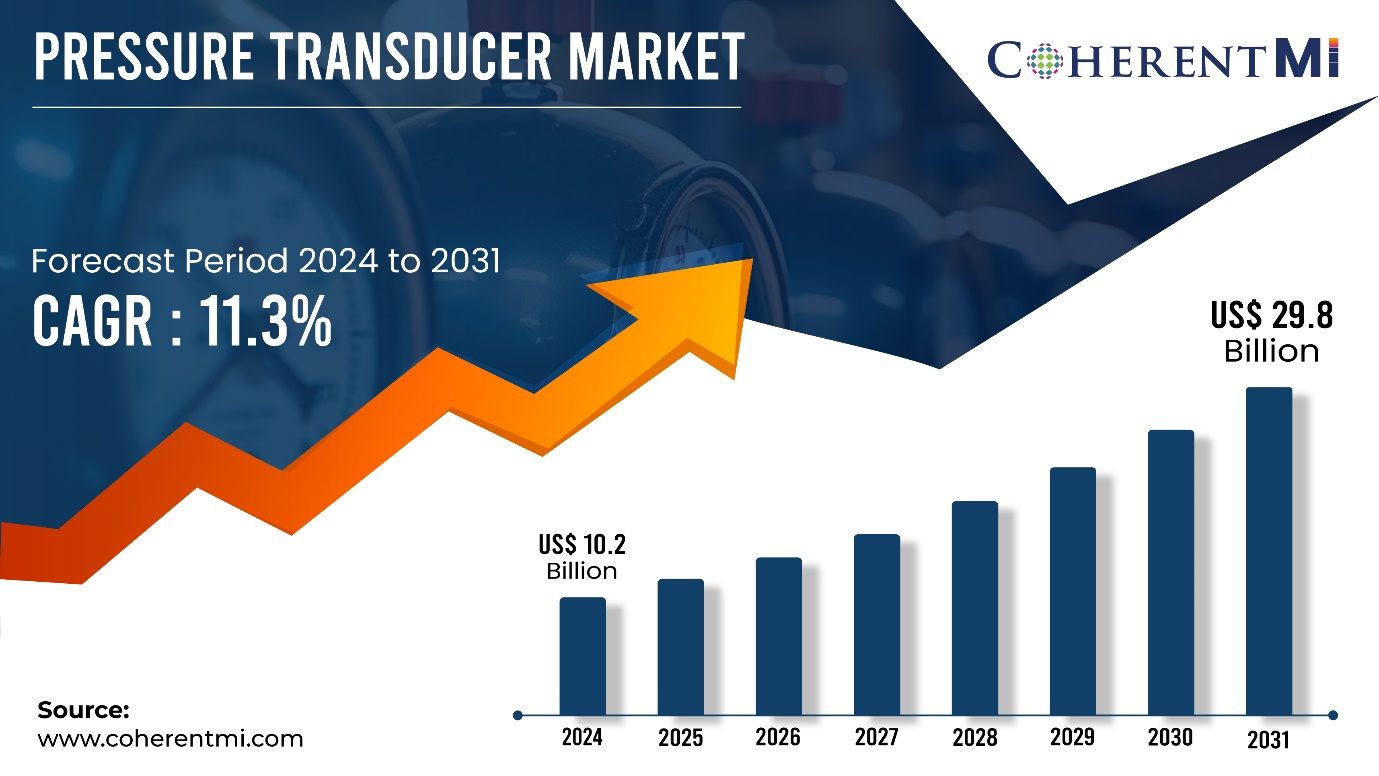

Burlingame, Nov. 28, 2024 (GLOBE NEWSWIRE) — Coherent MI: Pressure Transducer Market Size to Hit $29.8 Billion by 2031

According to the Coherent MI, The global Pressure Transducer Market Size was valued at USD 10.2 Billion in 2024 and is expected to reach USD 29.8 Billion by 2031, growing at a CAGR of 11.3% from 2024-2031.

Growing industrial automation is expected to drive the growth of the pressure transducer market over the forecast period. Pressure transducers are extensively used in process automation and control applications such as level measurement, flow monitoring etc. in various industries like oil & gas, chemical, food & beverages etc. According to International Federation of Robotics (IFR) report, spending on industrial robots grew 14% in 2021 to reach $16.5 billion globally. Rising demand for automation from manufacturing industries to improve productivity is creating demand for automation components like pressure transducers.

Get a Sample Report of Pressure Transducer Market @ https://www.coherentmi.com/industry-reports/pressure-transducer-market/request-sample

Secondly, increasing adoption of pressure transducers in various healthcare applications including blood pressure and respiratory monitoring devices is also anticipated to support market growth. Small yet growing application areas like wearable medical devices, patient monitoring systems etc. require accurate pressure sensors which can drive lucrative opportunities for pressure transducer providers.

Market Trends:

Piezoelectric pressure transducer is gaining popularity in the pressure transducer market. Piezoelectric transducers use piezoelectric effect of certain materials which generate electric charge when mechanical stress is applied. They are being increasingly used in process control and monitoring applications requiring high accuracy and reliability. The inherent oscillating nature of quartz piezoelectric material inside these transducers enables measurements with fine precision and fast response times.

Another major trend gaining traction is the growing demand for digital pressure transducers. Compared to analog transducers, digital transducers provide benefits like noise immunity, high accuracy and simple process integration. They convert analog pressure signal into digital output which can be directly interfaced with digital controllers and automation systems. Their growing use in automation equipment, data loggers and process monitoring will support growth of digital pressure transducers over the forecast period.

Pressure Transducer Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $10.2 billion |

| Estimated Value by 2031 | $29.8 billion |

| Growth Rate | Poised to grow at a CAGR of 11.3% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Technology, By Pressure, By End-use |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Increasing Demand for Pressure Transducers in the Automotive Industry for Applications such as Engine Oil Pressure And TPMS • Industrial Automation Adoption Boosts Market Developments |

| Restraints & Challenges | • Regulatory Compliance Challenges, Including Adaptability Risks and Compliance Costs. |

Market Opportunities:

The global pressure transducer market size was valued at US$ 10.2 billion in 2024 and is anticipated to witness a CAGR of 11.3% during the forecast period of 2024-2031.

Piezoresistive strain gauge technology segment held the largest market share in 2024 owing to its low cost, high reliability, compact size and good tolerance to shock and vibration. Piezoresistive strain gauge works on the principle that the electrical resistance of the material changes with applied mechanical stress. Its ability to handle both static and dynamic pressure measurement applications has increased its adoption across industries.

Immediate Delivery Available | Buy This Premium Research Report @ https://www.coherentmi.com/industry-reports/pressure-transducer-market/buynow

Absolute pressure measurement finds widespread application in measuring true pressure independent of atmospheric conditions. Within the absolute pressure segment, absolute pressure transducers dominated with a market share of over 40% in 2024 due to their use in medical devices, weather monitoring equipment, and process applications involving gases and liquids.

The automotive end-use industry segment accounted for the highest pressure transducer sales in 2024 and is expected to maintain its dominance during the forecast period. Growing vehicle production along with stringent vehicular emission and safety regulations have increased the adoption of pressure transducers in automotive applications such as engine management systems, transmission control, and tire-pressure monitoring systems.

North America held the largest share of over 30% of the global pressure transducer market in 2024 owing to rapid industrialization and ongoing infrastructure development activities in the region. Stringent regulatory norms regarding safety and emissions in various industries have also propelled the demand for pressure transducers in the region.

Key Market Takeaways:

The global pressure transducer market is anticipated to witness a CAGR of 11.3% during the forecast period 2024-2031, owing to the growing adoption of Industry 4.0, industrial automation, and rising demand from consumer electronics and automotive industries.

On the basis of technology, piezoresistive strain gauge segment is expected to hold a dominant position, owing to its low cost, high reliability and good tolerance to shock and vibration. On the basis of end use, automotive segment is projected to dominate the market, due to stringent vehicular emission and safety regulations.

Regionally, North America is expected to hold a dominant position over the forecast period, due to rapid industrialization and ongoing infrastructure development activities in the region.

Key players operating in the pressure transducer market include ABB Ltd., Honeywell International Inc., Robert Bosch GmbH, Panasonic Corporation, TE Connectivity, Amphenol Corporation, Siemens AG among others. These companies are focusing on new product launches and partnerships to gain higher market share.

Ask For Customization @ https://www.coherentmi.com/industry-reports/pressure-transducer-market/request-sample

Pressure Transducer Market Segmentation

By Technology

- Piezoresistive Strain Gauge

- Capacitance

By Pressure

- Absolute Pressure

- Guage Pressure

- Differential Pressure

By End-use

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Oil & Gas

By Region:

- North America

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

About Us:

At CoherentMI, we are a leading global market intelligence company dedicated to providing comprehensive insights, analysis, and strategic solutions to empower businesses and organizations worldwide. Moreover, CoherentMI is a subsidiary of Coherent Market Insights Pvt Ltd., which is a market intelligence and consulting organization that helps businesses in critical business decisions. With our cutting-edge technology and experienced team of industry experts, we deliver actionable intelligence that helps our clients make informed decisions and stay ahead in today’s rapidly changing business landscape.

Mr. Shah CoherentMI, U.S.: +1-650-918-5898 U.K: +44-020-8133-4027 Australia: +61-2-4786-0457 INDIA: +91-848-285-0837 Email: sales@coherentmi.com Website: https://www.coherentmi.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Savings interest rates today, November 28, 2024 (up to 4.75% APY)

If you’re looking to supercharge your savings, a high-yield savings account could provide a competitive return to help your balance grow faster. However, not all banks offer high rates, which is why it’s important to shop around and find the most competitive savings interest rates available. Read on to learn more about where to find the best savings interest rates.

Savings account rates have been on an upward trend over the past two years or so, but are now trending down following the Fed’s recent rate cuts.

The good news is that many high-yield savings accounts still offer rates of 5% APY and up. The best rates are typically offered by online banks, although you may be able to find comparable savings interest rates at some credit unions and community banks.

As of November 28, 2024, the highest savings account rate offered by our partners is 4.75% APY. This rate is offered by Everbank and there is no minimum opening deposit required.

Here is a look at some of the best savings rates available today from our verified partners:

Related: 10 best high-yield savings accounts>>

Following several years of near-zero interest rates, the Federal Reserve began raising the federal funds rate in 2022 in order to combat rapidly rising inflation. As a result, savings interest rates skyrocketed as well, reaching a 15-year high.

However, the Fed recently decided to cut the federal funds rate, and savings account have started dropping. It’s also expected that the Fed will implement more rate cuts in 2025.

It’s difficult to predict exactly how and when interest rates will change going forward, but one thing is for sure: Today’s high savings account rates won’t last forever. So, if you’re hoping to give your savings a boost and take advantage of the best rates on the market, there’s no better time than now.

The requirements involved in opening a savings account vary by financial institution. However, if you’re ready to open an account, you can follow these general steps:

-

Research savings account rates: Of course, when choosing a savings account, one of the most important factors to evaluate are the interest rates. Be sure that you select a savings account with a competitive rate to help your money grow.

-

Figure out your must-haves: Although savings account interest rates should be top of mind, that’s not the only factor to consider. You’ll also want to think about what else you need from your account, whether it’s no minimum balance requirement, low fees, or other perks. Finding a savings account with a solid rate that also helps you achieve your goals is key.

-

Prepare documentation: Opening a bank account requires you to provide a few important personal details and documents. Before you start your application, be sure you have your Social Security number, driver’s license or passport number, and proof of address.

-

Fill out the application: In many cases, you can apply for savings account online. However, some financial institutions may require you to visit the branch in person to apply. Either way, the application for a new savings account should only take a few minutes to complete. In many cases, you’ll get your approval decision instantly.

-

Fund your account: Once your savings account application is approved, you’ll need to add funds to the account. Be sure you’re aware of any minimum opening deposit requirements and timeline for funding.

Read more: Step-by-step instructions for opening a high-yield savings account

If You Bought The Bitcoin Dip By Investing $1000 During 'Thanksgiving Day Massacre,' Here's How Much You'd Have Today

Sandwiched between the Halloween and the Christmas festivities, the Thanksgiving holiday is another special day for Americans that draws families and communities together.

Thanksgiving is celebrated on the fourth Thursday of November. This year, it falls on Nov. 28.

However, away from the festivities and food, the cryptocurrency community was hit hard four years ago to the day, in what has become infamously known as the “Thanksgiving Day Massacre.”

What happened: Back in 2020, the Thanksgiving holiday fell on Nov. 26.

Between Tuesday, Nov. 24, and Thursday, Nov. 27, 2020, Bitcoin BTC/USD, the world’s leading cryptocurrency, fell from about $19,500 to $16,200, marking a dip of almost 17%.

The plunge impacted cryptocurrency portfolios and dampened the festive mood to a great degree.

However, if you were a bold dip buyer and took advantage of the decline to bag Bitcoins at a discount, you would have been smiling four years later.

An investment of $1000 when BTC was trading at $16,200 would have fetched you 0.0617 units of the cryptocurrency.

This Thanksgiving, the price of one Bitcoin has leaped to $95,736.86. Accordingly, your Bitcoin stash would have been worth $5909.68, marking a gain of 490%, or nearly a sixfold increase.

Why It Matters: Interestingly, leading up to the holiday, Bitcoin had a steep drop from nearly $100,000 to $91,500, fueling concerns about a repetition of the 2020 episode.

However, the corrective action lost steam, and Bitcoin surged back to the $95,000-$96,000 zone just a day ahead of Thanksgiving.

Price Action: At the time of writing, Bitcoin was trading at $95,736.86, up 2.65% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Photo courtesy: Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Debit card fraud protection: What to know if your card is compromised

In 2024, debit cards are a popular method of payment — almost as popular as credit cards. But there are several drawbacks to using debit cards over credit cards and other forms of payment, including the fact that they don’t give you as much protection against fraud.

If someone uses your debit card without your permission — also known as debit card fraud — will you get your money back? If you don’t catch the issue fast enough, there’s a chance your bank account could be cleaned out for good.

Debit card fraud is a two-part crime that starts with having your debit information compromised. This can happen in a variety of ways:

-

Data breach

-

Theft of your physical debit card

-

Theft of your debit card number

-

Theft of a new card from the mail

-

Theft of an ATM and the information that’s stored in the machine

-

Skimming of card information at an ATM, gas pump, or other point of sale

Once the information is stolen, the thief commits the second part of the crime by using your card in person or online, cloning the card, or selling the card details on the black market.

This crime, which happens most often through online theft of a victim’s debit card information, has become more common in the past few years and is expected to continue increasing as technology evolves. In 2023, 83,370 people reported debit card fraud to the Federal Trade Commission (FTC).

As a result of Federal Regulation E, there are rules that protect you from losing all of your money due to debit card fraud.

According to the regulation, your liability (the amount of money you can potentially lose) depends on your response to the crime. The faster you inform the card issuer, the less liability you have for unauthorized charges.

You can also check to see if your bank has additional debit card fraud protections to help protect your money, but the possibility is slim.

Despite the fact that many major banks and credit unions advertise “zero liability” policies for their debit accounts — including Bank of America, Chase, Citizens Bank, HSBC, and Navy Federal Credit Union — these institutions don’t offer any coverage beyond what you’re guaranteed through Regulation E.

Read more: What is Regulation E, and how does it protect you?

Some homeowners and renters insurance plans have extra coverage for debit card fraud beyond what federal law provides. However, if you didn’t pay extra for this protection, you probably don’t have any coverage.

For example, State Farm policies allow you to add fraud coverage to your plan. And if you have Nationwide renters insurance, you may have been prompted to select a reimbursement limit for unauthorized debit and credit card transactions when you set up your policy.

If you find that someone has made an unauthorized transaction on your debit card, or you believe someone plans to use your card without permission, it’s crucial to take these steps and report the incident ASAP. The longer you wait, the more money you could lose.

1. Call the card issuer or log into its mobile banking app. Report the incident, have the card canceled, and get a replacement.

2. Contact one of the three credit bureaus to place a fraud alert on your reports. Fraud alerts are free, and they protect you for one year by requiring companies to verify your identity before approving new credit cards and loans in your name. You can contact any one of the credit bureaus here:

3. File a report with the FTC at IdentityTheft.gov and see further recommended action steps based on your situation.

4. Review your bank statement to see where your card was used. Contact the fraud department for each impacted business and ask them to remove the fraudulent charges.

Once you report the incident, be prepared for the solution to take some time. Unfortunately, it could be a matter of days or weeks until your account is reimbursed for the money that was stolen.

Read more: How to dispute a debit card charge

The best way to avoid debit card fraud is to take preventative measures that protect your card. Practicing these good debit card habits is your best defense:

-

When possible, always tap your card instead of swiping

-

Never use ATMs or card readers that appear damaged

-

Keep your debit card in a secure place

-

Memorize your debit card PIN and don’t write it down or share it

-

Cover keypads when entering your PIN

-

Avoid remote ATMs or machines in poorly lit areas

-

Set up transaction alerts for unusual account activity

-

Never give your debit card information to an inbound caller

To avoid losing money, be sure to review your bank statement regularly. If you let even a few business days go by before reporting a fraudulent transaction, you could end up losing as much as $500.

Read more: Guide to ATM safety: Tips for protecting yourself and your money

Read the latest financial and business news from Yahoo Finance