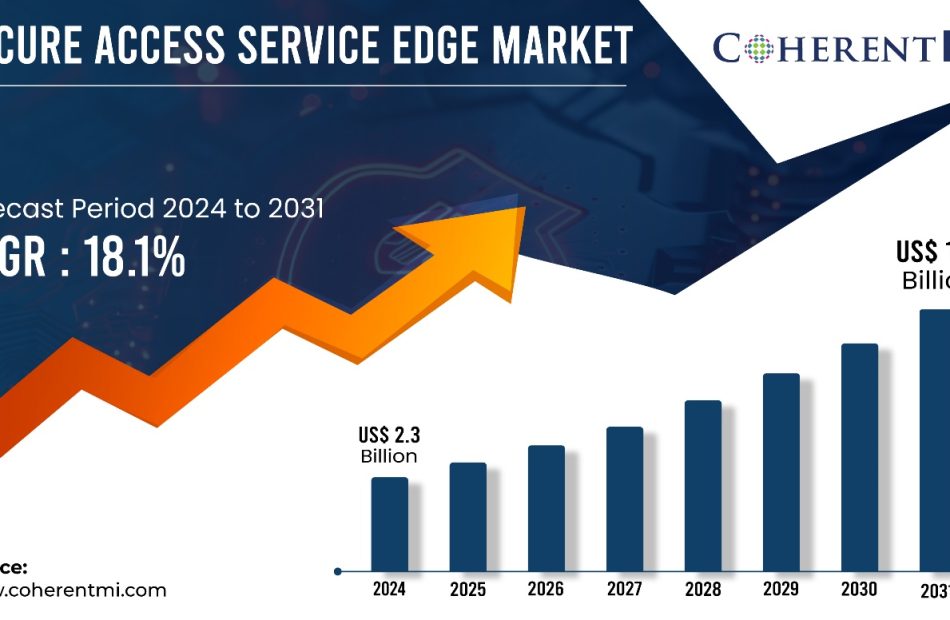

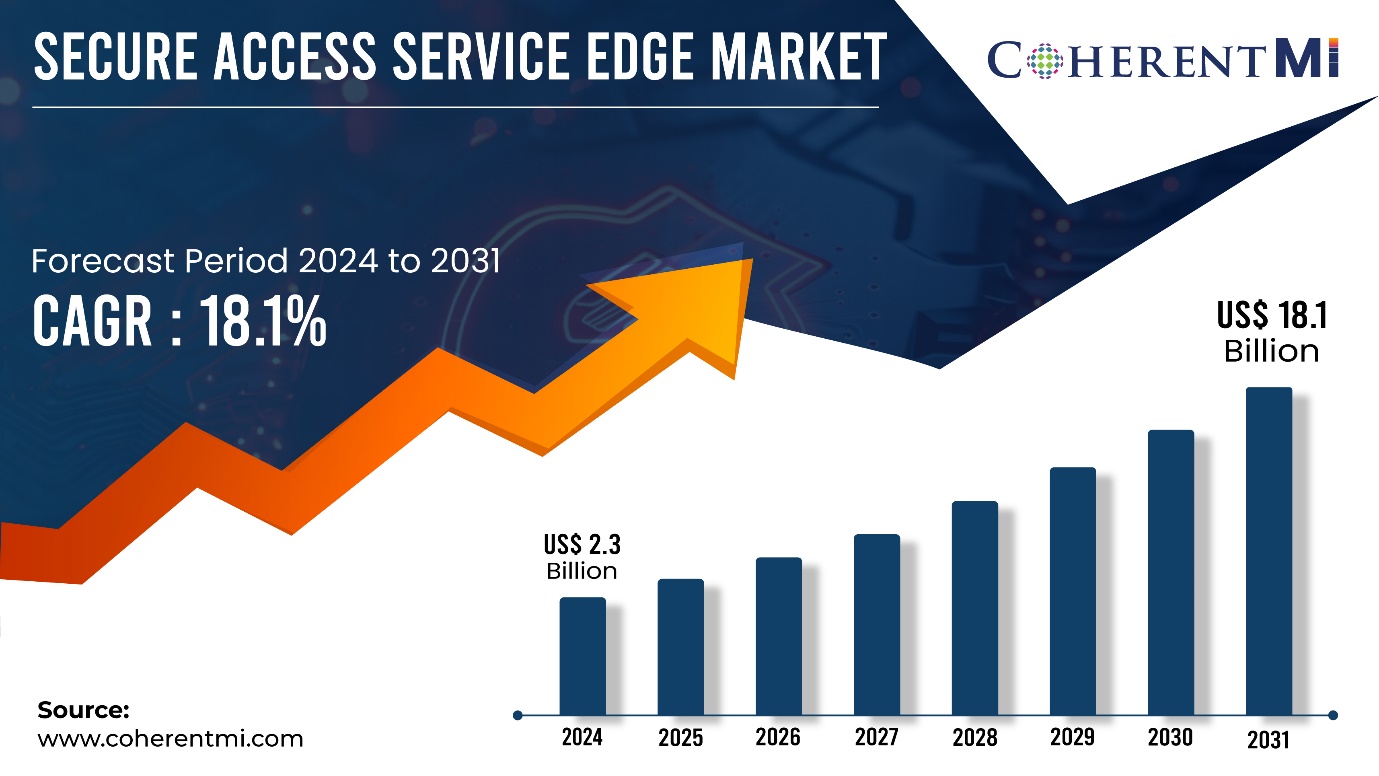

Coherent MI: Secure Access Service Edge Market Poised to Hit $19.1 Billion by 2031

Burlingame, Nov. 28, 2024 (GLOBE NEWSWIRE) — According to the Coherent MI, The global Secure Access Service Edge Market Size was valued at USD 2.3 Billion in 2024 and is expected to reach USD 19.1 Billion by 2031, growing at a CAGR of 18.1% from 2024-2031.

The growth of the Secure Access Service Edge Market is primarily driven by the emergence of cloud technologies and increasing adoption of cloud services by enterprises. Cloud adoption is gaining traction as it offers benefits such as scalability, flexibility and reduced costs. However, it has also given rise to security issues such as lack of visibility, vulnerability exploitation and lack of access controls. SAS Edge addresses these challenges by providing unified access and micro-segmentation capabilities for all cloud environments. It enables zero-trust security model and restricts access to only authorized users and applications. Furthermore, increasing demand for work from anywhere model amid COVID-19 pandemic is also propelling the demand for SAS Edge solutions to securely access cloud applications remotely.

Get a Sample Report of Secure Access Service Edge Market @ https://www.coherentmi.com/industry-reports/secure-access-service-edge-market/request-sample

Market Trends:

Adoption of zero-trust security framework and micro-segmentation capabilities offered by SAS Edge solutions is a major trend in the market. Zero-trust assumes there is no implicit trust granted to assets and users inside or outside the network perimeter. It implements least privilege access whereby access to applications are granted based on a continuous verification/authorization of who is requesting access, the context of the request and the risk posture of the user. Another key trend gaining traction is growing demand for SAS Edge offerings that are cloud-agnostic and can secure applications hosted on public/private/hybrid clouds in a unified manner. Vendors are focusing on developing cloud-agnostic solutions that offer centralized visibility, policy management and enforcement across multiple cloud environments.

Secure Access Service Edge Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $2.3 billion |

| Estimated Value by 2031 | $19.1 billion |

| Growth Rate | Poised to grow at a CAGR of 18.1% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Component, By Application |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Strict Government Regulations and Data Protection Laws Globally, •Leading to the Adoption of Secure Cloud-Based Solutions |

| Restraints & Challenges | • Misinformation and Confusion About the SASE Framework and its Deployment. |

Market Opportunities:

Cloud-enabled SASE platforms are increasingly being adopted by enterprises looking to simplify their network security platforms. By integrating functionality like secure web gateway, cloud access security broker, and zero trust network access onto a single cloud-delivered platform, SASE offers advantages of reduced cost and complexity over traditional on-premise firewalls and VPNs. Major SASE vendors are offering comprehensive cloud-delivered security suites to capitalize on this trend.

Immediate Delivery Available | Buy This Premium Research Report @ https://www.coherentmi.com/industry-reports/secure-access-service-edge-market/buynow

More organizations are recognizintg the need to converge their networking and cybersecurity strategies to ensure consistent security policies across any user, device, or location. Traditional silos between network and security teams are breaking down, creating demand for integrated platforms like SASE that deliver networking and security as a unified service. By providing consistent security and connectivity globally, SASE aims to simplify operations for IT and security teams.

Key Market Takeaways

The global SASE market is anticipated to witness a CAGR of 18.1% during the forecast period 2024-2031, owing to the rising need to simplify network security architectures. On the basis of component, the platform segment is expected to hold a dominant position, accounting for over 60% market share by 2031 due to its comprehensive set of features.

By application, IT & telecom is expected to be the leading segment over the forecast period, driven by demand from telecom operators and managed services providers for SASE’s unified connectivity and security capabilities.

Regionally, North America is expected to dominate the SASE market through 2031, with major vendors based in the US offering advanced cloud-delivered SASE solutions.

Key players operating in the SASE market include Cisco, Palo Alto Networks, VMware, Inc., Versa Networks, Inc., Cato Networks, Check Point Software Technologies Ltd., McAfee, LLC, Open Systems, Hewlett Packard Enterprise Development LP and Barracuda Networks, Inc. Consolidation among SASE vendors is expected in order to offer more comprehensive capabilities through partnerships.

Need any customization research on Secure Access Service Edge Market @ https://www.coherentmi.com/industry-reports/secure-access-service-edge-market/request-sample

Market Segmentation

By Component

By Application

- IT & Telecom

- BFSI

- Manufacturing

- Retail & E-commerce

- Healthcare

- Others

By Region:

- North America

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

Find Most Trending Related Reports:

Global remote sensing services market size is estimated to be valued at US$ 17.13 Bn in 2023 and is expected to reach US$ 37.82 Bn by 2030, exhibit a compound annual growth rate (CAGR) of 11.8% from 2023 to 2030.

The Global Robotic Platform Market is estimated to be valued at USD 10.6 Bn in 2024 and is expected to reach USD 17.9 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2031.

The Global Video Management System Market is estimated to be valued at USD 17.1 Bn in 2024 and is expected to reach USD 58.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 12.1% from 2024 to 2031.

About Us:

At CoherentMI, we are a leading global market intelligence company dedicated to providing comprehensive insights, analysis, and strategic solutions to empower businesses and organizations worldwide. Moreover, CoherentMI is a subsidiary of Coherent Market Insights Pvt Ltd., which is a market intelligence and consulting organization that helps businesses in critical business decisions. With our cutting-edge technology and experienced team of industry experts, we deliver actionable intelligence that helps our clients make informed decisions and stay ahead in today’s rapidly changing business landscape.

Mr. Shah CoherentMI, U.S.: +1-650-918-5898 U.K: +44-020-8133-4027 Australia: +61-2-4786-0457 INDIA: +91-848-285-0837 Email: sales@coherentmi.com Website: https://www.coherentmi.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock-Split Watch: 1 Under-the-Radar Growth Stock Up 510% Since the Beginning of 2023

Stock splits have been in vogue recently. Large technology companies like Amazon, Alphabet, Nvidia, and Tesla have split their stocks after seeing their share prices get close to $1,000 or more. This financial engineering tactic didn’t change anything about these stocks’ underlying businesses, but it can make it easier for individual investors to buy a single share.

One potential stock-split candidate is Spotify (NYSE: SPOT). The audio streaming leader is up over 500% since the start of 2023, and the stock is now approaching $500 per share, or stock-split territory. Here’s why the stock has made a massive turnaround, and whether you should buy shares of Spotify after its big gains.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Many investors will know Spotify as it is one of the most popular music and podcast streaming services worldwide. With 640 million monthly active users (MAUs), perhaps only YouTube has a larger reach around the world in this niche.

Spotify mostly makes money by selling ad-free music listening through a subscription service. Premium subscription revenue has grown consistently since Spotify went public in 2018 with 24% growth on a foreign currency-neutral basis last quarter. In U.S. dollars, the segment is closing in on $15 billion in annual subscription revenue.

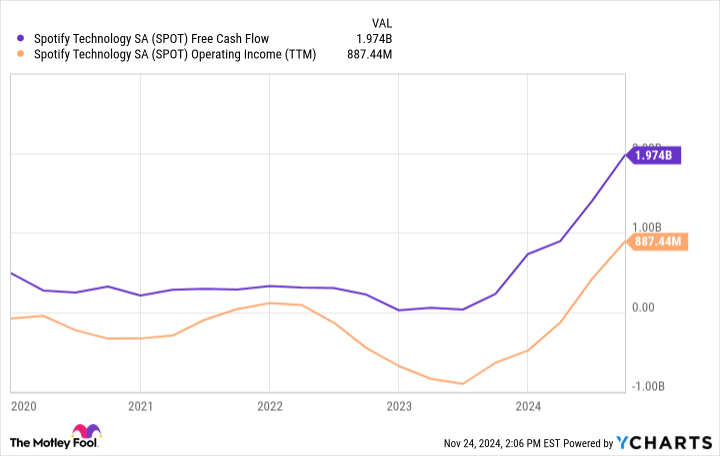

Investors were never concerned about Spotify’s revenue growth. The problems were around profitability. In the third quarter of 2023, Spotify’s gross margin was a measly 26.4%, not much higher than when it went public. Operating margin was only 1.0%, and it had been negative for many quarters before that. One year later, and the story has completely changed. Gross profit margin was 31.1% in Q3 2024 with operating margin exploding higher to 11.4%.

Spotify was able to do this for a few reasons. First, it cut down on its full-time employees, trimming them by over 20% in the past year while seeing no effect on revenue growth. Second, it is seeing more revenue from its high-margin promotional marketplace, which is leading to gross margin expansion. Third, the company has started to raise prices on its subscription services, which — along with the falling employee numbers — has led to operating leverage and the double-digit operating margin.

Given the stock’s rally and the platform’s 640 million MAUs, investors may worry Spotify will hit user saturation sometime soon. This may be true in its most mature markets like the Nordics (the first market it entered), but it’s nowhere near the case in the majority of countries around the world. Internet penetration in places such as India, Indonesia, and Latin America will continue to grow in the coming years, which should lead Spotify to more MAU gains.

Prediction: This Hypergrowth Stock Will Be the First $10 Trillion Stock (Hint: It's Not Nvidia)

In fact, this company is increasingly encroaching on Nvidia’s turf.

Three stocks have now reached market capitalizations of $3 trillion: Apple, Microsoft, and most recently Nvidia. Earnings growth across the technology sector has been phenomenal in the last decade-plus, leading investors to get increasingly enthusiastic about these stocks. Most recently, innovations in artificial intelligence (AI) have further spurred on these shareholder gains.

Investors have seen stocks continuously surpass trillion-dollar market cap thresholds. But what about $10 trillion? I think there is one stock primed to achieve this milestone before anyone else, and it isn’t one of the three companies mentioned above.

Amazon (AMZN -1.02%) can be the first stock to reach a market cap of $10 trillion and will be the most valuable company in the world once again. Here’s why.

E-commerce profits coming from an unlikely source

For years, investors doubted the profitability of Amazon’s e-commerce operations. With thousands of warehouse workers and delivery drivers, there are a lot of costs associated with running a vertically integrated online marketplace. The core e-commerce business model has razor-thin margins, which will never change. However, the company has layered in highly profitable business lines on top of the e-commerce marketplace.

First, the company has its long-standing Amazon Prime subscription business. Subscription revenue was $43 billion over the last 12 months, up from a measly $2.76 billion in 2014. Amazon has the ability to let these profits fall to the bottom line if it decides to stop reinvesting for growth.

Second, Amazon is now generating $54 billion in annual advertising revenue, mainly from sponsored listings on its e-commerce platform. This is high-margin revenue that can fall directly to the bottom line, just like the subscription business.

Add the two together, and you have close to $100 billion in earnings potential even if you believe the core e-commerce, third-party sellers, and physical retail locations will never generate a lick of earnings.

Why use these estimates? To show the profit potential of Amazon’s global retail business lines. These segments have the potential to generate close to $100 billion in earnings in the near future. If revenue keeps growing at a double-digit rate, segment earnings could expand to $150 billion or even $200 billion within the next 10 years.

A standing advantage in cloud and AI

Amazon’s most profitable business line is Amazon Web Services (AWS). The leading cloud computing giant generates around $100 billion in revenue and $36 billion in earnings, or a profit margin of 36%. That makes it one of the most profitable businesses in the world, and it is just a subsidiary of the Amazon complex.

Cloud computing revenue is only growing and is now supercharged by AI spending. AWS seems to be positioned well to take advantage of this trend and is even investing in its own computer chips to take some of the huge costs it pays to companies like Nvidia every year. Analysts estimate cloud computing spend will grow at a 22% annual clip from 2024 through 2030, supercharged by AI.

Assuming AWS can maintain its profit margins and market share, six years of 22% earnings growth would mean AWS is generating more than $100 billion in earnings in 2030. An ambitious estimate, but one that is achievable if the AI boom is for real, which it increasingly looks like it is.

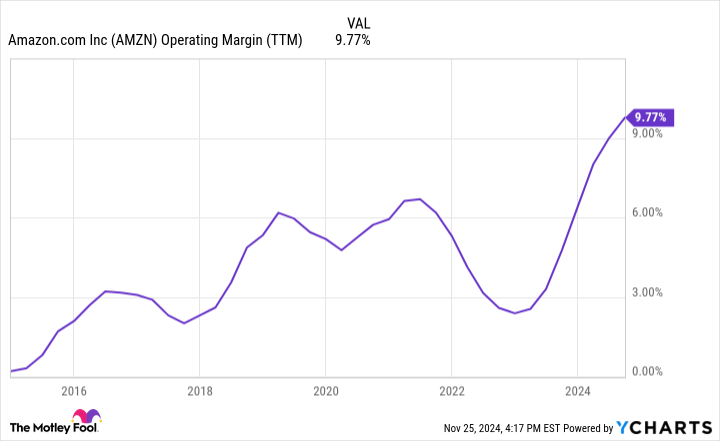

AMZN Operating Margin (TTM) data by YCharts

Running the math to $10 trillion

Combining all its segments together, it looks like Amazon has the potential to generate around $300 billion in earnings in 2030. This figure could even be surpassed if its new projects in healthcare, pharmacy, and satellite internet with Project Kuiper bear any fruit. Regardless, the company has a ton of momentum that should only continue over the next five years.

A $10 trillion market cap on $300 billion in annual earnings is a price-to-earnings ratio (P/E) of 33. While that’s a premium earnings multiple, I don’t think it is unreasonable that Amazon would trade at this valuation. For reference, Apple and Microsoft both trade at earnings ratios above 33 right now.

With multiple tailwinds at its back and rapidly expanding profit margins (operating margin has surged to a record 10% over the last 12 months), Amazon is poised to be the first company with a $10 trillion market cap.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia's Next Big Catalyst? Analyst Sees Jensen Huang-Led Company's Stock Jumping 27% By Early 2025

Investors are eyeing a potential surge in Nvidia Corp. NVDA stock, with analysts predicting a significant rise in the early days of 2025. The anticipation is fueled by expectations surrounding CEO Jensen Huang‘s keynote address at the event.

What Happened: Analysts at Citi have placed Nvidia on a “positive catalyst watch” for the upcoming 90 days, Business Insider reported on Thursday. The firm predicts the chipmaker’s shares could climb by 27%, reaching a target price of $175. This forecast comes as Huang prepares for his keynote at CES 2025, scheduled from Jan.7 to Jan.10. Huang will deliver the opening keynote on Jan. 6, followed by a Q&A session for financial analysts on Jan. 7, according to Citi.

Citi analyst Atif Malik forecasts that Nvidia’s profit margin will bottom out in the April quarter, with an upward trend expected thereafter. The company is anticipated to address AI robotics demand in sectors like warehouses, manufacturing, and humanoid robots.

Citi has maintained a “Buy” rating on Nvidia shares, raising its price target from $170 to $175 following the company’s third-quarter earnings release. Nvidia shares have surged 176% year-to-date, driven by strong demand for its AI GPU chips.

Why It Matters: Nvidia’s recent financial performance has been impressive, with the company surpassing third-quarter revenue and earnings per share estimates. The revenue of $35.1 billion, was a 94% increase year-over-year, beating the Street consensus estimate of $33.12 billion.

Additionally, the CES 2025 event is expected to be a platform for Nvidia to potentially reveal its next-generation GPUs. Rumors suggest that Nvidia might unveil updates about its RTX 50 series, including desktop GPUs based on the Blackwell architecture. This anticipated announcement could further bolster Nvidia’s market position and stock performance.

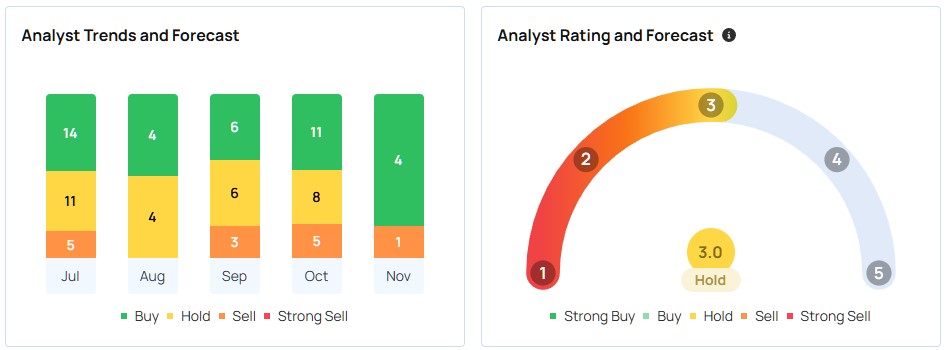

Price Action: Meanwhile, as per Benzinga Pro data, Nvidia has a consensus price target of $170.56 based on the ratings of 40 analysts. The high is $220 issued by Rosenblatt while the low is $120 issued by New Street Research.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shares in ASML and peers climb amid hopes for less severe US curbs on China chips

(Reuters) -Shares of ASML (ASML, ASML.AS) and its peers in the European computer chip equipment sector climbed on Thursday after Bloomberg News reported that looming U.S. restrictions on the Chinese semiconductor industry may be less severe than expected.

Shares in ASML were up 4.3% by 0809 GMT, with Dutch rivals BE Semiconductor (BESI.AS) and ASM International (ASM.AS, ASMIY) rising by 5% and 2.9% respectively, among top performers on the European benchmark STOXX 600 index (^STOXX).

The Bloomberg report, citing unnamed sources, said that major Chinese memory chip manufacturer ChangXin Memory Technologies Inc (CXMT) would not be added to U.S. trade restrictions lists, adding that the timing and contents of the decision are not certain.

The U.S. Commerce Department oversees U.S. restrictions on China exports and is expected to issue new guidance after the Thanksgiving holiday.

ASML, the largest supplier of semiconductor-making equipment, declined to comment. At an investor day two weeks ago the company said it expects sales of its tools to China to drop to 20% of total sales in 2025 from nearly 50% over the previous six quarters.

Other top computer equipment suppliers include Applied Materials (AMAT), KLA Corp (KLAC), Lam Research (LRCX) and Tokyo Electron (TOELY, 8035.T).

(Reporting by Nathan Vifflin in Gdansk and Toby Sterling in AmsterdamEditing by Milla Nissi and David Goodman)

Auto Dealer Software Market Set For 6.2% Growth, Reaching $8,162.89 Million By 2032 Globally

Gondia, India, Nov. 28, 2024 (GLOBE NEWSWIRE) — As per the latest research report published by IMIR Market Research, the global Auto Dealer Software Market is experiencing unprecedented growth, driven by rising demand for improved customer engagement, streamlined dealership operations, and integrated dealer management systems (DMS).

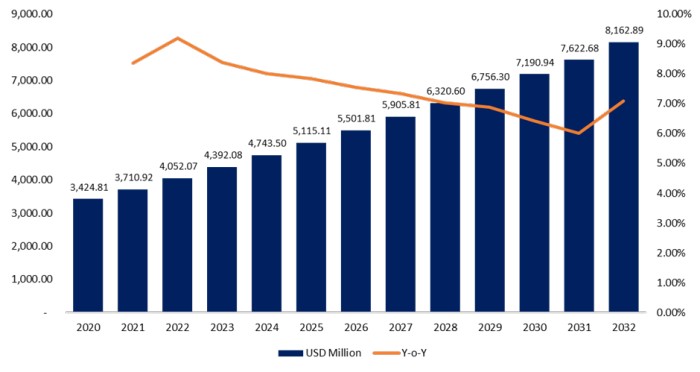

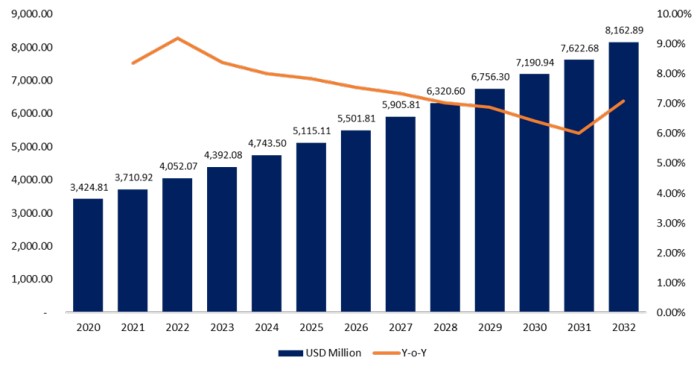

As per our research, in 2023, the Auto Dealer Software market was valued at USD 4,392.08 Million and is expected to reach USD 8,162.89 Million by 2032 at the CAGR of 6.2% during 2024-2032.

Our Report will help you understand the consumer behavior analysis towards the products and raw material across different age group.

To get the Detailed Report Now: https://www.intellectualmarketinsights.com/download-sample/IMI-000444

Figure: Global Auto Dealer Software Market, 2020-2032, (USD Million)

Key Growth Factors in the Auto Dealer Software Market

The use of cloud-based dealer management systems and automotive software solutions has brought drastic changes to the face of the automotive dealership landscape. Dealerships look at utilizing data analytics, real-time tracking, and predictive sales to improve the customer journey; hence, the emergence of Auto Dealer Software solutions is on the rise. With the growth of online automobile retailing and automobile e-commerce websites, comes the increased demand for the more advanced software tools that can ensure smoother transaction processes with proper CRM.

Innovations in Dealer Management Systems Drive Market Growth

Auto dealer software solutions are gradually moving away from the simple management systems, integrating features of artificial intelligence, machine learning, and data analytics into the solution to provide predictive insights and customized experiences for the dealerships. They help dealerships streamline the inventory management process, optimize their sales forecasting, and achieve better customer retention. Since real-time inventory tracking lets dealerships respond better to customer demands, it thus enhances operational efficiency and profit margins.

Moreover, with advanced CRM software deployed inside dealer systems, it tends to maintain dealerships with personal ties with customers as well as ensure stronger loyalty and lifetime value. Rising global pressure on the digitalization of automotive industries brings greater attention towards the software related to auto dealers for an improvement in business growth along with efficiency in their working.

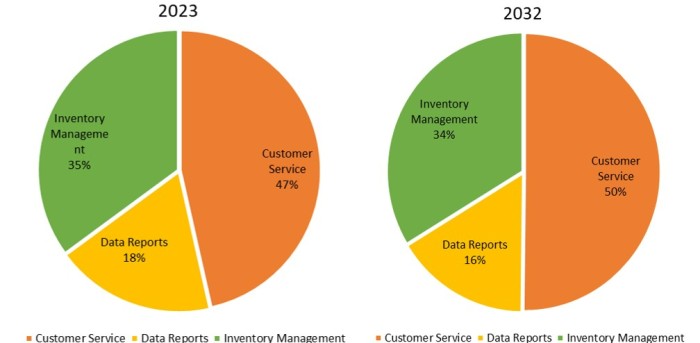

Based on function, the market is segmented into customer service, data reports, and inventory management

North America and Asia-Pacific Leading the Market

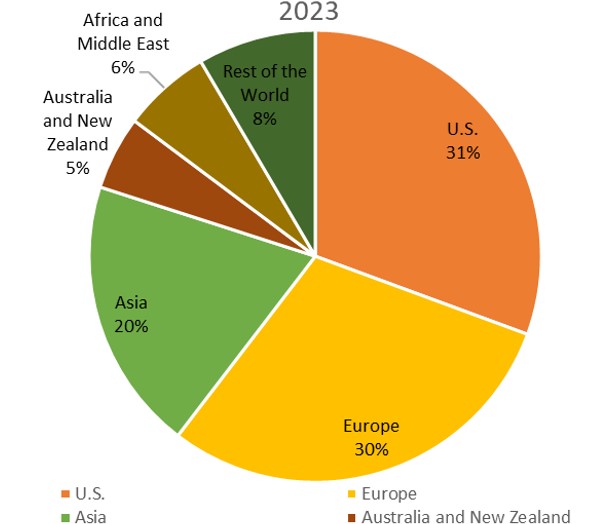

Because of regions, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Auto dealer software is gaining the highest regional scope across many regions, and North America happens to be the most dominant market because of its wide adoption of technology and a prominent automobile industry. The Asia-Pacific region is proving to be a significant growth contributor since vehicle sales are increasing, automotive retail has shown a huge hike, and investments in digital dealership platforms are undertaking. As dealerships in those locations upgrade their businesses, more advanced dealer software would probably be in high demand.

Get sample copy of this premium report: https://www.intellectualmarketinsights.com/download-sample/IMI-000444

Outlook

The future of auto dealer software will rest solely in its capacity to adjust to the changing needs of modern dealerships and to their customers. Hence, as dealerships would eventually focus on upgrading their service through digital interfaces as well as personalizing service lines, the usage of this dealer management software is expected to be promoted at a faster pace. The emergence of electric vehicles and the integration of sustainability initiatives are also likely to change market dynamics and create an opportunity for the innovation and capitalization of green automotive trends by software vendors.

Key Players and Competitor

The market features several prominent players, including CDK Global Inc., Cox Automotive Inc., Reynolds and Reynolds, and Dealertrack Technologies. These companies continue to invest in R&D to develop innovative software solutions, thereby consolidating their market position. Strategic partnerships and acquisitions are also prevalent as firms expand their product offerings and enhance their service capabilities.

Key Developments

- A B2B sales platform for purchasing and selling automotive software was developed in March 2024 by General Motors (GM), Magna, a major global automotive supplier, and Wipro Limited, a significant provider of technology services and consultancy. By offering a platform that connects buyers and sellers of embedded automotive software, SDVerse seeks to transform the sourcing and procurement process for automotive software.

- Xzilon, the market standard for high-performance vehicle protection solutions, was acquired by The Reynolds and Reynolds Company in July 2023. With its exterior protection products (Carbon Ceramic with Graphene and Diamond Grade 9H Ceramic System), all-in-one interior protection (Xmicrobe), and a comprehensive line of other industry-leading appearance protection products, the Xzilon brand is well-known in dealership F&I departments and is nationally recognized.

Market Segmentations:

| By Deployment Type | |

| By Application |

|

| By Dealership Size |

|

| By End-User |

|

| By Region |

|

Regional Snapshots:

By region, Insights into the markets in North America, Europe, Asia-Pacific, Latin America and MEA are provided by the study. North America on a strong dominant position with the well-matured and developed automobile industry which carries an immense number of dealerships with implementation of latest technology in them. The count of dealerships here makes the trend of dealers here to demand more levels of software for day-to-day operations, not only on customer-related interaction but due to very strict regulatory norms. The presence of the major vendors and innovative minds in the region adds more strength to the North American software market.

The European market for auto dealer software is boisterous with increasing emphasis on customer-centric services and the entry of digital solutions in dealership operations. Leaders in the adoption of CRM and inventory management systems are Germany and the UK, and more dealerships are beginning to understand the impact data analytics has on sales strategies. The changing legislation on emissions and good practice, the dealership felt a need to invest more in compliance management and ensure clear operations through the support of software.

Auto dealer software is emerging as one of the fastest-growing markets within the Asia-Pacific region given an increase in vehicle ownership across China and India and expanding rapidly in the automotive business. The growing demand of vehicles has its reasons behind it and these include an increasing number of a middle class having disposable income; it is only with more effective management, dealerships need to adapt more advanced software solutions concerning inventory management, sales as well as relationships with their customers. One other force promoting the application of software is the rapid increase of the influence of e-commerce among automotive businesses: a dealer that wants to launch online sales becomes obligated to explore cloud-based software solutions as well.

Latin America, although in its growth stage, still has immense potential in the auto dealer software market. Countries like Brazil and Mexico are experiencing a gradual transition toward digital solutions by dealerships for more modernized operations and improvement of customer experience. However, economic instability and variable levels of technological infrastructure will affect rapid adoption.

The region for the Middle East and Africa is one of unique opportunity and challenges for the auto dealer software market. This is because although the region boasts a burgeoning automotive market, the uptake of more complex software solutions remains very small. The adoption of more digital solutions for engaging with customers and managing dealership processes and operations remains relatively underdeveloped. There are exceptions in large urban areas experiencing high levels of new car sales, but there remain broader regulatory and economic hurdles.

The auto dealer software market shows regional diversity, where North America and Europe have a higher rate of adoption, but the Asia-Pacific region has shown the maximum growth potential. In light of this, as more dealerships recognize the necessity of digital transformation, there will be the need for particular solutions that will fulfil the regional needs, thereby becoming essential for market players in order to gain their share of opportunities that are arising.

Get Access of this Report: https://www.intellectualmarketinsights.com/report/auto-dealer-software-market-size/imi-000444

About Us:

IMIR® Market Research Pvt Ltd.

Intellectual Market Insights Research is a market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including, Semiconductor, aerospace, Automation, Agriculture, Food & Beverages, Automotive, Chemicals and Materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports.

IMIR has the distinguished objective of providing optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Digvijay Chakravarty | digvijay.C@intellectualmarketinsights.com

Follow Us: LinkedIn

Email: sales@intellectualmarketinsights.com

Call Us: +1 (814) 487 8486

Contact Data Managing Director: Digvijay Chakravarty | Email: digvijay.c@intellectualmarketinsights.com Call us: +1 (814) 487 8486, +919764079503

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ASML and peers climb on hopes for less severe US curbs on China chips

(Reuters) -Shares of ASML and its peers in the European computer chip equipment sector climbed on Thursday after Bloomberg News reported that looming U.S. restrictions on the Chinese semiconductor industry may be less severe than expected.

Shares in ASML were up 4.3% by 0809 GMT, with Dutch rivals BE Semiconductor and ASM International rising by 5% and 2.9% respectively, among top performers on the European benchmark STOXX 600 index.

The Bloomberg report, citing unnamed sources, said that major Chinese memory chip manufacturer ChangXin Memory Technologies Inc (CXMT) would not be added to U.S. trade restrictions lists, adding that the timing and contents of the decision are not certain.

The U.S. Commerce Department oversees U.S. restrictions on China exports and is expected to issue new guidance after the Thanksgiving holiday.

ASML, the largest supplier of semiconductor-making equipment, declined to comment. At an investor day two weeks ago the company said it expects sales of its tools to China to drop to 20% of total sales in 2025 from nearly 50% over the previous six quarters.

Other top computer equipment suppliers include U.S. companies Applied Materials , KLA Corp, Lam Research and Tokyo Electron.

(Reporting by Nathan Vifflin in Gdansk and Toby Sterling in AmsterdamEditing by Milla Nissi and David Goodman)

Factbox-Airports to cooking oil: the many businesses of India's Gautam Adani

(Reuters) – Indian billionaire Gautam Adani oversees a sprawling conglomerate with activities spanning construction of airports to supply of electricity and the sale of cooking oil.

U.S. authorities have accused Adani, his nephew and executive director Sagar Adani and managing director of Adani Green, Vneet S. Jaain, of being part of a scheme to pay bribes of $265 million to secure Indian power supply contracts, and misleading U.S. investors during fund raises there.

The group has called the allegations baseless.

Here are key details of the Adani Group’s businesses:

** Energy: It mines thermal coal and produces power through its utilities firm Adani Power, which is transmitted via Adani Energy Solutions.

The renewable energy arm of the ports-to-power conglomerate is Adani Green Energy, which is at the center of the U.S. indictment. It focuses on solar, wind and hybrid power generation and has a presence in a dozen Indian states.

Adani Total Gas, which distributes piped natural gas, is run in a partnership with TotalEnergies.

** Airports: Since entering the space in 2019, the group runs airports in cities from Mumbai, the commercial capital, to the tourist city of Jaipur and southern Thiruvananthapuram, through its flagship firm, Adani Enterprises.

The flagship also has a presence in roadways, real estate and infrastructure.

** Edible oils and food: The group’s joint venture with Singapore’s Wilmar International makes edible oils and packaged food items such as fragrant basmati rice, wheat flour and sugar under the Adani Wilmar banner.

** Port operations: Adani Ports, India’s top private operator by volume, manages 13 domestic ports, including the country’s busiest private port, Mundra in the western state of Gujarat.

Outside India, Adani Ports owns a stake of 70% in Israel’s port of Haifa and 51% in Sri Lanka’s Colombo port.

** Cement: The group entered the industry in 2022, inking its biggest-ever deal in the space by acquiring Holcim AG’s stake in Ambuja Cements and ACC. It has been on an acquisition spree since in its bid to topple India’s top cement maker, UltraTech Cement.

** Media: Adani entered India’s media industry by acquiring a majority stake in Quintillion Business Media, a financial news digital media platform, in 2022. Afterwards, it strengthened its hold in the space by striking deals with news broadcaster NDTV in 2022 and news agency IANS in 2023.

It also builds and runs data centres nationwide.

** Defence and aerospace: One of the few private players in a state-dominated weapons sector, the group supplies domestically made weapons to Indian forces. In 2018, it signed a supply deal with Israel’s Elbit Systems.

(Reporting by Kashish Tandon and Hritam Mukherjee in Bengaluru; Editing by Clarence Fernandez)

Tesla Cybercab Spotted Testing In Giga Texas Facility

Tesla Inc. TSLA has been spotted testing the recently announced Cybercab at the Giga Texas facility.

What Happened: Tesla’s Cybercab has been observed undergoing tests at the Giga Texas facility. A video shared on social media showcased the Cybercab navigating traffic autonomously within the premises.

Earlier this month, the electric vehicle community was abuzz when a video surfaced showing the Cybercab in action at Giga Texas. The footage highlighted the robotaxi’s self-driving capabilities, sparking excitement among enthusiasts.

Longtime Giga Texas observer Joe Tegtmeyer reported that Tesla has been conducting test drives of the Cybercab along the main building of the factory over the past weeks. Notably, a modified gaming joystick is used for manual interventions during these tests.

See Also: Tesla Sweetens Referral Program, Allowing Customers To Earn Up To $10,000

Additional tests, including water ingress tests, are reportedly being carried out at the west end-of-line facility and other areas around Giga Texas. A significant amount of production equipment has been spotted at the staging lot, hinting at a potential new production line.

During the Q3 2024 earnings call, Elon Musk mentioned that Tesla aims for volume production of the Cybercab by 2026, with initial production possibly starting in 2025. The company plans to produce at least 2 million units annually.

Why It Matters: The testing of the Cybercab at Giga Texas marks a significant step in Tesla’s unveiling of its two-seater robotaxi earlier this year.

The Cybercab, priced under $30,000, is part of Tesla’s strategy to revolutionize urban transportation with autonomous vehicles. This comes at a time when there is skepticism from industry rivals like Lucid Group Inc. LCID, whose CEO Peter Rawlinson doubts the near-term feasibility of self-driving cars.

In pursuit of this goal, Tesla is actively recruiting top talent to enhance its teleoperation capabilities for the Cybercab and other projects, as reported in recent initiatives.

Price Action: Tesla stock closed at $332.89 on Wednesday, down 1.6% for the day. In after-hours trading, the stock increased slightly by 0.5%. Year to date, Tesla’s stock has gained 34%, according to data from Benzinga Pro.

The consensus rating from analysts is “Neutral” for the Tesla stock, according to data from Benzinga Pro. The highest price target is $400, while the consensus price target is 232.20, implying a 30% downside.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Tesla

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Could Buying Roku Stock Today Set You Up for Life?

Netflix, now one of the world’s largest technology companies, is the gold standard of the streaming industry. Although many competitors have entered the fray, Roku (NASDAQ: ROKU) remains one of the field’s oldest players, with ties to Netflix’s early years in streaming.

Roku lucratively rewarded shareholders from its initial public offering (IPO) through 2021 but has lost 85% of its value since peaking in the 2021 stock market bubble. Could buying the stock position investors for a remarkable comeback story and set them up for life? Or is the stock’s decline a permanent loss, a warning sign to prospective investors to stay away?

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Here is what you need to know.

Most consumers recognize Roku for its streaming dongles, speakers, and Roku-branded streaming televisions. However, Roku sells its hardware at a loss, which investors should view as bait to get users into its ecosystem. Roku’s core business is its software platform, which you use whenever you stream content on a Roku device, Roku TV, or third-party TV using Roku’s licensed operating system. Roku generates platform revenue from ads and fees to third-party partners (such as streaming services).

It’s a little complex, but the simple point is this: Roku wants to be the gatekeeper to the streaming viewer. It intends to profit from streaming no matter what you watch, as long as it’s on a Roku device.

This middle role of sorts comes with competition from both sides. Roku competes with other TV manufacturers, and its in-house streaming service, The Roku Channel, competes for eyeballs with other streaming services. For example, Roku and (HBO) Max partnered so Roku users can access Max. However, there’s underlying competition since Max and Roku would prefer you watch their respective streaming service versus the other.

I suspect the market has come to fear this competitive dynamic, which might help explain why Roku stock trades near its lowest valuation since going public (more on that in a minute).

But what’s indisputable is that Roku has continued to grow; its user base reached 85.5 million households in the third quarter. It’s not as large as the leading streaming services — Netflix has almost 283 million paid subscribers — but it’s large enough to create leverage in that streamers feel the need to work with Roku.