Cement giant Heidelberg Materials further expands US presence with $600 million deal

By Rachel More

BERLIN (Reuters) -Heidelberg Materials has struck a deal to buy U.S.-based Giant Cement Holding and its subsidiaries for $600 million, it said on Thursday, the latest acquisition by the German cement maker to expand its foothold in the United States.

Heidelberg Materials, the world’s second-largest cement maker, and larger peer Holcim have both been singling out the U.S. market as a place to grow aggressively, banking on what they say will be prolonged construction activity due to infrastructure projects and economic stimulus.

Shares of European construction firms have risen on hopes that Donald Trump’s presidency could be positive for construction activity in the United States.

“The acquisition … will further strengthen our cement footprint in the growing Southeastern U.S. and New England markets,” said Chris Ward, CEO of Heidelberg Materials North America.

The transaction, to be completed in the first quarter of 2025, is expected to contribute around $60 million in earnings before interest, taxes, depreciation and amortisation (EBITDA) in the first year of operation, “before significant additional synergies”, the company said in a statement.

The German building materials company adds Giant Cement to its growing list of assets in the country, after it bought three U.S. companies in June for $380 million in total.

“The valuation (10x forward EBITDA) is not cheap, but the U.S. market has an attractive structure and growth potential,” Davy Research wrote in a note.

Shares in Heidelberg Materials were up 1%.

Heidelberg Materials had scaled back its U.S. presence three years ago by selling cement factories in the west of the country for $2.3 billion.

Giant Cement Holding was owned by Mexican billionaire Carlos Slim’s Spanish cement and real estate unit Inmocemento, which will book a capital gain of $145 million on the asset sale, the Spanish company said in a separate filing to the Spanish stock market regulator.

Inmocemento was spun off from Slim’s Spanish conglomerate FCC earlier this month.

(Reporting by Rachel More and Javi West Larrañaga; Editing by Inti Landauro, Christoph Steitz and Susan Fenton)

Coherent MI: Reciprocating Compressors Market Poised to Reach $7.8 Billion by 2031

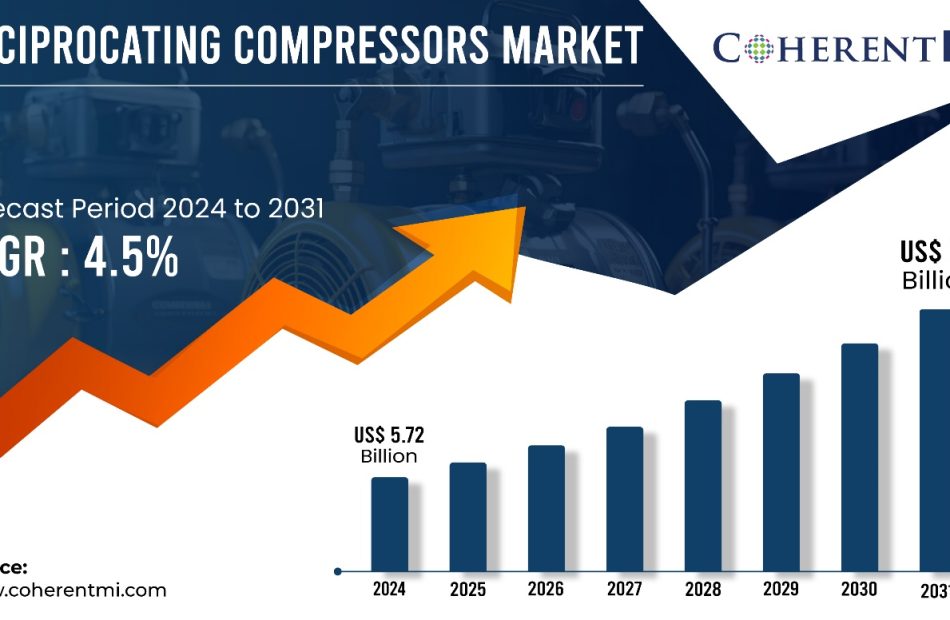

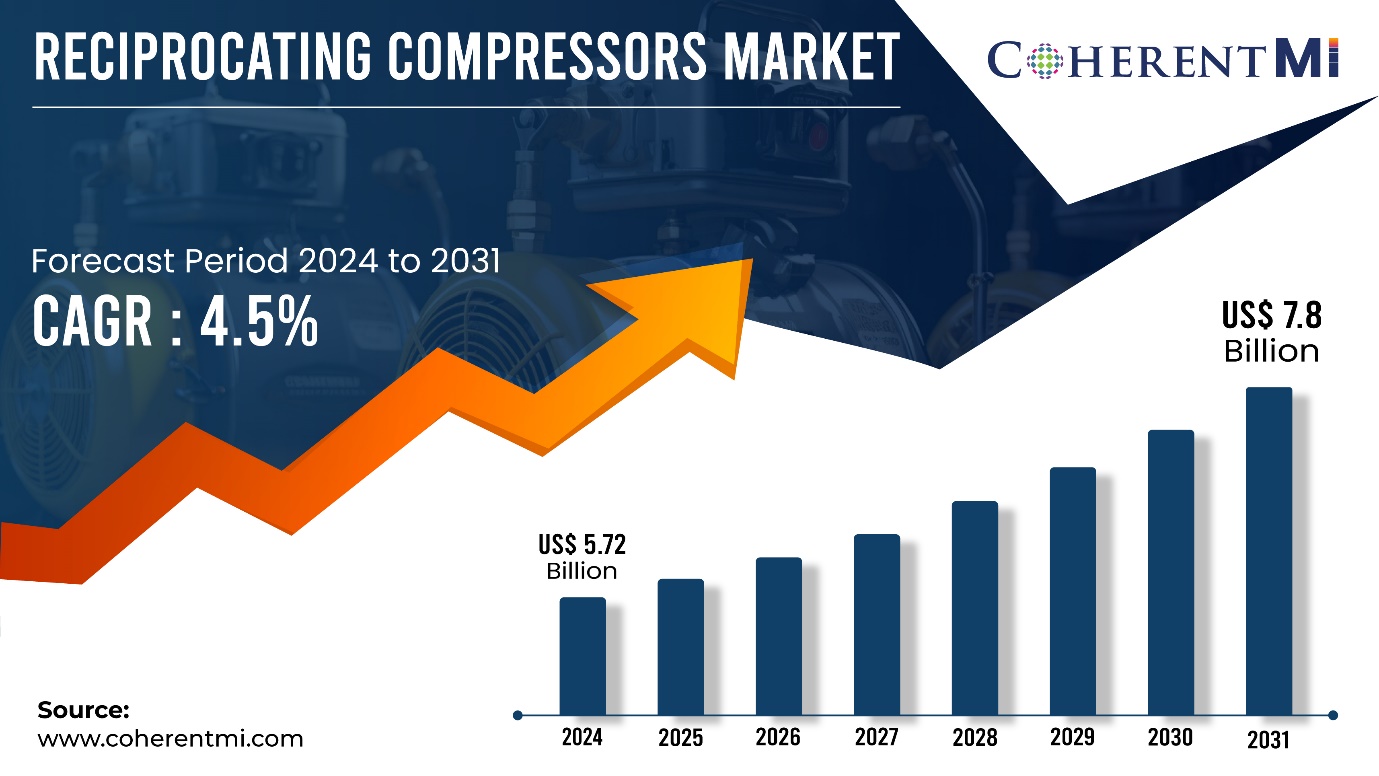

Burlingame, Nov. 28, 2024 (GLOBE NEWSWIRE) — According to the Coherent MI, The global Reciprocating Compressors Market Size was valued at USD 5.72 Billion in 2024 and is expected to reach USD 7.8 Billion by 2031, growing at a CAGR of 4.53% from 2024-2031.

The growth of the reciprocating compressors market is driven by rising oil and gas production activities across the globe. According to the U.S. Energy Information Administration (EIA), global crude oil production is expected to reach 101.3 million barrels per day (b/d) by 2030, up from 96.9 million b/d in 2020. Furthermore, natural gas production is also expected to grow at a rate of 1.6% annually during 2021-2050.

Get a Sample Report of Reciprocating Compressors Market @ https://www.coherentmi.com/industry-reports/reciprocating-compressors-market/request-sample

Rising demand for oil and gas is prompting companies to ramp up their production activities, thereby driving market growth for reciprocating compressors that are widely used in oil & gas production and transportation applications. In addition, growing carbon capture and storage projects are also propelling the demand for reciprocating compressors as they are used for transporting and injecting carbon dioxide into underground sites for safe storage.

Market Trends:

Increasing demand for hybrid compressors: Hybrid compressors that combine centrifugal and reciprocating compressors enable optimum capacity control over wider flow regimes and are gaining increasing adoption. For instance, in May 2021, Siemens Energy completed the successful commissioning of a hybrid compressor system at an LNG plant in Canada. Adoption of smart reciprocating compressors: Manufacturers are focusing on developing smart reciprocating compressors integrated with automation, remote monitoring, and predictive maintenance capabilities to improve performance and reduce downtime. For example, in January 2021, Burckhardt Compression introduced B-smart, a digitally enabled smart compressor solution. Growing aftermarket services: The aftermarket services for reciprocating compressor maintenance and overhauls is growing owing to increasing installed base and demand for minimizing downtime. Major companies are focusing on expanding their aftermarket footprint and service capabilities globally.

Reciprocating Compressors Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $5.72 billion |

| Estimated Value by 2031 | $7.8 billion |

| Growth Rate | Poised to grow at a CAGR of 4.53% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type, By End-use Industry, By Lubrication, By Service |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Increasing Industrialization Globally, Especially in Industries like Automotive, Oil and Gas, and Healthcare • Rising Demand for Energy-Efficient Solutions in Manufacturing Sectors |

| Restraints & Challenges | • High Cost of Repairs and Maintenance when Operational Limits are Exceeded |

Market Opportunity:

Single-acting reciprocating compressors held the largest market share of around 40% in 2024. This is owing to their simplistic design and ability to operate at a steady shaft speed regardless of system pressure changes.

Immediate Delivery Available | Buy This Premium Research Report @ https://www.coherentmi.com/industry-reports/reciprocating-compressors-market/buynow

Oil & gas was the dominant end use industry for reciprocating compressors in 2024, accounting for over 35% of the global market. This is attributed to increasing oil and gas exploration and production activities around the world.

Key Market Takeaways

The global reciprocating compressors market is anticipated to witness a CAGR of 4.53% during the forecast period 2024-2031, owing to growing demand from industries like oil & gas, chemical, and power generation.

On the basis of type, single-acting compressor segment is expected to hold a dominant position, owing to their simplistic design and ability to operate at steady speeds.

On the basis of end use industry, oil & gas industry will dominate the market over the forecast period, due to increasing oil and gas E&P activities globally.

By lubrication, oil-free segment is expected to be the leading segment owing to their various advantages over oil filled compressors.

Regionally, North America is expected to hold the largest market share during the forecast period, due to high demand from oil & gas industry in the US.

Key players operating in the reciprocating compressors market include Ariel Corporation, Atlas Copco, Burckhardt Compression AG, Gardner Denver Holdings Inc., GE Company, IHI Corporation Ltd., Siemens AG, Mitsui E&S Holdings Co., Ltd., Howden Group Ltd., and Mayekawa Mfg. Co, Ltd. Strategic partnerships andnew product launches are expected to be the key strategies adopted by these players.

Ask For Customization @ https://www.coherentmi.com/industry-reports/reciprocating-compressors-market/request-sample

Reciprocating Compressors Market Segmentation

By Type:

- Single-Acting Reciprocating Compressors

- Double-Acting Reciprocating Compressors

- Diaphragm Compressors

By End-use Industry:

- Oil & Gas Industry

- Chemical Industry

- Petrochemicals

- Fertilizers

- Manufacturing Industry

- Metals & Mining

- Automotive

- Power Generation Industry

- Thermal Power Plants

- Nuclear Power Plants

By Lubrication:

By Service:

- Upstream Services

- Midstream Services

- Downstream Services

By Region:

- North America

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

Find Most Trending Related Reports:

The Global Outdoor Power Equipment Market is estimated to be valued at USD 36.9 Bn in 2024 and is expected to reach USD 61.9 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2031.

The Global Oilfield Equipment Market is estimated to be valued at USD 129.6 Bn in 2024 and is expected to reach USD 173.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 3.7% from 2024 to 2031.

The Global Magnetic Filter Market is estimated to be valued at USD 11.4 Billion in 2024 and is expected to reach USD 19.3 Billion by 2031, growing at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2031.

The Global Brewery Equipment Market is estimated to be valued at USD 22.1 Bn in 2024 and is expected to reach USD 33.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2031.

The Global cleaning robot market is estimated to be valued at USD 16.1 Bn in 2024 and is expected to reach USD 48.4 Bn by 2031, growing at a compound annual growth rate (CAGR) of 24.4% from 2024 to 2031.

About Us:

At CoherentMI, we are a leading global market intelligence company dedicated to providing comprehensive insights, analysis, and strategic solutions to empower businesses and organizations worldwide. Moreover, CoherentMI is a subsidiary of Coherent Market Insights Pvt Ltd., which is a market intelligence and consulting organization that helps businesses in critical business decisions. With our cutting-edge technology and experienced team of industry experts, we deliver actionable intelligence that helps our clients make informed decisions and stay ahead in today’s rapidly changing business landscape.

Mr. Shah CoherentMI, U.S.: +1-650-918-5898 U.K: +44-020-8133-4027 Australia: +61-2-4786-0457 INDIA: +91-848-285-0837 Email: sales@coherentmi.com Website: https://www.coherentmi.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ByteDance seeks $1.1 million damages from intern in AI breach case, report says

BEIJING (Reuters) – China’s ByteDance is suing a former intern for $1.1 million, alleging he deliberately attacked its artificial intelligence large language model training infrastructure, a case that has drawn widespread attention within China amid a heated AI race.

The parent company of TikTok is seeking 8 million yuan ($1.1 million) in damages from the former intern, Tian Keyu, in a lawsuit filed with the Haidian District People’s Court in Beijing, the state-owned Legal Weekly reported this week.

While lawsuits between companies and employees are common in China, legal action against an intern and for such a large sum is unusual.

The case has drawn attention due to its focus on AI LLM training, a technology that has captured global interest amid rapid technological advances in so-called generative AI, used to produce text, images or other output from large bodies of data.

ByteDance declined to comment on the lawsuit on Thursday. Tian, whom other Chinese media outlets have identified as a postgraduate student at Peking University, did not immediately respond to emailed messages.

Tian is alleged to have deliberately sabotaged the team’s model training tasks through code manipulation and unauthorized modifications, according to Legal Weekly, which cited an internal ByteDance memo.

In a social media post in October, ByteDance said it had dismissed the intern in August. It said that, while there were rumors that the case had cost ByteDance losses in millions of dollars and involving over 8,000 graphics processing units, these were “seriously exaggerated.”

(Reporting by Liam Mo and Brenda Goh; Editing by Kevin Liffey)

Meet Wall Street's Newest Stock-Split Stock — an Industry-Leading Company That's Soared 2,100% Since Its IPO

In October, Wall Street celebrated the two-year anniversary of the current bull market. While the rise of artificial intelligence (AI) has played an undeniably important role in lifting Wall Street’s major stock indexes to new heights, the excitement surrounding select stock splits in 2024 has been key, as well.

A stock split is a tool publicly traded companies have at their disposal that allows them to superficially adjust their share price and outstanding share count by the same magnitude. These adjustments are cosmetic in the sense that they don’t affect a company’s market cap or in any way impact its operating performance.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Although there are two types of stock splits — forward and reverse — investors overwhelmingly favor one more than the other. Reverse splits are designed to increase a company’s share price, often with the goal of ensuring continued listing on a major stock exchange. Since this type of split is usually undertaken by struggling companies, most investors tend to avoid them.

On the other hand, forward stock splits are aimed at making a company’s shares more nominally affordable for everyday investors who might not have access to fractional-share purchasing through their broker. This type of split is almost always completed by businesses that have been consistently out-innovating and out-executing their competition, which is what’s made forward splits so popular within the investing community.

To add, companies enacting forward splits have been handily outperforming the benchmark S&P 500. Based on an analysis from Bank of America Global Research, companies conducting forward splits have averaged a 25.4% return in the 12 months following their split announcement since 1980, which is more than double the 11.9% average annual return for the S&P 500 over the same timeline.

Since Walmart kicked things off by announcing a 3-for-1 forward split in late January, more than a dozen high-profile companies have followed suit. This includes AI leader Nvidia, which completed its largest split on record (10-for-1) in June, and AI-networking specialist Broadcom, which enacted its first-ever split, also 10-for-1, in mid-July.

Given the overwhelming success companies conducting forward splits have demonstrated for more than four decades, investors are constantly on the lookout for which market-leading company will become Wall Street’s next stock-split stock.

Coherent MI: Expedition Truck Market Poised to Hit $481.7 Million by 2031

Burlingame, Nov. 28, 2024 (GLOBE NEWSWIRE) — According to the Coherent MI, The global Expedition Truck Market Size was valued at USD 221.2 Million in 2024 and is expected to reach USD 481.7 Million by 2031, growing at a CAGR of 8.9% from 2024-2031.

The growth of the expedition truck market is mainly driven by the increasing number of adventure tourism activities as well as off-road events across the globe. According to Adventure Travel Trade Association, the global participation in adventure tourism was 827 million in 2019 and is expected to reach 1.8 billion by 2030. Furthermore, the growing popularity of off-road racing and rallies such as Dakar Rally are also promoting the sales of expedition trucks.

Get a Sample Report of Expedition Truck Market @ https://www.coherentmi.com/industry-reports/expedition-truck-market/request-sample

Market Trends:

The expedition truck market is witnessing significant demand for trucks equipped with features such as all-wheel drive systems, increased ground clearance, reinforced chassis, auxiliary fuel tanks, and mounting points for additional accessories. Manufacturers are focusing on developing trucks with enhanced off-road capabilities as well as comfort features for onboard adventure travelers and enthusiasts. For instance, Overland Expedition Vehicles launched different expedition truck models such as X-Pac, X-Terra, and X-Recon, integrated with features such as roof-mounted tents, rear cargo systems, overhead storage units, and more. Furthermore, the introduction of hybrid and electric powertrains in expedition trucks is expected to be a major trend in the market over the forecast period. Major manufacturers such as Toyota Motors and Ford Motors are working on developing electric and hybrid expedition truck prototypes with superior off-road performance.

Expedition Truck Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $221.2 million |

| Estimated Value by 2031 | $481.7 million |

| Growth Rate | Poised to grow at a CAGR of 8.9% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Component, By Application |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Increasing demand for fully equipped expedition trucks for long-distance travel and camping activities. • The Growing Interest in Off-road Travel and Remote Area Exploration. |

| Restraints & Challenges | • High Initial Purchase and Maintenance Costs of Expedition Trucks Limit Market Expansion. |

The <3.5 Tonnes weight segment is anticipated to hold a dominant position in the expedition truck market, accounting for around 45% of the global sales in 2024. This is attributed to the fact that lighter expedition trucks provide sufficient loading capacity for most expedition trips while being very fuel efficient and easy to drive on tough terrains. These trucks are apt for short to medium trips and tend to be highly customizable as per customer requirements.

The 2WD drive system segment currently dominates the market with over 35% share globally. 2WD expedition trucks offer superior on-road handling and drivability at lower costs compared to their 4WD counterparts. However, with increasing focus towards off-road capabilities, the 4WD segment is expected to witness fastest growth during the forecast period. Above 4WD systems will remain a niche segment restricted to heavy expedition activities.

Immediate Delivery Available | Buy This Premium Research Report @ https://www.coherentmi.com/industry-reports/expedition-truck-market/buynow

Key Market Takeaways

The global expedition truck market is anticipated to witness a CAGR of 8.9% during the forecast period 2024-2031, driven by increasing interest of people in adventure travels and exploring remote areas. On the basis of weight, the <3.5 Tonnes segment is expected to hold a dominant position owing to optimal loading capacity and fuel efficiency. Based on drive system, while 2WD currently dominates, 4WD systems are expected to increase in demand for superior off-road capabilities.

Regionally, North America is anticipated to dominate the expedition truck market through 2031 supported by large off-road vehicle enthusiast base in countries like U.S. and Canada. Key players like Krug Expedition Truck, Gekkotruck, Global Expedition Vehicles, Action Mobile GmbH, and Bliss Mobil collectively account for over 50% of global sales. With increasing customization demands, specialty manufacturers are expected to garner higher growth rates over established brands.

Krug Expedition Truck, Gekkotruck, Global Expedition Vehicles, Action Mobile GmbH, Bliss Mobil, ROVER Off Road, Unicat GmbH, Motorcraft Adventure Developments, 27 North Inc and Boxmanufaktur are some of the leading players operating in the global expedition truck market. Overall, with the rising adventurism, the expedition truck market is expected to witness steady growth during the forecast period. Customers’ focus towards off-road capabilities and sustainability will shape market trends.

Recent Developments:

In July 2024, Krug Expedition launched the Bedrock XT2 in collaboration with Arctic Trucks, a vehicle designed for extreme off-road conditions, targeted at the U.S. market. This truck offers advanced off-road capabilities with top-of-the-line expedition features.

In November 2023, Storyteller Overland celebrated its 5th anniversary with the launch of a limited-edition adventure van, the “Retro OG MODE,” tailored for long-distance travel and off-road adventures.

Ask For Customization @ https://www.coherentmi.com/industry-reports/expedition-truck-market/request-sample

Find Most Trending Related Reports:

The Global Truck Rental Market is estimated to be valued at USD 270.1 Bn in 2024 and is expected to reach USD 330.1 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2031.

The Global Light Duty Vehicles Market is estimated to be valued at USD 87.2 Bn in 2024 and is expected to reach USD 188.2 Bn by 2031, growing at a compound annual growth rate (CAGR) of 11.1% from 2024 to 2031.

The Global Industrial Vehicle Market is estimated to be valued at USD 41.7 Bn in 2024 and is expected to reach USD 65.6 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2031.

About Us:

At CoherentMI, we are a leading global market intelligence company dedicated to providing comprehensive insights, analysis, and strategic solutions to empower businesses and organizations worldwide. Moreover, CoherentMI is a subsidiary of Coherent Market Insights Pvt Ltd., which is a market intelligence and consulting organization that helps businesses in critical business decisions. With our cutting-edge technology and experienced team of industry experts, we deliver actionable intelligence that helps our clients make informed decisions and stay ahead in today’s rapidly changing business landscape.

Mr. Shah CoherentMI, U.S.: +1-650-918-5898 U.K: +44-020-8133-4027 Australia: +61-2-4786-0457 INDIA: +91-848-285-0837 Email: sales@coherentmi.com Website: https://www.coherentmi.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

World markets head for reality check after month of Trump

By Naomi Rovnick, Dhara Ranasinghe and Nell Mackenzie

LONDON (Reuters) – November was a month of clear winners and losers from Donald Trump’s Nov. 5 U.S. election victory.

Trump trades, essentially punishing tariff-sensitive assets from European exporters to Mexico’s peso and driving investment towards U.S. stocks and the dollar, proved successful. Wall Street has rallied, the dollar gained 2% against rival major currencies and bitcoin surged.

But December could be bumpy, with the Trump trade vulnerable to a potential bond market backlash against fiscal largesse, while tariffs might boost inflation and snarl up supply chains.

“Elevated (U.S.) equity valuations reflect complacency as the more challenging environment we expect is not priced in,” BCA Research said.

Here’s a look at some assets in the spotlight.

1/ CURRENCY WOES

The euro has suffered its worst monthly drop since early 2022, losing just over 3% to around $1.05, on U.S. tariff risks, political upheaval in Germany and France and a sharp regional economic downturn.

Analysts expect more volatility in the $7.5 trillion-a-day currency markets as debate rages about how low the euro can go and whether Trump really will boost the U.S. economy while most others suffer.

Mexico’s peso dropped over 1% against the dollar in November, sterling lost almost 2%. China’s offshore yuan was set for its biggest monthly drop since Aug 2023, down almost 2%.

The key question in FX markets, Monex Europe senior market analyst Nick Rees said, is: “does Trump’s election victory presage a fundamental structural shift in the global economy, or are markets just engaged in a knee-jerk panic?”

2/ BITCOIN, BOOM OR BUST?

If there’s one asset that smashed it out of the park in November, it’s bitcoin.

The crypto currency has surged 37%, briefly eying the $100,000 milestone, on hopes of a more crypto-friendly regulatory environment under Trump.

The last time bitcoin surged as much was February, when money flooded into new bitcoin exchange-traded products.

So, what’s next? For some in the industry, a rise to $100,000 would mark the niche asset finally going mainstream.

“If bitcoin smashes through the $100,000 level… then even more people could find crypto on their radar,” said AJ Bell investment analyst Dan Coatsworth.

Others reckon there is a risk of speculative excess, meaning bitcoin’s surge could just as easily be followed by a sharp fall that catches some investors out.

3/ TECH UNDER TARIFFS

Wall Street’s tech-heavy Nasdaq 100 has scored its best monthly gain since June as Trump ally Elon Musk’s Tesla surged 33% and AI fervour boosted Nvidia even as the chipmaker forecast slower sales growth.

ISC's Technology Solutions Segment Wins Liechtenstein Contract to Deliver a Digital Commercial Registry System

- ISC wins contract with the Principality of Liechtenstein.

- Total contract valued at CHF$6.2 million (CA$10.0 million) over 5 years.

- Along with implementation, support and maintenance are included.

- Demonstrates ISC’s continued growth and expansion in delivering registry solutions globally.

REGINA, Saskatchewan, Nov. 28, 2024 (GLOBE NEWSWIRE) — Information Services Corporation ISV (“ISC” or the “Company”) is pleased to announce a new contract win. Through its wholly owned subsidiary, Enterprise Registry Solutions Limited, the Company has signed an agreement with the Principality of Liechtenstein (the “Principality”) to deliver a digital commercial registry system. The total value of the contract is CHF$6.2 million (approximately CA$10.0 million) and is for a period of 5 years.

The contract—which includes the deployment of an end-to-end digital solution for the Principality’s eHandelsregister—will be powered by ISC’s flexible and scalable RegSys platform. This system will enable government personnel to streamline workflows, provide efficient and accessible services to businesses, and individuals, and support the Principality’s commitment to digital transformation. RegSys will provide a suite of integrated features that support filing submissions, registry searches, and document retrieval, all delivered through a secure and intuitive customer portal designed for accessibility across all devices.

“With over two decades of experience delivering innovative and secure registry solutions internationally, we are well-positioned to support the Principality’s digital transformation as a trusted partner,” says Shawn Peters, President and CEO of ISC. “This project reflects our dedication to providing tailored registry solutions that enhance efficiency, improve the user experience and deliver lasting value to our customers and clients around the world.”

Utilizing the RegSys platform, ISC’s Technology Solutions segment has successfully implemented and supported corporate registries across three continents, including implementations in Ireland, Guernsey, Jersey, Cyprus, the Dutch Caribbean, and at various levels of government in Canada, among others. For sales inquiries or to request a product demonstration of the RegSys platform, please email us at contact@isc.ca.

See how ISC’s three lines of business are growing the registry operations, technology solutions and information services landscape: https://company.isc.ca/what-we-do.

About ISC

Headquartered in Canada, ISC is a leading provider of registry and information management services for public data and records. Throughout our history, we have delivered value to our clients by providing solutions to manage, secure and administer information through our Registry Operations, Services and Technology Solutions segments. ISC is focused on sustaining its core business while pursuing new growth opportunities. The Class A Shares of ISC trade on the Toronto Stock Exchange under the symbol ISV.

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking information within the meaning of applicable Canadian securities laws including, without limitation, statements related to the term of the Agreement between ISC and the Principality of Liechtenstein and anticipated benefits and the economic resiliency of contract terms. Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed or implied by such forward-looking information. Important factors that could cause actual results to differ materially from the Company’s plans or expectations include risks relating to changes in economic, market and business conditions, implementation within the time specified and at the expected cost, changes in technology and customers’ demands and expectations, termination risks and other risks detailed from time to time in the filings made by the Company including those detailed in ISC’s Annual Information Form for the year ended December 31, 2023 and ISC’s unaudited Condensed Consolidated Interim Financial Statements and Notes and Management’s Discussion and Analysis for the third quarter and nine months ended September 30, 2024, copies of which are filed on SEDAR+ at www.sedarplus.ca.

The forward-looking information in this release is made as of the date hereof and, except as required under applicable securities laws, ISC assumes no obligation to update or revise such information to reflect new events or circumstances.

Investor Contact

Jonathan Hackshaw

Senior Director, Investor Relations & Capital Markets

Toll Free: 1-855-341-8363 in North America or 1-306-798-1137

investor.relations@isc.ca

Media Contact

Jodi Bosnjak

External Communications Specialist

Toll Free: 1-855-341-8363 in North America or 1-306-798-1137

corp.communications@isc.ca

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GOP Megadonor Ken Griffin Slashes Citadel's Palantir Stake By 91%, Bets Big On Nvidia As Jensen Huang-Led Company Rises Over 180% In 2024

GOP Megadonor Ken Griffin‘s fund Citadel Advisors LLC made a major shift within the AI-linked investment universe by slashing its stake in Palantir Technologies Inc. PLTR and more than tripling its stake in Nvidia Corp NVDA, as per its third quarter 13F filings with the SEC.

Citadel Cuts Stake In Palantir

Having been on both the NYSE and Nasdaq exchanges this year, Palantir’s shares have risen by 298.37% year-to-date. This compares to 20% and 25% moves in the NYSE Composite and Nasdaq 100 Index, respectively, in the same period.

Alex Karp-led company deals with providing access to artificial intelligence targeting tools to the government and military contracts. Knowing Palantir’s business it’s unlikely for the financial market participants to peg this company for having a vehement, meme-making fandom.

However, its chief executive officer, Griffin-led fund – Citadel, has decisively cut its exposure to Palantir in the third quarter.

The fund boosted its call positions by 91% and put positions by 55%, but significantly reduced its ownership from 5.68 million shares to 508,086 shares in the third quarter—a 91% decline—bringing the stake’s value to $18,900 as of Sept. 30.

Also read: JD Vance’s Investment Playbook Has Bitcoin And ETFs: Here’s What Else The VP-Elect Is Betting On

Citadel Increase Stake In Nvidia

Nvidia shares have also outperformed the Nasdaq 100 Index as it has zoomed by 181% on a year-to-date basis. It has also been in a tight race with Apple Inc AAPL in terms of market capitalization. While it has surpassed Apple’s market cap earlier, at the time of the publication of this article Apple was ahead with a market cap of $3.551 trillion, while the Jensen Huang-led company stood at $3.314 trillion.

Citadel, one of the largest funds in the U.S., holds positions across 14,115 companies with a total invested value of $518.2 billion. The fund increased its stake by 194% to 7.122 million shares amounting to $864.96 million in Nvidia during the third quarter.

The AI industry’s bellwether, Nvidia, under the leadership of Huang, has issued optimistic projections for the forthcoming quarter and fiscal year 2025. This positive outlook is underpinned by the escalating production of the Blackwell chip.

Analyst Views On Palantir And Nvidia

According to Benzinga pro data, Palantir has a consensus price target of $30.22 apiece based on the ratings of 18 analysts. The highest price target among all the analysts tracked by Benzinga is $75 issued by BofA Securities on Nov. 25, whereas the lowest price target is $7.5 issued by Wolfe Research on Aug. 8, 2023.

The average price target of $63.67 between BofA Securities, Wedbush, and Goldman Sachs implies a 3.83% downside for Palantir.

According to Benzinga pro data, Nvidia has a consensus price target of $170.56 apiece based on the ratings of 40 analysts. The highest price target among all the analysts tracked by Benzinga is $220 per share issued by Rosenblatt on Nov. 21, whereas the lowest price target is $120 apiece issued by New Street Research on Aug. 6.

The average price target of $154.67 between DA Davidson, Phillip Securities, and Truist Securities implies a 13.74% upside for Nvidia.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

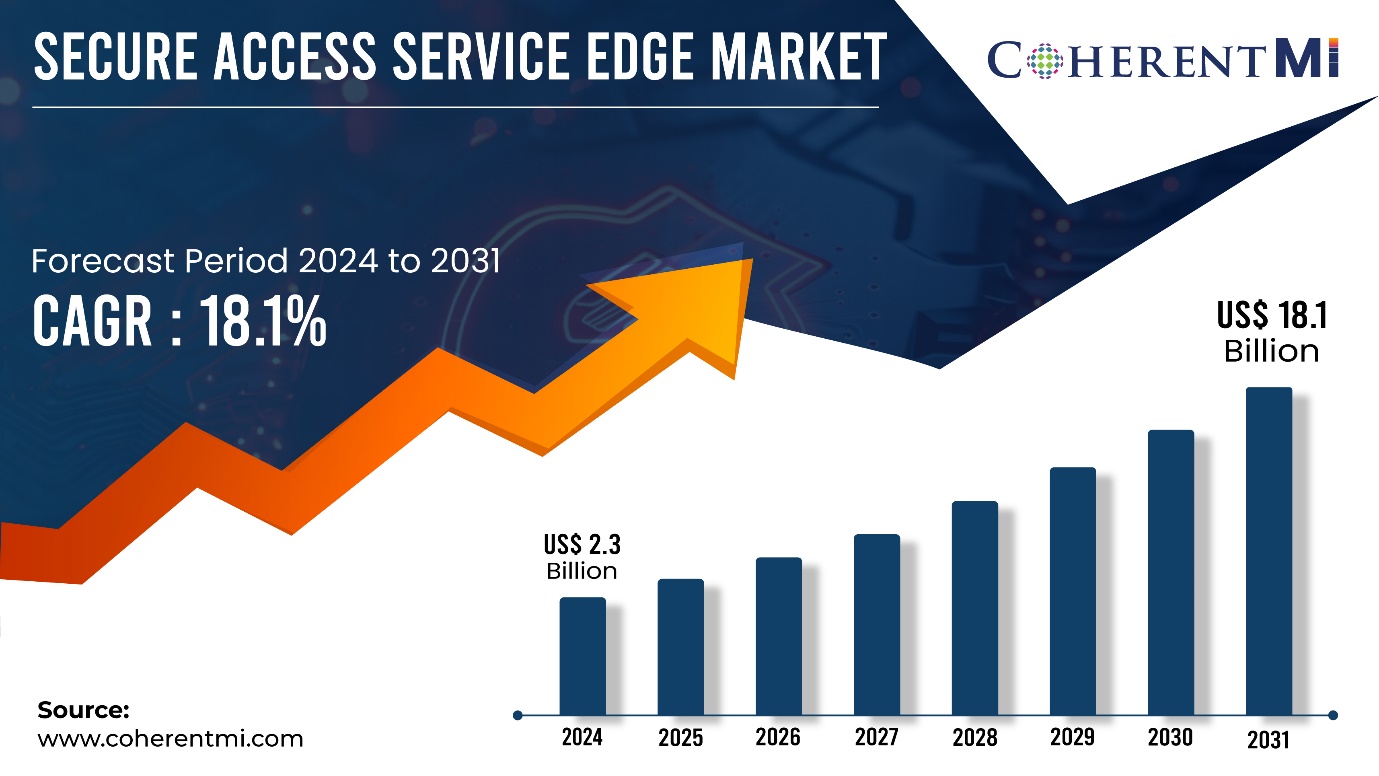

Coherent MI: Secure Access Service Edge Market Poised to Hit $19.1 Billion by 2031

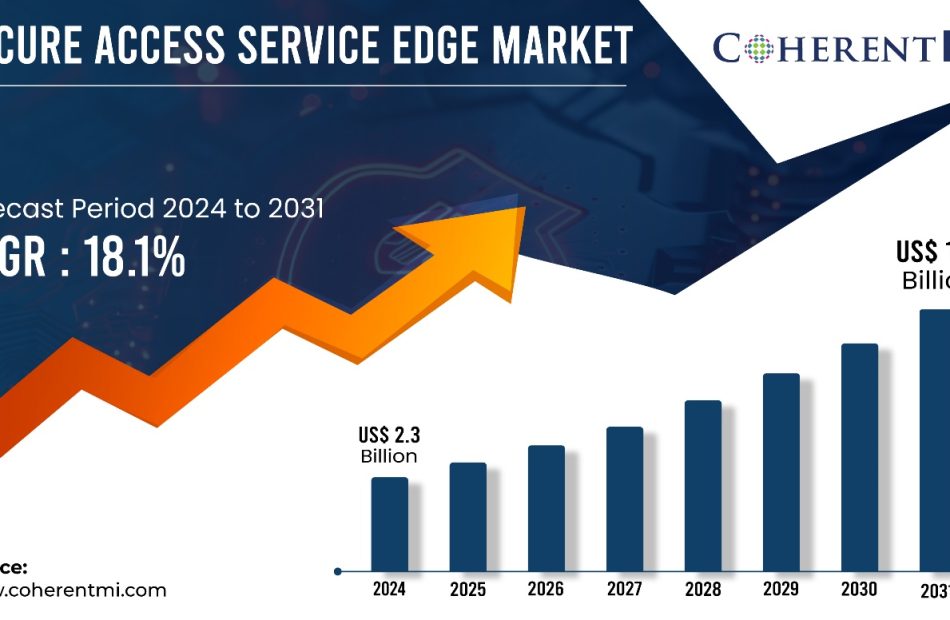

Burlingame, Nov. 28, 2024 (GLOBE NEWSWIRE) — According to the Coherent MI, The global Secure Access Service Edge Market Size was valued at USD 2.3 Billion in 2024 and is expected to reach USD 19.1 Billion by 2031, growing at a CAGR of 18.1% from 2024-2031.

The growth of the Secure Access Service Edge Market is primarily driven by the emergence of cloud technologies and increasing adoption of cloud services by enterprises. Cloud adoption is gaining traction as it offers benefits such as scalability, flexibility and reduced costs. However, it has also given rise to security issues such as lack of visibility, vulnerability exploitation and lack of access controls. SAS Edge addresses these challenges by providing unified access and micro-segmentation capabilities for all cloud environments. It enables zero-trust security model and restricts access to only authorized users and applications. Furthermore, increasing demand for work from anywhere model amid COVID-19 pandemic is also propelling the demand for SAS Edge solutions to securely access cloud applications remotely.

Get a Sample Report of Secure Access Service Edge Market @ https://www.coherentmi.com/industry-reports/secure-access-service-edge-market/request-sample

Market Trends:

Adoption of zero-trust security framework and micro-segmentation capabilities offered by SAS Edge solutions is a major trend in the market. Zero-trust assumes there is no implicit trust granted to assets and users inside or outside the network perimeter. It implements least privilege access whereby access to applications are granted based on a continuous verification/authorization of who is requesting access, the context of the request and the risk posture of the user. Another key trend gaining traction is growing demand for SAS Edge offerings that are cloud-agnostic and can secure applications hosted on public/private/hybrid clouds in a unified manner. Vendors are focusing on developing cloud-agnostic solutions that offer centralized visibility, policy management and enforcement across multiple cloud environments.

Secure Access Service Edge Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $2.3 billion |

| Estimated Value by 2031 | $19.1 billion |

| Growth Rate | Poised to grow at a CAGR of 18.1% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Component, By Application |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Strict Government Regulations and Data Protection Laws Globally, •Leading to the Adoption of Secure Cloud-Based Solutions |

| Restraints & Challenges | • Misinformation and Confusion About the SASE Framework and its Deployment. |

Market Opportunities:

Cloud-enabled SASE platforms are increasingly being adopted by enterprises looking to simplify their network security platforms. By integrating functionality like secure web gateway, cloud access security broker, and zero trust network access onto a single cloud-delivered platform, SASE offers advantages of reduced cost and complexity over traditional on-premise firewalls and VPNs. Major SASE vendors are offering comprehensive cloud-delivered security suites to capitalize on this trend.

Immediate Delivery Available | Buy This Premium Research Report @ https://www.coherentmi.com/industry-reports/secure-access-service-edge-market/buynow

More organizations are recognizintg the need to converge their networking and cybersecurity strategies to ensure consistent security policies across any user, device, or location. Traditional silos between network and security teams are breaking down, creating demand for integrated platforms like SASE that deliver networking and security as a unified service. By providing consistent security and connectivity globally, SASE aims to simplify operations for IT and security teams.

Key Market Takeaways

The global SASE market is anticipated to witness a CAGR of 18.1% during the forecast period 2024-2031, owing to the rising need to simplify network security architectures. On the basis of component, the platform segment is expected to hold a dominant position, accounting for over 60% market share by 2031 due to its comprehensive set of features.

By application, IT & telecom is expected to be the leading segment over the forecast period, driven by demand from telecom operators and managed services providers for SASE’s unified connectivity and security capabilities.

Regionally, North America is expected to dominate the SASE market through 2031, with major vendors based in the US offering advanced cloud-delivered SASE solutions.

Key players operating in the SASE market include Cisco, Palo Alto Networks, VMware, Inc., Versa Networks, Inc., Cato Networks, Check Point Software Technologies Ltd., McAfee, LLC, Open Systems, Hewlett Packard Enterprise Development LP and Barracuda Networks, Inc. Consolidation among SASE vendors is expected in order to offer more comprehensive capabilities through partnerships.

Need any customization research on Secure Access Service Edge Market @ https://www.coherentmi.com/industry-reports/secure-access-service-edge-market/request-sample

Market Segmentation

By Component

By Application

- IT & Telecom

- BFSI

- Manufacturing

- Retail & E-commerce

- Healthcare

- Others

By Region:

- North America

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

Find Most Trending Related Reports:

Global remote sensing services market size is estimated to be valued at US$ 17.13 Bn in 2023 and is expected to reach US$ 37.82 Bn by 2030, exhibit a compound annual growth rate (CAGR) of 11.8% from 2023 to 2030.

The Global Robotic Platform Market is estimated to be valued at USD 10.6 Bn in 2024 and is expected to reach USD 17.9 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2031.

The Global Video Management System Market is estimated to be valued at USD 17.1 Bn in 2024 and is expected to reach USD 58.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 12.1% from 2024 to 2031.

About Us:

At CoherentMI, we are a leading global market intelligence company dedicated to providing comprehensive insights, analysis, and strategic solutions to empower businesses and organizations worldwide. Moreover, CoherentMI is a subsidiary of Coherent Market Insights Pvt Ltd., which is a market intelligence and consulting organization that helps businesses in critical business decisions. With our cutting-edge technology and experienced team of industry experts, we deliver actionable intelligence that helps our clients make informed decisions and stay ahead in today’s rapidly changing business landscape.

Mr. Shah CoherentMI, U.S.: +1-650-918-5898 U.K: +44-020-8133-4027 Australia: +61-2-4786-0457 INDIA: +91-848-285-0837 Email: sales@coherentmi.com Website: https://www.coherentmi.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock-Split Watch: 1 Under-the-Radar Growth Stock Up 510% Since the Beginning of 2023

Stock splits have been in vogue recently. Large technology companies like Amazon, Alphabet, Nvidia, and Tesla have split their stocks after seeing their share prices get close to $1,000 or more. This financial engineering tactic didn’t change anything about these stocks’ underlying businesses, but it can make it easier for individual investors to buy a single share.

One potential stock-split candidate is Spotify (NYSE: SPOT). The audio streaming leader is up over 500% since the start of 2023, and the stock is now approaching $500 per share, or stock-split territory. Here’s why the stock has made a massive turnaround, and whether you should buy shares of Spotify after its big gains.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Many investors will know Spotify as it is one of the most popular music and podcast streaming services worldwide. With 640 million monthly active users (MAUs), perhaps only YouTube has a larger reach around the world in this niche.

Spotify mostly makes money by selling ad-free music listening through a subscription service. Premium subscription revenue has grown consistently since Spotify went public in 2018 with 24% growth on a foreign currency-neutral basis last quarter. In U.S. dollars, the segment is closing in on $15 billion in annual subscription revenue.

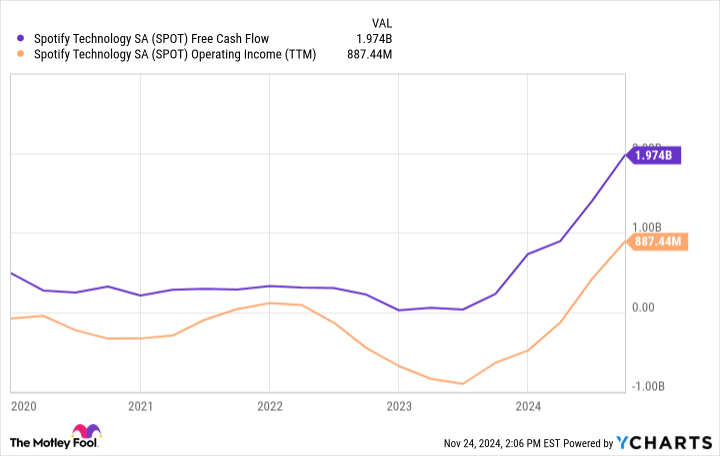

Investors were never concerned about Spotify’s revenue growth. The problems were around profitability. In the third quarter of 2023, Spotify’s gross margin was a measly 26.4%, not much higher than when it went public. Operating margin was only 1.0%, and it had been negative for many quarters before that. One year later, and the story has completely changed. Gross profit margin was 31.1% in Q3 2024 with operating margin exploding higher to 11.4%.

Spotify was able to do this for a few reasons. First, it cut down on its full-time employees, trimming them by over 20% in the past year while seeing no effect on revenue growth. Second, it is seeing more revenue from its high-margin promotional marketplace, which is leading to gross margin expansion. Third, the company has started to raise prices on its subscription services, which — along with the falling employee numbers — has led to operating leverage and the double-digit operating margin.

Given the stock’s rally and the platform’s 640 million MAUs, investors may worry Spotify will hit user saturation sometime soon. This may be true in its most mature markets like the Nordics (the first market it entered), but it’s nowhere near the case in the majority of countries around the world. Internet penetration in places such as India, Indonesia, and Latin America will continue to grow in the coming years, which should lead Spotify to more MAU gains.