Wall Street's December Surprise: What Investors Need to Know Now

Major U.S. indices have advanced between 18% to 27% year-to-date. The S&P 500 Index scaled its 52nd record high this year on Tuesday, Nov. 26. Bulls and Bears are locking horns as S&P 500 is on track to deliver 20% plus year-to-date gains for the second time.

What Happened: Markets have been under pressure only once in the month of December over the last 95 years, according to the data highlighted by Ryan Detrick, chief market strategist at Carson Group LLC.

Thanksgiving falls on the fourth Thursday of November every year, addressing the next month of December, Detrick shared the data and said “Something to be thankful for?”, in an X (formerly Twitter). The data from 1928 to 2023 showed that September has been the worst 13 times while April is the worst month this year with a 4% drop.

On the other hand, David Cox, CMT, CFA, portfolio manager at Raymond James Ltd., in an X Post highlighted the likelihood of an upcoming to the investors, saying “If you want to sidestep a decline, watch the trend…”

The 13/34-week Exponential Moving Average signals a bullish market trend when the 13-week EMA line is above the 34-week EMA line and a bullish crossover results in a market correction. Predicting an upcoming crossover through his chart Cox said that “there will be another red circle some day”, The red circle in his chart represents a bullish crossover.

According to a note by CMGWealth, the 13/34-week EMA analysis is a “simple, tactical trend indicator that has historically captured the cyclical bull and bear market trends.”

Why It Matters: Markets have been trading higher than their pre-election levels and the expectations of a further 25 basis point rate cut in December rose to just 66.3%, according to CME Group’s FedWatch tool. This indicates a further upside in the stock markets.

The S&P 500 index has risen 26.48% year-to-date to basis. Whereas, the Nasdaq 100, Dow Jones, and Russell 200 Index have returned 25.39%, 18.58%, and 20.54%, respectively. The SPDR S&P 500 ETF Trust SPY was up by 26.7% and the Invesco QQQ ETF QQQ advanced by 23.39%, according to Benzinga Pro data.

Read next: JD Vance’s Investment Playbook Has Bitcoin And ETFs: Here’s What Else The VP-Elect Is Betting On

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Uniqlo risks boycott in China after CEO's Xinjiang comment

BEIJING (Reuters) – Casual wear giant Uniqlo is facing calls for a consumer boycott in China after the CEO of the clothing company’s owner said it does not source cotton from China’s Xinjiang, which has faced allegations of forced labour in recent years.

Fast Retailing CEO Tadashi Yanai made the comment during an interview in Tokyo with the British Broadcasting Corporation that was published on Thursday.

Two hashtags on Yanai’s comment went viral on Friday on Chinese social media platform Weibo, where several users slammed the company and vowed to never purchase its products.

“With this kind of attitude from Uniqlo, and their founder being so arrogant, they’re probably betting that mainland consumers will forget about it in a few days and continue to buy. So, can we stand firm this time?” one user wrote.

Fast Retailing did not immediately respond to a request for comment.

China is Fast Retailing’s biggest overseas market and it has more than 900 stores on the mainland. Greater China, including Taiwan and Hong Kong, accounts for more than 20% of the company’s revenue.

The issue of sourcing from Xinjiang has been a geopolitical minefield for foreign firms with a large presence in China.

This was demonstrated by the consumer boycott Uniqlo’s rival, H&M, faced in China in 2021 for a statement posted on its website where it expressed concern about the allegations of forced labour in Xinjiang and said it would no longer source cotton from there.

H&M saw its stores removed from major e-commerce platforms and its store locations moved from map apps in China as it bore the brunt of consumer anger at companies refusing to source cotton from Xinjiang, although other Western brands including Nike, Puma, Burberry and more were also caught up in the controversy.

(Reporting by Eduardo Baptista in Beijing and Casey Hall in Shanghai; Editing by Raju Gopalakrishnan)

Cathie Wood Sees Tesla As 'Largest AI Project On Earth' — Here's Why She's Not Worried About Tech Investments

Cathie Wood, founder and CEO of ARK Investment Management LLC, defended the future of artificial intelligence investments while highlighting Tesla Inc. TSLA as a cornerstone of technological innovation during a recent podcast appearance with SoFi‘s Head of Investment Strategy, Liz Thomas.

What Happened: Wood popularly known for leading ARK Innovation ETF ARKK characterized Tesla as “the largest AI project on Earth,” emphasizing AI’s transformative potential across multiple sectors.

She particularly highlighted healthcare advancements, where AI’s convergence with sequencing technologies could revolutionize cancer diagnosis through blood testing, especially when combined with CRISPR gene editing capabilities.

Addressing concerns about heavy GPU and cloud infrastructure investments by major tech companies, Wood acknowledged investor skepticism about capital expenditure increases.

Wood cited Microsoft Corp‘s MSFT dramatic spending surge from $30 billion to $60 billion in 18 months as an example of investments that have yet to demonstrate clear returns.

Why It Matters: The ARK Invest CEO’s comments come amid her firm’s recent portfolio adjustments, including an $18 million reduction in Tesla holdings through its flagship funds. Despite these sales, Wood maintains a bullish long-term outlook on Tesla’s autonomous driving potential, projecting a “trillion-dollar-plus revenue opportunity.”

Wood’s investment thesis extends beyond Tesla to the broader biologics sector, where she envisions a $400 billion market opportunity emerging from the convergence of AI, genetic sequencing, and gene editing technologies.

Her ARK Genomic Revolution ETF ARKG, managing $1.179 billion in assets, reflects this conviction through significant investments in companies like Twist Bioscience Corp. TWST and CRISPR Therapeutics AG CRSP.

Responding to concerns about elevated market valuations, Wood noted that current market multiples in the low 20s leave little room for error. However, she remains confident in the emergence of transformational business models, particularly at the intersection of AI and healthcare innovation, where she sees potential for revolutionary advances in disease treatment and diagnosis.

Read Next:

Image via Ark Invest

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

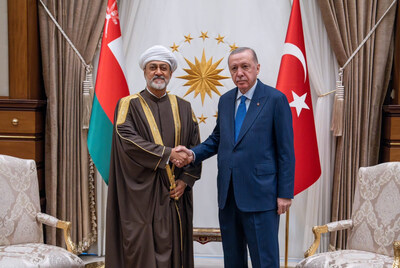

OIA ANNOUNCES A US$500 MILLION STRATEGIC COLLABORATION WITH TÜRKIYE'S OYAK FUND

MARKING ITS NINTH STRATEGIC PARTNERSHIP WITH GLOBAL WEALTH FUNDS

MUSCAT, Oman, Nov. 29, 2024 /PRNewswire/ — As part of His Majesty Sultan Haitham bin Tarik’s state visit to the Republic of Türkiye, Oman Investment Authority (OIA), Oman’s Sovereign Wealth Fund, announced a US$500 million collaboration with Türkiye’s state-owned OYAK Fund. This joint capital allocation, with equal contributions from both entities, underscores Oman’s commitment to strengthening economic ties with global partners while advancing mutual growth and development.

This partnership will focus on investments in Oman and Türkiye, with prospects for expansion into other international markets.This initiative further reinforces OIA’s ongoing strategy to establish high-value investment alliances that deliver significant financial and strategic returns.

H.E. Abdulsalam bin Mohammed Al Murshidi, President of the Oman Investment Authority, stated: “We have built a global reputation and sufficient expertise to form impactful partnerships that bring tangible benefits to Oman’s economy. This latest collaboration with OYAK Fund seamlessly aligns with our strategic objectives to expand our investment network and secure meaningful returns.”

OYAK General Manager Süleyman Savaş Erdem added, “The joint fund we have established with the Oman Investment Authority is an indication of the trust in our country and our corporation. With this fund, we will be making investments in strategic areas not only in both countries, but also in different regions of the world. This partnership will strengthen our vision of being a global company.”

OYAK Fund brings significant resources and expertise to this collaboration, enhancing its potential to drive economic growth in both countries. Key industries targeted for investment include mining, metals, automotive manufacturing, logistics, chemicals, agriculture, food production, and energy. It also aims to facilitate technology transfer and localize expertise in Oman, fostering capacity building and knowledge sharing.

This agreement marks OIA’s ninth strategic partnership with global entities, building on successful collaborations with Saudi Arabia, Qatar, Spain, Brunei Darussalam, Vietnam, Uzbekistan, Pakistan, and India. These alliances have delivered positive outcomes, such as new investments, profitable exits, and increased capital allocations. The authority’s growing portfolio underscores its pivotal role in driving Oman’s economic diversification and international economic diplomacy.

By leveraging the expertise and resources from trusted international partners, OIA continues to pave the way for sustained economic growth and prosperity for the Sultanate of Oman.

Contact:

For more information, please contact:

Fahad Al Toubi, Senior Specialist – Media Relations

+968 92155655

Fahad.AlToubi@oia.gov.om

Photo – https://stockburger.news/wp-content/uploads/2024/11/Oman_Investment_Authority.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/oia-announces-a-us500-million-strategic-collaboration-with-turkiyes-oyak-fund-302318623.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/oia-announces-a-us500-million-strategic-collaboration-with-turkiyes-oyak-fund-302318623.html

SOURCE Oman Investment Authority

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Montreal Chest Institute Rehabilitation Project Multi-Awarded at the World Architecture Festival in Singapore

MONTRÉAL, Nov. 28, 2024 /CNW/ – The architecture of the Inspire bio innovations project has gained international recognition by receiving the title of Future Office: Project of the Year at the prestigious World Architecture Festival (WAF). Held in Singapore this year, the annual event gathers standout projects from around the world, recognizing the best of design through competitions before a live jury. The project, initiated by Jadco Group and designed by NEUF architect(e)s, was also honoured with a WAFX Award, an out-of-competition category highlighting the architects’ innovative approach to tomorrow’s challenges: successfully repurposing an abandoned urban infrastructure, integrating heritage elements, enhancing community resilience, and incorporating sustainable development.

PROJECT IMAGES AND VIDEOS: CLICK HERE

World Architecture Festival

WAF is the only festival to bring together architects from every continent to celebrate the best in design, technology and sustainability through inspiring awards and seminars. The event features a unique live awards programme, where designers present their work to their peers. This year’s edition received almost 1,000 entries from 68 countries, resulting in almost 400 finalists. Among the winners, only one was from Quebec: the firm NEUF architect(e)s, recognized for its rehabilitation project at the Montreal Chest Institute.

Having won at previous editions of the festival, this year NEUF competed in the Future Projects-Health and Future Projects-Offices categories and received its first award during the shortlisting stage, winning the WAFX award for its exemplary approach to heritage, both respectful and creative. The presentation by Azad Chichmanian, lead designer, particularly impressed the panel of experts and elicited very positive reactions from all the members of the jury, who unanimously selected the rehabilitation project for the Montreal Chest Institute as a winner. This week, another award from the Rethinking the Future competition in the Health category and a nomination for the DNA Paris Design Awards bear further witness to the exceptional quality of the proposal.

Breathing life into an abandoned urban hospital

Constructed in the 1930s as the Royal Edward Institute, the Montreal Chest Institute (MCI) was a key medical centre in the history of Montreal and Quebec. A surgical wing was added in the 1950s. Neglected and finally abandoned, the campus will now be revived as a new life sciences hub specializing in research into respiratory illnesses, continuing the site’s original vocation at the foot of Mount Royal.

Inspire bio innovations

Located in the heart of downtown Montreal and the university quadrilateral, directly across from the Institut de recherches cliniques de Montreal (IRCM), Inspire Bio Innovations is emerging as the centrepiece of the life sciences ecosystem. This dynamic hub will bring together major pharmaceutical companies, biotechnology firms, research institutes, students, university researchers, and innovative start-ups to collaboratively accelerate the development of scientific discoveries and make them accessible worldwide. Ultimately, this Jadco Group project will provide 450,000 square feet dedicated to advancing the life sciences.

Phase 1, currently under construction, will host the global headquarters of CellCarta, a leading provider of specialized precision medical laboratory services to the biopharmaceutical industry. The second phase will bring together researchers and health technology companies in a new nine-storey addition that matches the height of the Clinical Research Institute of Montreal (CRIM), located just to the north. A glazed atrium and rooftop garden will create a simplified, light massing that will expand and frame views of the mountain, create a common meeting point and provide teaching spaces for the growing life sciences community.

Quotes

“I am delighted that the architectural excellence and innovative design of this rehabilitation project have received international recognition. This award paves the way for the next phases in the redevelopment of the former Montreal Chest Institute and heralds the fact that this new centre for employment and innovation in the health sector will help to revitalize the Milton-Parc district.” – Luc Rabouin, Mayor of the borough of Plateau-Mont-Royal, Ville de Montreal.

“As an architect, it’s particularly important to receive recognition from such respected peers, especially in a competition as prestigious as the WAF, and despite the complexity of constraints that had to be resolved for this project. This distinction is rare in our field and reflects the rigorous work of my team to achieve such a high level of design quality. We were humbled by the jury’s praise and the congratulations we received after each presentation. We are proud to bring home these awards, not only for our firm, but also for Montreal and Quebec. It’s further proof that our local talent is being recognized worldwide.” – Azad Chichmanian, Architect and Partner, NEUF architect(e)s.

“Jadco Group is very proud of this prestigious award, which underlines the exceptional architectural quality of the Inspire bio innovations project and reinforces its position as one of the world’s top life sciences innovation hubs. This recognition reinforces its status as an internationally renowned magnet for talent, biotech companies and local and international investment. – Normand Rivard, Managing Partner, Inspire bio innovations by Jadco Group.

Technical information

Name: Rehabilitation of the Montreal Chest Institute

Surface area: 282,110 ft2/20,926 m2

Year: 2025

Location: Montreal (QC), Canada

Architect: NEUF architect(e)s

Consultants: BC2 and Fahey et associés (urban planning); Bouthillette Parizeau (building engineering and sustainable development); NCK (structural engineering)

Client: Inspire bio innovations by Jadco Group

About NEUF architect(e)s

Founded in 1971, NEUF has become one of Canada’s largest and most diversified architecture and design firms. With offices in Montreal, Ottawa and Toronto, its practice is built on lasting client relationships and the commitment of its 250 employees. Its collaborative approach has resulted in more than 8,000 projects serving communities worldwide. NEUF is recognized for the exceptional quality of its design services in several sectors, building a rich and diverse portfolio that includes projects for iconic Canadian institutions, private and public real estate developers, and state-of-the-art industrial buildings for international market leaders.

About Jadco Group

Founded in 1987, Jadco Group is a Quebec-based real estate company that designs, develops and builds signature residential and industrial projects specifically for the life sciences ecosystem. Renowned for the high quality of its projects, which meet the most stringent ESG standards, Jadco and its institutional partners have accumulated over $1.2 billion in investments in Quebec. The company also acts as a property manager. www.jadcocorporation.com

SOURCE Neuf Architect(e)s

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/28/c7249.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/28/c7249.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Paratus Reports Q3 2024 Results, Reaffirms Commitment to Shareholder Returns

HAMILTON, Bermuda, Nov. 29, 2024 /PRNewswire/ — Paratus Energy Services Ltd. PLSV (“Paratus” or the “Company”) today reported operational and financial results for the third quarter of 2024, highlighted by $110 million in revenues and $63 million in adjusted EBITDA. At quarter-end, the Group held $165 million in cash deposits and had a net debt balance of $597 million.

Building on the momentum established by the inaugural quarterly cash distribution to shareholders for the second quarter, Paratus is pleased to announce that the Board of Directors (“Board”) has authorized a cash distribution to shareholders of $0.22 per share for the third quarter of 2024. This distribution reflects the continued confidence in the Company’s financial strength and commitment to creating long-term value for shareholders.

“Paratus is delivering on our commitment to return a majority of our excess free cash in the form of stable distributions to shareholders.” said Robert Jensen, CEO of Paratus. “Including this distribution, we will have returned more than 10% of our current market cap to shareholders since early September. This is a testament to our strong balance sheet and solid operational performance this year, and highlights Paratus’ differentiated capital returns program.”

(Note: numbers below are based on management reporting)

Key highlights

- Revenues of $110 million, including $8 million of variable revenue previously not recognized in Mexico.

- EBITDA of $63 million on the back of solid operational performance and cost discipline. EBITDA excluding variable revenue in Mexico was $54 million broadly in line with the previous quarter ($55 million).

- Reported net loss of $15 million was primarily due to a one-time, non-cash accounting expense of $35 million related to the partial redemption of the 2026 Notes. Excluding this item, the Company generated net income of $20 million.

- Exited the quarter with Group cash balance of $165 million and $597 million in net debt.

- Seagems secured $32 million additional backlog for Esmeralda and Fontis dayrates were adjusted up 4% following contractual market indexation, effective August.

- In October 2024, Paratus invested $12 million (its pro-rata share) in a private placement of Archer to support a strategic acquisition transaction.

- In November 2024, Paratus successfully uplisted onto the Euronext Oslo Børs.

- In November 2024, the Board of Directors authorized a cash distribution to shareholders of $0.22 per share for the third quarter of 2024, in line with the previous quarter.

Fontis

Fontis recorded total revenues of $63 million (Q2 2024: $72 million) including $8 million (Q2 2024: $15 million) in recognition of variable revenue from previously unbilled services that were agreed with the customer. Operating expenses (Opex) were $23 million, which was lower than the previous quarter (Q2 2024: $24 million), and general and administrative expenses (G&A) were $1 million, in line with the previous quarter (Q2 2024: $1 million). Adjusted EBITDA was $39 million compared to $47 million in Q2 2024 primarily due to a smaller portion of variable revenue from previously unbilled services compared to Q2 2024. For informational purposes, EBITDA generated during the quarter excluding variable revenues, was $31 million, which was largely in line with the previous quarter (Q2 2024: $32 million), despite the planned downtime of the Courageous for 58 days during the quarter due to the installation of a new crane.

In Q3 2024, Fontis achieved an average dayrate of $135.1 thousand per day (Q2 2024: $126.7 thousand per day) and an average technical utilization of 99.0% (Q2 2024: 99.8%), closing the quarter with a contract backlog of $317 million.

At the end of Q3 2024, the notional amount of the accounts receivable was $283 million, up from $215 million in Q2 2024. Fontis collected $106 million of receivables during the first nine months of 2024, including $90 million in Q2 2024. No payments have been received since the start of the third quarter, consistent with trends amongst other similar service companies in Mexico, causing receivables to rise with billed and accrued revenues. Additionally, $29 million was invoiced for previously unbilled services, further increasing the receivables balance. The Company has noted that the Mexican government has publicly expressed plans to support Fontis’ customer, including direct financial assistance and a tax reform to help the customer address its financial obligations and achieve operational efficiencies. The Company, leveraging over a decade-long relationship, has booked revenues of around $825 million and collected around $850 million since 2021, demonstrating strong collection resilience despite short-term fluctuations. The Company is actively engaging with the client to expedite the collection of outstanding receivables and expects to recover the full amount, as has been the case in the past, while acknowledging and planning for the possibility of ongoing fluctuations in the timing of collections. Consequently, the Company is also actively exploring alternative opportunities to potentially monetize part of its receivables balance of $283 million and will update the market accordingly if it enters any such transactions.

Seagems JV

The Company’s 50% share in the JV contributed with $47 million in contract revenues (Q2 2024: $52 million) and $25 million in adjusted EBITDA (Q2 2024: $28 million). The decrease in revenue was mainly driven by lower average dayrate and lower average technical utilization. Operating expenses (Opex) were $17 million and general and administrative expenses (G&A) were $3 million, both largely in line with the previous quarter (Q2 2024: $17 million and $3 million, respectively).

The JV achieved an average contractual rate of $185.7 thousand per day (Q2 2024: $200.8 thousand per day) and an average technical utilization of 97.7% (Q2 2024: 99.3%). The lower average dayrate in Q3 2024 compared to Q2 2024 was mainly due to Jade and Onix operating under contracts with lower dayrates in the quarter, compared to spot contracts with higher dayrates in the previous quarter.

As previously announced, pursuant to an agreed plan amongst the JV shareholders, Seagems distributes all excess cash to its JV shareholders. During Q3 2024, the JV distributed $22 million to Paratus (Q2 2024: $14 million).

In September, Seagems received the 2024 Petrobras Best Supplier Award as the best Pipelaying Company. This is the third time in seven editions that the company receives this award.

(*) Figures reflect period between 2021-Q3 2024. Included in the $850 million figure is VAT and the nominal value of $196 million unsecured notes issued by the customer in lieu of cash settlement for an equivalent amount of outstanding Fontis accounts receivables. During 2022, Fontis sold these notes for $186 million.

Webcast and Q&A Session

Paratus will host a presentation of the Q3 2024 results via an audio webcast today at 15:00 CET. The presentation will be led by CEO Robert Jensen and CFO Baton Haxhimehmedi. A Q&A session will follow the presentation, with instructions on how to submit questions provided at the start of the session.

To join the webcast, please use the following link: https://channel.royalcast.com/landingpage/paratus-energy/20241129_2/

For further information, please contact:

Robert Jensen, CEO, Robert.Jensen@paratus-energy.com, +47 958 26 729

Baton Haxhimehmedi, CFO, Baton.Haxhimehmedi@paratus-energy.com, +47 406 39 083

This information is subject to the disclosure requirements pursuant to section 5-12 the Norwegian Securities Trading Act.

Attachments

- Q3 2024 Interim Results Report

- Q3 2024 Interim Results Presentation

An updated company presentation is also available at the Company’s website (www.paratus-energy.com).

About Paratus

Paratus Energy Services Ltd. PLSV is an investment holding company of a group of leading energy services companies. The Paratus Group is primarily comprised of its ownership of Fontis and a 50/50 JV interest in Seagems (formerly Seabras). Fontis is an offshore drilling company with a fleet of five high-specification jack-up rigs working under contracts in Mexico. Seagems is a leading subsea services company, with a fleet of six multi-purpose pipe-laying support vessels under contracts in Brazil. In addition, Paratus is the largest shareholder in Archer Ltd, a global oil services company, listed on the Euronext Oslo Børs.

Forward-Looking Statements

This release includes forward-looking statements. Such statements are generally not historical in nature, and specifically include statements about the Company’s and / or the Paratus Group’s (including any member of the Paratus Group) plans, strategies, business prospects, changes and trends in its business and the markets in which it operates. These statements are based on management’s current plans, expectations, assumptions and beliefs concerning future events impacting the Company and / or the Paratus Group and therefore involve a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, which speak only as of the date of this news release. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, management’s reliance on third party professional advisors and operational partners and providers, the Company’s ability (or inability) to control the operations and governance of certain joint ventures and investment vehicles, oil and energy services and solutions market conditions, subsea services market conditions, and offshore drilling market conditions, the cost and timing of capital projects, the performance of operating assets, delay in payment or disputes with customers, the ability to successfully employ operating assets, procure or have access to financing, ability to comply with loan covenants, liquidity and adequacy of cash flow from operations of its subsidiaries and investments, fluctuations in the international price of oil or alternative energy sources, international financial, commodity or currency market conditions, including, in each case, the impact of pandemics and related economic conditions, changes in governmental regulations, including in connection with pandemics, that affect the Paratus Group, increased competition in any of the industries in which the Paratus Group operates, the impact of global economic conditions and global health threats, including in connection with pandemics, our ability to maintain relationships with suppliers, customers, joint venture partners, professional advisors, operational partners and providers, employees and other third parties and our ability to maintain adequate financing to support our business plans, factors related to the offshore drilling, subsea services, and oil and energy services and solutions markets, the impact of global economic conditions, our liquidity and the adequacy of cash flows for our obligations, including the ability of the Company’s subsidiaries and investment vehicles to pay dividends, political and other uncertainties, the concentration of our revenues in certain geographical jurisdictions, limitations on insurance coverage, our ability to attract and retain skilled personnel on commercially reasonable terms, the level of expected capital expenditures, our expected financing of such capital expenditures, and the timing and cost of completion of capital projects, fluctuations in interest rates or exchange rates and currency devaluations relating to foreign or U.S. monetary policy, tax matters, changes in tax laws, treaties and regulations, tax assessments and liabilities for tax issues, legal and regulatory matters, customs and environmental matters, the potential impacts on our business resulting from climate-change or greenhouse gas legislation or regulations, the impact on our business from climate-change related physical changes or changes in weather patterns, and the occurrence of cybersecurity incidents, attacks or other breaches to our information technology systems, including our rig operating systems. Consequently, no forward-looking statement can be guaranteed.

Neither the Company nor any member of the Paratus Group undertakes any obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict all of these factors. Further, we cannot assess the impact of each such factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement.

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/paratus-reports-q3-2024-results-reaffirms-commitment-to-shareholder-returns-302318606.html

View original content:https://www.prnewswire.com/news-releases/paratus-reports-q3-2024-results-reaffirms-commitment-to-shareholder-returns-302318606.html

SOURCE Paratus Energy Services Ltd

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple Impersonators Drain Elderly Man's Account In Crypto Fraud, Feds Seek $1M Forfeiture

Federal prosecutors in Cleveland are seeking forfeiture of nearly $1 million in cryptocurrency linked to a scam that drained an elderly Elyria man’s life savings, highlighting the growing trend of sophisticated crypto fraud targeting vulnerable investors.

What Happened: The victim lost $408,000 after scammers, posing as Apple Inc. support representatives, gained remote access to his computer in October 2023. The criminals transferred his funds through Tether USDT/USD, the largest stablecoin platform, to obscure the money trail, according to news publication Cleveland.

The case marks the second time in two months that Cleveland prosecutors have pursued the seizure of stolen funds laundered through Tether.

“The scammers wired money from the victim’s bank to a virtual currency account, then transferred it through multiple cryptocurrency wallets,” prosecutors told U.S. District Judge Pamela Barker in their filing. The victim and his wife now rely solely on Social Security and family support.

The Cleveland FBI’s investigation revealed an additional $539,000 in suspected stolen or laundered cryptocurrency linked to the same criminal network, bringing the total seized funds to $947,000.

Why It Matters: This case emerges amid an unprecedented surge in cryptocurrency crime in 2024, with industry losses exceeding $1.58 billion, according to recent reports. Just this August, the SEC uncovered a $650 million crypto fraud scheme, while a separate Genesis creditor heist resulted in $243 million in losses.

The scam followed a common pattern where criminals initiate contact through computer alerts, phone calls, or social media. In this instance, the perpetrators exploited the victim’s trust through a fake computer security alert and sophisticated social engineering tactics.

Read Next:

Image via Freepik

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Western Forest Products and United Steelworkers Reach Tentative Collective Agreement

VANCOUVER, British Columbia, Nov. 28, 2024 (GLOBE NEWSWIRE) — Western Forest Products Inc. WEF (“Western” or the “Company”) announced today that the Company and the United Steelworkers Local 1-1937 (“USW”) have agreed to the terms of a tentative collective agreement. The USW represents approximately 1,000 Western employees.

The tentative agreement is subject to a ratification vote by USW membership, which is expected to occur before the end of the year. The USW bargaining committee has advised that they will be recommending that its members accept this agreement.

“This tentative agreement is the result of the professional and principled work of the bargaining team members from both the USW and Western, who worked respectfully to find common ground and solutions that support both employees and the business,” said Steven Hofer, President and CEO of Western Forest Products. “A new collective agreement will provide critical business certainty to the Company as we look to accelerate the transition to higher value products through reinvestment in our operations. I want to thank the bargaining team members for their work to deliver a fair and balanced agreement.”

About Western Forest Products Inc.

Western is an integrated forest products company building a margin-focused log and lumber business to compete successfully in global softwood markets. With operations and employees located primarily on the coast of British Columbia and Washington State, Western is a premier supplier of high-value, specialty forest products to worldwide markets. Western has a lumber capacity of 885 million board feet from six sawmills, as well as operates four remanufacturing facilities and two glulam manufacturing facilities. The Company sources timber from its private lands, long-term licenses, First Nations arrangements, and market purchases. Western supplements its production through a wholesale program providing customers with a comprehensive range of specialty products.

Forward-looking Statements

This press release contains statements that may constitute forward-looking statements under the applicable securities laws. Readers are cautioned against placing undue reliance on forward-looking statements. All statements herein, other than statements of historical fact, may be forward-looking statements and can be identified by the use of words such as “will”, “plans”, “expects” and similar references to future periods. Forward-looking statements in this news release include, but are not limited to statements relating to the timing and ratification of the tentative collective agreement by USW membership, the USW bargaining committee’s recommendation in relation thereto and the Company’s pursuit of potential reinvestment opportunities. Although such statements reflect management’s current reasonable beliefs, expectations and assumptions, there can be no assurance that forward-looking statements are accurate, and actual results or performance may materially vary. Many factors could cause our actual results or performance to be materially different, including economic and financial conditions, the actions of the USW membership and the bargaining committee, and the factors referenced under the “Risks and Uncertainties” section of our MD&A in our 2023 Annual Report dated February 13, 2024.

| Investor Contact: | Media Contact: |

| Glen Nontell | Babita Khunkhun |

| Chief Financial Officer | Senior Director, Communications |

| (604) 648-4500 | (604) 648-4562 |

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

57 social and affordable housing units to be built quickly in Québec under the Programme d'habitation abordable Québec

QUÉBEC, Nov. 28, 2024 /CNW/ – Jean-François Simard, Member of the National Assembly for Montmorency, on behalf of Mme France-Élaine Duranceau, Minister responsible for Housing, marked the start of construction of the Coopérative d’habitation du Haut-de-la-Rue, a building with 57 social and affordable housing units for independent individuals or seniors and families. The project, selected during the Société d’habitation du Québec’s (SHQ’s) first call for projects under the Programme d’habitation abordable Québec (PHAQ), is spearheaded by the co-operative of the same name.

The total cost of this project is $24.2 million. The Government of Quebec is providing more than $10.8 million, including over $9.9 million through the PHAQ and additional funding of $877,000. The Government of Canada is contributing $4.1 million through the third Canada-Quebec Rapid Housing Initiative Agreement. Lastly, the City of Québec is contributing $3.9 million. The organization has also taken out a mortgage loan, rounding out the funding package.

Quotes:

“Adding these 57 units is excellent news for the Capitale-Nationale region. It shows that, with the Programme d’habitation abordable Québec, we can deliver the expected projects and that it’s an effective tool for increasing the affordable housing supply, for the benefit of all Quebecers.”

France-Élaine Duranceau, Quebec Minister Responsible for Housing

“The federal government will continue to work hard toward ensuring that everyone in Quebec and across Canada has a safe and stable place to call home. We’re quickly providing new affordable housing to those who need it most across the country, thanks to the Canada-Quebec Rapid Housing Initiative Agreement and collaboration from all levels of government.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“Through its investments in housing, our government is helping those who need it most here in Quebec City, and across the country. Today’s inauguration will help ensure that more Quebecers have a safe and affordable place to call home.”

The Honourable Jean-Yves Duclos, Minister of Public Services and Procurement, Quebec Lieutenant and Member of Parliament for Québec

“What a great project for Montmorency residents! I am pleased that they will now have access to 57 new affordable housing units. I want to congratulate all the partners in this project, particularly the Coopérative Haut-de-la-Rue. I encourage all stakeholders to work together to launch more initiatives like this.”

Jean-François Simard, Member of the National Assembly for Montmorency

“This project embodies our vision of a city where every citizen, regardless of income, can find a decent, affordable home. By joining forces with government and community partners, we are pursuing our commitment to building a Québec where access to quality housing is a priority. It is these concrete projects that help shape a more equitable city for future generations.”

Bruno Marchand, Mayor of Québec

“After several years of hard work, we’re finally beginning construction of what will be our future cooperative. We recently held a meeting to present the project, and over 80 people interested in staying were in attendance. This is proof that our housing cooperative meets a crying need for housing in our community. Thanks to Pivot and Table Concertation Habitation Beauport for their initial support, and to SOSACO, the technical resource group accompanying us on this adventure.”

Blanche Paradis, President of the Board of Directors, Coopérative d’habitation du Haut-de-la-Rue

Highlights:

- Some of the households that will move into these units could benefit from the Société d’habitation du Québec’s (SHQ’s) Rent Supplement Program, ensuring that they spend no more than 25% of their income on rent. This additional assistance is covered by the SHQ (90%) and the City of Québec (10%).

- To keep the other units affordable, a maintenance period for this assistance will be required. This period could last up to 35 years. Assistance rates will vary based on the term of the commitment. Rents may be indexed each year based on the percentages set by the Tribunal administratif du logement.

- The Programme d’habitation abordable Québec (PHAQ) aims to engage all partners who can develop affordable housing projects. Co-operatives, non-profits, housing bureaus and private-sector businesses can submit projects under the Program. The PHAQ also aims to accelerate residential construction, which is why its standards stipulate that projects must be started within 12 months of being selected. This period may be extended to 18 months in certain circumstances.

About the Société d’habitation du Québec

As a leader in housing, the SHQ’s mission is to meet the housing needs of Quebecers through its expertise and services to citizens. It does this by providing affordable and low-rental housing and offering a range of assistance programs to support the construction, renovation and adaptation of homes, and access to homeownership.

To find out more about its activities, visit www.habitation.gouv.qc.ca/english.

SocietehabitationQuebec

HabitationSHQ

LinkedIn

About Canada Mortgage and Housing Corporation

Visit canada.ca/housing for the most-requested Government of Canada housing information.

CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that everyone in Canada has a home they can afford, and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/28/c8856.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/28/c8856.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sam Altman-Founded World Network Coin Soars 13% On Launch Of New Pilot Project 'World ID Credentials'

World Network WLD/USD emerged as one of the biggest cryptocurrency market gainers Thursday after the identity verification project unveiled a pilot feature that would allow users to claim additional tokens.

What happened: WLD, the native cryptocurrency of the newly-branded network, previously called Worldcoin, spiked over 13% to become the second-best-performing cryptocurrency in the last 24 hours.

The coin’s trading volume jumped 145% to around $1.35 billion, boosting the volume-to-market cap ratio to 67%.

The surge in buying pressure came following the launch of a new feature, called “World ID Credentials,” aimed at making the network more accessible.

“The new feature can be added to a person’s World ID whether or not they have verified their humanness at an Orb,” World Network announced.

Furthermore, using Credentials, World ID holders may claim additional WLD tokens, regardless of whether their World ID was validated at an Orb location.

The project would be rolled out in select countries including Chile, Colombia, Malaysia and South Korea

Why It Matters: Sam Altman, co-founder of OpenAI, launched the Worldcoin project last year amid significant media attention.

The project collects people’s irises to authenticate their humanness and creates a digital ID, thereby making them eligible to receive free WLD tokens.

However, the initiative has encountered challenges related to personal data protection. The project has been prohibited in Hong Kong, Kenya, and Spain.

Price Action: At the time of writing, Worldcoin was trading at $2.86, up 13.51% in the last 24 hours, according to data from Benzinga Pro.

Image by CryptoFX on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.